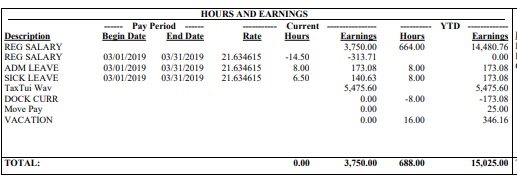

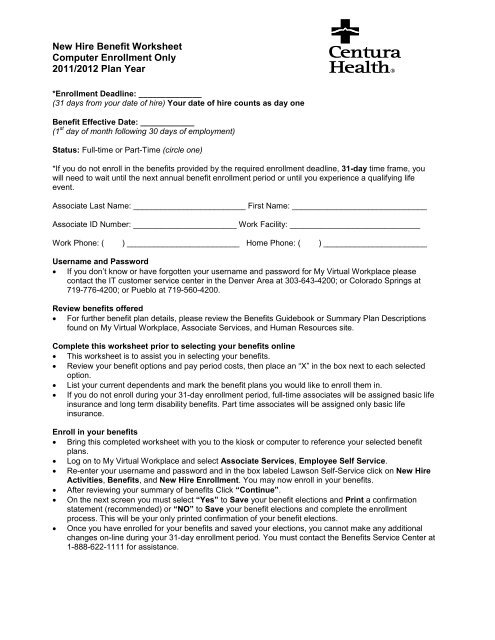

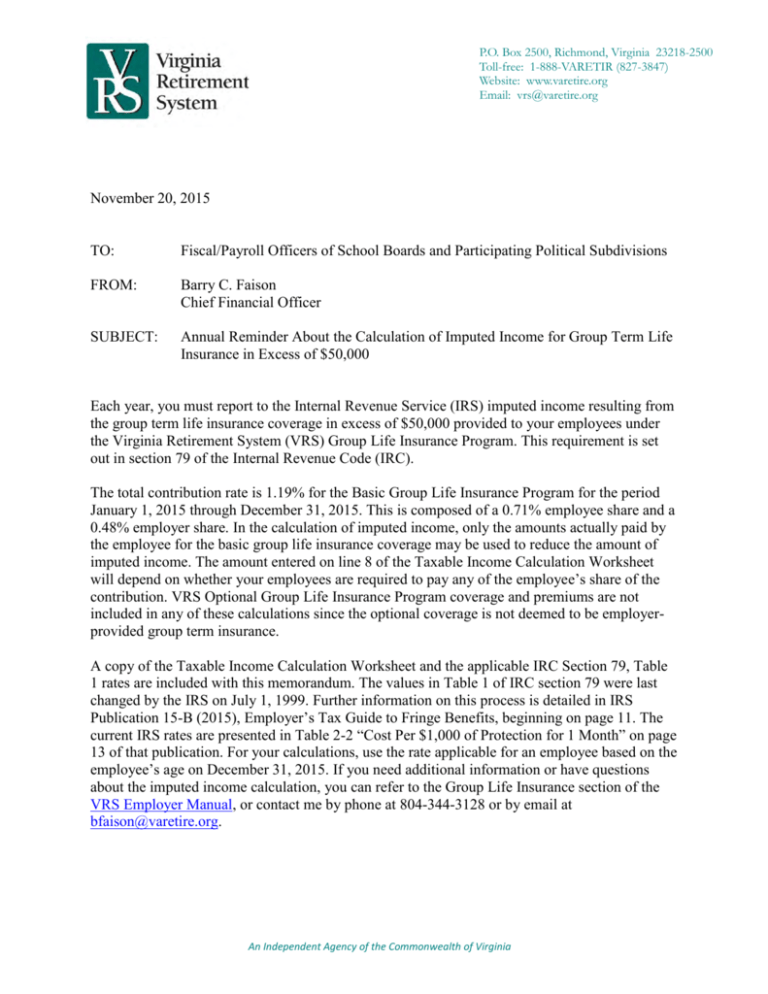

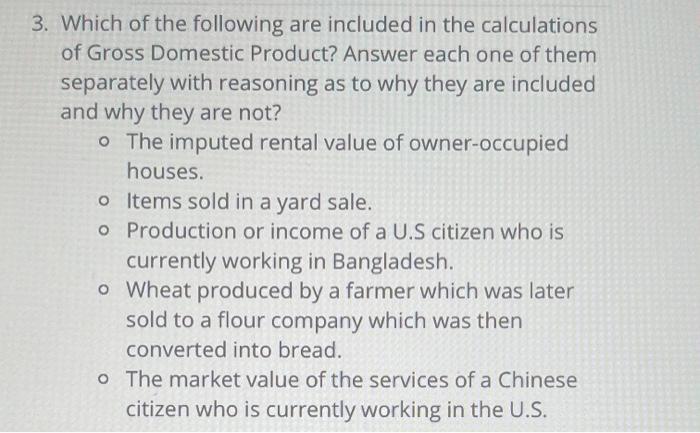

39 domestic partner imputed income worksheet

Instructions for Form 1120-F (2021) | Internal Revenue Service The foreign corporate partner (taxpayer) must complete a separate Form 8978 to report adjustments pertaining to income that is effectively connected with the conduct of a trade or business in the United States under section 882 (an “ECI Form 8978”) and a separate Form 8978 to report adjustments pertaining to income from U.S. sources not ... Instructions for Schedule M-3 (Form 1065) (12/2021) Partner A is paid a deductible guaranteed payment of $3,000 for services rendered to the partnership during the tax year. Partner Z is paid a $1,000 guaranteed payment, which is capitalized to land for tax accounting. Both guaranteed payments, in the total amount of $4,000, are treated as expenses in arriving at net financial accounting income.

Publication 541 (03/2022), Partnerships | Internal Revenue ... Section 1061 reporting. Section 1061 recharacterizes certain long-term capital gains of a partner that holds one or more applicable partnership interests as short-term capital gains. An applicable partnership interest is an interest in a partnership that is transferred to or held by a taxpayer, directly or indirectly, in connection with the performance of substantial services by the taxpayer ...

Domestic partner imputed income worksheet

Publication 550 (2021), Investment Income and Expenses ... For example, you may receive distributive shares of interest from partnerships or S corporations. This interest is reported to you on Schedule K-1 (Form 1065), Partner's Share of Income, Deductions, Credits, etc., and Schedule K-1 (Form 1120S), Shareholder's Share of Income, Deductions, Credits, etc. Instructions for Form 1120-L (2021) | Internal Revenue Service The amount included in income from Form 6478, Biofuel Producer Credit, if applicable. The amount included in income from Form 8864, Biodiesel and Renewable Diesel