38 non cash charitable donations worksheet

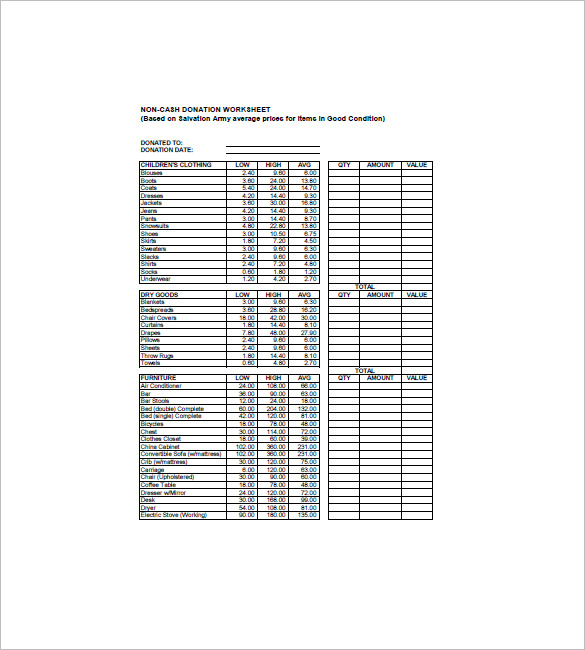

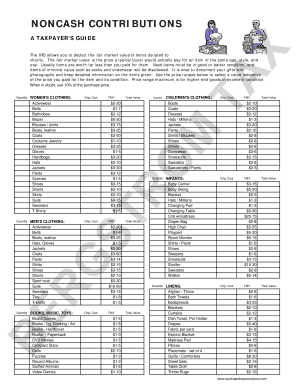

Charitable Contribution Worksheet | STAC Accounting Charitable Contribution Worksheet. Karen. December 20, 2017. Reporting Non Cash Charitable Donations can be extremely beneficial to your bottom line tax liability. Although, pulling it all together can also be painfully arduous. I am providing access to a worksheet built in excel. Download it and open in your 'sheets' app (excel, numbers ... PDF NON-CASH DONATION WORKSHEET (Based on Salvation Army average prices for ... NON-CASH DONATION WORKSHEET (Based on Salvation Army average prices for items in Good Condition) DONATED TO: DONATION DATE: MISCELLANEOUS LOW HIGH AVG QTY AMOUNT VALUE Adding Machines 24.00 90.00 57.00 Christmas Trees 18.00 60.00 39.00 Broiler Ovens 18.00 30.00 24.00 Copier 120.00 240.00 180.00

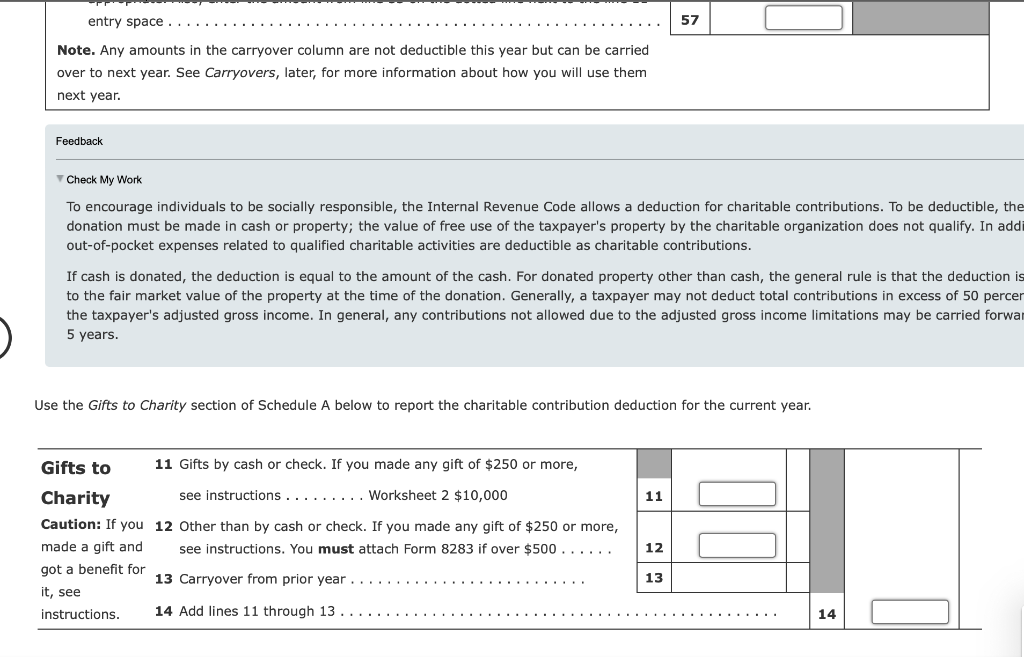

› articles › taxesAn Overview of Itemized Deductions - Investopedia Jan 19, 2022 · Charitable donations Any donation made to a qualified charity is deductible within certain limitations. For cash contributions between 2018 and 2025, the amount that can be deducted is limited to ...

