41 qualified dividends and capital gain tax worksheet

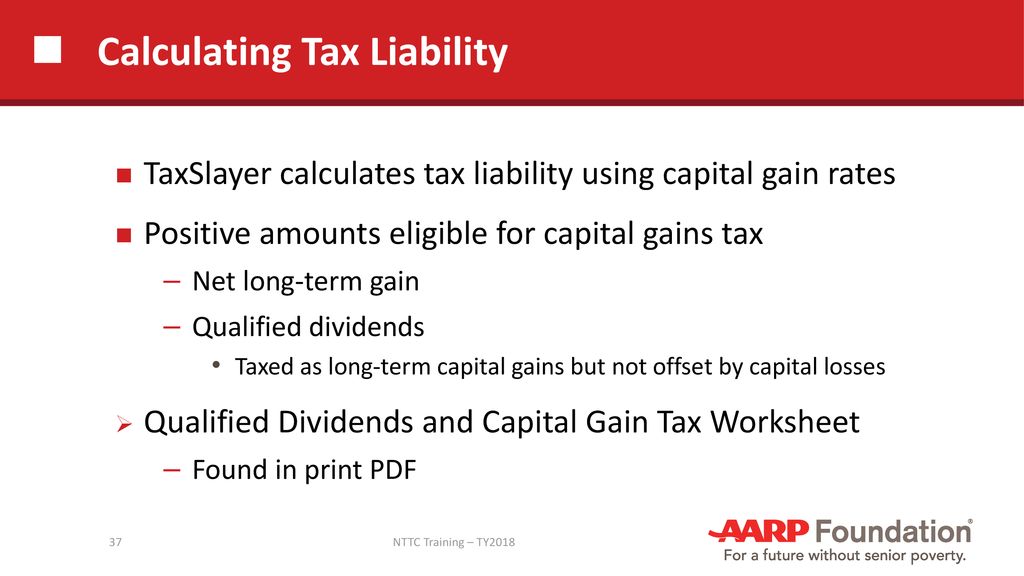

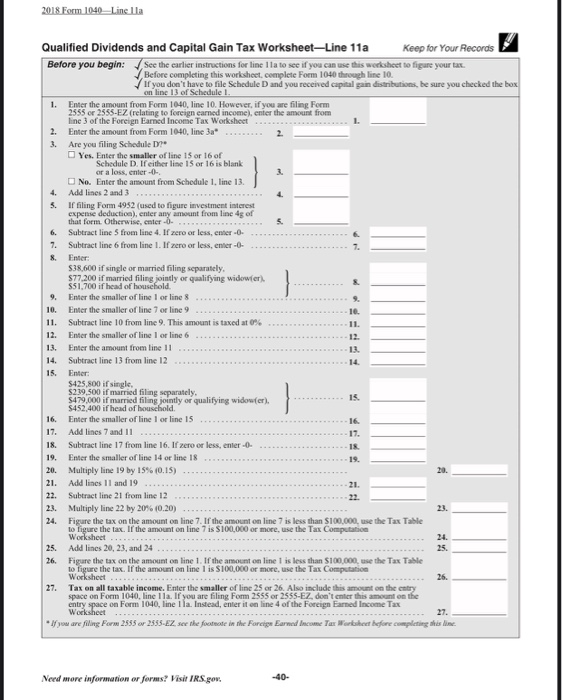

Are Qualified Dividends Included in Gross Income? - Investopedia May 21, 2021 · Qualified dividends are similar to ordinary dividends but are subject to the same 0%,15% or 20% rates that apply to long-term capital gains. Your qualified dividends will appear in box 1b of Form ... How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet Sep 24, 2021 · For this reason, the first step of the Qualified Dividends and Capital Gain Tax Worksheet is to split those two separate types back out. Lines 1-5: Qualified Income & Ordinary Income. Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates.

Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 - Fill ... Complete Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 in a few minutes following the guidelines listed below: Find the document template you need from our collection of legal form samples. Select the Get form key to open it and start editing. Fill in all of the requested fields (they are marked in yellow).

Qualified dividends and capital gain tax worksheet

How to Download Qualified Dividends and Capital Gain Tax Worksheet ... Qualified Dividends and Capital Gain Tax Worksheet. The worksheet is part of Form 1040 which is mandatory for every individual tax filer as well as joint filers. The worksheet has 27 lines, and all fields must be filled according to relevant information. Tax filers with qualified dividends and capital gains have to fill the relevant worksheet. Qualified Dividends and Capital Gain Tax Worksheet." - Intuit Click Forms in the upper right (upper left for Mac) and look through the "Forms In My Return" list and open the Qualified Dividends and Capital Gain Tax Worksheet. The "Line 44 worksheet" is also called the Qualified Dividends and Capital Gain Tax Worksheet. June 7, 2019 4:12 PM. It is actually labeled as "QualDiv/Cap Gn" on the forms listing ... Qualified Dividends and Capital Gains Flowchart - The Tax Adviser The complexity comes from the phaseout of the 0% and 15% rates as other taxable income rises. It takes 27 lines in the IRS qualified dividends and capital gain tax worksheet to work through the computations (Form 1040 Instructions (2013), p. 43). With a good understanding of the mechanics, preparers can spot opportunities to advise clients to ...

