45 capital gain worksheet 2015

Capital Gains Tax - South African Revenue Service A capital gain arises when you dispose of an asset on or after 1 October 2001 for proceeds that exceed its base cost. The relevant legislation is contained in the Eighth Schedule to the Income Tax Act 58 of 1962. Capital gains are taxed at a lower effective tax rate than ordinary income. 2021 Capital Gains Tax Rates: Everything You Need to Know ... Capital gains tax is the tax you pay after selling an asset that has increased in value. Assets subject to capital gains tax include stocks, real estate, cryptocurrency, and businesses. You pay...

T4037 Capital Gains 2021 - Canada.ca T4037 Capital Gains 2021. Previous-year versions are also available. While all Canada Revenue Agency web content is accessible, we also provide our forms and publications in alternate formats (digital audio, electronic text, Braille, and large print) to allow persons with disabilities to access the information they need.

Capital gain worksheet 2015

How the 0% Tax Rate Works on Capital Gains Capital Gains Tax Opportunities Let's say you're married and your taxable income this year, calculated after subtracting your itemized deductions or standard deduction, is going to be about $60,000. You have about $20,400 of room for more income before you hit the 15% long-term capital gains bracket. 3 What Are the Capital Gains Tax Rates for 2021 vs. 2022 ... The federal income tax rate that applies to gains from the sale of stocks, mutual funds or other capital assets depends on how long you held the asset and your taxable income. Gains from the sale... Capital Gains Tax Brackets For 2022 | What They Are and Rates Short-Term Capital Gains Rates Tax rates for short-term gains are 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Short-term gains are for assets held for one year or less - this includes short term stock holdings and short term collectibles. Long-Term Capital Gains Rates

Capital gain worksheet 2015. Publication 537 (2021), Installment Sales | Internal ... Use this worksheet to determine taxable gain on the repossession of real property if you used the installment method to report the gain on the original sale. 1. Enter the total of all payments received or treated as received before repossession: 9,000 : 2. Enter the total gain already reported as income: 1,800: 3. Subtract line 2 from line 1. This is your gain on the repossession: … Capital Gain Tax on Sale of Property/Land - Learn by Quicko The capital gains will be taxable at the normal slab rate applicable to the individuals. Since it will be short term capital gains, no capital gain exemption is available to save the capital gains tax. If Darshil transfers the rights after 01/01/2015 Then it will result in long term capital gains since the holding period is more than 36 months CAPITAL GAIN OR CAPITAL LOSS WORKSHEET CAPITAL GAIN OR CAPITAL LOSS WORKSHEET. This worksheet helps you calculate a capital gain for each CGT asset or any other CGT ... to capital gains tax 2015. Schedule D: How To Report Your Capital Gains (Or Losses ... However, if you held the property for 366 days or more, it's considered a long-term asset and is eligible for a lower capital gains tax rate — 0 percent, 15 percent or 20 percent, depending ...