Non cash charitable donations worksheet

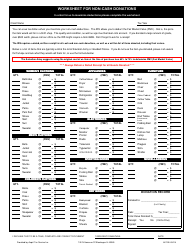

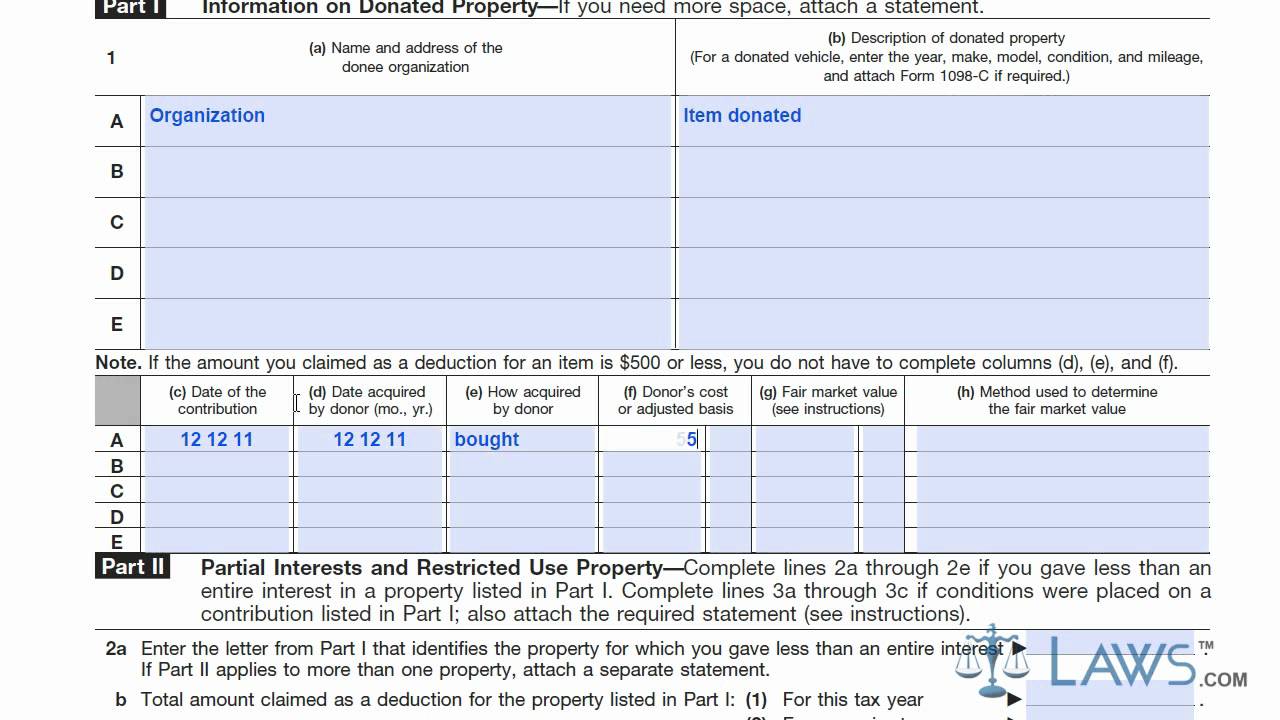

PDF Missing Information: Non-Cash Charitable Contributions Worksheet Missing Information: Non-Cash Charitable Contributions Worksheet Prepared By: Oelerich & Associates PC 02-14-2012 2831 Brady St. Davenport IA 52803-1519 Tel: (563) 323-7882 Fax: (563) 323-7888 Name: Tax Year: Home Telephone: Work Telephone: Cell: The following is a guideline for valuation of non-cash charitable contributions. Get NON-CASH DONATION WORKSHEET - US Legal Forms Ensure the details you fill in NON-CASH DONATION WORKSHEET is updated and accurate. Add the date to the record with the Date feature. ... Noncash Charitable Contributions applies to deduction claims totaling more than $500 for all contributed items. If a donor is claiming over $5,000 in contribution value, there is a section labeled Donee ... About Form 8283, Noncash Charitable Contributions Information about Form 8283, Noncash Charitable Contributions, including recent updates, related forms and instructions on how to file. Form 8283 is used to claim a deduction for a charitable contribution of property or similar items of property, the claimed value of which exceeds $500.

