38 rental income calculation worksheet

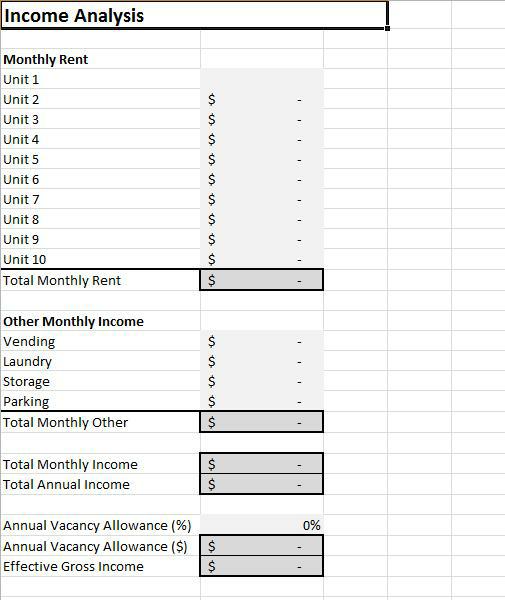

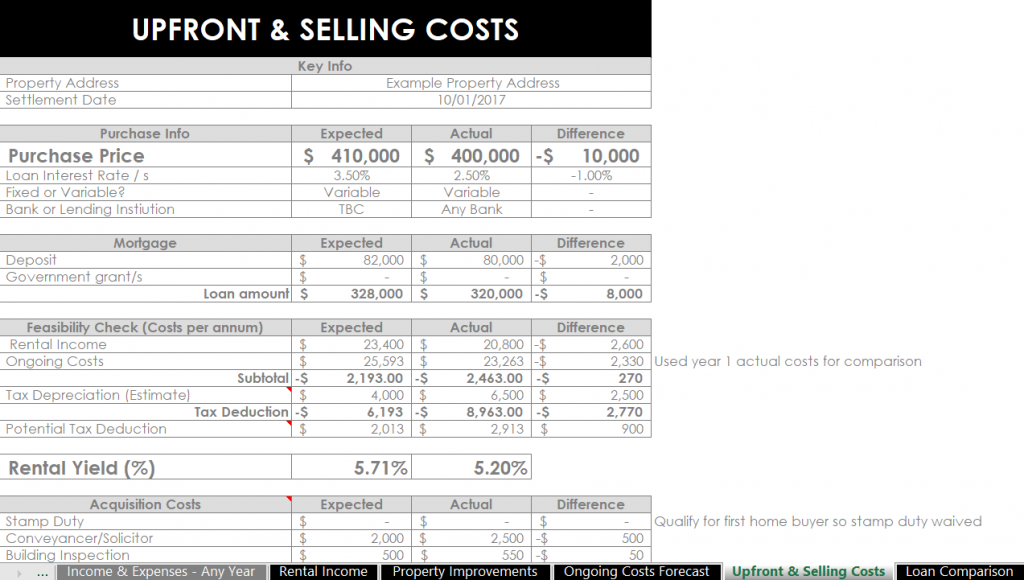

Rental Income - Canada.ca To calculate your rental income or loss, fill in the areas of the form that apply to you. This chapter explains how to calculate your rental income or loss, as well as how to fill in the "Income" and "Expenses" parts of the form. ... Worksheet for the return (for all except non-residents). See line 22100 in the Federal Income Tax and Benefit ... Arch Mortgage | USMI - Calculators Qualifying Income Calculator (AMIQuiC) A Set of Arch MI Qualifying Income Calculator Tools. Download XLSX. ... Individual Rental Income from Investment Property(s) (up to 10 properties) Download XLXS. Freddie Mac Form 92 Schedule E - Net Rental Income Calculations.

HOPWA Income Eligibility Worksheet & Tenant Income and Rent Calculation ... This Excel workbook was created to assist HOPWA grantees and project sponsors determine household income eligibility for all HOPWA program activities, except Housing Information Services, which does not require an income eligibility assessment. Resource Links. HOPWA Income Eligibility Worksheet & Tenant Income and Rent Calculation Worksheet (XLSX)

Rental income calculation worksheet

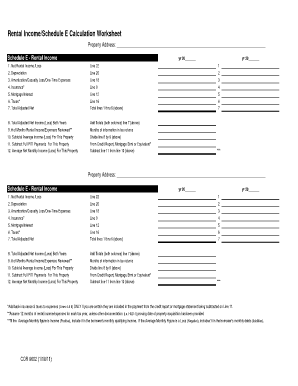

PDF Net Rental Income Calculations - Schedule E - Freddie Mac Refer to Section 5306.1(c)(iii) for net rental Income calculation requirements . 2 . Refer to Chapter 5304 and Form 91 for the treatment of all rental real estate income or loss reported on IRS Form 8825, regardless of Borrower's percentage of ownership interest in the buisiness or whether the Borrower is personally obligated on Single-Family Homepage | Fannie Mae Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) ... Calculate monthly qualifying rental income (loss) using Step 2A: Schedule E OR Step 2B: Lease Agreement or Fannie Mae Form 1007 or Form 1025. A1 Enter total rents received. A2 Subtract A3 Add A4 A5 A6 B3-3.1-08, Rental Income (05/04/2022) - Fannie Mae Fannie Mae publishes four worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The worksheets are: Rental Income Worksheet - Principal Residence, 2- to 4-unit Property , Rental Income Worksheet - Individual Rental Income from Investment Property(s) (up to 4 properties) ,

