42 calculating sales tax worksheet

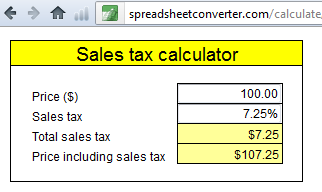

Sales Tax Calculator The Sales Tax Calculator can compute any one of the following, given inputs for the remaining two: before-tax price, sale tax rate, and final, or after-tax price. Before Tax Price Sales Tax Rate After Tax Price Related VAT Calculator What is Sales Tax? A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Use the Sales Tax Deduction Calculator The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A (Forms 1040 or 1040-SR). Your total deduction for state and local income, sales and property taxes is limited to a combined, total deduction of $10,000 ($5,000 if married filing separately).

Fremont, California Sales Tax Calculator (2022) - Investomatica Details. The average cumulative sales tax rate in Fremont, California is 10.45% with a range that spans from 10.25% to 10.75%. This includes the rates on the state, county, city, and special levels.

Calculating sales tax worksheet

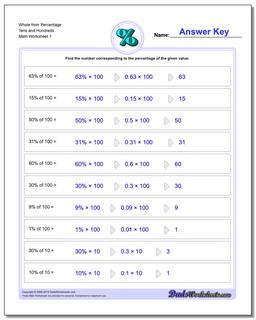

