42 1031 like kind exchange worksheet

Knowledge Base Solution - How do I complete a like-kind exchange in a ... Note the schedule and entity number of the like-kind exchange. Example: Schedule E entity 1 Go to the Income/Deductions > Rent and Royalty worksheet. Select section 7 - Depreciation and Amortizationand select Detail. Select section 1 - General. Line 23 - Sale Number, input the number of the sale. Wr case and sons cutco 10212 - fhxx.investlife.info W.R. Case & Sons Cutlery Knives 1031 Oval Patch Red with White Embroidered Case XX Logo. Smooth Antique Bone Tribal Lock Knife, Polished finish stainless steel true-sharp spear blade. Please be kind to each other and feel free to post your favorite Michael Myers content.

2021 S Corporation Tax Booklet | FTB.ca.gov - California Like-Kind Exchanges. California requires taxpayers who exchange property located in California for like-kind property located outside of California under IRC Section 1031, to file an annual information return with the FTB. For more information, get form FTB 3840, California Like-Kind Exchanges, or go to ftb.ca.gov and search for like kind. Payments

1031 like kind exchange worksheet

1031 Exchange Calculator | Calculate Your Capital Gains If you need immediate assistance, call Bill at (571) 327-1031 Capital Gains Calculator Realty Exchange Corporation has created this simple Capital Gain Analysis Form and Calculator to estimate the tax impact if a property is sold and not exchanged, and to calculate the reinvestment requirements for a tax-free exchange. PDF Reporting the Like-Kind Exchange of Real Estate Using IRS Form ... - 1031 kind properties, cash or other (not like-kind) property. Few real estate exchanges are multi-asset exchanges. See Page 1 of the Instructions for Form 8824 on multi-asset exchanges and reporting of multi-asset exchanges. d. Realized Gain, Recognized Gain and Basis of Like-Kind Property Received. This is the primary purpose of Part III and IRS ... Publication 523 (2021), Selling Your Home | Internal Revenue Service See Like-kind/1031 exchange. You used the entire property as a vacation home or rental after 2008 or you used a portion of the home, separate from the living area, for business or rental purposes. ... For each number, take the number from your “Total” worksheet, subtract the number from your “Business or Rental” worksheet, and enter the ...