Rental income calculation worksheet. Hud Rent Calculation Worksheet Excel Form - signNow Section 8 Rent Calculation Worksheet. Check out how easy it is to complete and eSign documents online using fillable templates and a powerful editor. Get everything done in minutes. ... Start signing hud income calculation worksheet by means of solution and become one of the millions of happy customers who've already experienced the benefits ... PDF Net Rental Income Calculations - Schedule E - Arch Mortgage Refer to Section 5306.1(c)(iii) for net rental Income calculation requirements . 2 . Refer to Chapter 5304 and Form 91 for the treatment of all rental real estate income or loss reported on IRS Form 8825, regardless of Borrower's percentage of ownership interest in the buisiness or whether the Borrower is personally obligated on PDF FHA REO NET RENTAL INCOME CALCULATION WORKSHEET JOB AID - Franklin American Notes for FHA REO Net Rental Income Calculation Worksheet usage: • Enable Macros before using the worksheet (if required). • Do not include one-unit Primary Residence on this worksheet. • Always refer to FAMC/Agency guidelines for correct Net Rental calculation. • Use additional worksheet for more properties than this worksheet allows. Income Analysis Worksheet | Essent Guaranty Our income analysis tools and worksheets are designed to help you evaluate qualifying income quickly and easily. ... Calculate the monthly qualifying income for a borrower who is a sole proprietor. Download Worksheet (PDF) ... Rental Income Generated From an ADU.

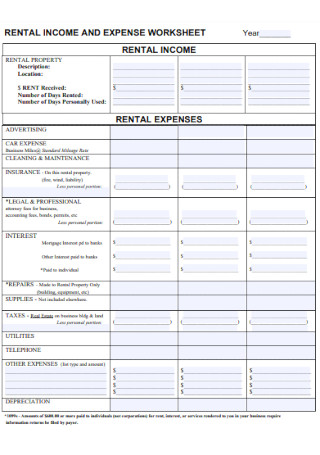

Mortgage industry tools and resources from MGIC Rethink MI: Fresh solutions for lenders and loan officers. If you think mortgage insurance is just for first-time homebuyers, it's time to rethink your MI strategy. MI Solutions can broaden your borrowers' financial options so they find the loan - and home - that's best for them. Where can I find rental income calculation worksheets? - Fannie Mae Fannie Mae publishes worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The rental income worksheets are: Principal Residence, 2- to 4-unit Property (Form 1037)*, Individual Rental Income from Investment Property (s) (up to 4 properties) (Form 1038)*, Individual Rental Income from Investment ... Rental Income and Expense Worksheet - Rentals Resource Center To download the free rental income and expense worksheet template, click the green button at the top of the page. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the "rental income" category or HOA dues, gardening service and utilities in the "monthly expense" category. Single-Family Homepage | Fannie Mae Monthly qualifying rental income (loss): Step 2. Calculate monthly qualifying rental income (loss) using Step 2A: Schedule E OR Step 2B: Lease Agreement or Fannie Mae Form 1007 or Form 1025. Step 1. When using Schedule E, determine the number of months the property was in service by dividing the Fair Rental Days by 30. Step 2A. Schedule E - Part I

