44 non cash charitable contributions worksheet

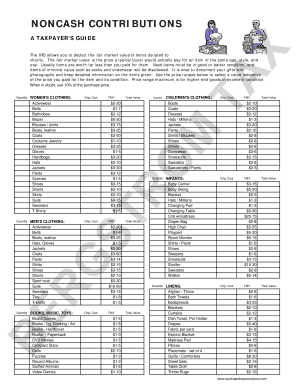

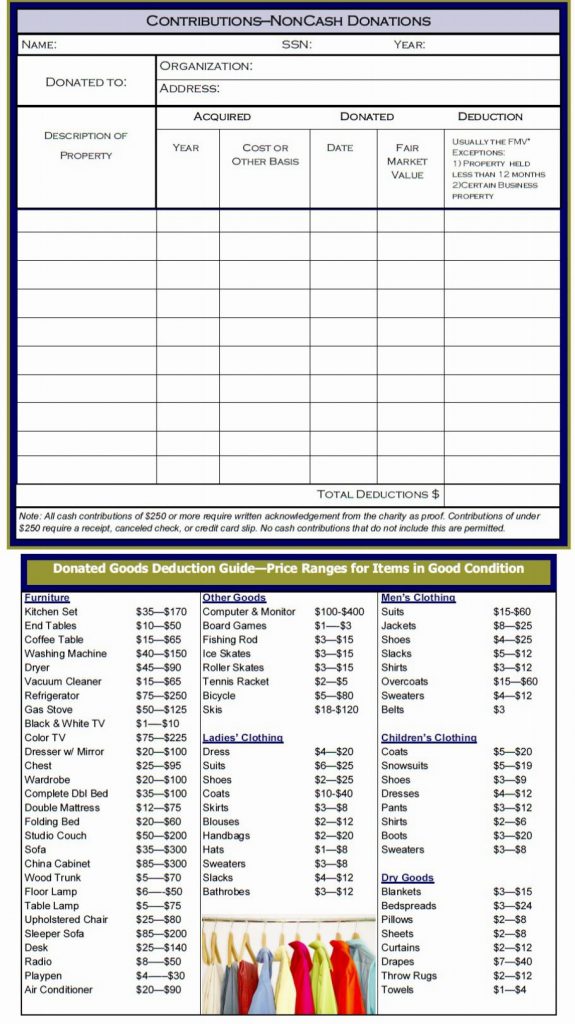

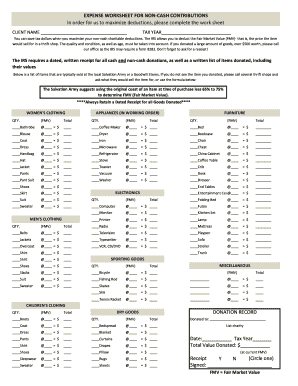

Charitable Contributions: Tax Breaks and Limits - Investopedia Jul 30, 2022 · Nonitemizers can deduct cash gifts to charities of up to $300 if single and $600 if married, and itemizers' AGI limits stay at increased 2020 levels. PDF Non-Cash Charitable Contribution Worksheet Use One Worksheet per ... Non-Cash Charitable Contribution Worksheet The following tables are estimates only. Actual FMV could vary significantly. ... Non-cash Contributions, updated 1-2-2015 Item Qty Amount Qty Amount Subtotal Excellent Condition Average Condition End Table 35.00 x = 7.00 x = Floor Lamp 35.50 x = 8.00 x = Folding Bed 60.00 x = 20.00 x =

