45 itemized deduction worksheet 2015

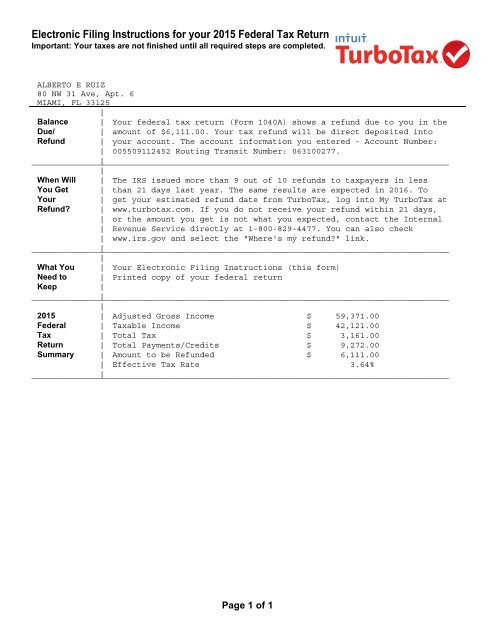

PDF 2015 Individual Income Tax Instructions - ksrevenue.gov Kansas itemized deductions are now calculated using 100 percent charitable contributions, 50 percent qualified residential interest, and 50 percent real and personal property taxes as claimed on your federal itemized deductions. See Part C of Schedule S. SOCIAL SECURITY NUMBER (SSN) REQUIREMENT. Individuals claiming income tax credits must have a PDF 2015 SCHEDULE CA (540) California Adjustments - Residents Schedule CA (540) 2015 Side 1 TAXABLE YEAR 2015 California Adjustments — Residents SCHEDULE CA (540) Important: Attach this schedule behind Form 540, Side 5 as a supporting California schedule. Name(s) as shown on tax return. SSN or ITIN. Part I. Income Adjustment Schedule Section A - Income. A

PDF 2015 schedule a itemized deductions worksheet 2015 schedule a itemized deductions worksheet. Schedule A (Form 1040 or 1040-SR): Itemized Deductions is an Internal Revenue Service (IRS) form for U.S. taxpayers who choose to itemize their tax-deductible expenses rather than take the standard deduction. The Schedule A form is an optional attachment to the standard 1040 form that U.S ...

Itemized deduction worksheet 2015

nj worksheet h - printablequizzliam.z21.web.core.windows.net Itemized Deductions Worksheet 2015 - Worksheet List nofisunthi.blogspot.com 1116 deductions itemized deduction Infantry Belt Buckle. Company I 1st Nj Infantry Division World War I infantry buckle belt company 4th virginia wwii division 39 Work Power And Energy Worksheet Answers - Combining Like Terms Worksheet How to Calculate Deductions & Adjustments on a W-4 Worksheet If the standard deduction that you qualify for is higher than your itemized deductions, you should choose the standard deduction. On the other hand, deductions should be itemized if doing so will result in you paying lower taxes. The W-4 deductions worksheet asks you to select the larger of the two deductions on line three. Fill - Free fillable Form 2015: Itemized Deductions Dental Medical ... Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Form 2015: Itemized Deductions Dental Medical (Form 1040) (IRS) On average this form takes 18 minutes to complete. The Form 2015: Itemized Deductions Dental Medical (Form 1040) (IRS) form is 1 page long and contains: 0 signatures.

Itemized deduction worksheet 2015. Deduction | Iowa Department Of Revenue If you itemize deductions, a portion of the automobile or multipurpose vehicle annual registration fee you paid in 2015 may be deducted as personal property tax on your Iowa Schedule A, line 6, and federal Schedule A, line 8. This deduction is for annual registration fees paid based on the value of qualifying automobiles and multipurpose vehicles. deduction worksheet preschool Itemized Deductions Worksheet 2015 - Worksheet List nofisunthi.blogspot.com. 1116 itemized deductions foreign deduction 1120s calculate passive. Itemized deduction worksheet homeschooldressage.com. 15 free esl deduction worksheets. Deductions must poetry lesson fun esl deduction worksheets resources Itemized deductions: a beginner's guide - Money Under 30 Anyways, for the tax year 2021 (aka the taxes you file in April, 2022), the standard deductions are as follows, based on your filing status: $12,550 for single filers and married filing separately, $26,900 for joint filers, and. $19,400 for head of household. So if you make $60,000, and you choose the standard deduction amount of $12,550, your ... About Schedule A (Form 1040), Itemized Deductions Information about Schedule A (Form 1040), Itemized Deductions, including recent updates, related forms, and instructions on how to file. This schedule is used by filers to report itemized deductions. Use Schedule A (Form 1040 or 1040-SR) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the ...