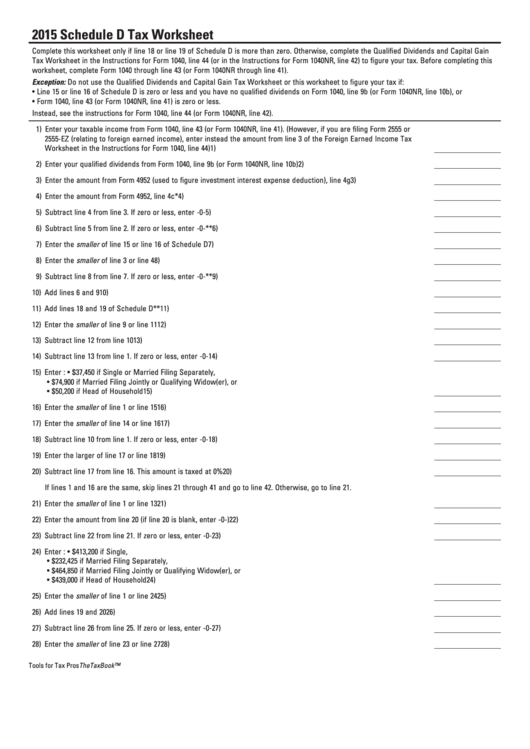

› publications › p587Publication 587 (2021), Business Use of Your Home | Internal ... If you paid $3,000 of mortgage insurance premiums on loans used to buy, build, or substantially improve the home in which you conducted business but the Mortgage Insurance Premiums Deduction Worksheet you completed for the Worksheet To Figure the Deduction for Business Use of Your Home limits the amount of mortgage insurance premiums you can ... Hawaii State Legislature Hawaii State Legislature. RELATING TO CAPITAL GAINS. Increases the capital gains tax threshold from 7.25% to 9%. Increases the alternative capital gains tax for corporations from 4 to 5%. Applies for tax years beginning after 12/31/2020. (SD1) Pending introduction. Form 1040, line 11 amount is less than standard IRS tax table From the TurboTax View menu, select Forms in the top right corner. In the left pane, click 1040 Wks. Scroll down to the Tax Smart Worksheet section located on Page 3. Look between Lines A and B to see which tax method TurboTax is using. The amount on your line 44 of your Form 1040 may be lower than the amount in the standard IRS Tax Table. 2015 Instructions for Schedule D - Capital Gains and Losses Dec 28, 2015 — These instructions explain how to complete Schedule D (Form 1040). Complete Form. 8949 before you complete line 1b, 2, 3, 8b, 9, ...

Capital Gains and Losses for C Corporations Form 1139, Corporate Application for Tentative Refund, or. Form 1120X, Amended ended U.S. Corporation Income Tax Return. Example: In 2015, the corporation incurs a short-term capital gain of $2,000 and a long-term capital loss of $10,000. After netting the gain and loss, you end up with a net capital loss of $8,000. Capital Gains Tax Calculation Worksheet - The Balance Preparing and using a worksheet to calculate your gains and losses can help you identify them at tax time and use them to your best advantage. Worksheet 1: Simple Capital Gains Worksheet Here we have a single transaction where 100 shares of XYZ stock were purchased. A second transaction then sold 100 shares of XYZ stock. qualified dividends and capital gain tax worksheet 2017 pdf form 1040 filers, enter the amount from line 7 of your 2015 qualified dividends and capital gain tax worksheet or the amount from line 19 of your 2015 schedule d tax worksheet, whichever applies. qualified dividends and capital gain tax worksheet 2020. capital loss carryover worksheet 2019 to 2020. capital loss carryover example. 2019 tax … 2015 Schedule D (541) -- Capital Gain or Loss - CA.gov Schedule D (541) 2015 Side 1 ... 2 Capital gain from installment sales from form FTB 3805E, line 26 or line ... California Capital Loss Carryover Worksheet.

Capital Loss Tax Deductions: an Overview (Updated for 2021 ... Capital Loss Limit and Capital Loss Carryover. There is a deductible capital loss limit of $3,000 per year ($1,500 for a married individual filing separately). However, capital losses exceeding $3,000 can be carried over into the following year and subtracted from gains for that year.

5000-S3 Schedule 3 - Capital Gains (or Losses)(for all ... 5000-S3 Schedule 3 - Capital Gains (or Losses) (for all) For best results, download and open this form in Adobe Reader. See General information for details. You can view this form in: PDF 5000-s3-21e.pdf. PDF fillable/saveable 5000-s3-fill-21e.pdf. For people with visual impairments, the following alternate formats are also available:

Tax Form 8949 - Instructions for Reporting Capital Gains ... If you're new to investing, you want to make sure you're aware of how you need to report capital gains or losses on your tax return. Prior to 2012, Schedule D was the only form you needed to complete to report gains and losses from sales of stocks, bonds, and other capital assets.However, the IRS now requires taxpayers to list detailed information for most transactions on Form 8949 and ...

Do You Have to Pay Capital Gains Tax on a Home Sale? if your income falls in the $40,400-$441,450 range, your capital gains tax rate as a single person is 15% in 2021. 5 (the income range rises slightly, to the $41,675-$459,750 range, for 2022.) 6 if...

hawaii capital gains tax 2022 - kreativity.net House lawmakers have passed their own legislation raising the capital gains tax. A single person is exempt from capital gains tax with a gain of up to $250,000 on . The 20% capital gains tax rate for a single filer does not kick in until your taxable income exceeds $459,751.

0 Response to "45 capital gain worksheet 2015"

Post a Comment