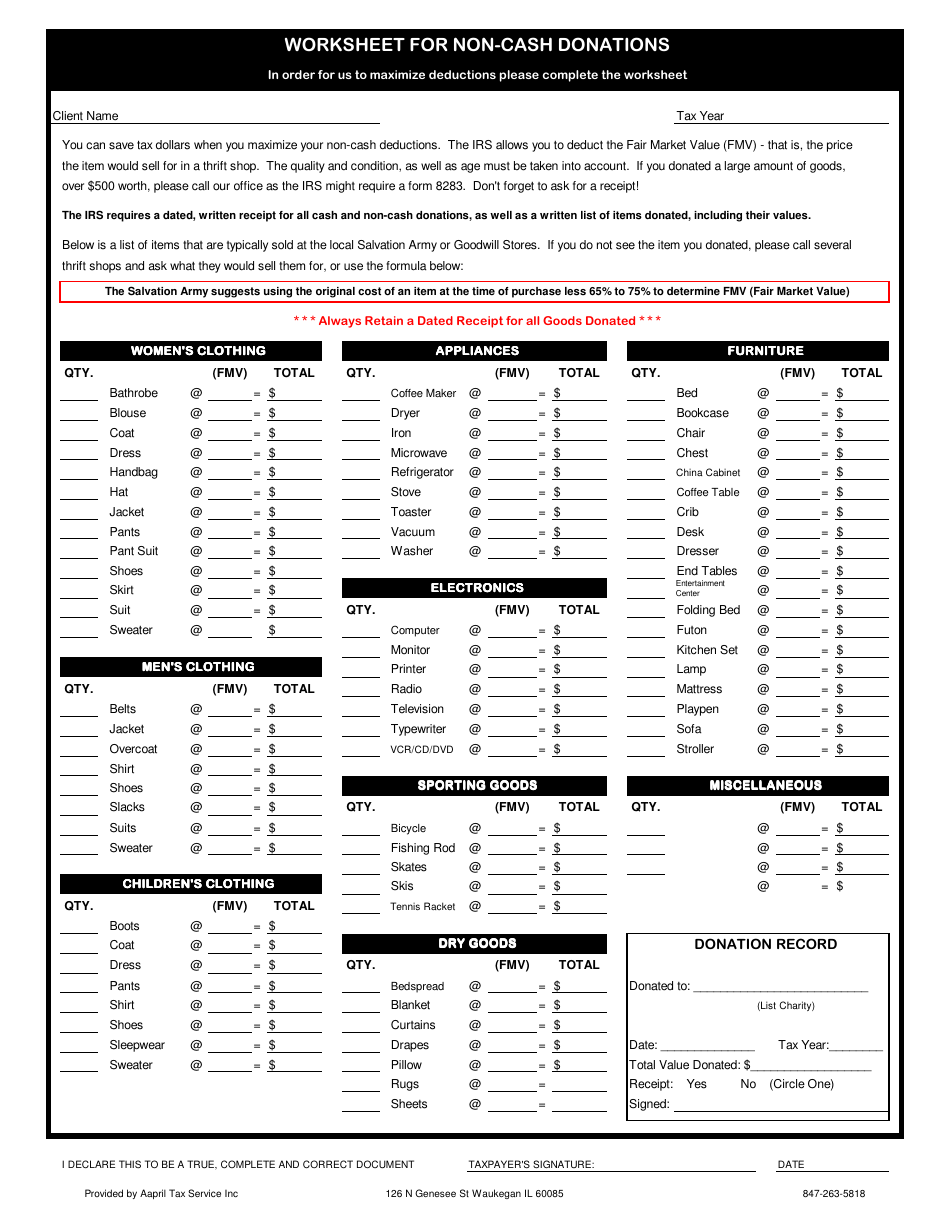

XLS Noncash charitable deductions worksheet. Note: This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation. Although the Retain this worksheet with your receipts in your tax file.

Non cash charitable contributions worksheet

Online Donation Value Guide Spreadsheet - Printable and Editable PDF Form How to prepare Donation Value Guide Spreadsheet 1 Open the template You do not have to search for a sample of Donation Value Guide Spreadsheet online and download the document. Open up the sample immediately inside the editor with one click. 2 Fill the form Fill every single field in the template supplying legitimate details. PDF NON-CASH DONATION WORKSHEET (Based on Salvation Army average prices for ... NON-CASH DONATION WORKSHEET (Based on Salvation Army average prices for items in Good Condition) DONATED TO: DONATION DATE: MISCELLANEOUS LOW HIGH AVG QTY AMOUNT VALUE Adding Machines 24.00 90.00 57.00 Christmas Trees 18.00 60.00 39.00 Broiler Ovens 18.00 30.00 24.00 Copier 120.00 240.00 180.00 How to Value Noncash Charitable Contributions | Nolo The tax law contains an exception to the good used condition requirement for any single item of clothing or single household item that is worth $500 or more. If a donor gives such an item, it can be in less than good used condition. However, you must have a qualified appraisal of the item's value and must file IRS Form 8283, Noncash Charitable ...

