38 business income insurance worksheet

What is Business Income Coverage? - The Hartford Insurance Your business income coverage, also known as business interruption coverage or extra expense coverage, can cover lost income when you need to close your business suddenly. This coverage applies an extra layer of protection beyond general commercial property insurance. Your policy can also include extended business income coverage to help ... PDF Business Income Worksheets: Simplified! Business Income Worksheets: Simplified! A Tutorial for the Confused By Robert M. Swift, CPCU, CIPA, CBCP Business Income (BI) worksheets are an integral part of the insurance selection process because they easily determine an organization's financial risk/exposure to loss. If "agreed amount" coverage is requested, insurance companies must ...

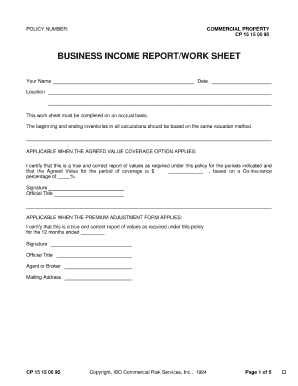

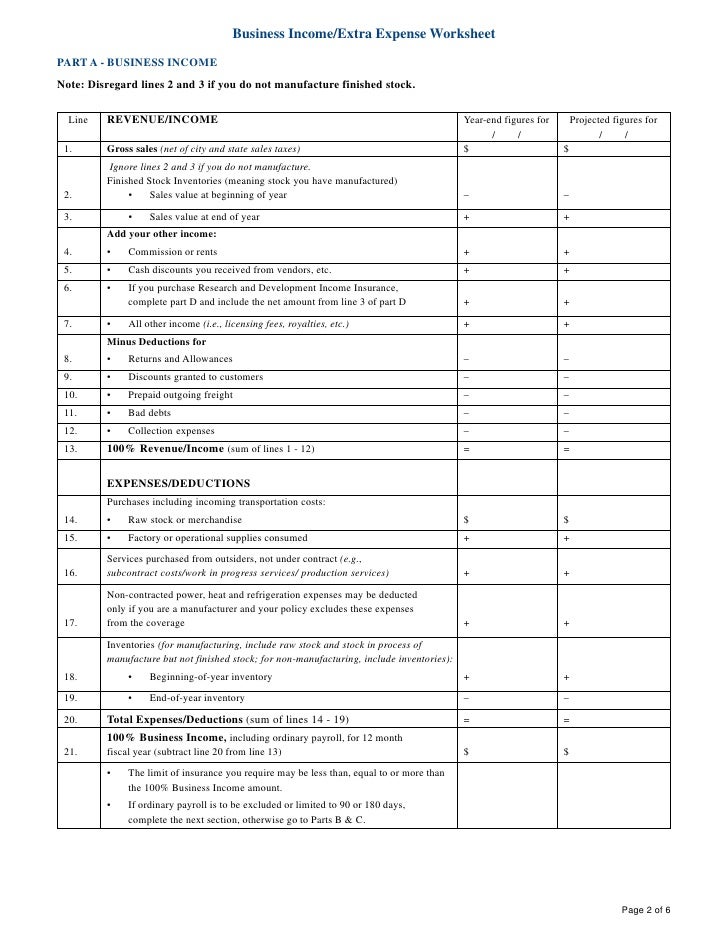

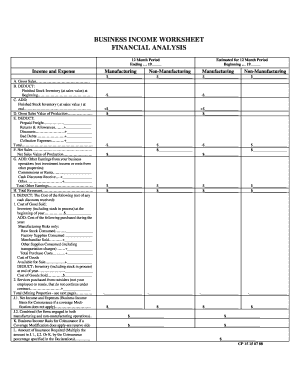

Calculating the Correct Business Income Coinsurance The business income section of the worksheet is completed in this post; and possibly more importantly, how the correct business income coinsurance percentage is developed is explained below. Not discussed in this commentary are the two remaining lines of the business income report/worksheet: the Extra Expense amount ("K.1.") ; and the Extended ...

