38 worksheet for figuring net earnings loss from self employment

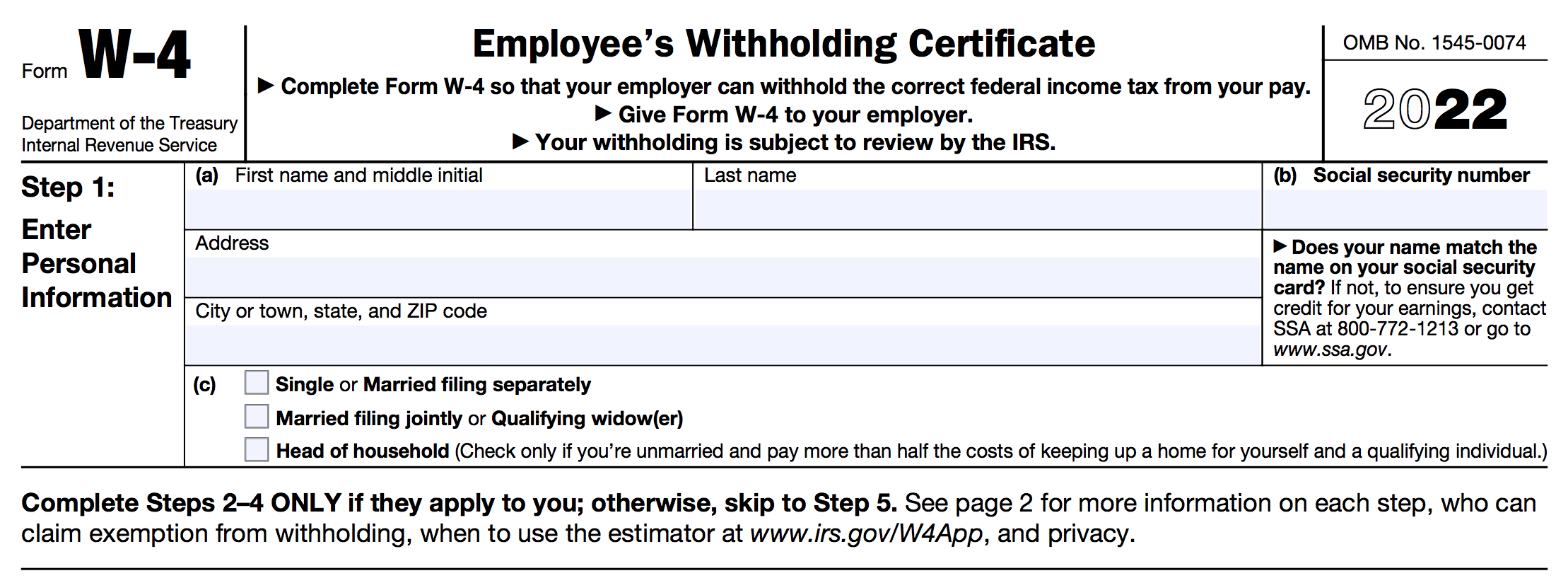

Publication 505 (2022), Tax Withholding and Estimated Tax WebIf you expect to have income from self-employment, use Worksheet 2-3 to figure your expected self-employment tax and your allowable deduction for self-employment tax. Include the amount from Worksheet 2-3 in your expected adjustments to income. If you file a joint return and both you and your spouse have net earnings from self-employment, … › publications › p536Publication 536 (2021), Net Operating Losses (NOLs) for ... Figured separately, his NOL is $1,800 and her NOL is $3,000. The sum of their separate NOLs ($4,800) is less than their $5,000 joint NOL because his deductions included a $200 net capital loss that is not allowed in figuring his separate NOL. The loss is allowed in figuring their joint NOL because it was offset by Nancy's capital gains.

Publication 590-B (2021), Distributions from Individual Retirement ... WebNet Investment Income Tax (NIIT). For purposes of the NIIT, net investment income doesn't include distributions from a qualified retirement plan (for example, 401(a), 403(a), 403(b), or 457(b) plans, and IRAs). However, these distributions are taken into account when determining the modified adjusted gross income threshold. Distributions from a …

