44 funding 401ks and roth iras worksheet answers

Funding 401(k)s & Roth IRAs Chart.docx - Course Hero Complete Funding 401ks and Roth IRAs Worksheet.jpg. No School ... I need help with this? can someone give me the answers. 2022 2023 2024 Medicare Part B IRMAA Premium MAGI Brackets 13/10/2022 · Anyhow, in reply to Bev on figuring how much to Roth convert for this year, 2020, I’d recommend looking at the threshold amounts for next year, 2021, based on 2019 income. 2nd tier goes from $88,001 to $110,000 for 2021, so I would be comfortable Roth converting up to a MAGI of $108,000 this year, about $2000 less than the threshold.

Copy of Funding 401(k)'s and Roth IRA's - WORKSHEET View Copy of Funding 401(k)'s and Roth IRA's - WORKSHEET from MATH 12345 at New Life Academy, Woodbury. Investment Joe Melissa Tyler & Megan Adrian David ...

Funding 401ks and roth iras worksheet answers

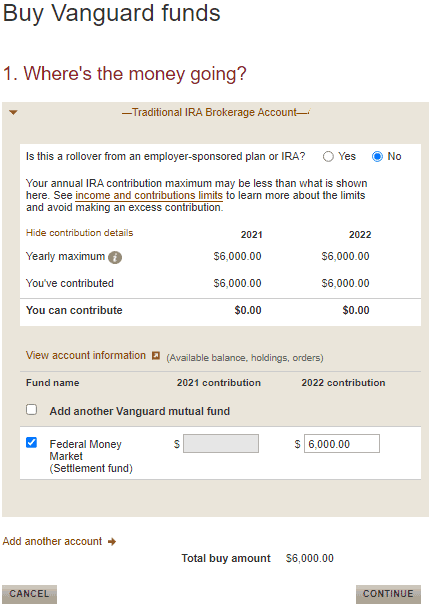

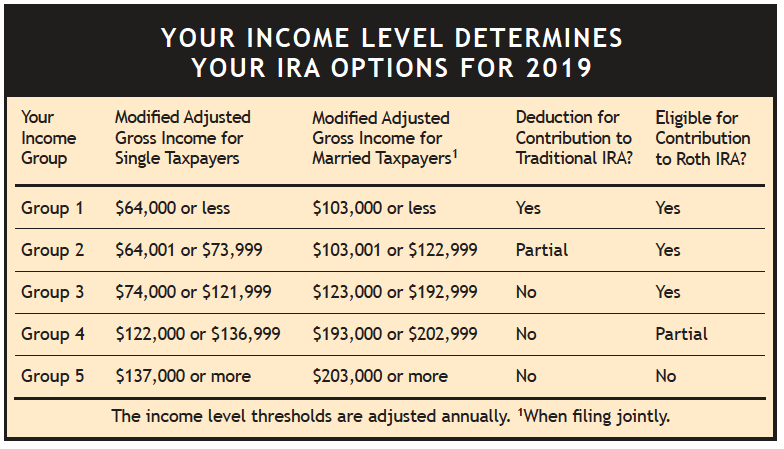

Retirement Plans FAQs Regarding IRAs | Internal Revenue Service Your Roth IRA contributions may also be limited based on your filing status and ... See the discussion of required minimum distributions and worksheets to ... Dave Ramsey Ch. 12 Lesson 3 PDF Questions - Docsity Apr 18, 2022 ... Will have to pay taxes on it later. - Roth IRA grows tax free, and lets you invest post tax. 2. What is the similarity between a 401K and a 403B ... SEP IRA for an S Corp: The #1 Contribution Guide for 2022 Oct 26, 2022 · Large contributions: In comparison to traditional IRAs, SEP IRAs allow high contributions ($57,000 for SEP IRA Vs. $6,000 + $1,000 for IRA). Easy setup and maintenance: SEP IRAs are easy to set up and manage in comparison to other plans. You have limited filing obligations, making it easier to manage the plan.

