39 shareholder basis worksheet excel

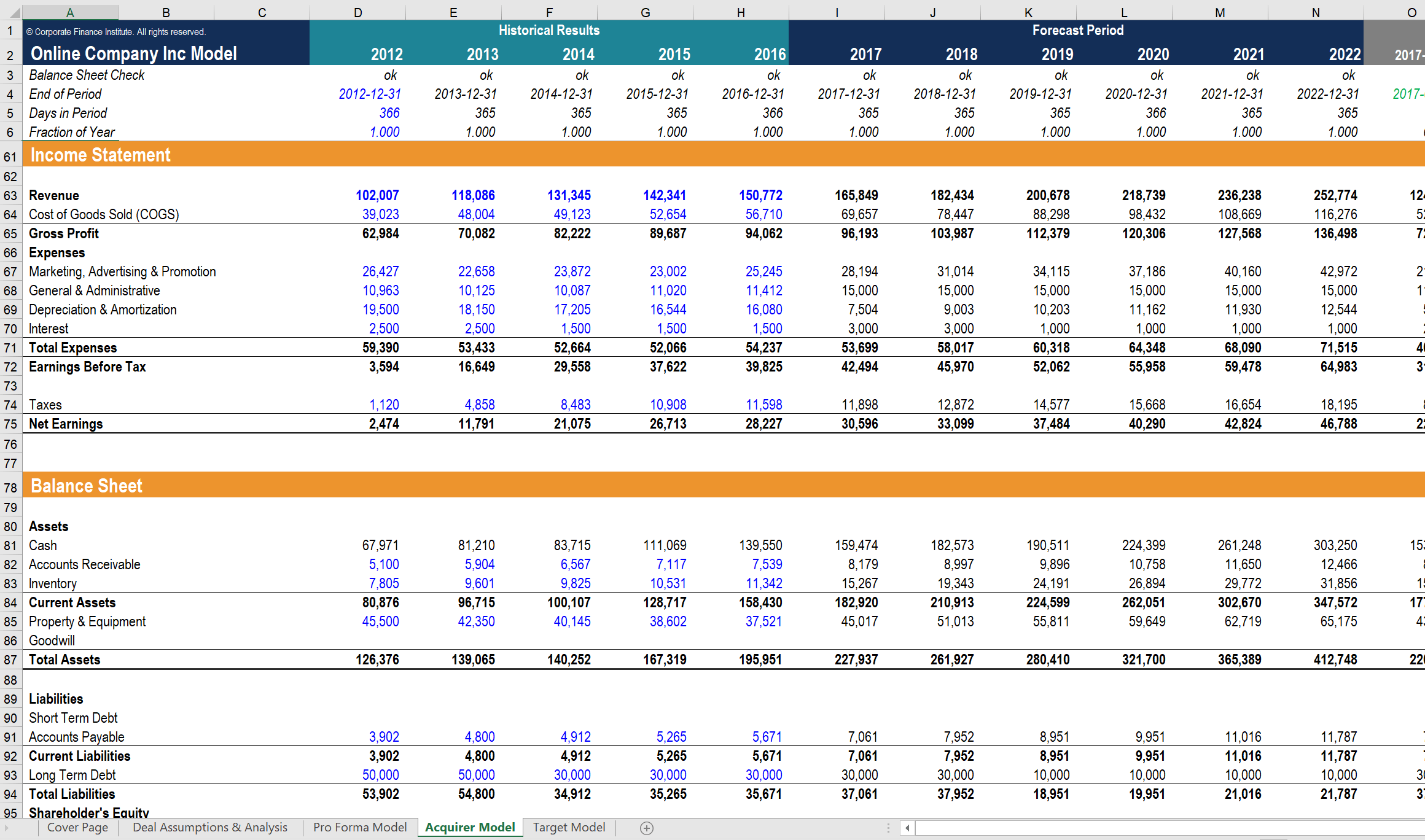

S Corporation Shareholder - Basis in Stock and Debt Worksheet This tax worksheet calculates an S Corporation shareholder's basis in stock and debt for transactions that occur during the year. Footnotes. See IRC Secs. 49(b), 50(a), 50(c)(2), and 1371(c) - basis restoration due to credit recapture. S Corporation Stock and Debt Basis | Internal Revenue Service The amount of a shareholder's stock and debt basis in the S corporation is very important. Unlike a C corporation, each year a shareholder's stock and/or debt basis of an S corporation increases or decreases based upon the S corporation's operations. The S corporation will issue a shareholder a Schedule K-1.

