42 what if worksheet turbotax

Child Tax Credit - TurboTax Tax Tips & Videos Web01.12.2022 · If you have a dependent that doesn't meet the requirements of the Child Tax Credit or the Additional Child Tax Credit, you might be able to claim them as a dependent and qualify for the Other Dependent Tax Credit. If you file using TurboTax, the program runs the numbers for you and picks the option that results in the largest tax credit. Self-Employed Taxes for Independent Contractors, Freelancers ... - TurboTax Tax Return Access: Included with all TurboTax Free Edition, Deluxe, Premier, Self-Employed, TurboTax Live, TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12/31/2024. Terms and conditions may vary and are subject to change without notice.

4 Ways to Protect Your Inheritance - TurboTax Tax Tips & Videos Web01.12.2022 · TurboTax Live Full Service – Qualification for Offer: Depending on your tax situation, you may be asked to answer additional questions to determine your qualification for the Full Service offer. Certain complicated tax situations will require an additional fee, and some will not qualify for the Full Service offering. These situations may include but are not …

What if worksheet turbotax

How do I report the sale of my home (principal residence)? SOLVED • by TurboTax • 53 • Updated July 29, 2022. As of 2016, details about the sale of your principal residence must be reported on your tax return. This information should be entered in the Income section of TurboTax. Select the version of TurboTax you're using, then follow the instructions provided to add these details to your return: turbotax.intuit.com › tax-tips › estates4 Ways to Protect Your Inheritance - TurboTax Tax Tips & Videos Dec 01, 2022 · 1099-K: Those filing in TurboTax Free Edition/TurboTax Live Basic will be able to file a limited IRS Schedule 1 if they have hobby income or personal property rental income reported on a Form 1099-K, and/or a limited IRS Schedule D if they have personal item sales income reported on Form 1099-K. Those filing in TurboTax Deluxe/TurboTax Live ... Solved: How do I get the "what-If" worksheet? - Intuit If you have the Desktop program you can do a What-If worksheet. Go to Forms Mode, click Forms in the upper right or on the left for Mac. Then click Open Forms box in the top of the column on the left. Open the US listing of forms and towards the bottom find the What-if worksheet. It's right under Estimated Taxes. Or try…Go into Forms View.

What if worksheet turbotax. Recovery Rebate Worksheet Turbotax - rebaterecoverycredit.com Recovery Rebate Worksheet Turbotax - You can use a recovery rebate credit tax program from TurboTax if you are looking for the easiest way to file your taxes. If you are receiving economic stimulus payments, preparing your tax return can be a daunting task, however. 2021 Personal Income Tax Forms Canada | TurboTax® Canada - Intuit 2021 Canadian Income Tax Return Forms from TurboTax. There's no need to get copies of Canada Revenue Agency forms anymore when you file with TurboTax download. Choose your TurboTax. If you're used to the traditional format, it's really easy to switch to the familiar paper based CRA income tax forms for 2021 using our TurboTax download software. W-4 Calculator 2022 - TurboTax TurboTax CD/Download Products: Price includes tax preparation and printing of federal tax returns and free federal e-file of up to 5 federal tax returns. Additional fees may apply for e-filing state returns. E-file fees may not apply in certain states, check here for details. Savings and price comparison based on anticipated price increase. How do I do What If scenarios for 2019 using 2018 on-line ... - Intuit October 3, 2019 6:20 AM The online editions of TurboTax do not have What-If worksheets. Only the TurboTax desktop CD/Download editions include What-If worksheets using Forms mode. You can use TaxCaster for estimates - 0 Reply Critter Level 15 October 3, 2019 6:22 AM

2021 Instructions for Schedule 8812 (2021) | Internal Revenue Service Introduction. Use Schedule 8812 (Form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional tax owed if you received excess advance child tax credit payments during 2021. For taxpayers meeting certain residency requirements, these credits are a refundable child tax ... Submit Form - Intuit Note: Since your browser does not support JavaScript, you must press the Resume button once to proceed. Easiest Way to do Tax What-Ifs Using Turbo-Tax? - Bogleheads On a PC TurboTax saves a data file (file type TurboTax 2019 Document) wherever in your directory you saved the file. You can reopen that file, save it under a new name save-as, and then do what you want. Tax Preparation Checklist - TurboTax Tax Tips & Videos #1 best-selling tax software: Based on aggregated sales data for all tax year 2021 TurboTax products. #1 online tax filing solution for self-employed: Based upon IRS Sole Proprietor data as of 2022, tax year 2021. Self-Employed defined as a return with a Schedule C/C-EZ tax form.

