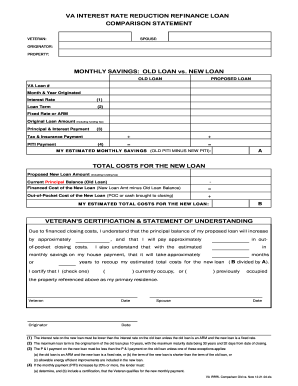

40 interest rate reduction refinance loan worksheet

VA Home Loan Options Overview - MilitaryBenefits.info VA Refinance Loan Options: Cash-Out, Interest Rate Reduction Refinance Loans. VA home loans can be used to refinance an existing mortgage. For VA cash-out refinance loans, the mortgage to be refinanced does NOT have to be a VA home loan; conventional, USDA, FHA and other mortgages may be refinanced with a VA mortgage loan. VA Mortgage Rates for May 2022 - CNET 30-Year Fixed-Rate FHA. 4.54%. 5.34%. 30-Year Fixed-Rate Jumbo. 5.34%. 5.35%. *Rates as of May 23, 2022. We use information collected by Bankrate, which is owned by the same parent company as CNET ...

Agency Information Collection Activity: Interest Rate Reduction ... The purpose is to consolidate information collection requirements applicable only for interest rate reduction refinance loans (IRRRLs) under one information collection package. An agency may not conduct or sponsor, and a person is not required to respond to a collection of information unless it displays a currently valid OMB control number.

Interest rate reduction refinance loan worksheet

PDF Interest Rate Reduction - HUD Created Date: 4/17/2015 9:16:23 AM Agency Information Collection Activity: Interest Rate Reduction ... Title: Interest Rate Reduction Refinancing Loan Worksheet (VA 26-8923). OMB Control Number: 2900-0386. Type of Review: Revision. Abstract: VA is revising this information collection to incorporate regulatory collection requirements previously captured under OMB control number 2900-0601. The purpose is to consolidate information collection ... Loan Modification Vs. Refinance | Rocket Mortgage Jan 06, 2022 · Unlike a refinance, a loan modification doesn’t pay off your current mortgage and replace it with a new one. Instead, it directly changes the conditions of your loan. ... Interest rate reduction: If interest rates are lower now than when you locked into your mortgage loan, you might be able to modify your loan and get a lower rate. This ...

Interest rate reduction refinance loan worksheet. VA IRRRL Document Checklist for a Smooth Loan Process Interest Rate Reduction Refinancing Worksheet which calculates your maximum loan amount Report and Certification of Loan Disbursement HUD-1 Closing Statement Federal Collection Policy Notice Certification from your lender that your current VA loan payments were on time Any documentation pertaining to energy efficient changes included in the loan PDF Circular 26-17-12 - Change 1 - Veterans Affairs Washington, D.C. 20420 May 12, 2017 Instructions for Completion of VA Form 26-8923, Interest Rate Reduction Refinance Loan Worksheet 1. Purpose. The purpose of this change is to make minor corrections to Circular 26-17-12. 2. Therefore, Circular 26-17-12 is changed as follows: SBA ELIGIBILITY QUESTIONNAIRE FOR STANDARD 7(a) … SBA has restrictions on the guaranty percentage, loan maturity, interest rate and amount of the loan. Complete all items below. If “No” is checked, the loan may not comply with these loan term restrictions. a. Maximum Guaranty Percentage. The SBA maximum guaranty percentage is 85% for loans of $150,000 Publication 537 (2021), Installment Sales - IRS tax forms The test rate of interest for a contract is the 3-month rate. The 3-month rate is the lower of the following applicable federal rates (AFRs). The lowest AFR (based on the appropriate compounding period) in effect during the 3-month period ending with the first month in which there’s a binding written contract that substantially provides the ...