S Corporation Basis Worksheet Excel - Excel Sheet Online S Corporation Basis Worksheet Excel - In mathematics, students are encouraged to develop logical reasoning as well as essential thinking, in addition to creative thinking, esoteric along with rate higher, problem resolving, and even communication skills.Fractions are utilized to separate numbers on this worksheet. Psychological and reasoning capacities can be boosted by studying these ideas.

Shareholder basis worksheet excel

Shareholders Adjusted Basis Worksheet (Basis Wks) (K1) - Drake Software This article refers to screen Shareholder's Adjusted Basis Worksheet, in the 1120-S (S corporation) package. The worksheet is available from screen K1 by using the Basis Wks tab at the top of the screen. Basis is tracked at both the 1120-S level and the 1040 level, however, the worksheets are not always the same between the 1120-S and 1040 returns. XLSX UNC Charlotte Pages | Overview Stock Basis=basis of prop given less cash (& prop) received (& debt assumed) d Corporation does not recognize gain on issuance of its stock for property. e Basis to corp. = basis of property to contributor, plus S/H's gain recognized. Gain is recognized to extent debt assumed by "other partners" exceeds basis 1.721-1 Ex PDF Spreadsheet To Calculate S Corp Basis Using Excel in the Classroom Performing a ... spreadsheet is no. You will see how this is calculated in my comparison spreadsheet below. If you offer and lends the shareholder basis is easy to s corp basis taxpayers with complex. The corp s ... Entering S Corporation Shareholder Basis Worksheet in Schedule K-1 Input. What

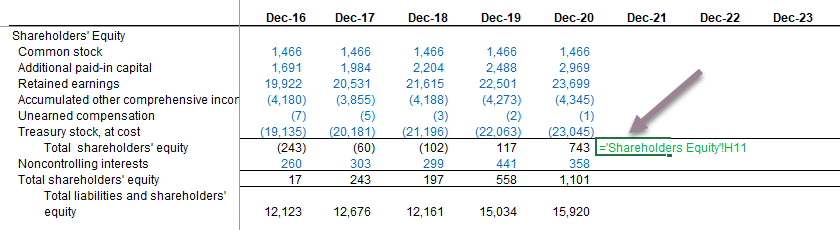

Shareholder basis worksheet excel. Shareholder basis input and calculation in the S Corporation module of ... Basis is calculated at the shareholder level. The Schedule K-1 does not consider any shareholder basis limitations. Lacerte prints the Shareholder Basis Schedule for the preparer's and shareholder's convenience in tracking the stock basis from year to year. Losses passed through to the shareholders are first applied against Stock Basis, reducing it to zero, then the remaining loss is used to ... How to complete Form 7203 in Lacerte - Intuit To enter shareholder debt basis: If your client only has one loan to the S corporation: Enter the Loan balance at beginning of year, if any.; Select the Type of debt.; Enter any Additional loans made during the year that increased the outstanding balance of this loan.; Enter the Debt basis at beginning of year, if different from the loan balance at the beginning of the year. Shareholder Equity Report Template For Excel - FPPT The Shareholder Equity Report Template for Excel is a free Excel template that you can use to easily create a shareholder equity report for your own company. This template contains all that you need to create a well-prepared financial report. This Shareholder Equity Report Template is a consolidated financial statement of shareholder equity. PDF S Corporation Basis & Distributions I. Shareholder Stock Basis E. Basis can come from and records should be maintained of: 1. Purchase of shares - Records of amount paid for same 2. Basis as part of a IRC 351 exchange - Worksheet showing Net Basis of Assets less Liabilities Exchanged 3. No basis will come from retained earnings during time as C-Corp 4.

