43 schedule d tax worksheet 2014

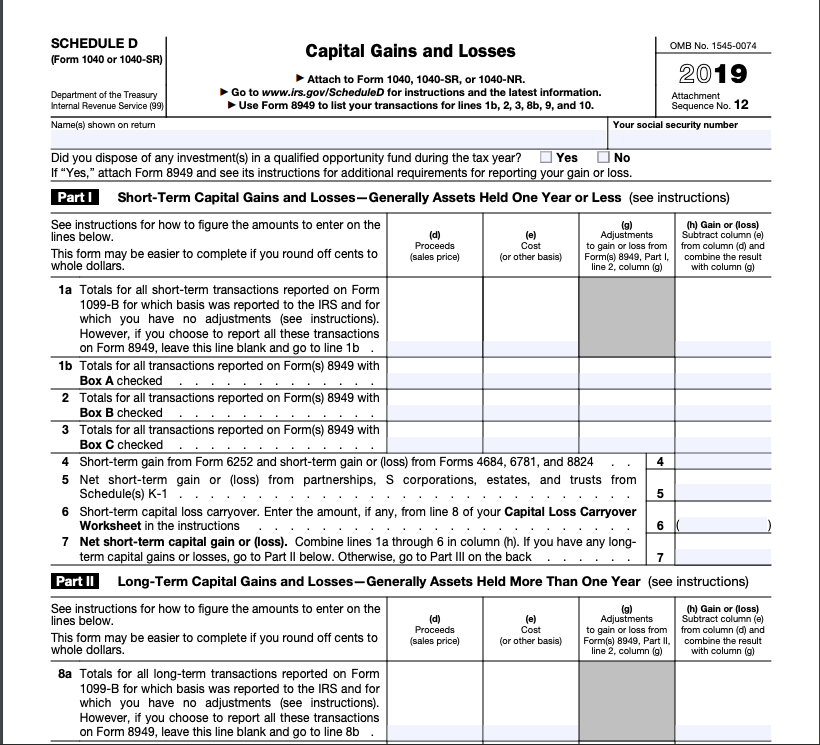

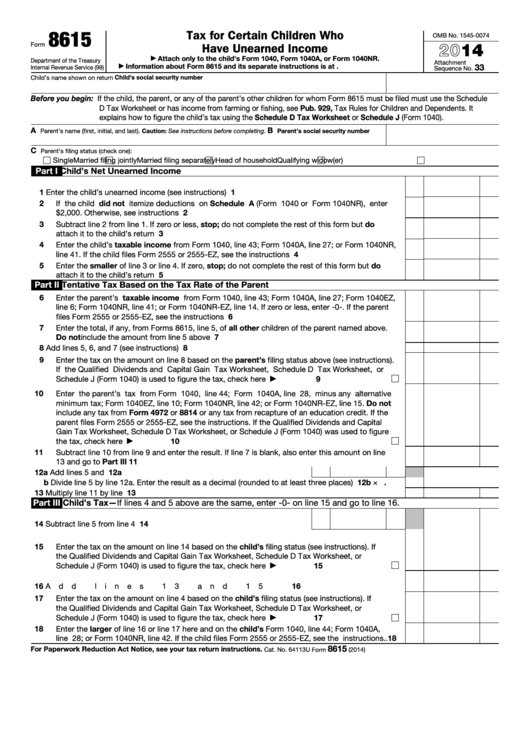

FREE 2014 Printable Tax Forms | Income Tax Pro Schedule D instructions - Capital Gains and Losses Schedule E instructions - Supplemental Income and Loss 4972 - Tax on Lump-Sum Distributions 4952 - Investment Interest Expense Deduction 5329 instructions - Additional Taxes on Qualified Plans 6251 instructions - Alternative Minimum Tax 8582 instructions - Passive Activity Loss Limitations Schedule D - Fill Out and Sign Printable PDF Template | signNow Follow the step-by-step instructions below to eSign your schedule d instructions: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of eSignature to create. There are three variants; a typed, drawn or uploaded signature. Create your eSignature and click Ok. Press Done.

