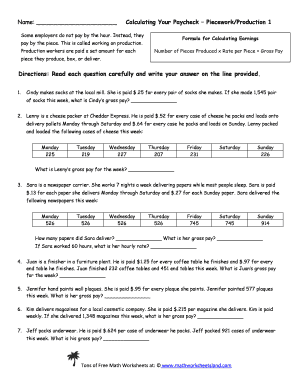

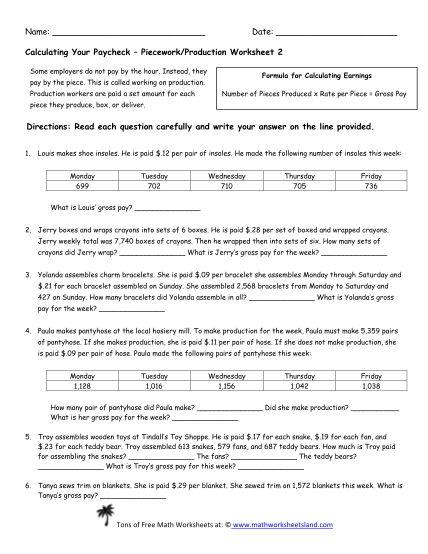

38 calculating your paycheck worksheet

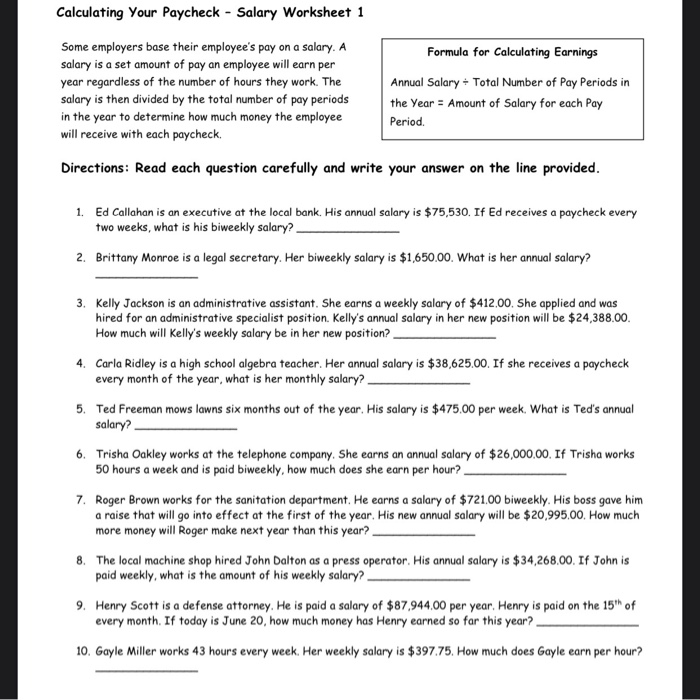

Get Calculating Your Paycheck Salary Worksheet 1 Answer Key The tips below will help you fill out Calculating Your Paycheck Salary Worksheet 1 Answer Key quickly and easily: Open the template in the full-fledged online editing tool by clicking Get form. Complete the necessary fields which are colored in yellow. Press the arrow with the inscription Next to jump from one field to another. Solved Calculating Your Paycheck - Salary Worksheet 1 Some | Chegg.com Formula for Calculating Earnings Annual Salary + Total Number of Pay Periods in the Year = Amount of Salary for each Pay Period Directions: Read each question carefully and write your answer on the line provided. 1. Ed Callahan is an executive at the local bank. His annual salary is $75,530.

Calculate your paycheck with paycheck calculators and withholding ... Free salary, hourly and more paycheck calculators. paycheck calculators. Use PaycheckCity's free paycheck calculators, gross-up and bonus and supplementary calculators, withholding forms, 401k savings and retirement calculator, and other specialty payroll calculators for all your paycheck and payroll needs.