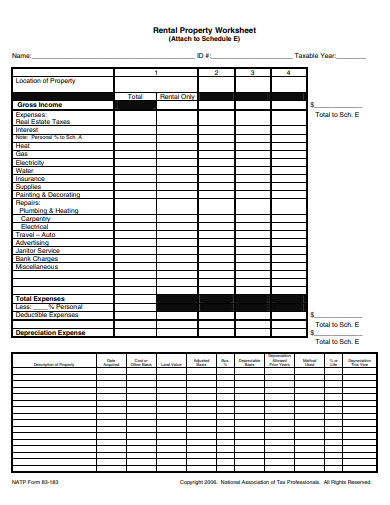

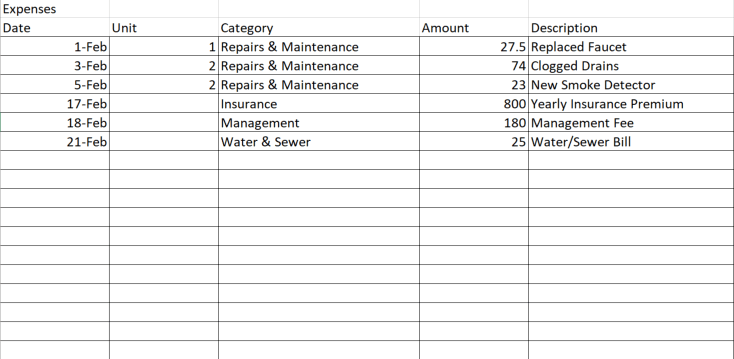

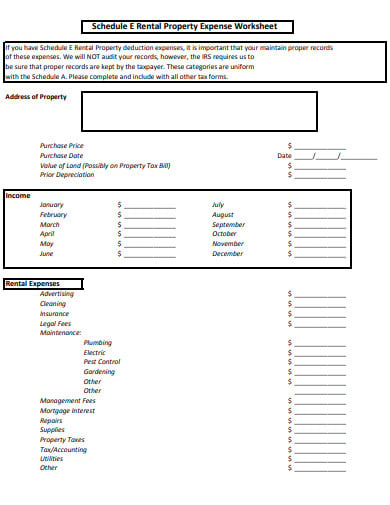

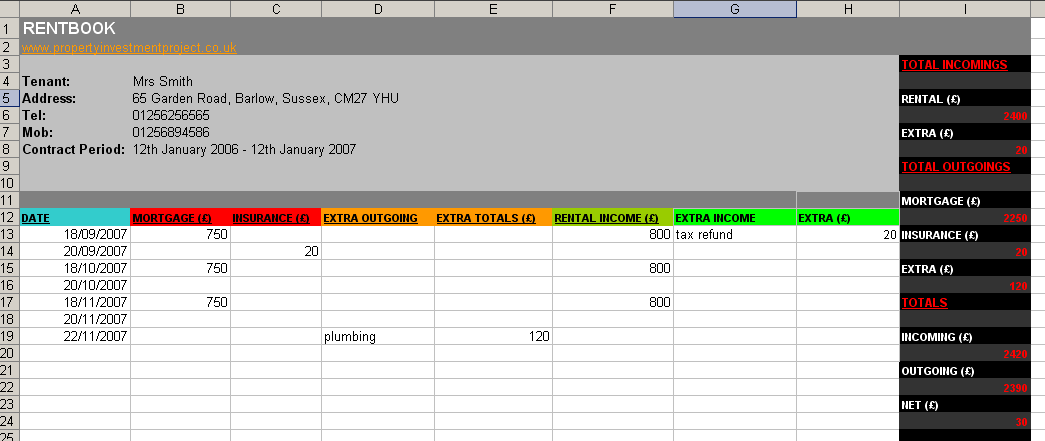

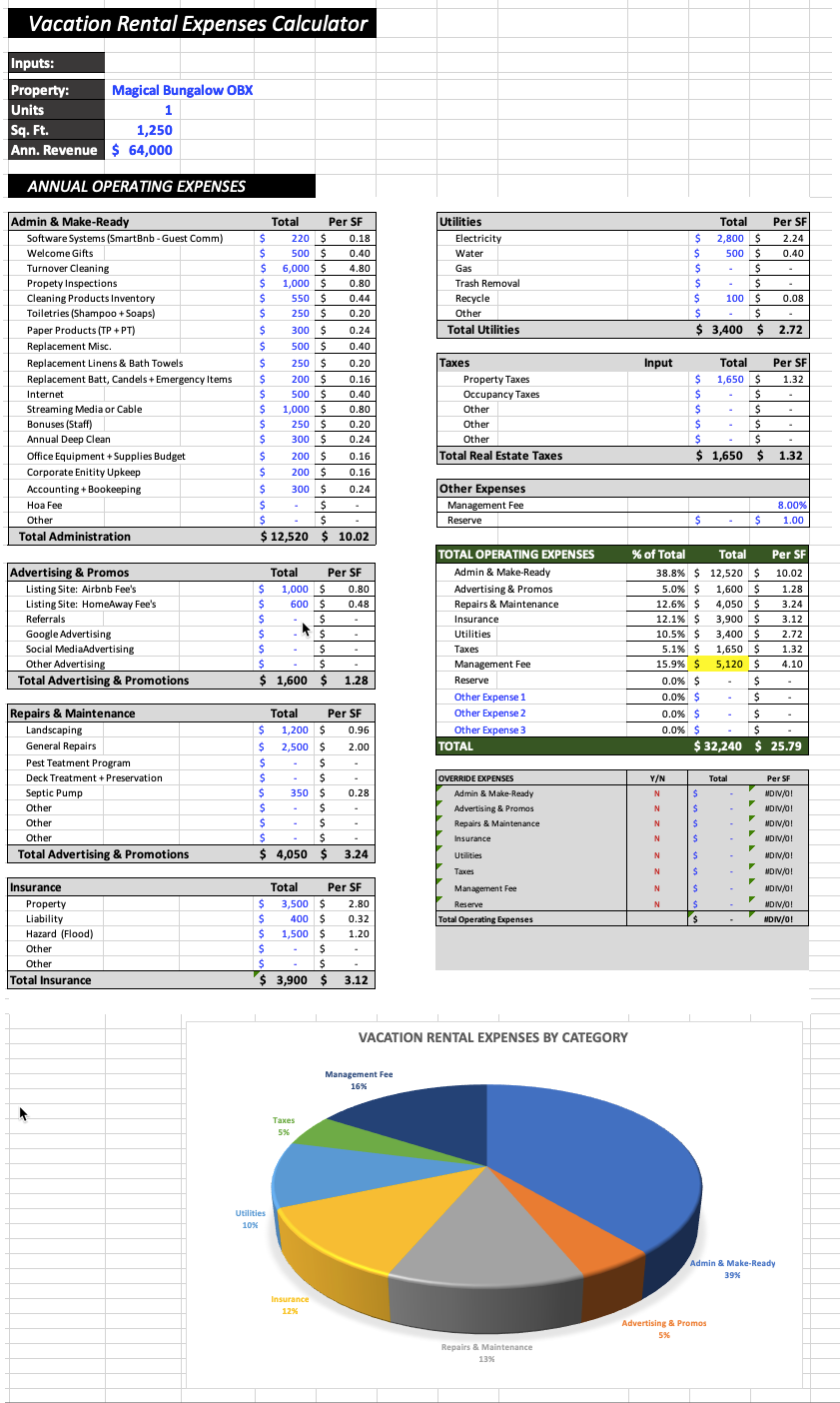

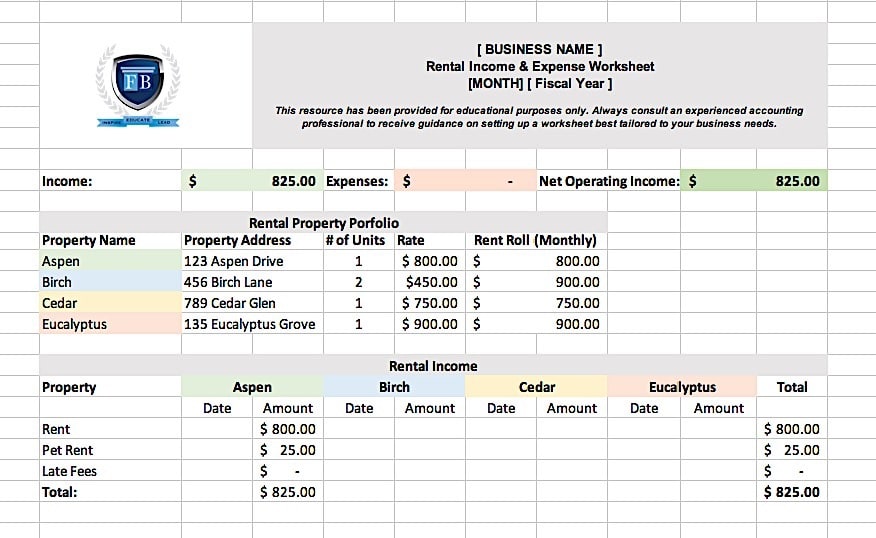

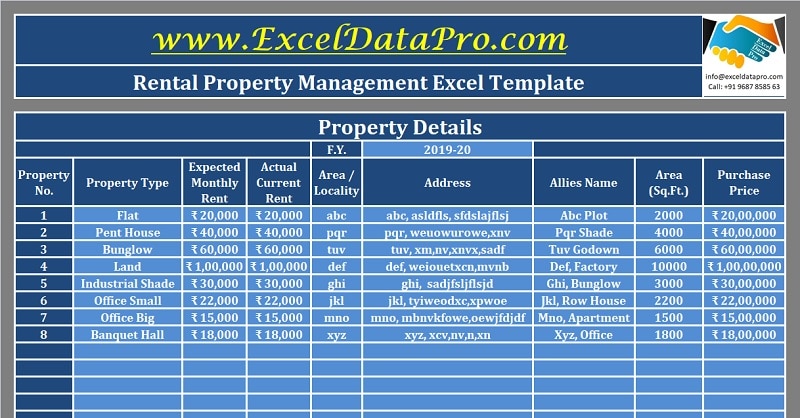

Rental Income and Expense Worksheet - PropertyManagement.com 1 Income and expenses are an essential part of effectively managing your rental. 2 Personalize your expenses with this worksheet. 3 Totals are automatically calculated as you enter data. 4 This sheet will also track late fees and any maintenance costs. To help you stay on top of your bookkeeping and generate the most value from your investment ... B3-3.1-08, Rental Income (05/04/2022) - Fannie Mae Fannie Mae publishes four worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The worksheets are: Rental Income Worksheet - Principal Residence, 2- to 4-unit Property , Rental Income Worksheet - Individual Rental Income from Investment Property(s) (up to 4 properties) , SEB cash flow worksheets - MGIC Updated for the 2021 tax year, our editable and auto-calculating cash flow analysis worksheets are fitted specifically for loan officers and mortgage pros. MGIC's self-employed borrower worksheets are uniquely suited for analyzing: Cash flow and YTD profit and loss (P&L) Comparative income. Liquidity ratios. PDF Income & Resident Rent Calculation Worksheet - HUD Exchange 6) Net income from operation of a business or profession. $0 . 7) Interest, dividends, and other net income of any kind from real or personal property. Where net family assets are in excess of $5,000, annual income shall include the . greater of actual income derived from net family assets or a percentage of the value

PDF Form 1038: Rental Income Worksheet - Enact MI Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) Documentation Required: ... Click the gray button to calculate the adjusted monthly rental income. If Line A9 is zero, "error" will show. Schedule E, Line 3 Schedule E, Line 20 Schedule E, Line 9 Schedule E, Line 12

