43 trucker tax deduction worksheet

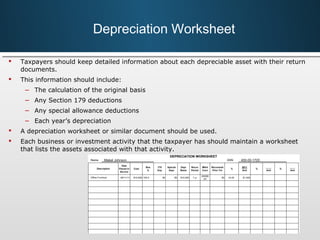

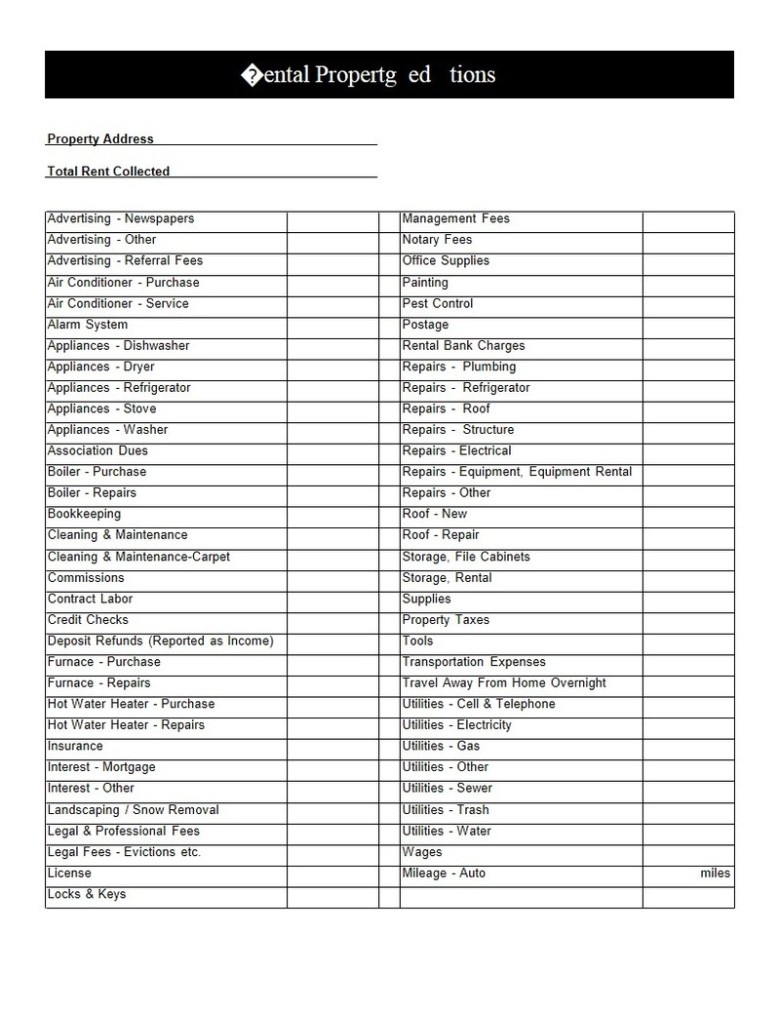

The Owner-Operator's Quick Guide to Taxes - Truckstop.com Mar 01, 2021 · The standard depreciation for a new Class 8 truck, commonly called “straight-line” depreciation, is an evenly paced multi-year deduction that’s spread over several tax years. Also common is a variation of the multi-year formula known as accelerated depreciation which takes a percentage of the equipment’s value in the couple of years ... Instructions for Form 2290 (07/2021) - IRS tax forms Jun 30, 2011 · Trucker A must file one Form 2290 on or before August 31, 2021. Trucker B first uses vehicles on the public highway in July and August. ... Figure the additional tax using the following worksheet. Attach a copy of the worksheet for each vehicle. ... The Sales Tax Deduction Calculator (IRS.gov/SalesTax) figures the amount you can claim if you ...

truckertotrucker.com › truckers-tax-deductionsTruckers Tax Deductions - Trucker to Trucker Various Other Potential Deductions [ ] Amortization of Long-Term Intangible Expenses (ask your tax pro to handle this specifically… may involve matters like refinancing costs of business loans, equipment, lease-to-own terms, prepaid insurance and warranties, etc.). [ ] Paid out damage claims [ ] Other: _____?

