45 realtor tax deduction worksheet

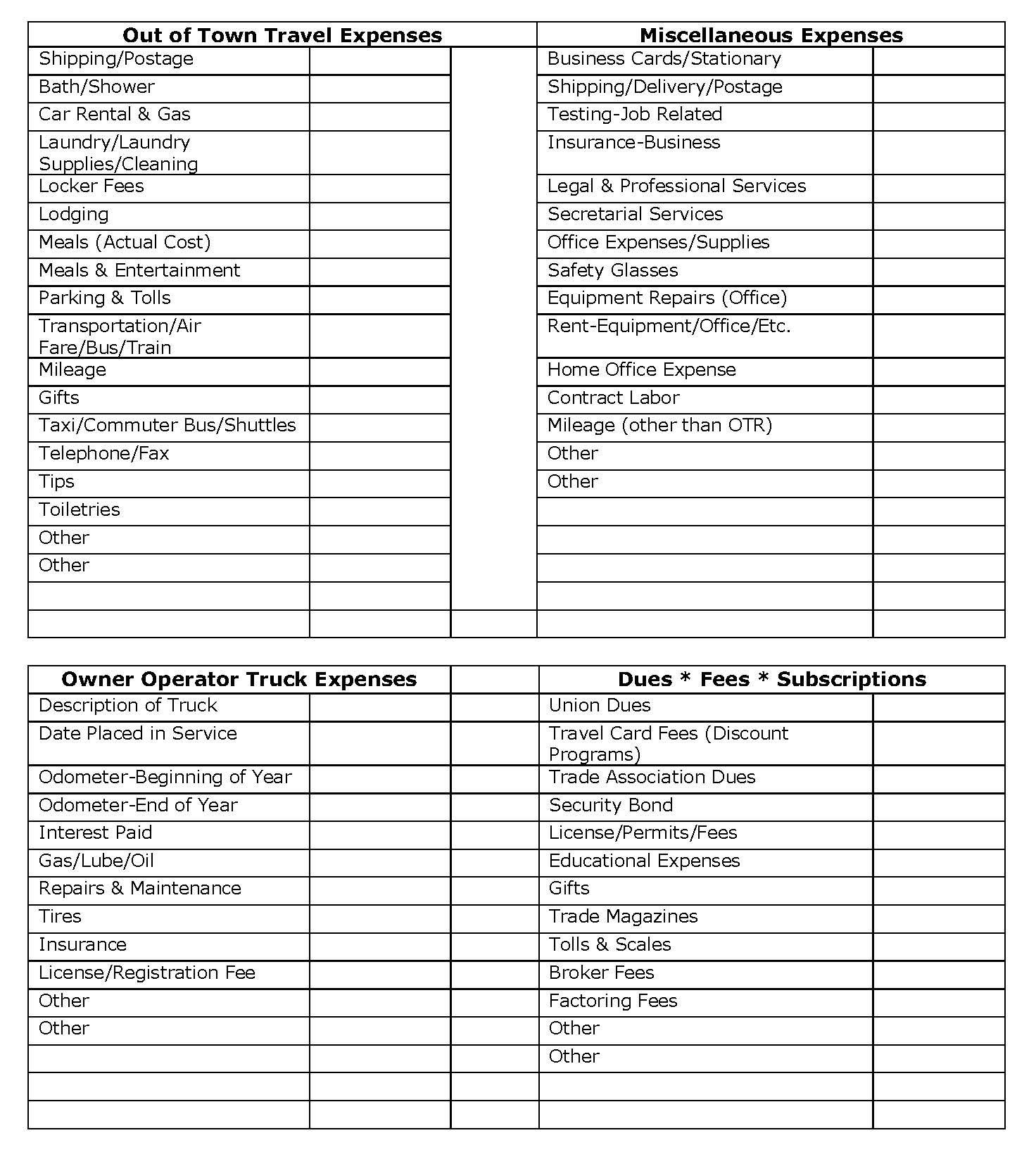

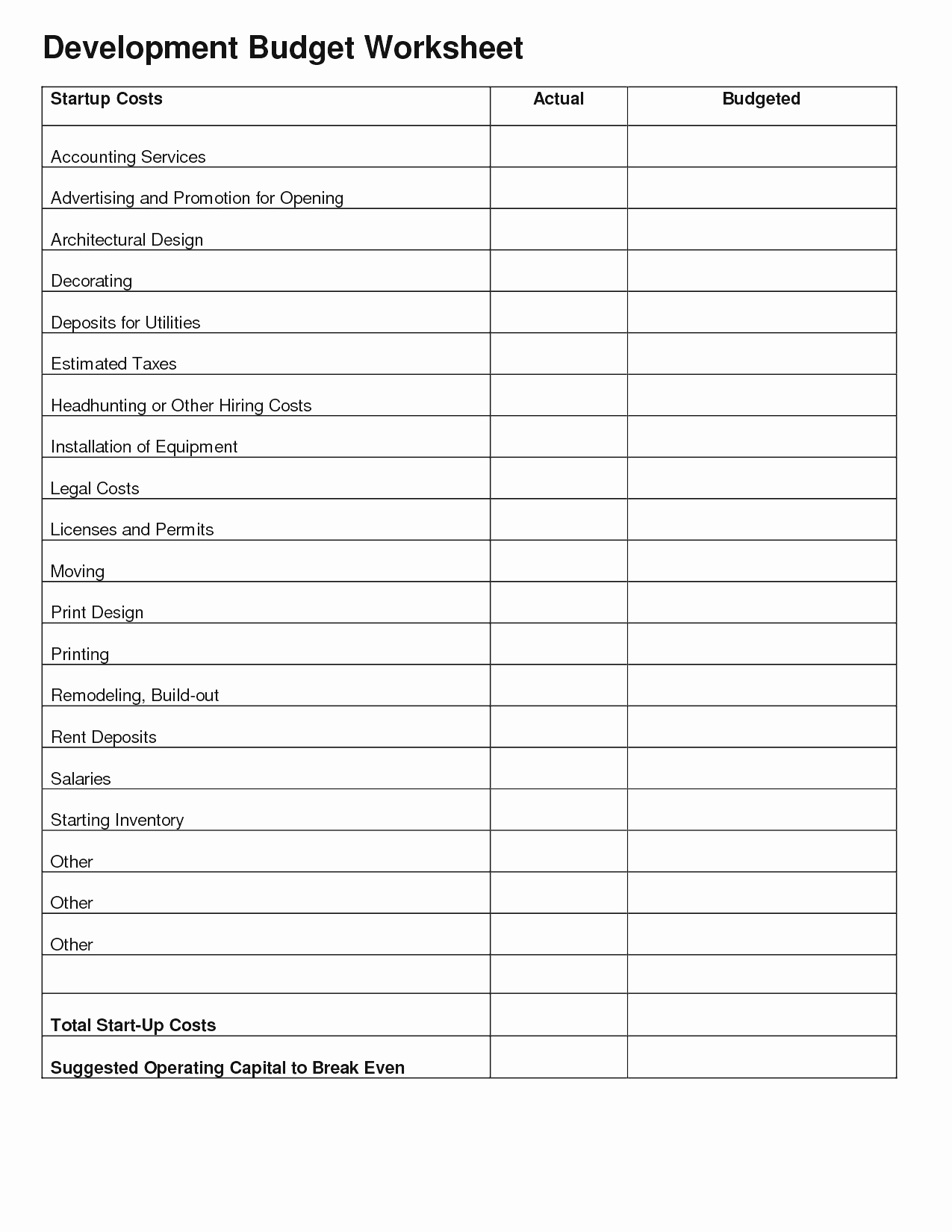

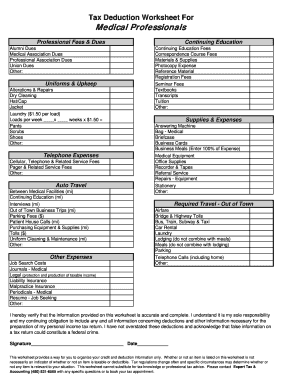

PDF Realtors Tax Deduction Worksheet - FormsPal Realtors Tax Deduction Worksheet Due to the overwhelming response to last month's Realtor "tax tip" article, Daszkal Bolton LLP has created this Realtors' Tax Deduction Worksheet to assist our clients in becoming more organized for taking advantage of tax deductible business expenses. PDF Real Estate Agent Deductions REAL ESTATE AGENT DEDUCTIONS The purpose of this worksheet is to help you organize your tax deductible business expenses. In order for an expense to be deductible, it must be considered an "ordinary and necessary" expense for your business or profession. You may be able to deduct other expenses that are not listed below.

