38 student loan interest deduction worksheet 1040a

Form 1098-E | Cornell University Division of Financial Affairs Each student receiving a 1098-E form is responsible for determining whether he or she is eligible to deduct the interest in accordance with IRS regulations. See IRS Forms and Publications for more details. For other questions about the 1098-E form, contact the Student Loan office, (607) 255-7234. What is a 1098-E form? How to Deduct Student Loan Interest - Tax Guide • 1040.com ... The max deduction is $2,500 for your 2021 tax return. This max is per return, not per taxpayer, even if both spouses on a joint return qualify for the deduction. Note: Since federal student loan interest was waived in 2021, the interest deduction will only apply to non-federal loans that continued to charge interest.

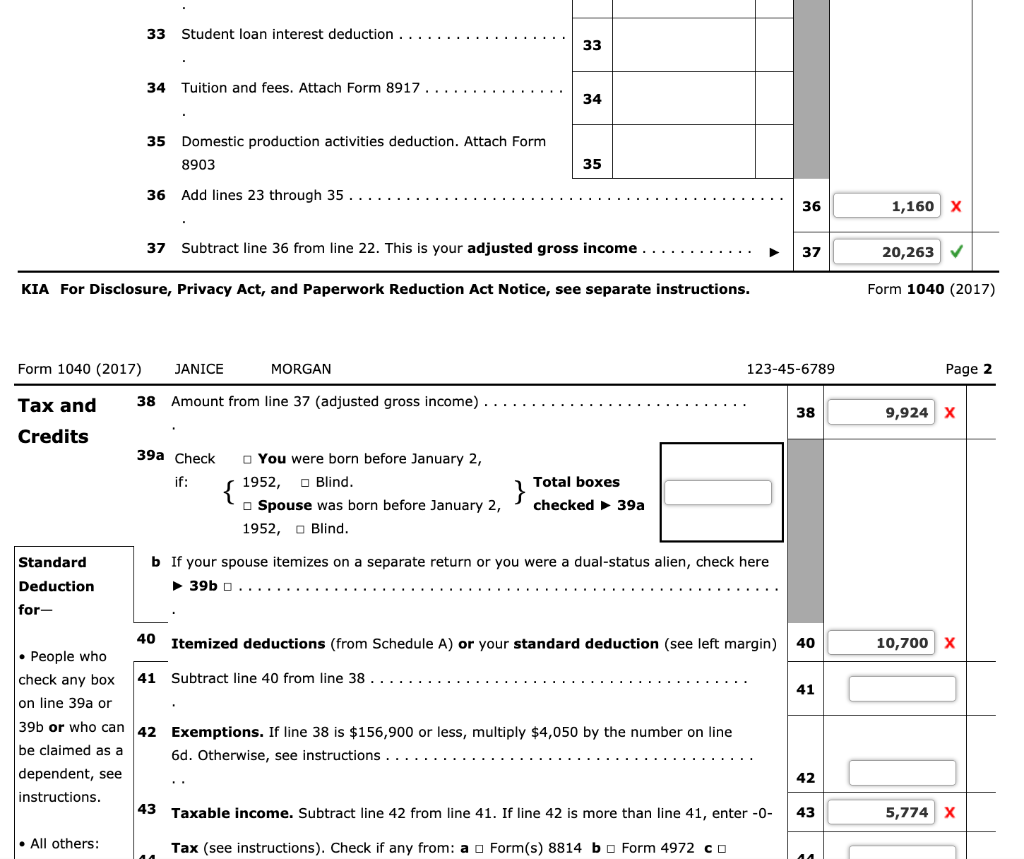

Tax Form 1040 Student Loan Interest - Frank Financial Aid Tax Form 1040 Student Loan Interest. Updated August 20, 2021. Most interest that you pay throughout the year isn't tax-deductible. However, for some people, there's a special deduction they can take for paying interest on a student loan when they file the standard federal income tax form 1040. This can reduce your income tax by up to $2,500.

