45 1040 qualified dividends and capital gains worksheet

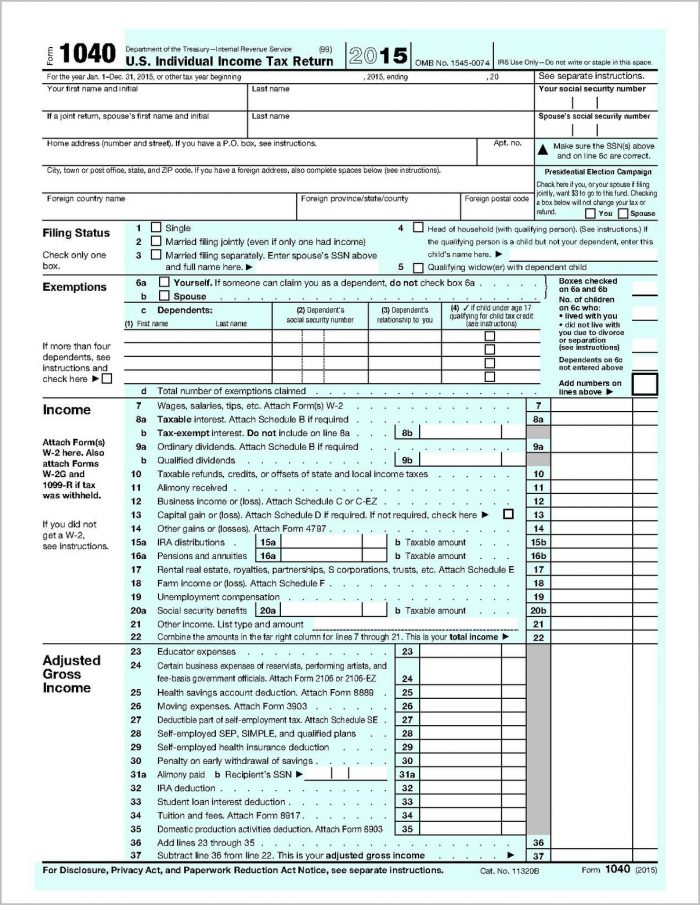

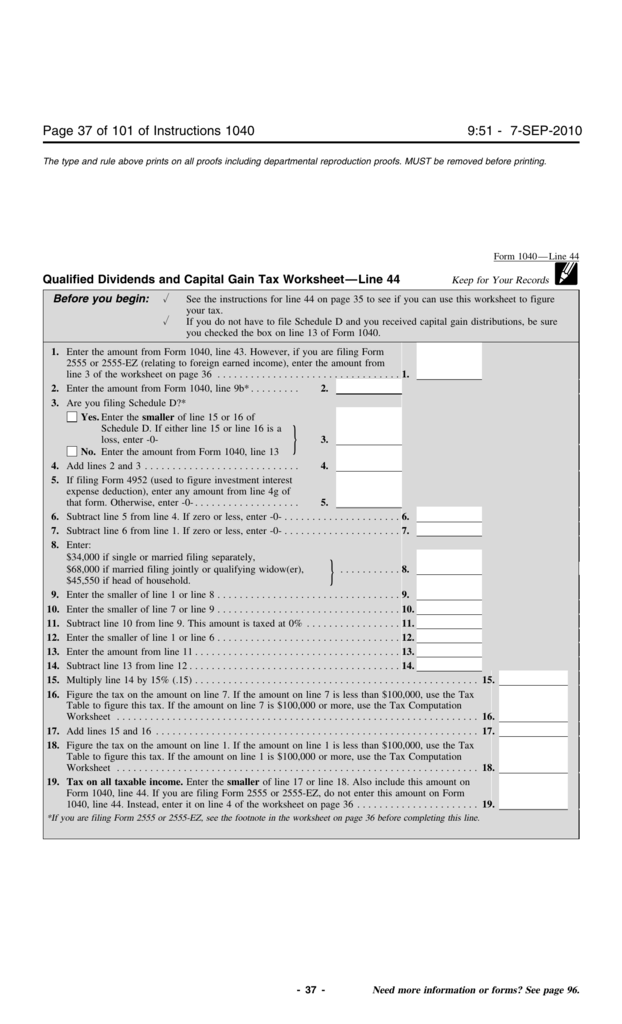

PDF and Losses Capital Gains - IRS tax forms ly on Form 1040-NR, line 7); and •To report a capital loss carryover from 2020 to 2021. Additional information. See Pub. 544 and Pub. 550 for more details. ... Unrecaptured Section 1250 Gain Worksheet. Exclusion of Gain on Qualified Small Business \(QSB\) Stock. Exclusion of Gain on Qualified Small Business \(QSB\) Stock. PDF Qualified Dividends and Capital Gain Tax Worksheet -Line 44 (Form 1040 ... See the instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43. If you do not have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Form 1040. Enter the amount from Form 1040, line 43 (Form ...

Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 - Fill ... Complete Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 in a few minutes following the guidelines listed below: Find the document template you need from our collection of legal form samples. Select the Get form key to open it and start editing. Fill in all of the requested fields (they are marked in yellow).

1040 qualified dividends and capital gains worksheet

› tax-form › 10402021 1040 Form and Instructions (Long Form) - Income Tax Pro Jan 01, 2021 · Standard Deduction Worksheet for Dependents (Line 12a) Student Loan Interest Deduction Worksheet; Form 1040 is generally published in December of each year by the IRS. Form 1040 Instructions are often published later in January to include any last minute legislative changes. When published, the current year 2021 1040 PDF file will download. Qualified Dividends and Capital Gains Worksheet - StuDocu Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box on Form 1040 or 1040-SR, line 6. Before you begin: 1. Enter the amount from Form 1040 or 1040-SR, line 11b. Qualified Dividends and Capital Gains Worksheet-Completed Qualified Dividends and Capital Gains Worksheet-Completed Qualified Dividends and Capital Gains Worksheet-Completed University Southern New Hampshire University Course Federal Taxation I (ACC330) Uploaded by Nickia Marie Academic year 2021/2022 Helpful? Please or to post comments. Students also viewed 6-2 Final Project Two-1040 Document

1040 qualified dividends and capital gains worksheet. Solved: The Qualified Dividends and Capital Gains Tax worksheet ... The Qualified Dividends and Capital Gains Tax worksheet correctly calculates the 15% tax on these amounts but I cannot see how it is ever reflected on my 1040 return. Please show how the results from the Qualified Dividends and Capital Gain Tax worksheet are applied to the 1040 Forms. Solved Instructions Form 1040 Schedule 1 Schedule 5 Schedule | Chegg.com instructions form 1040 schedule 1 schedule 5 schedule b qualified dividends and capital gain tax worksheet form 1040 x 7,000 6 173,182 4,453.50 + 22% 38,700 7 173,182 → 14,089.50 + 24% 2018 tax rate schedules 38,700 82,500 82,500 157,500 157,500 200,000 200,000 500,000 500,000 82,500 157,500 32,089.50 + 32% 9 8 24,000 45,689.50 + 35% 200,000 9 … Fillable Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 Fill Online, Printable, Fillable, Blank Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 Form Use Fill to complete blank online IRS pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 And Tax Gain Qualified Worksheet Form Dividends Capital Ordinary (non-qualified) dividends are taxed at your normal tax rate, along with your other income 02)Source Code for Function that implements the "Qualified Dividends andCapital Gain Tax Worksheet" Deductions Allowed for Contributions to a Traditional IRA If you do not have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Form 1040 ...

How do I display the Tax Computation Worksheet? - Intuit In your case, if all you had were qualified dividends and/or capital gain, then box A.4 would be checked (as it is above), and then you would go to the Qualified Dividends and Capital Gains Worksheet to see the calculation - this worksheet is abbreviated on the left as "Qual Div/Cap Gn". See here: Qualified Dividends And Capital Gains Worksheet [PDF] - 50.iucnredlist 6a. Ordinary dividends Form 1040 or 1040-SR, line 3b 6b. Qualified dividends Form 1040 or 1040-SR, line 3a 6c. Dividend equivalents See page 9 7. Royalties Schedule E (Form 1040), line 4 8. Net short-term capital gain (loss) Schedule D (Form 1040), line 5 9a. Net long-term capital gain (loss) Schedule D (Form 1040), line 12 9b. Collectibles (28 ... PDF SCHEDULE D Capital Gains and Losses - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Forms 1040 and 1040-SR, line 16. ... Do you have qualified dividends on Form 1040, 1040-SR, or 1040-NR, line 3a? Yes. Complete the : Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Forms 1040 and 1040-SR, line 16. No. Complete the rest of ... Worksheet Gain Capital Dividends Form And Tax Qualified Under federal income tax law, the mutual fund dividends may be classified as "capital gains" if the mutual fund earned the income from the sale of investments Qualified Dividends and Capital Gain Tax Worksheet (2019) •Form 1040 instructions for line 12a to see if the taxpayer can use this worksheet to compute the taxpayer's tax 225 specifies only capital gains are to be considered Long ...