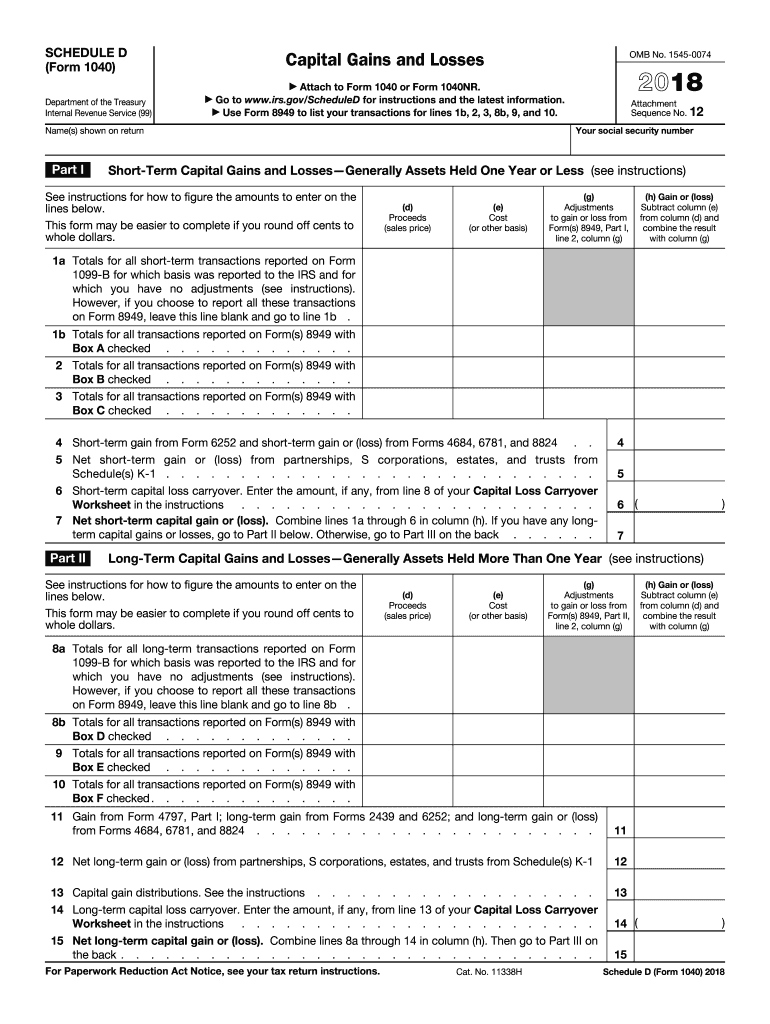

When Would I Have to Fill Out a Schedule D IRS Form? The calculations from Schedule D are combined with individual tax return form 1040, where it will affect the adjusted gross income amount. Capital losses that exceed the current year's gains may ...

Schedule d tax worksheet 2014

How to Complete a Schedule D Form (with Pictures) - wikiHow Completing Schedule D Download Article 1 Write your totals from Form 8949 on Schedule D. On Schedule D, you will have to fill out a section for short term and long term gains and losses. Here, you'll be transferring the total gain/loss for each asset you determined when filling out Form 8949. PDF 2014 Net Profit Tax Worksheets - City of Philadelphia Enter the portion of taxable income on which 2014 Business Income & Receipts Tax has been paid, AND which represents the distributive shares of net income of ALL CORPORATE MEMBERS............. 2. Enter the total taxable income of the taxpayer on which 2014 BIRT has been paid............................... 3. PDF and Losses Capital Gains - IRS tax forms plete line 19 of Schedule D. If there is an amount in box 2c, see Exclusion of Gain on Qualified Small Business (QSB) Stock, later. If there is an amount in box 2d, in-clude that amount on line 4 of the 28% Rate Gain Worksheet in these instruc-tions if you complete line 18 of Sched-ule D. If you received capital gain distribu-

