43 1040 qualified dividends worksheet

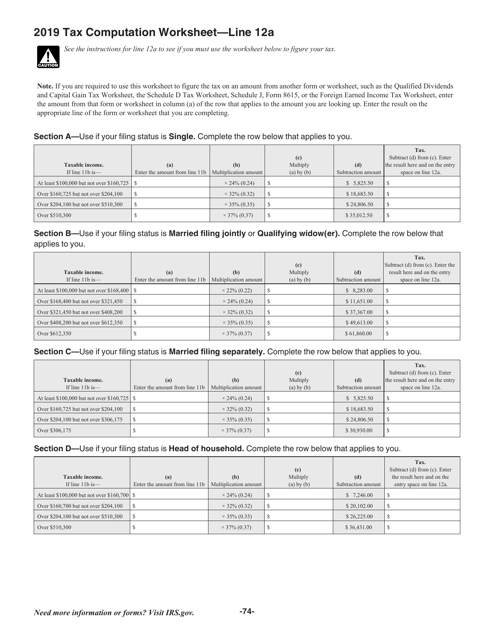

Qualified Dividends and Capital Gain Tax Worksheet: An … rates to qualified dividends received after 2002 and before 2009. The IRS added several lines to Schedule D, Capital Gains and Losses, to capture the ... of rates will apply for the whole year. Worksheet Alternative For several years, the IRS has provided a tax computation worksheet in the Form 1040 and 1040A instructions for certain investors ... PDF Qualified Dividends and Capital Gain Tax Worksheet -Line 44 (Form 1040 ... See the instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43. If you do not have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Form 1040. Enter the amount from Form 1040, line 43 (Form ...

