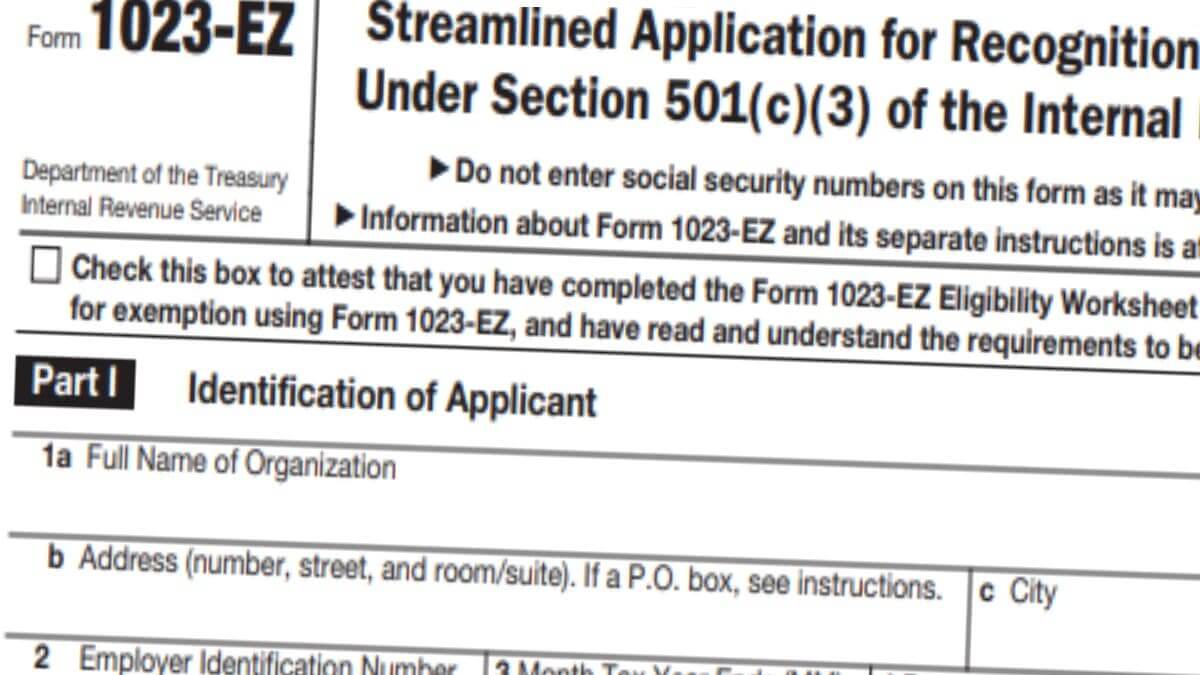

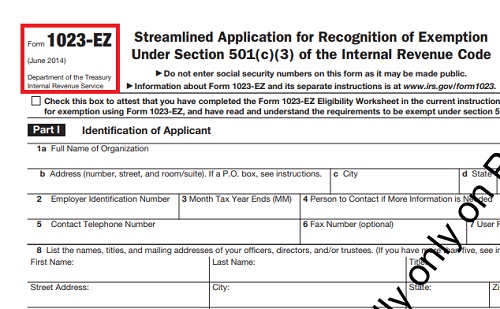

45 form 1023 ez eligibility worksheet

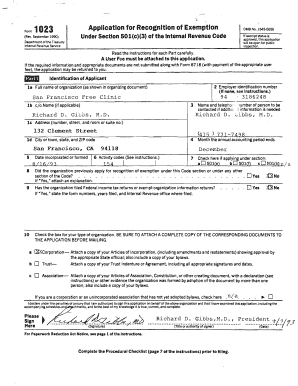

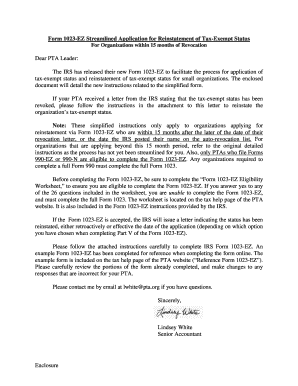

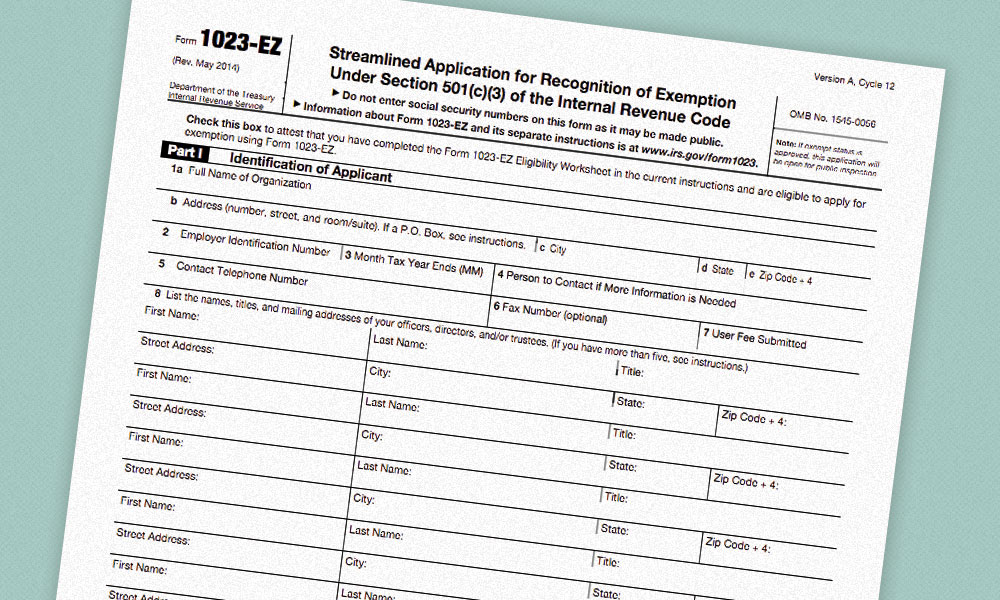

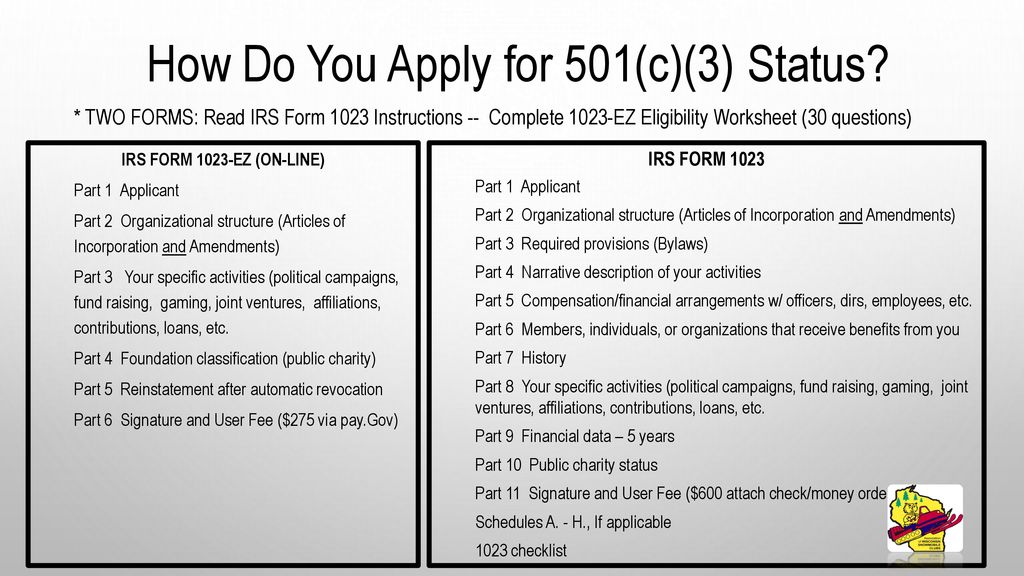

› forms-pubs › about-form-1023About Form 1023, Application for Recognition of Exemption ... Changes to Jan. 2020 Revision of Instructions for Form 1023, Schedule E, Line 2 and Line 2a-- 27-JAN-2021. Updated Information on Signing Electronically Submitted Form 1023-- 05-MAY-2020. Taxpayer Relief for Certain Tax-Related Deadlines Due To Coronavirus Pandemic-- 14-APR-2020. Electronic Filing of Form 1023-- 31-JAN-2020 › charities-non-profits › form-1023-ezForm 1023-EZ Revisions | Internal Revenue Service - IRS tax forms Oct 05, 2022 · Question 29 on the Form 1023-EZ Eligibility Worksheet now requires that an automatically revoked organization applying for reinstatement must seek the same foundation classification they had at the time of automatic revocation to be eligible to use the Form 1023-EZ. Organizations that are not seeking that same foundation classification must ...

