40 amt qualified dividends and capital gains worksheet

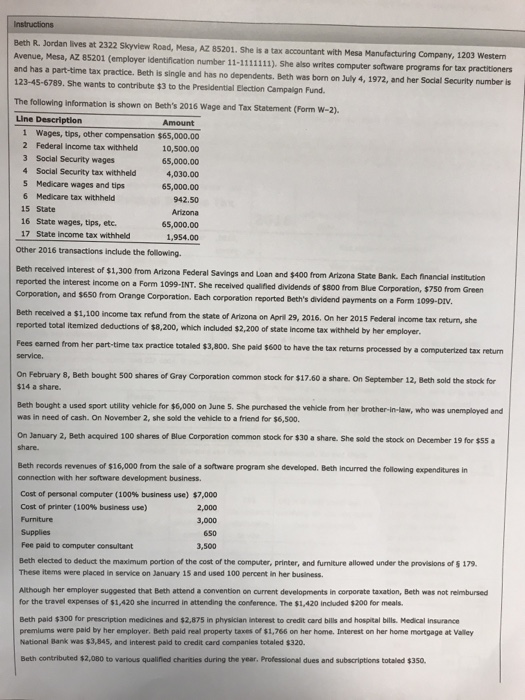

Partner's Instructions for Schedule K-1 (Form 1065-B) (2017) Box 3. Qualified Dividends. Note. Box 4a. Net Capital Gain or (Loss) From Passive Activities. Limited partners only. Box 4b. Net Capital Gain or (Loss) From Other Activities; Box 5. Net Passive AMT Adjustment. Limited partners only. Box 6. Net Other AMT Adjustment; Box 7. General Credits; Box 8. Low-Income Housing Credit; Box 9. Other. Codes A ... Instructions for Form 4626 (2017) | Internal Revenue Service It may be helpful to refigure the following for the AMT: Form 8810, Corporate Passive Activity Loss and Credit Limitations, and related worksheets; Schedule D (Form 1120), Capital Gains and Losses; Section B of Form 4684, Casualties and Thefts; or Form 4797, Sale of Business Property.

Publication 17 (2021), Your Federal Income Tax | Internal ... If a child's only income is interest and dividends (including capital gain distributions and Alaska Permanent Fund dividends), the child was under age 19 at the end of 2021 or was a full-time student under age 24 at the end of 2021, and certain other conditions are met, a parent can elect to include the child's income on the parent's return.

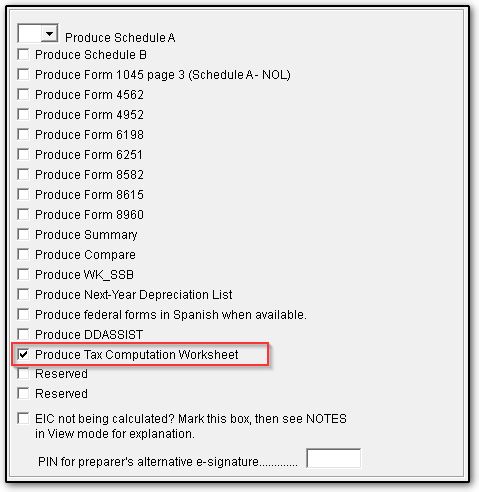

Amt qualified dividends and capital gains worksheet

Instructions for Form 8801 (2021) | Internal Revenue Service Jan 13, 2022 · To see if you have an AMT capital gain excess, subtract Form 8801, line 10, from line 4 of your 2020 Qualified Dividends and Capital Gain Tax Worksheet or line 10 of your 2020 Schedule D Tax Worksheet, whichever applies. Schedule K-1 (Form 1120S) - Other Information – Support Line 17Y– Section 199A REIT dividends - Amounts reported in Box 17, Code X are the REIT dividends received by the corporation. This amount will automatically pull to the applicable Qualified Business Income Deduction worksheet under the Tax Computation Menu and is used in the calculation of the QBID. Publication 929 (2021), Tax Rules for Children and Dependents If line 8 includes any net capital gain or qualified dividends, use the Qualified Dividends and Capital Gain Tax Worksheet to figure this tax. For details, see the instructions for Form 8615, line 9. However, if the child, the parent, or any other child has 28% rate gain or unrecaptured section 1250 gain, use the Schedule D Tax Worksheet.

Amt qualified dividends and capital gains worksheet. 2021 Form 6251 - IRS tax forms Enter the amount from line 5 of the Qualified Dividends and Capital Gain Tax Worksheet or the amount from line 14 of the Schedule D Tax Worksheet, whichever applies (as figured for the regular tax). If you did not complete either worksheet for the regular tax, enter the amount from Form 1040 or 1040-SR, line 15; if zero or less, enter -0-. Publication 929 (2021), Tax Rules for Children and Dependents If line 8 includes any net capital gain or qualified dividends, use the Qualified Dividends and Capital Gain Tax Worksheet to figure this tax. For details, see the instructions for Form 8615, line 9. However, if the child, the parent, or any other child has 28% rate gain or unrecaptured section 1250 gain, use the Schedule D Tax Worksheet. Schedule K-1 (Form 1120S) - Other Information – Support Line 17Y– Section 199A REIT dividends - Amounts reported in Box 17, Code X are the REIT dividends received by the corporation. This amount will automatically pull to the applicable Qualified Business Income Deduction worksheet under the Tax Computation Menu and is used in the calculation of the QBID. Instructions for Form 8801 (2021) | Internal Revenue Service Jan 13, 2022 · To see if you have an AMT capital gain excess, subtract Form 8801, line 10, from line 4 of your 2020 Qualified Dividends and Capital Gain Tax Worksheet or line 10 of your 2020 Schedule D Tax Worksheet, whichever applies.

0 Response to "40 amt qualified dividends and capital gains worksheet"

Post a Comment