Calculating your paycheck worksheet

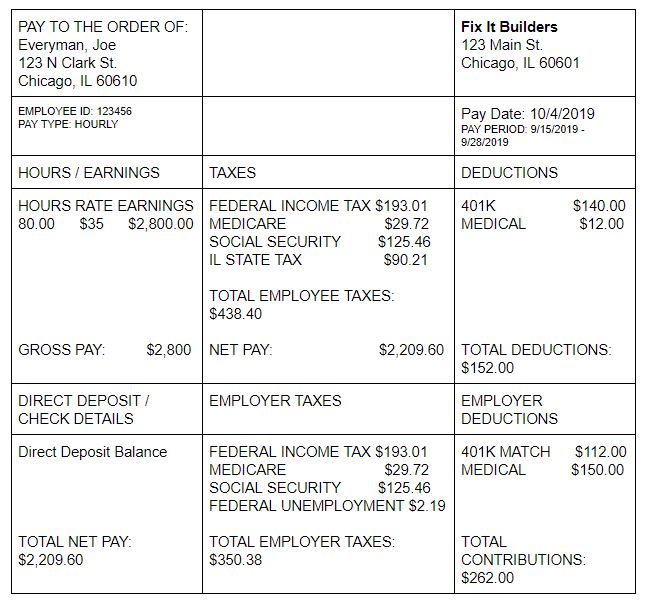

Newest 2021 MA Child Support Calculator | Amherst Divorce After you have calculated your results and downloaded a court-ready .pdf, you should check your final calculations against the state court’s calculating .pdf at: MA fillable .pdf 2021 child support calculator. You may find the state court form very difficult to fill out unless you you use my website first. Calculating the numbers in your paycheck | Consumer Financial ... Calculating the numbers in your paycheck Updated Aug 25, 2022 Students review a pay stub from a sample paycheck to understand the real-world effect of taxes and deductions on the amount of money they receive. Big idea The amount of money you earn from your job is different from the amount of money you receive in your paycheck. Essential questions Tax Withholding Estimator | Internal Revenue Service Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. This is tax withholding. See how your withholding affects your refund, take-home pay or tax due. How It Works Use this tool to: Estimate your federal income tax withholding

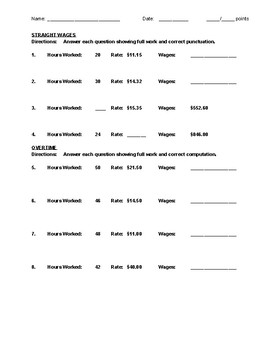

Calculating your paycheck worksheet. Why Aren't They Taking Out Enough Federal Taxes from My Paycheck? Insufficient federal income tax withholding can happen if you’re married and you and your spouse both work but you didn’t complete the Two Earners/Multiple Jobs Worksheet on page 2 of Form W-4. By completing that section of the form and stating the additional amount you want withheld from each of your paychecks on line 6, you avoid having ... How to Calculate Payroll Taxes | Business.org For the 2020 tax year, employers and employees both pay 6.2% of the employee's wages toward Social Security (the total contributions must equal 12.4%). And employers and employees both pay 1.45% towards Medicare for a matched total of 2.9%. In total, FICA taxes (from both employer and employee) should total 15.3% of each employee's paycheck. PDF Bring Home The Gold - National Payroll Week Your paycheck = total hours worked x rate of pay. 4. Name two mandatory deductions. 5. Name three other deductions. 10 Calculating a Paycheck #1 EMPLOYEE AT A GOURMET COFFEE Employee's name: Pay period Weekly Semimonthly Monthly Number of allowances (0 or more) Single Married GROSS PAY 1. Basic Monthly Budget Worksheets Everyone Should Have - The Balance A good first step is to calculate your monthly income. On the first tab of the worksheet, enter the income you expect to receive from all sources in the "Gross Income" category in the "Projected" column. Enter any deductions from your paycheck in the "Taxes Withheld and Payment Deductions" section and the "Projected" column.