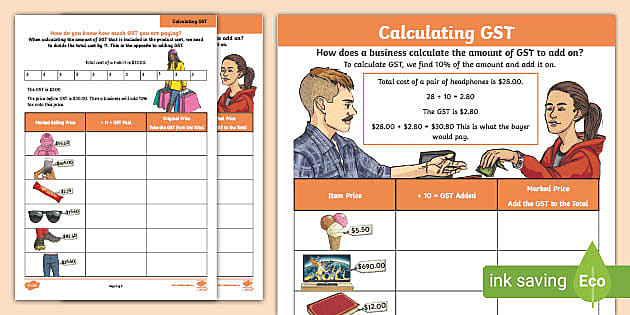

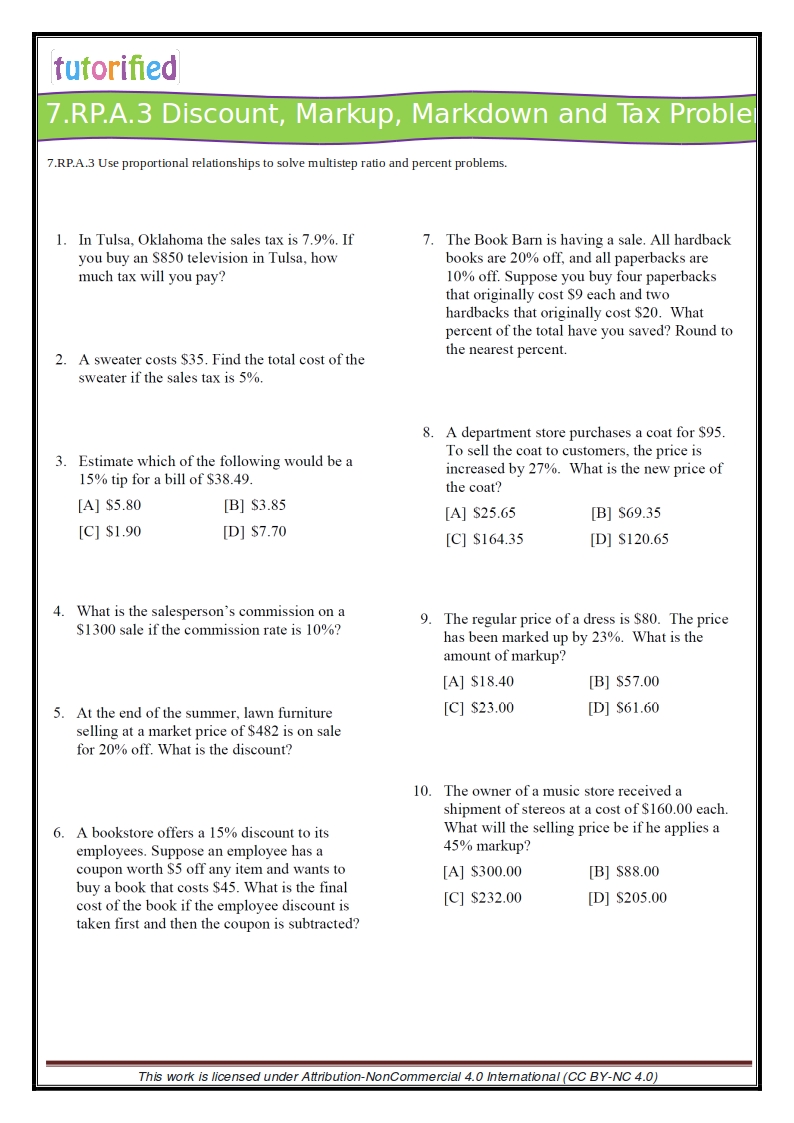

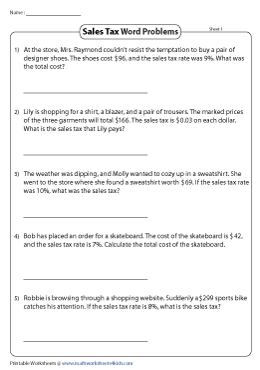

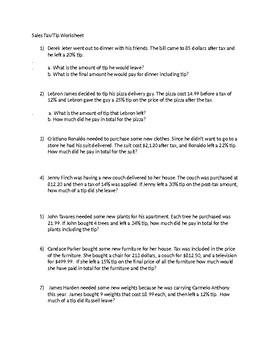

Calculating Tax Worksheets - K12 Workbook Worksheets are Sales tax practice work, Work calculating marginal average taxes, Sales tax and discount work, Sales tax and discount work, Income calculation work, Tip and tax homework work, Ira required minimum distribution work, Work for determining support. *Click on Open button to open and print to worksheet. 1. Sales Tax Practice Worksheet 2. 1040 (2021) | Internal Revenue Service - IRS tax forms Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments PDF Sales Tax Worksheet - EMSD63 Sales Tax Worksheet Directions: Using percents and proportions solve the following problems. Show all work. 1. If the sales tax rate in 7.25% in California, how much did Debbie pay if she bought a pair of jeans for $38? 2. Kristen bought a scarf for $22 in New York. In New York there is a 6.2% sales