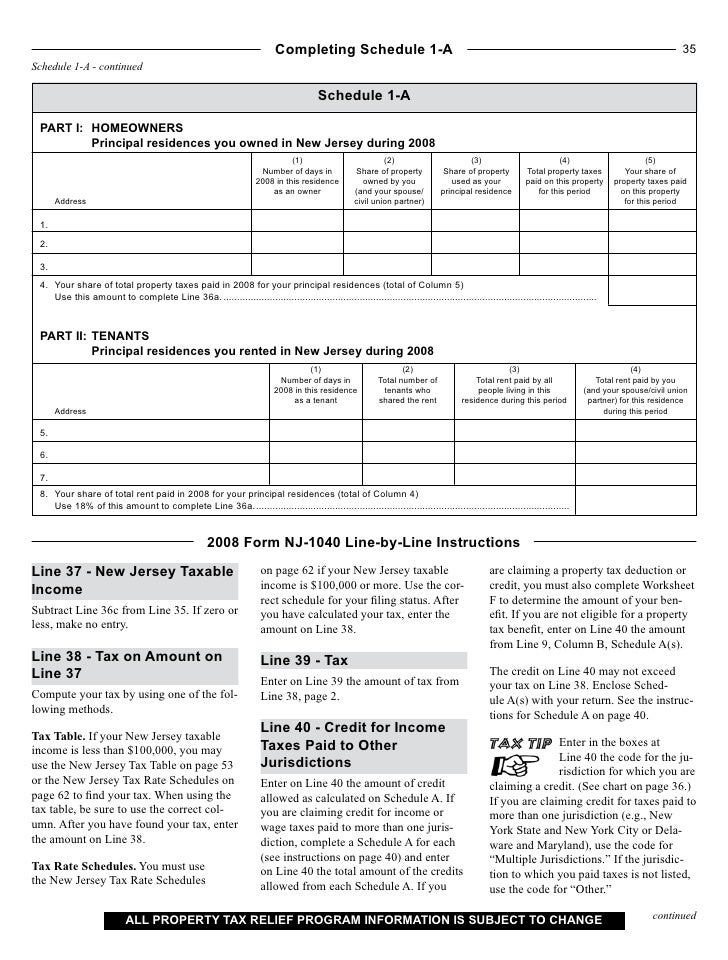

Schedule d tax worksheet 2014. PDF 2014 Instruction 1040 - TAX TABLE - IRS tax forms Cat. No. 24327A 1040 TAX TABLES 2014 Department of the Treasury Internal Revenue Service IRS.gov This booklet contains Tax Tables from the Instructions for Form 1040 only. Changes to the 1040 Schedule D Will Make the 2014 Filing Season a Bit ... Tax preparers should also be aware of two additional changes impacting Schedule D and Form 8949 filing: (For estates and trusts) Many transactions that, in previous years, would have been reported by estates and trusts on Schedule D or Schedule D-1 must now be reported on Form 8949 if they have to be reported on a 2013 form. Schedule D Tax Worksheet - Intuit JamesG1. Expert Alumni. March 22, 2020 5:00 PM. Line 44 of the Schedule D Tax Worksheet (page D-17) is computed using the 2019 Tax Computation Worksheet. The 2019 Tax Computation Worksheet can be found on page 253 of IRS publication 17. **Say "Thanks" by clicking the thumb icon in a post. **Mark the post that answers your question by clicking ... 2014 Personal Income Tax Forms - Pennsylvania Department of Revenue PA-40 D -- 2014 PA Schedule D - Sale, Exchange or Disposition of Property PA-40 E -- 2014 PA Schedule E - Rents and Royalty Income (Loss) PA-40 ESR (F/C) -- Declaration of Estimated Tax or Estimated Withholding Tax For Fiduciaries & Partnerships PA-40 ESR (I) -- Declaration of Estimated Tax PA-40 F -- PA Schedule F - Farm Income and Expenses

