41 mortgage loan comparison worksheet

templatelab.com › amortization-schedule28 Tables to Calculate Loan Amortization Schedule (Excel) For example, if you have taken a loan of $500,000, your loan schedule on excel will show a zero interest rate, reducing the loan period and saving the rest of your money. There is no doubt that value of scheduling the extra payments depends upon the amount of frequency. › mortgage-ratesCurrent Mortgage Rates: Average US Daily Interest Rate Trends ... Mortgage rates vary depending upon the down payment of the consumer, their credit score, and the type of loan that will be acquired by the consumer. For instance, in February, 2010, the national average mortgage rate for a 30 year fixed rate loan was at 4.750 percent (5.016 APR).

Mortgage Loan Comparison Worksheet - United Credit Union Below is a worksheet you can use to start to do some economic analysis to compare mortgages. The first seven lines set the basis for the analysis and the remaining lines track the balance of the mortgage from the initial loan balance until the loan is paid off, a process known as amortization. Note: Payments 4 through 359 are not shown.

Mortgage loan comparison worksheet

The Ultimate Refinancing Spreadsheet Calculator - Keep Thrifty On the Comparison sheet, enter in your current mortgage information in the white boxes in column C. This includes what payment you can comfortably afford each month. Do not include any escrow amount - just put the amount going toward principal and interest Enter the proposed mortgage terms in column D. Home loan comparison - templates.office.com Home loan comparison Weigh the pros and cons of various mortgages with this accessible loan comparison template. Excel Download Open in browser Share Find inspiration for your next project with thousands of ideas to choose from PDF , or both. You should ask all the costs involved in the loan. Knowing just the amount of the monthly payment or the interest rate is not enough. Ask for information about the same loan amount, loan term, and type of loan so that you can compare the information. The following informa-tion is important to get from each lender and broker: Rates • Ask each lender and ...

Mortgage loan comparison worksheet. › learn › tangible-net-benefitsWhat Is A Tangible Net Benefit? | Rocket Mortgage Jan 27, 2022 · 1 Based on Rocket Mortgage data in comparison to public data records. Rocket Mortgage, 1050 Woodward Ave., Detroit, MI 48226-1906 NMLS #3030. Calculator for Mortgage Payment, Excel Worksheet ... - HomeFair.com Below is a worksheet you can use to start to do some economic analysis to compare mortgages. The first seven lines set the basis for the analysis and the remaining lines track the balance of the mortgage from the initial loan balance until the loan is paid off, a process known as amortization. Note: Payments 4 through 359 are not shown. The Ultimate Loan Scenario Comparison Tool - TechSoft Click the link below to get to the worksheet: Buying, compare two loans. Refinance. Buy vs. Rent. Pay cash vs. Borrow. 30 year vs. 15 year (or other durations) Pay points or not. Buy property or invest in non-property. Which of two properties to purchase. What Is A Tangible Net Benefit? | Rocket Mortgage 27.1.2022 · When you refinance your mortgage loan, you’re taking on a completely new loan, so many states and even the federal government require there to be a defined benefit for you in many cases. In one form or another, there must be a tangible net benefit to any refinance you undertake if you’re a resident of states with these types of homeowner protection laws.

