43 flsa professional exemption worksheet

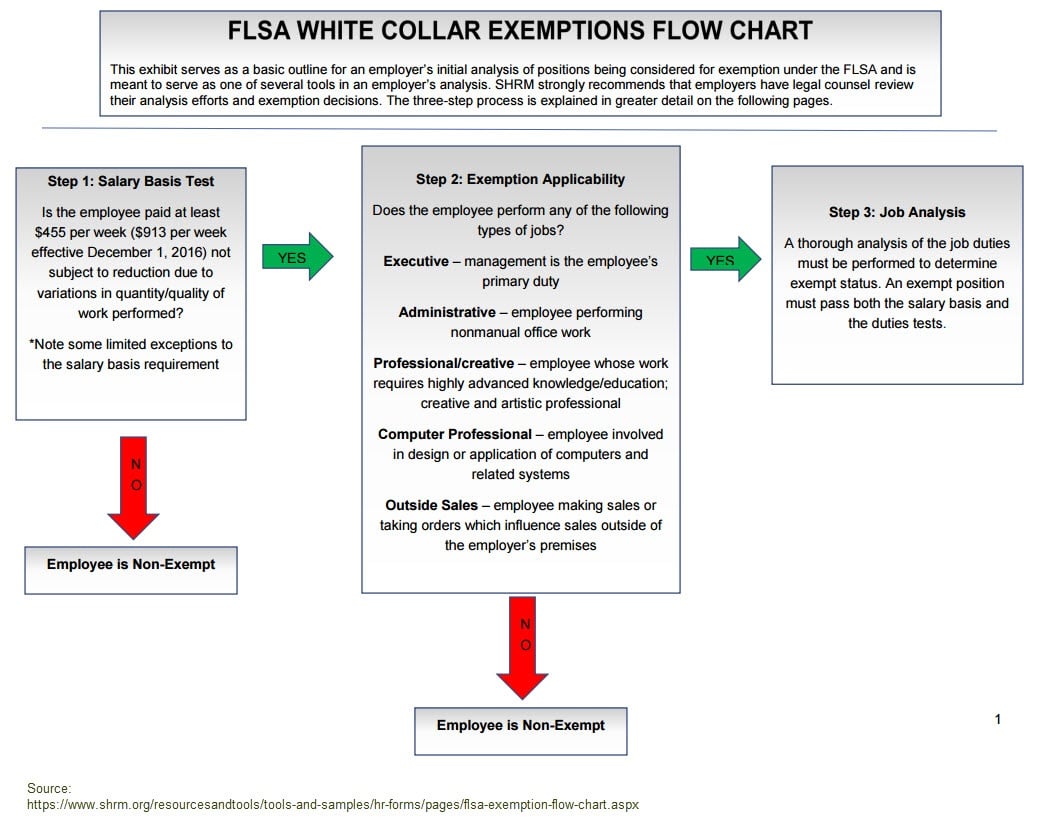

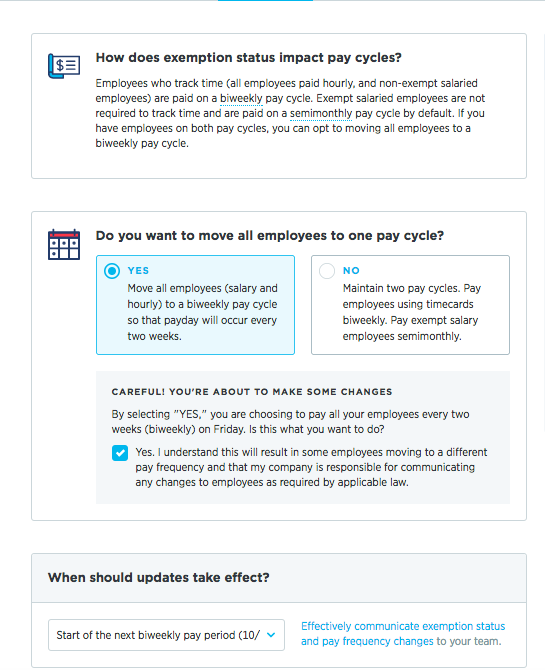

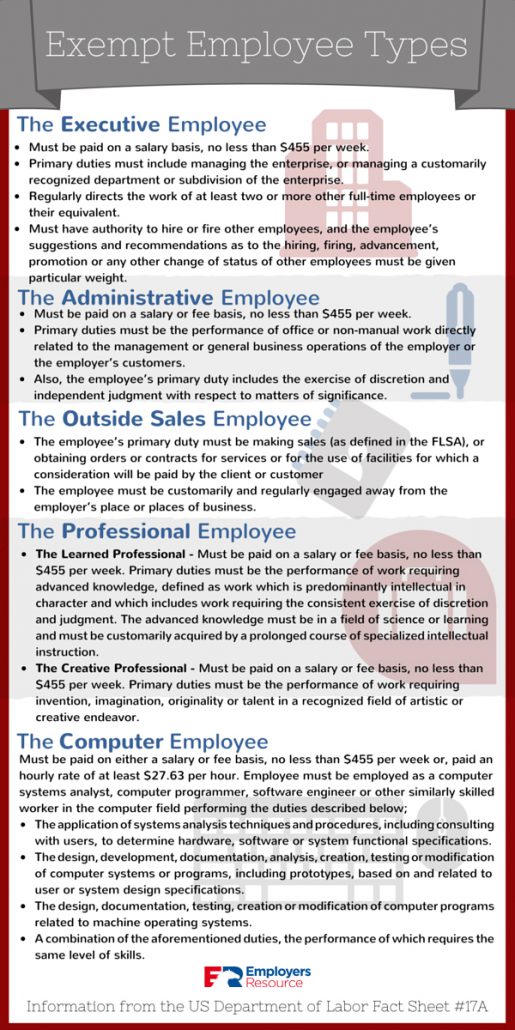

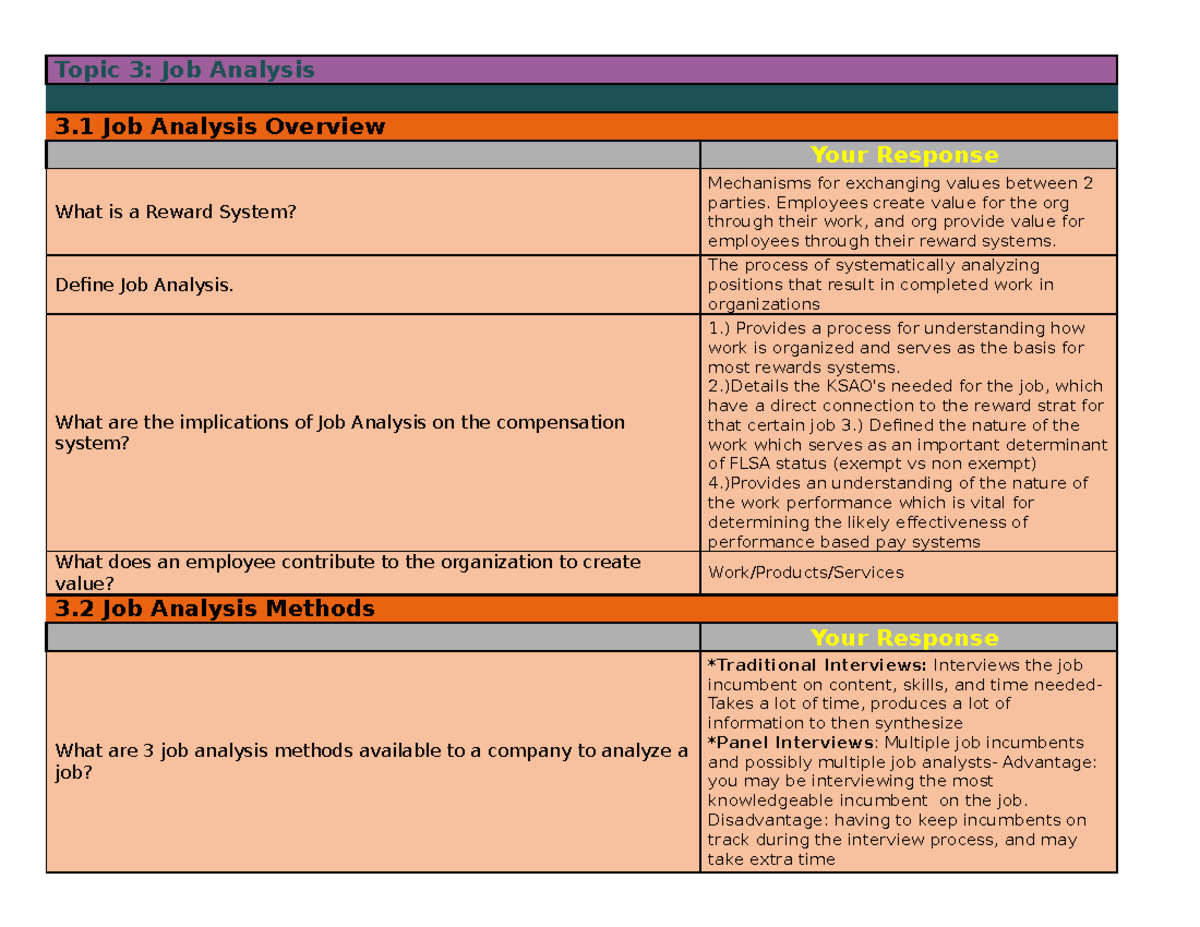

PDF Fair Labor Standards Act (FLSA) Designation Worksheet (5 CFR Part 551) Professional Exemption (§551.207) o this exemption criteria, must check the "Primary Duty" box AND the boxes of at least one of the two Professionals or Computer Employees listed below ☐ Primary duty must be the performance of work requiring knowledge of an advanced type in aield of f science or learning customarily FLSA Exemption Classification - SHRM Determining who must be paid overtime under the Fair Labor Standards Act (FLSA) is critical to wage and hour compliance. HR can use the tools and guidance in this resource hub page to identify ...