Worksheet for figuring net earnings loss from self employment

1065-US: Calculating Schedule K, line 14a - Net earnings from self ... UltraTax CS calculates self-employment earnings (SE) per activity for partners in the Partner's Self-Employment Worksheet based on the type of partner selected in the Partner tab in the Partner Information window in View > Partner Information. General Partner and LLC Member (SE Income) calculate SE for all applicable items. SI 00820.200 Net Earnings from Self-Employment (NESE) TN 48 (11-08) SI 00820.200 Net Earnings from Self-Employment (NESE) CITATIONS: Sections 1612 (a) (1) (B) and 211 of the Social Security Act ; 20 CFR 416.1110 (b), 416.1111 (b), and 404.1065 - 404.1096 A. Definition of NESE NESE is the gross income from any trade or business less allowable deductions for that trade or business. SI 00820.210 How to Determine Net Earnings from Self-Employment (NESE) SI 00820.210 How to Determine Net Earnings from Self-Employment (NESE) A. Policy 1. Determining monthly NESE NESE is determined on a taxable year basis. The yearly NESE is divided equally among the months in the taxable year to get the NESE for each month. 2. Offsetting net loss

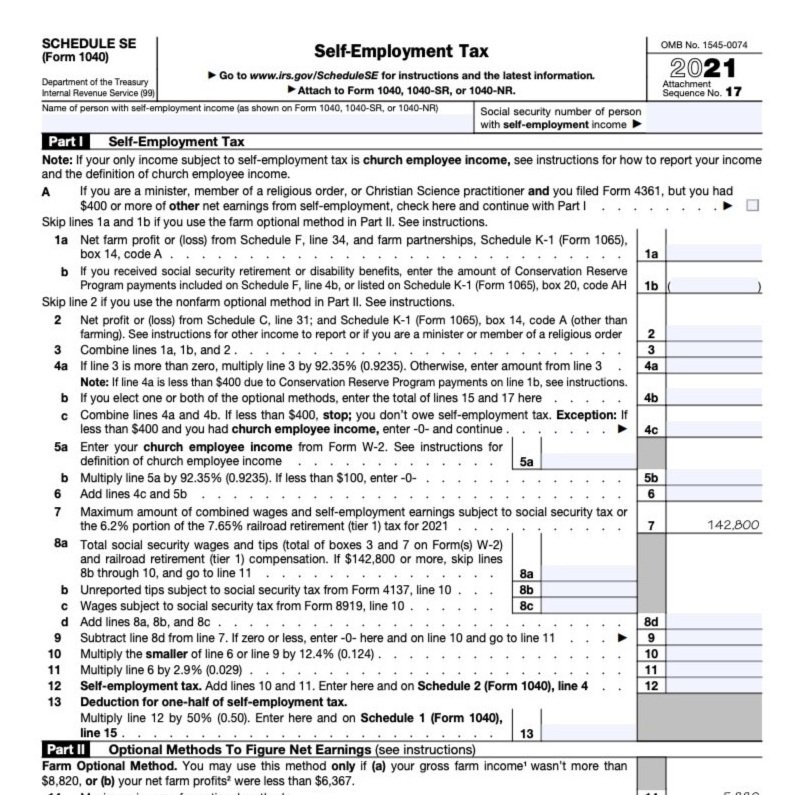

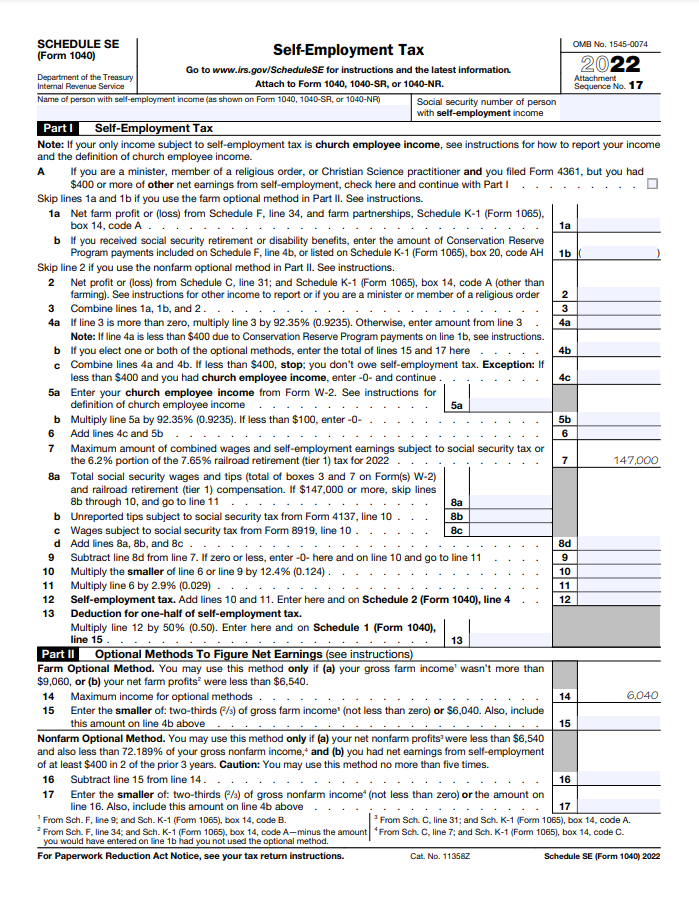

Worksheet for figuring net earnings loss from self employment. How to Calculate Self-Employment Income - Experian Calculating Your Income for a Mortgage Application. Mortgage lenders like to see stability—long employment histories and steady income. Most prefer to see at least two years of self-employment to show your ability to generate income over time. To calculate your monthly income for a mortgage application, start with this simple formula: Calculating Your Net Earnings From Self-Employment You must complete the following federal tax forms by April 15 following any year in which you have net earnings of $400 or more: Form 1040 (U.S. Individual Income Tax Return). Schedule C (Profit or Loss from Business) or Schedule F (Profit or Loss from Farming) as appropriate. Schedule SE (Self-Employment Tax). Publication 970 (2021), Tax Benefits for Education | Internal … WebWhen figuring an education credit or tuition and fees