43 gross pay vs net pay worksheet

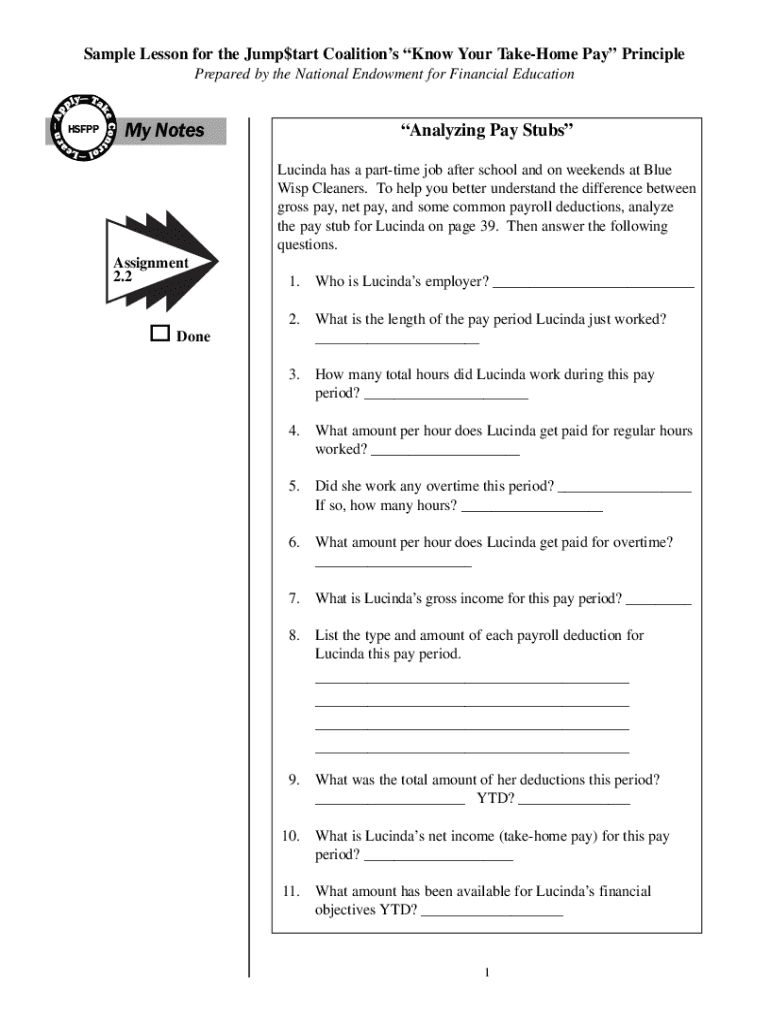

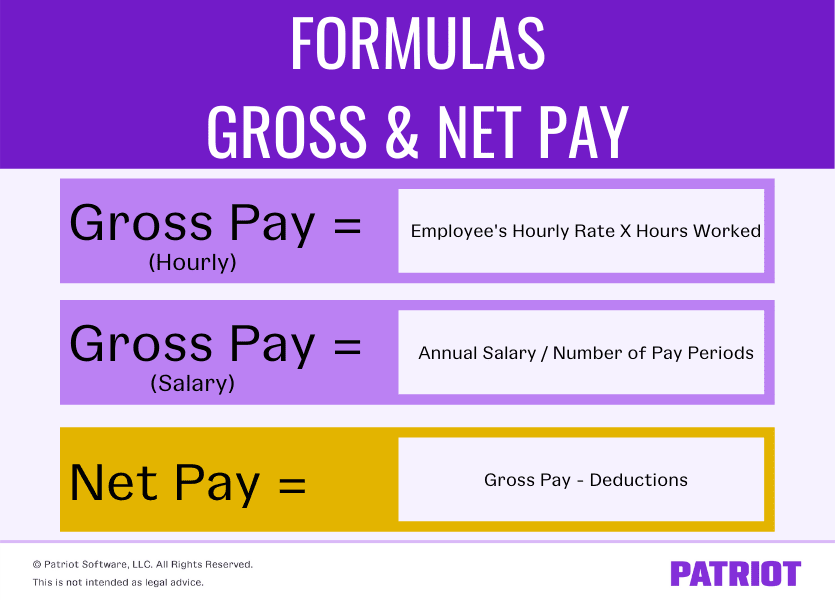

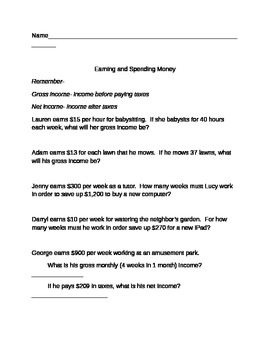

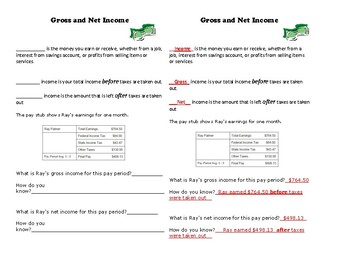

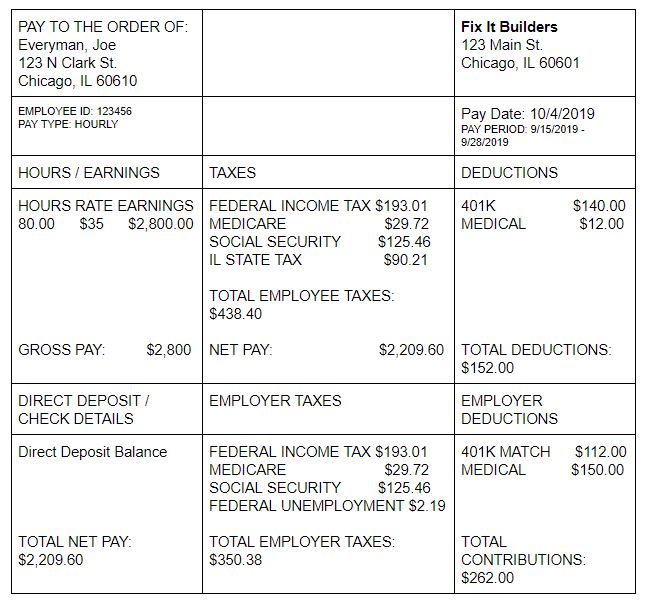

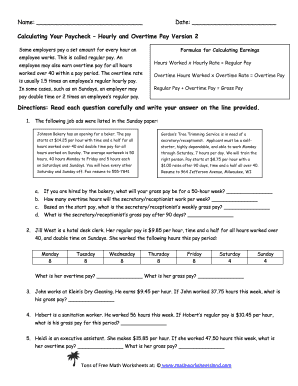

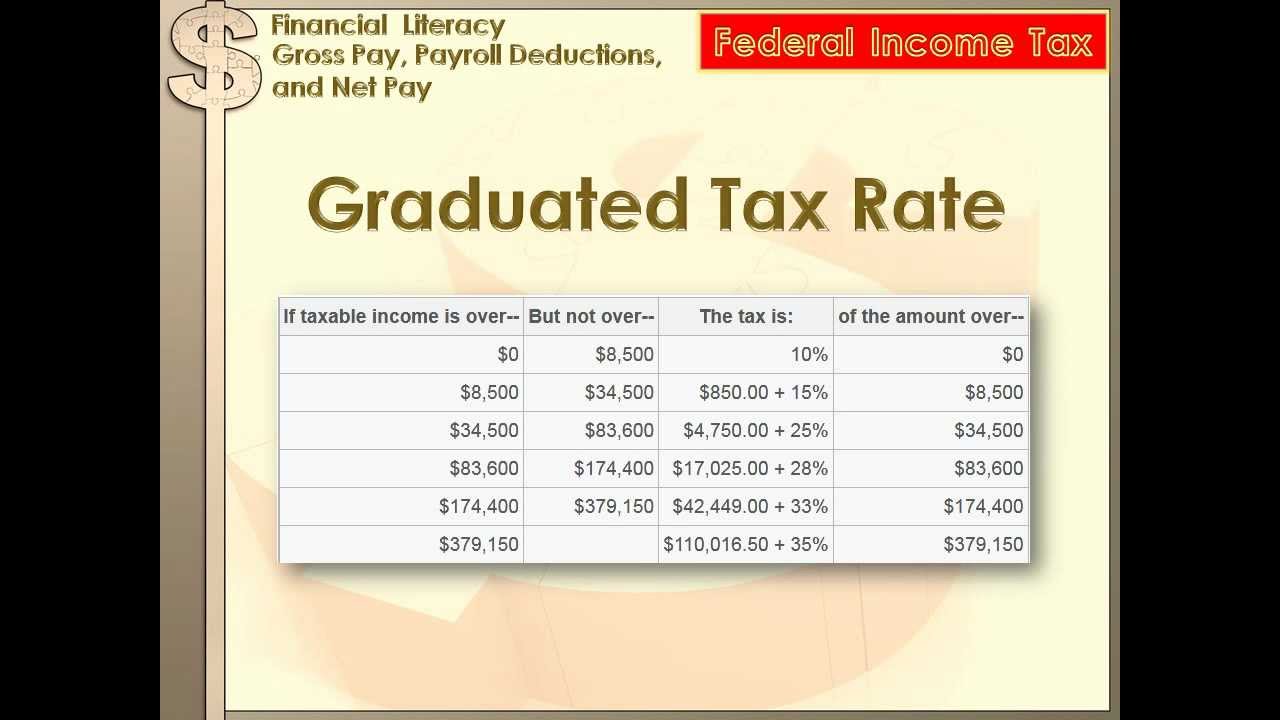

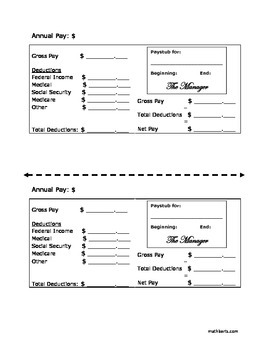