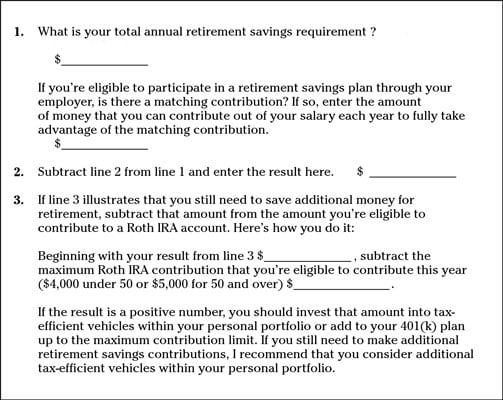

Funding 401ks and roth iras worksheet answers. Funding 401 K S And Roth Iras Worksheet Answers - Pinterest Dec 12, 2019 - A Funding 401 K S And Roth Iras Worksheet Answers is a few short questionnaires on a certain topic. A worksheet can be prepared for any ... Modified Adjusted Gross Income (MAGI) - Obamacare Facts Jan 08, 2015 · HSA’s, retirement accounts like 401ks, and other tax advantaged investment vehicles can be a smart choice for lowering GI, AGI, and MAGI. Specifically for ObamaCare, HSA’s really stand out. Not only can you lower your MAGI with an HSA (it lowers AGI and isn’t added back to MAGI), you can also accumulate interest tax-free, and spend money ... 2022 2023 2024 Medicare Part B IRMAA Premium MAGI Brackets Oct 13, 2022 · I’m still waiting to do Roth conversions and/or stock capital gains this year until I get more info on future irmaa bracket possibilities. Not sure if they can dip below $85,000/ $170,000. It would be nice to know that 2022 would be above the 2021 brackets $88,000/$176,000. Solved Activity: Funding 401(k)s and Roth IRAs Objective - Chegg You'll get a detailed solution from a subject matter expert that helps you learn core concepts. See Answer ...