11+ Payroll Worksheet Templates in Google Docs | Google Sheets | XLS ... 6 Steps to Make a Payroll Worksheet Step 1: Choose a Software There are a lot of software applications to be used to make a payroll worksheet. This includes Word, Excel, Google Sheets, Numbers, etc. You can select any, to make the worksheet. However, MS Excel is the most widely used software application. How to Calculate Payroll | Taxes, Methods, Examples, & More Multiply 6.2% by the employee's gross taxable wages for the pay period to find their Social Security tax amount. Medicare tax Medicare is the other tax that both employers and employees contribute to. The total tax is 2.9%, so employees pay 1.45%, and employers pay 1.45%. Salary Paycheck Calculator - Calculate Net Income | ADP How to calculate annual income To calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year. For example, if an employee earns $1,500 per week, the individual's annual income would be 1,500 x 52 = $78,000. How to calculate taxes taken out of a paycheck Income Calculation Worksheet - NRPS Right click on the below link, select "open in a new tab" to launch the Income Calculation Worksheet: Income Calculation Worksheet Income Calculation Worksheet is required to be utilized on all wag...

Lesson Plan: Calculating Gross and Net Pay - Scholastic Use the example of a $740 laptop computer in a state with 5% sales tax. First, show how 5% is converted to the decimal .05 and multiplied by $740 to arrive at a sales tax of $37. Adding the price of the laptop ($740) and the sales tax ($37) results in the total cost of $777. Step 3: While sales tax is added to the starting amount of a purchase ... Calculating Your Paycheck Salary Worksheet 1 Answer Key 2020-2022 ... Use your e-signature to the PDF page. Click on Done to save the adjustments. Download the record or print your PDF version. Send instantly to the receiver. Make use of the quick search and advanced cloud editor to generate an accurate Calculating Your Paycheck Salary Worksheet 1 Answer Key. Remove the routine and produce paperwork on the internet! Salary Paycheck Calculator · Payroll Calculator · PaycheckCity To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. This number is the gross pay per pay period. Subtract any deductions and payroll taxes from the gross pay to get net pay. Don't want to calculate this by hand? The PaycheckCity salary calculator will do the calculating for you. Free Employer Payroll Calculator and 2022 Tax Rates | OnPay Social Security tax: Withhold 6.2% of each employee's taxable wages until they earn gross pay of $147,000 in a given calendar year. The maximum an employee will pay in 2022 is $9,114.00. As the employer, you must also match your employees' contributions. Medicare tax: Under FICA, you also need to withhold 1.45% of each employee's taxable ...

PDF Calculating the numbers in your paycheck This answer guide provides possible answers for the "Calculating the numbers in . your paycheck" worksheet. Keep in mind that students' answers may vary. The . important thing is for students to have reasonable justification for their answers. Answer guide. 1. Which tax provides for federal health insurance? A. State income tax

Kami Export - calculating your paycheck worksheet 1.pdf The salary is then divided by the total number of pay periods in the year to determine how much money the employee will receive with each paycheck. Formula for Calculating Earnings Annual Salary ÷ Total Number of Pay Periods in the Year = Amount of Salary for each Pay Period. Directions: Read each question carefully and write your answer on ...

PDF Net Pay Worksheet - Calculate the Net Pay for each situation below. Net Pay Worksheet - Calculate the Net Pay for each situation below. 1) Sandra earns $13.50/hour and works 32 hours. ... Federal Tax = 15% of your gross pay Social Security Tax = 6.2% of your gross pay Medicare Tax = 1.45% of your gross pay State Tax = 4% of your gross pay