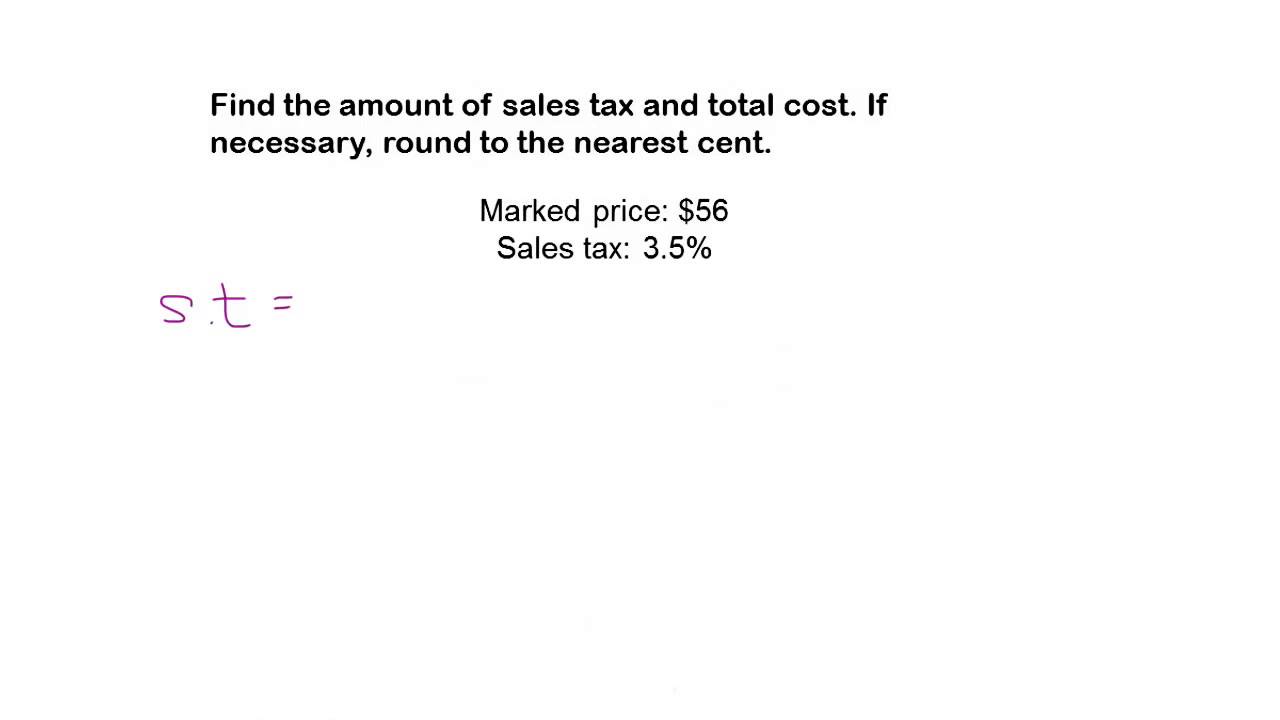

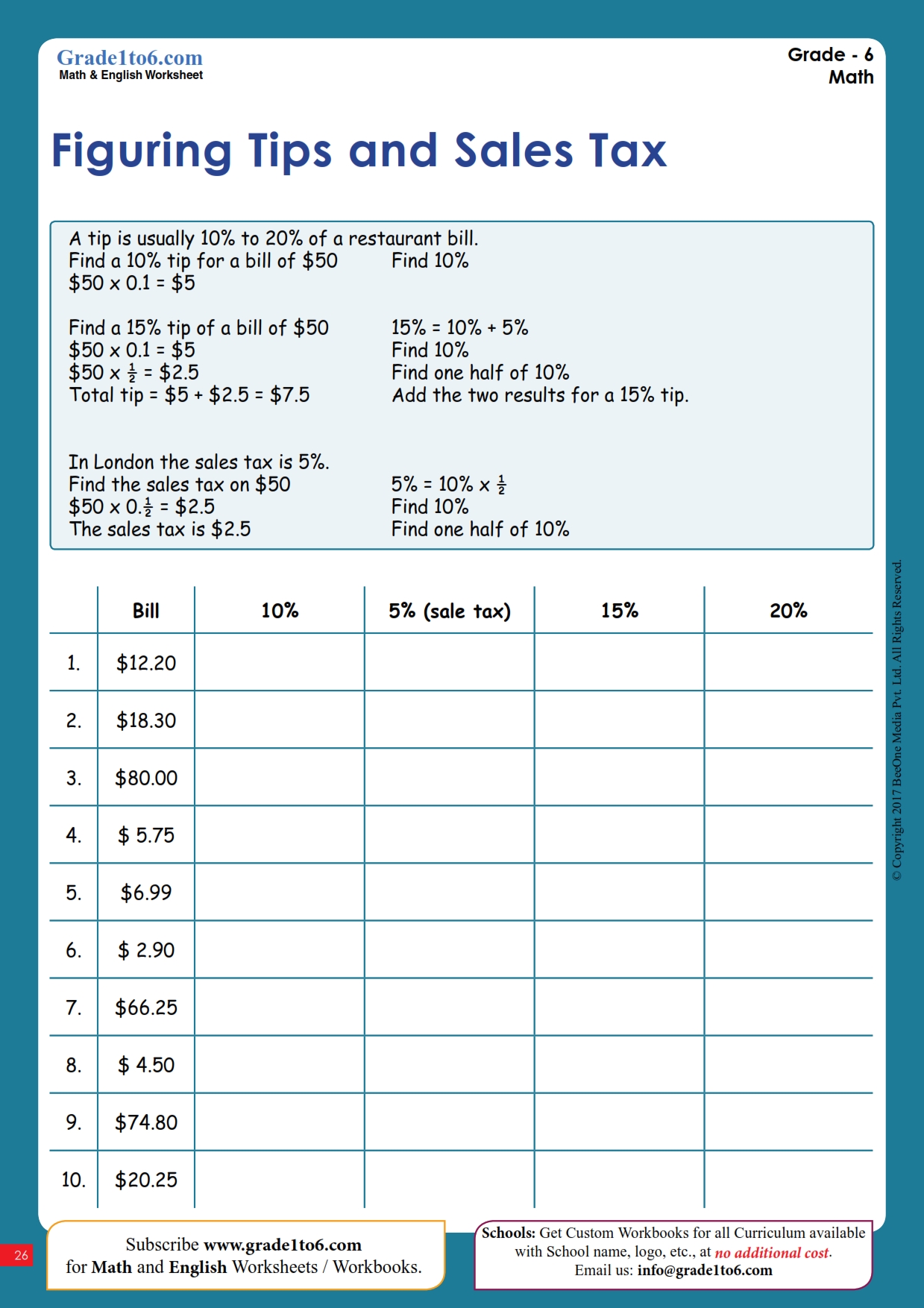

Calculating sales tax worksheet. Sales Tax Worksheets - Math Worksheets 4 Kids Find the sales tax and calculate the total cost of the items using these 3-part printable worksheets! Finding the Original Price If the sale price is $460 and the sales tax rate is 4%, what is the original price? All there's to do is to substitute the values in the appropriate formula and proceed to solve for the missing values. Sales Tax Worksheets Teaching Resources | Teachers Pay Teachers This is a color by number worksheet focused on calculating total cost after after calculating sales tax, tip, or discount. The worksheet contains 12 problems. Answer Key provided.Great for basic independent practice or as a station activity. Subjects: Basic Operations, Decimals, Math Grades: 6th - 7th Types: Activities › publications › p523Publication 523 (2021), Selling Your Home - IRS tax forms Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Welcome to the Illinois Department of Revenue By law, Monday, October 17, 2022, was the last day to submit information to receive the Illinois Income Tax Rebate and Property Tax Rebate (Public Act 102-0700). No filing extensions are allowed. Processing of rebates and issuance of payments will continue after October 17, until all have been issued by the Illinois Comptroller’s Office.