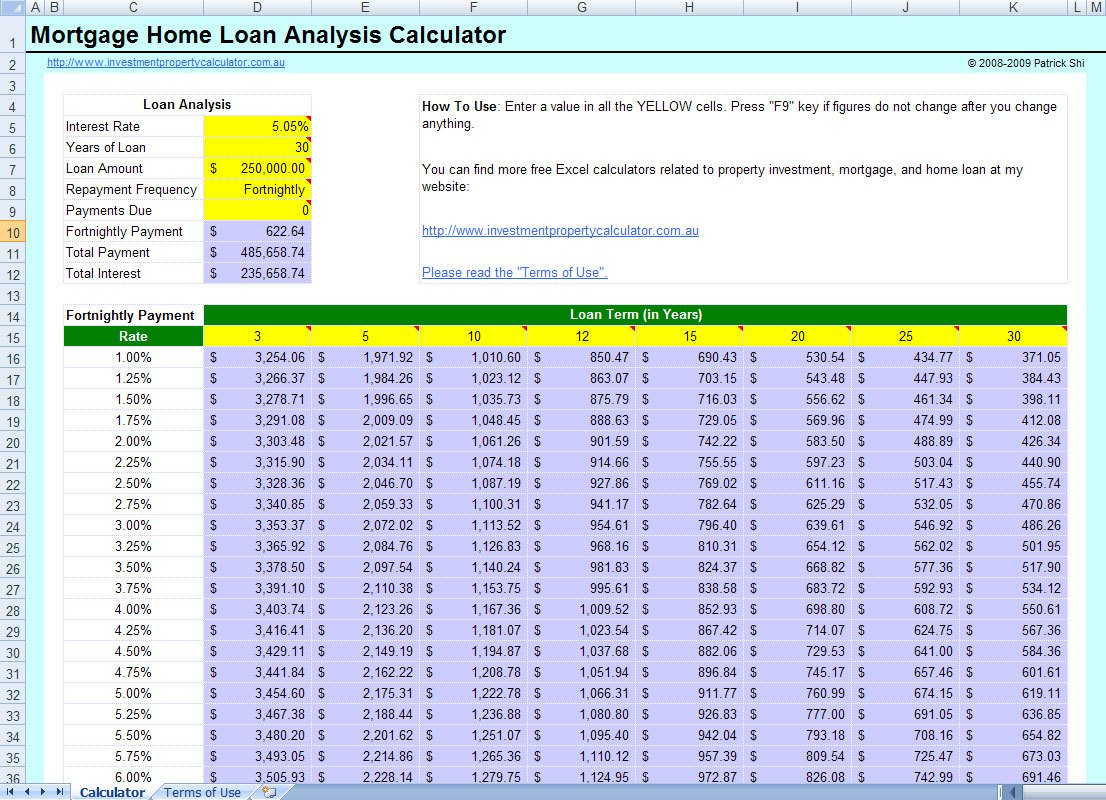

PDF Mortgage Comparison Worksheet - Freddie Mac Mortgage Comparison Worksheet As you are working with lenders to select a mortgage, there are several factors to consider that may make a big difference in your monthly payments and the overall cost of your loan. Use this worksheet to help you identify the mortgage option that is best for your situation and financial goals. Lender 1 Lender 2 reverse.mortgage › counselingTop 10 Reverse Mortgage Counseling Agencies (Free & Online ... Mar 15, 2022 · Request your pre-counseling document set (Includes loan comparison, closing cost worksheet, amortization schedule, TALC – total annual loan costs) Have these mandatory documents available: HUD document titled “ Preparing for your counseling session ” (PDF file, 4 Pages) and the National Council on Aging (NCOA) booklet “ Use Your Home to ... How To Compare Two Mortgage Offers - MortgageInfoGuide.com To find the best mortgage lender, compare as many offers as youre comfortable devoting time to. Closely compare the loan estimates side by side. Take a mental magnifying glass to all costs listed, and consider them and your budget before choosing which lender to work with. Youll do plenty of leg work to find the best deal, so once youve chosen ... Mortgage Comparison Sheet - My Excel Templates Using the Mortgage Comparison Sheet Once you have the template downloaded and ready to go, simply enter the initial loan amount in the first cell of the template and start in the "Scenario 1" column. You will enter the loan period in years, the payment frequency, and the annual interest rate.

