43 qualified dividends and capital gain tax worksheet 2015

1040 US Individual Income Tax Return - eFile.com 65 2015 estimated tax payments and amount applied from 2014 return ... Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions.45 pages 2015 Form 1099-DIV instructions - Vanguard You also must complete the Qualified Dividends and Capital Gain Tax Worksheet included in the Form 1040 or 1040A instructions to determine your taxes due on ...6 pages

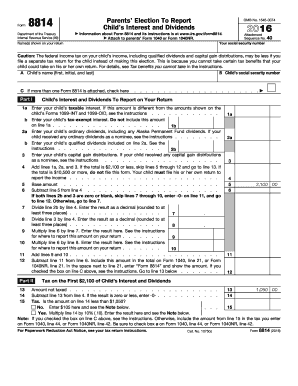

› Capital-Gain-Tax-WorksheetCapital Gain Tax Worksheet - 2015 Form 1040Line 44 Qualified ... View full document. 2015 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43.

Qualified dividends and capital gain tax worksheet 2015

Capital gains tax in the United States - Wikipedia The Capital Gains and Qualified Dividends Worksheet in the Form 1040 instructions specifies a calculation that treats both long-term capital gains and qualified dividends as though they were the last income received, then applies the preferential tax rate as shown in the above table. 2015 Instructions for Schedule D - Capital Gains and Losses Dec 28, 2015 — If qualified dividends that you re- ported on Form 1040, line 9b, or Form. 1040NR, line 10b, include extraordinary dividends, any loss on the ... Qualified Dividends And Capital Gain Worksheet Qualified Dividends And Capital Gain Tax Worksheet 2015 2022 Form Irs Instruction 1040 Line 44 Fill Online Printable Fillable Blank Pdffiller ... 2018 Qualified Dividends And Capital Gain Tax Worksheet Pdf Qualified Dividends And Capital Gain Tax Worksheet 2018 U2022 See Form 1040 Instructions For Course Hero Tags. Capital Dividends Gain wallpaper.

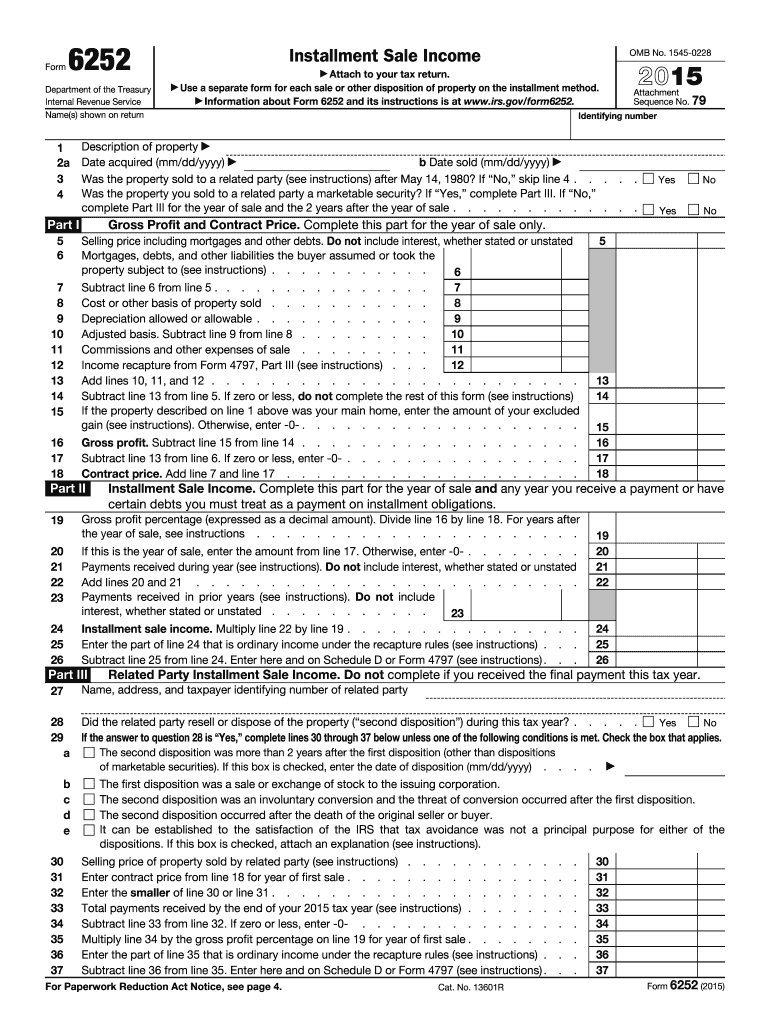

Qualified dividends and capital gain tax worksheet 2015. Federal Tax Form 4797 Instructions | eSmart Tax Qualified capital gain. The qualified capital gain is any gain recognized on the sale or exchange of a DC Zone asset that is a capital asset or property used in a trade or business. It does not include any of the following gain: Gain treated as ordinary income under section 1245; Gain treated as unrecaptured section 1250 gain. 2019 Fiduciary Income 541 Tax Booklet | FTB.ca.gov Jan 01, 2015 · Instructions for Form 541 California Fiduciary Income Tax Return. References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2015, and to the California Revenue and Taxation Code (R&TC).. In general, for taxable years beginning on or after January 1, 2015, California law conforms to the Internal Revenue Code (IRC) as of … PDF Qualified Dividends and Capital Gain Tax Worksheet: An ... The worksheet is for taxpayers with dividend income only or those whose only capital gains are capital gain distributions reported in box 2a or 2b of Form 1099-DIV that were received from mutual funds, other regulated investment companies, or real estate investment trusts. tmsxe.bdblaw.com › download › Qualified_DividendsQualified Dividends And Capital Gain Tax Worksheet Fillable Qualified Dividends And Capital Gain Tax Worksheet Fillable As recognized, adventure as with ease as experience very nearly lesson, amusement, as without difficulty as concord can be gotten by just checking out a books Qualified Dividends And Capital Gain Tax Worksheet Fillable with it is not directly done, you could endure even more in this ...

