43 at&t cost basis worksheet

PDF cost basis worksheet - Denver Tax The information described in this worksheet provides some, but not all, of the information needed to determine your tax basis. The other information which you need to determine your tax basis is particular to you individual situation, and your tax advisor can assist you in identifying this other information. AT&T Divestiture Cost Basis Calculator - Denver Tax This program has the basis history - mergers, splits, spin - offs, etc. - since December, 1963. You will find this faster and easier than any AT&T "worksheet." AT&T Divestiture Basis Tracker - Order & Download Software Now! Special discounted price through 4/30/2022 $79. Regular Price $119. (3,011 KB Approx. 3 minute download [broadband])

If you acquired your AT&T, Inc. shares prior to March 20, 1998 (date of last stock split) or through a previous acquisition or merger transaction, determining your cost basis is a TWO-STEP process -- first calculate your AT&T Cost Basis per share on one of the worksheets click here and then use that output for the allocation below.

At&t cost basis worksheet

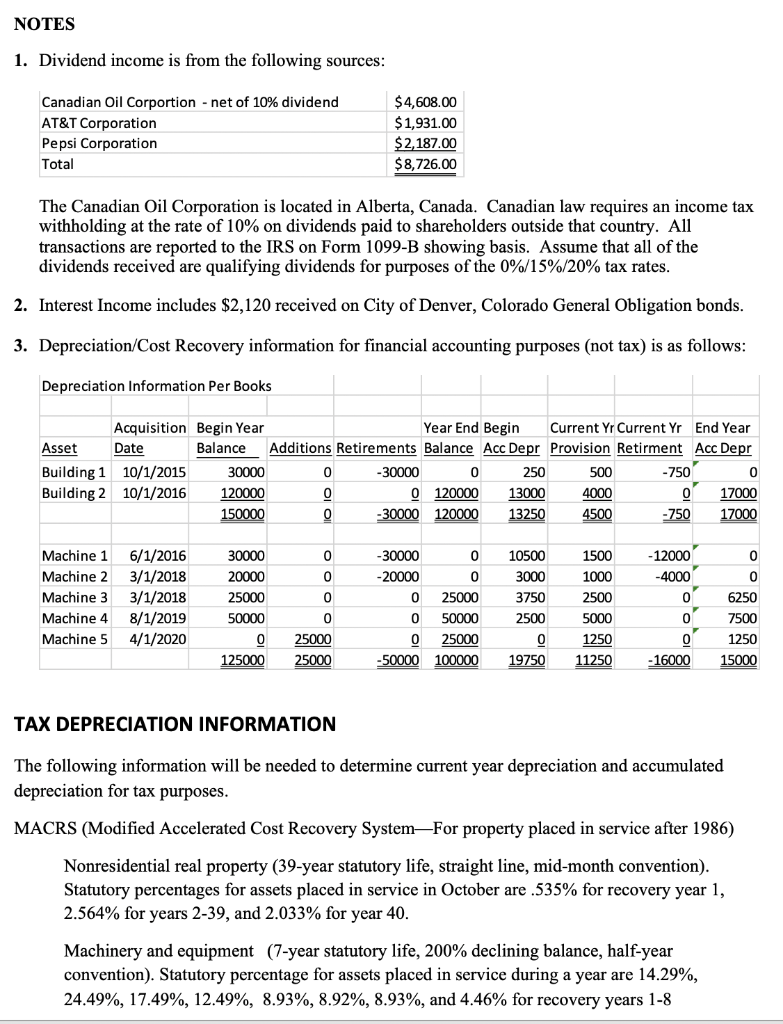

TRACKING COST BASIS OF AT&T, OFFSPRING - Hartford Courant The cost basis for your original shares of AT&T; would have been about $5,700 (before broker commissions). That original $5,700 purchase price, however, must be divided into many parts. Here's why ... AT&T Wireless Tax Basis Worksheet - smkinfo.com tax basis allocation of the spin-off should be: AT & T Corp 77.66% AT & T Wireless 22.34% (Based upon the cost basis of AT & T stock purchased or owned prior to 06/22/2001) For detailed information please go to Investor Relations on the AT&T website PDF Verizon Cost Basis Worksheet This worksheet describes some of the information needed to computer gain or loss, for income tax purposes, if you sell or otherwise dispose of your Verizon Communications Inc. ("Verizon") common ... Original tax basis per AT&T share _____ (A) Adjust for AT&T Divestiture, Divide (A) by 8.47916 _____ New Basis three stock splits and spin-offs ...