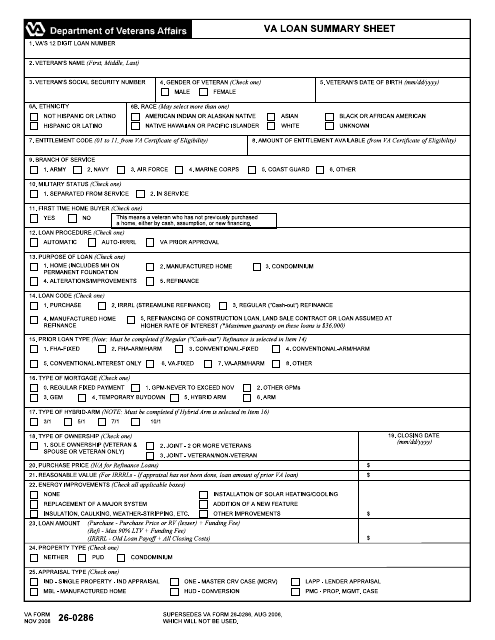

INTEREST RATE REDUCTION REFINANCING LOAN ... NOTE - Submit this form when requesting guaranty on an Interest Rate Reduction Refinancing Loan. 18. EXISTING VA LOAN BALANCE (PLUS COST OF ENERGY EFFICIENT.1 page VA Rate Reduction Form Changes - Summit Help Knowledge Base - Confluence VA Circular 26-17-12 clarifies the VA requirements regarding the completion of VA Form 26-8923, Interest Rate Reduction Refinancing Loan Worksheet, effective for all Interest Rate Reduction Refinance Loan (IRRRL) applications originated (initial Fannie Mae Form 1003 application date) on or after July 2, 2017. This Circular clarifies that the ... About VA Form 26-8923 | Veterans Affairs About VA Form 26-8923. Form name: Interest Rate Reduction Refinancing Loan Worksheet. Related to: Housing assistance. Form last updated: January 4, 2022. origination guide 13 - Veterans Affairs ~ To refinance an existing home loan. ~ Cash-out refinance. ~ Reduce the interest rate (Interest Rate Reduction Loan or Streamline) ~ Hybrid Adjustable Rate Mortgage ~ Adjustable Rate Mortgage ~ Convert an adjustable rate mortgage (ARM) to a fixed rate mortgage. ~ To purchase a multi-family property (up to four units). The veteran must occupy ...

VA Interest Rate Reduction Refinance Loans (IRRRL) IRRRL borrowers who are not exempt will need to pay the VA Funding Fee. The good news is that this fee is significantly lower for an IRRRL (0.5 percent) compared to the fee for first-time and subsequent purchase and Cash-Out refinance loans. For example, the funding fee on a typical $200,000 loan would be $1,000. Interest Rate Reduction Refinance Loan | Veterans Affairs Jan 12, 2022 · Often called a “streamline” refinance, an IRRRL may help you to: Lower your monthly mortgage payment by getting you a lower interest rate, or Make your monthly payments more stable by moving from a loan with an adjustable or variable interest rate (an interest rate that changes over time) to one that’s fixed (the same interest rate over the life of the loan) Supporting Dtatement for Va Form 26-8923 2. Lenders are required to complete VA Form 26-8923, Interest Rate Reduction Refinancing Loan Worksheet, on all interest rate reduction refinancing loans and submit the form in the loan file when selected by VA for quality review. PDF Interest Rate Reduction Refinance Loan Rate Reduction Refinance Loan (IRRRL) generally lowers the interest rate by refinancing an existing VA home loan. By obtaining a lower interest rate, the monthly mortgage payment should decrease. Eligible borrowers can also refinance an adjustable-rate mort - gage (ARM) into a fixed-rate mortgage.

PDF Interest Rate Reduction Refinancing Loan Worksheet SECTION I - INITIAL COMPUTATION OMB Approved No. 2900-0386 Respondent Burden: 10 minutes VA LOAN NUMBER NOTE - Submit this form when requesting guaranty on an Interest Rate Reduction Refinancing Loan. 18. EXISTING VA LOAN BALANCE (PLUS COST OF ENERGY EFFICIENT IMPROVEMENTS) 2. 3. SUBTOTAL ADD % DISCOUNT BASED ON LINE 4 LINE NO.

Va Irrrl Worksheet : Best Va Interest Rate Reduction Refinance Loans Irrrl : If you currently ...

PDF Interest Rate Reduction Refinancing Loan Worksheet INTEREST RATE REDUCTION REFINANCING LOAN WORKSHEET. VA will not disclose information collected on this form to any source other than what has been ...

Va Irrrl Worksheet : Best Va Interest Rate Reduction Refinance Loans Irrrl : If you currently ...

Interest Rate Reduction Refinancing Loan Tips | Military.com An Interest Rate Reduction Refinancing Loan (IRRRL) can be done only when the veteran already has his or her entitlement used for a VA loan on the property to be refinanced. In other words, it must...

Originate & Underwrite - Freddie Mac Find out if Freddie Mac owns your loan using our secured lookup tool. ... .pdf Interest Rate Cap Options for Floating-Rate Cash Loans 2/19/2016.pdf Supplemental Loans: ... cash equity, .10x increase in dcr, 5% reduction in ltv, commercial space underwritten as vacant, forbearance, inspection guidance, ...

VA Clarifies and Establishes Requirements with ... - Loan Audit Software existing loan balance allowable, Interest Rate Reduction Refinancing Loan Worksheet, maximum allowable closing costs, maximum loan amount, principal reduction from veteran VA issued Circular 26-17-12, clarifying and establishing requirements with respect to completion of VA Form 26-8923 (Interest Rate Reduction Refinancing Loan Worksheet).

VA IRRRL Cost Recoupment Worksheet VA IRRRL Cost Recoupment Worksheet This worksheet is REQUIRED for all VA Interest Rate Reduction Refinance loans. File Name: Loan Number: MONTHS TO RECOUP The following calculates the total number of months to recoup all fees and charges financed as part of ... If the IRRRL reduces the loan term or converts an existing ARM to a fixed rate ...

Chapter 4 The form is not required for Interest Rate Reduction Refinancing Loans (except IRRRLs to refinance delinquent VA loans). 5 Indicate the loan decision in item 50 of the Loan Analysis after ensuring that the treatment of income, debts, and credit is in compliance with VA underwriting standards. 6 Loans closed by an automatic lender

0 Response to "40 interest rate reduction refinance loan worksheet"

Post a Comment