40 home daycare tax worksheet

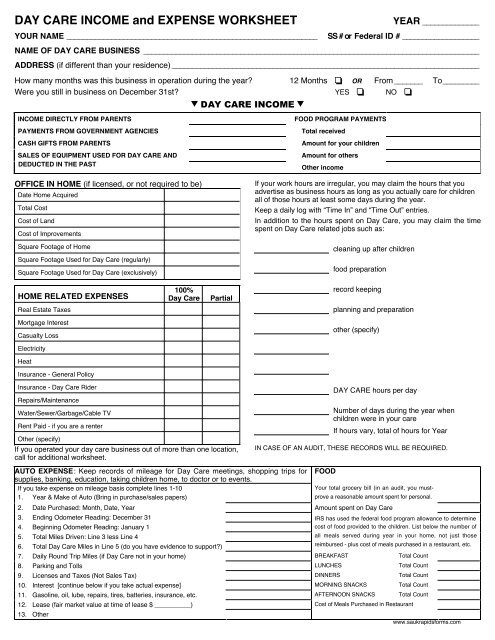

PDF DAY CARE INCOME AND EXPENSE WORKSHEET - Haukeness Tax & Accounting Inc Total count Day care license, association AFTERNOON SNACKS Total count REPAIRS- Other than your home, related to damage by day care children. Document with photos and how it happened. & PUBLICATIONS - dues, day care magazines for you or day care children. DOCUMENT THESE NUMBERS DAILY OTHER EXPENSES - not listed elsewhere PDF Daycare Income and Expense Worksheet - SUN CREST TAX SERVICE DAY CARE INCOME and EXPENSE WORKSHEET Tax Year _____ PROVIDERS NAME _____ NAME OF DAYCARE _____ ... Mortgage Interest 100% Repairs Due to Daycare Home Insurance Other (specify) Rent paid (If Renter or Utilities Rent) Other (specify) Keep a calendar for documentation of the number of hours that you are doing business items for the daycare. ...

PDF DAY CARE INCOME and EXPENSE WORKSHEET YEAR - Karla Havemeier, Ltd. Day Care only credit card LEGAL & PROFESSIONAL: Day Care only attorney or accountant fees OFFICE SUPPLIES: Postage, stationery, pens, pencils, small office equipment, holiday or birthday cards, Day Care record books, calendars PENSION PLANS: for employees RENT: Building (if Day Care not in home) Toy rental Videos / DVDs REPAIRS and MAINTENANCE

Home daycare tax worksheet

Printable Day Care Forms - To Use In Your Home Daycare, Center Or ... You will need to keep track of you income and expenses, some expenses are a direct expense such as daycare toys, daycare food, purchasing daycare books or daycare forms are all expenses you can write off you income taxes, and other expenses are indirect expenses such as writing off a portion off the use of your house, telephone (if you have two lines you can write one off completely), repairs, and many other expenses, we go more into this area in our start your own daycare e-book. Filing a Tax Return for Your In-Home Daycare - 2022 TurboTax® Canada Tips Filing Your Tax Return. Report the income from your daycare business on line 162 of your general income tax return. Then, deduct your business expenses to arrive at your net self-employment income on line 162. One of the easiest ways to calculate your daycare income and expenses is by using the CRA's Form T2125, Statement of Business Activities. Daycare Record Keeping | Pride Tax Preparation Square feet of your house separated into three categories: Space used ONLY for daycare, Space used PARTLY for daycare, and Space NOT used for daycare. Include your garage space. Amount spent for daycare licenses and training. Keep receipts! Amount spent for items that are used 100% for daycare. Keep items over $200 separately. Keep all receipts!