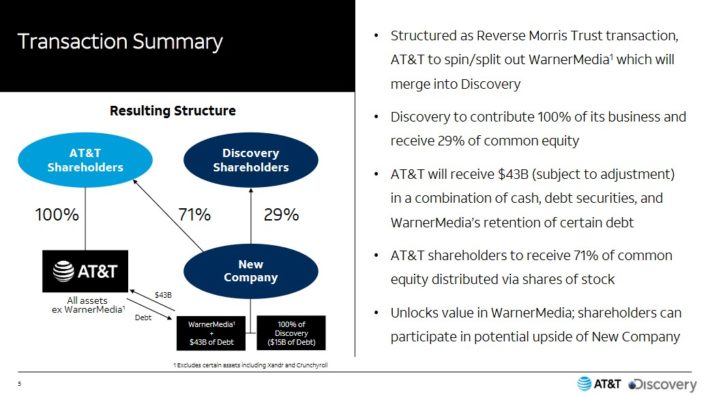

At&t cost basis worksheet. what is the verizon stock cost basis from original AT&T spinoff… Cost basis of spinoff of Lucent tech. from AT&T Corp. on Sept. 30, 1996 How much a share was Lucent Tech. when it was spinoff from AT&T Corp. on Sept. 30, 1996. I got(NNN) NNN-NNNNshares. … read more PDF Welcome to AT&T - static1.1.sqspcdn.com You can find these in the Benefits section of HROneStop or access.att.com. Cost of Coverage ... to your enrollment worksheet or the AT&T Benefits Center Web site for details, or check your applicable SPD. 5 Y our finances ... pay on a before- or after-tax basis. Also, you will be eligible to receive a ... How to adjust cost basis in Quicken for AT&T & WBD post-spinoff (in ... To calculate the basis, I multiplied the spinoff ratio (0.241917) times the WBD closing price on 4/11 ($24.78) to get the spinoff value ($5.9947). I then added the WBD spinoff value ($5.9947) to the T closing price ($19.63), and divided the sum ($25.6747) into the spinoff value ($5.9947) to arrive at the percentage of the original T cost basis ... Worksheet - AT&T Official Site This results in a post-spin-off tax basis of $4.49 per AT&T share. Your aggregate tax basis in the Comcast Corporation shares received in the Comcast Merger equals your aggregate tax basis in the AT&T Broadband shares (i.e. $751.20). You were entitled to receive 32.35 shares of Comcast Corporation as a result of the Merger.

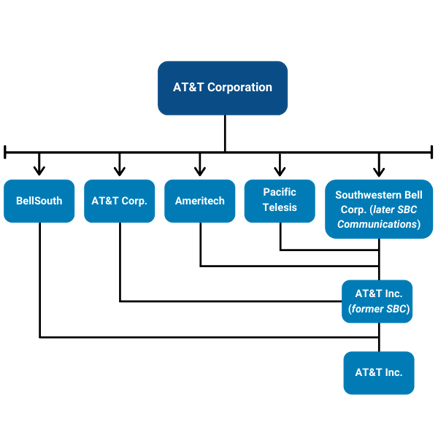

AT&T Corp Flowchart - cost-basis-charts.com Basis Allocation: AT&T - 37.4%, AT&T Broadband- 62.6%. All shares of AT&T Broadband were converted into shares of Comcast shortly after the distribution as result of the merger of a wholly owned subsidiary of Comcast Corporation with and into AT&T Broadband. Fractional shares received cash payments. SBC AT&T Merger Merger. How to Handle the Taxes on the AT&T Spinoff of Warner Bros. An investor who paid $32 for AT&T stock a year ago would have a cost basis of about $24 a share in AT&T (75% of $32) and about $8 for Warner Bros. Discovery (25% of $32). The effective cost basis in Warner Bros. Discovery stock would be $32 a share—or $8 divided by 0.25. It gets complicated if an investor has purchased AT&T in multiple ... A T & T - Cost Basis Starting from your own acquisition date, apply the spinoffs, splits, and name changes in order of occurrence to arrive at your cost basis today. You can use the excellent calculators provided on the AT&T website at to compute each successive step. NCR - Teradata Chart - cost-basis-charts.com more whole shares to their original position." Teradata Corporation. 1/21/2005 2 for 1 Stock Split. Type: Spin-off. Shares: 1 share of Teradata for each 1 share of NCR held on 9/14/2007. Basis Allocation: 47.63% NCR, 52.37% Teradata. Due to spin-off of Lucent, AT&T basis now diluted. to 72.01% of previous basis.