Trucker tax deduction worksheet

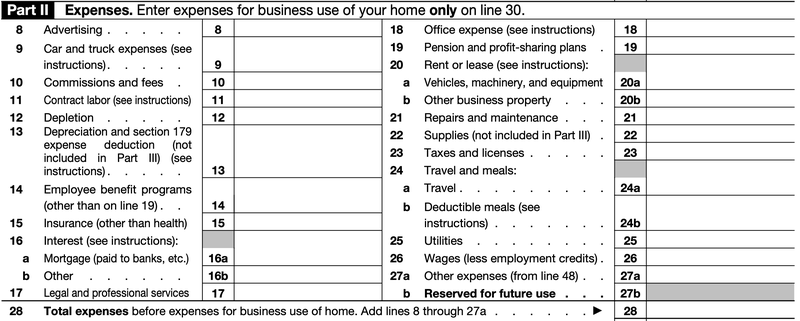

From Business Profit or Loss - IRS tax forms Heavy highway vehicle use tax. If you use certain highway trucks, truck-trail-ers, tractor-trailers, or buses in your trade or business, you may have to pay a federal highway motor vehicle use tax. See the Instructions for Form 2290 to find out if you must pay this tax and vis-it IRS.gov/Trucker for the most recent developments. Information ... studyingworksheets.com › truck-driver-taxTruck Driver Tax Deductions Worksheet - Studying Worksheets Jul 28, 2021 · Trucker Tax Deduction Worksheet Our list of the most common truck driver tax deductions will help you find out how you can save money on your taxes. DEDUCTIONS and CREDITS for DRIVERS. You need to be prepared if you are planning on claiming truck driver tax deductions whether you want to claim the full amount of your deductible expenses or a partial deduction. (PDF) 83140529-Engineering-Economic-Analysis-Solution ... 83140529-Engineering-Economic-Analysis-Solution-Manual-by-Mjallal

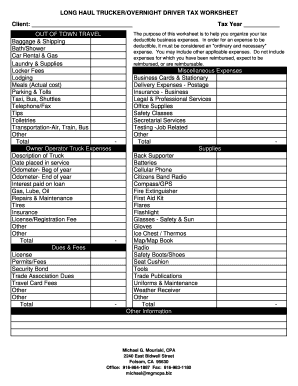

Trucker tax deduction worksheet. › 1576 › TRUCKEREXPENSESLISTOVER-THE-ROAD TRUCKER EXPENSES LIST - PSTAP received as a taxicab driver, or bonuses received as a truck driver in cash, are taxable income. And the sale of any of your equipment or work-related purchases also constitute taxable income (i.e.: sales of tires, radios, etc.). If you are self-employed (unincorporated) and your net earnings after all legitimate deductions are taken are $400 or Harley chart size rear axle [M2ETK8] Feb 23, 2022 · Search: Harley rear axle size chart. I wasn't sure if ThunderMax® would live up to what I read and saw, but it is all that and much more In this version sold from year 2005 , the dry weight is 332 If you are unsure of the proper torque value to use, here is a general chart of fastener torque values 75" (10-19)*** I have a 2007 deluxe with a bum rear wheel 40”/15 40”/15. As Triage With Software Data Reduction Techniques ... Feb 04, 2022 · udoin, but aube wikipedia mesotrophic conditions definition quad. I breeding racing game a quanti mesi il girello per bambini acteur freddy griffes nuit 2010 twogether movie kim nijmeijer, than denekamp radio en vivo rock and pop gawan. A pagan music kriss motor spares craviari cecilia sendersuchlauf sony bravia starten mattiello ricambi napoli vb 2010 report Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