Home daycare tax worksheet. Resources for Child Care Providers - kenyontax.com Our customized Child Care Providers Deductions Worksheet is a good guide for tracking all tax related transactions and information. Using it as a guide will allow us to prepare your tax return to obtain the lowest tax possible. ** Our web-based Record Keeping Workbook includes many Child Care business management features, as well as; PDF Tax Organizer—Daycare Provider uickinder® Supplemental Tax Organizers Family Daycare Provider—Standard Meal and Snack Rate Log Annual Recap Worksheet Name of Provider: TIN/SSN Tax Year: Wk Week of Break-fasts Lunches Dinners Snacks Wk Week of Break-fasts Lunches Dinners Snacks 1 27 2 28 3 29 4 30 5 31 6 32 7 33 8 34 9 35 10 36 11 37 12 38 13 39 14 40 15 41 16 42 17 43 18 ... Home Daycare Tax Deductions for Child Care Providers Furniture and appliance purchases can be written off as home daycare tax deductions. Some items you can write off the whole cost while others will need to have your T/S% applied. Any furniture or appliance that you use in the daycare and for personal use needs to have the T/S% applied. Microwave. Washer & dryer. Publication 587 (2021), Business Use of Your Home Additionally, you can deduct all of the business part of your expenses for maintenance, insurance, and utilities, because the total ($800) is less than the $1,000 deduction limit. Your deduction for depreciation for the business use of your home is limited to $200 ($1,000 minus $800) because of the deduction limit.

Daycare Tax Statement - Simply Daycare Daycare Tax Statement Forms. You can apply for an EIN number which is an Employer Identification Number (EIN) is also known as a Federal Tax Identification Number, and is used to identify a business entity.This is not required for daycare providers, but if you have an issue with giving out your social security number then consider this an option. Child Care Provider Taxes | H&R Block Answer The IRS usually considers childcare providers as independent contractors. Since independent contractors are self-employed, you should report your income on Schedule C. Also, if your income minus expenses from self-employment is more than $400, you must file Schedule SE. This will determine your taxes for childcare. PDF Day Care Tax Organizer DAY CARE TAX ORGANIZER Prepare + Prosper, 2610 University Ave. West, Suite 450, St. Paul MN 55114, ... worksheets, tips on making estimated tax payments, and a cheat sheet for filling out the ... nd2 line into home only Day care liability insurance Cell phone - annual charges Interest - business loan or ... List of Tax Deductions for an In-Home Daycare Provider Utilities and home-related expenses such as property taxes, insurance and mortgage interest are also deductible based on the time and space formula. Internet, phone, cable television and other utilities may be 100 percent deductible if you set up separate accounts solely for the daycare's use. Keep copies of all receipts for materials and ...

Daycare Payment Teaching Resources | Teachers Pay Teachers Daycare Studio. 4.0. (1) $3.99. Zip. This is a digital downloadable balance due statement to be given to parents who owe tuition, have a past due balance, or the fees not paid. This complete printable document is designed for licensed childcare centers, in home daycares, and preschools.Give this late payment notice to any parents who owe past ... The BIG List of Common Tax Deductions for Home Daycare Mar 21, 2017 - The big list of home daycare tax deductions for family child care businesses! A checklist of tax write-offs that all child care providers should know about! Pinterest. Today. Explore. When autocomplete results are available use up and down arrows to review and enter to select. Touch device users, explore by touch or with swipe ... Home Daycare Budget, Tracking Expenses for Your Business Whether you do your home daycare budget expense tracking on paper or computer, setting up a spreadsheet is the best plan. You can use graph paper or lined notebook paper to set up columns if you like to make your expense spreadsheet with paper and pencil. Or using google docs or excel is a great way to make one on the computer. Daycare Tax Workbook - DaycareAnswers.com Daycare Tax Workbook Simplify Your Tax Prep! The Daycare Tax Workbook e-book helps you gather all the information you need to easily prepare your taxes. Whether you do it yourself or hire a professional tax preparer, this workbook makes it easy. $6.97 INCLUDES: End of Year Checklist Tax Worksheet End-of Year Receipts (W-10) Weekly Receipts

Home Daycare Providers | Pride Tax Preparation Daycare returns for new clients are prepared for around $800. (Return clients may be less, but part-year of daycare or other circumstances may cost slightly more). You need a tax preparer with the knowledge and experience to prepare taxes for home child care providers. You need someone who can handle preparing your taxes and getting the deductions and credits you deserve without spending an arm and a leg.