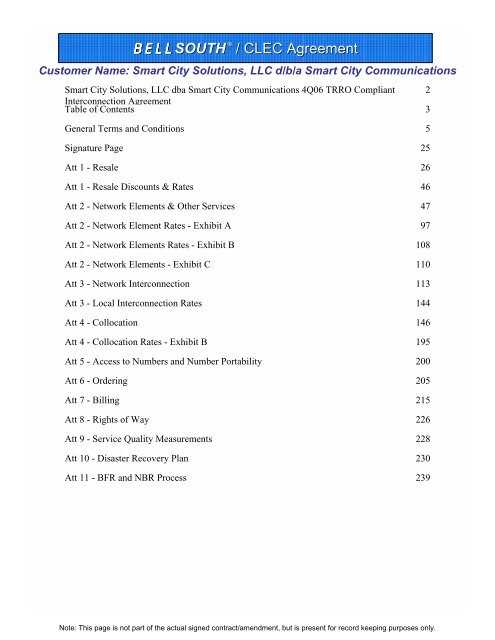

NCR Tax Basis Worksheet - smkinfo.com Shareholders of AT & T received 6 shares of NCR common stock for every 100 shares of AT & T owned. Since this special distribution (of NCR stock) was a tax-free distribution, the tax basis allocation of the spin-off should be: AT & T Corp 95.23%. NCR Corporation 4.77%. (Based upon the cost basis of AT & T stock purchased or owned prior to 12/13 ... Worksheet - AT&T Official Site Your per share cost basis in new AT&T, Inc. equals the aggregate cost basis of $1,500 divided by the total number of new AT&T, Inc. shares received - 77.94 - which is $19.25. * The tax basis of a fractional share interest would be a proportional part of the basis of a whole share. Consult Your Tax Advisor Figuring the Basis of AT&T Shares | Kiplinger Your basis should be allocated 28.5% to ATT and the remaining 71.5% split among the seven baby bells, with each at a different rate -- from 8.94% for US West to 13.53% for Bell South. (See the... If you owned AT&T common stock (T) as of the close of business on April 5, 2022, the record date for distribution of shares of SpinCo, first calculate your AT&T Cost Basis using the worksheet below and then use that output for the AT&T Inc. / WBD allocation. BellSouth Corporation (BLS)

Comcast Corporation Comcast Corporation

How to calculate worth of AT&T stock after splits - SFGATE You can get the answer to your question from the AT&T Web site, at . First, click on the link for "investor relations." On the next page, click on "tax basis information." Then, click on...

Tax Basis Worksheet - smkinfo.com Basis Worksheet Please be aware that the information contained herein is general in nature and should not be construed to be legal, business, or tax advice. You should consult your personal tax advisor as to the particular tax consequences of each transaction highlighted here, including the applicability and effect of any

PDF Comcast Corp Class A Common/Philadelphia PA-CMCSA spinoff ... - Cost Basis New Cost Basis ÷ No. of AT&T Corp. Shares = New Per Share Cost Basis Example AT&T Corp. $ 100.00 x 0.374 = $37.40 ÷ 102 = $0.37 Your Calculation AT&T Corp. $ x 0.374 = ÷ = $ Holders of Comcast The cost basis of your new Comcast stock is the equivalent of the cost basis for your

PDF calculate your cost basis in your AT&T shares as well as other stock ... Example: Original Shares 100 New Shares 300 Original per share cost basis $18 New per share cost basis $6 Original total cost basis $1,800 New total cost basis $1,800 Step 3 Hughes Split-off and News Corporation Transaction

Spinoff Calculator - Cost Basis For double spins use same cost basis for both calculations. $ (no commas) 10. Cash received in lieu of fractional shares (often denoted as CIL) (enter 0.00 if none) $ 11. Tax status of spinoff, enter 1 for tax-free, 2 for taxable, 3 for return of capital, 4 for mixed status : 12. If tax status is taxable or mixed, enter market value per share ...

At&T Tax Basis Worksheet - smkinfo.com 27.99% (Based upon the cost basis of AT & T stock purchased or owned prior to 9/17/96) Tax Basis Update New Comcast and AT & T Broadband Merger AT&T Corp received a ruling from the IRS to the effect that the spin-off of AT & T Broadband will be tax free to the AT&T shareholders. Since all

Cost Basis Calculator for Investors | About Verizon Download the Cost Basis Worksheet (PDF) to determine the cost basis in Idearc, Fairpoint or Frontier shares or if your shares of MCI, Inc. were acquired by Verizon on January 6, 2006. For Bell Atlantics and NYNEX shares acquired in the AT&T divestiture: The cost basis needs to be calculated for each company

If YES, use this worksheet below to calculate the allocation of your cost basis between AT&T Inc. and WBD common stock. AT&T Inc. / WBD If you acquired your AT&T Inc. shares on or after March 20, 1998 (the date of the last stock split), your cost basis before the SpinCo Distribution is the same as the actual price paid for the shares.

Capital Gains Tax Calculation Worksheet - The Balance Here are the steps to build a worksheet to calculate capital gains. See how the math works and ways to organize your investment data for tax purposes. ... We take the basis of the shares we acquired first, all 100 shares of the January purchase, with a cost basis of $1,225. So now we've identified the basis for 100 shares out of the 150 shares ...

PDF Verizon Cost Basis Worksheet This worksheet describes some of the information needed to computer gain or loss, for income tax purposes, if you sell or otherwise dispose of your Verizon Communications Inc. ("Verizon") common ... Original tax basis per AT&T share _____ (A) Adjust for AT&T Divestiture, Divide (A) by 8.47916 _____ New Basis three stock splits and spin-offs ...

AT&T Wireless Tax Basis Worksheet - smkinfo.com tax basis allocation of the spin-off should be: AT & T Corp 77.66% AT & T Wireless 22.34% (Based upon the cost basis of AT & T stock purchased or owned prior to 06/22/2001) For detailed information please go to Investor Relations on the AT&T website

TRACKING COST BASIS OF AT&T, OFFSPRING - Hartford Courant The cost basis for your original shares of AT&T; would have been about $5,700 (before broker commissions). That original $5,700 purchase price, however, must be divided into many parts. Here's why ...

0 Response to "43 at&t cost basis worksheet"

Post a Comment