41 2014 tax computation worksheet

2014 Individual Income Tax Forms - Income Tax Forms Amended Individual Income Tax Return : IL-1040-X-V Payment Voucher for Amended Individual Income Tax: IL-1310 Statement of Person Claiming Refund Due a Deceased Taxpayer : IL-2210: Instr. Computation of Penalties for Individuals: IL-4562: Instr. Special Depreciation: IL-4644: Instr. 2014 Individual Income Tax Forms - Maryland Office of the ... Worksheet for resident taxpayers who were required to reduce their federal itemized reductions. ... Computation of Tax Preference Income Modification: ... Form and instructions for nonresidents to use to complete a nonresident amended return for tax year 2014.

› instructions › i1120ssdInstructions for Schedule D (Form 1120-S) (2021) - IRS tax forms Dec 31, 2020 · Enter the amount from line 28 of Form 1120 on line 17 of Schedule D. Attach to Schedule D the Form 1120 computation or other worksheet used to figure taxable income. For corporations figuring the built-in gains tax for separate groups of assets, taxable income must be apportioned to each group of assets in proportion to the net recognized built ...

2014 tax computation worksheet

PDF Ri-1041 Tax Computation Worksheet 2014 RI-1041 TAX COMPUTATION WORKSHEET 2014 BANKRUPTCY ESTATES use this schedule If Taxable Income- RI-1041, line 7 is: $0$0.00 (a) Enter Taxable Income amount from RI-1041, line 7 (b) Multiplication amount (c) Multiply (a) by (b) (d) Subtraction amount (e) Subtract (d) from (c) Enter here and on RI-1041, line 8 TAX $596.00 $2,276.20 $59,600 PDF 2014 Form IL-1040 Instructions - Illinois tax year 2014. Schedule CU. Schedule CU, Civil Union Income Report, has been eliminated . for tax year 2014. If you are in a civil union, you must file your Illinois return using the same filing status as on your federal return. Form 1099-G. Save taxpayer dollars and help the environment by obtaining . your 1099-G information from our website at PDF 2014 MIChIGAN Corporate Income Tax Penalty and Interest ... 2014 MIChIGAN Corporate Income Tax Penalty and Interest Computation for Underpaid Estimated Tax Issued under authority of Public Act 38 of 2011. Taxpayer Name Federal Employer Identification Number (FEIN) PART 1: ESTIMATED TAX REQUIRED 1. Total Tax Liability from Form 4891, line 43; Form 4905, line 41; or Form 4908, line 22. (If amending, see ...

2014 tax computation worksheet. › treasury › taxationNJ Division of Taxation - Prior Year Corporation Business Tax ... Form Title Category Document Link; Form Title Document Link; CBT-100: Corporation Business Tax Return Forms – Tax Years 2020-2015 CBT-100 – Separate Filer J.K. Lasser's Your Income Tax 2014: For Preparing Your 2013 ... J.K. Lasser Institute · 2013 · Business & EconomicsIfyour taxable income is less than $100,000, you generally must use the IRS Tax Table to look up your tax (22.2). Ifyour taxable income is $100,000 or more, ... 2014 Individual Income Tax Instructions (Rev. 9-14) - Kansas ... If line 7 is more than $100,000, you will need to use the Tax Computation. Worksheet on page 27 to compute your tax. If you are filing as a resident, skip lines ...25 pages 2014 Income Tax Forms - Nebraska Department of Revenue Form 1041N, Electing Small Business Trust Tax Calculation Worksheet. Form. Form 3800N - Nebraska Employment and Investment Credit Computation for All Tax Years. View Forms. Form 7004N, Application for Automatic Extension of Time to File Nebraska Corporation, Fiduciary, or Partnership Return. Form. Form 4797N, 2014 Special Capital Gains Election ...