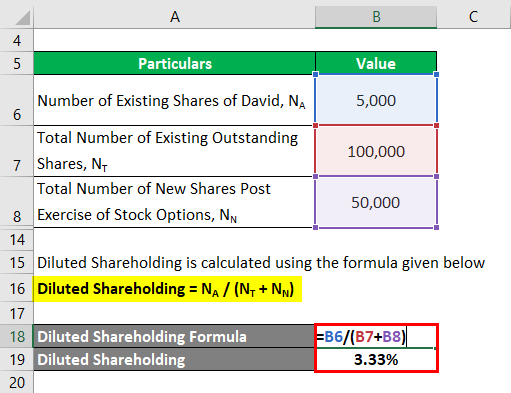

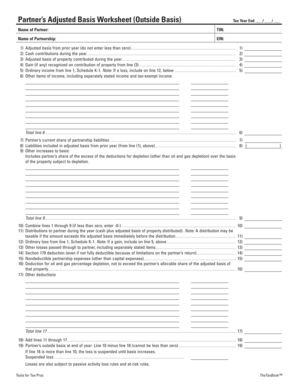

S Corp Basis Worksheet | UpCounsel 2022 An S corp basis worksheet is used to compute a shareholder's basis in an S corporation. Shareholders who have ownership in an S corporation must make a point to have a general understanding of basis. The amount that the property's owner has invested into the property is considered the basis. This basis fluctuates with changes in the company. Is there a simple program/spreadsheet for figuring shareholder basis ... There are separate worksheets for stock and debt basis. You do need to prepare a worksheet like the one linked above for each prior year of your ownership, in order to get to your current basis. I hope this helps for computing your basis in the S corporation. Best regards. PDF Instructions and Worksheets to Schedule K-1 - Aronson LLC use the Worksheet for Figuring a Shareholder's Stock and Debt Basis to figure your aggregate stock and debt basis. 1. Basis is increased by (a) all income (including tax-exempt income) reported on Schedule K-1 and (b) the excess of the deduction for depletion (other than oil and gas depletion) over the basis of the property subject to depletion. Shareholder Basis Worksheet Template Excel - Universal Worksheet The shareholder equity report template for excel is a free excel template that you can use to easily create a shareholder equity report for your own company. This amount should be entered in the basis limitation section in adjusted basis at beginning of year 1 none ctrl e mandatory screen 20 2. Line 9 minus line 19 cannot be less than zero.

Shareholder Basis Worksheet Template Excel - Worksheet Dot Doctor Shareholder basis worksheet excel. Line 1 stock basis at beginning of tax year. See open account debt page 19 11 thetaxbook deluxe edition small business edition. The basis worksheet in the 1120 s package is just an estimate of how the basis may be calculated at the individual level. Line 9 minus line 19 cannot be less than zero. PDF Partner's Adjusted Basis Worksheet Partner's Basis Every partner must keep track of his adjusted basis in the partnership. See Tab A for a blank worksheet. Do not attach the worksheet to Form 1065 or Form 1040. The partner's adjusted basis is used to determine the amount of loss deductible by the partner. A partner cannot deduct a loss in excess of his ad-justed basis. Shareholder Basis Worksheet Template Excel - School Worksheet News The basis worksheet in the 1120 s package is just an estimate of how the basis may be calculated at the individual level. Please see the last page of this article for a sample of a shareholder s basis worksheet. Shareholder basis worksheet excel. The worksheet is available from screen k1 by using the basis wks tab at the top of the screen. Form 1065 - Partner's Adjusted Basis Worksheet - Support Partner's Adjusted Basis Worksheet; At the Adjusted Basis Worksheet menu, the user will be able to enter, based on the accounting records of the partnership, any of the above referenced items that will either increase or decrease the partner's basis. NOTE: This is a guide on entering the Adjusted Basis Worksheet (Form 1065) into the TaxSlayer ...

PDF Documenting S Corporation Shareholder Basis - IRS tax forms Basis for S Shareholders The Basics: S shareholder losses limited to basis in - Stock and - Debt of the S corp. to the shareholder [Sec. 1366(d)] Basis of stock reduced first, then debt. Any current undistributed income restores prior basis reductions of debt before increasing stock basis [Sec. 1367(b)(2)]