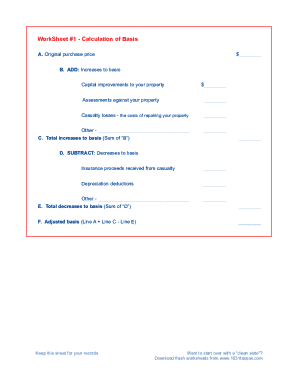

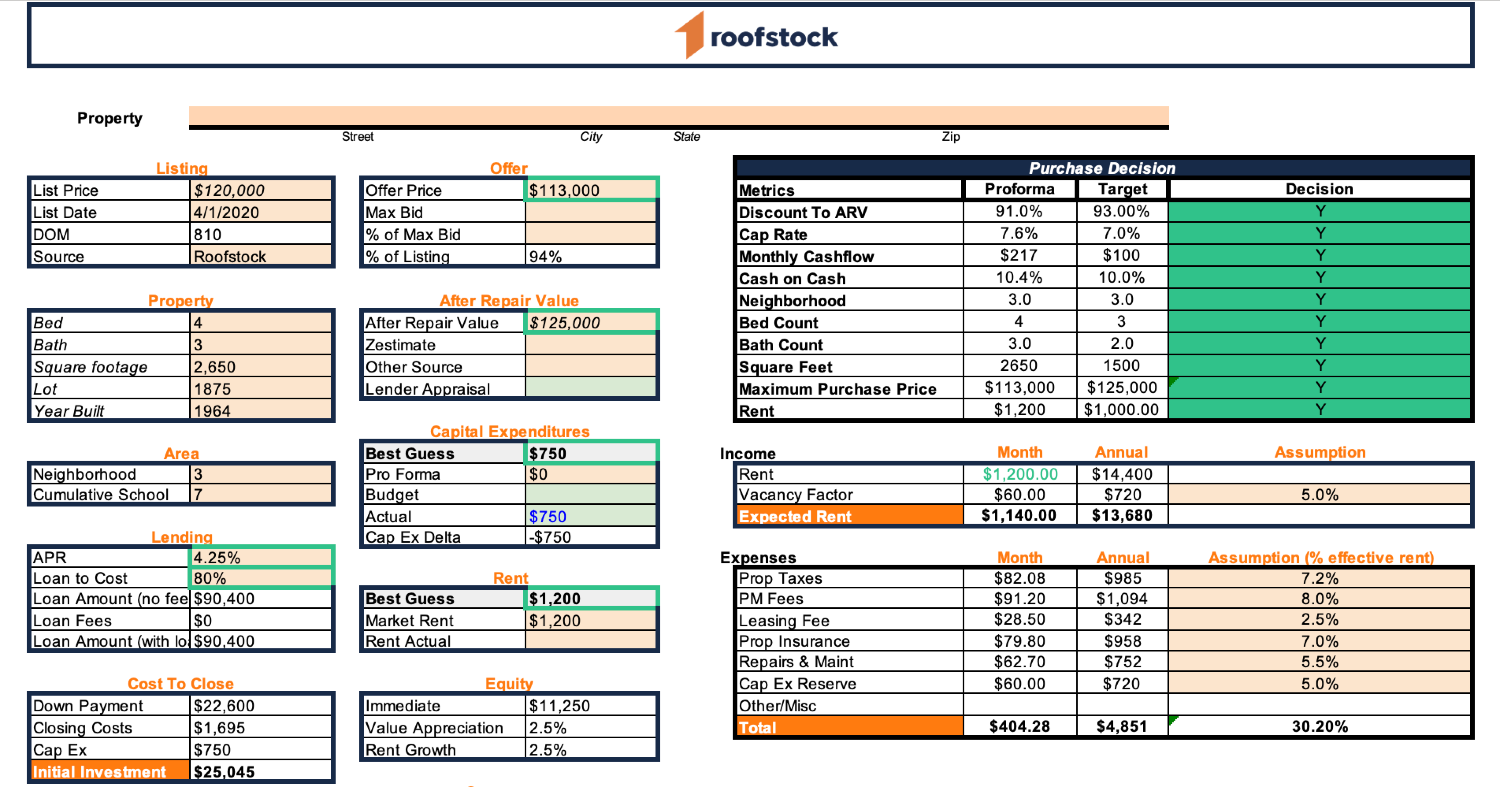

1031 like kind exchange worksheet. 1031 Like Kind Exchange Calculator - Excel Worksheet - Pinterest Nov 27, 2019 - Download the free like kind exchange worksheet. This 1031 calculator is the same tool our experts use to calculate deferrable taxes when selling a property. Pinterest. Today. Explore. When autocomplete results are available use up and down arrows to review and enter to select. Touch device users, explore by touch or with swipe ... Instructions for Form 8824 (2021) | Internal Revenue Service The final regulations, which apply to like-kind exchanges beginning after December 2, 2020, provide a definition of real property under section 1031, and address a taxpayer's receipt of personal property that is incidental to real property the taxpayer receives in the exchange. See Regulation sections 1.1031 (a)-1, 1.1031 (a)-3, and 1.1031 (k)-1. How do you price furniture for an estate sale Aug 02, 2017 · the greens springdale ar. Explanation: The statute of frauds requires contracts for the sale of real estate to be in writing. Explanation: The tenants had an estate for years: a lease for a specific period of time. The seller told the buyer that … IRS 1031 Exchange Worksheet And Vehicle Like Kind ... - Pruneyardinn We always effort to reveal a picture with high resolution or with perfect images. IRS 1031 Exchange Worksheet And Vehicle Like Kind Exchange Example can be valuable inspiration for those who seek a picture according specific categories, you will find it in this site. Finally all pictures we have been displayed in this site will inspire you all.