PDF Realtor - Tax Deduction Worksheet Tax regulations change often and specific circumstances may determine whether or not any item is relevant to your situation. This worksheet cannot substitute for tax knowledge or professional tax advice. Please contact Expert Tax & Accounting (480) 831-6565 with any specific questions or to book your tax appointment. Other: Other: Rent

Realtor tax deduction worksheet

115 Popular Tax Deductions For Real Estate Agents For 2022 The average real estate agent salary is around $40,000 annually. Going back to our example of $100,000 adjusted gross income, let's assume you paid yourself a salary of $40,000 and took $60,000 in dividends. In this scenario, you'd only pay the 15.3% SE tax on the $40,000. Realtors Tax Deductions Worksheet | Justlistedinmarkham Deduction Worksheet for Many professions. real estate Agent Spreadsheet - Each tab can record expenses for a different year. When you file a tax return, you usually have a choice to make: whether to itemize deductions or take the standard deduction. You should compare. state income taxes or sales taxes (but not both), Realtors Property Resource. PDF Realtors Tax Deductions Worksheet Realtors Tax Deductions Worksheet AUTO TRAVEL Your auto expense is based on the number of qualified business miles you drive. Expenses for travel between business locations or daily transportation expenses between your residence and temporary work locations are deductible; include them as business miles.

Realtor tax deduction worksheet. Real Estate Agent Tax Deductions Worksheet 2021 - signNow Follow the step-by-step instructions below to design your rEvaltor tax deduction worksheet form: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done. Realtor Tax Deductions And Tips You Must Know - Easy Agent PRO Want our Realtor tax deduction worksheet? Check it out right here: Little-Known Realtor Tax Deductions One of the key strategies in getting better tax returns is starting New Years Day. Your tax strategy starts from day #1. Keep is simple and keep every single receipt for transactions starting today! Real Estate Agent Tax Deductions - Fill Out and Use Realtors Tax Deductions Worksheet AUTO TRAVEL Your auto expense is based on the number of qualified business miles you drive. Expenses for travel between business locations or daily transportation expenses between your residence and temporary work locations are deductible; include them as business miles. Tax Worksheets - CPA for Real Estate Agents Important Tax Preparation Deadlines for Our Firm: ... Common deductions available for real estate agents as self employment expenses . Rental Property Worksheet ... CPA for Real Estate Agents 548 Nautical Dr., Suite 202 Lake Wylie SC 29710 | info@cpaforrealestateagents.com

Real Estate Appraisers Tax Deductions 2021-2022 (Ultimate Guide) If you rent office space for your real estate office, then the rent you pay is tax-deductible along with Office utilities such as electricity, water & trash service. This is an important Tax Deductions for Real Estate Agents for 2021-2022 as many real estate agents pay for Desk Fee or shared cost of utilities for their office. 11. Real Estate Professional Expense Worksheet - atmTheBottomLine TAX BASICS About Your Business. TYPE OF BUSINESS Business or Hobby? SOLE PROPRIETORSHIPS; DEDUCTIONS What you need to know; EXPENSE FORMS Keep Track of Your Expenses. Clergy Expense Worksheet; Daycare Expense Worksheet; Outside Sales Expense Worksheet; Real Estate Professional Expense Worksheet; ABOUT US and Contact Info. ABOUT US; STAFF ... The Best Home Office Deduction Worksheet for Excel [Free ... - Keeper Tax How to use this home office deduction worksheet. We built this worksheet in Google Docs, so you can use it anywhere you want, for free: all you need is an internet connection. But if you'd like to download your copy and use it in Excel, you can do that too. The worksheet is split up into three parts: 🧮 Your Business-Use Percentage Calculator. Real Estate Agent Tax Deduction Wordsheet - Google Sheets Real Estate Agent Tax Deduction Wordsheet - Google Sheets. To enable screen reader support, press Ctrl+Alt+Z To learn about keyboard shortcuts, press Ctrl+slash. Quotes are not sourced from all markets and may be delayed up to 20 minutes. Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice.

PDF Object Moved This document may be found here Cyataxes Realtors Tax Deductions Worksheet - US Legal Forms Get the Cyataxes Realtors Tax Deductions Worksheet you need. Open it using the cloud-based editor and begin adjusting. Fill in the empty areas; concerned parties names, places of residence and phone numbers etc. Customize the template with smart fillable fields. Include the particular date and place your electronic signature. PDF Tax Worksheet for Self-employed, Independent contractors, Sole ... harbor home office deduction we'll need to depreciate the structure every year. ... Looking on the real estate assessment for the property to figure out what the land portion ... ***Please email or fax worksheet De'More Tax Service Office: 817-726-2181 Mobile: 972-885-9709 Top 20 Real Estate Agent Tax Deductions in 2021 - Bonsai If you use a company car, don't worry - the mileage will already be tracked for you. Standard mileage deduction involves you taking a cost per mileage driven for business purposes. For the tax year 2021, the standard mileage rate for use of a car (also vans, pickups, or panel trucks) is 56 cents per mile driven.