Qualified dividends and capital gain tax worksheet. Qualified Dividends and Capital Gains Worksheet.pdf View Qualified Dividends and Capital Gains Worksheet.pdf from FEDERAL TA ACC 330 at Southern New Hampshire University. Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Qualified dividends and capital gain tax worksheet 2019 pdf: Fill out ... Click on New Document and choose the form importing option: upload 2021 qualified dividends and capital gains worksheet from your device, the cloud, or a protected URL. Make changes to the template. Use the upper and left panel tools to modify 2021 qualified dividends and capital gains worksheet. Qualified Dividends And Capital Gain Tax Worksheet 2021 The sigNow extension was developed to help busy people like you to reduce the burden of signing documents. Start eSigning 2021 qualified dividends and capital gain tax worksheet by means of solution and become one of the millions of happy clients who’ve already experienced the key benefits of in-mail signing. How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates. Qualified Income is the sum of qualified dividends (line 2) and long-term capital gains (line 3). Ordinary Income is everything else or Taxable Income minus Qualified Income.

Qualified Dividends and Capital Gains Worksheet-Completed Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records. Before you begin: See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. Qualified Dividends and Capital Gains Worksheet - StuDocu Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records. See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. Qualified Dividends and Capital Gain Tax - prd.taxact.com Qualified Dividends and Capital Gain Tax. Information reported to you on Form 1099-DIV and Form 1099-B can be entered in the TaxAct program in the Investment Income section of the Federal QA, or directly on the forms where applicable. The Tax Summary screen will indicate if the tax has been computed on the Schedule D Worksheet or the Qualified ... 5. Travel costs are business related and do not | Chegg.com Schedule 1, schedule 3 , Schedule A, Qualified Dividends and capital gain worksheet, form 2441, schedule E, form 8812, form 4562, form 8995. please help, thank you. Show transcribed image text ... Part 2: Schedule C, Schedule SE, Schedule D, and Qualified Dividends and Capitat Gains Tax Worksheet Wote: This problem is divided into three parts ...

Qualified Dividends and Capital Gain Tax Worksheet: An … For 2003, the IRS added qualified dividends and the new rates to the worksheet so that millions of taxpayers will still be able to get their full tax benefits without the Schedule D. The worksheet is for taxpayers with dividend income only or those whose only capital gains are capital gain distributions reported in box 2a or 2b of Form 1099-DIV ... Qualified Dividend and Capital Gains Tax Worksheet? - YouTube The tax rate computed on your Form 1040 must consider any tax-favored items, such as qualified dividends and long-term capital gains, which are generally sub... PDF Qualified Dividends and Capital Gain Tax Worksheet—Line 11a Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. ... complete Form 1040 through line 10. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box ... enter the amount from line 3 of the Foreign Earned Income Tax Worksheet .....1. 2. Enter the amount from Form 1040, line 3a ... Capital Gains and Losses - Short Sale Dividends Paid Payments in Lieu ... You can deduct these payments only if you hold the short sale open at least 46 days (more than 1 year in the case of an extraordinary dividend, as defined later) and you itemize your deductions. You deduct these payments as investment interest on Schedule A (Form 1040 or 1040-SR). See Interest Expenses in chapter 3 for more information.

1040 (2021) | Internal Revenue Service - IRS tax forms Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments

2022 Instructions for Schedule D (2022) - IRS tax forms Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4g, even if you don’t need to file Schedule D. Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line ...

Topic No. 409 Capital Gains and Losses - IRS tax forms Nov 25, 2022 · Capital Gain Tax Rates. ... The taxable part of a gain from selling section 1202 qualified small business stock is taxed at a maximum 28% rate. ... You may use the Capital Loss Carryover Worksheet found in Publication 550, Investment Income and Expenses or in the Instructions for Schedule D (Form 1040) ...

Foreign Income and Tax vs US Capital Gains : r/personalfinance See the Qualified Dividends and Capital Gain Tax Worksheet in the 1040 instructions. Oh and yes, the total foreign income tax is more than the std deduc. First, you can't take a deduction for the full amount of foreign income tax you paid if you're taking the FEIE to exclude your foreign earned income.

Publication 590-A (2021), Contributions to Individual Retirement ... Qualified disaster tax relief. ... The Instructions for Form 1040 include a similar worksheet that you can use instead of the worksheet in this publication. ... Their combined modified AGI, which includes $2,000 interest and dividend income and a large capital gain …

How Your Tax Is Calculated: Understanding the Qualified Dividends and ... Instead, 1040 Line 44 "Tax" asks you to "see instructions." In those instructions, there is a 27-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet, which is how you actually calculate your Line 44 tax. The 27 lines, because they are so simplified, end up being difficult to follow what exactly they do.