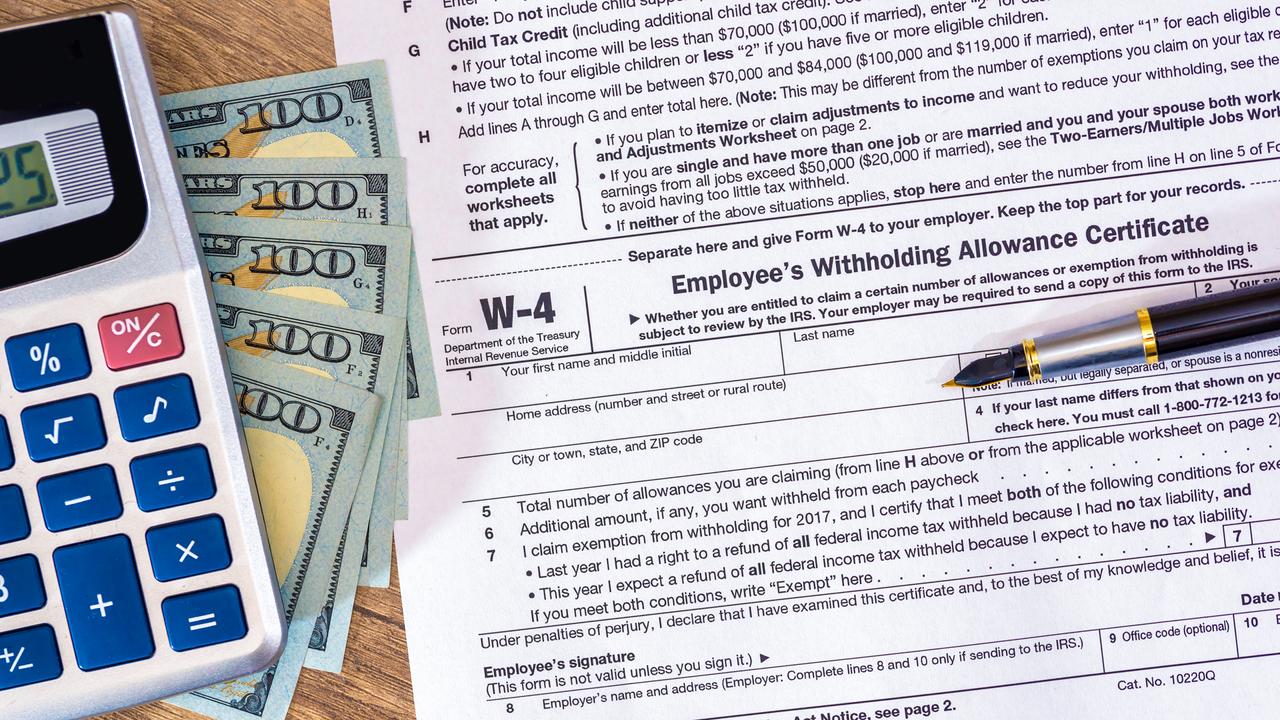

Paycheck & Tax Withholding Calculator for W-4: Tax Planning - e-File Then, look at your last paycheck's tax withholding amount, e.g. $250, and subtract the refund adjust amount from that: $250 minus $200 = $50. That result is the tax withholding amount you should aim for when you use this tool, in this example, $50. The W-4 requires information to be entered by the wage earner in order to tell their employer how ...

Free Paycheck Calculator: Hourly & Salary - SmartAsset Use SmartAsset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. ... When you fill out your W-4, there are worksheets that will walk you through withholdings based on your marital status, the number of children you have, the number of ...

INCOME CALCULATION WORKSHEET - bostonplans.org Earnings ÷ Number of pay periods YTD = Average earnings per pay period x Period (Number of per year) = Estimated Annual Income ÷ = x =$ ÷ = x =$ ÷ = x =$ ÷ = x =$ Total $ LINE 2 Asset Calculation Type of Account Bank Name & Account # Current Balance x 1% = Total Imputed Assets

Paycheck Calculator - Take Home Pay Calculator - Vertex42.com Use our Free Paycheck Calculator spreadsheet to estimate the effect of deductions, withholdings, federal tax, and allowances on your net take-home pay. Unlike most online paycheck calculators, using our spreadsheet will allow you to save your results, see how the calculations are done, and even customize it.

