40 mortgage insurance premiums deduction worksheet

Mortgage Insurance Premiums - taxact.com See Line 13 in the instructions for Schedule A (Form 1040) and complete the Mortgage Insurance Premiums Deduction Worksheet to figure the amount you can deduct. If your adjusted gross income is more than $109,000 ($54,500 if married filing separately), you cannot deduct your mortgage insurance premiums. Form 1098. PDF 2018 Qualified Mortgage Insurance Premium Worksheet limited and you must use the worksheet below to figure your deduction. 1. Enter the total premiums you paid in 2017 for qualified mortgage insurance for a contract entered into on or after January 1, ... 2018 Qualified Mortgage Insurance Premiums Deduction Worksheet

PDF 2021 Itemized Deduction Worksheet Dentists & Dental Work Mortgage Insurance Premium Hearing Aids Nursing Home Second Home Mortgage Optometry, Glasses, Contacts Points (Form 1098) ... Total Itemized Deductions: 2021 ITEMIZED DEDUCTION WORKSHEET *Donations over $250 must include a Receipt" Standard Deduction (Single $12,550, Head of Household $18,800, Married $25,100)

Mortgage insurance premiums deduction worksheet

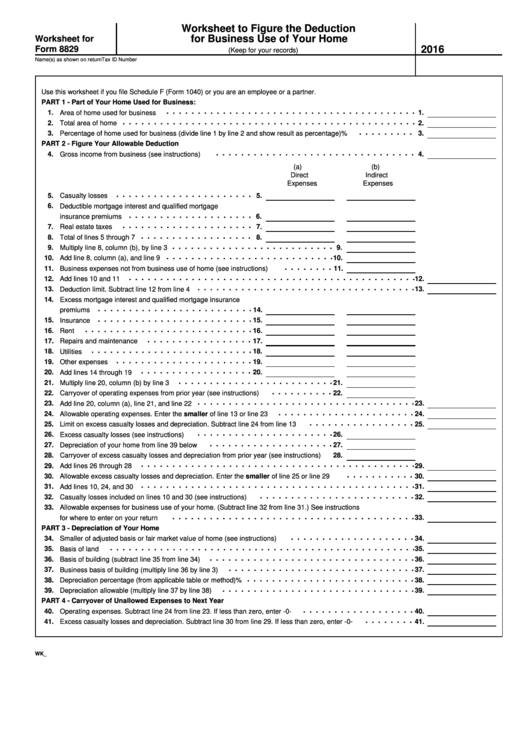

Instructions for Form 8829 (2021) | Internal Revenue Service Add the business percentages you figured in the first two steps and enter the result on line 7. Attach a statement with your computation and enter "See attached computation" directly above the percentage you entered on line 7. Line 4 Enter the total number of hours the facility was used for daycare during the year. Example. Montana Standard Deduction, Qualified Mortgage Insurance ... Standard Deduction, Qualified Mortgage Insurance Premiums Deduction and Itemized Deduction Limitation (OBSOLETE) Form 2 Worksheet V and IV St No ap le s Clear Form 2018 Montana Individual Income Tax Return Form 2 For the year Jan 1 - Dec 31, 2018 or the tax year beginning M M D D 2 0 1 8 and ending M M D D 2 0 Y Y First name and initial Last name Social security number Deceased? Can I Deduct My Mortgage Insurance Premiums? - The Nest The IRS provides you with a "Qualified Mortgage Insurance Premiums Deduction Worksheet" to fill out to determine limitations for deducting mortgage insurance. Again, this applies if your AGI exceeds $100,000, or $50,000 for married filing separately.