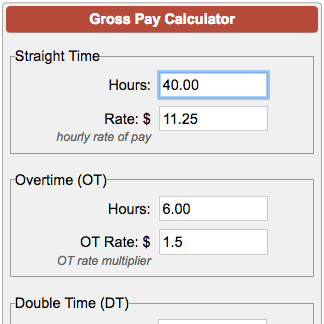

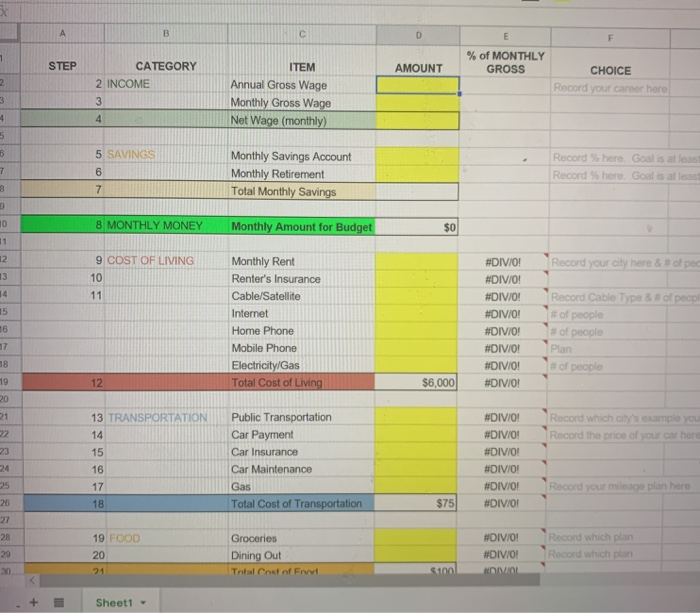

Gross Pay vs. Net Pay: What's the Difference? - ADP Gross pay is what employees earn before taxes, benefits and other payroll deductions are withheld from their wages. The amount remaining after all ... Reading a Pay Stub Extension Activity for Managing Money ... understand the difference between gross and net pay. • identify taxes and deductions taken ... Calculating Monthly Gross & Net Pay worksheet (1 per student).10 pages

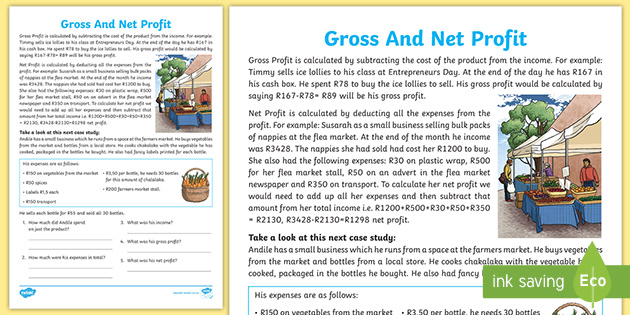

Gross Pay vs Net Pay: What's the Difference and How to ... Net pay is what happens to an employee's income after all gross pay deductions have been taken out. It doesn't matter if we're talking about hourly gross vs.

