40 truck driver tax deductions worksheet

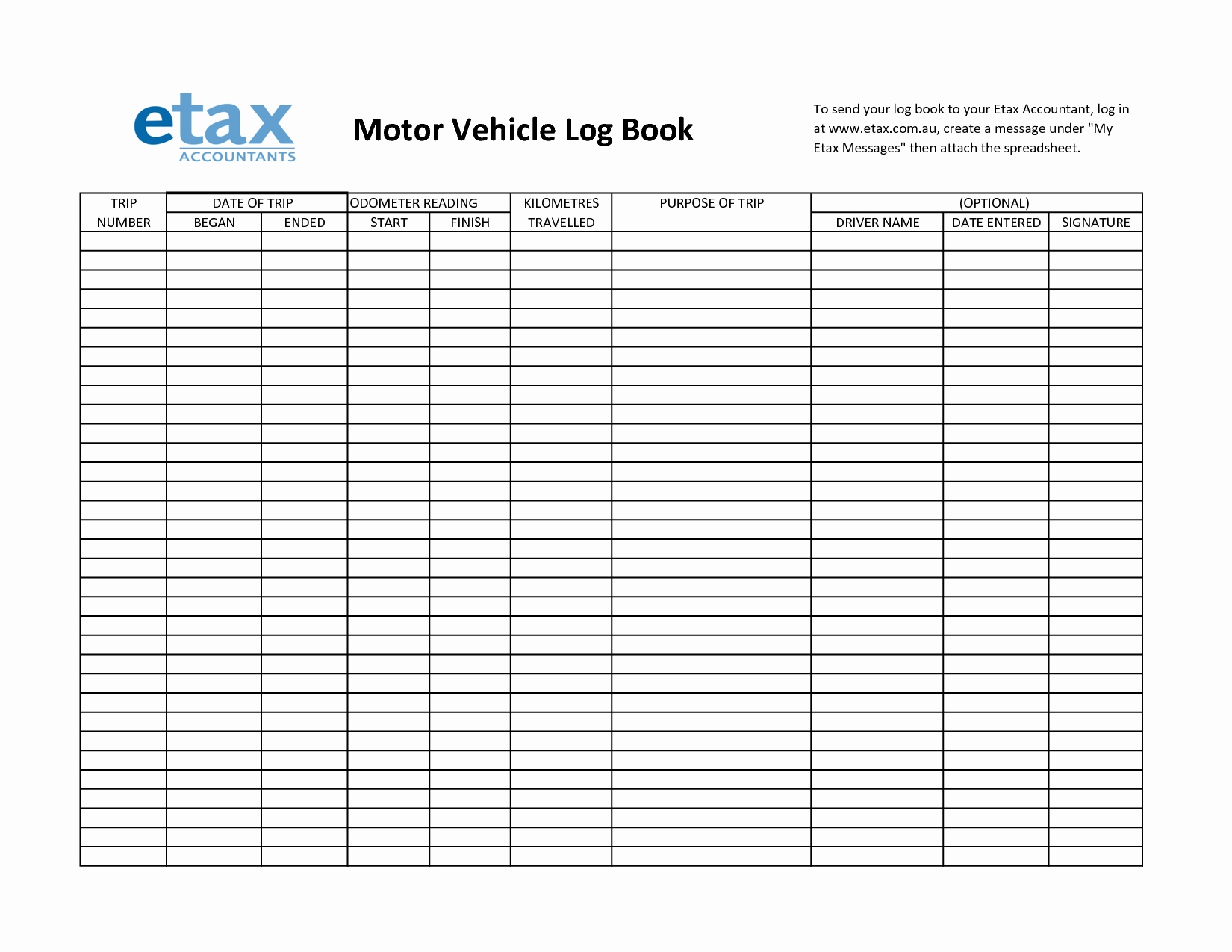

Truck Driver Tax Deductions | H&R Block Other unreimbursed expenses you can deduct include: Log books. Lumper fees. Cell phone that's 100% for business use. License and fees for truck and trailer. Interest paid on loan for truck and trailer. Depreciate your truck and trailer: Over three years for a semi-truck for regular tax — or over four years for the Alternative Minimum Tax ... 31 Best Tax Deductions for Truckers, Truck Drivers & Owner Operators Form 2290 is used by Truck Driver and owner operator truck drivers to calculate their Heavy Highway Use Tax. This tax is based on the amount of travel that a vehicle has done on public roads during the tax year. The rate is $550 per year for vehicles that travel 5,000 miles or less, and $100 for each 1,000 miles over 5,000.