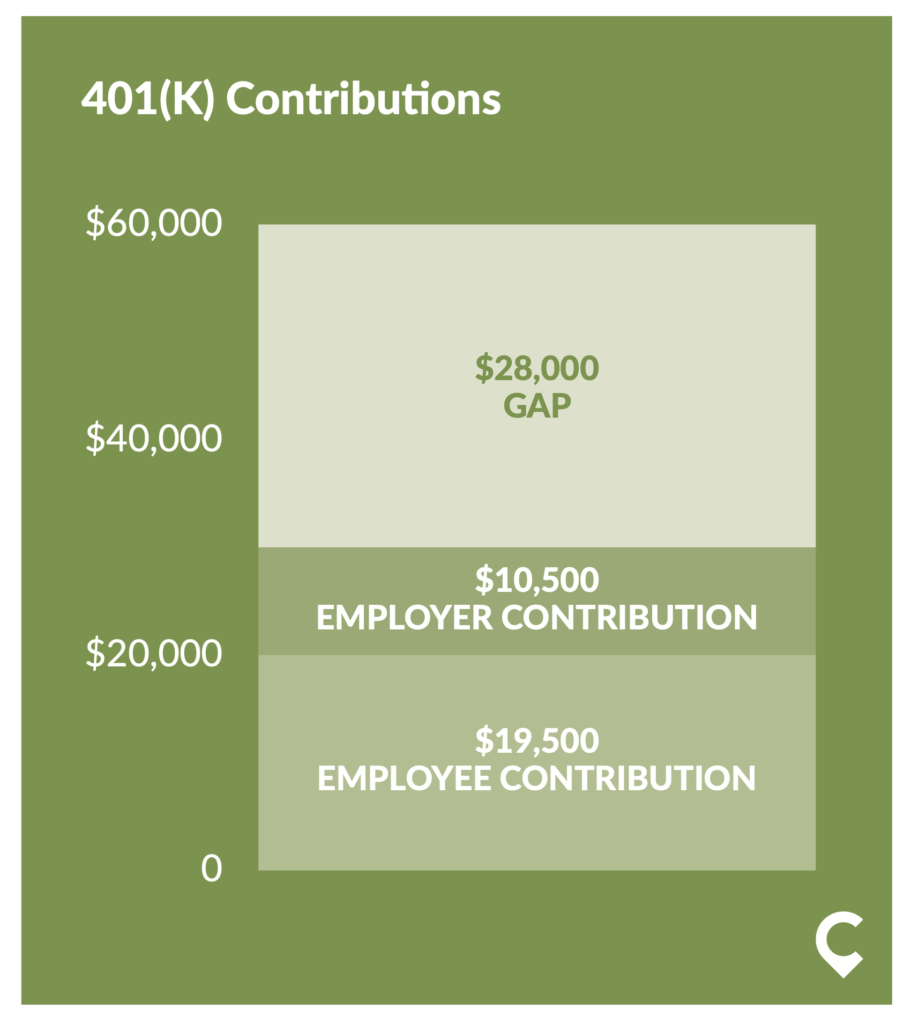

If You Have a 401(k), Do You Need an IRA, Too? | Charles Schwab There are two types of IRAs: a traditional tax-deductible IRA and a Roth IRA. For 2022, the annual contribution limit for both is $6,000 with a $1,000 ... Funding a 401 K and Roth - financial lit Flashcards - Quizlet ROTH IRA. -Retirement account funded with after-tax dollars that subsequently ... same as 401k but is used for nonprofit organizations such as schools, ... SEP IRA for an S Corp: The #1 Contribution Guide for 2022 26/10/2022 · Large contributions: In comparison to traditional IRAs, SEP IRAs allow high contributions ($57,000 for SEP IRA Vs. $6,000 + $1,000 for IRA). Easy setup and maintenance: SEP IRAs are easy to set up and manage in comparison to other plans. You have limited filing obligations, making it easier to manage the plan. Funding 401ks and roth iras worksheet answers? - Eyelight.vn Apr 14, 2022 ... melissa will fund the 401k my roth ira worksheet answers brandon will fund his 401(k) up to the match, and then put the remainder in his roth ...

Modified Adjusted Gross Income (MAGI) - Obamacare Facts 08/01/2015 · If the amount on line 6 of Worksheet 1-1 above is less than zero, seeLine 3, later, before you enter an amount on Form 8962, line 3. Line 2b. Enter the modified AGI for all of your dependents on line 2b. Use the worksheet below to figure the combined modified AGI for the dependents claimed as exemptions on your return. Only include the modified ... Roth IRA Conversion Calculator | Converting an IRA - Charles Schwab Use our Roth IRA Conversion Calculator to compare estimated future values and ... until you expect to take your first withdrawal from the converted funds. SEP IRA for an S Corp: The #1 Contribution Guide for 2022 Oct 26, 2022 · Large contributions: In comparison to traditional IRAs, SEP IRAs allow high contributions ($57,000 for SEP IRA Vs. $6,000 + $1,000 for IRA). Easy setup and maintenance: SEP IRAs are easy to set up and manage in comparison to other plans. You have limited filing obligations, making it easier to manage the plan. Dave Ramsey Ch. 12 Lesson 3 PDF Questions - Docsity Apr 18, 2022 ... Will have to pay taxes on it later. - Roth IRA grows tax free, and lets you invest post tax. 2. What is the similarity between a 401K and a 403B ...

Retirement Plans FAQs Regarding IRAs | Internal Revenue Service Your Roth IRA contributions may also be limited based on your filing status and ... See the discussion of required minimum distributions and worksheets to ...

![How to Do a Backdoor Roth IRA [Step-by-Step Guide] | White ...](https://www.whitecoatinvestor.com/wp-content/uploads/2020/06/Screen-Shot-2020-06-20-at-7.44.13-AM.png)

0 Response to "44 funding 401ks and roth iras worksheet answers"

Post a Comment