Business income insurance worksheet

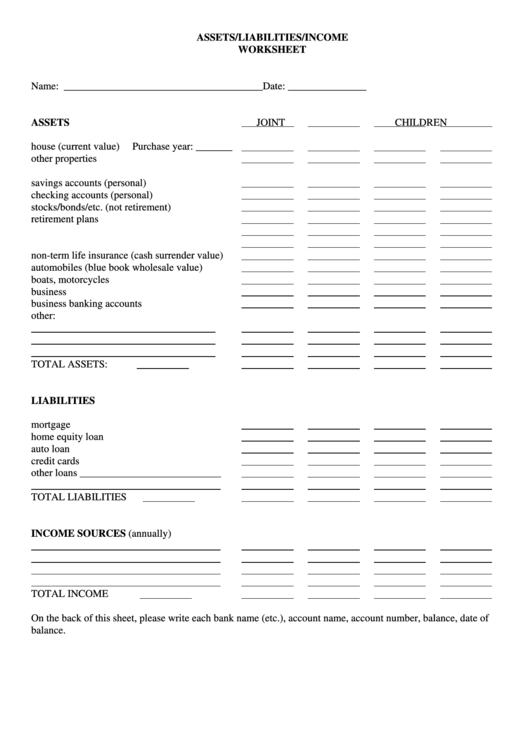

singlefamily.fanniemae.com › media › 7746Cash Flow Analysis (Form 1084) - Fannie Mae If the Schedule K-1 does not reflect a documented, stable history of receiving cash distributions of income from the business consistent with the level of business income being used to qualify, then the lender must confirm the business has adequate liquidity to support the withdrawal of earnings. IRS Form 1040 – Individual Income Tax Return . 1. BUSINESS INCOME WORKSHEETS - BISimplified Why do I need to complete a Business Income worksheet? It is used to estimate the net profits plus continuing expenses (Business Income) that a business would have realized had no loss occurred. It is required if the policy provides agreed amount. What is agreed amount? Business Income Insurance Definition 🟨 Jun 2022 Business Income Insurance Definition - If you are looking for a way to find different types of quotes then try our popular online service. business income loss examples, business income insurance example, iso acord business income worksheet, loss of business income and extra expense, business income actual loss sustained, business income period ...