PDF Name Year TRUCK DRIVERS WORKSHEET THIS IS AN INFORMATIONAL WORKSHEET ... TRUCK DRIVERS WORKSHEET THIS IS AN INFORMATIONAL WORKSHEET FOR OUR CLIENTS CALL IF YOU NEED HELP WITH IT. Total Income (Gross Amount Of All Checks) - Possible Deductions From Checks- Licenses & Permits Bobtail Fees Pager Fees Health Insurance Physical Damage Reserve Withdrawals Truck Washes -Other Deductions-

Truck driver tax deductions worksheet

Tax Deduction List for Owner Operator Truck Drivers For tax year 2021, participants with family coverage, the floor for the annual deductible is $4,800, up from $4,750 in 2020; however, the deductible cannot be more than $7,150, up $50 from the limit for tax year 2020. For family coverage, the out-of-pocket expense limit is $8,750 for tax year 2021, an increase of $100 from tax year 2020. Tax Deductions for Truck Drivers - Jackson Hewitt Self-employed truck drivers may also deduct 80% of the special standard meal allowance rate or their actual expenses. The 2018 special standard meal allowance is $63/full day within the US, $68/full day outside the US, $47.25/partial day within the US, $51/partial day outside the US. Expense Operator Spreadsheet Owner Trucking expenses spreadsheet is created to help the owner-operator or a small truck fleet business Even though becoming an owner-operator offers the opportunity to make more money, take off the rose-colored sunglasses (3) The facility owner or operator shall pay the cost of notice required to be provided under this section A tax deduction is a tax-saving measure you can take that reduces the ...

Truck driver tax deductions worksheet. ATBS | Free Owner-Operator Trucker Tools 2022 Per Diem Tracker. Our per diem calendar will help you keep track of your days on the road for the truck driver per diem tax deduction. Write a slash (/) through partial days and an X through full days on the road. Download 2021 Per Diem Tracker. Download 2020 Per Diem Tracker. 19 Truck Driver Tax Deductions That Will Save You Money So if your new laptop cost $1,000 and you use it for work 50% of the time, you can deduct $500. Education If you pay for truck driver school or other training to maintain your CDL license, you can deduct it. Other education may be tax deductible too, as long as it's directly related to your trucking career. PDF Tax Organizer--Long Haul Truckers and Overnight Drivers PART 2—Owner/Operator Truck Expenses Description of Truck Date Placed in Service Odometer—Beginning of Year Odometer—End of Year Vehicle Weight Interest Paid Gas, Lube and Oil Repairs and Maintenance Tires Insurance License and Registration Fees Other: PART 3—Dues and Fees License Permits and Fees Security Bond Trade Association Dues 2020 Truck Driver Tax Deductions Worksheet Form - signNow Follow the step-by-step instructions below to design your list of itemized deductions worksheet: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done.