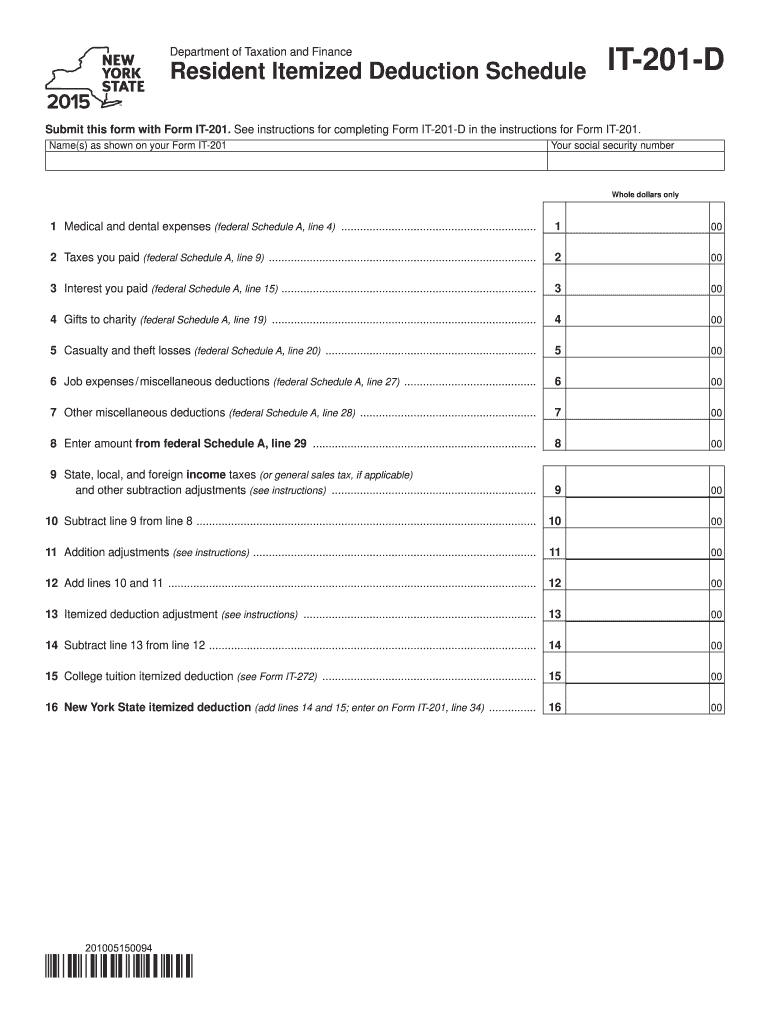

PDF Itemized Deductions - Internal Revenue Service Itemized Deductions 20-1 Itemized Deductions Introduction This lesson will assist you in determining if a taxpayer should itemize deductions. Generally, taxpayers should itemize if their total allowable deductions are higher than the standard deduction amount. Objectives At the end of this lesson, using your resource materials, you will be able to: deduction worksheet preschool 39 Itemized Deduction Worksheet 2015 - Combining Like Terms Worksheet chripchirp.blogspot.com. itemized deduction. Free Print Diy Preschool Workseet - Home Design homecreativa.com. workseet collarbone. Itemized Tax Deduction Worksheet - Cialis-genericcheapest-price.org Itemized Deductions Worksheet 2015 - Worksheet List DD9 8 Best Images of Monthly Bill Worksheet - 2015 Itemized Tax Deduction ... How to Fill Out a Form W-4 (2019 Edition) 10 Best Images of 2014 Itemized Deductions Worksheet - 1040 Forms ... Job Vacancy In Nepal Bank Limited - Job Finder in Nepal ... 1992-93 Ferguson's Ceylon Directory. 2015 personal income tax forms 2015 personal income tax forms; Form number Instructions Form title; DTF-620: ... Nonresident and Part-Year Resident Income Allocation and College Tuition Itemized Deduction Worksheet: IT-203-C (Fill-in) Instructions on form: Nonresident or Part-Year Resident Spouse's Certification: IT-203-D (Fill-in)