deduction, use only the amounts you paid and are deemed to have paid during the tax year for qualified education expenses. In most cases, the student should receive Form 1098-T from the eligible educational institution by January 31, 2022. However, the amount on Form 1098-T might be different from the … Schedule K-1 (Form 1065) - Self-Employment Earnings (Loss) SELF-EMPLOYMENT EARNINGS (LOSS) Line 14A - Net Earnings (Loss) from Self-Employment - Amounts reported in Box 14, Code A represent the amount of net earnings from self-employment. For Limited Partners this amount generally includes any guaranteed payments received for services rendered to or on behalf of the partnership.

› publications › p3Publication 3 (2021), Armed Forces' Tax Guide | Internal ... Publication 3 - Introductory Material What's New Reminders Introduction. Due date of return. File Form 1040 or 1040-SR by April 18, 2022. The due date is April 18, instead of April 15, because of the Emancipation Day holiday in the District of Columbia—even if you don’t live in the District of Columbia. Self-Employed Individuals - Calculating Your Own Retirement-Plan ... You can use the Table and Worksheets for the Self-Employed (Publication 560) to find the reduced plan contribution rate to calculate the plan contribution and deduction for yourself. Deducting retirement plan contributions Total limits on plan contributions depend in part on your plan type. See the contribution limits for your plan. Net Earnings from Self-Employment - Loopholelewy.com Schedule C net profit $20,000. $20,000 net profit carried to Schedule SE, Line 2. Line 2 net profit of $20,000 combined with any amounts, if any, on Lines 1a and 1b. Total of Lines 1a, 1b and 2 entered on Line 3. Line 3 amount multiplied by .9235. Assume no amounts on lines 1a and 1b. Multiply Line 3 amount, $20,000, by .9235 = $18,470. PDF Self-employment Income Worksheet - Ndhfa To calculate Income from Schedule C Profit or Loss from Business: Line 31 Net profit or (loss) Add Line 11 Contract labor: Add any part of the amount for contract labor that is paid to self or household members living in the unit AddLine 12 Depletion AddLine 13 Depreciation and Section 179 expense Deduction