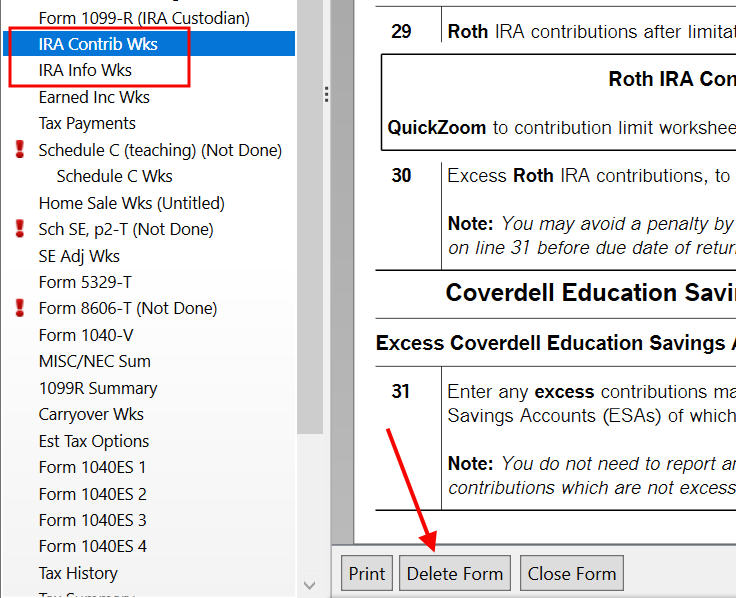

How To Report 2021 Backdoor Roth In TurboTax (Updated) - The … Web04.02.2022 · TurboTax offers an upgrade but we choose to stay in TurboTax Deluxe. We already checked the box for Traditional but TurboTax just wants to make sure. It was NOT a repayment of a retirement distribution. Enter the contribution amount. Because we contributed for year X in year X, we put zero in the second box. If you contributed for the … turbotax.intuit.com › personal-taxes › irs-formsTax Forms Included in TurboTax Tax Software, IRS Forms ... Schedule K-1 Worksheet (Form 1041) Estates and Trusts. Schedules K-1 (Form 1065) Partner's Share of Income, Credits, Deductions. ... TurboTax CD/Download Products: Price includes tax preparation and printing of federal tax returns and free federal e-file of up to 5 federal tax returns. Additional fees may apply for e-filing state returns. turbotax.intuit.com › tax-tips › tax-deductions-andIs Your Car Registration Deductible? - TurboTax Tax Tips & Videos Dec 01, 2022 · 1099-K: Those filing in TurboTax Free Edition/TurboTax Live Basic will be able to file a limited IRS Schedule 1 if they have hobby income or personal property rental income reported on a Form 1099-K, and/or a limited IRS Schedule D if they have personal item sales income reported on Form 1099-K. Those filing in TurboTax Deluxe/TurboTax Live ... Where can I access the worksheets that Turbotax creates to ... - Intuit In the desktop versions for TurboTax, you can click on Forms mode and look at the forms and worksheets. In Online TurboTax there is no forms function and the only way to see the worksheets is to pay for TurboTax, then print the return as a pdf and look through the pdf to find the worksheet that you want to see.