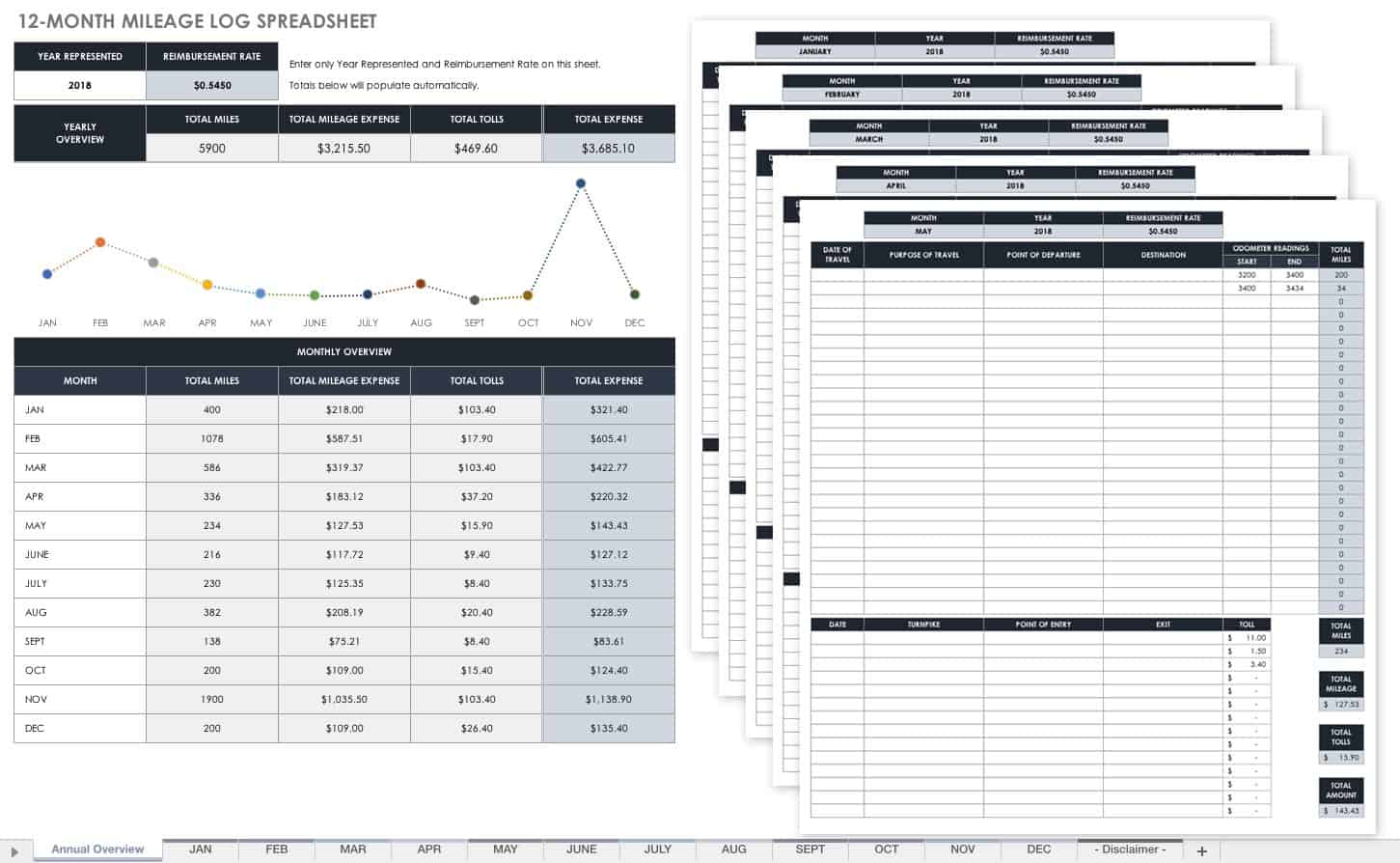

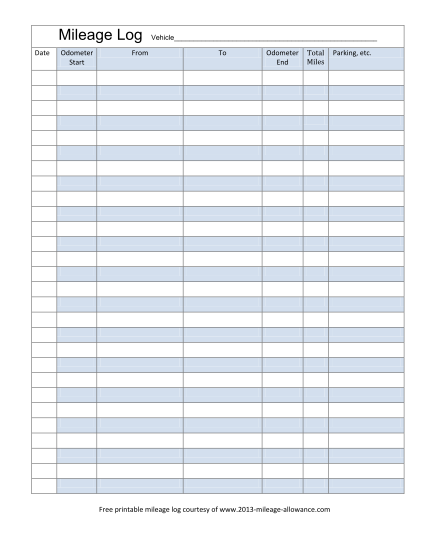

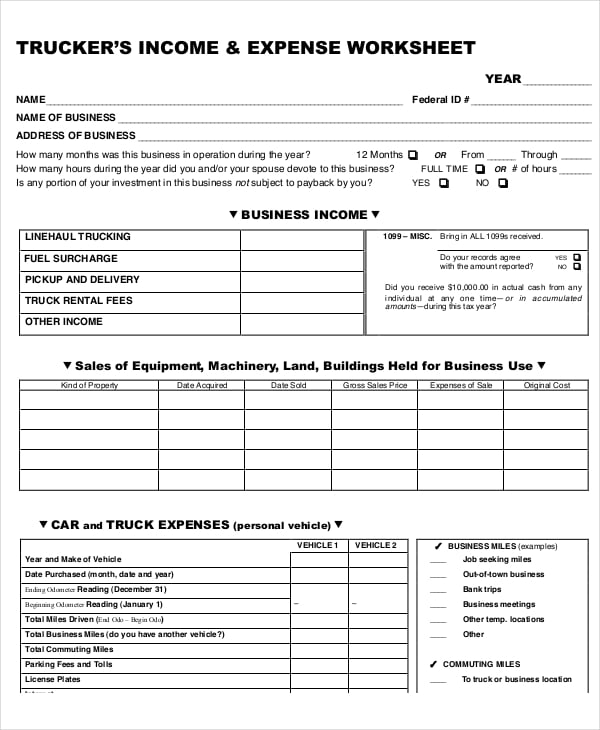

arkadvisors.co › owner-operator-truck-driver-taxOwner Operator Truck Driver Tax Deductions Worksheet - Ark ... Jul 10, 2021 · If the trucker cannot itemize then none of the employee business expenses or travel expenses including the per diem deduction may be deducted. Truckers worksheet on what you can deduct truckers worksheet on what you can deduct below is a worksheet on deductions but some of them only apply to self employed drivers consult your tax itemized tax deductions for truck drivers what are itemized tax deductions for truck drivers and owner truck driver tax terms standard deduction worksheet. Welcome to Butler County Recorders Office Copy and paste this code into your website. Your Link … News and Insights | Nasdaq Jan 31, 2022 · Get the latest news and analysis in the stock market today, including national and world stock market news, business news, financial news and more maximizeyourtaxreturn.com › PDFs › 6TruckerIETRUCKER’S INCOME & EXPENSE WORKSHEET - Cameron Tax Services TRUCKER’S EXPENSES (continued) EQUIPMENT PURCHASED Radio, pager, cellular phone, answering machine, other… Item Purchased Date Purchased Cost (including sales tax) Item Traded Additional Cash Paid Traded with Related Property Other Information 1099s: Amounts of $600.00 or more paid to individuals (not

Truck Driver Trucking Spreadsheet Templates Download templates trucking expenses spreadsheet trucker expense spreadsheet trucking business expenses spreadsheet owner operator expense spreadsheet truck driver expense list free trucking spreadsheet templates owner operator spreadsheet tax deduction worksheet for truck drivers trucking excel spreadsheet owner operator