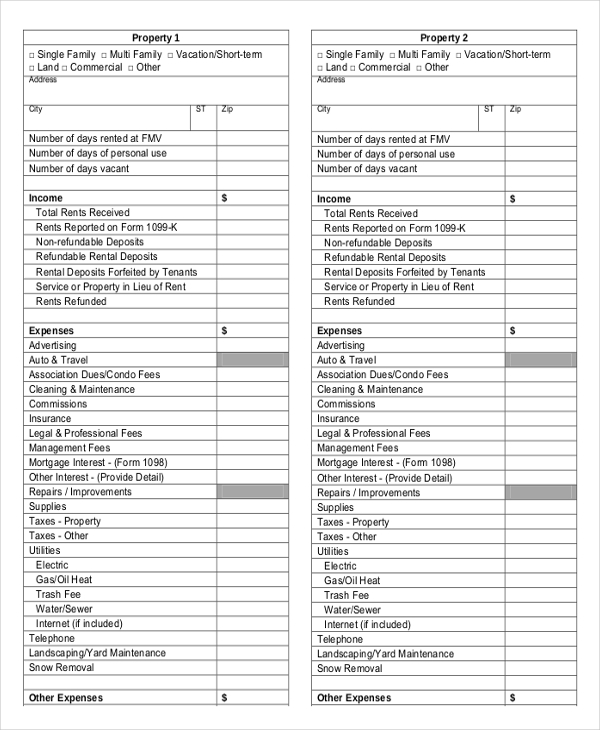

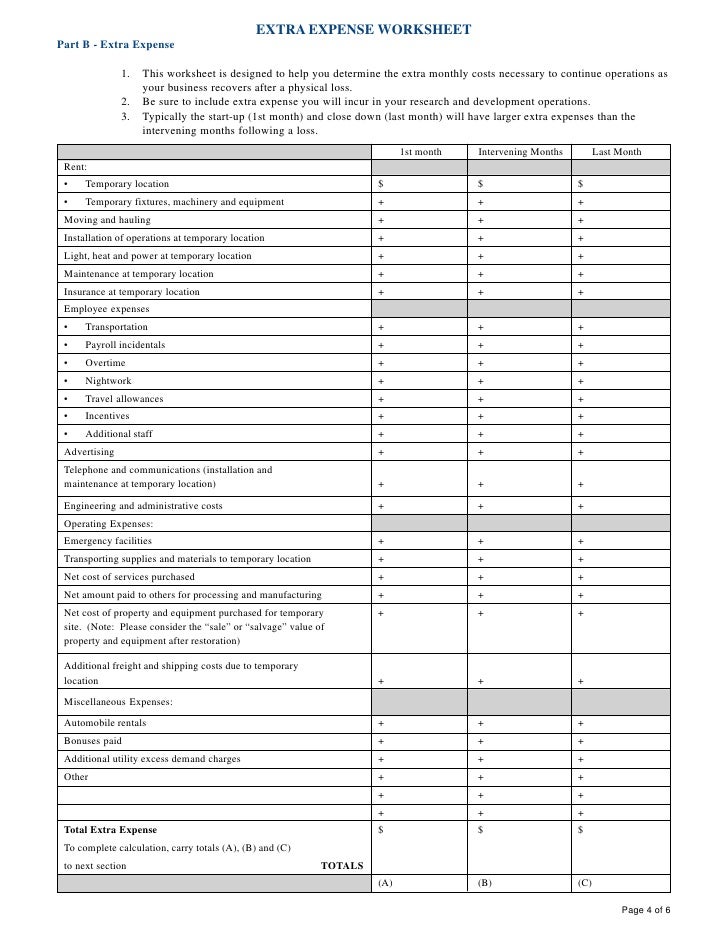

Business income insurance worksheet. › Forms › Income-tax-status-reviewIncome tax status review worksheet for self-assessing non ... This worksheet helps non-profit organisations self-assess their income tax status as either income tax exempt or taxable. XLS Business Income Coverage Worksheet: HEALTHCARE Business Income Coverage Worksheet: HEALTHCARE Revenue Inpatient Services Outpatient Services Emergency Room and Ambulance Charges Room and board, laboratory fees, x-rays, anesthetics, prescription drugs, physiotherapy, blood bank, oxygen, MRI and other ancillary services PDF BUSINESS INCOME REPORT/WORK SHEET - BSR Insurance The figure in L. represents 100% of your estimated Business Income exposure for 12 months, and additional expenses. Using this figure as information, determine the approximate amount of insurance needed based on your evaluation of the number of months needed (may exceed 12 months) to replace your property, resume The Business Income Report/Worksheet—Step by Step | Insurance Coverage ... The business income worksheet calculates additional expenses. · K. Additional Expenses. Estimated for a twelve-month period with a beginning date supplied by the insured. · K.1. Extra expenses....