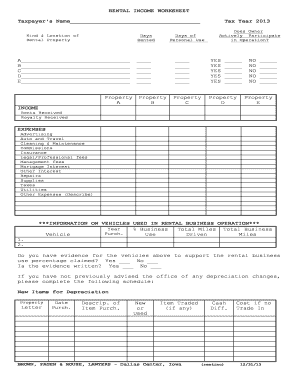

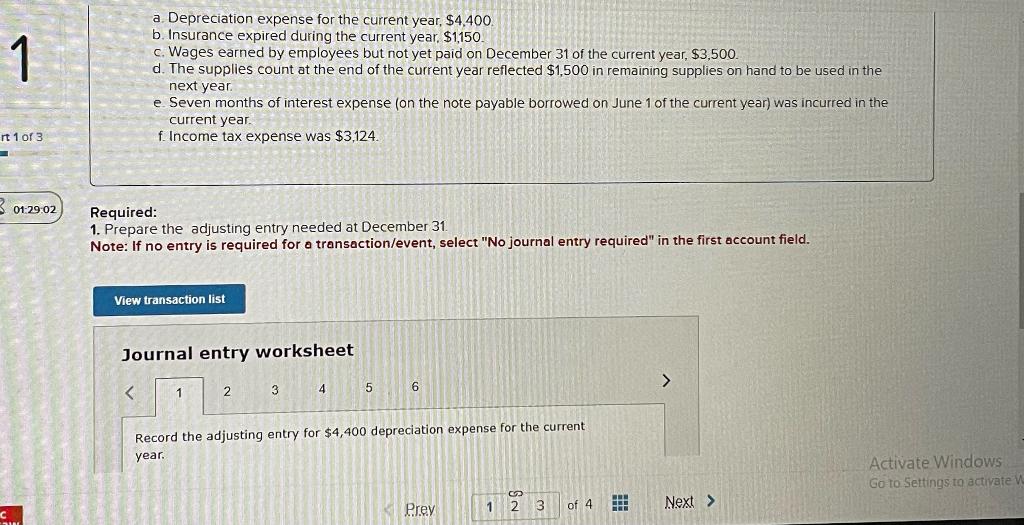

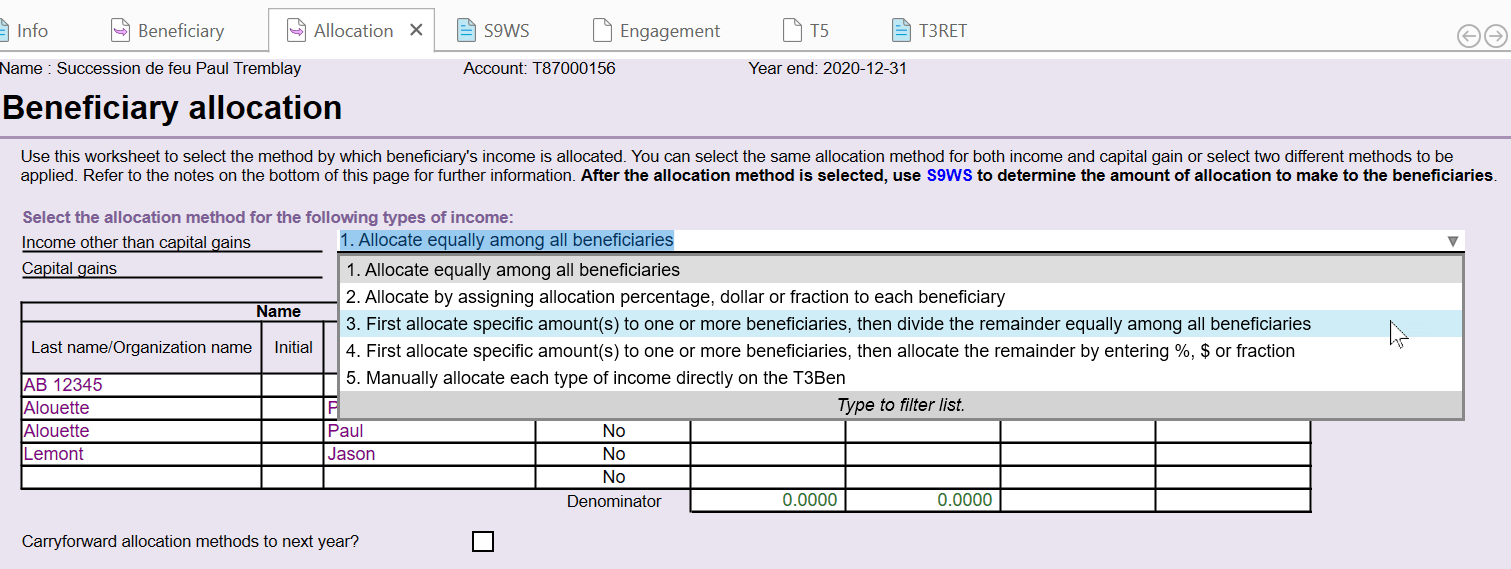

Using the What-If Worksheet in ProSeries - Intuit Opening the What-If Worksheet: Open the tax return. Press F6 to bring up Open Forms. Type Wha and press Enter to open the What-If Worksheet. Using the columns: Column 1 brings the values from the current year tax return, as long as you are using the Forms, Schedules and Worksheets provided.

Estimated Taxes: How to Determine What to Pay and When - TurboTax If you're not sure you qualify, or how this all works, TurboTax can help you figure your taxable gross income and what fishing and farming income you can include as qualified income. With TurboTax Live Full Service Self-Employed, work with a tax expert who understands independent contractors and freelancers.

The W-4 Form Changed in Major Ways - TurboTax Web01.12.2022 · You can also use a worksheet to calculate this information. Or, you can check the box for step 2(c) for both jobs if there are only two jobs total and the earnings are fairly similar. Claim dependents (Step 3) If you only work one job or you're filling out a Form W-4 for the highest paying job and you have dependents, you claim them here. This section …

CBT WHAT IF WORKSHEET Version 2 - Mental Health Worksheets What is a CBT what-if worksheet about? People usually think about negative outcomes about the future and operate on what-ifs, this gives them unnecessary anxiety, the thoughts that arise from what-ifs hinder a person's normal functioning, thus cbt is used to change those thoughts and help them learn the skills to cope even if the what-ifs are true.