Non cash charitable donations worksheet. Non Charitable Donations Worksheets - K12 Workbook Showing 8 worksheets for Non Charitable Donations. Worksheets are Non cash charitable contributions donations work, Non cash donation work based on sa... K12 Workbook; Home; Common Core. Math. Kindergarten; Grade 1 ... Tax e-form Non-Cash Charitable Contribution Worksheet. Reload Open Download. 6. 2020 Charitable Contributions Noncash FMV Guide. XLS Noncash charitable deductions worksheet. - Lake Stevens Tax Service Note: This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation. › pub › irs-pdf2021 Publication 526 - IRS tax forms cash contribution even if you don’t itemize de-ductions on Schedule A (Form 1040). See Cash contributions for individuals who do not itemize deductions next. Cash contributions for individuals who do not itemize deductions. For the 2021 tax year, cash contributions up to $600 can be claimed on Form 1040 or 1040-SR, line 12b. PDF Non-Cash Charitable Contribution Worksheet Use One Worksheet per ... Non-Cash Charitable Contribution Worksheet The following tables are estimates only. Actual FMV could vary significantly. ... Non-cash Contributions, updated 1-2-2015 Item Qty Amount Qty Amount Subtotal Excellent Condition Average Condition End Table 35.00 x = 7.00 x = Floor Lamp 35.50 x = 8.00 x = Folding Bed 60.00 x = 20.00 x =

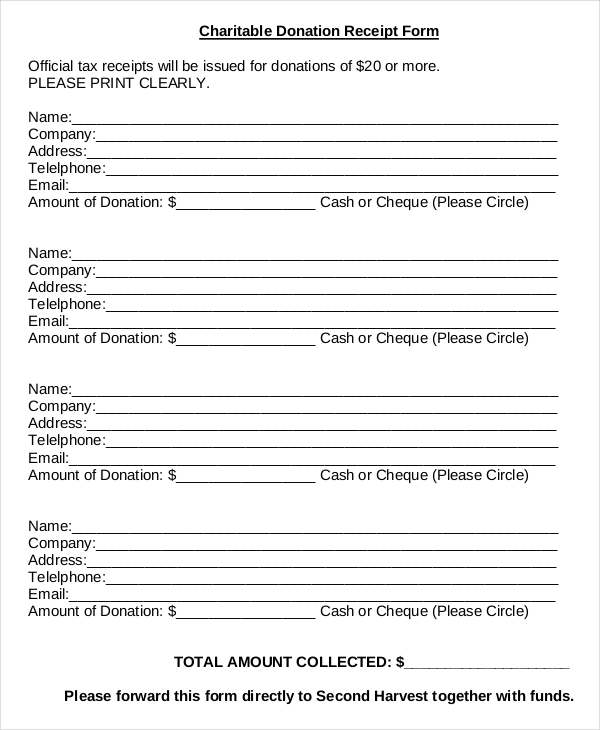

Non Cash Charitable Donations Worksheets - K12 Workbook Displaying all worksheets related to - Non Cash Charitable Donations. Worksheets are Non cash charitable contributions donations work, The salvation army valuation guide for donated items, Thrift store valuation guide, Non cash donation work based on salvation army, Anderson financial services, Fair market value guide for used items, 2019 publication 526, Valuation guide for goodwill donors. Donation Value Guide 2021 Spreadsheet - Fill Online, Printable ... A Non Cash Charitable Contributions/Donations Worksheet is necessary for individuals who make non-cash charitable donations to the Salvation Army that do not exceed $5,000. People in the USA are encouraged to become contributors not only due to the moral virtues inherent to this act, but they will also be to claim corresponding deductions from ... PDF Non-Cash Charitable Contributions Worksheet - LB Tax Services Missing Information: Non-Cash Charitable Contributions Worksheet Name. Home Telephone: Work Telephone: Tax Year: 2016 Cell: The following is a guideline for valuation of non-cash charitable contributions. When valuing items, take into consideration the condition of the items. If the value of the donated items is $250 or more to one charity in › tax-center › filingClaiming A Charitable Donation Without A Receipt | H&R Block If claiming a deduction for a charitable donation without a receipt, you can only include cash donations, not property donations, of less than $250. And, you must provide a bank record or a payroll-deduction record to claim the tax deduction. You need a receipt and other proof for both of these: Cash donations of $250 or more; Non-cash donations