Use Excel to File 2015 Form 1040 and Related Schedules The 2015 version of the spreadsheet includes both pages of Form 1040, as well as these supplemental schedules: Schedule A: Itemized Deductions; Schedule B: Interest and Ordinary Dividends; Schedule C: Profit or Loss from Business; Schedule D: Capital Gains and Losses (along with its worksheet) Schedule E: Supplemental Income and Loss PDF 2015 ITEMIZED DEDUCTIONS WORKSHEET - saralandtax.com 2015 ITEMIZED DEDUCTIONS WORKSHEET For 2015 the "Standard Deduction" is $12,600 on a Joint Return, $9,250 for a Head of Household, and $6,300 if you are Single. If you normally itemize your personal deductions or even think that itemized deductions might ... 2015 ITEMIZED DEDUCTIONS - FINAL as of 9-18-2015.pub Author: Joe Created Date: 12/22 ... An Overview of Itemized Deductions - Investopedia For 2021 taxes, the standard deduction is $12,550 for singles ($12,950 for 2020), $18,800 for heads of household ($19,400 for 2022) and $25,100 for married filing jointly taxpayers ($25,900 for... Publication 946 (2021), How To Depreciate Property Section 179 deduction dollar limits. For tax years beginning in 2021, the maximum section 179 expense deduction is $1,050,000. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds $2,620,000.Also, the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2021 is $26,200.

2021 Instructions for Schedule CA (540) | FTB.ca.gov References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2015, and the California Revenue and Taxation Code (R&TC). ... YES: Complete the Itemized Deductions Worksheet in the next column. Note: If married or an RDP and filing a separate tax return, you and your spouse/RDP must either both itemize your deductions ...

2014 itemized deductions worksheet Itemized Deductions Worksheet 2015 - Worksheet List nofisunthi.blogspot.com. deductions itemized fillable. Itemized Deductions Spreadsheet Printable Spreadshee Itemized db-excel.com. worksheet deductions itemized tax deduction spreadsheet template sheet business driver excel profit loss estate balance settlement loan interest printable truck.

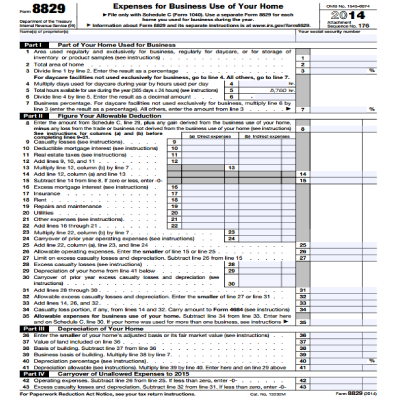

Publication 527 (2020), Residential Rental Property You may also need to attach Form 4562 if you are claiming a section 179 deduction, amortizing costs that began during 2020, or claim any other deduction for a vehicle, including the standard mileage rate or lease expenses. See Pub. 946 for information on preparing Form 4562.

PDF Schedule A - Itemized Deductions - Internal Revenue Service Schedule A - Itemized Deductions (continued) To enter multiple expenses of a single type, click on the small calculator icon beside the line. Enter the first description, the amount, and Continue. Enter the information for the next item. They will be totaled on the input line and carried to Schedule A. If taxpayer has medical insurance

Publication 587 (2021), Business Use of Your Home If you paid $3,000 of mortgage insurance premiums on loans used to buy, build, or substantially improve the home in which you conducted business but the Mortgage Insurance Premiums Deduction Worksheet you completed for the Worksheet To Figure the Deduction for Business Use of Your Home limits the amount of mortgage insurance premiums you can ...

Publication 501 (2021), Dependents, Standard Deduction, and ... The standard deduction for taxpayers who don't itemize their deductions on Schedule A of Form 1040 or 1040-SR is higher for 2021 than it was for 2020. The amount depends on your filing status. You can use the 2021 Standard Deduction Tables near the end of this publication to figure your standard deduction. Charitable contribution deduction.

What Is an Itemized Deduction? - The Balance Itemizing involves reporting your expenses for specific types of allowable deductions, adding them all together, then entering that total on your tax return. The itemized total is subtracted from your AGI to reduce the amount of taxable income. If you plan to itemize, you should keep track of your qualified expenses during the year.

Publication 590-A (2021), Contributions to Individual ... Modified AGI limit for certain married individuals increased. If you are married and your spouse is covered by a retirement plan at work and you aren’t, and you live with your spouse or file a joint return, your deduction is phased out if your modified AGI is more than $204,000 (up from $198,000 for 2021) but less than $214,000 (up from $208,000 for 2021).