Forms | Bureau of Land Management Small Business Certification Required on all Preferential Sales of Set-aside Timber 5430-001: May 1965 Self Certificate Clause Bidders Statement 5430-011: Nov 2011 Independent Price Determination Certificate 5440-009: June 2022 Deposit & Bid for Timber and other Vegetative Resource Sales 5450-003: Sept 2022 Contract for the sale of Timber ... › car-loan-calculatorAuto Loan Payment Calculator | Cars.com Sales tax is a percentage of the car price that you owe to your state. Be sure to research how sales tax works for car purchases in your state – some states charge tax on the full price of the ... Calculating Sales Tax Worksheets - K12 Workbook Worksheets are Sales tax and discount work, Sales tax practice work, Calculating sales tax, Calculating sales tax, Calculating sales tax, Unit 3, Sales tax tips and discounts, Sales tax tips and discounts. *Click on Open button to open and print to worksheet. 1. Sales Tax and Discount Worksheet - ReloadOpenDownload 2. Sales Tax Practice Worksheet Calculating a Sales Tax Lesson Plan, Worksheet, Classroom Teaching Activity Print out the teaching lesson pages and exercise worksheets for use with this lesson: Printable lesson worksheet and activity. To teach and learn money skills, personal finance, money management, business, careers, and life skills please go to the Money Instructor home page. Teaching Money Calculate Sale Tax Lesson Plan Rules Guide Elementary ...