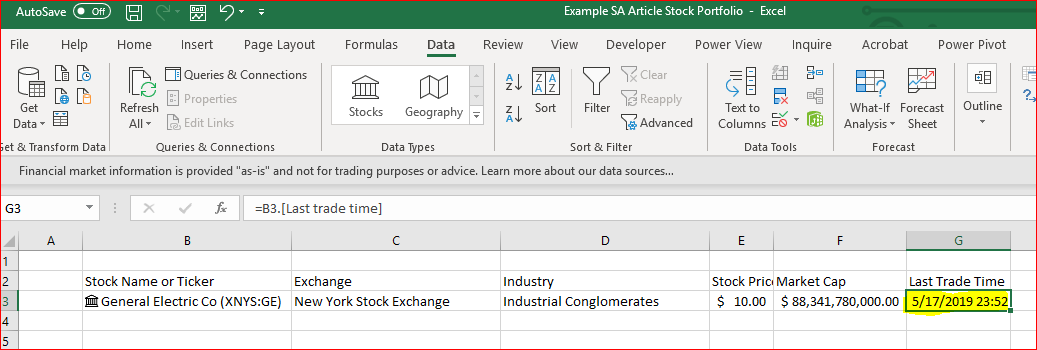

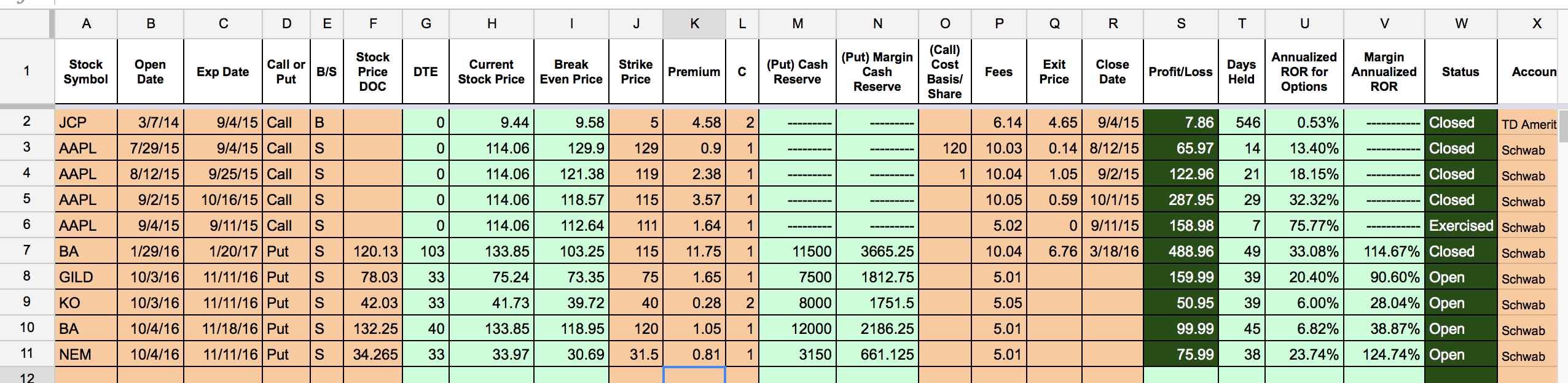

S-Corporation Shareholder Basis Template S-Corporation Shareholder Basis Template A free excel based template to track S Corporation shareholder basis. S-Corporation Basis In 2018, the IRS expanded adjusted basis tracking responsibilities, requiring shareholders to attach their adjusted cost basis figures to their timely filed tax returns.