Worksheet Deductions Realtors Tax - Texascatholicyouth Realtor Deductions.. New Clients - Please provide depreciation worksheets from your previous tax. Real Estate-related Items You Can't Deduct. Recovery Limited to Deduction. Reduced Deductions or Credits.. State and Local General Sales Tax Deduction Worksheet. Student Loan Interest Deduction.

Deductions Tax Worksheet Realtors - Sellingsarasotalifestyles Showing top 8 worksheets in the category - Realtor Tax Deduction Lists. Some of the worksheets displayed are Real estate income expense work, Itemized deductions checklist, 2015 itemized deductions work, Small business work, Tax preparation checklist, Rental ie work 2, Square footage guidelines residential, Passive activity loss.

Realtor Tax Deductions Worksheet - signNow Follow the step-by-step instructions below to design your tax deductions for a rEvaltor form: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done.

PDF Realtor/Real Estate Agent - Tax Deduction Cheat Sheet REALTOR/REAL ESTATE AGENT - TAX DEDUCTION CHEAT SHEET Advertising Billboards Brochures/Flyers Business Cards Copy Editor Fees Direct Mail Email Marketing & Newsletters Graphic Designer Fees Internet Ads (Google, Facebook, etc) Leads/Mailing Lists ...

PDF Real Estate Agent/Broker - Finesse Tax Reduce your taxes by tracking your tax deductions ... Finesse Tax Accounting, LLC Real Estate Agent/Broker Do Your Taxes With Finesse 2035 2nd St. NW Suite G-102 Washington, DC 20001 Office: 240.417.7234 Mobile: 202.664.2490 Fax: 240.559.0990 Email: finessetax@gmail.com

DOC Income Tax Deduction Checklist --- REALTORS Business Tax Deduction Checklist . Title: Income Tax Deduction Checklist --- REALTORS Author: Joseph J. Gawalis Jr., MBA, CPA-NJ Last modified by: Joseph J. Gawalis Jr., MBA, CPA-NJ Created Date: 6/25/2004 2:27:00 PM Company: Accountancy Consultants of New Jersey, LLC Other titles:

Deductions Tax Worksheet Realtors - Choosemabry Itemized deductions - tax.ny.gov - For federal purposes, your total itemized deduction for state and local taxes paid in 2018 is limited to a combined amount not to exceed $10,000 ($5,000 if married filing separate). In addition, you can no longer deduct foreign taxes you paid on real estate.

Tax Deductions for Real Estate Agents 2022: Ultimate Guide Solo 401k. 2022 individual contribution limit is $22,000, $27,000 if over 50. However, like a corporate 401k, your company can also contribute to this plan - as much as 25% of your compensation. The max individual plus business contribution to this plan can be as high as $58,000 or $64,500 if over 50, for 2022.

16 Real Estate Tax Deductions for 2022 | 2022 Checklist Hurdlr Real estate agents can deduct legal and professional fees to the extent they are an ordinary part of and necessary to operations. Deduction #4 Show Detail Advertising Expense The IRS allows you to deduct reasonable advertising expenses that are directly related to your business activities. Deduction #5 Show Detail Home Office Deduction

PDF Realtors Tax Deductions Worksheet Realtors Tax Deductions Worksheet AUTO TRAVEL Your auto expense is based on the number of qualified business miles you drive. Expenses for travel between business locations or daily transportation expenses between your residence and temporary work locations are deductible; include them as business miles.

Realtors Tax Deductions Worksheet | Justlistedinmarkham Deduction Worksheet for Many professions. real estate Agent Spreadsheet - Each tab can record expenses for a different year. When you file a tax return, you usually have a choice to make: whether to itemize deductions or take the standard deduction. You should compare. state income taxes or sales taxes (but not both), Realtors Property Resource.

115 Popular Tax Deductions For Real Estate Agents For 2022 The average real estate agent salary is around $40,000 annually. Going back to our example of $100,000 adjusted gross income, let's assume you paid yourself a salary of $40,000 and took $60,000 in dividends. In this scenario, you'd only pay the 15.3% SE tax on the $40,000.

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

0 Response to "45 realtor tax deduction worksheet"

Post a Comment