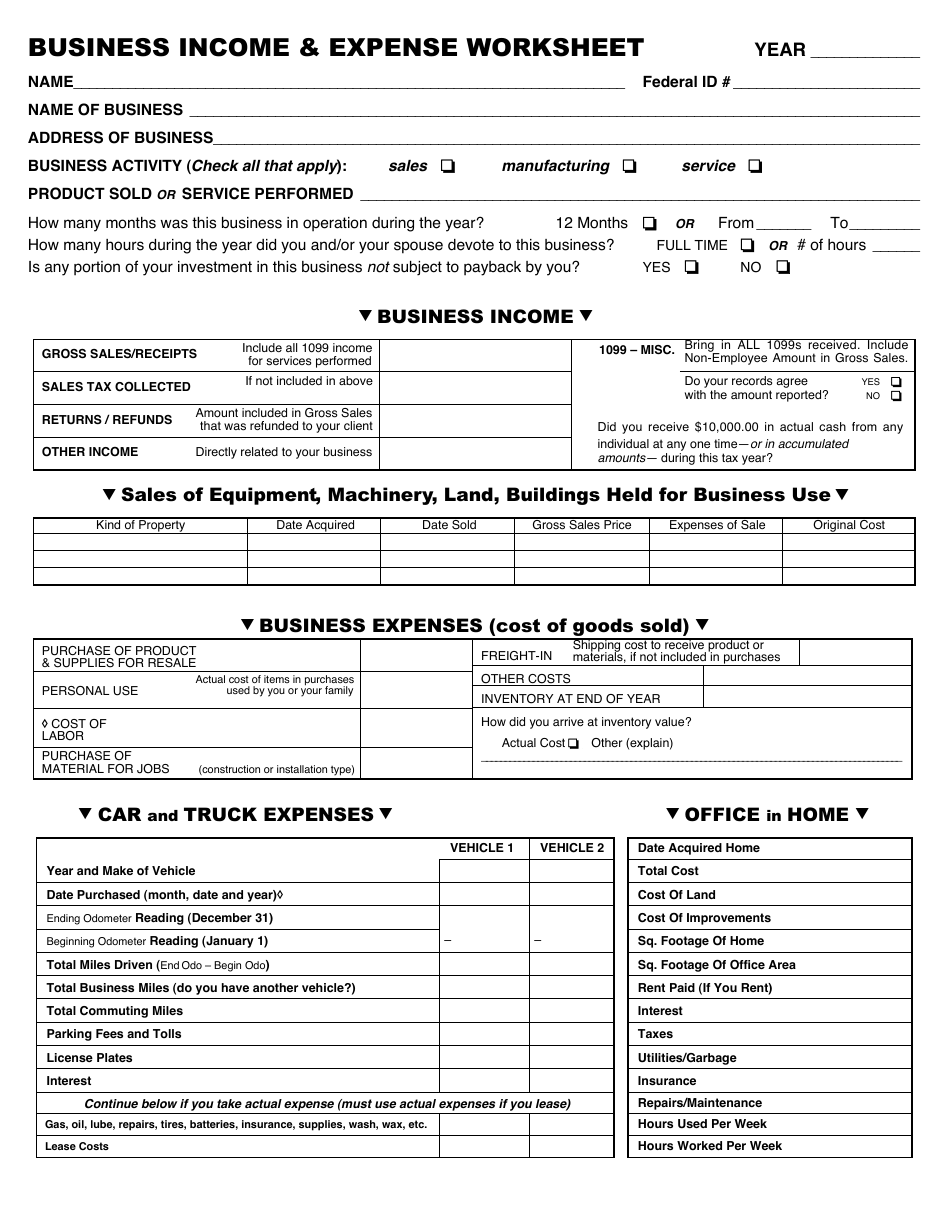

How to Calculate Business Income for Insurance | The Hartford What Will My Business Income Insurance Cost? Insurance Services Office (ISO) worksheets can be helpful when calculating business income. Following these worksheets can help you: Calculate how much income your business generated in the previous 12-month period. Estimate your income for the future 12-month period. XLS Business Income Coverage Worksheet: PROFESSIONAL SERVICES BI Worksheet Instructions CP ResetExtraExpense ResetForm Seasonality Next Fiscal Year Actual Estimate Cost of Goods Sold BI Value Repairs and Maintenance Bad Debts Interest Expense Depreciation & Depletion Pension, profit-sharing, etc. plans Employee benefit programs Last Fiscal Year Taxes and Licenses (excluding income tax) Business Interruption (Income) Insurance and Coverage Basics - Chubb Business insurance policies vary from insurance company to insurance company, but business interruption coverage typically includes compensation for: Lost revenue - based on prior financial records. Mortgage, rent and lease payments. Employee payroll. Taxes and loan payments - due during the covered period. Relocation costs - if the business ... How a Business Income Worksheet Helps You Rebuild after Disaster What Is a Business Income Worksheet? Completing a worksheet may seem like a hassle, but it will help you estimate recovery costs and give you a blueprint to follow during the restoration period. It also documents your organization's pre-loss income and expenses when you submit a worksheet as part of your application for coverage.

› publications › p560Publication 560 (2021), Retirement Plans for Small Business ... Earned income includes amounts received for services by self-employed members of recognized religious sects opposed to social security benefits who are exempt from self-employment tax. If you have more than one business, but only one has a retirement plan, only the earned income from that business is considered for that plan. PDF Business Income & Extra Expense Worksheet Manufacturers Q. Minimum Amount of Business Income Insurance needed for your estimated Period of Restoration (Sum of Line N + P or Sum of Line O + P) =$ ... business income worksheet must be submitted to and accepted by us prior to a loss. A new worksheet must be submitted if you (1) change the limit of insurance mid-term, or (2) at the end of each 12 month ... › retirement › life-insuranceLife Insurance Needs Analysis Worksheet - Calculators That means if you make $50,000 a year, you will need a life insurance policy that pays around $500,000. The second way to calculate insurance needs is through a shortfall calculation. With this formula, you begin with the amount of income you would like to give to your family for a certain number of years. Business Income and Extra Expense Insurance - Travelers Business Income and Extra Expense insurance (BIEE) provides coverage when your business shuts down temporarily due to a fire or other covered loss. It helps replace your income and covered expenses like rent, payroll and other financial responsibilities while your property is being repaired or replaced. YouTube. View Video Transcript.