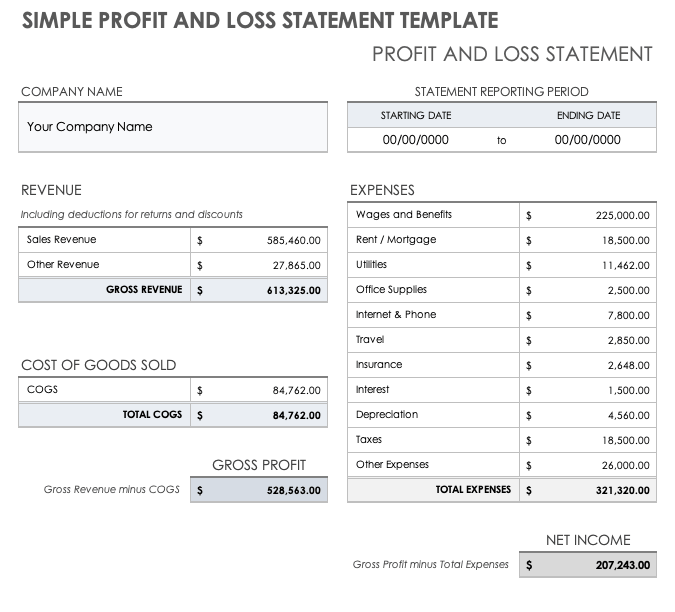

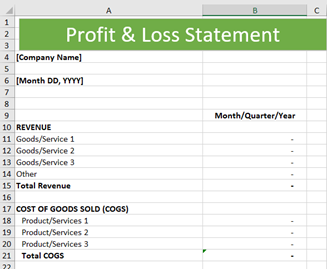

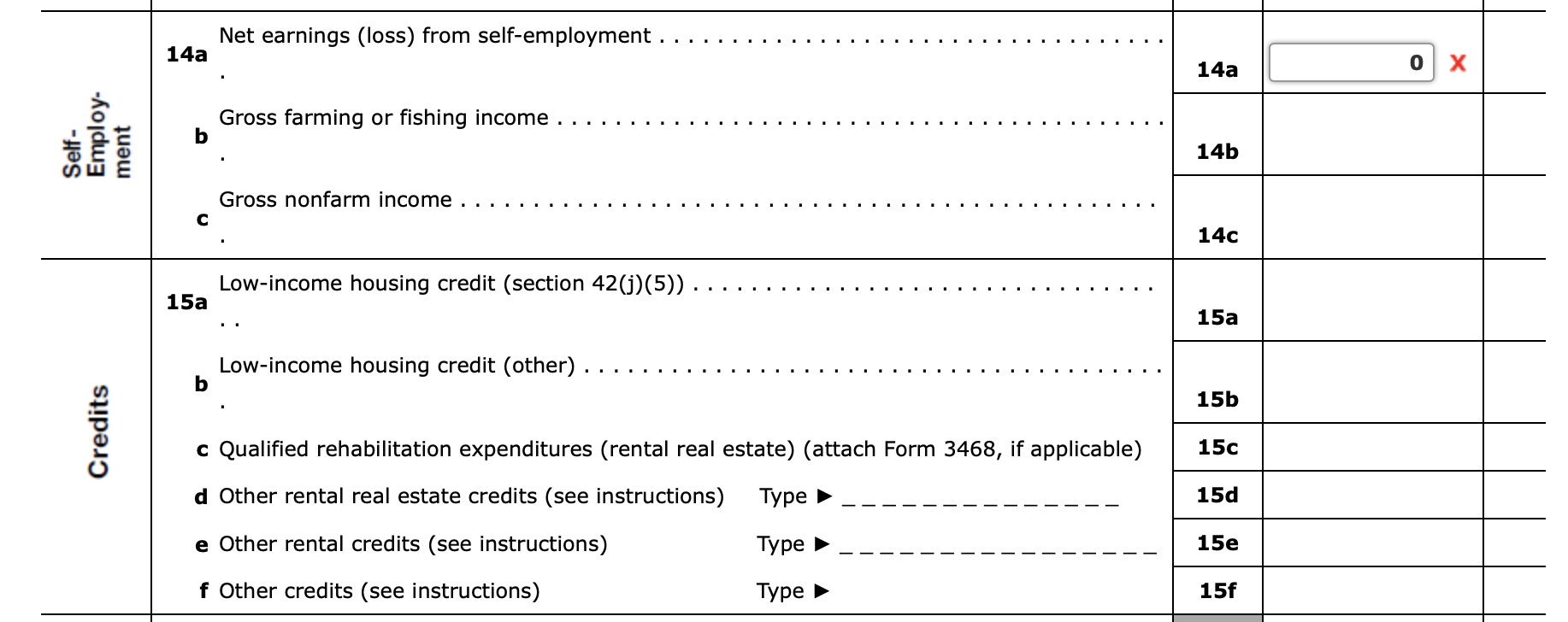

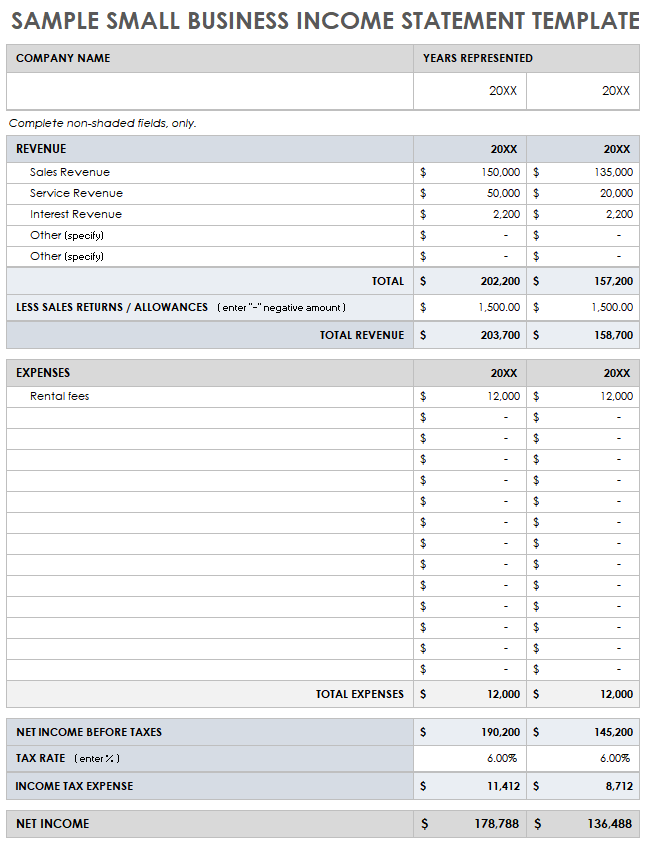

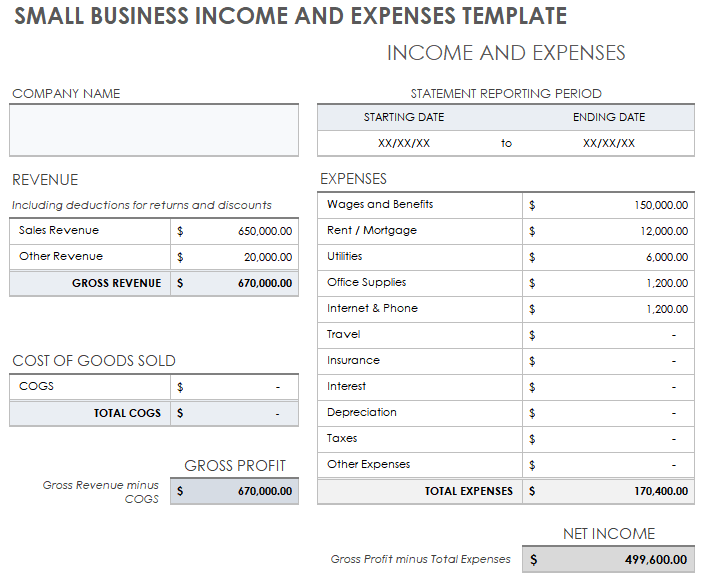

Self-Employment Income Worksheet: Partnership (Schedule K-1 ... INSTRUCTIONS: Complete all the fields on this worksheet. ... Name – Self-Employed Individual. Case Number ... 2 Net rental real estate income or loss. Publication 560 (2021), Retirement Plans for Small Business WebNot everyone who has net earnings from self-employment for social security tax purposes is self-employed for qualified plan purposes. See Common-law employee and Net earnings from self-employment, earlier. In addition, certain fishermen may be considered self-employed for setting up a qualified plan. See Pub. 595, Capital Construction Fund for ... Publication 575 (2021), Pension and Annuity Income WebForm 8915-F replaces Form 8915-E. Form 8915-F, Qualified Disaster Retirement Plan Distributions and Repayments, replaces Form 8915-E for reporting qualified 2020 disaster distributions and repayments of those distributions made in 2021 and 2022, as