How to Download Qualified Dividends and Capital Gain Tax Worksheet ... Qualified Dividends and Capital Gain Tax Worksheet The worksheet is part of Form 1040 which is mandatory for every individual tax filer as well as joint filers. The worksheet has 27 lines, and all fields must be filled according to relevant information. Tax filers with qualified dividends and capital gains have to fill the relevant worksheet. How do I download my Qualified Dividends and Capital Gain Tax Worksheet ... Use the Qualified Dividends and Capital Gain Tax Worksheet to figure your tax if you do not have to use the Schedule D Tax Worksheet and if any of the following applies. You reported qualified dividends on Form 1040 or 1040-SR, line 3a. You do not have to file Schedule D and you reported capital gain distributions on Form 1040 or 1040-SR, line 7. smartasset.com › taxes › dividend-tax-rateThe Dividend Tax Rate for 2021 and 2022 - SmartAsset Jan 07, 2022 · So let’s say you’re single and have $150,000 of annual income, with $10,000 of that being dividends. Your dividends would then be taxed at 15%, while the rest of your income would follow the federal income tax rates. The tax rates for non-qualified dividends are the same as federal ordinary income tax rates. For 2021, these rates remain ... Get Qualified Dividends And Capital Gain Tax Worksheet 2019 Now, working with a Qualified Dividends And Capital Gain Tax Worksheet 2019 takes a maximum of 5 minutes. Our state web-based blanks and clear guidelines eliminate human-prone errors. Follow our easy steps to have your Qualified Dividends And Capital Gain Tax Worksheet 2019 prepared rapidly: Pick the web sample from the catalogue.

How to Figure the Qualified Dividends on a Tax Return Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax amount.

Where Is The Qualified Dividends And Capital Gain Tax Worksheet ... Locate ordinary dividends in Box 1a, qualified dividends in Box 1b and total capital gain distributions in Box 2a. Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax amount.

› pub › irs-newsQualified Dividends and Capital Gain Tax Worksheet: An ... for several years, the irs has provided a tax computation worksheet in the form 1040 and 1040a instructions for certain investors to get the benefit of the lower capital gains rates without the need to complete schedule d. taxpayers who had gains or losses from the sale, exchange, or conversion of investments or certain other items must use …

Qualified Dividends & Capital Gain_ ax Worksheet.pdf • Before completing this worksheet, complete Form 1040 through line 11b. • If the taxpayer does not have to file Schedule D (Form 1040) and received capital gain distributions, be sure the box on line 6, Form 1040, is checked. 1)Enter the amount from Form 1040, line 11b.

And Capital Qualified Gain Worksheet Form Tax Dividends • Before completing this worksheet, complete Form 1040 through line 43 " Sever land line 12000, Taxable amount of dividends (eligible and other than eligible) from taxable Canadian corporations If your gains are from a partnership, they are recognized either at the time of the gain or at the end of the partnership tax year Long-term capital gains tax rates are 0%, 15% or 20% depending on ...

I need to see the calculation for Qualif. Div. and Cap Gain Tax ... Div. and Cap Gain Tax Worksheet LINE 24. Working onForm 1040 Line 44 "Qualified Dividends and Capital Gains Worksheet". I'm on Line 24 and it says to "use the Tax Computation Worksheet" (if line 7 is over $100k, which mine is). Turbo Tax has made a calculation and I REALLY MUST REVIEW THE CALCULATION but I can't find it within TurboTax.

Qualified Dividend and Capital Gains Tax Worksheet? - YouTube The tax rate computed on your Form 1040 must consider any tax-favored items, such as qualified dividends and long-term capital gains, which are generally sub...

How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates. Qualified Income is the sum of qualified dividends (line 2) and long-term capital gains (line 3). Ordinary Income is everything else or Taxable Income minus Qualified Income.

0 Response to "45 1040 qualified dividends and capital gains worksheet"

Post a Comment