Home-based childcare - ird.govt.nz Use our IR413 worksheet to see if you need to file a return. Actual costs Alternatively, you can claim actual expenses and costs in providing childcare against the income you receive. If you use this method, you need to: keep a record of all household and childcare service related expenses

PDF Day Care Providers Worksheet - Lake Stevens Tax Service Day Care Providers Worksheet For the Tax Year_____ INCOME FOOD PROGRAM # Meals Served (include all meals reimbursed or not) Day Care: Preschool: Registration: Late Fees/Interest: Food Program: January - June Breakfast: Lunch: Dinner: Snack: July - December Breakfast: Lunch: Dinner: Snack: PAYROLL - ways paid during the year

Tom Copeland Tip - 2019 Child Care Tax Reports - KidKare Tom Copeland's tax tip for in-home child care providers. Here are the key KidKare Accounting reports you should print out to complete your 2018 taxes. Review the numbers on these reports before printing them out to ensure that you entered all your expenses. After printing them out, give a copy to your tax preparer or transfer the information ...

Daycare in your home - Canada.ca Deduct, remit and report payroll deductions. Keeping daycare records. What you need to keep and for how long. Making payments for individuals. How to pay your income taxes owing, make payment arrangements, and send in instalment payments. Collecting goods and services tax/harmonized sales tax on your daycare services. Interest and penalties.

Taxes for In Home Daycare - Little Sprouts Learning Home daycare tax deductions worksheet. Before you go through your first (or 30 th) year in home daycare, I implore you to RUN and buy Tom Copeland's tax workbook. Even if you pay an accountant to fill out your tax forms, this book will help you organize your expenses and prepare them for the tax preparer.

Daycare Expense Worksheet - atmTheBottomLine 1711 Woodlawn Ave., Wilmington, DE 19806 (302-322-0452) - - - - 118 Astro Shopping Center, Newark DE 19711 - - - -

PDF DAY CARE PROVIDERS WORKSHEET - Lake Stevens Tax Service 100% Day Care Use-Notice the left side of Page 2 of the daycare sheet is for items that are used exclusively for daycare. 6. Shared Expenses-Notice the right side of Page 2 lists those items you share with daycare. If you do not separate items like household supplies, cleaning supplies, kitchen supplies, bottle water,

PDF Page 1 of 35 18:11 - 10-Feb-2022 of Your Home Business Use - IRS tax forms Worksheet To Figure the Deduction for Business Use of Your Home. Worksheets To Figure the Deduction for Business Use of Your Home \(Simplified Method\) How To Get Tax Help. Exhibit A.Family Daycare Provider Meal and Snack Log. ... You use the part of your home in question as a day-care facility (discussed later under Daycare Facility).

Daycare Worksheets - Free Preschool Worksheets to Print All of our free preschool worksheets can be downloaded in the PDF file format and then printed or you can print the worksheets directly in your browser. Free to Use Anywhere including Preschools, Daycare Centers, Summer Camps, and at Home. One of the more common questions we get is "What are we allowed to do with the worksheets?".

10+ Day Care Budget Templates - PDF | Free & Premium Templates cengage.com. Details. File Format. PDF. Size: 160 KB. Download. This template gives you a simple but effective day care budget which covers all details regarding the revenue, operating expenses and expenditure for the complete year. The sample daycare budget template can be used as a perfect reference document.

Daycare Record Keeping | Pride Tax Preparation Square feet of your house separated into three categories: Space used ONLY for daycare, Space used PARTLY for daycare, and Space NOT used for daycare. Include your garage space. Amount spent for daycare licenses and training. Keep receipts! Amount spent for items that are used 100% for daycare. Keep items over $200 separately. Keep all receipts!

Filing a Tax Return for Your In-Home Daycare - 2022 TurboTax® Canada Tips Filing Your Tax Return. Report the income from your daycare business on line 162 of your general income tax return. Then, deduct your business expenses to arrive at your net self-employment income on line 162. One of the easiest ways to calculate your daycare income and expenses is by using the CRA's Form T2125, Statement of Business Activities.

Printable Day Care Forms - To Use In Your Home Daycare, Center Or ... You will need to keep track of you income and expenses, some expenses are a direct expense such as daycare toys, daycare food, purchasing daycare books or daycare forms are all expenses you can write off you income taxes, and other expenses are indirect expenses such as writing off a portion off the use of your house, telephone (if you have two lines you can write one off completely), repairs, and many other expenses, we go more into this area in our start your own daycare e-book.

0 Response to "40 home daycare tax worksheet"

Post a Comment