› taxes › donation-value-guideDonation Value Guide For 2021 | Bankrate Sep 29, 2021 · If you make a single non-cash gift worth between $250 and $500 (if, for example, you donate a vehicle), you’re required to have a receipt or a written acknowledgment of your gift from a ... XLS Noncash charitable deductions worksheet. Note: This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation. Although the Retain this worksheet with your receipts in your tax file. non cash charitable contributions/donations worksheet 2007-2022 - Fill ... non cash charitable donations worksheet; If you believe that this page should be taken down, please follow our DMCA take down processhere. Ensure the security of your data and transactions. USLegal fulfills industry-leading security and compliance standards. VeriSign secured PDF Non-cash Charitable Contributions / Donations Worksheet Note: This worksheet is provided as a convenience and aid in calculating most common non-cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation. Although the

› articles › personal-financeCharitable Contributions: Tax Breaks and Limits - Investopedia Jul 30, 2022 · Nonitemizers can deduct cash gifts to charities of up to $300 if single and $600 if married, and itemizers' AGI limits stay at increased 2020 levels.

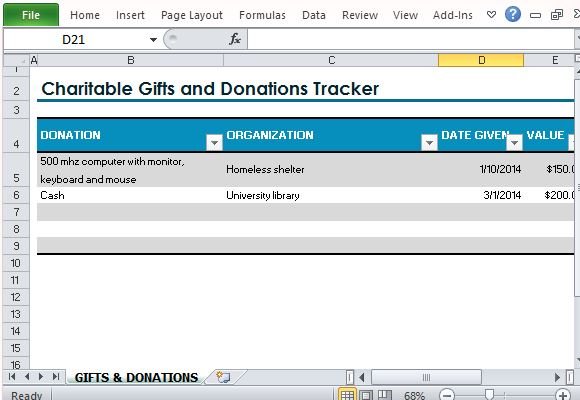

Charitable Donation Spreadsheets Below are FREE charitable donation spreadsheets. These spreadsheets will help you calculate and track your charitable donations for tax deduction purposes. All Practical Spreadsheets are easy to use and have pre-defined print areas. Most also include comments to aid in data entry. If these spreadsheets do not meet your needs, consider a Custom ...

itsdeductibleonline.intuit.comTax Deductions - ItsDeductible Existing Customers. Sign In. New Customers. Create New Account. Your account allows you to access your information year-round to add or edit your deductions.

Publication 526 (2021), Charitable Contributions - IRS tax forms For the 2021 tax year, cash contributions up to $600 can be claimed on Form 1040 or 1040-SR, line 12b. Enter the total amount of your contribution on line 12b. Don't enter more than: $300 if single, head of household, or qualifying widow (er); $600 if married filing jointly; or. $300 if married filing separately.

XLS Noncash charitable deductions worksheet. - A Better Choice Tax Note: This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation. Although the Retain this worksheet with your receipts in your tax file.

XLS Noncash charitable deductions worksheet. - lstax.com Note: This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation. Although the

XLS Noncash charitable deductions worksheet. noncash recap men's clothing children's clothing quantity good excellent total total of all donated items entity to whom donated: my / our best guess of value non cash charitable contributions / donations worksheet. insert tax year ===> insert date given ===> enter items not provided for in the above categories. set your own value.

goodwillnne.org › donate › donation-value-guideDonation value guide - Goodwill NNE Below is a donation value guide of what items generally sell for at Goodwill locations. To determine the fair market value of an item not on this list, use 30% of the item’s original price.

Non Cash Charitable Contributions Donations Worksheet: Fillable ... Read the following instructions to use CocoDoc to start editing and completing your Non Cash Charitable Contributions Donations Worksheet: In the beginning, look for the "Get Form" button and click on it. Wait until Non Cash Charitable Contributions Donations Worksheet is ready. Customize your document by using the toolbar on the top.

About Form 8283, Noncash Charitable Contributions Information about Form 8283, Noncash Charitable Contributions, including recent updates, related forms and instructions on how to file. Form 8283 is used to claim a deduction for a charitable contribution of property or similar items of property, the claimed value of which exceeds $500.

Get NON-CASH DONATION WORKSHEET - US Legal Forms Ensure the details you fill in NON-CASH DONATION WORKSHEET is updated and accurate. Add the date to the record with the Date feature. ... Noncash Charitable Contributions applies to deduction claims totaling more than $500 for all contributed items. If a donor is claiming over $5,000 in contribution value, there is a section labeled Donee ...

PDF Missing Information: Non-Cash Charitable Contributions Worksheet Missing Information: Non-Cash Charitable Contributions Worksheet Prepared By: Oelerich & Associates PC 02-14-2012 2831 Brady St. Davenport IA 52803-1519 Tel: (563) 323-7882 Fax: (563) 323-7888 Name: Tax Year: Home Telephone: Work Telephone: Cell: The following is a guideline for valuation of non-cash charitable contributions.

0 Response to "38 non cash charitable donations worksheet"

Post a Comment