Mortgage insurance premiums deduction worksheet. 2021 Instructions for Schedule A - IRS tax forms •Insurance premiums for medical and dental care, including premiums for qualified long-term care insurance con-tracts as defined in Pub. 502. But see Limit on long-term care premiums you can deduct, later. Reduce the insurance premiums by any self-employed health insurance deduction you claimed on Schedule 1 (Form 1040), line 17. You When Is Mortgage Insurance Tax Deductible? You bought a $200,000 house, put down 5%, and paid $1,500 in PMI premiums ($125 times 12 months). The deduction for PMI cuts your taxable income by $1,500. If you're in the 12% tax bracket, you... PDF Department of Taxation Announcement No. 2021-01 For taxpayers filing Form N-11, the deduction for mortgage interest premiums and other deductible interest will be added together in Worksheet A-3 in the 2020 Form N-11 Instructions and reported on Form N-11, line 21c. Mortgage Insurance Premiums Enter the qualified mortgage insurance premiums you paid under a mortgage insurance Qualified Mortgage Insurance Premiums - No Longer Deductible You can't deduct your mortgage insurance premiums if the amount on Form 1040, line 38, is more than $109,000 ($54,500 if married filing separately). If the amount on Form 1040, line 38, is more than $100,000 ($50,000 if married filing separately), your deduction is limited and you must use the Mortgage Insurance Premiums Deduction Worksheet to ...

Mortgage Insurance Premiums Deduction Worksheet Mortgage Insurance Premiums Deduction Worksheet 1/5 Kindle File Format Mortgage Insurance Premiums Deduction Worksheet Basis of Assets-United States. Internal Revenue Service Medical and Dental Expenses- 1990 Tele-tax-United States. Internal Revenue Service 1988 Your Federal Income Tax for Individuals-United States. Internal Revenue Service 1999 Qualified Mortgage Insurance Premiums - No Longer Deductible You can't deduct your mortgage insurance premiums if the amount on Form 1040, line 38, is more than $109,000 ($54,500 if married filing separately). If the amount on Form 1040, line 38, is more than $100,000 ($50,000 if married filing separately), your deduction is limited and you must use the Mortgage Insurance Premiums Deduction Worksheet to ... Publication 587 (2021), Business Use of Your Home ... Instructions for the Worksheet To Figure the Deduction for Business Use of Your Home Partners. Part 1—Part of Your Home Used for Business Lines 1-3. Part 2—Figure Your Allowable Deduction Line 4. Lines 5-7. Taxpayers claiming the standard deduction. Casualty losses reported on line 5. Casualty losses reported on Schedule A. Excess casualty losses. When is PMI Tax Deductible? - NextAdvisor with TIME Aug 05, 2021 · That’s $996 to $2316 in a year on top of your mortgage, interest, and homeowner’s insurance. In the past few years, the rules affecting the federal tax deduction have changed repeatedly.

PDF 2019 Qualified Mortgage Insurance Premiums Worksheet mortgage insurance" during 2019 in connection with home acquisition debt on your qualified home are deductible as home mortgage insurance premiums. Qualified mortgage insurance is mortgage insurance provided by the Veterans Administration, the Federal Housing Administration, or the Rural Housing Administration, and private mortgage insurance. Publication 936 (2021), Home Mortgage Interest Deduction You can deduct home mortgage interest on the first $750,000 ($375,000 if married filing separately) of indebtedness. However, higher limitations ($1 million ($500,000 if married filing separately)) apply if you are deducting mortgage interest from indebtedness incurred before December 16, 2017. Future developments. 2019 Qualified Mortgage Insurance Premiums Deduction ... You cannot deduct your mortgage insurance premiums if the amount on Form 740-NP, line 8, is more than $109,000 ($54,500 if married filing separate returns). If the amount on Form 740-NP, line 8, is more than $100,000 ($50,000 if married filing separate returns), your deduction is limited and e worksheet below to figure your deduction Created Date PDF Instructions for Form IT-196 New York Resident ... Therefore, the deduction for mortgage insurance premiums is notallowed as a New York itemized deduction for tax year 2021. Lines 10 and 11 - Home mortgage interest A home mortgage is any loan that is secured by your main home or second home. It includes first and second mortgages, home equity loans, and refinanced mortgages.

2021 Instructions for Schedule A (2021) - Internal Revenue ... You can't deduct insurance premiums paid by making a pre-tax reduction to your employee ... State and Local General Sales Tax Deduction Worksheet—Line 5a ...

Worksheet For Form 8829 - Worksheet To Figure The Deduction For Business Use Of Your Home - 2016 ...