PDF Calculating the numbers in your paycheck II TUDENT WORKSHEET 1 of 2 Calculating the numbers in your paycheck Name: Date: Class: BUILDING BLOCKS STUDENT WORKSHEET. Calculating the numbers in your paycheck Knowing how to read the pay stub from your paycheck can help you manage your money. The taxes and deductions on your pay stub may not always be easy to understand.

Calculating Your Gross Monthly Income Worksheet - NeighborWorks Calculating Your Gross Monthly Income Worksheet Calculating Your Gross Monthly Income Worksheet If you are paid hourly $ _________ x _________ x 52 weeks ÷ 12 months = $ ____________ (pay before (# of hours you (gross monthly deductions) work in 1 week) income) If you are paid weekly

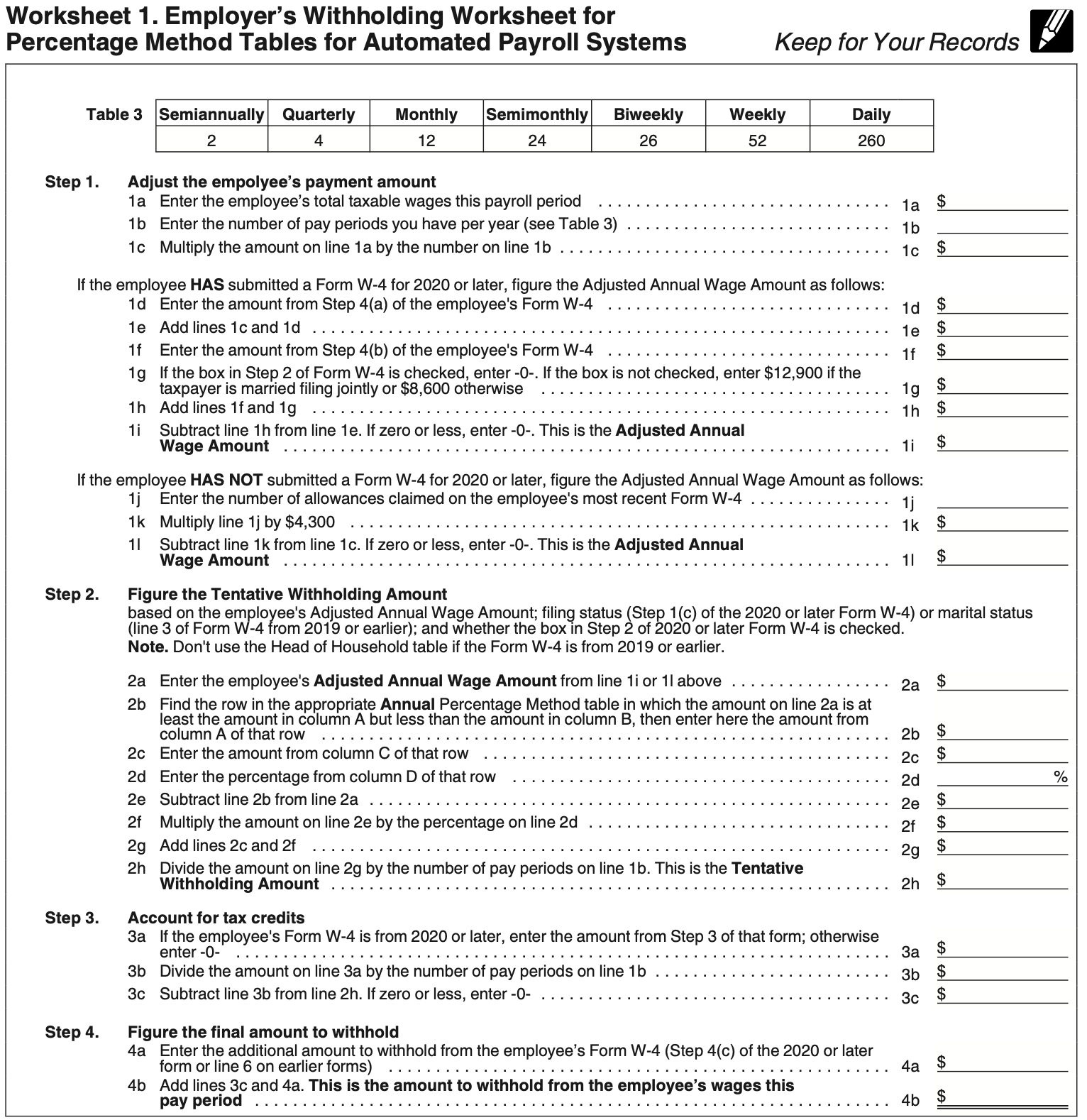

How to Calculate Deductions & Adjustments on a W-4 Worksheet The fourth step of this process involves finalizing your W-4 worksheet results, which means that the totals listed on your worksheet should be added to the appropriate W-4 section. The final deduction amount that you wrote down on line five of the deductions worksheet should be added to Step 4(b) on IRS Form W-4.

Net Worth Calculator: What is My Net Worth? | RamseySolutions.com Start with what you own: cash, retirement accounts, investment accounts, cars, real estate and anything else that you could sell for cash.Then subtract what you owe: credit card debt, student loans, mortgages, auto loans and anything else you owe money on.

Calculating Your Withholding | Integrated Service Center Jan 01, 2021 · How to Calculate Your Social Security/Medicare Withholding. The following guidance pertains to wages paid on and after January 1, 2022. To calculate the amount of Social Security and/or Medicare withheld from your paycheck, calculate your Taxable Gross: Gross Pay minus any Pre-Tax Reductions for Social Security/Medicare.* Then, determine your ...