FLSA Checklists | Human Resources | UNC Charlotte FLSA Exemption Checklists. Below are summaries of each FLSA exemption category. Managers should review this information to assess whether or not a position is likely to be exempt from overtime coverage. If a manager would like Human Resources to evaluate a position for an exemption, a checklist for the appropriate category must be completed and ...

Flsa professional exemption worksheet

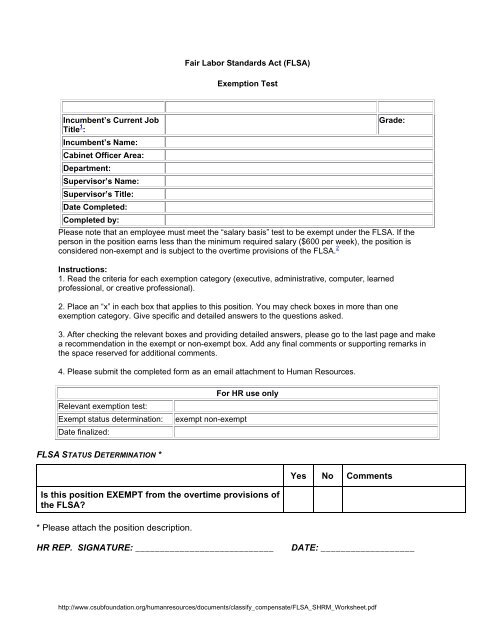

Fair Labor Standards Act: Professional Exemption The FLSA Fact Sheet goes on to state that "teachers are exempt if their primary duty is teaching, tutoring, instructing or lecturing in the activity of imparting knowledge, and if they are employed and engaged in this activity as a teacher in an educational establishment. The salary and salary basis requirements do not apply to bona fide teachers. Fact Sheet #17D: Exemption for Professional Employees Under the ... - DOL highly compensated employees performing office or non-manual work and paid total annual compensation of $107,432 or more (which must include at least $684 * per week paid on a salary or fee basis) are exempt from the flsa if they customarily and regularly perform at least one of the duties of an exempt executive, administrative or professional … FLSA Exemption Test Worksheet (Completed by Human Resources) FLSA Exemption Test Worksheet (Completed by Human Resources) Executive, Teaching, Professional, Administrative, and Computer Exemption Tests ... Federal law provides that certain PSU employees may be exempt from the overtime wage provisions of the Fair Labor Standards Act (FLSA) under the following exemption categories: EXECUTIVE, TEACHING ...