applicable.In previous years, distributions and repayments would be reported on the applicable Form … Simple Profit and Loss Statement for the Self-Employed If you're a self-employed worker or business owner, a profit and loss statement is an absolute necessity to: Reveal if your business is profitable or losing money, Provide the information you need to make sound business decisions, and Report financial information to interested parties, including your accountant, tax attorney, investors, and banks.

SELF EMPLOYMENT INCOME WORKSHEET (if a net loss is incurred during any of the months listed, then that month's income will equal zero, not a negative value. ) > Allowable expenses that can be ...

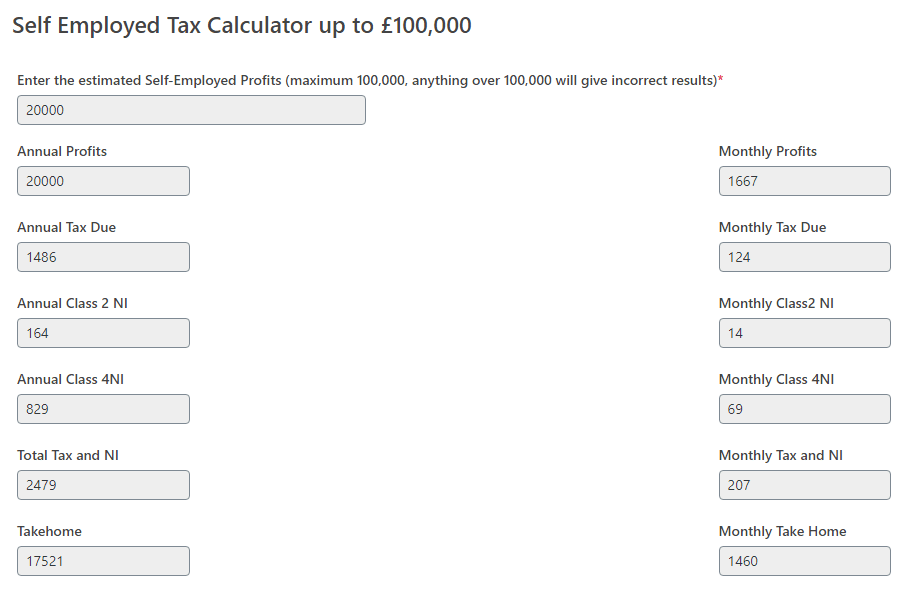

Calculating Net Earnings for Business Taxes - The Balance Small Business Net earnings (also called net income or profit) is your gross business income minus business expenses. No matter what kind of business you have, you begin with gross income and deduct allowable expenses to get net income. Gross income is the income received directly by an individual, before any withholding, deductions, or taxes.