2014 Tax Brackets 27 Nov 2013 — Table 1. 2014 Taxable Income Brackets and Rates. Rate, Single Filers, Married Joint Filers, Head of Household Filers · 10% ; Table 2. 2014 ...Married Filing Jointly: $82,100.00Single: $52,800.00Married Filing Separately: $41,050.00Filing Status: Exemption Amount Maryland Withholding Percentage Method Calculator Estimated Maryland and Local Tax Calculator - Tax Year 2014 This is an online version of the Form 502D tax worksheet. You can use this calculator to compute the amount of tax due, but this system does not allow you to file or pay the amount online. Once you have submitted the information, this system will generate an Estimated Tax Worksheet. Prior Year Products - IRS tax forms Tax Table, Tax Computation Worksheet, and EIC Table 2021 Inst 1040 (Tax Tables) Tax Table, Tax Computation Worksheet, and EIC Table 2020 Inst 1040 (Tax Tables) ... 2014 Inst 1040 (Tax Tables) Tax Table and Tax Rate Schedules 2013 Inst 1040 (Tax Tables) Tax Table and Tax Rate Schedules 2012 Inst 1040 (Tax Tables) ... PDF 2014 RI-1041ES Layout 1 - tax.ri.gov Your 2014 estimated income tax may be based upon your 2013 income tax liability. If you wish to compute your 2014 estimated income tax, use the enclosed estimated tax worksheet. WHEN AND WHERE TO MAKE ESTIMATES Make your first estimated payment for the period January 1, 2014 through December 31, 2014, on or before April 15, 2014.

PDF 2019 Tax Computation Worksheet - Wolters Kluwer 2019 Tax Computation Worksheet—Line 12a k! See the instructions for line 12a to see if you must use the worksheet below to figure your tax. Note. If you are required to use this worksheet to figure the tax on an amount from another form or worksheet, such as the Qualified Dividends Tax Worksheet 2014 - Balancing Equations Worksheet Tax Computation Worksheet 2014. If you your spouse or a dependent enrolled in health insurance through the marketplace you should A year beginning in 2014. Find helpsheets forms and notes to help you fill in the capital gains pages of your Self Assessment tax return. Complete the rest of Form 1040 or Form 1040NR. PDF 2014 Instruction 1040 - TAX TABLE - IRS tax forms 2014 Tax Table k! See the instructions for line 44 to see if you must use the Tax Table below to figure your tax. At Least But Less Than SingleMarried ling jointly* Married ling sepa-rately Head of a house-hold Tax Computation Worksheet 2014 - Templates : Resume Sample ... 21 Posts Related to Tax Computation Worksheet 2014 Tax Computation Worksheet 2014 In Excel Capital Gains Worksheet for 2014 2014 Capital Gains Carryover Worksheet Plate Tectonics Concept Map Worksheet 2015 Capital Gains Carryover Worksheet Capital Gains Tax Worksheet 2014 Best Resume Writing Books 2013 Plate Tectonics Worksheet Packet

PDF Tax Computation Worksheet - Louisiana Tax Computation Worksheet A Taxable Income: Print the amount from Line 3. 0 A0 B First Bracket: If Line A is greater than $12,500 ($25,000 if filing status is 2 or 5), Print $12,500 ($25,000 if filing status is 2 or 5). If Line A is less than $12,500 ($25,000 if filing status is 2 or 5), print the amount from Line A. B00 C 1. Combined Personal

apps.irs.gov › app › picklistForms and Instructions (PDF) - IRS tax forms 02/13/2014 Form 14457: Voluntary Disclosure Practice Preclearance Request and Application 0222 02/09/2022 Form 14454: Attachment to Offshore Voluntary Disclosure Letter 1217 12/21/2017 Form 14453: Penalty Computation Worksheet 1215 01/06/2016 Form 14452

› tax-forms › virginia-form-760Virginia Tax Form 760 Instructions | eSmart Tax A. Bonus Depreciation If depreciation was included in the computation of your Federal Adjusted Gross Income and one or more of the depreciable assets received the special 30% or 50% bonus depreciation deduction for federal purposes in any taxable year from 2001 through 2014, then depreciation must be recomputed for Virginia purposes as if such assets did not receive the special 30% or 50% ...

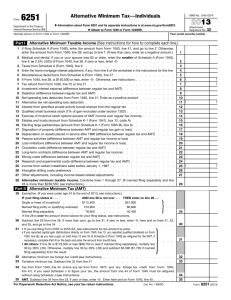

PDF 2020 Tax Computation Worksheet—Line 16 (a) Enter the amount from line 15 (b) Multiplication amount (c) Multiply (a) by (b) (d) Subtraction amount Tax. Subtract (d) from (c). Enter the result here and on the entry space on line 16. At least $100,000 but not over $163,300 × 24% (0.24) 5,920.50 Over $163,300 but not over $207,350 × 32% (0.32) $ 18,984.50 Over $207,350 but not over $518,400