Fuels Credit, if applicable. Ordinary income from trade or business activities of a partnership from Schedule K-1 (Form 1065), Partner's Share of Income, Deductions, Credits. Publication 525 (2021), Taxable and Nontaxable Income Contributions to eligible retirement plans, other than a Roth IRA or a designated Roth contribution, reduce the qualified settlement income that you must include in income. See Exxon Valdez settlement income under Other Income, later. Also, see Pub. 590-A for more information. Taxpayer identification number (TIN).

Domestic partner imputed income worksheet. Instructions for Form 1120-C (2021) | Internal Revenue Service Dividends received on certain debt-financed stock acquired after July 18, 1984, from domestic and foreign corporations subject to income tax that would otherwise be subject to the dividends-received deduction under section 243(a)(1), 243(c), or 245(a). Publication 525 (2021), Taxable and Nontaxable Income Contributions to eligible retirement plans, other than a Roth IRA or a designated Roth contribution, reduce the qualified settlement income that you must include in income. See Exxon Valdez settlement income under Other Income, later. Also, see Pub. 590-A for more information. Taxpayer identification number (TIN). Instructions for Form 1120-L (2021) | Internal Revenue Service The amount included in income from Form 6478, Biofuel Producer Credit, if applicable. The amount included in income from Form 8864, Biodiesel and Renewable Diesel Fuels Credit, if applicable. Ordinary income from trade or business activities of a partnership from Schedule K-1 (Form 1065), Partner's Share of Income, Deductions, Credits. Publication 550 (2021), Investment Income and Expenses ... For example, you may receive distributive shares of interest from partnerships or S corporations. This interest is reported to you on Schedule K-1 (Form 1065), Partner's Share of Income, Deductions, Credits, etc., and Schedule K-1 (Form 1120S), Shareholder's Share of Income, Deductions, Credits, etc.

0 Response to "39 domestic partner imputed income worksheet"

Post a Comment