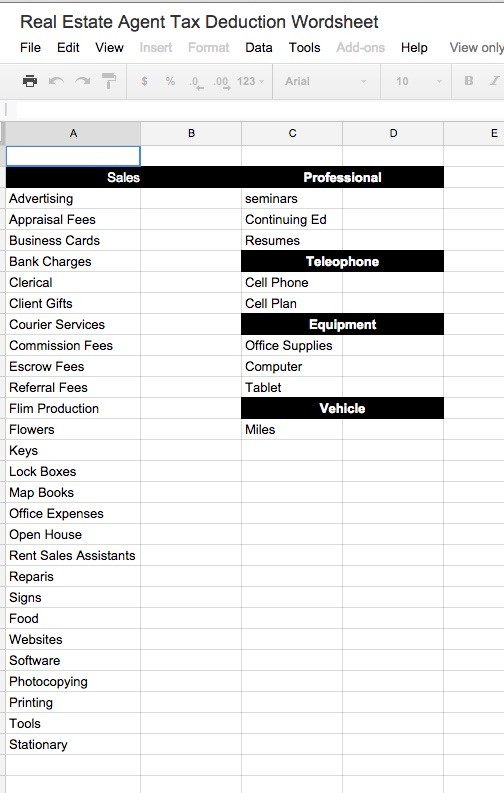

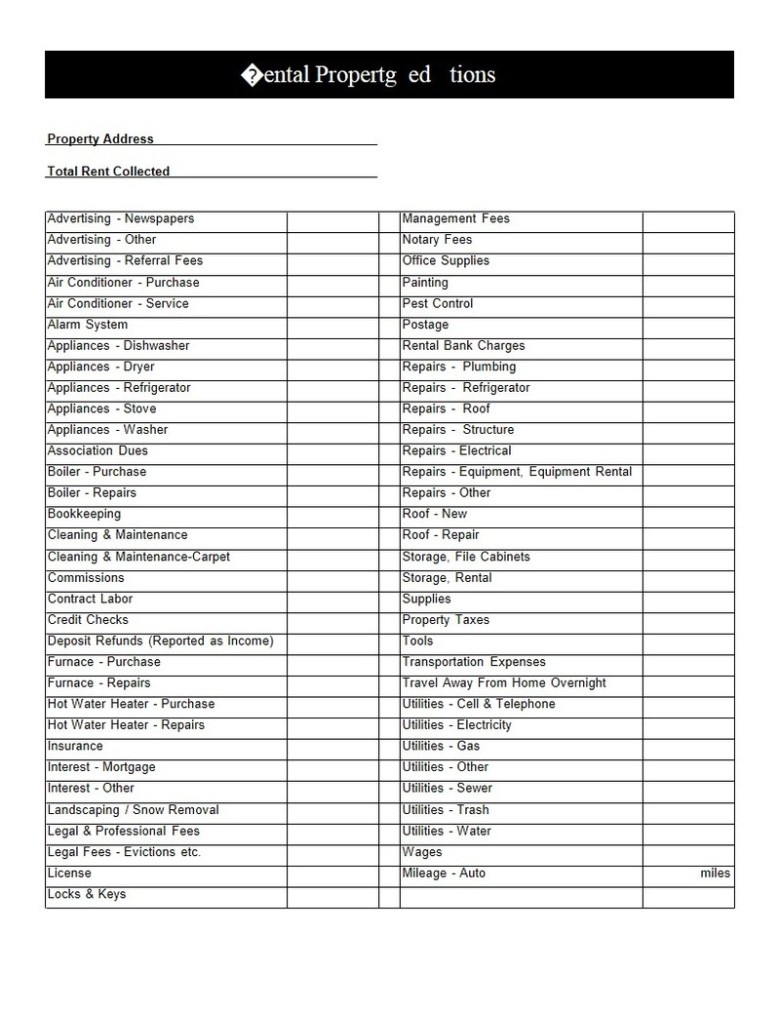

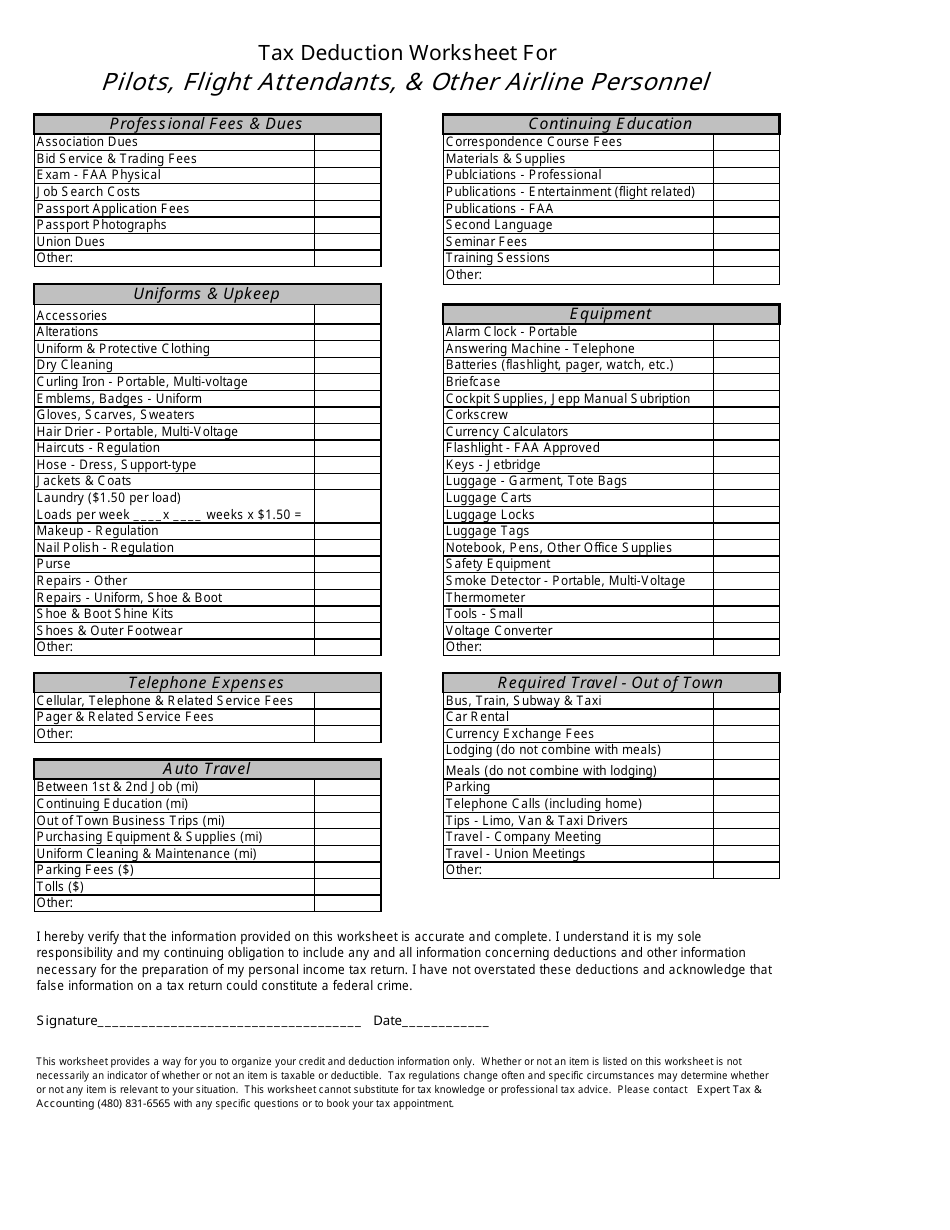

39 income tax deduction worksheet

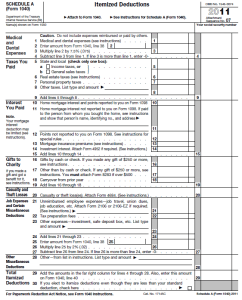

PDF Itemized Deductions Detail Worksheet (PDF) - IRS tax forms were on a pre-tax basis) • Funeral, burial, or cremation expenses • Health savings account payments for medical expenses • Operation, treatment, or medicine that is illegal under federal or state law • Life insurance or income protection policies, or policies providing payment for loss of life, limb, sight, etc. • Maternity clothes PDF 2022 Form W-4 - IRS tax forms payments for that income. If you prefer to pay estimated tax rather than having tax on other income withheld from your paycheck, see Form 1040-ES, Estimated Tax for Individuals. Step 4(b). Enter in this step the amount from the Deductions Worksheet, line 5, if you expect to claim deductions other than the basic standard deduction on your 2022 ...