Flsa professional exemption worksheet. PDF Questionnaire to Determine FLSA Exempt Status - hnbllc.com exemption, answer the questions and then evaluate the criteria for each relevant exemption category (executive, administrative, professional, computer professional, outside sales, commission sales, or highly compensated employees) based on responses to the questions. Note that a single employee may qualify for more than one exemption. eCFR :: 29 CFR Part 541 -- Defining and Delimiting the Exemptions for ... (a) Section 13(a)(1) of the Fair Labor Standards Act, as amended, provides an exemption from the Act's minimum wage and overtime requirements for any employee employed in a bona fide executive, administrative, or professional capacity (including any employee employed in the capacity of academic administrative personnel or teacher in elementary or secondary schools), or in the capacity of an ... FLSA Professional Employee Exemption: Learned or Creative or Teaching highly compensated employees performing office or non-manual work and paid total annual compensation of $107,432 or more (which, as of january 1, 2020, must include at least $684 per week paid on a salary or fee basis) are exempt from the flsa if they "customarily and regularly" perform at least one of the duties of an exempt executive, … Flsa Classification Worksheet FAIR LABOR STANDARDS ACT (FLSA) WORKSHEET. 1 week ago 1. This worksheet must be used in conjuction with FLSA guidance in 5 CFR 551 and in making FLSA determinations on domestic and U.S. non-foreign area position descriptions effective on … Courses 437 View detail Preview site

PDF U.S. Department of Labor Wage and Hour Division - DOL Fact Sheet #17D: Exemption for Professional Employees Under the Fair Labor Standards Act (FLSA) This fact sheet provides information on the exemption from minimum wage and overtime pay provided by Section 13(a)(1) of the F LSA as defined by Regulations, 29 C.F.R. Part 541, as applied to professional employees. The FLSA PDF California - Executive Exemption Worksheet - Paychex If covered by both the federal Fair Labor Standards Act (FLSA) and a CA labor code/wage order, then the employee must qualify under both exemptions to be exempt from overtime. Check all that apply: This position is paid on a salary basis and earns a monthly salary equivalent of no less than two times the state minimum wage for full-time employment. PDF FLSA Exemption Test Worksheet - Jacksonville State University FLSA Exemption Test Worksheet . Executive, Professional, Computer, and Administrative Exemption Tests . Federal law provides that employees may be exempt from the overtime wage provisions of the Fair Labor Standards Act (FLSA) in varying categories. Jacksonville State University has positions that could qualify in one of the following Get and Sign FLSA Exemption Test Worksheet 2016 Form Follow the step-by-step instructions below to design your flea exemption test worksheet: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done.