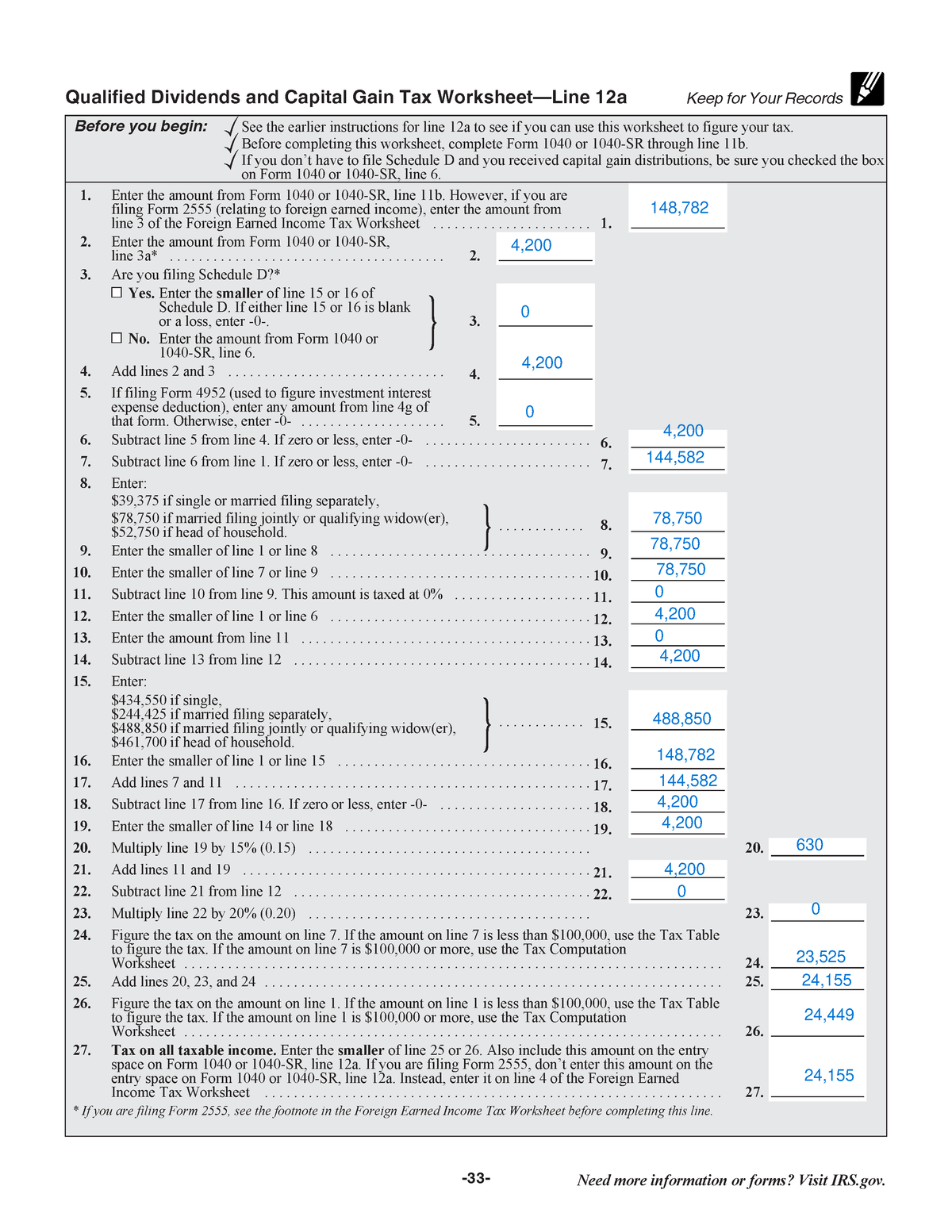

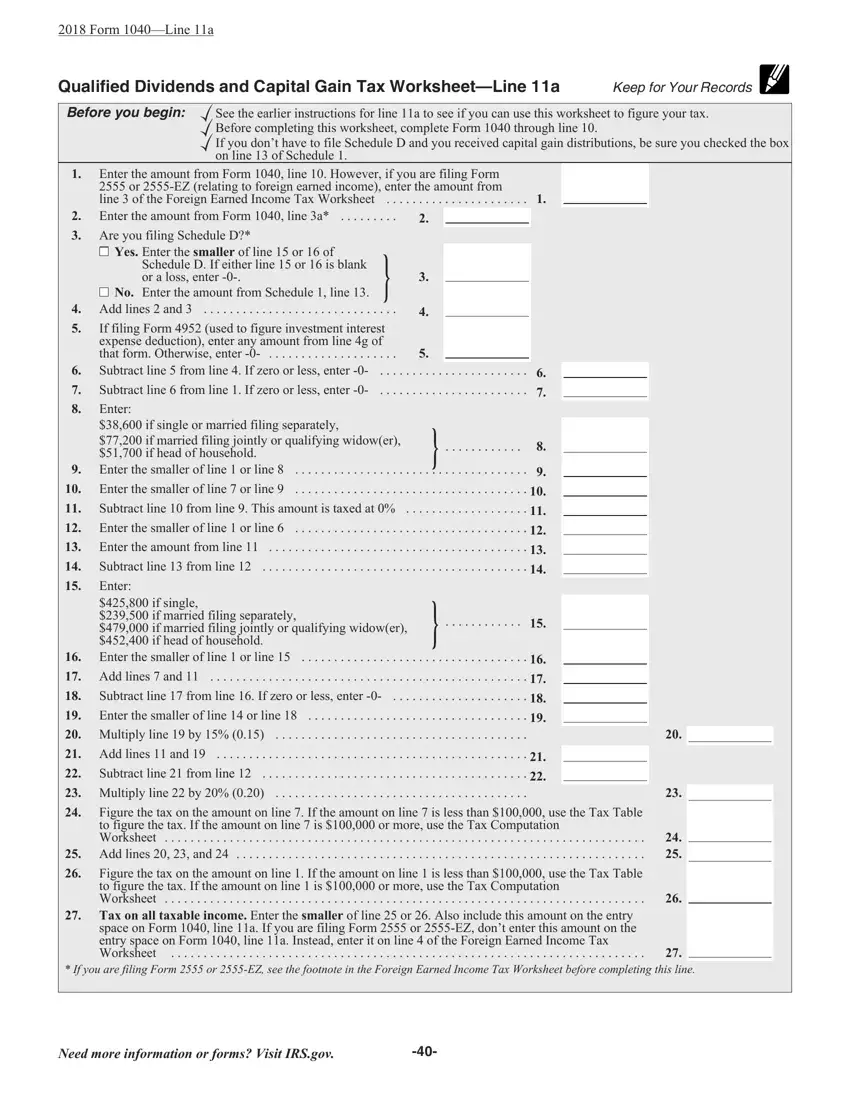

› how-your-tax-isHow Your Tax Is Calculated: Qualified Dividends and Capital ... Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates. Qualified Income is the sum of qualified dividends (line 2) and long-term capital gains (line 3). Ordinary Income is everything else or Taxable Income minus Qualified Income.

1040 qualified dividends worksheet

img1.wsimg.com › blobby › goQualified Dividends and Capital Gain Tax Worksheet (2020) Qualified Dividends and Capital Gain Tax Worksheet (2020) • See Form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. • Before completing this worksheet, complete Form 1040 through line 15. • If the taxpayer does not have to file Schedule D (Form 1040) and received capital gain ... Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 - Fill ... Complete Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 online with US Legal Forms. Easily fill out PDF blank, edit, and sign them. ... Qualified Dividends and Capital Gain Tax Worksheet Line 44 (Form 1040) Line 28 (Form 1040A) (Keep for Your Records) NAMEBefore you begin:SSN See the instructions for line 44 to see if you can use. › pub › irs-pdfFuture Developments What's New - IRS tax forms 1040 U.S. Individual Income Tax Return 1040-SR U.S. Tax Return for Seniors Schedule A (Form 1040) Itemized Deductions 8885 Health Coverage Tax Credit 8962 Premium Tax Credit (PTC) What Are Medical Expenses? Medical expenses are the costs of diagnosis, cure, mitiga-tion, treatment, or prevention of disease, and for the pur-

