42 airline pilot tax deduction worksheet

Non-Business Use of Employer-Provided Aircraft | NBAA ... The U.S. Department of Transportation recently released SIFL rates for the six-month period from Jan 1 to June. 30, 2022. These rates are necessary when applying the IRS aircraft valuation formula to compute values of non-business transportation aboard employer-provided aircraft. IRS Provides Continued Flexibility on SIFL Rates Oct. 21, 2021. Free Occupation Worksheet - Pacific Tax & Financial Group Receive A Free Occupation Tax Deductions Worksheet. Airline Pilot. Automobile Salesperson. Artist. Business Professional. Clergy. Construction Worker. Day Care Provider. Direct Seller.

PDF Pilot Professional Deductions - Diamond Financial Pilot Professional Deductions Proofs of expenses are required (receipts, credit or debit card statements, paystubs, etc.) Do not provide these to Diamond Financial; keep them for your records. All expenses below must be specifically for business use and not reimbursed by employer. Enter amounts as year's totals unless otherwise specified.

Airline pilot tax deduction worksheet

PDF Aircrew Taxes Flight Attendant Worksheet AIRCREW TAXES (770) 884-7565 FAX (770) 795-9799 1 Flight Attendant Professional Deductions Receipts are not required for travel expenses under $75 if entered into your logbook, including item, date & cost. Do not send receipts; keep them for your records. TOTAL BLOCKS will be completed by Tax Preparer PDF 2020 a ear - Pilot-Tax Please list the institutions for which 2020 interest income was received for you, your spouse, and any dependents under the age of 24. If your child files their own tax return and their interest and dividends are over $2,200, it must be reported on your return or be taxed at your tax rate on their return. Air Crew Tax Specialist for Pilots and Crew Members Amended Tax Returns If your previous years' tax return returns were not prepared by someone specializing in airline taxation you may be able to claim an additional refund for those years. We can amend your previous years' tax returns to capture the pilot deductions that may have been overlooked resulting in an increased refund due.

Airline pilot tax deduction worksheet. PDF TRUCKER'S INCOME & EXPENSE WORKSHEET - Cameron Tax Services sales tax) Item Traded Additional Cash Paid Traded with Related Property Other Information 1099s: Amounts of $600.00 or more paid to individuals (not corporations) for rent, interest, or services rendered to you in your business, require information returns to be filed by payer. Due date of return is January 31. Nonfiling penalty can be $150 ... Tax Deductions - Airline Pilot Central Forums A company called Tax Crew out in California has a great worksheet called the "2005 Tax Organizer" that you can get from there web page. They also have ones for prior tax years if needed, but I think they are all relatively the same. You can print it out and use it for yourself or have them file your return. It is a downloadable .pdf file. Solved Alexander Smith and his wife Allison are married ... Accounting questions and answers. Alexander Smith and his wife Allison are married and file a joint tax return for 2021. The Smiths live at 1234 Buena Vista Drive, Orlando, FL 32830. Alexander is a commuter airline pilot but took 6 months off from his job in 2021 to obtain a higher level pilot's license. The Smiths have a 17 year-old son, Brad ... Essay Fountain - Custom Essay Writing Service - 24/7 ... Custom Essay Writing Service - 24/7 Professional Care about Your Writing

PDF PROFESSIONAL DEDUCTIONS - Pilot-Tax Bryant, U.S. Ct. App. 3rd cir. 74 AFTR2d 94-5440) disallowing a deduction for home computers. Although they are a huge asset to our jobs, the airline does not require that we have a personal computer or laptop as a condition of employment. Alexander Smith and his wife Allison are married and ... This amount is taxed at 0% 9. 10. Enter the smaller of line 1 or line 4 10. 11. Enter the amount from line 9 11. 12. Subtract line 11 from line 10 12. 13. Enter: $445,850 if single, $250,800 if married filing separately, 13. $501,600 if married filing jointly or qualifying widow (er), $473,750 if head of household. 14. Instructions for Form 2106 (2021) | Internal Revenue Service If you are claiming a section 179 deduction on other property, or you placed more than $2,620,000 of section 179 property in service during the year, use Form 4562 to figure your section 179 deduction. Enter the amount of the section 179 deduction allocable to your vehicle from Form 4562, line 12, on Form 2106, line 31.. flightax.com We are open Monday thru Friday 9am-5pm EST. Reach us by phone at 317-984-5812 or by email at info@flightax.com. Services Tax Prep Flightax has been in business since 1990. Our team of Tax Professionals provide you with the... Learn More Foreign Base If you were based at a foreign domicile for any part of the year, you have a couple of options...