5 Look at the Worksheet for Figuring Net Earnings Loss from Self ... That sec 179 expenses should reduce self - employment income , something not on the worksheet . Also , TAM 9750001 says that SE losses are only usable against ...

Publication 590-A (2021), Contributions to Individual Retirement ... WebCompensation includes earnings from self-employment even if they aren’t subject to self-employment tax because of your religious beliefs. Self-employment loss. If you have a net loss from self-employment, don’t subtract the loss from your salaries or wages when figuring your total compensation. Alimony and separate maintenance. For IRA purposes, …

2022 Instructions for Schedule SE (2022) | Internal Revenue Service Use Schedule SE (Form 1040) to figure the tax due on net earnings from self-employment. The Social Security Administration uses the information from Schedule SE to figure your benefits under the social security program. This tax applies no matter how old you are and even if you are already getting social security or Medicare benefits.

5 look at the worksheet for figuring net earnings - Course Hero - In general, Line1, 3c, and 4 are involved in the calculation of Self-Employment income. Line 1---Ordinary business income (Loss) Line 3C---Other net rental income (Loss) Line 4---Guaranteed payments to partners - In a partner's self-employment income, the guaranteed payment included are payments to partners derived from a trade or business.

Schedule K Line 14a (Form 1065) Calculating Self-Employment Earnings Lacerte computes line 14a using the Worksheet for Figuring Net Earnings (Loss) From Self-Employment from page 41 of the 1065 form instructions. To generate Lacerte's version of the Self-Employment worksheet: Click on Settings. Click on Options. Select the Tax Return tab. Scroll down to the Federal Tax Options section.

Reporting Self-Employment Income to the Marketplace Filling out your Marketplace application On your Marketplace application, you'll report your net income from your self-employment. (Net income is sometimes called "profit.") If your self-employment income is higher than your business expenses, you report this net income. If your business expenses are higher than your income, you report a net loss.

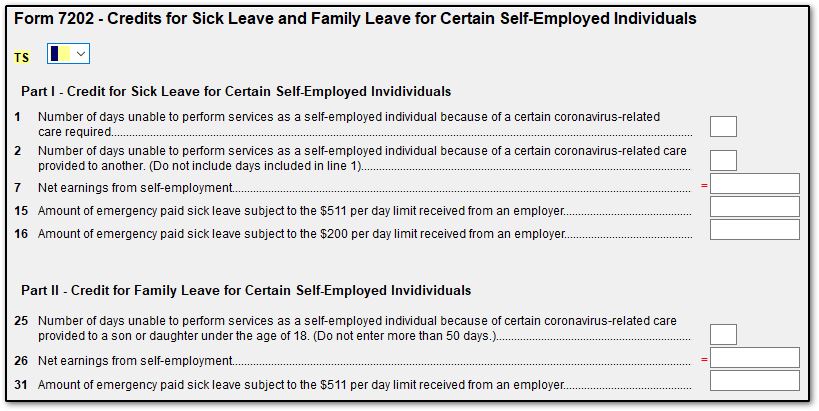

How do I generate Schedule SE, page 2 in an Individual return using ... Self employment income entered will automatically produce Schedule SE if earnings are above $400. Business Income: Go to the Income/Deductions > Business worksheet. Select section 2 - Income and Cost of Goods Sold . Enter line 1 - Gross Receipts or sales. Partnership Passthrough: Go to the Income/Deductions > Partnership Passthrough worksheet.

› publications › p505Publication 505 (2022), Tax Withholding and Estimated Tax If self-employed, first complete Worksheet 2-3 to figure your expected deduction for self-employment tax. Subtract the amount from Worksheet 2-3, line 11, to figure the line 1 entry: 1. 2. If you: • Don’t plan to itemize deductions on Schedule A (Form 1040), use Worksheet 2-4 to figure your expected standard deduction. •

› publications › p560Publication 560 (2021), Retirement Plans for Small Business Distributions of other income or loss to limited partners aren't net earnings from self-employment. For SIMPLE plans, net earnings from self-employment are the amount on line 4 Schedule SE (Form 1040), Self-Employment Tax, before subtracting any contributions made to the SIMPLE plan for yourself.