1040 qualified dividends worksheet. › instructions › i1040gi1040 (2021) | Internal Revenue Service - IRS tax forms ABC Mutual Fund paid a cash dividend of 10 cents a share. The ex-dividend date was July 16, 2021. The ABC Mutual Fund advises you that the part of the dividend eligible to be treated as qualified dividends equals 2 cents a share. Your Form 1099-DIV from ABC Mutual Fund shows total ordinary dividends of $1,000 and qualified dividends of $200. Qualified Dividends and Capital Gains Worksheet.pdf Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. I have qualified dividends (1040 line 3a) and ordinary dividends (1040 ... When you enter qualified dividends and/or capital gains on your return, taxes will not be calculated using the tax tables, but using either the Schedule D Tax Worksheet provided in the Instructions for Schedule D, or the Qualified Dividends and Capital Gains Tax Worksheet in the Instructions for Form 1040 and 1040-SR. 0 Reply KV10 Level 2 Qualified Dividends Tax Worksheet - Fill Out and Use This PDF - FormsPal The IRS has made available a new qualified dividends tax worksheet form (1096-DIV) for the 2019 tax year. The form is used to report distributions on Form 1040, Schedule B, and ensure that the correct amount of tax is withheld. This guide will provide an overview of the form and instructions on how to complete it. What are qualified dividends?