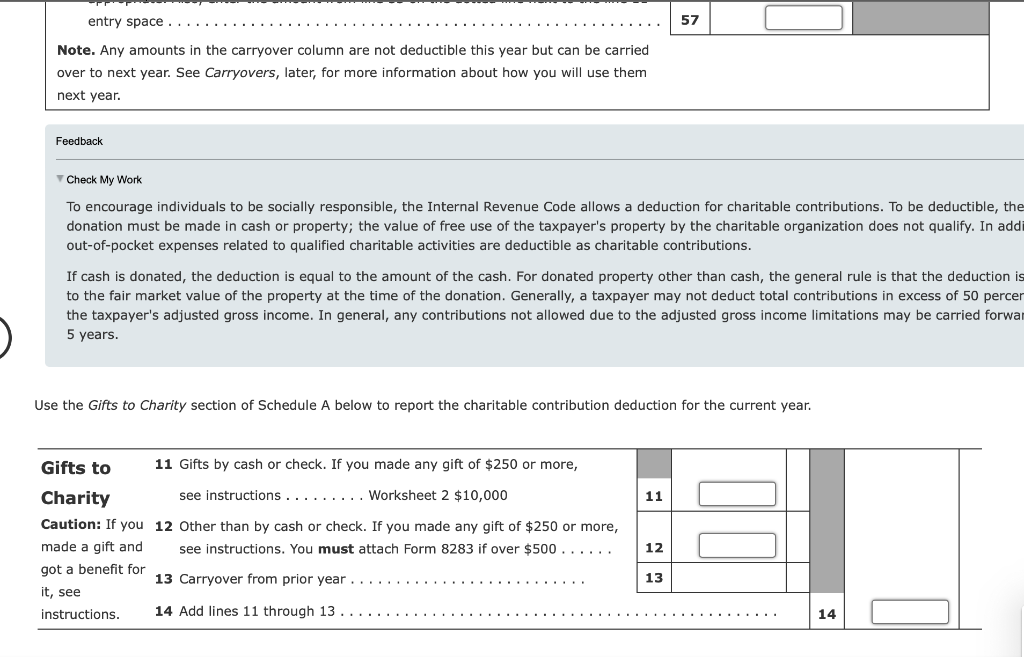

Non cash charitable contributions worksheet. Course Help Online - Have your academic paper written by a ... We have an essay service that includes plagiarism check and proofreading which is done within your assignment deadline with us. This ensures all instructions have been followed and the work submitted is original and non-plagiarized. We offer assignment help on any course. We offer assignment help in more than 80 courses. Publication 526 (2021), Charitable Contributions | Internal ... Step 2. Enter your other charitable contributions made during the year. 3. Enter cash contributions that you elect to treat as qualified contributions plus cash contributions payable for relief efforts in qualified disaster areas that you elected to treat as qualified contributions. Don’t include this amount on line 4 below: 3 4. charitable contributions worksheet 31 Non Cash Charitable Contributions Worksheet - Worksheet Resource Plans starless-suite.blogspot.com. charitable cash non template worksheet contributions donation sheet pdf contribution documents. 27 Non Cash Charitable Contributions Worksheet - Worksheet Information nuviab6ae4.blogspot.com. XLS Noncash charitable deductions worksheet. NON CASH CHARITABLE CONTRIBUTIONS / DONATIONS WORKSHEET. Insert Tax Year ===> Insert Date Given ===> ENTER ITEMS NOT PROVIDED FOR IN THE ABOVE CATEGORIES. SET YOUR OWN VALUE. WHAT IS YOUR ORIGINAL COST BASED ON RECIEPTS, OR YOUR BEST ESTIMATE, OF THE ITEMS DONATED? Charity's Address Blouse Coats Dresses Evening dresses Handbags WOMEN's CLOTHING