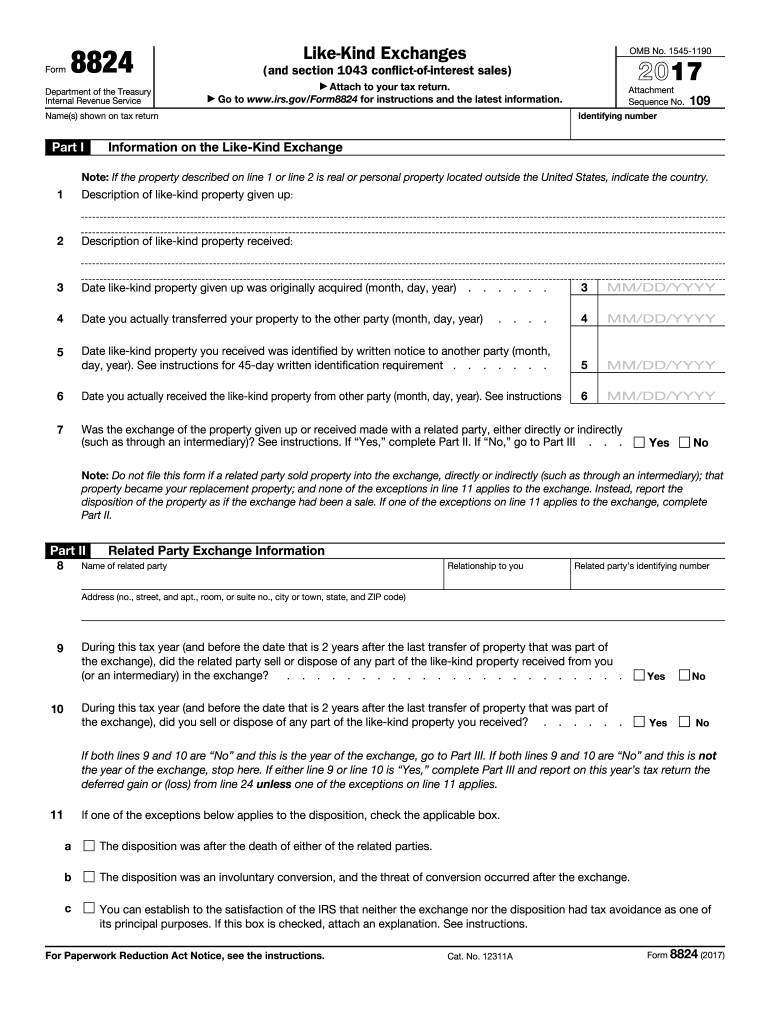

PDF FORM 8824 WORKSHEET Worksheet 1 Tax Deferred Exchanges Under IRC § 1031 Before preparing Worksheet 1, read the attached Instructions for Preparation Of Form 8824 Worksheets. Then, prepare Worksheet 1 after you have finished the preparation of worksheets 2 and 3. _____ 1031 Corporation - Longmont/Boulder, CO 303-402-1031 (Local) 888-367-1031 (Toll Free) 1031 Tool Kit - TM 1031 Exchange Purchase 1031 Exchange Books Suggested Books on 1031 Exchanges Get a Free Property List & Consultation For specific questions about 1031 Exchanges call 1-877-486-1031 or click here to EMail. Informed Decisions Make the Best Investments Thousands of Properties Rated Each Month. Only the Worthiest Investments Make it Into Your Vault. 1031worksheet - Learn more about 1031 Worksheet In a 1031 Exchange, Section 1031 of the Internal Revenue Code (IRC) allows taxpayers to defer capital gain taxes by exchanging qualified, real or personal property (known as the "relinquished property") for qualified "like-kind exchange" property (replacement property). The net result is that the exchanger can use 100% of the proceeds (equity) from their sale to buy another property ... Like Kind 1031 Exchange/Form 8824 - Intuit I understand conceptually how a 1031 Like Kind Exchange works. My challenge is to know if I am doing it correctly in ProSeries. ... I've always found with 1031's I create my own worksheet for the gain deferral and basis of replacement real estate and then make sure the bottom line numbers match the IRS form. Most people do so few that they're ...

1031 Like Kind Exchange Worksheet And Form 8824 ... - Pruneyardinn We always attempt to show a picture with high resolution or with perfect images. 1031 Like Kind Exchange Worksheet And Form 8824 Worksheet Template can be valuable inspiration for people who seek a picture according specific topic, you can find it in this website. Finally all pictures we have been displayed in this website will inspire you all. 1031 exchange worksheet 1031 Exchange Experts | Section 1031 Like Kind Exchanges . exchange 1031 worksheet kind excel calculator capital realized gains tax gain state rate laptop section rates experts. 26 Like Kind Exchange Worksheet - Worksheet Information nuviab6ae4.blogspot.com. irs. 1031 Exchange Worksheet | Tagua . 1031 tagua IRC 1031 Like-Kind Exchange Calculator Exchange vs. Sale A 1031 arrangement allows you to defer all of your capital gains taxes. And this amounts to getting a long-term and interest-free loan from the Internal Revenue Service. The real advantage is not just in tax savings - investors who take advantage of 1031 provisions can acquire much more investment real estate than those who don't. PDF WorkSheets & Forms - 1031 Exchange Experts WorkSheet #2 - Calculation of Exchange Expenses HUD-1 Line # A. Exchange expenses from sale of Old Property Commissions $_____ 700 ... Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21

Replacement Property Basis Worksheet - efirstbank1031.com Replacement Property Basis Worksheet. ... Like-Kind Exchange Replacement Property Analysis of Tax Basis for Depreciation (pdf). Contact Us. Mail: Phone: Fax: Email: 1031 Corporation 1707 N Main St Longmont, CO 80501. 888-367-1031. 303-684-6899. 1031 Team. Resources. 1031 Exchange Manual; 1031 Exchange Manual; Escrow Services; What is a 1031 ...