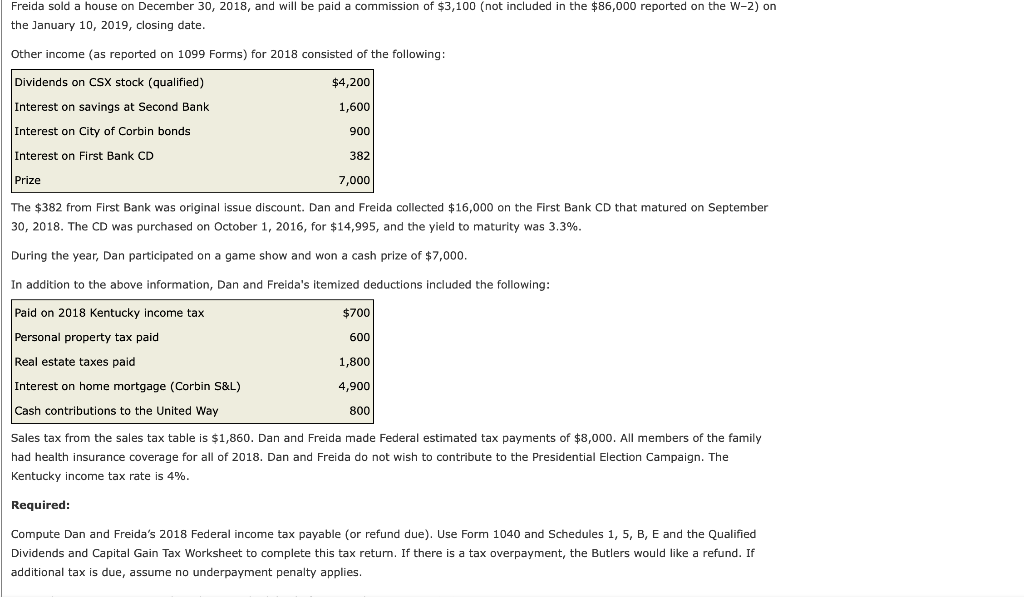

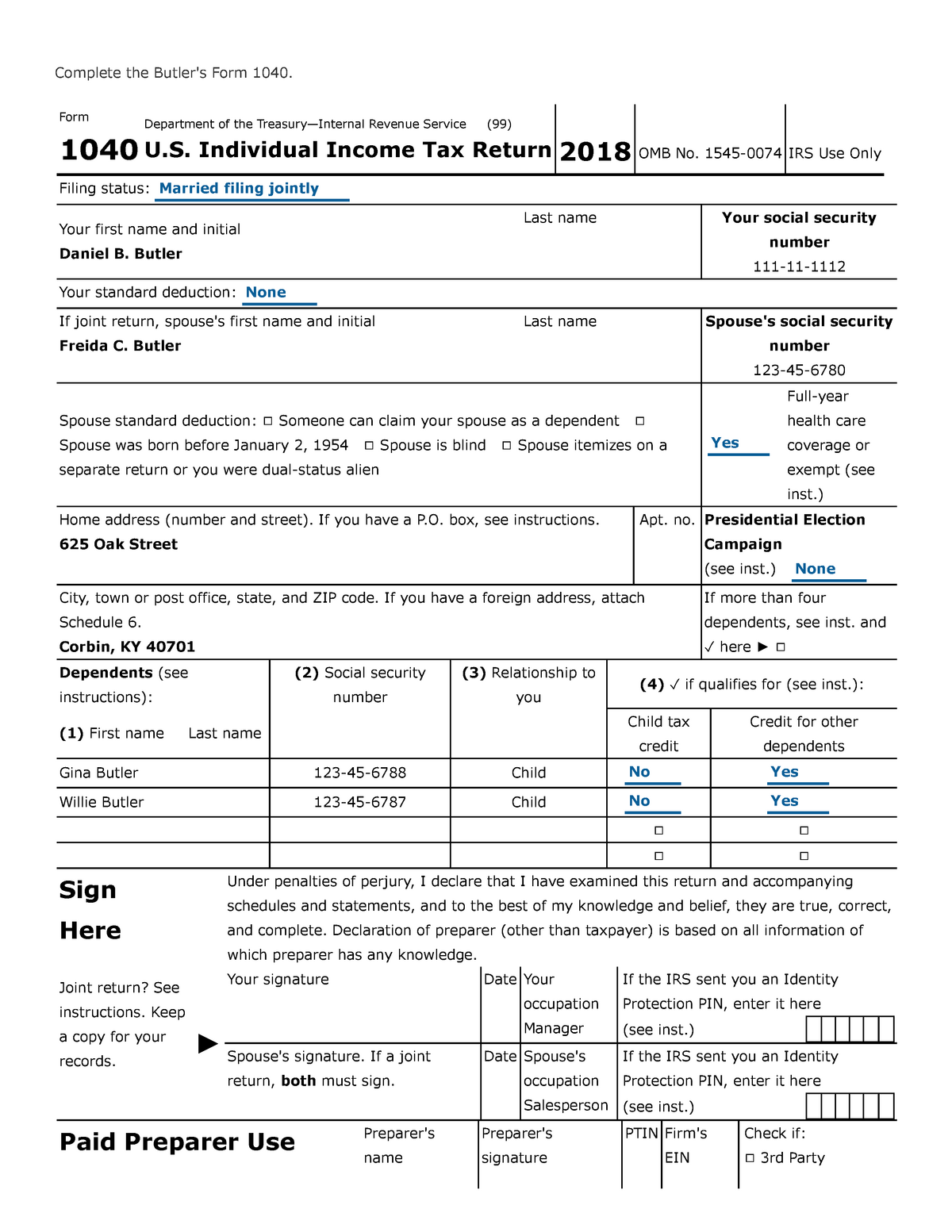

Qualified Dividends and Capital Gains Worksheet - StuDocu Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records. See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. If you don't have to file Schedule D and you received capital gain ... PDF Page 40 of 117 - IRS tax forms 2018 Form 1040—Line 11a Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10. Fillable Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 Use Fill to complete blank online IRS pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018. On average this form takes 7 minutes to complete. The Form 1040 Qualified Dividends and Capital Gain Tax ... Qualified Dividends and Capital Gains Worksheet - StuDocu Qualified Dividends and Capital Gains Worksheet Mr. and Mrs. Butler 2019 I got an A on this assignment qualified dividends and capital gain tax 12a keep for. Introducing Ask an Expert 🎉 ... Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. If you don't have to file Schedule D and you received capital gain ...

PDF SCHEDULE D Capital Gains and Losses - IRS tax forms Do you have qualified dividends on Form 1040, 1040-SR, or 1040-NR, line 3a? Yes. Complete the : Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Forms 1040 and 1040-SR, line 16. No. Complete the rest of Form 1040, 1040-SR, or 1040-NR. Schedule D (Form 1040) 2021: Future Developments What's New - IRS tax forms 1040 U.S. Individual Income Tax Return 1040-SR U.S. Tax Return for Seniors Schedule A (Form 1040) Itemized Deductions 8885 Health Coverage Tax Credit 8962 Premium