Calculating Sales Tax Worksheet: Fillable, Printable & Blank PDF Form ... How to Edit The Calculating Sales Tax Worksheet with ease Online. Start on editing, signing and sharing your Calculating Sales Tax Worksheet online with the help of these easy steps: click the Get Form or Get Form Now button on the current page to access the PDF editor. hold on a second before the Calculating Sales Tax Worksheet is loaded Calculating Total Cost after Sales Tax worksheet Calculating Total Cost after Sales Tax Finding Sales Tax and Total Cost after it is applied. ID: 839531 Language: English School subject: Math Grade/level: Grade 5 Age: 7-15 Main content: Percentage Other contents: Sales Tax Add to my workbooks (38) Download file pdf Embed in my website or blog Add to Google Classroom Add to Microsoft Teams Publication 523 (2021), Selling Your Home - IRS tax forms Any sales tax you paid on your home (such as for a mobile home or houseboat) and then claimed as a deduction on a federal tax return ... For each number, take the number from your “Total” worksheet, subtract the number from your “Business or Rental” worksheet, and enter the result in your “Home” worksheet (for example, subtract the ... Calculate Sales Tax | Worksheet | Education.com Worksheet Calculate Sales Tax It would be great if we never had to learn about sales tax, but since we do, 4th grade is as good a time as any! Throw in some favorite baseball game snacks for fun and get cracking. Add the sales tax and find how much each person's meal will cost. Download Free Worksheet See in a set (11) View answers

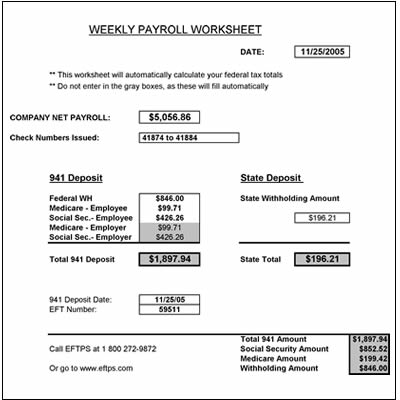

Federal withholding tax table - Article - QuickBooks Jun 21, 2021 · But now, on updated W-4s, employees can only lower their tax withholding by claiming dependents or by using the deduction worksheet on the form. What is the income tax rate for 2021? The federal withholding tax has seven rates …

www2.illinois.gov › revWelcome to the Illinois Department of Revenue FY 2023-03, Sales Tax Rate Change Summary, Effective January 1, 2023: 11/3/2022 5:00:00 AM: 2022 Tax Practitioner Meeting – Register Today :

sftaxcounsel.com › demystifying-irs-form-1116Demystifying IRS Form 1116- Calculating Foreign Tax Credits Calculating foreign tax credits and completing a Form 1116 can be complicated. If you are uncertain how to properly compute a foreign tax credit or complete a Form 1116, you should contact a qualified international tax professional. Anthony Diosdi is one of several tax attorneys and international tax attorneys at Diosdi Ching & Liu, LLP.

PDF Calculating Sales Tax - raymondgeddes.com Sales Tax Sales Receipt Worksheet Sales Tax Rate: ____ Sales Tax Rate Converted to Decimal: ___ Receipt #1 Customer Name: Monica Item Name Retail Price x Quantity = Total Price Retro Pencils $.20 5 $ Piranha Sharpener $.50 1 $ 6-Color Pen $.75 2 $ Dessert Eraser $.15 2 $ _____ Subtotal $ Sales Tax Amount $ _____ Total $

California Sales Tax Calculator - Tax-Rates.org The Tax-Rates.org California Sales Tax Calculator is a powerful tool you can use to quickly calculate local and state sales tax for any location in California. Just enter the five-digit zip code of the location in which the transaction takes place, and we will instantly calculate sales tax due to California, local counties, cities, and special taxation districts.