XLS Noncash charitable deductions worksheet. - lstax.com Note: This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation. Although the Charitable Donations | H&R Block Non-cash donations of $5,000 or more If your non-cash single charitable donation for one item or a group of similar items is more than $5,000: The organization must give you a written acknowledgement. You must keep the records required under the rules for donations of more than $500 but less than $5,000. Rules For Deducting Cash And Non-Cash Charitable Contributions - Tax Blog Generally, non-cash charitable contributions are tax deductible at the fair market value (FMV) of the property contributed. The following rules apply to non-cash contributions: • For donations of used cars, boats, airplanes, if you claim a value of $500 or more for any of these items, you must obtain a written acknowledgement from the organization. 2022 Free Non Cash Charitable Contributions Worksheet Non Cash Charitable Contribution Worksheet PDF, Google Sheet, EXCEL from e-database.org. Worksheets are non cash charitable contributions donations work, non cash charitable contributions work, the. Most cell phones today can take pictures. This worksheet is provided as a convenience and aide in calculating. Source:

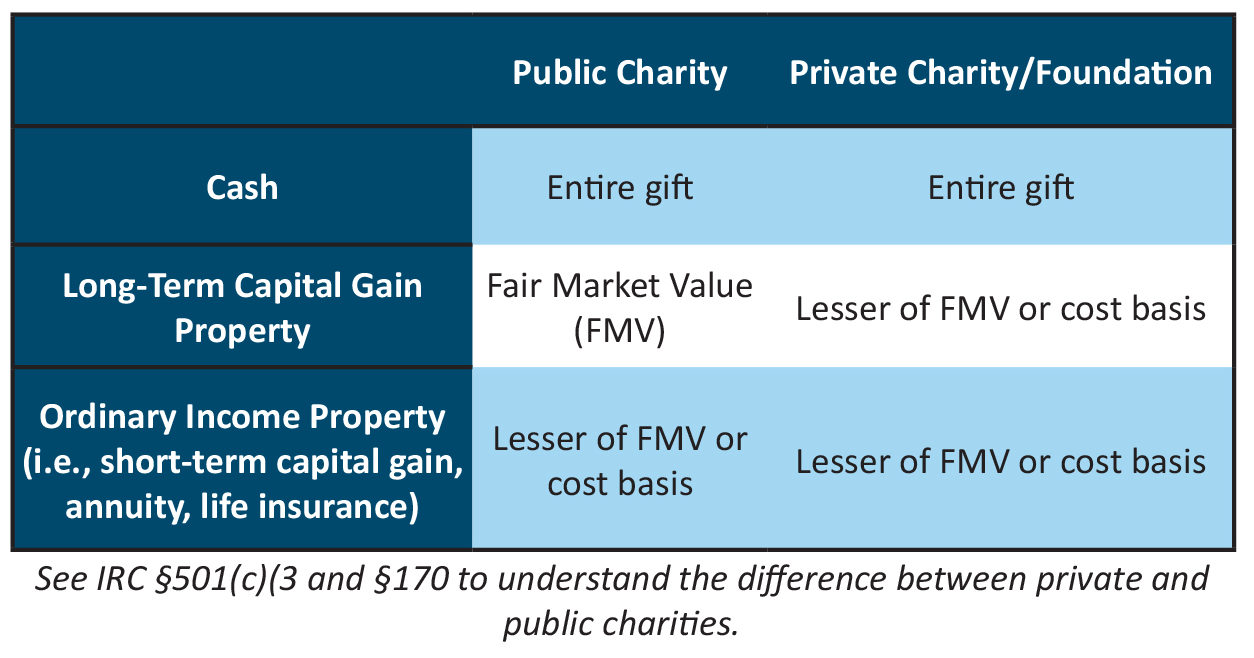

Non Cash Charitable Contributions Donations Worksheet: Fillable ... Read the following instructions to use CocoDoc to start editing and completing your Non Cash Charitable Contributions Donations Worksheet: In the beginning, look for the "Get Form" button and click on it. Wait until Non Cash Charitable Contributions Donations Worksheet is ready. Customize your document by using the toolbar on the top. Form 8283: Noncash Charitable Contributions Definition - Investopedia Non-cash contributions can include securities, property, vehicles, collectibles, and art. The form can be downloaded from the IRS website. 2 Key Takeaways Donated non-cash items may... Knowledge Base Solution - Why are my Charitable contributions not ... Go to the Income / Deductions > Charitable Contributions worksheet. In section5. Column Description, input the description. Column Type, input the type. ... Line 5 - Non Cash Contributions (30%). Line 6 - Capital gain property to a 50% Organization (30%). Line 7 - Capital gain property (20%). Calculate the return. Solution Tools Publication 17 (2021), Your Federal Income Tax | Internal ... For more information, see Pub. 526, Charitable Contributions.. Virtual currency. If, in 2021, you engaged in a transaction involving virtual currency, you will need to answer “Yes” to the question on page 1 of Form 1040 or 1040-SR.