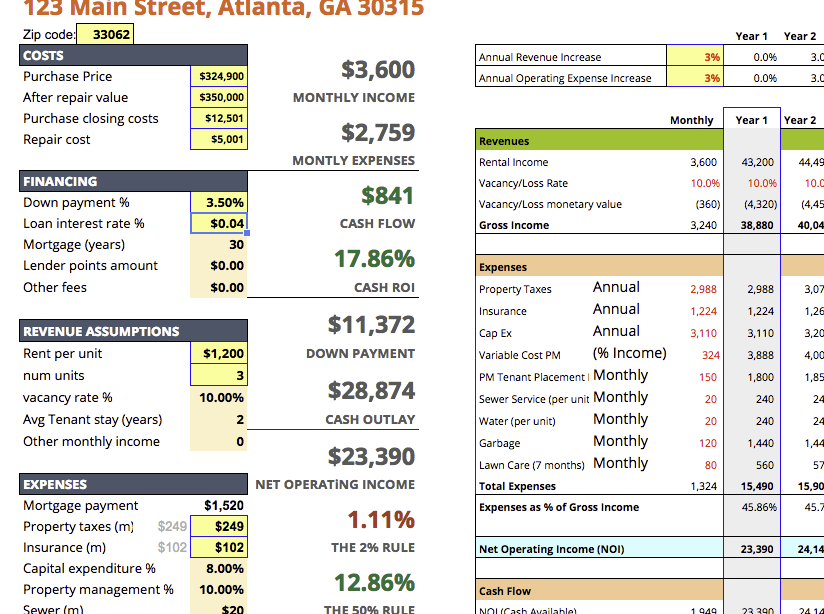

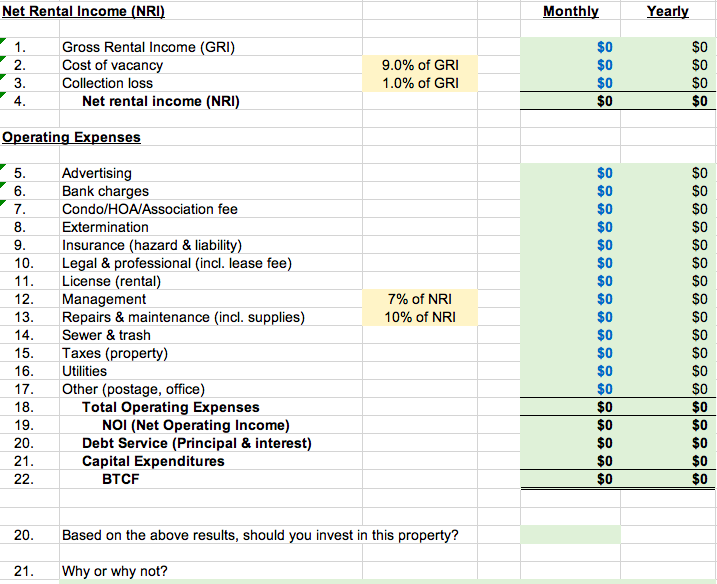

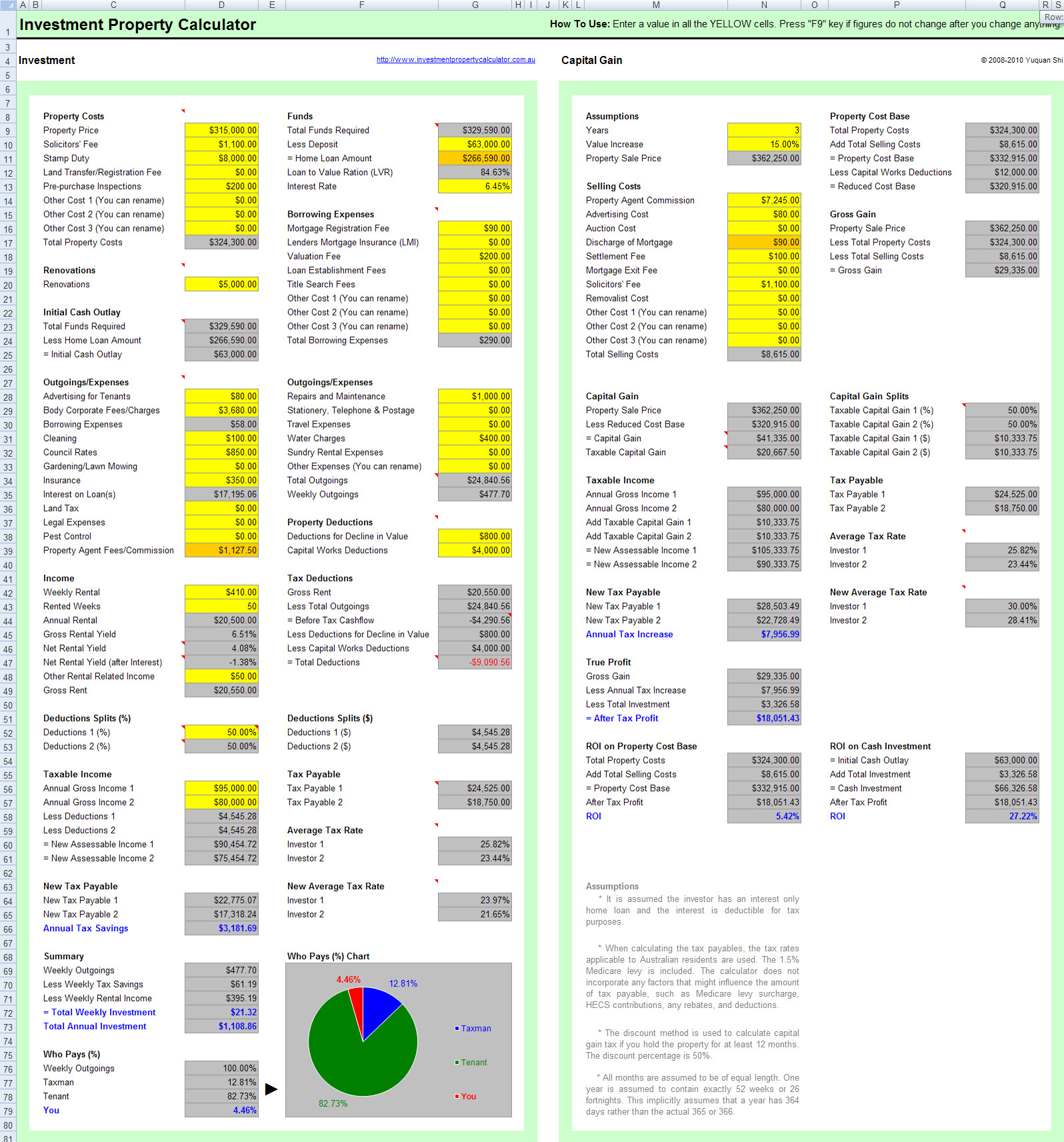

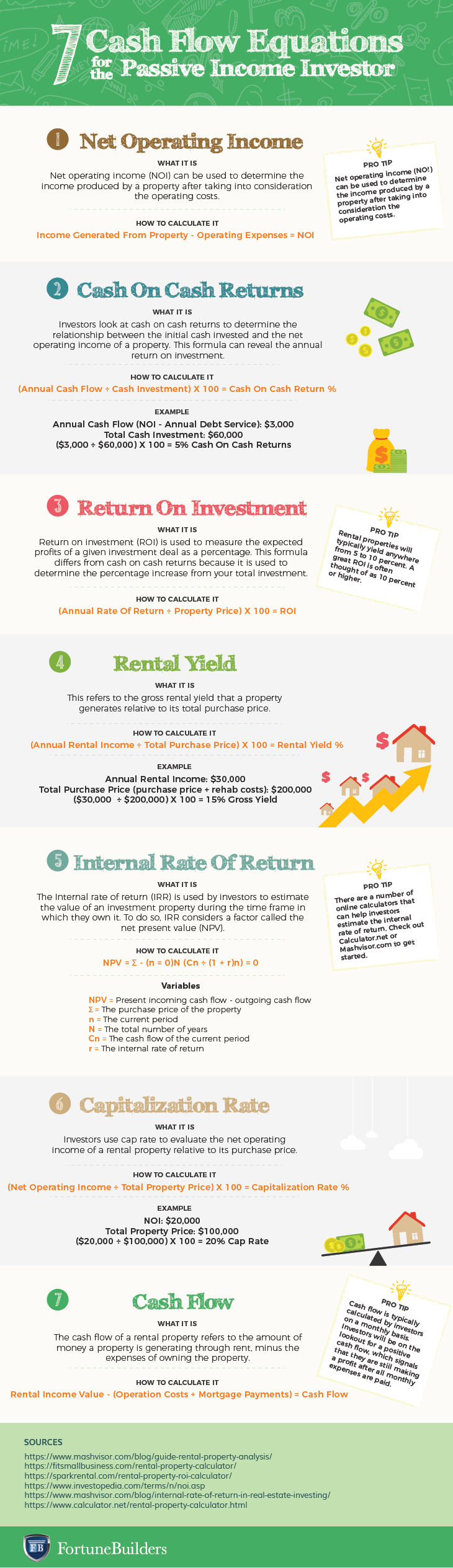

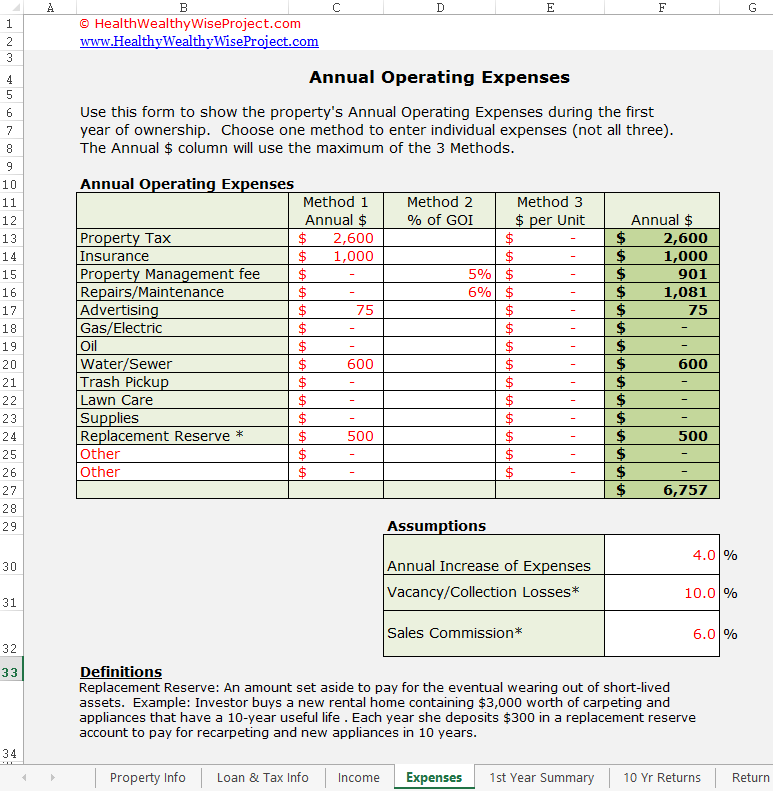

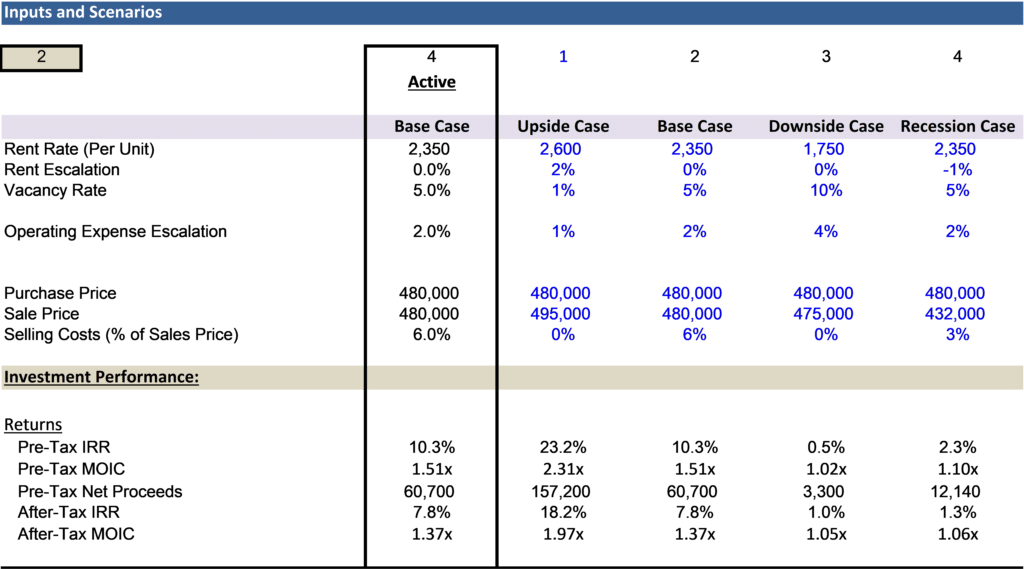

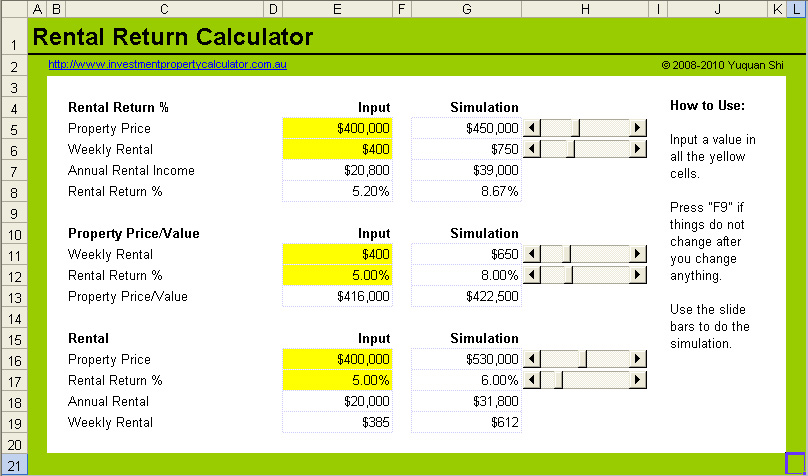

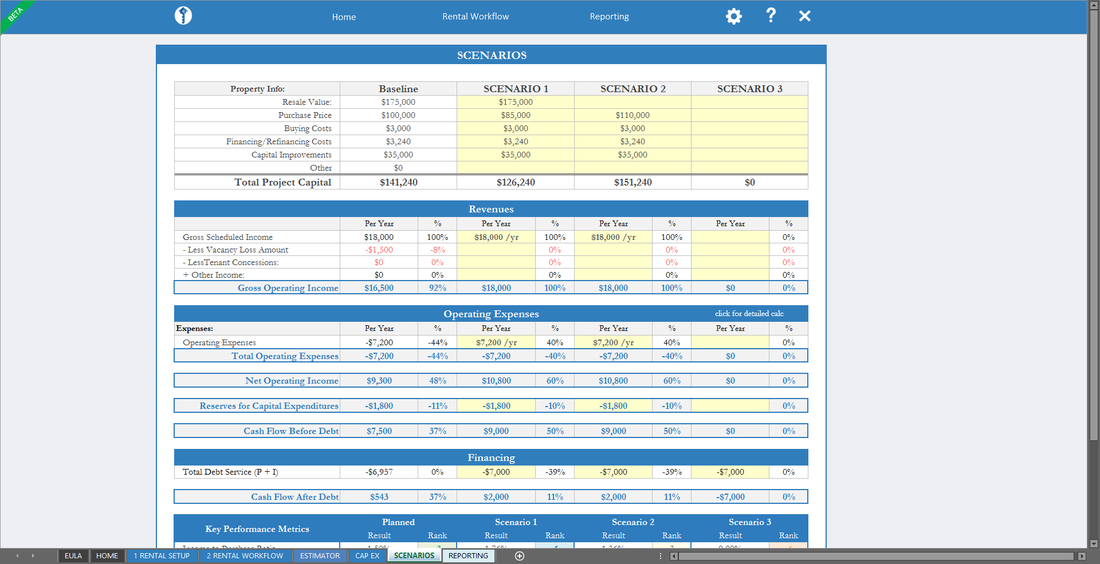

Rental Income and Expense Worksheet: Free Resources - Stessa Real estate investors use a rental income and expense worksheet to accurately track cash flow each and every month, calculate return on investment or "ROI," identify opportunities to increase revenues, and make sure they are claiming every tax deduction the IRS allows. In this article, we'll take an in-depth look at the rental income and ...

B3-3.1-08, Rental Income (05/04/2022) - Fannie Mae Fannie Mae publishes four worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The worksheets are: Rental Income Worksheet - Principal Residence, 2- to 4-unit Property , Rental Income Worksheet - Individual Rental Income from Investment Property(s) (up to 4 properties) ,

Single-Family Homepage | Fannie Mae Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) ... Calculate monthly qualifying rental income (loss) using Step 2A: Schedule E OR Step 2B: Lease Agreement or Fannie Mae Form 1007 or Form 1025. A1 Enter total rents received. A2 Subtract A3 Add A4 A5 A6

PDF Net Rental Income Calculations - Schedule E - Freddie Mac Refer to Section 5306.1(c)(iii) for net rental Income calculation requirements . 2 . Refer to Chapter 5304 and Form 91 for the treatment of all rental real estate income or loss reported on IRS Form 8825, regardless of Borrower's percentage of ownership interest in the buisiness or whether the Borrower is personally obligated on

0 Response to "38 rental income calculation worksheet"

Post a Comment