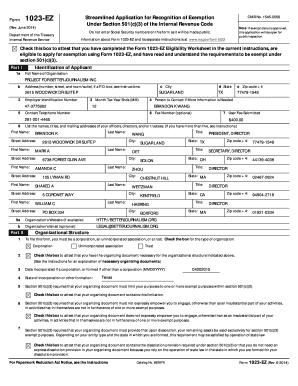

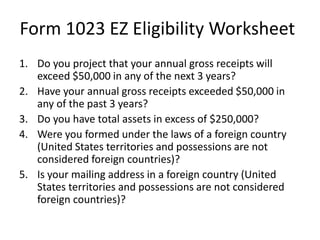

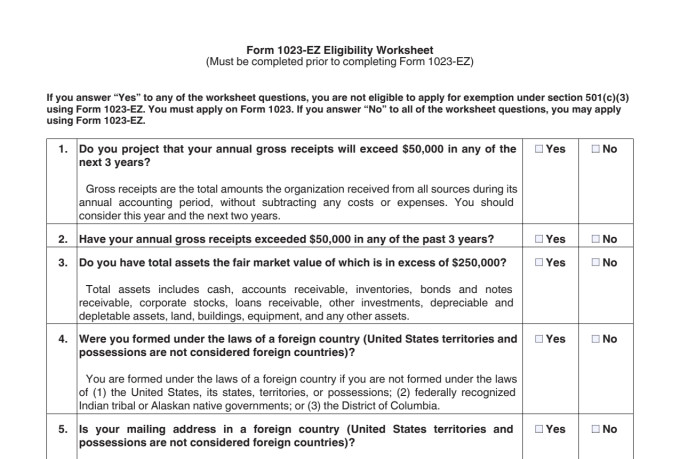

› pub › irs-pdfInstructions for Form 1023-EZ (Rev. January 2018) - IRS tax forms Form 1023-EZ Eligibility Worksheet. If you answer “Yes” to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. You must apply on Form 1023. If you answer “No” to all of the worksheet questions, you may apply using Form 1023-EZ.

Form 1023 ez eligibility worksheet

› 2022/10/19 › 23411972Microsoft is building an Xbox mobile gaming store to take on ... Oct 19, 2022 · Microsoft’s Activision Blizzard deal is key to the company’s mobile gaming efforts. Microsoft is quietly building a mobile Xbox store that will rely on Activision and King games. › forms-pubs › about-form-1023-ezAbout Form 1023-EZ, Streamlined Application for Recognition ... To submit Form 1023-EZ, you must: Read the Instructions for Form 1023-EZ and complete its Eligibility Worksheet found at the end of the instructions. (If you are not eligible to file Form 1023-EZ, you can still file Form 1023.) If eligible to file Form 1023-EZ, register for an account on Pay.gov. Enter "1023-EZ" in the search box. Complete the ... › instructions › i1023ezInstructions for Form 1023-EZ (01/2018) | Internal Revenue ... Dec 20, 2019 · To determine if you are eligible to file Form 1023-EZ, you must complete the Form 1023-EZ Eligibility Worksheet. If you answer “Yes” to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ.

Form 1023 ez eligibility worksheet. › instructions › i1023Instructions for Form 1023 (01/2020) | Internal Revenue Service Unless an exception applies, an organization must file Form 1023 or Form 1023-EZ (if eligible) to obtain recognition of exemption from federal income tax under section 501(c)(3). You can find information about eligibility to file Form 1023-EZ at IRS.gov/Charities. › instructions › i1023ezInstructions for Form 1023-EZ (01/2018) | Internal Revenue ... Dec 20, 2019 · To determine if you are eligible to file Form 1023-EZ, you must complete the Form 1023-EZ Eligibility Worksheet. If you answer “Yes” to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. › forms-pubs › about-form-1023-ezAbout Form 1023-EZ, Streamlined Application for Recognition ... To submit Form 1023-EZ, you must: Read the Instructions for Form 1023-EZ and complete its Eligibility Worksheet found at the end of the instructions. (If you are not eligible to file Form 1023-EZ, you can still file Form 1023.) If eligible to file Form 1023-EZ, register for an account on Pay.gov. Enter "1023-EZ" in the search box. Complete the ... › 2022/10/19 › 23411972Microsoft is building an Xbox mobile gaming store to take on ... Oct 19, 2022 · Microsoft’s Activision Blizzard deal is key to the company’s mobile gaming efforts. Microsoft is quietly building a mobile Xbox store that will rely on Activision and King games.

0 Response to "45 form 1023 ez eligibility worksheet"

Post a Comment