About Form 8283, Noncash Charitable Contributions About Form 8283, Noncash Charitable Contributions Individuals, partnerships, and corporations file Form 8283 to report information about noncash charitable contributions when the amount of their deduction for all noncash gifts is more than $500. Current Revision Form 8283 PDF Instructions for Form 8283 (Print Version) PDF Recent Developments

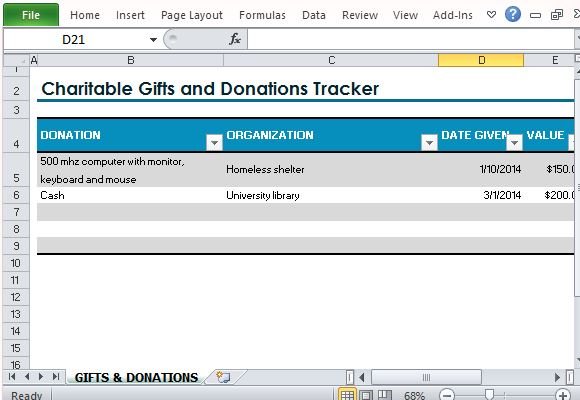

Charitable Contribution Worksheet | STAC Accounting December 20, 2017 Reporting Non Cash Charitable Donations can be extremely beneficial to your bottom line tax liability. Although, pulling it all together can also be painfully arduous. I am providing access to a worksheet built in excel. Download it and open in your 'sheets' app (excel, numbers, google sheets).

Donation value guide - Goodwill NNE Furniture should be in gently-used, non-broken condition. Fabric should be free of stains and holes. Coffee Table. $15 – $100. Dresser. $20 – $80. End Table. $10 – $75. Kitchen Set. $35 – $135. Lamp, Floor. $8 – $34. Lamp, Table. $3 – $20. Sofa. $40 – $395. Stuffed Chair. $10 – $75. Computer Equipment. Computer equipment of any condition can be donated to Goodwill. …

non cash charitable contributions/donations worksheet 2007-2022 - Fill ... Stick to these simple actions to get non cash charitable contributions/donations worksheet ready for sending: Get the document you require in the collection of legal forms. Open the template in the online editing tool. Read through the recommendations to discover which details you must give. Click the fillable fields and put the requested data.

PDF NON-CASH CHARITABLE CONTRIBUTION WORKSHEET - Holberton Tax non-cash charitable contribution worksheet date _____ organization _____ address_____ the following tables are estimates only. actual fmv may vary significantly. women's clothing qty amount qty amount subtotal bathrobe 12.00 x = 9.00 x =

PDF 1RQ &DVK &KDULWDEOH &RQWULEXWLRQV :RUNVKHHW - Lenny Letcher &olhqw bbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbb7d[

Goodwill Donation Worksheets - K12 Workbook 1. NON-CASH CHARITABLE CONTRIBUTIONS / DONATIONS WORKSHEET 2. NON-CASH DONATION WORKSHEET (Based on Salvation Army ... 3. VALUATION GUIDE FOR GOODWILL DONORS 4. 2020 Charitable Contributions Noncash FMV Guide 5. CHARITABLE CONTRIBUTIONS or DONATIONS 6. NON-CASH CONTRIBUTION WORKSHEET 7. Itemized Deductions Worksheet 8.