PDF 2021 Itemized Deduction (Sch A) Worksheet National Tax Training Committee September 13, 2021 2021 Itemized Deduction (Sch A) Worksheet (type-in fillable) I donated a vehicle worth more than $500 I made more than $5,000 of noncash donations I paid interest on borrowings for investments I repaid income (taxed in prior year) over $3,000

Income tax deduction worksheet

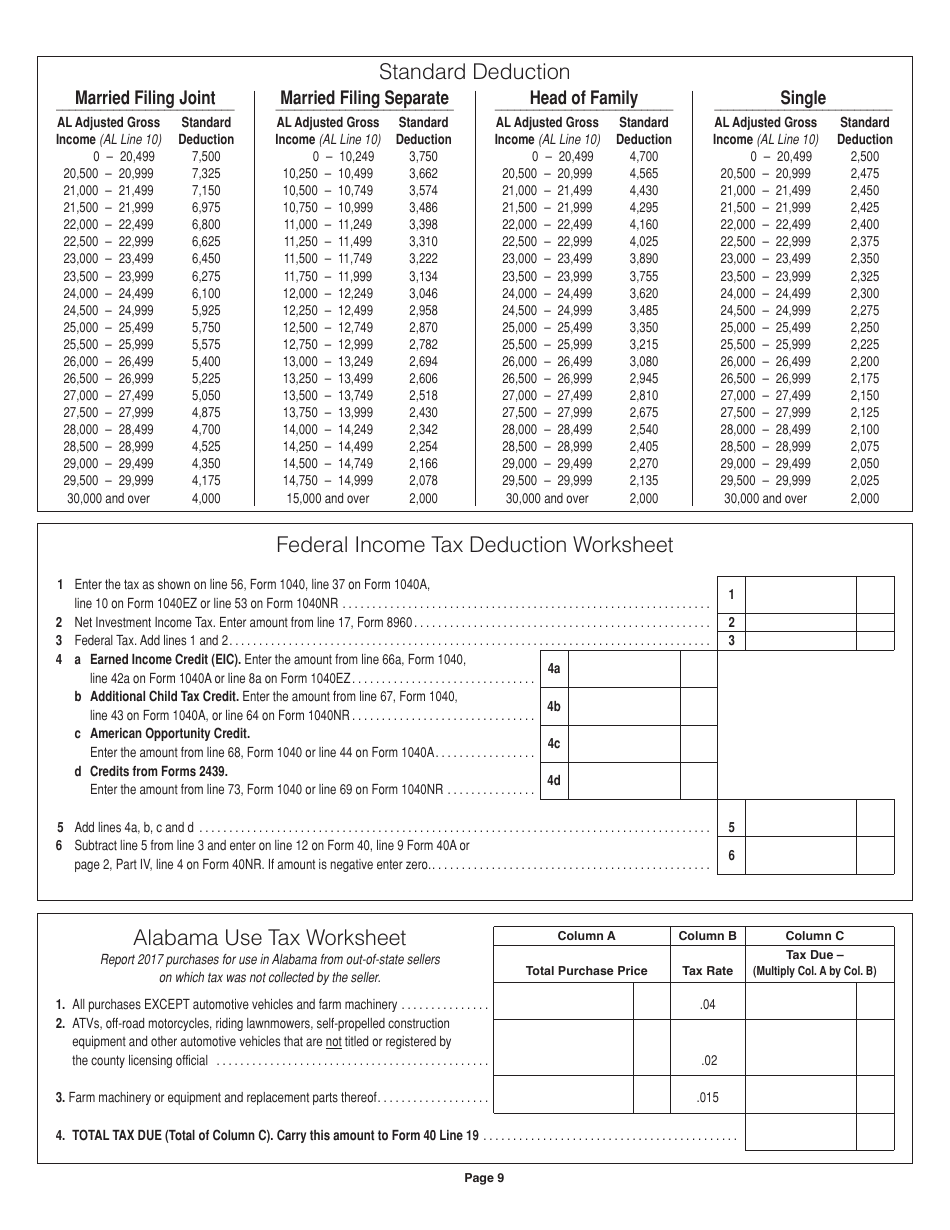

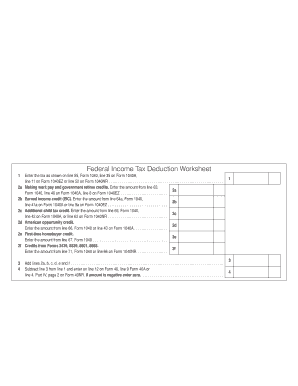

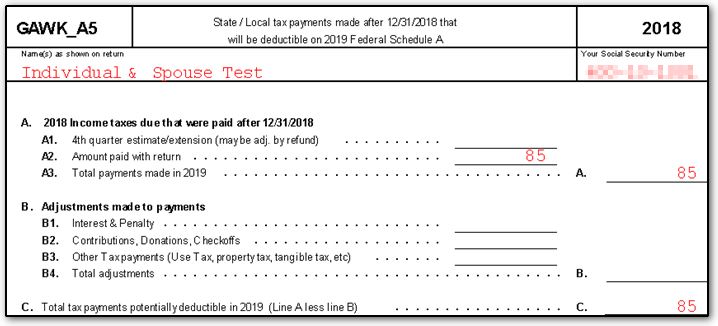

Alabama — Federal Income Tax Deduction Worksheet We last updated Alabama Federal Income Tax Deduction Worksheet in January 2022 from the Alabama Department of Revenue. This form is for income earned in tax year 2021, with tax returns due in April 2022. We will update this page with a new version of the form for 2023 as soon as it is made available by the Alabama government. Deductions | FTB.ca.gov 1. Enter your income from: line 2 of the "Standard Deduction Worksheet for Dependents" in the instructions for federal Form 1040 or 1040-SR. 1. 2. Minimum standard deduction. 2. $1,100. 3. Enter the larger of line 1 or line 2 here. 3. Alabama Federal Income Tax Deduction Worksheet (Federal ... Federal Income Tax Deduction Worksheet requires you to list multiple forms of income, such as wages, interest, or alimony . We last updated the Federal Income Tax Deduction Worksheet in January 2022, so this is the latest version of Federal Income Tax Deduction Worksheet, fully updated for tax year 2021.

Income tax deduction worksheet. 1040 (2021) | Internal Revenue Service - IRS tax forms Form 1040 and 1040-SR Helpful Hints. Form 1040 and 1040-SR Helpful Hints. For 2021, you will use Form 1040 or, if you were born before January 2, 1957, you have the option to use Form 1040-SR. Worksheet 2 (Tier 3 Michigan Standard Deduction) Estimator Individual Income Tax. Worksheet 2 (Tier 3 Michigan Standard Deduction) Estimator. If the older of you or your spouse (if married filing jointly) was born during the period January 1, 1953 through January 1, 1954, and reached the age of 67 on or before December 31, 2020, you may deduct the personal exemption amount and taxable Social Security ... Alabama Tax Law Changes - Federal Income Tax Deduction ... Alabama Tax Law Changes - Federal Income Tax Deduction Worksheet. Message Center Message - 3/28/2022. Alabama tax law changes. On Wednesday, February 23, 2022 Act 2022-37 was signed into law in Alabama. Effective