40 1031 exchange calculation worksheet

1031 Exchange Calculator - cchwebsites.com This 1031 Exchange calculator will estimate the taxable impact of your proposed sale and purchase. To pay no tax when executing a 1031 Exchange, you must purchase at least as much as you sell (Net Sale) AND you must use all of the cash received (Net Cash Received). The Ultimate Partial 1031 Boot Calculator (Avoid Boot!) Partial 1031 exchange boot calculator This calculator will use your information, including your 1031 exchange boot tax rate, to tell you how much boot you can anticipate having — and how big of a tax bill you can expect. Partial 1031 exchange boot examples Let's look at two examples to illustrate how cash boot and mortgage boot work.

1031 Exchange Worksheet - Pruneyardinn Worksheet April 19, 2018 18:23 The 1031 Exchange worksheet is often used in financial and accounting applications, because it allows users to import or export data from one format to another. This can be done on any operating system, including Windows and Macs. There are many different kinds of formats you can work with when you use the worksheet.

1031 exchange calculation worksheet

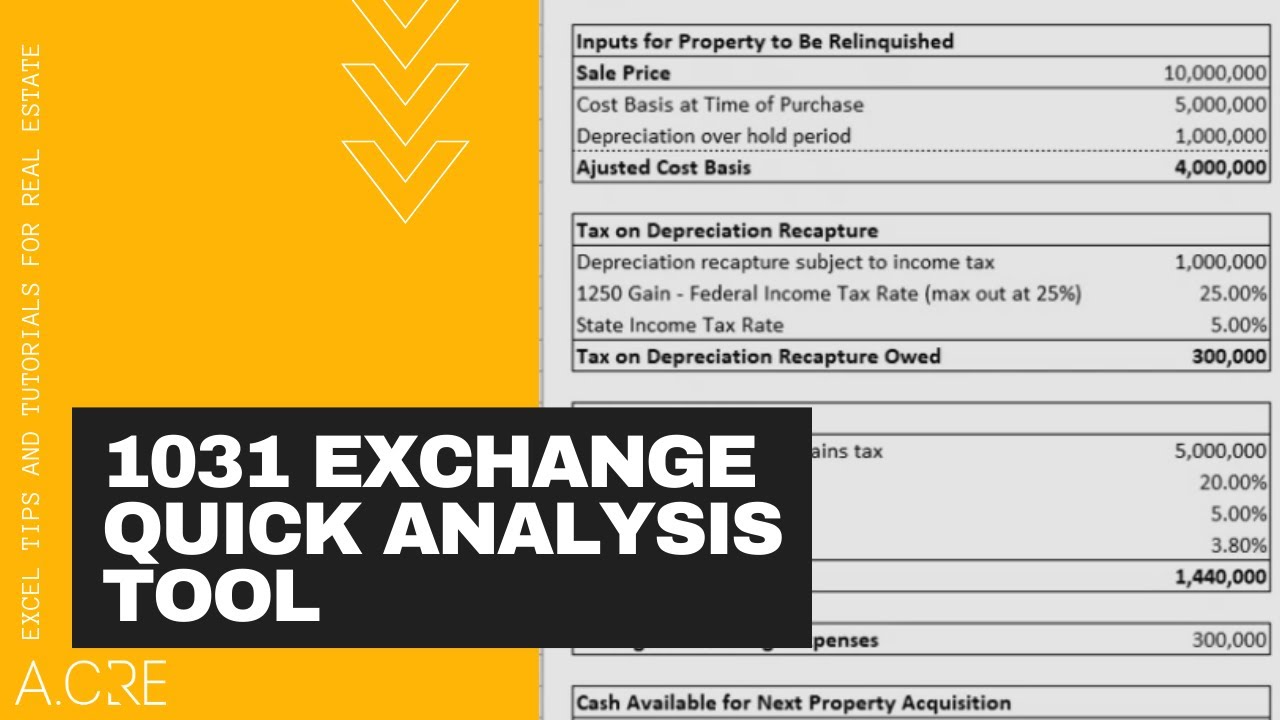

sec 1031 exchange worksheet 33 1031 Exchange Calculation Worksheet - Free Worksheet Spreadsheet dotpound.blogspot.com. 1031 calculation. 1031 Exchange Worksheet Excel - Promotiontablecovers promotiontablecovers.blogspot.com. 1031 recapture accounting. 33 Sec 1031 Exchange Worksheet - Worksheet Resource Plans starless-suite.blogspot.com › forms › miscFTB Publication 1017 | FTB.ca.gov - California However, an individual who comes to perform a particular contract of short duration will be considered a nonresident. For more information on residency, see FTB Publication 1031, Guidelines for Determining Resident Status. 36. How can withholding agents identify resident payees? The following are examples of accepted reasonable methods: Example 1: The Ultimate Depreciation Recapture Calculator - Inside the 1031 Exchange Depreciation recapture tax rates. Since depreciation recapture is taxed as ordinary income as opposed to capital gains, your depreciation recapture tax rate is going to be your income tax rate, with a cap at 25%. This 25% cap was instituted in 2013. Previously, the cap was 15%. Your depreciation recapture tax rate will break down like this ...