Topic No. 554 Self-Employment Tax | Internal Revenue Service Oct 13, 2022 ... All of your net earnings are subject to the Medicare tax. Optional Methods. If you had a loss or small amount of income from your self- ...

Free Profit and Loss Templates | Smartsheet Download Self-Employed Profit and Loss Template Microsoft Excel | Adobe PDF | Google Sheets Self-employed people and freelancers have unique needs. This self-employed profit and loss template takes these requirements into account by breaking out income by client and by using expense categories that apply to people who work for themselves.

1065 Preparation and Planning Guide 2009 Sidney Kess, Barbara Weltman · 2008 · Business & EconomicsSee Passive Activity Self - Employment Reporting Requirements on page 13 . ... from Worksheet for Figuring Net Earnings ( Loss ) From Self - Employment 3a ...

Publication 334 (2021), Tax Guide for Small Business WebThe maximum net self-employment earnings subject to the social security part of the self-employment tax is $147,000 for 2022. Standard mileage rate. For 2022, the standard mileage rate for the cost of operating your car, van, pickup, or panel truck for each mile of business use is 58.5 cents a mile. Reminders. Self-employed tax payments deferred in …

How To Calculate Self Employment Income for a Mortgage | 2022 To get approved, you'll need: A FICO score of at least 580. A debt-to-income ratio below 50 percent. A 3.5% down payment. It's possible to find an FHA lender willing to approve a loan even if your credit score falls as low as 500, but the lender would require a 10 percent down payment instead of the usual 3.5 percent.

Self Employed Profit and Loss Statement Template Your net profit (or loss) is the bottom line of your P&L statement. This is used to determine if the business is profitable or not and by how much. If the result indicates a profit, it means you made more money than you spent. If the results show a loss, it means you spent more than you earned. To manage your business accordingly, creating a ...

How do I calculate self-employment income in a 1065 for all limited ... Go to Partners > Partner Information worksheet. Select the applicable partner. Select Detail. Expand Section 3 - Guaranteed Payments / Partner Options. In Line ...

SSA Handbook § 1200 - Social Security Administration To calculate the net earnings from self-employment, follow the steps below: Add up your total gross income as calculated under the income tax law. Include income from all your trades and businesses. Subtract all the deductions, including the allowances for depreciation that you are allowed when you calculate your income tax from the result in (A).

1040 (2021) | Internal Revenue Service - IRS tax forms WebBut, in figuring gross income, don’t reduce your income by any losses, including any loss on Schedule C, line 7, or Schedule F, line 9. ... You had net earnings from self-employment of at least $400. 4. You had wages of $108.28 or more from a church or qualified church-controlled organization that is exempt from employer social security and …

How to Calculate Lost Earnings if You're Self Employed Maryland law is clear that when a victim of negligence is in business for herself, loss of profits is the same thing as loss of earnings from personal services. So lost profit is the key to and calculating damages for an injury claim. If you are a small business owner, documenting self-employment income to compute lost earnings can be complicated.

Understanding Schedule K-1 self-employment income for partners ... - Intuit The program creates a worksheet to show the calculation of net earnings from self-employment. Follow these steps to view the Self-Employment Worksheet: Go to the Forms tab. Select Worksheets from the left-side Form window. Select Self-Emp. Worksheet from the left-side Page window. How do I enter adjustments or overrides for self-employment income?

Impact of Self-Employment Loss on Earned Income - Journal of Accountancy The worksheet says, "Generally, your earned income is the total of the amounts reported on form 1040, lines 7 (wages), 12 (business income or loss), and 18 (farm income or loss) minus the amount, if any, on line 27 (self-employment tax deduction).". In Allyson Christina Briggs v. Commissioner, TC summary opinion 2004-22, the issue for the ...

1084 self employed worksheet worksheet income rental calculation mae fannie fillable 1084 cash flow sam form. 29 Worksheet For Figuring Net Earnings Loss From Self Employment - Free dotpound.blogspot.com. worksheet self employment income template figuring earnings worksheets tax plan motivation worksheeto loss care printable. Cash Flow Analysis (Form 1084): PDF studylib.net

Net Earnings from Self-Employment - SocialSecurityHop.com To calculate the net earnings from self-employment, follow the steps below: Add up your total gross income as calculated under the income tax law. Include income from all your trades and businesses. Subtract all the deductions, including the allowances for depreciation that you are allowed when you calculate your income tax from the result in (A).