Air Crew Tax Specialist for Pilots and Crew Members The link to download the client tax organizers or applicable worksheets are below. In order to prepare your tax returns you must complete the blocks that pertain to your individual tax situation. Only items of income and expenses for the particular tax year you want us to prepare should be printed on the organizer or worksheet. PDF Is this Deductible? - IRS tax forms deduction for meals - Duggan 77 TC 911 . no deduction even during 24- hour shifts - Phillips TCM 1990-356 . no deduction even though union rules required common meals - Morton TCM 1986- 132 . no deduction despite severe peer and supervisory pressure segment and angle proofs worksheet with answerswhat streams ... Jan 24, 2021 · โรงพยาบาลจิตเวชเลยราชนครินทร์. Menu. หน้าแรก; ข้อมูลหน่วยงาน Tax Deduction Worksheet for Pilots, Flight Attendants ... This worksheet provides a way for you to organize your credit and deduction information only. Whether or not an item is listed on this worksheet is not necessarily an indicator of whether or not an item is taxable or deductible. Tax regulations change often and specific circumstances may determine whether

PDF Airline Professional - Tax Deduction Worksheet Tax Deduction Worksheet For Pilots, Flight Attendants, & Other Airline Personnel Dry Cleaning Curling Iron - Portable, Multi-voltage Continuing Education Correspondence Course Fees Materials & Supplies Equipment Publications - FAA Luggage Carts Luggage Locks Luggage Tags Publications - Entertainment (flight related) Alarm Clock - Portable ...

25 examples! What can flight crews write off? Why or why not? Expense example 15: A pilot tips a van driver to take him from the airport to the hotel (or vice versa). Yes. A tip to a van driver is deductible. This is a travel expense. Also, because it is a travel expense that is less than $75 a receipt is not required. However, the van tips still need to be substantiated.