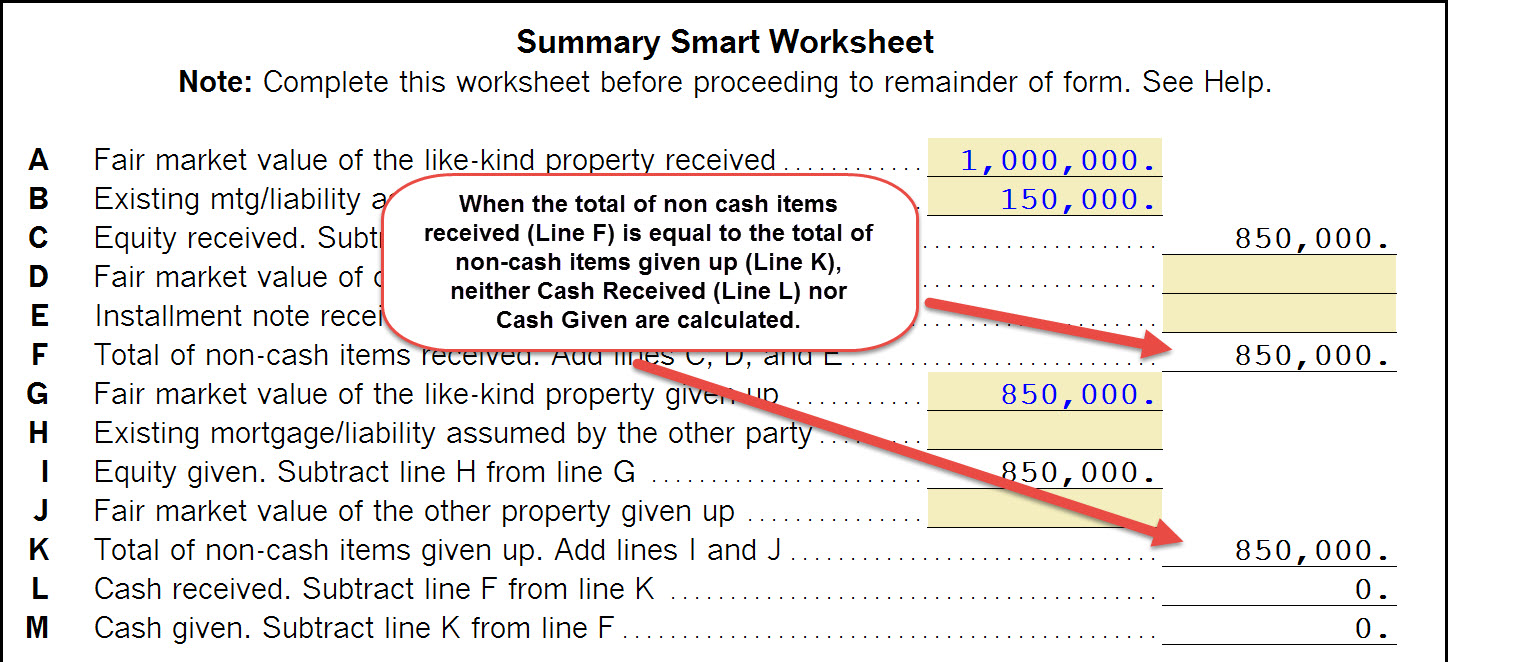

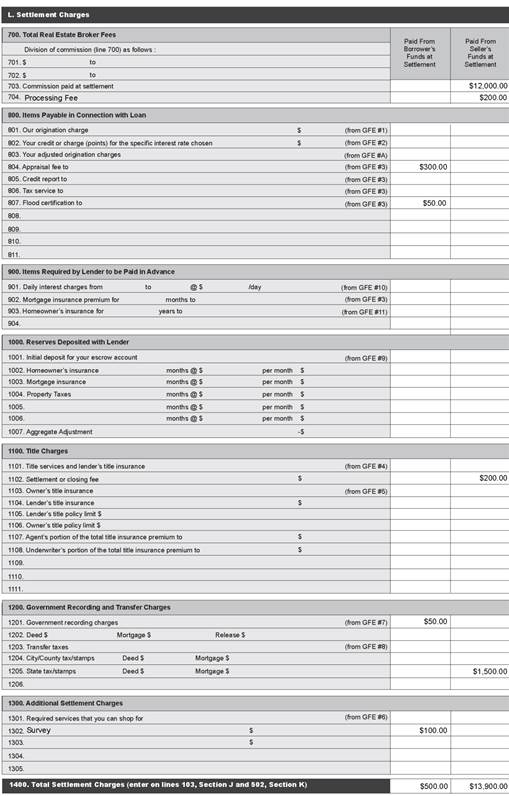

1031 exchange calculation worksheet. › forms › 20212021 Personal Income Tax Booklet | California Forms ... California Standard Deduction Worksheet for Dependents. Use this worksheet only if your parent, or someone else, can claim you (or your spouse/RDP) as a dependent on their return. Use whole dollars only. Enter your earned income from: line 2 of the “Standard Deduction Worksheet for Dependents" in the instructions for federal Form 1040 or 1040-SR. 1031 Exchange Examples: Like-Kind Examples to Study & Learn From Example 3. You own a $4,000,000 investment property with a tax basis of $3,500,000 — meaning that you have a $500,000 capital gain. You would like to do a 1031 exchange into a $3,800,000 7-Eleven in Newport News, Virginia. If you exchange your $4,000,000 property for the $3,800,000 7-Eleven. Therefore, a taxable cash boot of $200,000 is realized. Instructions for Form 8824 (2022) | Internal Revenue Service Fill out only lines 15 through 25 of each worksheet Form 8824. On the worksheet Form 8824 for the part of the property used as a home, follow steps (1) through (3) above, except that instead of following step (2), enter the amount from line 19 on line 20. ️1031 Exchange Worksheet Excel Free Download| Qstion.co 1031 Exchange Worksheet Excel Master Of This 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. 4.1 enter the sum of line 1.1 minus lines 2.3 and 3.1 as the cost basis of all §1031 replacement property received. (=)$ _____ 4.2 allocation of basis between two or more §1031 replacement properties:

1031 Exchange Calculator - The 1031 Investor This 1031 Exchange calculator will estimate the taxable impact of your proposed sale and purchase. To pay no tax when executing a 1031 Exchange, you must purchase at least as much as you sell (Net Sale) AND you must use all of the cash received (Net Cash Received). 1031 Exchange Calculator | Calculate Your Capital Gains If you need immediate assistance, call Bill at (571) 327-1031 Capital Gains Calculator Realty Exchange Corporation has created this simple Capital Gain Analysis Form and Calculator to estimate the tax impact if a property is sold and not exchanged, and to calculate the reinvestment requirements for a tax-free exchange. › instructions › i8995aInstructions for Form 8995-A (2021) | Internal Revenue Service Jan 19, 2022 · S-corporation portion of an ESBT filer: ESBT Tax Worksheet, line 13, plus ESBT Tax Worksheet, line 11. Schedule A (Form 8995-A)—Specified Service Trades or Businesses Complete Schedule A only if your trade or business is a SSTB and your taxable income is more than $164,900 but not $214,900 ($164,925 and $214,925 if married filing separately ... 1031 Tool Kit - TM 1031 Exchange Purchase 1031 Exchange Books Suggested Books on 1031 Exchanges Get a Free Property List & Consultation For specific questions about 1031 Exchanges call 1-877-486-1031 or click here to EMail. Informed Decisions Make the Best Investments Thousands of Properties Rated Each Month. Only the Worthiest Investments Make it Into Your Vault.

