38 1023 ez eligibility worksheet

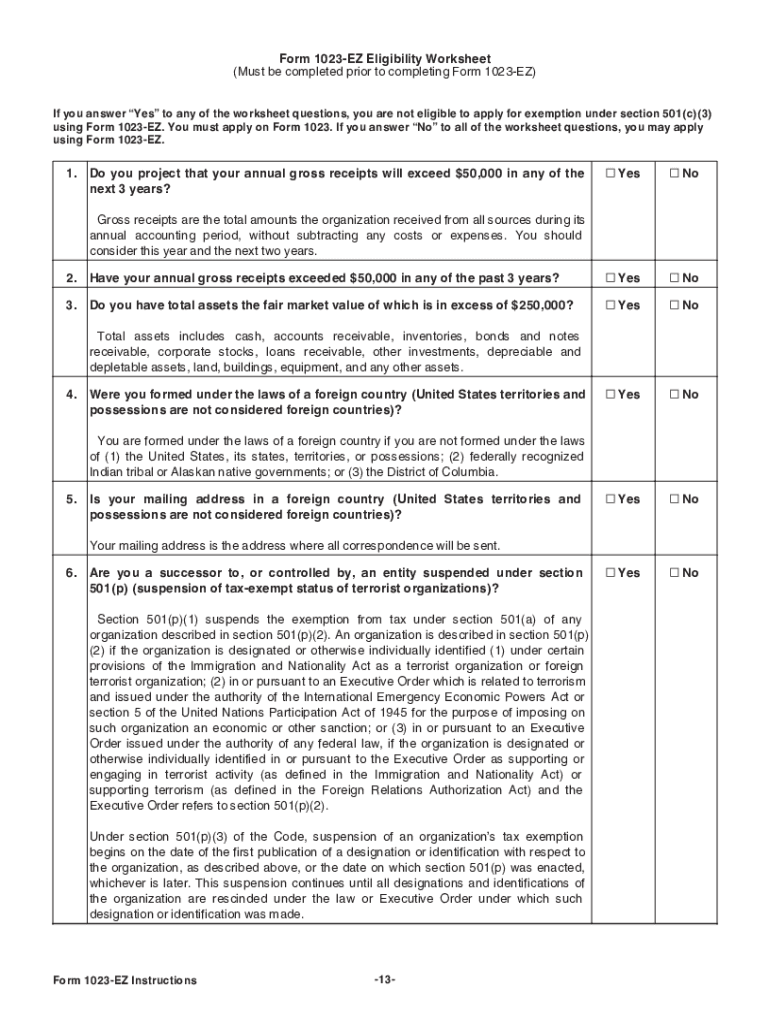

Form 1023-EZ Eligibility Worksheet (Must be completed prior ... If you answer “No” to all of the worksheet questions, you may apply using Form 1023-EZ. 1. Do you project that your annual gross receipts will exceed $50,000 in ...8 pages Application for Recognition of Exemption Under Section 501(c ... You must complete the Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZ to determine if you are eligible to file that form.

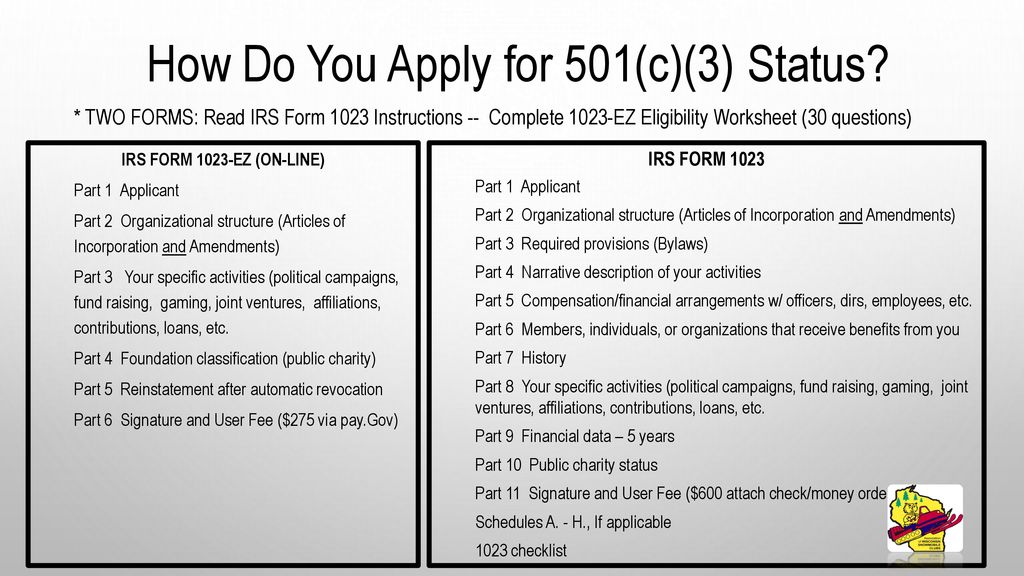

Instructions for Form 1023 (01/2020) | Internal Revenue Service Unless an exception applies, an organization must file Form 1023 or Form 1023-EZ (if eligible) to obtain recognition of exemption from federal income tax under section 501(c)(3). You can find information about eligibility to file Form 1023-EZ at IRS.gov/Charities.