Wynward Insurance Group - Business Income Worksheet Business Income Worksheet. Wynward is pleased to provide our customers with a tool to assist in establishing the correct limit of insurance for the resultant loss of business income after a loss occurs. Please be sure to consult with one of our professional broker partners for advice in this area and in completing the form.

PDF Repairs Tires - Norwalk Business Service Business Address _____ Business Owner - You / Spouse / Both *Per AB5, only an Attorney can advise you as to whether an individual is eligible for Independent Contractor treatment Income - Sales $_____ Car and/or Truck Expenses

PDF Business Income Worksheet - Great American Insurance Group $1,000,000 12-month expected BI exposure (item E, page 1) 8 month max expected period of recovery (item 2, page 1) 3 peak months generate an average of 33% greater business income exposure $100,000 Extra Expense exposure (item F, page 1) a. $1,000,000 12 month BI exposure b. $1,000,000÷12 = $83,333 c. $83,333 × 8 months= $666,666 d.

PDF Simplified Business Income and Extra Expense Worksheet - Vantreo SIMPLIFIED BUSINESS INCOME AND EXTRA EXPENSE WORKSHEET This worksheet is designed to help determine a 12-month business income and extra expense exposure. Business income, in general, pays for net income (or loss) the insured would have earned or incurred, plus continuing normal operating expenses including payroll.

› business › corporate-income-andCorporate Income and Franchise Tax Forms | DOR Apr 07, 2014 · 83-180 | Application for Automatic Six Month Extension for Corporate Income & Franchise Tax Return

Business Income Insurance - Nationwide Business income insurance works with your property policy and provides coverage for events beyond your control such as fire, wind, hail, vandalism or damage from vehicles or aircraft that may cause direct physical loss or damage to covered property which interrupts your business.

DOC Business Income Worksheet - Hanover Insurance B. Total Revenue (sum of 1-4) C. Minus Costs: 1. Bad Debt 2. Adjustments & Allowances for Government Agency Requirements 3. Costs of Goods Sold 4. Excluding or Limiting 'ordinary payroll' expense? If 'yes', enter amount, if 'no', leave blank 5.

Business Income Insurance - Asking the Right Questions The ISO Business Income worksheet is not a tool designed to compute a limit of insurance. The worksheet's purpose is to determine the minimum limit required to satisfy coinsurance. Coinsurance is based on the combination of net profit and ALL operating expenses. The Insured's Responsibility

How Much Business Income Coverage You Need You have under-insured your business income exposure by $100,000. Here's how your insurer calculates your loss payment: Maximum loss payment = loss amount X (limit purchased/ the limit required) Amount paid by your insurer pays = $175,000 X (700,000 / 800,000) or $153,125. You must pay the remaining $21,875 yourself.

Business Income Insurance Coverage: Calculating How Much Your Company ... Completing a business income worksheet can help you accurately estimate how much business income coverage you may need. Together with a sound business continuity plan, it serves as a critical planning tool to help your business recover from unplanned business interruptions. To get started, choose from the industry selections below:

Business Income Insurance 🟨 Jun 2022 Business Income Insurance - If you are looking for a way to find different types of quotes then try our popular online service. insurance business income worksheet, business income loss examples, iso acord business income worksheet, business interruption claim examples, business income period of indemnity, business income worksheet, business ...

Business Income Worksheet | Insurance Glossary Definition | IRMI.com Definition Business Income Worksheet — a form used to estimate an organization's annual business income for the upcoming 12-month period, for purposes of selecting a business income limit of insurance.

Virtual University - Business Income - Independent Agent COVID-19: Extended Business Income Coverage. Following a business-closing loss, insureds suffer two income loss periods. Obviously, income is lost during the period the business is shut down or slowed down because of the property loss. But less obvious is the fact that income is or may continue to be lost AFTER the operations resume.

1ststepaccounting.com › wp-content › uploadsBusiness Income and Expense Summary Month & Year Health Insurance Wages: Insurance (other than health and auto) Other: Interest Legal and Professional Fees: Office Expense Pension and Profit Sharing: Postage and Delivery Rent – Vehicle and Machinery

0 Response to "38 business income insurance worksheet"

Post a Comment