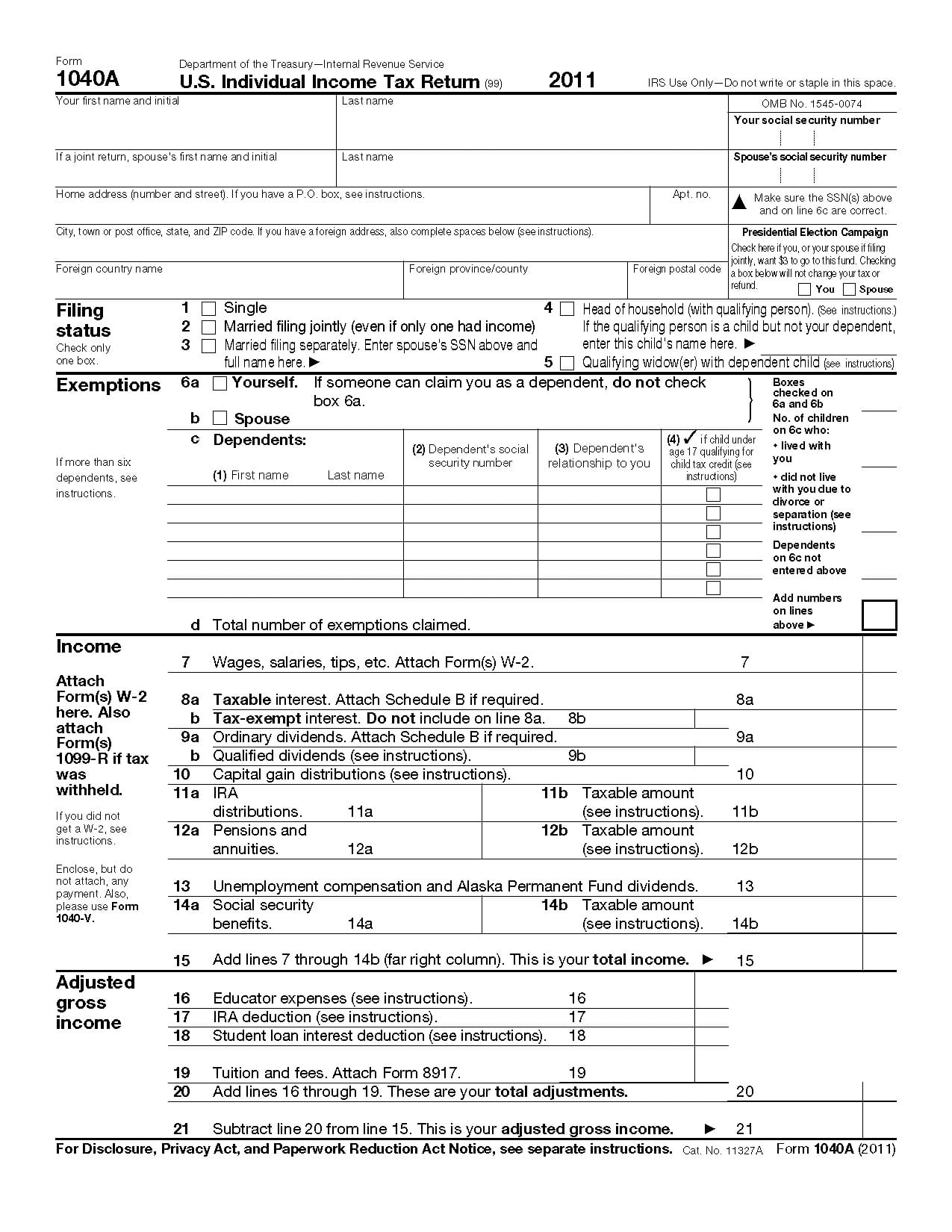

The Owner-Operator's Quick Guide to Taxes - Truckstop.com According to IRS.gov, the self-employment tax rate is 15.3% (12.4% for social security and 2.9% for Medicare). View full details about self-employment taxes at IRS.gov. Federal Income Tax and State Income Tax : This is calculated on your tax return. As a company employee, income taxes were estimated and withheld from your check. Truck Driver Expenses Worksheet - Fill Out and Use LONG HAUL/OVERNIGHT TRUCK DRIVER DEDUCTIONS The purpose of this worksheet is to help you organize your tax deductible business expenses. In order for an expense to be deductible, it must be considered an "ordinary and necessary" expense for your business or profession. You may be able to deduct other expenses that are not listed below. Truck drivers - income and work-related deductions Deductions. You may be able to claim deductions for your work-related expenses. These are expenses you incur to earn your income as a truck driver. For a summary of common claims, see Truck driver deductions (PDF, 343KB) This link will download a file. Or use the list of expenses below to learn more. To claim a deduction for work-related expenses: PDF Trucking Business Tax Worksheet - tnttaxserviceaz.com Trucking Business Tax Worksheet Name of Business: Taxpayer Name: Tax Payer SS#: Gross Income (provide any 1099's) *A $ Number of Miles Logged Bank Service Charges $ Telephone, Pager $ Computer Expense $ Tractor Rental $ Fuel Expense $ Tolls $

PDF TRUCKER'S INCOME & EXPENSE WORKSHEET - Cameron Tax Services TRUCKER'S EXPENSES (continued) EQUIPMENT PURCHASED Radio, pager, cellular phone, answering machine, other… Item Purchased Date Purchased Cost (including sales tax) Item Traded Additional Cash Paid Traded with Related Property Other Information 1099s: Amounts of $600.00 or more paid to individuals (not List of Common Tax Deductions for Owner Operator Truck Drivers Some trucking companies might have some differences when it comes to truck driver tax deductions or tax breaks. It all depends on the type of business the trucking company is in and their vehicle operating expenses. That said, there are common deductible business expenses that most owner operator truck drives can claim. Truck drivers - income and work-related deductions Deductions Record keeping Income - salary and allowances Include all the income you receive as a truck driver during the income year in your tax return, this includes: salary and wages allowances Don't include reimbursements. Your income statement or payment summary shows all your salary, wages and allowances for the income year. Salary and wages PDF Over-the-road Trucker Expenses List - Pstap received as a taxicab driver, or bonuses received as a truck driver in cash, are taxable income. And the sale of any of your equipment or work-related purchases also constitute taxable income (i.e.: sales of tires, radios, etc.). If you are self-employed (unincorporated) and your net earnings after all legitimate deductions are taken are $400 or

2020 Truck Driver Tax Deductions Worksheet - Fill Online, Printable ... LONG HAUL/OVERNIGHT TRUCK DRIVER DEDUCTIONS The purpose of this worksheet is to help you organize your tax-deductible business expenses. In order for an expense to be deductible, it must be considered

PDF Tax Deduction checklist for truck drivers Tax Deduction checklist for truck drivers. ---------------------------------------- ------------------------------------ ~a~ Organizer. 7. Long Haul Tr.uckers and Overnight 'Drivers.·. Name: Tax Year: Principal Business: - ------------------------------------- Business Name and Address: Date Business Started (if started this year): ...