Publication 519 (2021), U.S. Tax Guide for Aliens | Internal ... Charitable contributions. Students or business apprentices eligible for the benefits of Article 21(2) of the United States-India Income Tax Treaty who have elected to use the standard deduction may qualify to take a deduction for charitable contributions of up to $300. For more information, see chapter 5. Form 1040-NR-EZ discontinued.

What does "Noncash Contributions Worksheet: Cost/adjusted ... - Intuit You need to enter the worth of the property that you donated. For example if you donated a couch, it would be what you paid for the couch when you originally purchased it. June 1, 2019 12:45 PM. Go back to your charity entries and make sure you have filled out all of the information. It is likely that you did not enter the basis for something ...

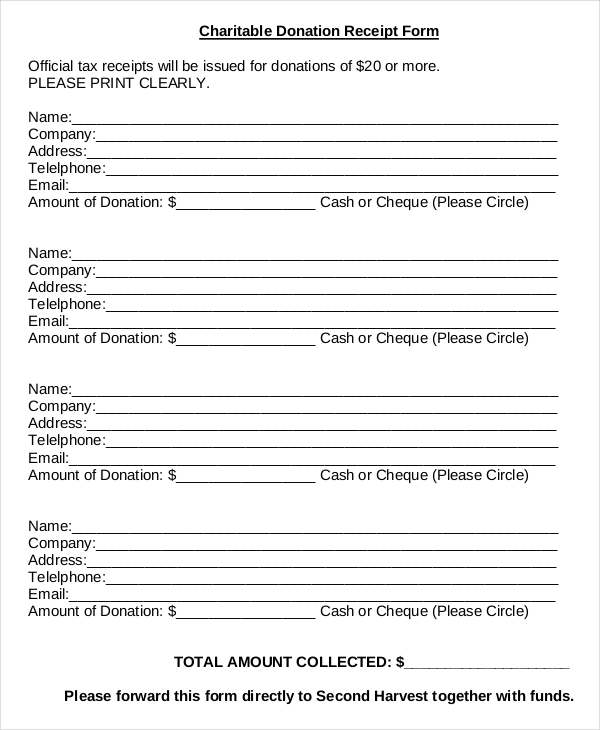

The Complete 2022 Charitable Tax Deductions Guide - Daffy Non-cash contributions: For non-cash contributions, the limit to make a deduction without a receipt is $500. Additionally, non-cash contributions also require an appraisal to determine the fair market value of the item you donated. If the value is $5,000 or less, you just need to hang onto the appraisal with your tax documents in case of an audit.

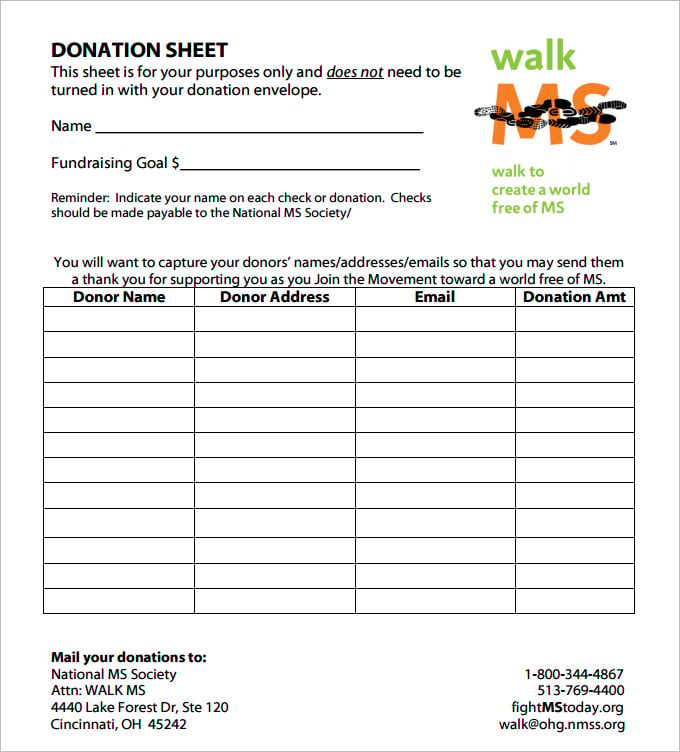

Charitable Donation Spreadsheets Charitable Donation Spreadsheets Below are FREE charitable donation spreadsheets. These spreadsheets will help you calculate and track your charitable donations for tax deduction purposes. All Practical Spreadsheets are easy to use and have pre-defined print areas. Most also include comments to aid in data entry.