› instructions › i1040gi1040 (2021) | Internal Revenue Service - IRS tax forms Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments

learn.microsoft.com › en-us › dynamics365Record Special Sales Prices and Discounts - Business Central Oct 11, 2022 · If you want to copy sales prices, such as an individual customer's sales prices to use for a customer price group, you must run the Suggest Sales Price on Wksh. batch job on the Sales Price Worksheet page. Choose the icon, enter Sales Price Worksheet, and then choose the related link. Choose the Suggest Sales Price on Wksh. action.

California (CA) Sales Tax Rates by City (N) - Sale-tax.com The latest sales tax rates for cities starting with 'N' in California (CA) state. Rates include state, county, and city taxes. 2020 rates included for use while preparing your income tax deduction. ... Sales Tax Calculator | Sales Tax Table. Follow @SaleTaxCom. Sales tax data for California was collected from here. Sale-Tax.com strives to have ...

IRS tax forms IRS tax forms

› pub › IRS-pdfIRS tax forms IRS tax forms

Calculating Sales Tax | Worksheet | Education.com To figure it out, you'll have to practice calculating sales tax. Catered to fifth-grade students, this math worksheet shows kids the steps to find the amount something costs with tax. This process uses decimal numbers, rounding, and division. Students practice what they learn in both straightforward calculations and in word problems.

Demystifying IRS Form 1116- Calculating Foreign Tax Credits Calculating foreign tax credits and completing a Form 1116 can be complicated. If you are uncertain how to properly compute a foreign tax credit or complete a Form 1116, you should contact a qualified international tax professional. Anthony Diosdi is one of several tax attorneys and international tax attorneys at Diosdi Ching & Liu, LLP.

Record Special Sales Prices and Discounts - Business Central Oct 11, 2022 · Choose New to create a new sales price list. On the General and Tax FastTabs, fill in the fields as necessary. Hover over a field to read a short description. ... Choose the OK button to fill in the lines on the Sales Price Worksheet page with the suggested new prices. To implement the suggestions, ... Calculating invoice discounts on sales.

Auto Loan Payment Calculator | Cars.com Sales tax is a percentage of the car price that you owe to your state. Be sure to research how sales tax works for car purchases in your state – some states charge tax on the full price of the ...

Could Call of Duty doom the Activision Blizzard deal? - Protocol Oct 14, 2022 · Hello, and welcome to Protocol Entertainment, your guide to the business of the gaming and media industries. This Friday, we’re taking a look at Microsoft and Sony’s increasingly bitter feud over Call of Duty and whether U.K. regulators are leaning toward torpedoing the Activision Blizzard deal.

Calculating Sales Tax Worksheets & Teaching Resources | TpT In this discovery worksheet, students will calculate discounts and taxes using one or two steps and using proportions or decimals.Included in this product:-2-page worksheet-2-page answer key-Teacher's Guide with CCSS, objectives, materials, and procedureThis product is part of the Discovery-Based Wo Subjects: Decimals, Math, Word Problems Grades:

PDF Sales Tax Worksheet - EMSD63 Sales Tax Worksheet Directions: Using percents and proportions solve the following problems. Show all work. 1. If the sales tax rate in 7.25% in California, how much did Debbie pay if she bought a pair of jeans for $38? 2. Kristen bought a scarf for $22 in New York. In New York there is a 6.2% sales

1040 (2021) | Internal Revenue Service - IRS tax forms Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments

Calculating Tax Worksheets - K12 Workbook Worksheets are Sales tax practice work, Work calculating marginal average taxes, Sales tax and discount work, Sales tax and discount work, Income calculation work, Tip and tax homework work, Ira required minimum distribution work, Work for determining support. *Click on Open button to open and print to worksheet. 1. Sales Tax Practice Worksheet 2.

0 Response to "42 calculating sales tax worksheet"

Post a Comment