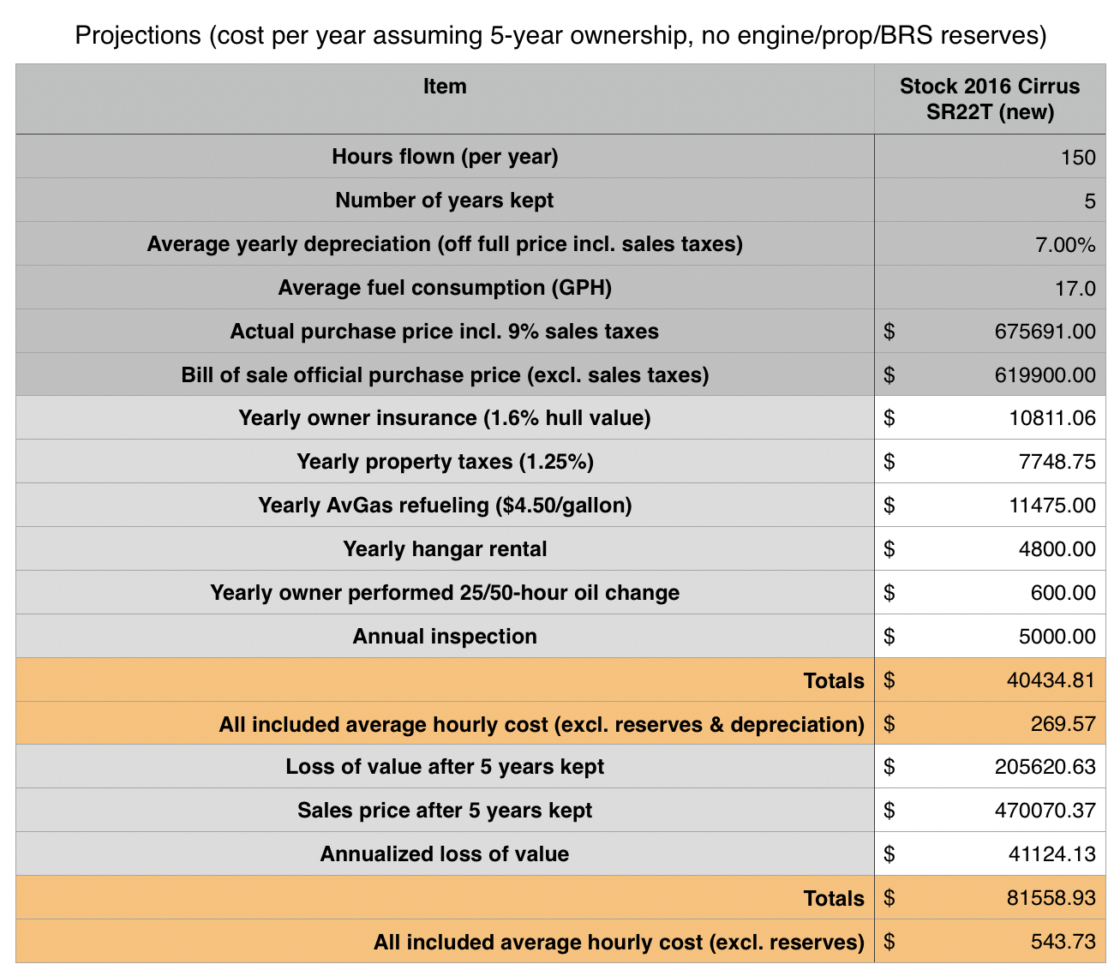

The Pilot's Guide to Taxes - AOPA The basic tax question posed by AOPA members who use aircraft for business purposes is whether their aircraft expenses are tax deductible. The types of expenses our members commonly look to deduct are the basic costs associated with aircraft operations, including maintenance, fuel, tie-down or hanger fees, landing fees, insurance, and depreciation.

Coursework Hero - We provide solutions to students Please Use Our Service If You’re: Wishing for a unique insight into a subject matter for your subsequent individual research; Looking to expand your knowledge on a particular subject matter;

Pilot-Tax - Your Tax Professionals They certainly know how to handle airline crew taxes from US airlines as well when I was an Ex-Pat, flying for a foreign airline. They knew the process. I have been impressed each year working with Brett Morrow and Pilot Tax." Henry Biernacki (Client Since 2003) EMAIL info@pilot-tax.com CALL 317-984-7666 FAX 1-800-951-8879

Per Diem Rates | GSA Sep 30, 2021 · Tax Questions? Have a question about per diem and your taxes? Please contact the Internal Revenue Service at 800-829-1040 or visit . GSA cannot answer tax-related questions or provide tax advice.

Air Crew Tax Specialist for Pilots and Crew Members 1. Go to the "Organizer page" and fill out the tax organizer that applies to your situation. Send the completed organizer, tax documents to Aircrew Taxes. New clients also have to include previous years tax returns. 2. Client makes payment with credit card, check, or refund transfer. 3. Aircrew Taxes processes all relevant tax information. 4.

Airline Pilot Salary – How Much Money Will I Earn As An Entry Level Pilot? And Who Are The ...

PDF Flight Crew Expense Report and Per Diem Information There are two types of deductions for pilots and flight attendants. First is out of pocket expenses such as uniforms, cell phone, union dues, etc. The second is the per diem allowance and deduction. We need both to prepare your tax returns. Please use this form to detail your flight attendant and pilot tax deductions.

0 Response to "42 airline pilot tax deduction worksheet"

Post a Comment