Tax Tip: Deducting Non-Cash Charitable Donations for 2021 In our last article, Deducting Charitable Cash Contributions for 2021, we discussed the proper ways to deduct cash donations on your tax return. However, what if you're making a non-cash donation such as food, clothing, household items or even a vehicle? The Internal Revenue Service (IRS) does allow taxpayers to deduct the value of these types of donations but have become increasingly ...

PDF Non-cash Charitable Contributions / Donations Worksheet NON-CASH CHARITABLE CONTRIBUTIONS / DONATIONS WORKSHEET TAXPAYERS NAME(S): Insert Tax Year ===> ... Note: This worksheet is provided as a convenience and aid in calculating most common non-cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed ...

Tax Deductions - ItsDeductible Existing Customers. Sign In. New Customers. Create New Account. Your account allows you to access your information year-round to add or edit your deductions.

Publication 535 (2021), Business Expenses | Internal Revenue ... Comments and suggestions. We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

PDF Non-Cash Charitable Contributions Worksheet - LB Tax Services Missing Information: Non-Cash Charitable Contributions Worksheet Name. Home Telephone: Work Telephone: Tax Year: 2016 Cell: The following is a guideline for valuation of non-cash charitable contributions. When valuing items, take into consideration the condition of the items. If the value of the donated items is $250 or more to one charity in

PDF Missing Information: Non-Cash Charitable Contributions Worksheet - HMS CPA Missing Information: Non-Cash Charitable Contributions Worksheet (pg 4) Prepared By: HMS CERTIFIED PUBLIC ACCOUNTANTS 09-24-2013 457 Lake Howell Rd. Maitland FL 32751 Tel: (407) 571-4080 Fax: (407) 571-4090 information@hmscpa.com Men's Clothing $$ Guideline Your Cost # Items Value Today Deduction Jackets 7.50 - 25.00 Overcoats 15.00 - 60.00

Non Cash Charitable Donations Worksheets - K12 Workbook *Click on Open button to open and print to worksheet. 1. NON-CASH CHARITABLE CONTRIBUTIONS / DONATIONS WORKSHEET 2. The Salvation Army Valuation Guide for Donated Items ... 3. Thrift Store Valuation Guide 4. NON-CASH DONATION WORKSHEET (Based on Salvation Army ... 5. Anderson Financial Services 6. FAIR MARKET VALUE GUIDE FOR USED ITEMS

How to Value Noncash Charitable Contributions | Nolo The tax law contains an exception to the good used condition requirement for any single item of clothing or single household item that is worth $500 or more. If a donor gives such an item, it can be in less than good used condition. However, you must have a qualified appraisal of the item's value and must file IRS Form 8283, Noncash Charitable ...

PDF NON-CASH DONATION WORKSHEET (Based on Salvation Army average prices for ... NON-CASH DONATION WORKSHEET (Based on Salvation Army average prices for items in Good Condition) DONATED TO: DONATION DATE: MISCELLANEOUS LOW HIGH AVG QTY AMOUNT VALUE Adding Machines 24.00 90.00 57.00 Christmas Trees 18.00 60.00 39.00 Broiler Ovens 18.00 30.00 24.00 Copier 120.00 240.00 180.00

Online Donation Value Guide Spreadsheet - Printable and Editable PDF Form How to prepare Donation Value Guide Spreadsheet 1 Open the template You do not have to search for a sample of Donation Value Guide Spreadsheet online and download the document. Open up the sample immediately inside the editor with one click. 2 Fill the form Fill every single field in the template supplying legitimate details.

0 Response to "44 non cash charitable contributions worksheet"

Post a Comment