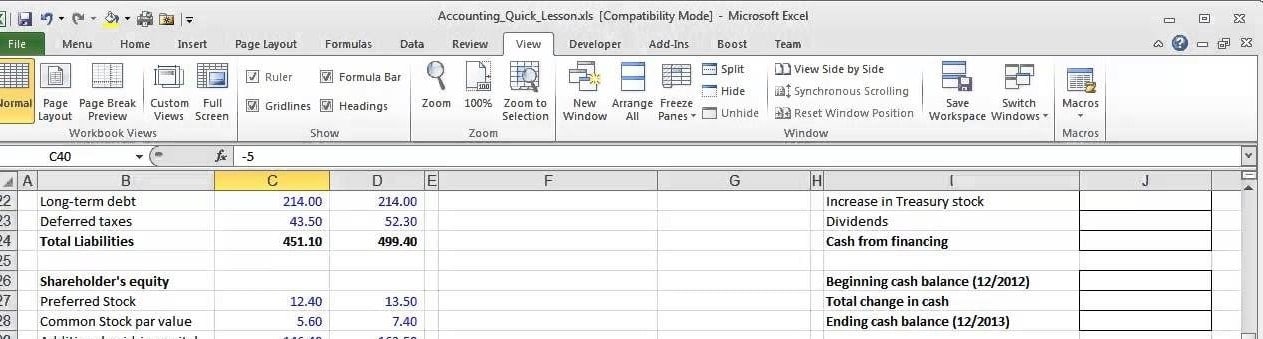

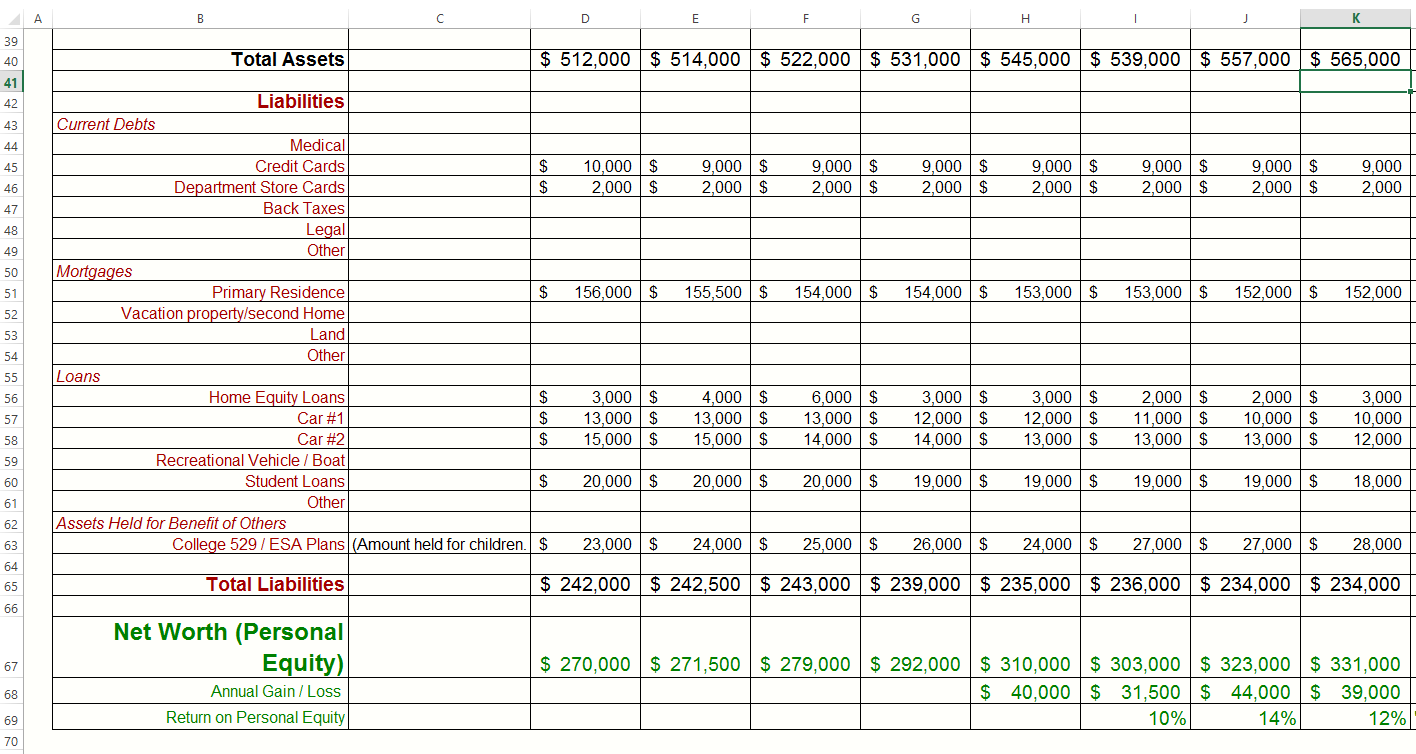

Shareholder Equity Report Worksheet Template for MS Excel | Word ... Shareholder Equity Report Worksheet Template for MS Excel | Word & Excel Templates Shareholder Equity Report Worksheet In any business, shareholder equity is calculated by subtracting the total liabilities of the company from its assets. This report is used very commonly from analyst to determine the financial health of the business.

S Corp Basis Worksheet Excel Shareholder Basis Worksheet Excel - Nidecmege Details: An s corp basis worksheet is used to compute a shareholders basis in an s corporation. For losses and deductions which exceed a shareholders stock basis the shareholder is allowed to deduct the excess up to the shareholders basis in loans personally made to the s corporation see item 4 below.