Tax Deductions That Went Away After the Tax Cuts and Jobs Act Dec 30, 2021 · IRS Publication 600: A document published by the Internal Revenue Service (IRS) that provides information on deducting state and local sales taxes from federal income tax. IRS Publication 600 was ...

Deduction - Iowa Standard Deduction If you use the Iowa standard deduction check the standard box on line 37 and enter your standard deduction. $1,900 for filing statuses 1, 3, and 4 $4,670 for filing statuses 2, 5, and 6 Itemized Deduction If you itemize, complete the Iowa Schedule A, check the itemized box on line 37 and enter your total itemized deduction.

Solved: Form 8829 line 10 standard deduction problem - Intuit Instructions for Form 8829 from IRS say that mortgage insurance premiums for those not itemizing deductions will also go to Line 16 excess mortgage interest. In TT, do not use the mortgage premium screed to enter this number, but instead, add it to the interest you are reporting as excess mortgage interest.

How Does VGLI Compare To Other Insurance Programs? - Life ... Jul 31, 2018 · Most insurance plans use a health review to determine eligibility for insurance coverage. Certain medical conditions can make it difficult to pass this health review and obtain coverage. In the case of VGLI, eligible members can apply during the “240-day no-health” application period and be approved without any health review, regardless of ...

How to populate qualified mortgage insurance premiums on ... The reason the Qualified Mortgage Insurance Premium isn't being allowed is because of the limit on the amount you can deduct: The limit is $109,000 ($54,500 if Married Filing Separately). If the amount is more than $100,000 ($50,000 if Married Filing Separately), your deduction is limited, and you must use the worksheet to figure your deduction.

Life Insurance Needs Analysis Worksheet - Calculators Especially when you are young and first contemplating the need for a life insurance policy, premiums can be frightening. There commonly two types of policies: term life and whole life. Term life policies are great when you need a large amount of insurance but do not have enough money to pay the larger premium of whole life (permanent) insurance.

Deduction Interest Mortgage - IRS tax forms Mortgage Insurance Premiums. Form 1098, Mortgage Interest Statement. How To Report. Special Rule for Tenant-Stockholders in Cooperative Housing Corporations. Part II. Limits on Home Mortgage Interest Deduction. Home Acquisition Debt. Grandfathered Debt. Worksheet To Figure Your Qualified Loan Limit and Deductible Home Mortgage Interest ...

Page 20 of 37 Instructions for Form 1041 and Schedules A ... amortizable bond premium on taxable limitations on indebtedness. the mortgage is satisfied before its bonds acquired after October 22, 1986, Qualified mortgage insurance term, no deduction is allowed for the but before January 1, 1988) that is paid premiums. Enter (on the worksheet unamortized balance. See Pub. 936 for

Mortgage Insurance Premium Tax Deduction 2019 - DGA Consultants - Home | Facebook / To deduct ...

Learn About Mortgage Insurance Premium Tax Deduction. If you're single, filing as head of household, or married and filing jointly, the deduction begins phasing out by 10% for each $1,000 by which your adjusted gross income (AGI) exceeds $100,000. 12 In effect, this means that you're not eligible to claim the deduction if your adjusted gross income exceeds $109,000.

Assets Plant Prepaid insurance Interest receivable Inventories Research costs Land revalued Loan ...

PDF Deductions (Form 1040) Itemized - IRS tax forms creased standard deduction, re-port amounts only on line 28 as instructed. See Increased Standard De-duction Reporting, later. Mortgage insurance premiums. The deduction for mortgage insurance premi-ums has been extended through 2017. You can claim the deduction on Line 13 for amounts that were paid or accrued in 2017.

PDF Mortgage Insurance Premiums Deduction Worksheet - Line 8d ... Enter the total premiums you paid in 2020 for qualified mortgage insurance for a contract issued after December 31, 2006 Enter the amount from Form 1040 or 1040-SR, line 11 Enter $100,000 ($50,000 if married filing separately) Is the amount on line 2 more than the amount on line 3? Your deduction isn't limited.

![[OR] Help me evaluate mortgage terms | Program Realty](https://carson.s3.amazonaws.com/grabs/loanestimate1.png)

0 Response to "40 mortgage insurance premiums deduction worksheet"

Post a Comment