1031 Exchange Examples | 2022 Like Kind Exchange Example A 1031 Exchange Example What is a 1031 Exchange? eBook The Ron and Maggie Story Let's take an example couple, Ron and Maggie 1, who purchased a small apartment building in California 10 years ago for $1,500,000. They invested $500,000 of their own money and financed the rest with a $1,000,000 mortgage. Purchase Price Step 1 Determine Adjusted Basis

Instructions for Form 8824 (2021) | Internal Revenue Service Beginning after December 31, 2017, section 1031 like-kind exchange treatment applies only to exchanges of real property held for use in a trade or business or for investment, other than real property held primarily for sale. ... If you made more than one like-kind exchange, you can file a summary on one Form 8824 and attach your own statement ...

PDF Like-Kind Exchanges Under IRC Section 1031 - Internal Revenue Service as part of a qualifying like-kind exchange. Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred, but it is not tax-free. The exchange can include like-kind property exclusively or it can include like-kind property along with cash, liabilities and property that are not like-kind. If you receive cash, relief from debt, or

1031 Exchange and Depreciation Recapture Explained A-to-Z - PropertyCashin Depreciation recapture applies to the $25,000 topping out at 25%. The remaining $95,000 of the $120,000 gain tops at a 20% tax rate. Yet, heirs have the option to defer capital gains taxes again. They can complete 1031 Exchanges, replacing inherited properties with like-kind ones into perpetuity.

1031 exchange worksheet 2020 foreign exchange rate project class 12. 12 Pics about foreign exchange rate project class 12 : 30 Sec 1031 Exchange Worksheet - Free Worksheet Spreadsheet, 31 1031 Like Kind Exchange Worksheet - Notutahituq Worksheet Information and also Unemployment Tax Refund - IRS - Zrivo.

2021 Corporation Tax Booklet Water’s-Edge Filers - California Like-Kind Exchanges. California requires taxpayers who exchange property located in California for like-kind property located outside of California under IRC Section 1031, to file an annual information return with the FTB. For more information, get form FTB 3840, California Like-Kind Exchanges, or go to ftb.ca.gov and search for like kind. Payments

1031 Exchange Examples: Like-Kind Examples to Study & Learn From You would like to do a 1031 exchange into a $3,975,000 Walgreens in McDonough, Georgia. You exchange your $4,000,000 property for the $3,975,000 7-Eleven and an adjoining lot worth $275,000 for a total value of $4,250,000. This means that there is no boot in the exchange. You qualify for a full tax deferral for the $500,000 capital gain.

PDF 2019 Exchange Reporting Guide - 1031 Corp Incomplete or Partial Exchange Spanning Two Tax Years 4 . Depreciation of Replacement Property 5 . Personal Property Exchanges after December 31, 2017 6 . Reporting State Capital Gain 6 . Completion of IRS Form 8824 "Like-Kind Exchanges" 6

1031 Like Kind Exchange Calculator - Excel Worksheet 1031 Like Kind Exchange Calculator - Excel Worksheet Smart 1031 Exchange Investments We don't think 1031 exchange investing should be so difficult That's why we're giving you the same 1031 exchange calculator our exchange experts use to help investors find smarter investments. Requires only 10 inputs into a simple Excel spreadsheet.

Publication 523 (2021), Selling Your Home | Internal Revenue Service See Like-kind/1031 exchange. You used the entire property as a vacation home or rental after 2008 or you used a portion of the home, separate from the living area, for business or rental purposes. ... For each number, take the number from your “Total” worksheet, subtract the number from your “Business or Rental” worksheet, and enter the ...

PDF Reporting the Like-Kind Exchange of Real Estate Using IRS Form ... - 1031 kind properties, cash or other (not like-kind) property. Few real estate exchanges are multi-asset exchanges. See Page 1 of the Instructions for Form 8824 on multi-asset exchanges and reporting of multi-asset exchanges. d. Realized Gain, Recognized Gain and Basis of Like-Kind Property Received. This is the primary purpose of Part III and IRS ...

1031 Exchange Calculator | Calculate Your Capital Gains If you need immediate assistance, call Bill at (571) 327-1031 Capital Gains Calculator Realty Exchange Corporation has created this simple Capital Gain Analysis Form and Calculator to estimate the tax impact if a property is sold and not exchanged, and to calculate the reinvestment requirements for a tax-free exchange.

0 Response to "42 1031 like kind exchange worksheet"

Post a Comment