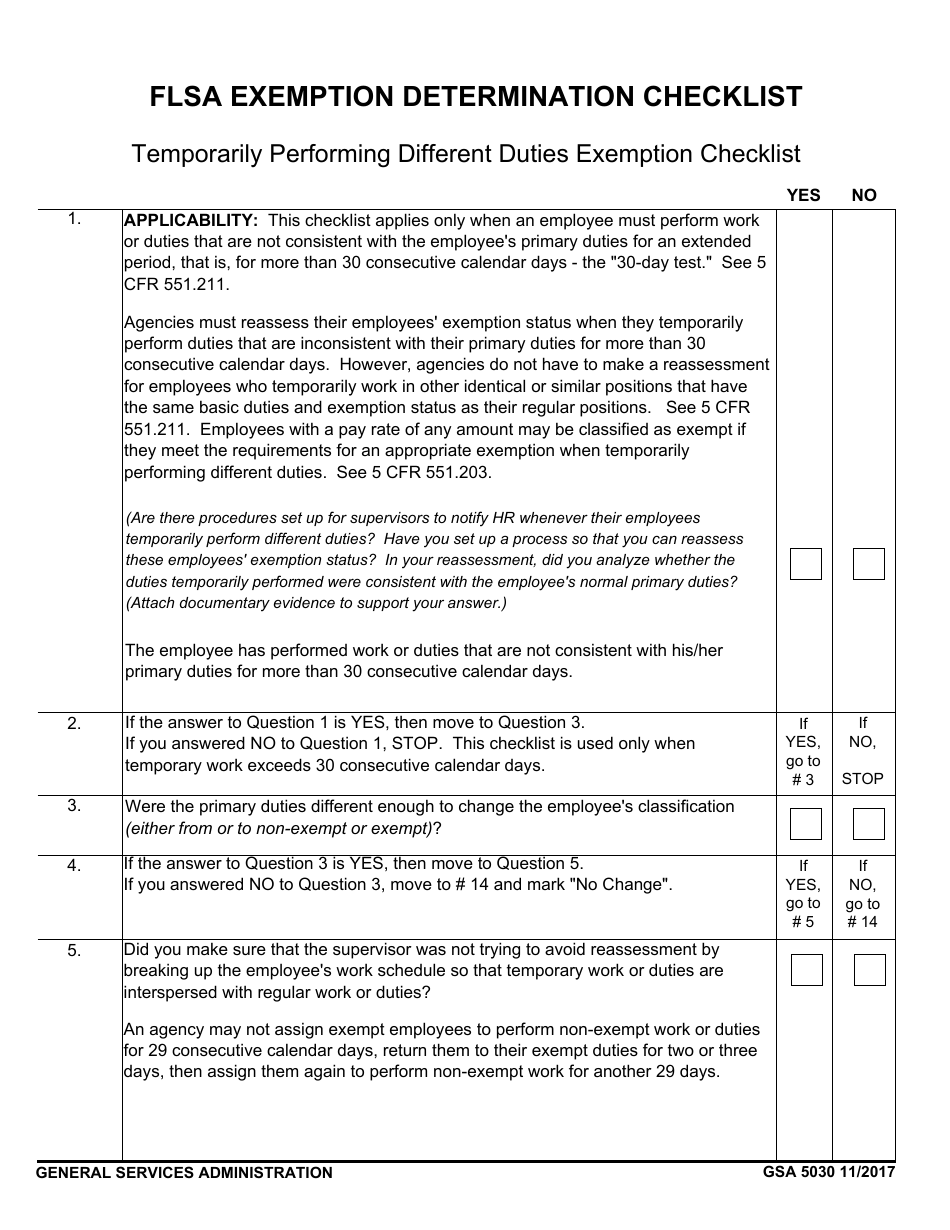

Flsa Exemption Determination Checklist whether the employees qualify for exemption. If the answers to Question 3a and b are NO, go to # 7. a. MANAGEMENT: An employee in this position performs work that is directly related to activities such as interviewing, selecting, and training employees; setting and adjusting FLSA Exemption Test | UpCounsel 2022 The FLSA exemption test refers to the status of a job as outlined in the Fair Labor Standards Act. The FLSA determines whether a job is exempt or nonexempt as it relates to overtime obligations. Overtime pay, minimum wage, record requirements, age restrictions, and hours worked are some of the standards for employees outlined in this law. PDF Exempt Worksheet - ThinkHR sales; or computer-related professional. Note that only salaried employees are eligible for executive, administrative, and professional exemptions. All EMPLOYER positions generally meet the salary threshold requirement of $455 per week. Computer professionals must earn an hourly rate of at least $27.63 an hour to be eligible for an FLSA exemption. DOCX FLSA Designation Worksheet - Oregon Professional Exemption Worksheet Salary Test: The employee must be paid on a salary basis and earn a salary of at least $684** per week (may not prorate for half-time employee). Teachers, doctors and lawyers are not subject to this requirement. $684** per week = $2,964 per month or $35,568 per year Job Duties Test

Exempt vs. Nonexempt: Navigating the FLSA Duties Test - Namely To qualify as exempt from overtime under this exemption, an employee must: Earn more than $684 per week, or $35,568 annually Perform work that requires "invention, imagination, originality, or talent" in the arts or a creative field All of the above conditions must be fulfilled for the employee to be considered exempt.

Fair Labor Standards Act (FLSA) | Office of Financial Management What is the Fair Labor Standards Act? The Fair Labor Standards Act (FLSA) is a federal law which establishes minimum wage, overtime pay eligibility, recordkeeping, and child labor standards affecting full-time and part-time workers in the private sector and in federal, state, and local governments.