How to Calculate Severance Pay · PaycheckCity If you have been at the company for 10 years, your severance pay would be $40,000 ($4,000 X 10 years). Remember severance pay is not always given; it is dependent on the scenario with your employer. If you are looking for an easy way to estimate severance paycheck out this worksheet: Severance Pay Estimation Worksheet.

Understanding and Calculating Year to Date (YTD) in Payroll Feb 15, 2022 · Apart from balancing the accounting books, these numbers play a significant role in calculating and filing quarterly and yearly tax liabilities. Typically, the quarterly filing includes IRS form 941, and other state withholding and unemployment insurance filings. For example, YTD values are used to calculate the Lines 2, 3, and 5a to 5d on Form ...

Free Paycheck & Payroll Calculator: Hourly & Salary | QuickBooks If the employee is hourly, input their hourly wage under "pay rate," and fill in the number of hours they worked that pay period. If the employee worked more than 40 hours, and thus accrued overtime, record 40 here and save the rest for "additional pay." If the employee is salaried, both the "pay rate" and "hours worked" fields will disappear.

Payroll Deductions Calculator - Bankrate Use this calculator to help you determine the impact of changing your payroll deductions. You can enter your current payroll information and deductions, and then compare them to your proposed...

Tax Withholding Estimator | Internal Revenue Service Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. This is tax withholding. See how your withholding affects your refund, take-home pay or tax due. How It Works Use this tool to: Estimate your federal income tax withholding