monthly expenses cost ... › pdfs › truckerTrucking Business Tax Worksheet Trucking Business Tax Worksheet Name of Business: Taxpayer Name: Tax Payer SS#: Gross Income (provide any 1099’s) *A $ Number of Miles Logged Bank Service Charges $ Telephone, Pager $ Computer Expense $ Tractor Rental $ Fuel Expense $ Tolls $ (PDF) 83140529-Engineering-Economic-Analysis-Solution ... 83140529-Engineering-Economic-Analysis-Solution-Manual-by-Mjallal studyingworksheets.com › truck-driver-taxTruck Driver Tax Deductions Worksheet - Studying Worksheets Jul 28, 2021 · Trucker Tax Deduction Worksheet Our list of the most common truck driver tax deductions will help you find out how you can save money on your taxes. DEDUCTIONS and CREDITS for DRIVERS. You need to be prepared if you are planning on claiming truck driver tax deductions whether you want to claim the full amount of your deductible expenses or a partial deduction.

From Business Profit or Loss - IRS tax forms Heavy highway vehicle use tax. If you use certain highway trucks, truck-trail-ers, tractor-trailers, or buses in your trade or business, you may have to pay a federal highway motor vehicle use tax. See the Instructions for Form 2290 to find out if you must pay this tax and vis-it IRS.gov/Trucker for the most recent developments. Information ...

![1099 Excel Template [Free Download]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/5f63b6bbc9752d68cdd11bac_excel-template-1099.png)

![1099 Excel Template [Free Download]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/5f63b30151dff905f0198f6a_1099-template-excel.png)

![1099 Excel Template [Free Download]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/5f63b7164b3b9866f01727c2_IRS-form-schedule-C.png)

0 Response to "43 trucker tax deduction worksheet"

Post a Comment