Student loan interest deduction worksheet 1040a

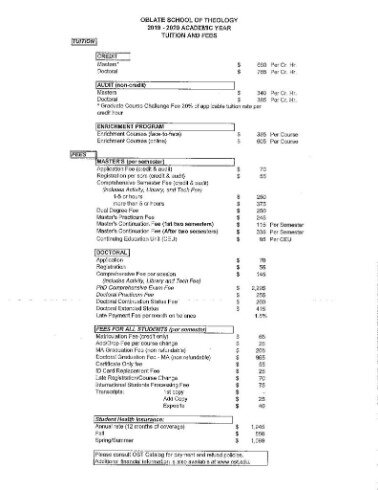

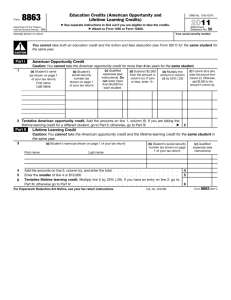

How Student Loan Interest Deduction Works | VSAC Please log into your MyVSAC account to view the amount of interest paid. Fill out your 1040 or 1040A. To determine your student loan interest tax deduction, use the information from your 1098-E and follow the directions within the IRS Form 1040 or 1040A instruction booklet. Ask for help. PDF for Education Tax Benefits - IRS tax forms Student loan interest deduction. • For 2021, the amount of your student loan interest de-duction is gradually reduced (phased out) if your MAGI is between $70,000 and $85,000 ($140,000 and $170,000 if you file a joint return). You can't claim the deduction if your MAGI is $85,000 or more ($170,000 or more if you file a joint return). • 1040A The only adjustment to income you can claim are educator expenses, IRA deduction, student loan interest deduction, or tuition and fees deduction. The only tax credits you can claim are the child tax credit, additional child tax credit, education credit, earned income credit, child and dependent care credit, or retirement savings contributions ...

Student loan interest deduction worksheet 1040a. What Is Form 1040-A? - The Balance Form 1040-A was much faster and easier to prepare by hand than the longer Form 1040, but it covered more deductions and tax credits than Form 1040EZ, the other simplified return option that was available until 2018. For example, it was possible to deduct IRA contributions and student loan interest on the 1040-A, but not on the 1040EZ. Publication 970 (2021), Tax Benefits for Education ... Student loan interest deduction. For 2021, the amount of your student loan interest deduction is gradually reduced (phased out) if your MAGI is between $70,000 and $85,000 ($140,000 and $170,000 if you file a joint return). ... You can use Worksheet 1-1 to figure the tax-free and taxable parts of your athletic scholarship. PDF Qualified student loan interest deductions are reported on ... Qualified student loan interest deductions are reported on Form 1040, Schedule 1. DO NOT FILE July 11, 2019 DRAFT AS OF SCHEDULE 1 (Form 1040 or 1040-SR) Department of the Treasury Internal Revenue Service Additional Income and Adjustments to Income Attach to Form 1040 or 1040-SR. Student Loan Interest Deduction - Uncle Fed Generally, you figure the deduction using the Student Loan Interest Deduction Worksheet in the Form 1040 or Form 1040A instructions. However, if you are filing Form 2555, 2555-EZ, or 4563, or you are excluding income from sources within Puerto Rico, you must complete Worksheet 4-1 below.

Entering Form 1098-E in ProSeries - Intuit Press F6 to bring up Open Forms. Type STU and press Enter. Enter the information from your client's form (s) 1098-E in Part I. Amount you enter in Part I, column (e) will flow to Part II, line 1 for the Computation of the Student Loan Interest Deduction. It is important to note the following: PDF Student Loan Interest Deduction Worksheet Form 1040, Line ... Enter the total interest you paid in 2016 on qualified student loans (see instructions). Do not enter more than $2,500 Enter the amount from Form 1040, line 22 or Form 1040A, line 15 Enter the total of the amounts from Form 1040, lines 23 through 32, plus any write-in adjustments you entered on the dotted line next to line 36 or from Form 1040A ... 2021 1040 Form and Instructions (Long Form) Standard Deduction Worksheet for Dependents (Line 12a) Student Loan Interest Deduction Worksheet Form 1040 is generally published in December of each year by the IRS. Form 1040 Instructions are often published later in January to include any last minute legislative changes. When published, the current year 2021 1040 PDF file will download. Topic No. 456 Student Loan Interest Deduction | Internal ... Mar 14, 2022 · It includes both required and voluntarily pre-paid interest payments. You may deduct the lesser of $2,500 or the amount of interest you actually paid during the year. The deduction is gradually reduced and eventually eliminated by phaseout when your modified adjusted gross income (MAGI) amount reaches the annual limit for your filing status.