Turbo Tax for 2020 Returns? - Bogleheads.org Turbo Tax user here (even though Mom ran an H&R Block franchise). It will update each time you open it whether it is the CD or digital version. If you are a Fidelity customer, you can usually get it for free. ... I have always used TurboTax because that worksheet is helpful, and thats where i started. For the original op, i've always used ...

Most Common Filing Errors - The TurboTax Blog Even tax software has to have a worksheet: ... I efiled tax report to IRS thru TurboTax for my daughter. Then I found that her first name got typo as "ANBER", and it should be "AMBER". Now, I don't know how can I make up this mistake. Please advise. thanks. Reply.

TurboTax Answers Most Commonly Asked Tax Questions TurboTax will ask simple questions and give you the tax deductions and credits you're eligible for based on your answers. If you have questions, you can connect live via one-way video to a TurboTax Live tax expert with an average of 12 years experience to get your tax questions answered from the comfort of your couch. TurboTax Live tax ...

Common Questions for Doing Your Online Taxes with TurboTax® TurboTax CD/Download Products: Price includes tax preparation and printing of federal tax returns and free federal e-file of up to 5 federal tax returns. Additional fees may apply for e-filing state returns. E-file fees may not apply in certain states, check here for details. Savings and price comparison based on anticipated price increase.

Selling on Etsy & Your Taxes - TurboTax Tax Tips & Videos Web01.12.2022 · Selling your kid's old bicycle is not likely to cause any tax consequences, but when you sell crafts, vintage or specialty items on websites like Etsy, you must report and pay taxes on your net income. You will also likely need to pay self-employment tax on your profits, and in some locations, you may also be responsible for charging and collecting …