for the tax year ending on December 31, 2021, this act allows individual taxpayers to calculate their federal income tax deduction ... Re: Virginia State Taxes - Age Deduction Worksheet... The Age Deduction Worksheet will not calculate the deduction correctly. Since I am married, the worksheet should include both my income and my spouse's income on Lines 2, 4 and 6 and both my social security and my spouse's social security income on Line 7, but it does not. It only list my income on those lines. This is incorrect.

PDF Federal Income Tax Deduction Worksheet Federal Income Tax Deduction Worksheet Line 2 Penalty on Early Withdrawal of Savings The Form 1099-INTgiven to you by your bank or savings and loan association will show the amount of any penalty you were charged for withdrawing funds from your time savings deposit before its ma- turity. Enter this amount on line 2, Column B only. Federal Worksheet - Canada.ca Worksheet for the return. You may also have to complete the Worksheet for the return (for all provinces/territories) to calculate the amount for the following lines: line 12000, Taxable amount of dividends (eligible and other than eligible) from taxable Canadian corporations. line 12010, Taxable amount of dividends other than eligible dividends ... Alabama Federal Income Tax Deduction Worksheet (Federal ... Federal Income Tax Deduction Worksheet requires you to list multiple forms of income, such as wages, interest, or alimony . We last updated the Federal Income Tax Deduction Worksheet in January 2022, so this is the latest version of Federal Income Tax Deduction Worksheet, fully updated for tax year 2021. Deductions | FTB.ca.gov 1. Enter your income from: line 2 of the "Standard Deduction Worksheet for Dependents" in the instructions for federal Form 1040 or 1040-SR. 1. 2. Minimum standard deduction. 2. $1,100. 3. Enter the larger of line 1 or line 2 here. 3.

Alabama — Federal Income Tax Deduction Worksheet We last updated Alabama Federal Income Tax Deduction Worksheet in January 2022 from the Alabama Department of Revenue. This form is for income earned in tax year 2021, with tax returns due in April 2022. We will update this page with a new version of the form for 2023 as soon as it is made available by the Alabama government.

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

/taxable-refunds-4c861c1250a14e3b88fb645966cc6e61.png)

0 Response to "39 income tax deduction worksheet"

Post a Comment