FLSA Professional Exemption - Learned/Creative Professional Exemption The highly compensated employee exemption, or HCE exemption, applies to professional, administrative, or executive employees who: Earn at least $100,000 a year, including a minimum of $455 in weekly salary Primarily perform office or non-manual work Regularly perform at least one of the exempt duties of an executive described in the job tests above

PDF FAIR LABOR STANDARDS ACT (FLSA) QUESTIONNAIRE - Louisiana Please refer to the FLSA Index (pages 6-11 of this document) for a description of the terms in boldand referenced by a superscript. Exempt/NonExempt. - The content of this questionnaire was developed from the FLSA Regulation, Part 541: Defining and delimiting the exemptions for Executive, Administrative, Professional,

PDF FAIR LABOR STANDARDS ACT (FLSA) WORKSHEET - United States Department of ... III. PROFESSIONAL EXEMPTION (5 CFR 551.207) & LEARNED PROFESSIONAL EXEMPTION (5 CFR 551.208) An employee whose primary duty meets A, B, and C below. An employee whose primary duty is managing an organizational unit, and who meets both of the conditions below. U.S. Department of State FAIR LABOR STANDARDS ACT (FLSA) WORKSHEET DS-5105 05-2017 ...

FLSA Exemption Determination Checklist - Learned Professional Exemption ... Form: GSA5029 FLSA Exemption Determination Checklist - Learned Professional Exemption Current Revision Date: 11/2017 DOWNLOAD THIS FORM: Choose a link below to begin downloading. GSA5029-17.pdf [PDF - 124 KB ] PDF versions of forms use Adobe Reader ™ . Download Adobe Reader™ FORMS LIBRARY ASSISTANCE: Forms@GSA.gov LATEST UPDATES

FLSA Exemption Worksheet | MRA Exempt Classification Download Now Must be a member to download. Please log in. Learn how to get access. Download The following FLSA exemption worksheet is designed to assist employers in conducting a review of employees' classifications under the Fair Labor Standards Act exemption rules and to document their process.

How to Determine if Your Employees Meet the FLSA Learned Professional ... An employee's FLSA status is determined by three factors: salary basis, salary level, and duties performed. An employee is considered FLSA exempt if all three of the following exemptions are true: The employee is compensated on a salary basis (not hourly). The employee earns at least $35,568 per year (or $684 per week).

Talon maalaus Vihti | Maalauspalvelut Uudellamaalla Talon maalaus asiantuntevasti Vihdistä koko Uudenmaan alueelle. Yhteystiedot. Maalausliike Helminen Oy on 35 vuoden kokemuksellaan maalausalan pitkän linjan toimija. Vuonna 2002 yrityksestämme tuli osakeyhtiö, mutta olemme edelleen kahden hengen perheyritys. Erityisalaamme on talon maalaus niin sisä- kuin ulkopinnoilla.

The FLSA Cheat Sheet | Complete Payroll Professional Exemption White Collar Overtime Exemptions Additional Resources A PDF Guide, 2 checklists and 3 policy templates that can be used to update your employee handbook. Employers must take many strategic steps to ensure they're in compliance with the FLSA. These tools make it easier. Click on any of the links below for a free download.

PDF FLSA Checklist: Exempt vs. nonexempt status - Ferris State University for exempt positions. Those positions generally fall into six categories: executive, administrative, learned professional, computer professional, creative professional and outside sales.' But it's not that simple. That's why HR Specialistprepared this checklist. Use it to determine whether your employees are exempt from the FLSA. (800 ...

FLSA Exemption Test Worksheet (Completed by Human Resources) FLSA Exemption Test Worksheet (Completed by Human Resources) Executive, Teaching, Professional, Administrative, and Computer Exemption Tests ... Federal law provides that certain PSU employees may be exempt from the overtime wage provisions of the Fair Labor Standards Act (FLSA) under the following exemption categories: EXECUTIVE, TEACHING ...

Fact Sheet #17D: Exemption for Professional Employees Under the ... - DOL highly compensated employees performing office or non-manual work and paid total annual compensation of $107,432 or more (which must include at least $684 * per week paid on a salary or fee basis) are exempt from the flsa if they customarily and regularly perform at least one of the duties of an exempt executive, administrative or professional …

Fair Labor Standards Act: Professional Exemption The FLSA Fact Sheet goes on to state that "teachers are exempt if their primary duty is teaching, tutoring, instructing or lecturing in the activity of imparting knowledge, and if they are employed and engaged in this activity as a teacher in an educational establishment. The salary and salary basis requirements do not apply to bona fide teachers.

0 Response to "43 flsa professional exemption worksheet"

Post a Comment