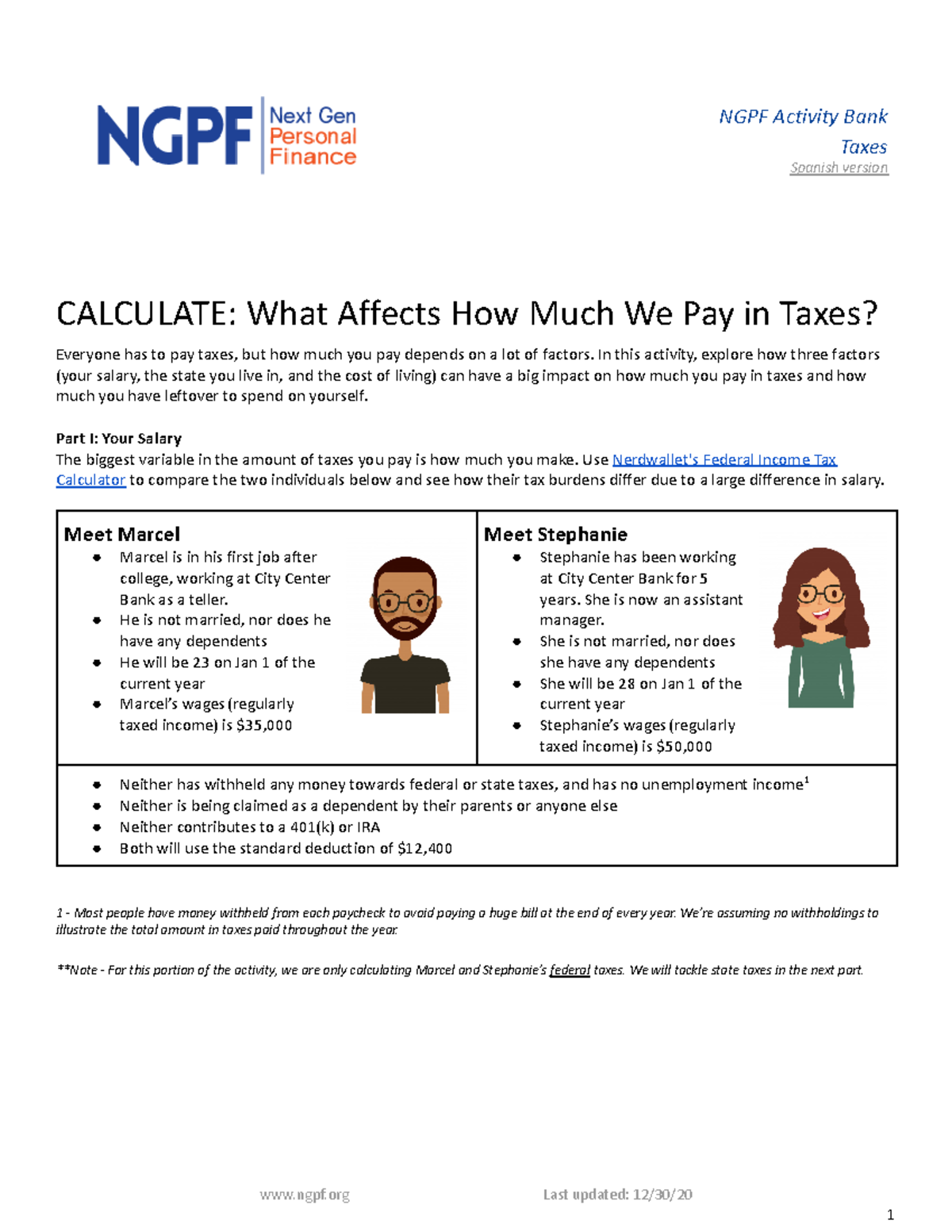

Calculating the numbers in your paycheck | Consumer Financial ... Calculating the numbers in your paycheck Updated Aug 25, 2022 Students review a pay stub from a sample paycheck to understand the real-world effect of taxes and deductions on the amount of money they receive. Big idea The amount of money you earn from your job is different from the amount of money you receive in your paycheck. Essential questions

Newest 2021 MA Child Support Calculator | Amherst Divorce After you have calculated your results and downloaded a court-ready .pdf, you should check your final calculations against the state court’s calculating .pdf at: MA fillable .pdf 2021 child support calculator. You may find the state court form very difficult to fill out unless you you use my website first.

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

0 Response to "38 calculating your paycheck worksheet"

Post a Comment