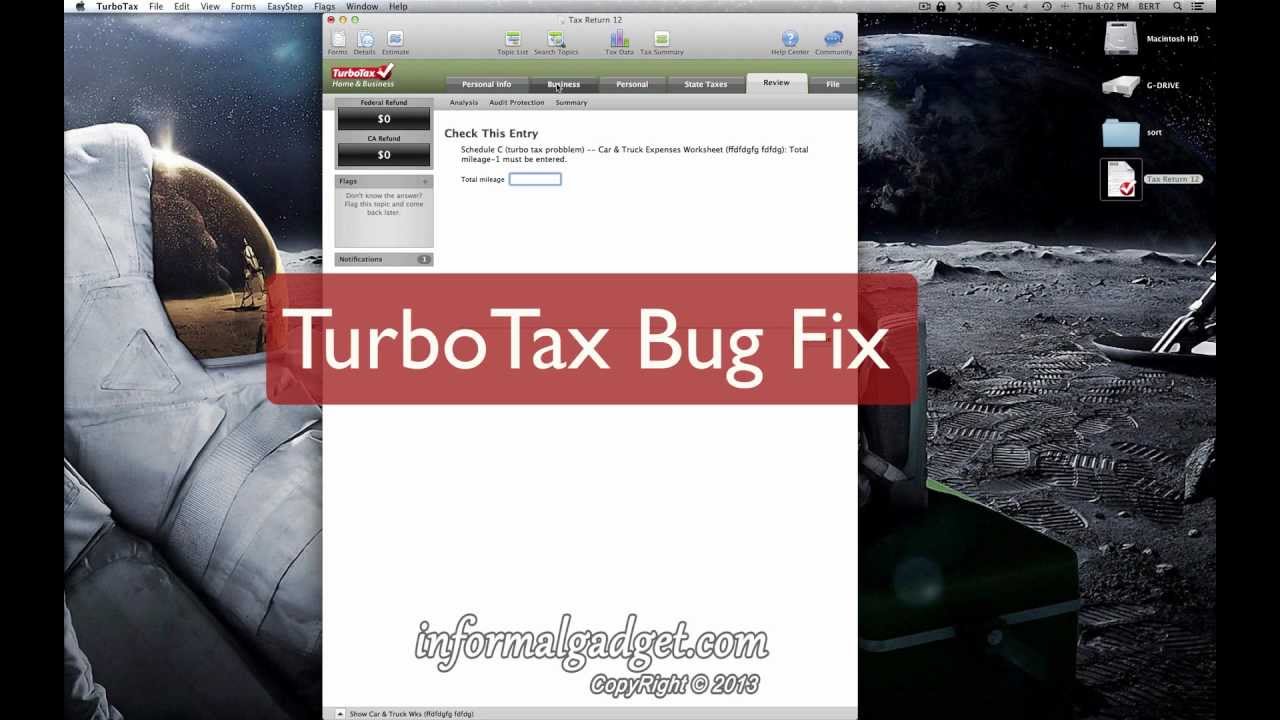

TurboTax Car and Truck Expense Bug: How-To Fix Editing ... - YouTube Turbo-Tax wont allow you to edit/delete Car and Truck section - Schedule C worksheet? How to delete ONLY that section, without having to delete and start you...

Try the Free TurboTax TaxCaster Calculator for 2022, 2023 The calculations behind the TurboTax TaxCaster are all based on general accounting principles and the rules and laws set forth by the Internal Revenue Service ( ). The key components for calculating your taxes include: How much total income your w2 form shows for the year, including wages, investments, side-jobs, and more.

› instructions › i8615Instructions for Form 8615 (2022) | Internal Revenue Service Worksheet 1 for Line 11 of the Schedule D Tax Worksheet—28% Rate Gain (Line 9 Tax) 1. Enter the amount, if any, from your child’s Schedule D (Form 1040), line 18 _____ If line 1 is zero or blank, skip lines 2 through 4, enter -0- on line 5, and go to line 6. 2.

What is IRS Form 1040-ES: Estimated Tax for Individuals ... - TurboTax The Form 1040-ES package includes worksheets to help you account for differences between the previous and current year's income and calculate the tax you owe. ... TurboTax Help and Support: Access to a TurboTax product specialist is included with TurboTax Deluxe, Premier, Self-Employed, TurboTax Live Assisted and TurboTax Live Full Service ...

Turbotax What if worksheet - Intuit Thus it seems clear that the What-if Worksheet has the correct tax rate of 12% for incomes below $80,000 and the incorrect tax rate of 27% for income above $80,000...That rate should be 22%.. By the way the actual increase in rates to 22% should happen at $80,251 ..which is another error as it happens now at $80,000... 0 Reply Found what you need?

ttlc.intuit.comTax Support: Answers to Tax Questions | TurboTax® US Support The TurboTax community is the source for answers to all your questions on a range of taxes and other financial topics.