2015 Individual Income Tax Forms - Maryland Office of the Comptroller Maryland Nonresident Itemized Deduction Worksheet: Worksheet for nonresident taxpayers who were required to reduce their federal itemized deductions. Resident Individuals Income Tax Forms. Number ... Form and instructions to be used by resident individuals for amending any item of a Maryland return for tax year 2015. 588:

PDF 19 2021 Itemized Deduction (Sch A) Worksheet - cotaxaide.org 19 - 2021 Itemized Deduction (Sch A) Worksheet (type-in fillable) I donated a vehicle worth more than $500 I made more than $5,000 of noncash donations I paid interest on borrowings for investments I repaid income (taxed in prior year) over $3,000 If you checked any of the above, please stop here and speak with one of our Counselors.

Publication 525 (2021), Taxable and Nontaxable Income Standard deduction limit. Standard deduction for earlier years. Negative taxable income. Recovery limited to deduction. Overall limitation on itemized deductions no longer applies. Worksheet 2a. Computations for Worksheet 2, lines 1a and 1b; Worksheet 2. Recoveries of Itemized Deductions; Unused tax credits. Subject to AMT. Nonitemized ...

PDF Itemized Deductions Worksheet-Line 15 2016 - 1040.com No. Stop. Your deduction is not limited. Enter the amount from line 1 above on Schedule A, line 15. Yes. Subtract line 6 from line 5 Multiply line 7 by 3% (.03) Enter the smaller of line 4 or line 8 Total itemized deductions. Subtract line 9 from line 1. Enter the result here and on Schedule A, line 15 WK_A_NR.LD Name(s) as shown on return Tax ...

List of Itemized Deductions Checklist Form - SignNow Follow the step-by-step instructions below to eSign your list of all itemized deductions: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of eSignature to create. There are three variants; a typed, drawn or uploaded signature. Create your eSignature and click Ok. Press Done.

Itemized Deduction Worksheets - K12 Workbook Worksheets are Schedule a itemized deductions, Deductions form 1040 itemized, Itemized deductions work, Itemized deduction work tax year, Personal itemized deductions work, Itemized deduction work 14a 178150 or more, Itemized deductions limitation work, Ia 104 itemized deductions work 41 104. *Click on Open button to open and print to worksheet. 1.

PDF Deductions (Form 1040) Itemized - Internal Revenue Service 2015 Instructions for Schedule A (Form 1040)Itemized Deductions Use Schedule A (Form 1040) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. If you itemize, you can deduct a part of your medical and dental expenses and unre-

2021 Instructions for Schedule A (2021) | Internal Revenue ... If the amount on Form 1040 or 1040-SR, line 11, is more than $100,000 ($50,000 if married filing separately), your deduction is limited and you must use the Mortgage Insurance Premiums Deduction Worksheet to figure your deduction.

PDF Form IT-203-B:2015:Nonresident and Part-Year Resident Income Allocation ... And College Tuition Itemized Deduction Worksheet Name(s) and occupation(s) as shown on Form IT-203 Your social security number Complete all parts that apply to you; see instructions (Form IT-203-I). Submit this form with your Form IT-203. Schedule A - Allocation of wage and salary income to New York State Nonworking days included in line 1a:

Small Business Itemized Tax Deduction - K12 Workbook Worksheets are Small business work, Small business tax work, Llc s corp small business work, Tax deductions checklist for small businesses, Schedule a tax deduction work, Work, Specialization tax year 2018 small business checklist, Personal itemized deductions work. *Click on Open button to open and print to worksheet. 1.

Fill - Free fillable Form 2015: Itemized Deductions Dental Medical ... Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Form 2015: Itemized Deductions Dental Medical (Form 1040) (IRS) On average this form takes 18 minutes to complete. The Form 2015: Itemized Deductions Dental Medical (Form 1040) (IRS) form is 1 page long and contains: 0 signatures.

How to Calculate Deductions & Adjustments on a W-4 Worksheet If the standard deduction that you qualify for is higher than your itemized deductions, you should choose the standard deduction. On the other hand, deductions should be itemized if doing so will result in you paying lower taxes. The W-4 deductions worksheet asks you to select the larger of the two deductions on line three.

nj worksheet h - printablequizzliam.z21.web.core.windows.net Itemized Deductions Worksheet 2015 - Worksheet List nofisunthi.blogspot.com 1116 deductions itemized deduction Infantry Belt Buckle. Company I 1st Nj Infantry Division World War I infantry buckle belt company 4th virginia wwii division 39 Work Power And Energy Worksheet Answers - Combining Like Terms Worksheet

0 Response to "45 itemized deduction worksheet 2015"

Post a Comment