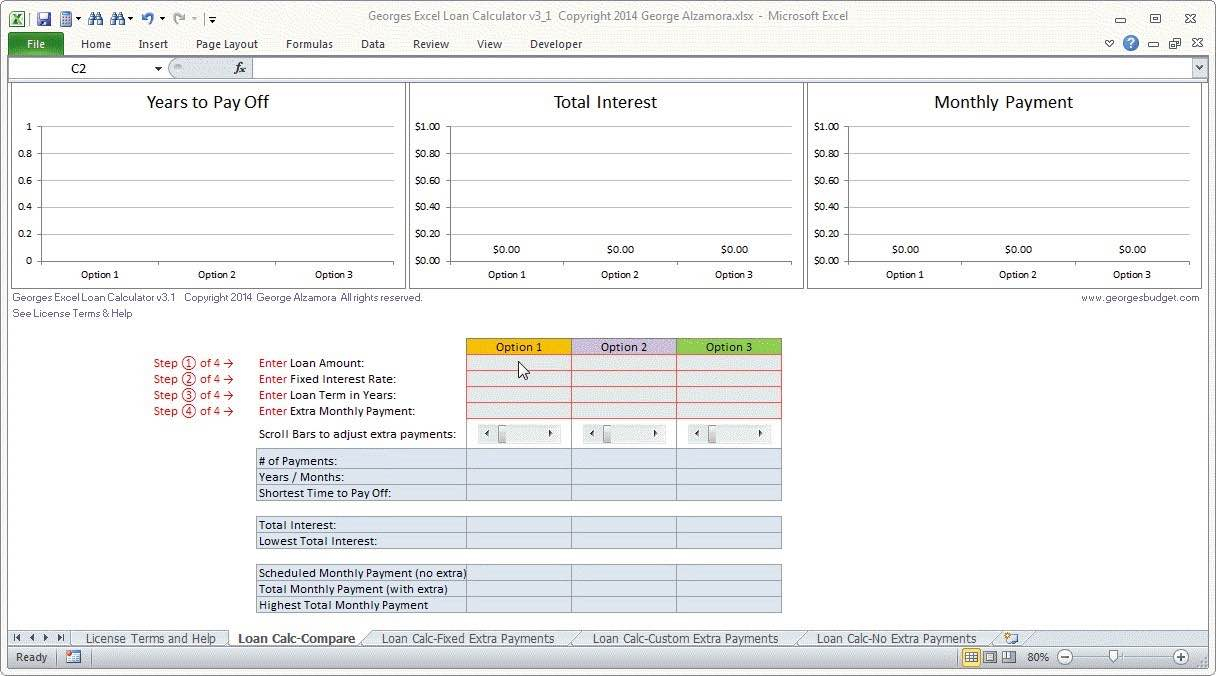

PDF Loan Comparison Worksheet Loan Type (check one) FHA Conventional Rate: % Fixed Loan Purpose (check one) Purchase Refinance APR: % ARM Loan Term: P&I Pymt: Prepayment Penalty Yes No Balloon Payment Yes No Document courtesy of Seattle/King County Coalition for Responsible Lending 1-877-RING DFI LOAN COMPARISON WORKSHEET Borrower's Name: Loan Officer: Lender: Loan comparison calculator - templates.office.com Loan comparison calculator This loan comparison calculator template helps you compare multiple loan scenarios to ascertain which one is best for you. The loan comparison calculator contains 3 scenarios that can all be customized as required. Compare mortgage rates and other loans with this accessible template for comparing loans. Excel Download 28 Tables to Calculate Loan Amortization Schedule (Excel) Lenders and borrowers use it for the installment loans to pay off the debts either for the car loan, mortgage or home loan. Terms About Amortization Schedule You Must Know. To properly understand the ... Price Comparison Templates Read More. 16 Apr 2019 Agency Agreements Read More. 31 Jan 2019 Collection Letter Templates Read More. 02 Sep 2017 ... PDF Reverse Mortgage Worksheet Guide independent reverse mortgage loan counselor to discuss whether or not a reverse mortgage is right for you. a list of approved counselors will be provided to you by the lender. senior citizen advocacy groups advise against using the proceeds of a reverse mortgage to purchase an annuity or related financial products. if you are

Free Mortgage Calculators for Excel - Vertex42.com More Free Mortgage Spreadsheets. Home Expense Calculator - This worksheet helps you estimate the overall monthly cost of owning a home, besides just the mortgage interest and principal. Amortization Chart - Explains how to create a chart showing balance vs. interest and principal, with an example spreadsheet.