Frequently Asked Questions | UIC Law | University of ... Figure the deduction using the "Student Loan Interest Deduction Worksheet" in the Form 1040 or Form 1040A instructions. There are many other provisions to the Taxpayer Relief Act.Please consult with your tax advisor to be sure you are eligible for any of these taxpayer benefits. Beneficial Education Credits for Student Expenses And ... Student Loan Interest Deduction. If you have started to pay back your student loans, you may be able to reduce your taxable income by up to $2,500 of the student loan interest you have paid for you, your spouse, or your dependent. This also includes the one-time "loan origination fee" charged by your lender. Where To Put Student Loan Interest On 1040 ... The student loan interest deduction is reportable on Form 1040 in the AGI category. Loan servicers make reporting this amount on your taxes easy: theyre required to send you a Form 1098-E stating how much you paid in interest. The student loan tax deduction for paid interest is limited to $2,500, and its also limited by your income. Student Loan Interest Deduction Generally, you figure the deduction using the Student Loan Interest Deduction Worksheet in the Form 1040 or Form 1040A instructions. However, if you are filing Form 2555, 2555-EZ, or 4563, or you are excluding income from sources within Puerto Rico, you must complete Worksheet 3-1 in this publication.

Solved: Student Loan Deduction - Intuit The "student loan interest received by lender" line item on my 1098-E form does not match the "student loan interest deduction" (line item 33) on my completed 1040 form. The "student loan interest received by lender" is much higher. Is my 1040 form correct? If so, how was this amount calculated?

PDF Page 96 of 117 14:16 - 24-Jan-2019 - IRS tax forms Enter the amount from Form 1040, line 6 2. 3. Enter the total of the amounts from Schedule 1, lines 23 through 32, plus any write-in adjustments you entered on the dotted line next to Schedule 1, line 36 other than any amounts identified as "DPAD" 3. 4. Subtract line 3 from line 2 4. 5. Enter the amount shown below for your filing status.

Student Loan Interest Deduction Worksheet - Agaliprogram This max is per return, not per taxpayer, even if both spouses on a joint return qualify for the deduction. You may deduct the lesser of $2,500 or the amount of interest you actually paid during the year. Enter the result here and on form 1040, line 33 or form 1040a, line 18. Since Federal Student Loan Interest.

Solved: Re: Student Loan Deduction The "student loan interest received by lender" line item on my 1098-E form does not match the "student loan interest deduction" (line item 33) on my completed 1040 form. The "student loan interest received by lender" is much higher. Is my 1040 form correct? If so, how was this amount calculated?

The Federal Student Loan Interest Deduction Dec 24, 2021 · The maximum student loan interest deduction you can claim is $2,500 as of the 2021 tax year, and it might be less. It can be limited by your income. The deduction is reduced for taxpayers with modified adjusted gross incomes (MAGIs) in a certain phaseout range and is eventually eliminated entirely if your MAGI is too high. 4

Section 2300: Student Loan Interest Deductions | NACUBO Tax The maximum available deduction is the total amount of student loan interest paid in the calendar year or $2,500, whichever is smaller, subject to the phase-out formula. PRACTICE TIP. The instructions to Form 1040, Form 1040A, and Form 1040NR include a Student Loan Interest Deduction Worksheet.

1040A The only adjustment to income you can claim are educator expenses, IRA deduction, student loan interest deduction, or tuition and fees deduction. The only tax credits you can claim are the child tax credit, additional child tax credit, education credit, earned income credit, child and dependent care credit, or retirement savings contributions ...

PDF for Education Tax Benefits - IRS tax forms Student loan interest deduction. • For 2021, the amount of your student loan interest de-duction is gradually reduced (phased out) if your MAGI is between $70,000 and $85,000 ($140,000 and $170,000 if you file a joint return). You can't claim the deduction if your MAGI is $85,000 or more ($170,000 or more if you file a joint return). •

How Student Loan Interest Deduction Works | VSAC Please log into your MyVSAC account to view the amount of interest paid. Fill out your 1040 or 1040A. To determine your student loan interest tax deduction, use the information from your 1098-E and follow the directions within the IRS Form 1040 or 1040A instruction booklet. Ask for help.

/ScheduleA-ItemizedDeductions-fc8aa38a36d84f93a4fc2cbb62779cd0.png)

0 Response to "38 student loan interest deduction worksheet 1040a"

Post a Comment