Tax Computation Worksheet 2014 In Excel - Templates ... Tax Table Worksheet 2014 Child Tax Credit Worksheet Part 2 2014 2014 Capital Gains Carryover Worksheet Excel Vba Column Width In Centimeters Tax Computation Worksheet In Excel Capital Gains Worksheet for 2014 Qualified Dividends and Capital Gain Tax Worksheet Line 24 Plate Tectonics Concept Map Worksheet Plate Boundaries Worksheet Doc

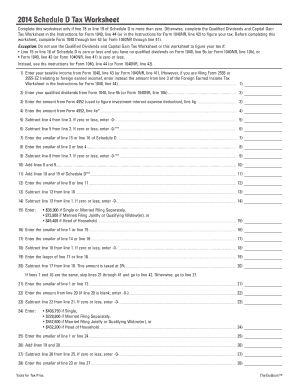

Qualified Dividends and Capital Gains ... - The Tax Adviser It takes 27 lines in the IRS qualified dividends and capital gain tax worksheet to work through the computations (Form 1040 Instructions (2013), p. 43). With a good understanding of the mechanics, preparers can spot opportunities to advise clients to take advantage of the 0% rate and minimize the 20% rate.

J.K. Lasser's Your Income Tax 2015: For Preparing Your 2014 ... J.K. Lasser Institute · 2014 · Business & EconomicsForeign Earned Income Tax Worksheet • Your 2014 tax liability from the TaxTable is ... tax liability on Form 1040 using the IRS's Tax Computation Worksheet.

PDF 2014 MICHIGAN Business Tax Penalty and Interest ... 2014 MICHIGAN Business Tax Penalty and Interest Computation for Underpaid Estimated Tax Issued under authority of Public Act 36 of 2007. Name Federal Employer Identification Number (FEIN) or TR Number PART 1: ESTIMATED TAX REQUIRED 1.

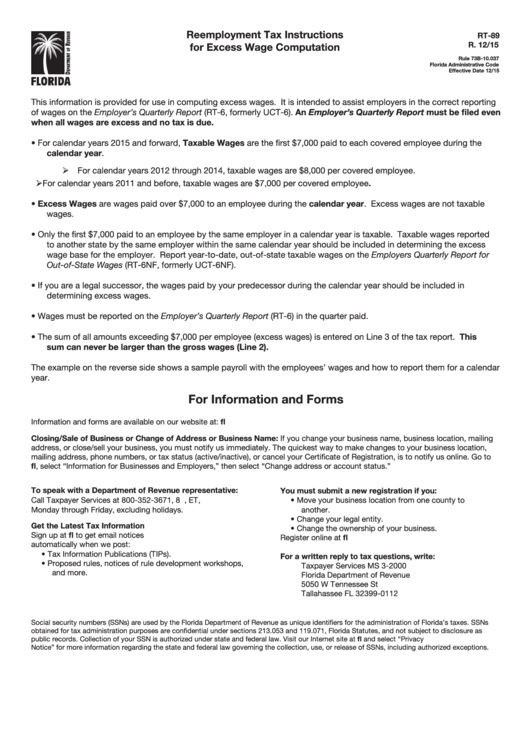

2014 Tax Tables Complete_Layout 1 RHODE ISLAND TAX COMPUTATION WORKSHEET. RHODE ISLAND TAX RATE SCHEDULE. 2014. TAX RATES APPLICABLE TO ALL FILING STATUS TYPES. Taxable Income (line 7).7 pages

Tax Organizer Worksheet 2014 - Worksheet : Template Sample ... Posts Related to Tax Organizer Worksheet 2014. Tax Organizer Template 2014. 2011 Tax Organizer Worksheet

How do I display the Tax Computation Worksheet? - Intuit The Tax Computation Worksheet does not appear as a form or worksheet in TurboTax. The calculation is done internally. You can see the Tax Computation Worksheet on page 89 of the IRS instructions for Form 1040. Be sure to read the paragraph at the top of the worksheet regarding what amount to enter in column (a).

PDF 2014 Net Profit Tax Worksheets - Phila WORKSHEETS A, B and C 2014 NET PROFITS TAX RETURN These are worksheets only. Do not file these worksheets with your return. Instructions for Worksheets A and B Enter on Line 1 the net income or loss from the appropriate Federal Tax return(s) or if applicable, the Profit and Loss Statement.

› instructions › i1040gi1040 (2021) | Internal Revenue Service - IRS tax forms Tax Table or Tax Computation Worksheet. Form 8615. ... 2014-44 I.R.B. 753, ... Use the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax ...

0 Response to "41 2014 tax computation worksheet"

Post a Comment