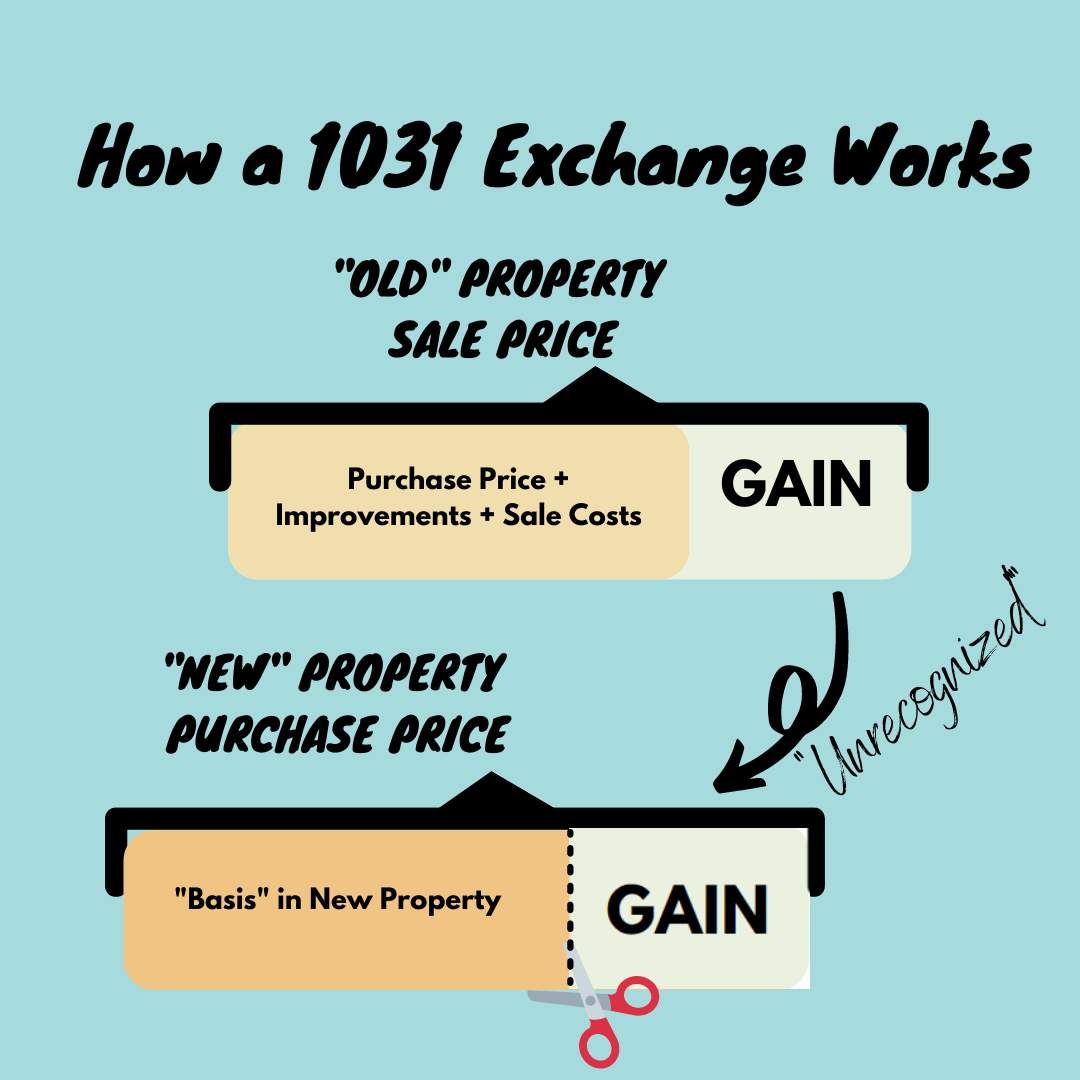

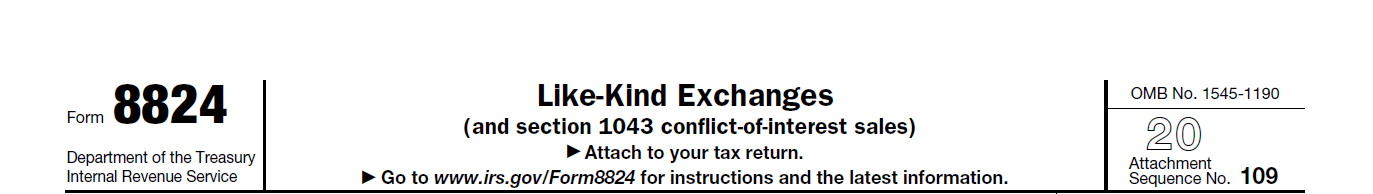

PDF Like-Kind Exchanges Under IRC Section 1031 - IRS tax forms type of Section 1031 exchange is a simultaneous swap of one property for another. Deferred exchanges are more complex but allow flexibility. They allow you to dispose of property and subsequently acquire one or more other like-kind replacement properties. To qualify as a Section 1031 exchange, a deferred exchange must be distinguished from the case IRS 1031 Exchange Worksheet And Section 1031 Exchange Calculation Worksheet Here it is. It was coming from reputable online resource and that we like it. We hope you can find what you need here. We always effort to show a picture with high resolution or with perfect images. IRS 1031 Exchange Worksheet And Section 1031 Exchange Calculation Worksheet can be beneficial inspiration for those who seek an image according ... Like Kind Exchange Calculator - cchwebsites.com Like Kind Exchange Calculator. If you exchange either business or investment property that is of the same nature or character, the IRS won't recognize it as a gain or loss. This calculator is designed to calculate recognized loss, gains and the basis for your newly received property. The Ultimate Depreciation Recapture Calculator - Inside the 1031 Exchange Depreciation recapture tax rates. Since depreciation recapture is taxed as ordinary income as opposed to capital gains, your depreciation recapture tax rate is going to be your income tax rate, with a cap at 25%. This 25% cap was instituted in 2013. Previously, the cap was 15%. Your depreciation recapture tax rate will break down like this ...

› forms › miscFTB Publication 1017 | FTB.ca.gov - California However, an individual who comes to perform a particular contract of short duration will be considered a nonresident. For more information on residency, see FTB Publication 1031, Guidelines for Determining Resident Status. 36. How can withholding agents identify resident payees? The following are examples of accepted reasonable methods: Example 1:

sec 1031 exchange worksheet 33 1031 Exchange Calculation Worksheet - Free Worksheet Spreadsheet dotpound.blogspot.com. 1031 calculation. 1031 Exchange Worksheet Excel - Promotiontablecovers promotiontablecovers.blogspot.com. 1031 recapture accounting. 33 Sec 1031 Exchange Worksheet - Worksheet Resource Plans starless-suite.blogspot.com

0 Response to "40 1031 exchange calculation worksheet"

Post a Comment