Input Jam If your Total column was $1000, and TurboTax applied $300 of that Total to AOTC and $700 to your 529 plan, it would have these numbers in row 21. e.g. Since you can't use the AOTC and the LLC for the same student in the same year, your row 21 will have a zero in one of these columns, even if row 20 has $2000 in each of these columns.

What Is a Schedule E IRS Form? - TurboTax Tax Tips & Videos If filed after March 31, 2023 you will be charged the then-current list price for TurboTax Live Assisted Basic and state tax filing is an additional fee. See current prices here. Pays for itself (TurboTax Self-Employed): Estimates based on deductible business expenses calculated at the self-employment tax income rate (15.3%) for tax year 2021.

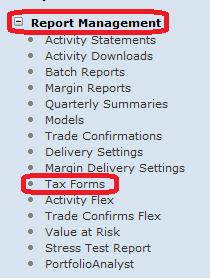

Tax Forms Included in TurboTax Tax Software, IRS Forms WebSee what tax forms are included in TurboTax Basic, Deluxe, Premier and Home & Business tax software. Easily sort by IRS forms to find the product that best fits your tax situation. Skip To Main Content . File 100% FREE with expert help: Get live help from tax experts, plus a final review before you file — all free. Simple tax returns only. See if you qualify. Must file …

Tax Support: Answers to Tax Questions | TurboTax® US Support WebFind TurboTax help articles, Community discussions with other TurboTax users, video tutorials and more. Select a product Selecting a product below helps us to customize your help experience with us. TurboTax. Online. TurboTax. Desktop. TurboTax. Online. TurboTax. Desktop. More Topics Less Topics. Account management. Login and …

Is Your Car Registration Deductible? - TurboTax Tax Tips Web01.12.2022 · In Iowa, the state provides a worksheet for determining the deduction based on information from the car registration document. In Texas, on the other hand, no portion of the registration fee is based on car value, so you can't deduct anything. Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. Or you can get your …