Corporate Income Tax Forms - 2014 | Maine Revenue Services Corporate Income Tax Forms - 2014 Corporate Income Tax Return. FORM NUMBER FORM TITLE INSTRUCTIONS; 1120ME (PDF) Corporate Income Tax Form (Form 1120ME, Schedule A, Schedule C, Schedule D, Schedule X) 1120ME Instructions (PDF) ... Minimum Tax Worksheet for Schedule B: Included: Schedule NOL (PDF) For Calculating the Net Operating Loss (NOL ... 2014 Massachusetts Personal Income Tax Forms and Instructions Form 1: Massachusetts Resident Income Tax Return. 2014 Form PV - Payment Voucher (PDF 60.54 KB) 2014 Schedule CB - Circuit Breaker Credit (PDF 316.08 KB) 2014 Schedule HC: Health Care Information (PDF 962.5 KB) 2014 Schedule E-2 - Partnership and S Corporation Income and (Loss) (PDF 68.48 KB) Prior Year Products - IRS tax forms Product Number. Title. Revision Date. Form 1040 (Schedule D) Capital Gains and Losses. 2021. Inst 1040 (Schedule D) Instructions for Schedule D (Form 1040 or Form 1040-SR), Capital Gains and Losses. 2021. How to Fill Out a Schedule D Tax Worksheet | Finance - Zacks Schedule D contains different worksheets that you may need to complete, including the Capital Loss Carryover Worksheet, 28% Rate Gain Worksheet and Unrecaptured Section 1250 Gain Worksheet. Each of...

Schedule D - Viewing Tax Worksheet - taxact.com Sign in to your TaxACT Online return Click Forms on the right side of the screen Click View complete Forms list below Forms Expand the Federal folder and then expand the Worksheets folder Scroll down and click Schedule D Tax Worksheet - Tax Worksheet - Line 20 Federal 1041 (Schedule D) (Capital Gains and Losses) - TaxFormFinder Sole proprietorships or disregarded entities like LLCs are filed on Schedule C (or the state equivalent) of the owner's personal income tax return, flow-through entities like S Corporations or Partnerships are generally required to file an informational return equivilent to the IRS Form 1120S or Form 1065, and full corporations must file the ... Get IRS 1040 - Schedule D 2019 - US Legal Forms Fill in the details required in IRS 1040 - Schedule D, making use of fillable lines. Insert pictures, crosses, check and text boxes, if it is supposed. Repeating info will be added automatically after the first input. If you have any difficulties, use the Wizard Tool. You will see useful tips for simpler finalization. PDF Capital Gain Tax Worksheet (PDF) - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. ... Schedule D. If either line 15 or 16 is blank or a loss, enter -0-. 3. No. Enter the amount from Schedule 1, line 13. 4. Add lines 2 and 3 .....

PDF Form 1099-A, Form 8949, and Schedule D - IRS tax forms SCHEDULE D (Form 1040) Department of the Treasury Internal Revenue Service (99) Capital Gains and Losses Attach to Form 1040 or Form 1040NR. Information about Schedule D and its separate instructions is at . Use Form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9, and 10. OMB No. 1545-0074 2014

2014 Business Income & Receipts Tax (BIRT) forms | Department of ... Instructions for filing the 2014 Business Income and Receipts Tax and Net Profits Tax. Use this form to file 2014 Business Income & Receipts Tax (BIRT). This form includes Schedules B, C-1, D, A, and E. Use this form to file 2014 Business Income & Receipts Tax (BIRT) if 100% of your business was conducted in Philadelphia.

Use Excel to File Your 2014 Form 1040 and Related Schedules The 2014 version of the spreadsheet includes both pages of Form 1040, as well as these supplemental schedules: Schedule A: Itemized Deductions. Schedule B: Interest and Ordinary Dividends. Schedule C: Profit or Loss from Business. Schedule D: Capital Gains and Losses (along with its worksheet) Schedule E: Supplemental Income and Loss.