Gross pay vs net pay worksheet

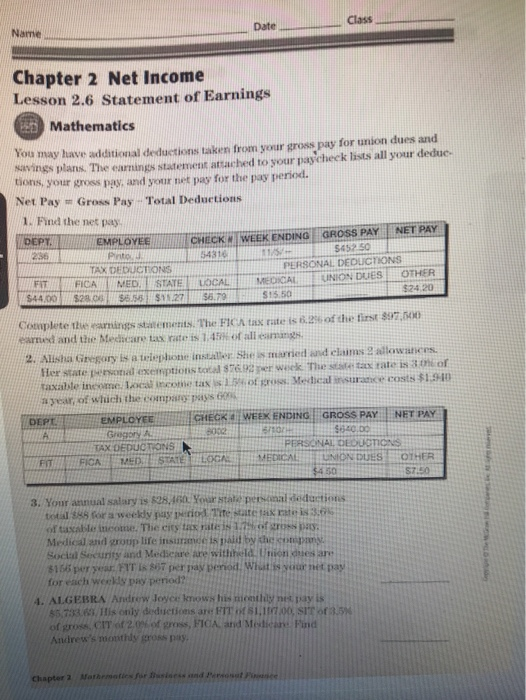

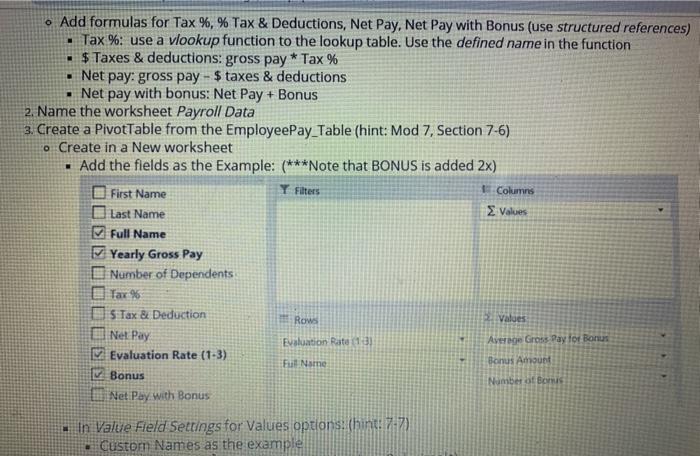

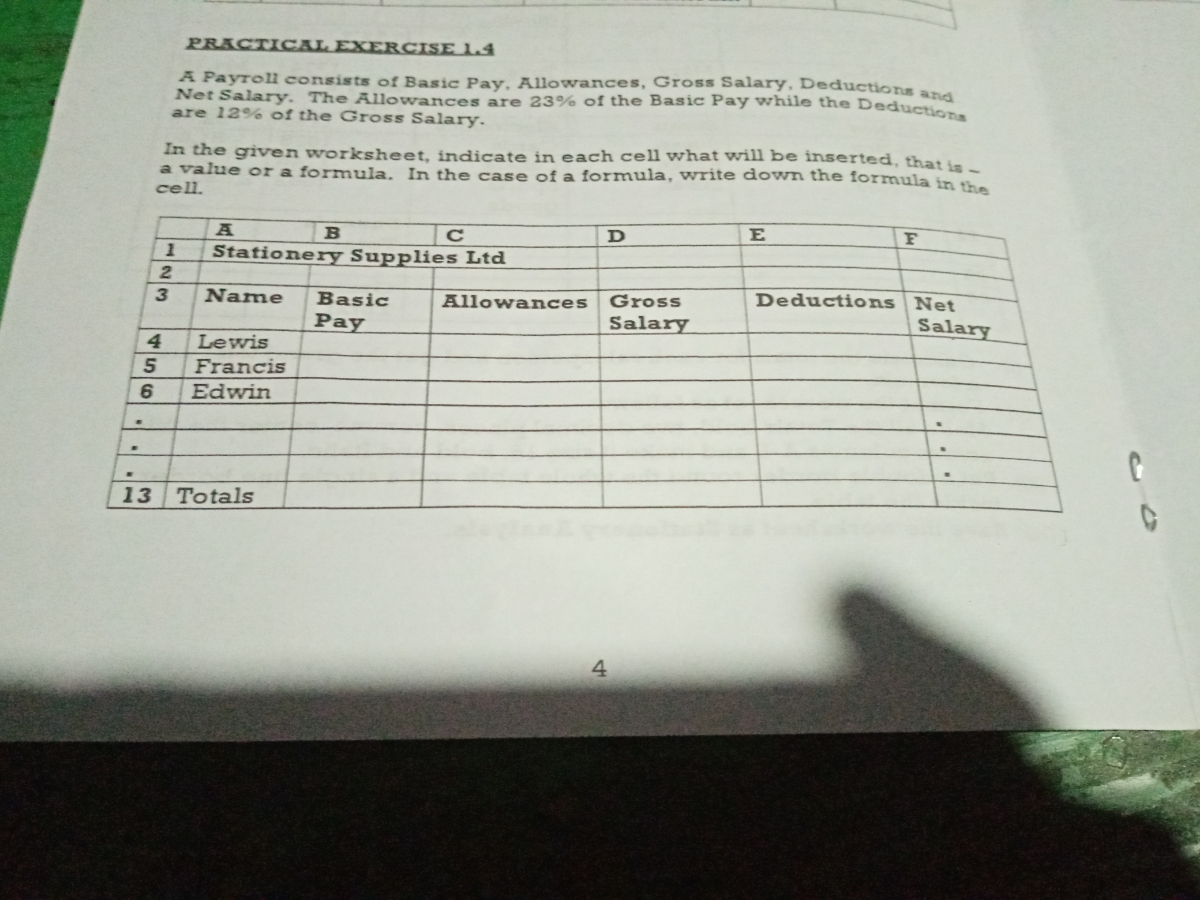

Calculating Gross and Net Pay - Lesson Plan - Scholastic Calculate the dollar amount of deductions by applying the relevant percentage to gross pay. Materials. Plan, Save, Succeed! Worksheet: Where Did the Money ... Calculate the Net Pay for each situation below. - eNetLearning Net Pay Worksheet – Calculate the Net Pay for each situation below. ... Hint: Net Pay = Gross Pay- Deductions ... Federal Tax = 15% of your gross pay.3 pages Gross Pay And Net Pay Teaching Resources Results 1 - 24 of 179 — This spreadsheet is a great way to get students calculating Gross pay, Net pay and payroll deductions with or without a calculator.

Gross pay vs net pay worksheet. 2018 STUDENT WORKBOOK - National Payroll Week Gross Pay, Net Pay. & Required Deductions | 4-6. Exercise 1, Filling out Form W-4 | 7. Worksheet 1, Form W-4 | 8. Exercise 2, Questions | 9.32 pages It's Your Paycheck! Lesson 2: "W" is for Wages, W-4, and W-2 Gross pay. Net pay. Form W-2. Income. Taxes. Form W-4. Income tax. Wages ... and want to reduce your withholding, use the Deductions Worksheet on page 3 and.18 pages Gross Pay And Net Pay Teaching Resources Results 1 - 24 of 179 — This spreadsheet is a great way to get students calculating Gross pay, Net pay and payroll deductions with or without a calculator. Calculate the Net Pay for each situation below. - eNetLearning Net Pay Worksheet – Calculate the Net Pay for each situation below. ... Hint: Net Pay = Gross Pay- Deductions ... Federal Tax = 15% of your gross pay.3 pages

Calculating Gross and Net Pay - Lesson Plan - Scholastic Calculate the dollar amount of deductions by applying the relevant percentage to gross pay. Materials. Plan, Save, Succeed! Worksheet: Where Did the Money ...

0 Response to "43 gross pay vs net pay worksheet"

Post a Comment