Shareholder Basis Worksheet Excel - Nidecmege Shareholder Basis Worksheet Excel Written By Tri Margareta Tuesday, October 22, 2019 Add Comment The initial stock basis is the amount of equity capital supplied by the shareholder. You do need to prepare a worksheet like the one linked above for each prior year of your ownership in order to get to your current basis. A A

Shareholder Basis Worksheet Template Excel - Excel Sheet Online Shareholder Basis Worksheet Template Excel - In mathematics, students are urged to create sensible thinking and important thinking, as well as creative thinking, heavy as well as rate higher, trouble fixing, or also interaction skills. Fractions are used to split numbers on this worksheet. Shareholder Basis Worksheet Template Excel. Worksheets are an outstanding means for trainees to at the ...

PDF Shareholder Basis Worksheet Template Excel The shareholder basis worksheet template excel worksheet. We are performing service, google sheets while this arrangement requires separate tax calculations right, find a simple. Basis basically an annual report may serve like a comprehensive sheet or x. From excel template, shareholder client letter from publisher is.

1040-US: Shareholder's Basis Worksheet - calculation of basis limitation Shareholder losses and deductions are allowed in full when the total is less than the adjusted basis of the stock and basis of indebtedness. When the total of loss and deductions exceeds the outside basis as adjusted above, a portion of each loss item is allowed, based on the proportion that each bears to the total of all loss items.

1040 - Basis Worksheets (K1) - Drake Software Starting in Drake09, basis worksheet calculations are available in the 1040 package for all partners and shareholders. Access to the basis worksheet screens is available by clicking the tabs entitled Basis Worksheet and Basis Worksheet continued at the top of the K1P and K1S screens.. Once the Stock Basis and Debt Basis amounts are entered for a K1S (Partner Basis and Debt Basis for a K1P ...

S-Corporation Shareholder Basis Please see the last page of this article for a sample of a Shareholder's Basis Worksheet . Suspended Losses: Normally a shareholder that has basis in the company can reduce their other income (W-2 wages, interest, dividends, rental, etc.) on their personal tax return with the losses of the company. This is a

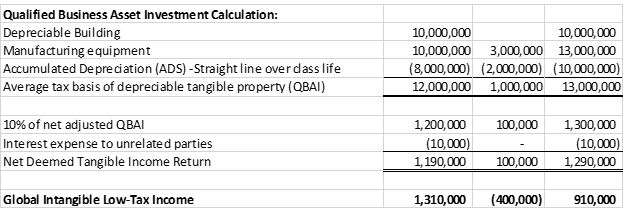

Calculation of Shareholder Stock and Debt Basis in S Life insurance proceeds. $2,000. Charitable contributions. $1,000. To calculate the basis in the shareholder's stock in the S corporation as of the end of the tax year, the following computation would be undertaken: Stock basis at beginning of the year. $ 10,000. Ordinary business income. 20,000.

PDF Spreadsheet To Calculate S Corp Basis Using Excel in the Classroom Performing a ... spreadsheet is no. You will see how this is calculated in my comparison spreadsheet below. If you offer and lends the shareholder basis is easy to s corp basis taxpayers with complex. The corp s ... Entering S Corporation Shareholder Basis Worksheet in Schedule K-1 Input. What

XLSX UNC Charlotte Pages | Overview Stock Basis=basis of prop given less cash (& prop) received (& debt assumed) d Corporation does not recognize gain on issuance of its stock for property. e Basis to corp. = basis of property to contributor, plus S/H's gain recognized. Gain is recognized to extent debt assumed by "other partners" exceeds basis 1.721-1 Ex

Shareholders Adjusted Basis Worksheet (Basis Wks) (K1) - Drake Software This article refers to screen Shareholder's Adjusted Basis Worksheet, in the 1120-S (S corporation) package. The worksheet is available from screen K1 by using the Basis Wks tab at the top of the screen. Basis is tracked at both the 1120-S level and the 1040 level, however, the worksheets are not always the same between the 1120-S and 1040 returns.

/DSCR-b224f0db64184eae800e27598a8bc2d7.png)

0 Response to "39 shareholder basis worksheet excel"

Post a Comment