PDF Capital Gain Tax Worksheet (PDF) - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10. PDF Qualified Dividends And Capital Gain Tax Worksheet Line 44 Qualified Dividends And Capital Gain Tax Worksheet Line 44 When somebody should go to the ebook stores, search introduction by shop, shelf by shelf, it is really problematic. This is why we give the books compilations in this website. It will totally ease you to see guide Qualified Dividends And Capital Gain Tax Worksheet Line 44 as you such as. 2020 S Corporation Tax Booklet | FTB.ca.gov Line 4 – Net capital gain. Enter on this line any net capital gain subject to the 1.5% tax rate (3.5% for financial S corporations) shown on Schedule D (100S), Section B, line 10, and any gains subject to the 8.84% tax rate (10.84% for financial S corporations) shown on Schedule D (100S), Section A, line 13. 2014 Qualified Dividends and Capital Gain Tax Worksheet ... Before completing this worksheet, complete Form 1040 through line 43. If you do not have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Form 1040. Before you begin: 1. Enter the amount from Form 1040, line 43.

PDF Qualified Dividends And Capital Gain Tax Worksheet Line 44 qualified-dividends-and-capital-gain-tax-worksheet-line-44 1/1 Downloaded from tmsxe.bdblaw.com on April 22, 2022 by guest Qualified Dividends And Capital Gain Tax Worksheet Line 44 ... Your 2015 Tax Return is an essential text that guides you in preparing and filing your tax return with confidence. 2015 Tax Return - Elizabeth Warren 37 Enter the amount from line 6 of the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 44, or the amount from line 13 ...39 pages Instructions for Form 6251 (2021) - IRS tax forms Foreign qualified dividends. Individuals with capital gain distributions only. Individuals with other capital gains or losses. Instructions for Worksheets A and B. Step 3. Simplified limitation election. Step 4. Instructions for AMT Worksheet for Line 18. Step 5. Step 6. AMTFTC Carryback and Carryforward How to Figure the Qualified Dividends on a Tax Return ... Treat qualified dividends (found in box 1b of your 1099-DIV) as ordinary dividends, which are subject to the zero to 15 percent tax rate that applies to capital gains. Subject qualified dividends...

PDF 2015 Form 6251 - IRS tax forms 2015 Form 6251 Form 6251 Department of the Treasury Internal Revenue Service (99) Alternative Minimum Tax—Individuals Information about Form 6251 and its separate instructions is at . Attach to Form 1040 or Form 1040NR. OMB No. 1545-0074 2015 Attachment Sequence No. 32 Name(s) shown on Form 1040 or Form 1040NR

Qualified Dividends and Capital Gain Tax Worksheet Form ... Use the qualified dividends and capital gain tax worksheet 2021 2015 template to simplify high-volume document management. Show details How it works Upload the capital gains tax worksheet 2021 Edit & sign 2021 qualified dividends and capital gain tax worksheet from anywhere Save your changes and share capital gains worksheet 2021

PDF Qualified Dividend And Capital Gain Tax Worksheet We present Qualified Dividend And Capital Gain Tax Worksheet and numerous book collections from fictions to scientific research in any way. among them is this Qualified Dividend And Capital Gain Tax Worksheet that can be your partner. 2020 Form 1099-DIV - IRS tax forms Qualified dividends $ 2a . Total capital gain distr. $ 2b . Unrecap.

Qualified Dividends and Capital Gain Tax - TaxAct Qualified Dividends and Capital Gain Tax With the passing of the American Taxpayer Relief Act of 2012, certain taxpayers may now see a higher capital gains tax rate than they have in recent years. The new tax rates continue to include the 0% and the 15% rates; however, will also now include a 20% rate.

united states - How to handle capital gains on a Virginia ... I reported capital gains (reported to me on a 1099-DIV) on my 2015 Form 1040A "U.S. Individual Income Tax Return" (line 10.) Using the "Qualified Dividends and Capital Gain Tax Worksheet" on p. 38 of the 2015 1040A instructions, these capital gains were taxed federally at a 15% rate, which is lower than my income tax rate for wages.

Printable qualified dividends and capital gain tax worksheet 2016 pdf - Edit, Fill Out ...

" " " " ; 9 p m o B B 9 ! ! Sep 2, 2016 — Qualified Dividends and Capital Gain Tax Worksheet. No. Schedule D (Form 1040) 2015. (. ) Schedule D (Form 1040) 2015.56 pages

1040 (2021) | Internal Revenue Service - IRS tax forms Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments

Qualified Dividends and Capital Gains Worksheet - ACC330 ... Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records. See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b.

0 Response to "43 qualified dividends and capital gain tax worksheet 2015"

Post a Comment