› learn › loan-modificationLoan Modification Vs. Refinance | Rocket Mortgage Jul 03, 2022 · A loan modification is a change to the original terms of your mortgage loan. Unlike a refinance, a loan modification doesn’t pay off your current mortgage and replace it with a new one. Instead, it directly changes the conditions of your loan. It’s also important to know that modification programs may negatively impact your credit score.

Loan Comparison Worksheet - Vantage Mortgage Brokers Loan Comparison Worksheet - Purchase Vantage Mortgage Group, Inc. DBA Vantage Mortgage Brokers 17040 Pilkington Rd Ste 300 Lake Oswego, OR 97035 Serving Oregon and Washington. 503-496-0431

en.wikipedia.org › wiki › Mortgage-backed_securityMortgage-backed security - Wikipedia A mortgage bond is a bond backed by a pool of mortgages on a real estate asset such as a house. More generally, bonds which are secured by the pledge of specific assets are called mortgage bonds. Mortgage bonds can pay interest in either monthly, quarterly or semiannual periods. The prevalence of mortgage bonds is commonly credited to Mike Vranos.

Current Mortgage Rates: Average US Daily Interest Rate Trends … Mortgage rates vary depending upon the down payment of the consumer, their credit score, and the type of loan that will be acquired by the consumer. For instance, in February, 2010, the national average mortgage rate for a 30 year fixed rate loan was at 4.750 percent (5.016 APR).

Loan Comparison Calculator - Mortgage Calculator Loan Comparison Calculator This calculator will calculate the monthly payment and interest costs for up to 3 loans -- all on one screen -- for comparison purposes. To calculate the payment amount and the total interest of any fixed term loan, simply fill in the 3 left-hand cells of the first row and then click on "Compute."

How to compare loans with different durations in Excel Here is how you can calculate a payment amount for a $140,000 loan with constant payments over 120 months, with a 3.00% annual interest rate. =PMT (0.03/12,120,140000) As shown in the example above, the annual interest rate is divided by 12 to match the actual rate to the period used in the formula (months).

Free Mortgage Payment Calculator Spreadsheet for Excel The Vertex42® Mortgage Payment Calculator is a very simple spreadsheet that lets you compare different mortgages side-by-side. It calculates your monthly payment and lets you include additional extra payment (prepayments) to see how soon you could pay off your home, or how much you could save by paying less interest.

Mortgage Comparison Worksheet - US Legal Forms Execute Mortgage Comparison Worksheet within a few minutes following the guidelines listed below: Choose the template you will need from our collection of legal form samples. Click the Get form button to open it and start editing. Fill out all the necessary fields (these are marked in yellow).

Top 10 Reverse Mortgage Counseling Agencies (Free & Online … 15.3.2022 · Request your pre-counseling document set (Includes loan comparison, closing cost worksheet, amortization schedule, TALC – total annual loan costs) Have these mandatory documents available: HUD document titled “ Preparing for your counseling session ” (PDF file, 4 Pages) and the National Council on Aging (NCOA) booklet “ Use Your Home to Stay Home ” …

Spreadsheets - The Mortgage Professor This spreadsheet allows you to compare your net worth in two situations: one where you liquidate assets to repay your mortgage, the other where you retain the assets and the mortgage. The spreadsheet lets you change the interest rate over time. Value of Assumptions.

Get and Sign Va Loan Comparison Worksheet 2004-2022 Form Follow the step-by-step instructions below to design your va loan comparison: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done.

Download Loan Comparison Calculator Excel Template Loan Comparison Calculator is a ready-to-use excel template to compare multiple scenarios and decide the best one for you. Comparison is based on 4 different criteria; interest, installments, repayment duration and total repayment. In addition to the above, the template represents the comparison in graphical format.

PDF Mortgage Loan Comparison Worksheet - eHome America Title: Trainer's Toolbox.pdf Author: berryman Created Date: 3/29/2016 10:40:00 PM

Loan Comparison Calculator - NerdWallet NerdWallet's loan comparison calculator helps you compare the monthly and total cost of two mortgage, small business or personal loan offers.

0 Response to "41 mortgage loan comparison worksheet"

Post a Comment