1023 ez eligibility worksheet

Form 1023-EZ (1023EZ) Application for 501c3 Pros & Cons Where can I find the form 1023 EZ eligibility worksheet? You can find the Form 1023 EZ eligibility worksheet from here. Conclusion. I could go on and on, but the honest verdict on the form 1023 EZ is that the only honest organizations that could possibly benefit from this short exemption application form are the very, very, very, small animal ... Filing Your Nonprofits Tax Exempt Forms: 1023 vs. 1023 EZ Form 1023-EZ: Eligibility Criteria. For determination of whether your nonprofit meets eligibility criteria for completing the EZ version of Form 1023, fill out this Eligibility Worksheet. If even a single time you must answer "yes" to one of the 30 questions, your organization is not eligible for the shortcut and must fill out the standard Form ... Form 1023-EZ Revisions | Internal Revenue Service - IRS tax forms Question 29 on the Form 1023-EZ Eligibility Worksheet now requires that an automatically revoked organization applying for reinstatement must seek the same foundation classification they had at the time of automatic revocation to be eligible to use the Form 1023-EZ. Organizations that are not seeking that same foundation classification must ...

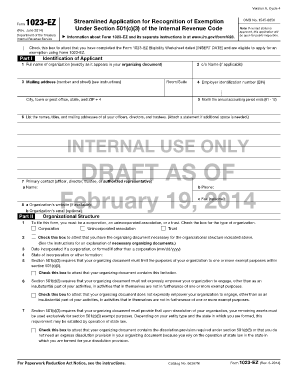

1023 ez eligibility worksheet. Instructions for Form 1023-EZ (Rev. January 2018) - IRS tax forms Form 1023-EZ Eligibility Worksheet. If you answer “Yes” to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. You must apply on Form 1023. If you answer “No” to all of the worksheet questions, you may apply using Form 1023-EZ. exempt organizations form 1023-ez approvals - IRS FORMREVISION. Form 1023-EZ version. ELIGIBILITYWORKSHEET. Eligibility Worksheet. ORGNAME1. Organization Primary Name. ORGNAME2. Organization Secondary Name.8 pages Instructions for Form 1023-EZ (01/2018) - IRS 20 Dec 2019 — Before completing the Form 1023-EZ, you must complete the Form 1023-EZ Eligibility Worksheet. If you meet the eligibility requirements, ... Filing the 1023 EZ Form for Your Nonprofit - Springly To make your life a little easier, we have broken down the process of filing the 1023-EZ line by line. We will cover all of the form sections as well how to tell if your organization is eligible for the EZ format: 1023 vs 1023-EZ; Eligibility Worksheet; Part 1: Identification of Applicant; Part 2: Organizational Structure; Part 3: Your Specific ...

About Form 1023, Application for Recognition of Exemption ... You must complete the Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZ PDF to determine if you are eligible to file this form. If you are not eligible to file Form 1023-EZ, you can still file Form 1023. About Form 1023-EZ, Streamlined Application for Recognition ... 26 Aug 2022 — Read the Instructions for Form 1023-EZ and complete its Eligibility Worksheet found at the end of the instructions. Form 1023-EZ (June 2014) - IRS Check this box to attest that you have completed the Form 1023-EZ Eligibility Worksheet in the current instructions, are eligible to apply.3 pages 1023 ez eligibility worksheet: Fill out & sign online - DocHub Edit, sign, and share 1023 ez eligibility worksheet online. No need to install software, just go to DocHub, and sign up instantly and for free.

Form 1023-EZ Revisions | Internal Revenue Service - IRS tax forms Question 29 on the Form 1023-EZ Eligibility Worksheet now requires that an automatically revoked organization applying for reinstatement must seek the same foundation classification they had at the time of automatic revocation to be eligible to use the Form 1023-EZ. Organizations that are not seeking that same foundation classification must ... Filing Your Nonprofits Tax Exempt Forms: 1023 vs. 1023 EZ Form 1023-EZ: Eligibility Criteria. For determination of whether your nonprofit meets eligibility criteria for completing the EZ version of Form 1023, fill out this Eligibility Worksheet. If even a single time you must answer "yes" to one of the 30 questions, your organization is not eligible for the shortcut and must fill out the standard Form ... Form 1023-EZ (1023EZ) Application for 501c3 Pros & Cons Where can I find the form 1023 EZ eligibility worksheet? You can find the Form 1023 EZ eligibility worksheet from here. Conclusion. I could go on and on, but the honest verdict on the form 1023 EZ is that the only honest organizations that could possibly benefit from this short exemption application form are the very, very, very, small animal ...

0 Response to "38 1023 ez eligibility worksheet"

Post a Comment