What Are Qualified Dividends, and How Are They Taxed? - Investopedia Nov 9, 2022 · Qualified Dividend: A qualified dividend is a type of dividend to which capital gains tax rates are applied. These tax rates are usually lower than regular income tax rates.

Qualified Dividend Income Fund Information. Qualified dividends are dividends received by a fund from a stock, provided that the fund has held the stock for a required holding period. Mutual funds may pass through to investors any qualified dividends it receives. At the fund level, these may be applied to ordinary income and/or short-term capital gains distributions.

Where Is The Qualified Dividends And Capital Gain Tax Worksheet ... Locate ordinary dividends in Box 1a, qualified dividends in Box 1b and total capital gain distributions in Box 2a. Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax amount.

Qualified Dividends and Capital Gain Tax - taxact.com Qualified Dividends and Capital Gain Tax. Information reported to you on Form 1099-DIV and Form 1099-B can be entered in the TaxAct program in the Investment Income section of the Federal QA, or directly on the forms where applicable. The Tax Summary screen will indicate if the tax has been computed on the Schedule D Worksheet or the Qualified ...

Qualified Dividends and Capital Gains Worksheet.pdf Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records Before you begin: See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 11b. If you do not have to file Schedule D and you received capital gain distributions, be sure you checked the box on Form 1040 ...

Are Dividends Capital Gains? | Differences & Deciding Which Is Better Non-qualified dividends are those that do not meet the requirements set forth by the IRS. These dividends are taxed at a higher rate than qualified dividends. Types of Capital Gains. Capital gains can be short-term or long-term: Short-Term Capital Gains. Short-term capital gains are taxed at your ordinary income tax rate.

2022 Instructions for Schedule D (2022) - IRS tax forms If you had any section 1202 gain or collectibles gain or (loss), enter the total of lines 1 through 4 of the 28% Rate Gain Worksheet. Otherwise, enter -0- ... complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 16, (or in the instructions for Form 1040-NR, line 16) to figure your tax. ...

1040 capital gains worksheet 33 Qualified Dividends And Capital Gain Tax Worksheet Line 44 dontyou79534.blogspot.com. dividends. Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 - Page worksheet.middleworld.net. irs fillable gains losses gain templateroller dividends. 1040 28 Rate Gain Worksheet - Worksheet Template Design cheaperpetsafeinvisiblefence ...

1040 qualified dividends and capital gains worksheet 34 Qualified Dividends And Capital Gain Tax Worksheet Line 44. 17 Pictures about 34 Qualified Dividends And Capital Gain Tax Worksheet Line 44 : 1040 Qualified Dividends Worksheet - Worksheet List, irs qualified dividends and capital gain tax worksheet - rap.iworksheet.co and also Download Instructions for IRS Form 1040 Schedule D Capital Gains and.

Tax Cuts and Jobs Act, Provision 11011 Section 199A - Qualified ... *Note: for purposes of IRC section 199A, net capital gain is net long-term capital gain over net short-term capital loss, as defined by IRC section 1222(11), plus any qualified dividend income, as defined in section 1(h)(11), for the taxable year. As such, net capital gain for purposes of IRC section 199A cannot, by definition, be negative.

How to Figure the Qualified Dividends on a Tax Return Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax amount.

Qualified Dividends and Capital Gains Flowchart - The Tax Adviser The complexity comes from the phaseout of the 0% and 15% rates as other taxable income rises. It takes 27 lines in the IRS qualified dividends and capital gain tax worksheet to work through the computations (Form 1040 Instructions (2013), p. 43). With a good understanding of the mechanics, preparers can spot opportunities to advise clients to ...

Qualified Dividends and Capital Gain Tax Worksheet." - Intuit Click Forms in the upper right (upper left for Mac) and look through the "Forms In My Return" list and open the Qualified Dividends and Capital Gain Tax Worksheet. The "Line 44 worksheet" is also called the Qualified Dividends and Capital Gain Tax Worksheet. June 7, 2019 4:12 PM. It is actually labeled as "QualDiv/Cap Gn" on the forms listing ...

How to Download Qualified Dividends and Capital Gain Tax Worksheet ... Qualified Dividends and Capital Gain Tax Worksheet. The worksheet is part of Form 1040 which is mandatory for every individual tax filer as well as joint filers. The worksheet has 27 lines, and all fields must be filled according to relevant information. Tax filers with qualified dividends and capital gains have to fill the relevant worksheet.

:max_bytes(150000):strip_icc()/1099-DIV-ffc2266fbad34acd9de5359089733572.jpg)

0 Response to "41 qualified dividends and capital gain tax worksheet"

Post a Comment