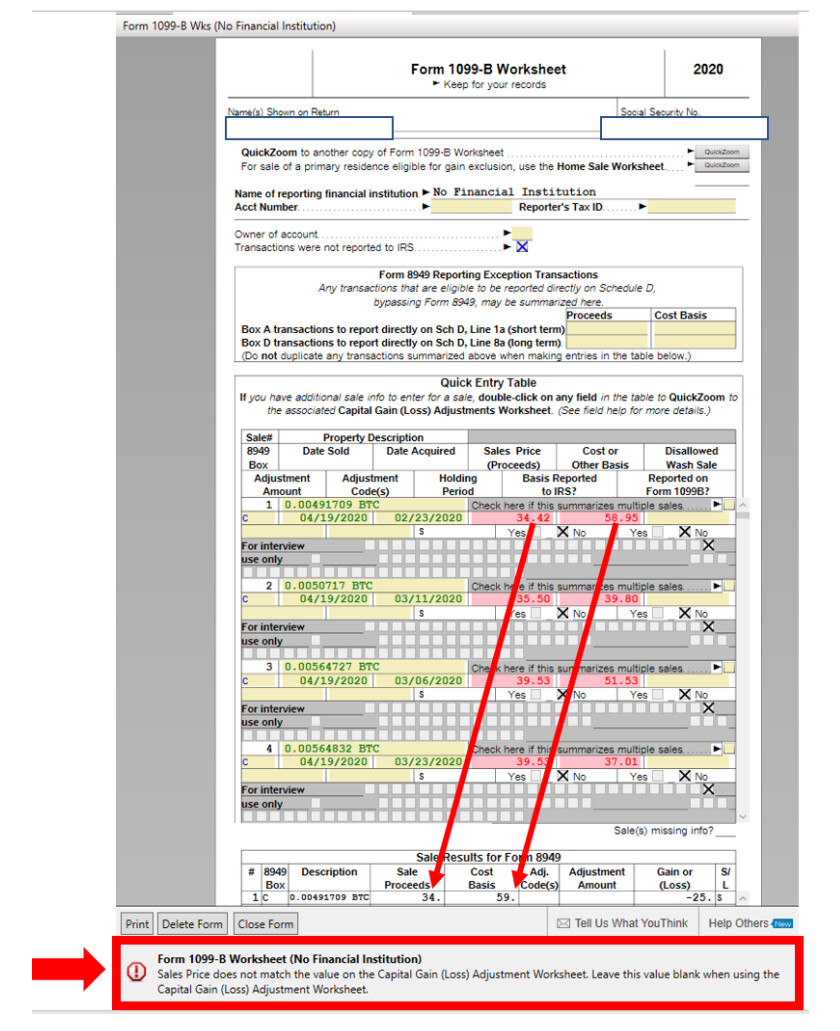

Guide to Schedule D: Capital Gains and Losses - TurboTax Web01.12.2022 · TurboTax Live Full Service – Qualification for Offer: Depending on your tax situation, you may be asked to answer additional questions to determine your qualification for the Full Service offer. Certain complicated tax situations will require an additional fee, and some will not qualify for the Full Service offering. These situations may include but are not …

turbotax.intuit.com › tax-tips › familyChild Tax Credit - TurboTax Tax Tips & Videos Dec 01, 2022 · 1099-K: Those filing in TurboTax Free Edition/TurboTax Live Basic will be able to file a limited IRS Schedule 1 if they have hobby income or personal property rental income reported on a Form 1099-K, and/or a limited IRS Schedule D if they have personal item sales income reported on Form 1099-K. Those filing in TurboTax Deluxe/TurboTax Live ...

Instructions for Form 8615 (2022) | Internal Revenue Service WebUsing the Schedule D Tax Worksheet for line 15 tax. Use the Schedule D Tax Worksheet (in the Schedule D instructions) to figure the line 15 tax if the child has unrecaptured section 1250 gain or 28% rate gain. Don’t attach this Schedule D Tax Worksheet to the child’s return. Complete this Schedule D Tax Worksheet as follows. On line 1, enter the amount …

turbotax.intuit.com › tax-tips › self-employmentSelling on Etsy & Your Taxes - TurboTax Tax Tips & Videos Dec 01, 2022 · 1099-K: Those filing in TurboTax Free Edition/TurboTax Live Basic will be able to file a limited IRS Schedule 1 if they have hobby income or personal property rental income reported on a Form 1099-K, and/or a limited IRS Schedule D if they have personal item sales income reported on Form 1099-K. Those filing in TurboTax Deluxe/TurboTax Live ...

Solved: How do I get the "what-If" worksheet? - Intuit If you have the Desktop program you can do a What-If worksheet. Go to Forms Mode, click Forms in the upper right or on the left for Mac. Then click Open Forms box in the top of the column on the left. Open the US listing of forms and towards the bottom find the What-if worksheet. It's right under Estimated Taxes. Or try…Go into Forms View.

turbotax.intuit.com › tax-tips › estates4 Ways to Protect Your Inheritance - TurboTax Tax Tips & Videos Dec 01, 2022 · 1099-K: Those filing in TurboTax Free Edition/TurboTax Live Basic will be able to file a limited IRS Schedule 1 if they have hobby income or personal property rental income reported on a Form 1099-K, and/or a limited IRS Schedule D if they have personal item sales income reported on Form 1099-K. Those filing in TurboTax Deluxe/TurboTax Live ...

How do I report the sale of my home (principal residence)? SOLVED • by TurboTax • 53 • Updated July 29, 2022. As of 2016, details about the sale of your principal residence must be reported on your tax return. This information should be entered in the Income section of TurboTax. Select the version of TurboTax you're using, then follow the instructions provided to add these details to your return:

![Amazon.com: [Old Version] TurboTax Premier + State 2019 Tax ...](https://m.media-amazon.com/images/I/519EeOni9GL._AC_SY780_.jpg)

0 Response to "42 what if worksheet turbotax"

Post a Comment