Tax Credit (PTC) What Are Medical Expenses? Medical expenses are the costs of diagnosis, cure, mitiga-tion, treatment, or prevention of disease, and for the pur- › pub › irs-newsQualified Dividends and Capital Gain Tax Worksheet: An ... rates to qualified dividends received after 2002 and before 2009. The IRS added several lines to Schedule D, Capital Gains and Losses, to capture the different rates that apply during 2003 and to include the dividend tax break. Schedule D will be much shorter for 2004, when one set of rates will apply for the whole year. Worksheet Alternative 2021 Instructions for Schedule D (2021) | Internal Revenue Service Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4g, even if you don’t need to file Schedule D. Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and ...

How to Download Qualified Dividends and Capital Gain Tax Worksheet ... Qualified Dividends and Capital Gain Tax Worksheet The worksheet is part of Form 1040 which is mandatory for every individual tax filer as well as joint filers. The worksheet has 27 lines, and all fields must be filled according to relevant information. Tax filers with qualified dividends and capital gains have to fill the relevant worksheet.

THIS BOOKLET DOES NOT CONTAIN INSTRUCTIONS FOR … 3. Include Form 8962 with your 1040, 1040A, or 1040NR. (Don t include Form 1095-A.) Health Coverage Individual Responsibiliyt Payment Report Health Care Coverage Check the Full-year coverage box on line 61 to indicate that you, your spouse (if filing jointly), and anyone you can or do claim as a dependent had qualifying health care coverage ...