Anchor Tax Service - Truck driver deductions Anchor Tax Service - Truck driver deductions Meal Allowance $59.00 per day Get in Touch With Us. Call us at 423 243-8015 with any questions or to schedule an appointment. Anchor Tax Service 8372 Dayton Pike Soddy Daisy, TN 37379 Or you may use our contact form. Office Hours You can reach us during the following hours: Non Tax Season

Truck Driver Tax Deductions: 9 Things to Claim - Drive My Way Step 1: Find your Form. If you are a company driver, you can no longer claim work-related deductions on your taxes. This is thanks to changes to the tax code made by the Tax Cuts and Jobs Act a few years ago. If you are an owner operator, the easiest way to report your income is with a 1099 form. The 1099 form is used to report miscellaneous ...

What You Need to Know About Truck Driver Tax Deductions While the IRS allows most industries to deduct 50% of meals, drivers subject to the Department of Transportation's "hours of service" limits, can claim 80% of their actual meal expenses. The hours of service rule requires drivers who have driven a certain amount of hours to stop and rest for an assigned period of time.

Truck Driver Tax Deductions: How to File in 2021 | TFX Truck drivers' standard tax deductions. When you claim work-related tax deductions, you also reduce your AGI (adjusted gross income). Which, in its turn, means that you will pay less in taxes. Truck driver write off list. Let's see the list of trucker tax deductions for both owner-operators and company drivers. Medical examinations. In this business the state of your health is crucial, so you can deduct all visits to the doctor that you had to make due to work-related problems.

PDF FEDERAL TAXES and O-T-R & O-O TRUCKERS DEDUCTIONS LIST you cannot legitimately deduct the income lost as a result of deadhead/unpaid mileageonly the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would likely be deductible. you cannot legitimately deduct for downtime (with some minor exceptionsask your tax pro). you cannot deduct charitable contributions …

Tax Deductions for Your Trucking Business Insurance Premiums - this includes company and personal paid insurance plans. Internet and Phone Bills - monthly charges for internet and phones used to operate your business can be deducted up to 50% of the bill. Leasing - if you have a lease agreement, 100% of your truck payments can be tax-deductible. However, the security deposit ...

PDF Trucker'S Income & Expense Worksheet &$/,)251,$ 7$; %287,48( Year RENT/LEASE: Truck lease WAGES: 9lrin~ourffi~fil' ave en of W-2s/941 s if they 1 e Machinery and equipment Wages to spouse (subjectto Soc.Sec. and Other bus. property, locker fees Medicare tax) REPAIRS & MAINTENANCE: Truck, equipment, Children under 18 (not subjectto etc. Soc.Sec. and Medicare tax) SUPPLIES: Maps, safety supplies

Tax Deduction Worksheets Etc. For Trucking - Page 1 | TruckingTruth Forum Becoming A Truck Driver is a dream we've all pondered at some point in our lives. We've all wondered if the adventure and challenges of life on the open road would suit us better than the ordinary day to day lives we've always known. At TruckingTruth we'll help you decide if trucking is right for you and help you get your career off to a great ...

Truck Driver Deductions Spreadsheet: Fill & Download for Free Click the Get Form or Get Form Now button to begin editing on Truck Driver Deductions Spreadsheet in CocoDoc PDF editor. Click on the Sign tool in the tools pane on the top; A window will pop up, click Add new signature button and you'll have three options—Type, Draw, and Upload. Once you're done, click the Save button.

Expense Operator Spreadsheet Owner Trucking expenses spreadsheet is created to help the owner-operator or a small truck fleet business Even though becoming an owner-operator offers the opportunity to make more money, take off the rose-colored sunglasses (3) The facility owner or operator shall pay the cost of notice required to be provided under this section A tax deduction is a tax-saving measure you can take that reduces the ...

Tax Deductions for Truck Drivers - Jackson Hewitt Self-employed truck drivers may also deduct 80% of the special standard meal allowance rate or their actual expenses. The 2018 special standard meal allowance is $63/full day within the US, $68/full day outside the US, $47.25/partial day within the US, $51/partial day outside the US.

Tax Deduction List for Owner Operator Truck Drivers For tax year 2021, participants with family coverage, the floor for the annual deductible is $4,800, up from $4,750 in 2020; however, the deductible cannot be more than $7,150, up $50 from the limit for tax year 2020. For family coverage, the out-of-pocket expense limit is $8,750 for tax year 2021, an increase of $100 from tax year 2020.

0 Response to "40 truck driver tax deductions worksheet"

Post a Comment