Metropolitan commuter transportation mobility tax (MCTMT) individual ... Net earnings from self-employment Net earnings from self-employment means your net earnings from self-employment as defined under Section 1402(a) of the Internal Revenue Code (IRC). Generally, this is the amount computed on federal Schedule SE (Form 1040), Part 1, line 6. Section 1402(b) defines self-employment income subject to Social Security ...

Publication 550 (2021), Investment Income and Expenses Web8960 Net Investment Income Tax—Individuals ... and the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet: Gain or loss from exchanges of like-kind investment property : Line 7; also use Schedule D, Form 8824, and the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet *Report …

WSHFC | AMC | Forms-RC | Self-Employment Income Worksheet Line 31: Net profit or (loss). Add Line 11: Contract labor: Add any part of the amount for contract labor that is paid to self or household members living ...

› publications › p590bPublication 590-B (2021), Distributions from Individual ... Jim decides to make a qualified charitable distribution of $6,500 for 2022. Jim completes his 2022 QCD worksheet by entering the amount of the remainder of the aggregate amount of the contributions he deducted in 2020 and 2021 ($4,000) on line 1. This amount is figured on his 2021 QCD worksheet and is entered on line 1 of his 2022 QCD worksheet.

5 Look at the Worksheet for Figuring Net Earnings Loss from Self ... Look at the Worksheet for Figuring Net Earnings (Loss) from Self-Employment(p. 35 for 2016) of the Form 1065 instructions. What lines from Schedule K are,in general, involved in the calculation of Self-Employment income? Line 1, 3c,and 4What guaranteed payments are included in a partner's self-employmentincome?

Net Earnings (Loss) Definition | Law Insider Worksheet for Figuring Net Earnings (Loss) From Self-Employment 1a Ordinary income (loss) (Schedule K, line 1) b Net income (loss) from certain rental real estate activities (see instructions) c Net income (loss) from other rental activities (Schedule K, line 3c) d Net loss from Form 4797, Part II, line 18, included on line 1a above.

Publication 536 (2021), Net Operating Losses (NOLs) for Individuals ... WebWorksheet 1. Figuring Your NOL. Use Worksheet 1 to figure your NOL. The following discussion explains Worksheet 1. See the Instructions for Form 1045. If line 1 is a negative amount, you may have an NOL. Nonbusiness capital losses (line 2). Don’t include on this line any section 1202 exclusion amounts (even if entered as a loss on Schedule D (Form …

› publications › p590aPublication 590-A (2021), Contributions to Individual ... Tom can take a deduction of only $5,850. Using Worksheet 1-2, Figuring Your Reduced IRA Deduction for 2021, Tom figures his deductible and nondeductible amounts as shown on Worksheet 1-2. Figuring Your Reduced IRA Deduction for 2021—Example 1 Illustrated. He can choose to treat the $5,850 as either deductible or nondeductible contributions.

› publications › p970Publication 970 (2021), Tax Benefits for Education | Internal ... When figuring an education credit or tuition and fees deduction, use only the amounts you paid and are deemed to have paid during the tax year for qualified education expenses. In most cases, the student should receive Form 1098-T from the eligible educational institution by January 31, 2022.

PDF Income Calculations - Freddie Mac Form 91 is to be used to document the Seller's calculation of the income for a self-employed Borrower. This form is a tool to help the Seller calculate the income for a self-employed Borrower; the Seller's calculations must be based on the requirements and guidance for the determination of stable monthly income in Topic 5300.

SI 00820.210 How to Determine Net Earnings from Self-Employment (NESE) SI 00820.210 How to Determine Net Earnings from Self-Employment (NESE) A. Policy 1. Determining monthly NESE NESE is determined on a taxable year basis. The yearly NESE is divided equally among the months in the taxable year to get the NESE for each month. 2. Offsetting net loss

SI 00820.200 Net Earnings from Self-Employment (NESE) TN 48 (11-08) SI 00820.200 Net Earnings from Self-Employment (NESE) CITATIONS: Sections 1612 (a) (1) (B) and 211 of the Social Security Act ; 20 CFR 416.1110 (b), 416.1111 (b), and 404.1065 - 404.1096 A. Definition of NESE NESE is the gross income from any trade or business less allowable deductions for that trade or business.

1065-US: Calculating Schedule K, line 14a - Net earnings from self ... UltraTax CS calculates self-employment earnings (SE) per activity for partners in the Partner's Self-Employment Worksheet based on the type of partner selected in the Partner tab in the Partner Information window in View > Partner Information. General Partner and LLC Member (SE Income) calculate SE for all applicable items.

![How to Prepare a Profit and Loss Statement [Free Template]](https://assets-blog.fundera.com/assets/wp-content/uploads/2019/05/22094451/profit-and-loss-statement.jpg)

0 Response to "38 worksheet for figuring net earnings loss from self employment"

Post a Comment