Qualified dividends, on 1040 Schedule D, worksheet, does not… This worksheet directly compute Qualified Dividends, into lower Tax rate. In 2018, they eliminated the Worksheet below. 2018 Schedule D Tax Worksheet, asks for data, but eliminated link to lower Tax rate for Qualified Divdidends.I have suspicion, how they are handling this issue of Qualified Dividends built into 2018 Schedule D worksheet.

2021 Instructions for Schedule A (2021) | Internal Revenue Service However, you can deduct qualified home mortgage interest (on your Schedule A) and interest on certain student loans (on Schedule 1 (Form 1040), line 21), as explained in Pub. 936 and Pub. 970. If you use the proceeds of a loan for more than one purpose (for example, personal and business), you must allocate the interest on the loan to each use.

Publication 575 (2021), Pension and Annuity Income Form 8915-F replaces Form 8915-E. Form 8915-F, Qualified Disaster Retirement Plan Distributions and Repayments, replaces Form 8915-E for reporting qualified 2020 disaster distributions and repayments of those distributions made in 2021 and 2022, as applicable.In previous years, distributions and repayments would be reported on the applicable Form 8915 …

› publications › p17Publication 17 (2021), Your Federal Income Tax | Internal ... Form 1040 or 1040-SR. If you file a paper return, attach any forms and schedules behind Form 1040 or 1040-SR in order of the “Attachment Sequence No.” shown in the upper right corner of the form or schedule. Then, arrange all other statements or attachments in the same order as the forms and schedules they relate to and attach them last.

Publication 523 (2021), Selling Your Home | Internal Revenue Service your gain from line 7, under Worksheet 2 less your non-qualified use gain, from Section B, Step 5. ... (Form 1040), Interest and Ordinary Dividends, to Form 1040 or 1040-SR and provide the buyer's name, address, and social security number. If you don’t show the buyer’s name, address, and SSN you may have to pay a $50 penalty.

Qualified Dividends and Capital Gain Tax Worksheet. - CCH Use the Qualified Dividends and Capital Gain Tax Worksheet to figure your tax, if you do not have to use the Schedule D Tax Worksheet and if any of the following applies. You reported qualified dividends on Form 1040, line 9b. You do not have to file Schedule D and you reported capital gain distributions on Form 1040, line 13.

Publication 525 (2021), Taxable and Nontaxable Income If you used one of these forms in the past, you’ll now file Form 1040 or 1040-SR. Qualified equity grants. For tax years beginning after 2017, certain qualified employees can make a new election to defer income taxation for up to 5 years for the qualified stocks received. See Qualified Equity Grants under Employee Compensation, later.

How do I download my Qualified Dividends and Capital Gain Tax Worksheet ... Use the Qualified Dividends and Capital Gain Tax Worksheet to figure your tax if you do not have to use the Schedule D Tax Worksheet and if any of the following applies. You reported qualified dividends on Form 1040 or 1040-SR, line 3a.

Publication 519 (2021), U.S. Tax Guide for Aliens | Internal … Form 1040-NR-EZ discontinued. Beginning with tax year 2020, Form 1040-NR-EZ is no longer available. ... you must report all interest, dividends, wages, or other compensation for services, income from rental property or royalties, and other types of income on your U.S. tax return. You must report these amounts from sources within and outside the ...

PDF 2021 Instruction 1040 - IRS tax forms 1040-SR and their instructions, such as legislation enacted after they were published, go to IRS.gov/Form1040. Free File is the fast, safe, and free way to prepare and e- le your taxes. See IRS.gov/FreeFile. Pay Online. It s fast, simple, and secure. Go to IRS.gov/Payments. Including the instructions for Schedules 1 through 3 1040 (and 2021 ...

Qualified Dividends and Capital Gains Worksheet.docx Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records Before you begin: See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b.