2014 Tax Brackets - Tax Foundation In 2014, the income limits for all brackets and all filers will be adjusted for inflation and will be as follows (Table 1). [1] The top marginal income tax rate of 39.6 percent will hit taxpayers with an adjusted gross income of $406,751 and higher for single filers and $457,601 and higher for married filers.

2021 Instructions for Schedule D (2021) - IRS tax forms Use Form 8960 to figure any net investment income tax relating to gains and losses reported on Schedule D, including gains and losses from a securities trading activity. Use Form 8997 to report each QOF investment you held at the beginning and end of the tax year and the deferred gains associated with each investment.

PDF TAXABLE YEAR SCHEDULE 2014 California Capital Gain or Loss Adjustment D ... TAXABLE YEAR SCHEDULE 2014 California Capital Gain or Loss Adjustment D (540NR) 1 77711444 14 (a) Description of property Identify S corporation stock Example: 100 shares of "Z" (S stock) (b) Sales price (c) Cost or other basis (d) Loss If (c) is more than (b), subtract (b) from (c) (e) Gain If (b) is more than (c), subtract (c) from (b)

5000-D1 T1 General 2014 - Federal Worksheet - canada.ca This federal worksheet is used by individuals to make calculations according to the line instructions contained in the T1 General Income Tax and Benefit Guide. ... ARCHIVED - General income tax and benefit package for 2014; ARCHIVED - 5000-D1 T1 General 2014 - Federal Worksheet - Common to all EXCEPT for QC and non-residents ...

PDF Capital Gains and Losses - IRS tax forms Schedule D Tax Worksheet: in the instructions. Do not: complete lines 21 and 22 below. 21 : If line 16 is a loss, enter here and on Form 1040, line 13, or Form 1040NR, line 14, the : smaller : of: ... 2014 Form 1040 (Schedule D) Author: SE:W:CAR:MP Subject: Capital Gains and Losses

PDF Attach to Form 1041, Form 5227, or Form 990-T. Use Form 8949 to list ... SCHEDULE D (Form 1041) Department of the Treasury Internal Revenue Service Capital Gains and Losses Attach to Form 1041, Form 5227, or Form 990-T. Use Form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9 and 10. Information about Schedule D and its separate instructions is at OMB No. 1545-0092 2014

Schedule D - Viewing Tax Worksheet - taxact.com Click the Print link at the top right side of the screen Click Print Individual Forms Expand the Federal Forms folder and then expand the Worksheets folder Scroll down and click Schedule D Tax Worksheet - Tax Worksheet - Line 20 Click Print and then click the worksheet name and the worksheet will appear in a PDF read-only format.

PDF and Losses Capital Gains - IRS tax forms plete line 19 of Schedule D. If there is an amount in box 2c, see Exclusion of Gain on Qualified Small Business (QSB) Stock, later. If there is an amount in box 2d, in-clude that amount on line 4 of the 28% Rate Gain Worksheet in these instruc-tions if you complete line 18 of Sched-ule D. If you received capital gain distribu-

PDF 2014 Net Profit Tax Worksheets - City of Philadelphia Enter the portion of taxable income on which 2014 Business Income & Receipts Tax has been paid, AND which represents the distributive shares of net income of ALL CORPORATE MEMBERS............. 2. Enter the total taxable income of the taxpayer on which 2014 BIRT has been paid............................... 3.

How to Complete a Schedule D Form (with Pictures) - wikiHow Completing Schedule D Download Article 1 Write your totals from Form 8949 on Schedule D. On Schedule D, you will have to fill out a section for short term and long term gains and losses. Here, you'll be transferring the total gain/loss for each asset you determined when filling out Form 8949.

0 Response to "43 schedule d tax worksheet 2014"

Post a Comment