1040 (2021) | Internal Revenue Service - IRS tax forms ABC Mutual Fund paid a cash dividend of 10 cents a share. The ex-dividend date was July 16, 2021. The ABC Mutual Fund advises you that the part of the dividend eligible to be treated as qualified dividends equals 2 cents a share. Your Form 1099-DIV from ABC Mutual Fund shows total ordinary dividends of $1,000 and qualified dividends of $200.

› publications › p525Publication 525 (2021), Taxable and Nontaxable Income If you used one of these forms in the past, you’ll now file Form 1040 or 1040-SR. Qualified equity grants. For tax years beginning after 2017, certain qualified employees can make a new election to defer income taxation for up to 5 years for the qualified stocks received. See Qualified Equity Grants under Employee Compensation, later.

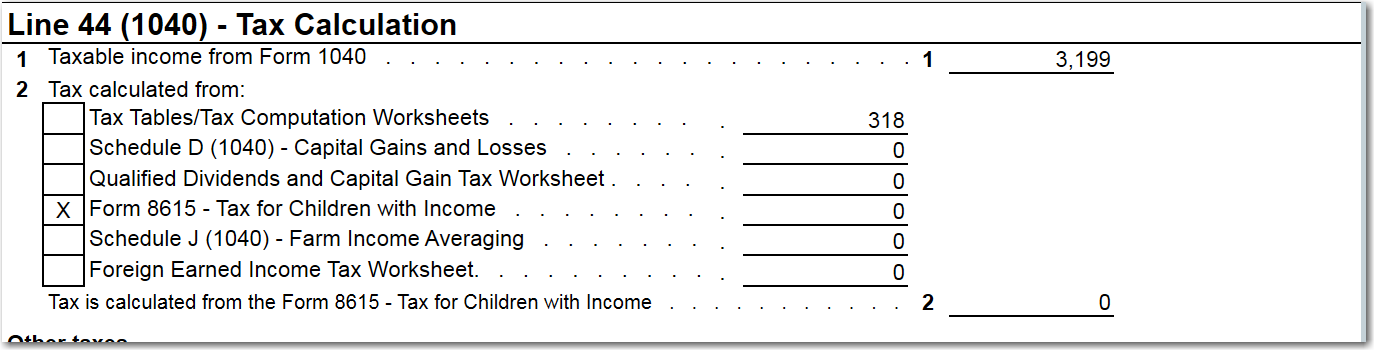

Clarification of Worksheet Line References in the 2020 Instructions for ... Under " Using the Qualified Dividends and Capital Gain Tax Worksheet for line 15 tax ," number 6 should read, "Complete lines 5 through 25 following the worksheet instructions. Use the child's filing status to complete lines 6, 13, 22, and 24 of the worksheet for Form 1040." The correct line is line 22, not line 23.

› pub › irs-pdfFuture Developments What's New - IRS tax forms 1040 U.S. Individual Income Tax Return 1040-SR U.S. Tax Return for Seniors Schedule A (Form 1040) Itemized Deductions 8885 Health Coverage Tax Credit 8962 Premium Tax Credit (PTC) What Are Medical Expenses? Medical expenses are the costs of diagnosis, cure, mitiga-tion, treatment, or prevention of disease, and for the pur-

Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 - Fill ... Complete Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 online with US Legal Forms. Easily fill out PDF blank, edit, and sign them. ... Qualified Dividends and Capital Gain Tax Worksheet Line 44 (Form 1040) Line 28 (Form 1040A) (Keep for Your Records) NAMEBefore you begin:SSN See the instructions for line 44 to see if you can use.

img1.wsimg.com › blobby › goQualified Dividends and Capital Gain Tax Worksheet (2020) Qualified Dividends and Capital Gain Tax Worksheet (2020) • See Form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. • Before completing this worksheet, complete Form 1040 through line 15. • If the taxpayer does not have to file Schedule D (Form 1040) and received capital gain ...

/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

0 Response to "43 1040 qualified dividends worksheet"

Post a Comment