40 self employed business expenses worksheet

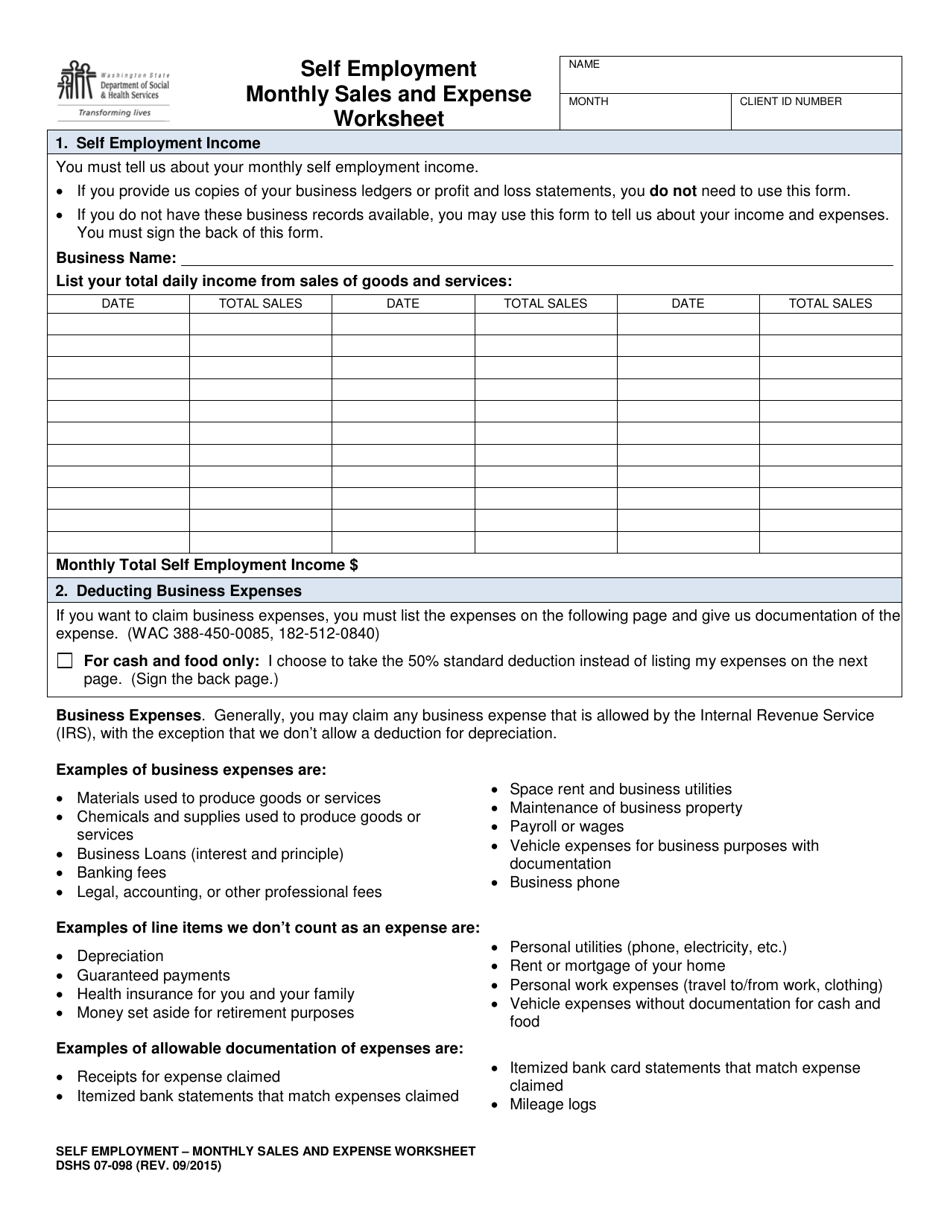

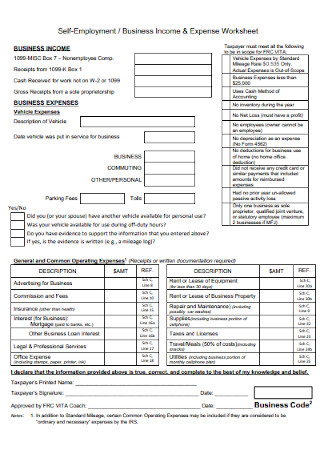

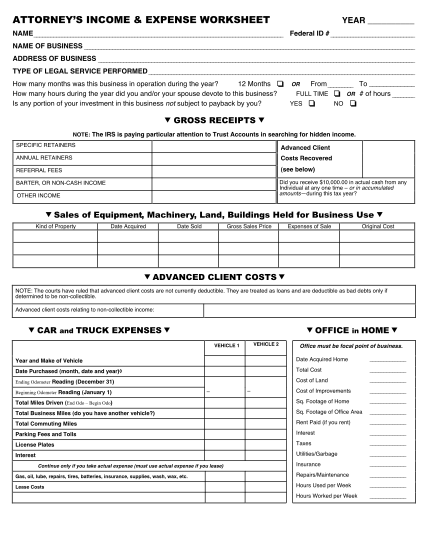

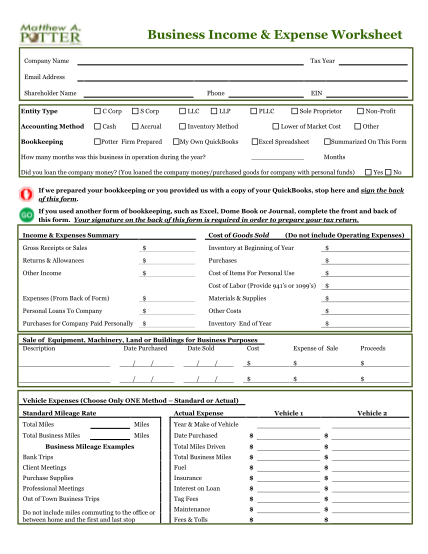

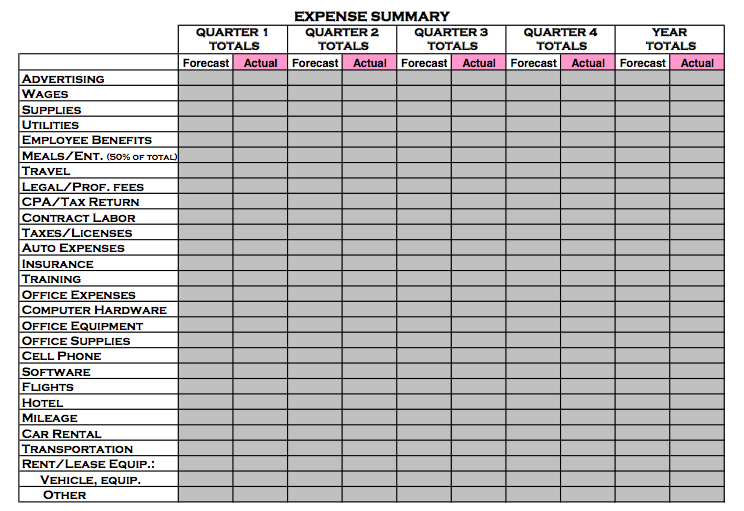

› docs › Kristels-ScheduleCSchedule C Worksheet for Self Employed Businesses and/or ... Schedule C Worksheet for Self Employed Businesses and/or Independent Contractors IRS requires we have on file your own information to support all Schedule C's Business Name (if any)_____ Address (if any) _____ Is this your first year in business? Yes Self-Employed Business Expense Worksheet BUSINESS SUPPLIES WORKSHEET LLC TAX YEAR The purpase of this worksheet is to help you organize your tax deductible business expenses. In order for expense to be deductible, it must be considered an *ordinary and necessary- expense. You may include other applicable expenses. Do not Include expenses for

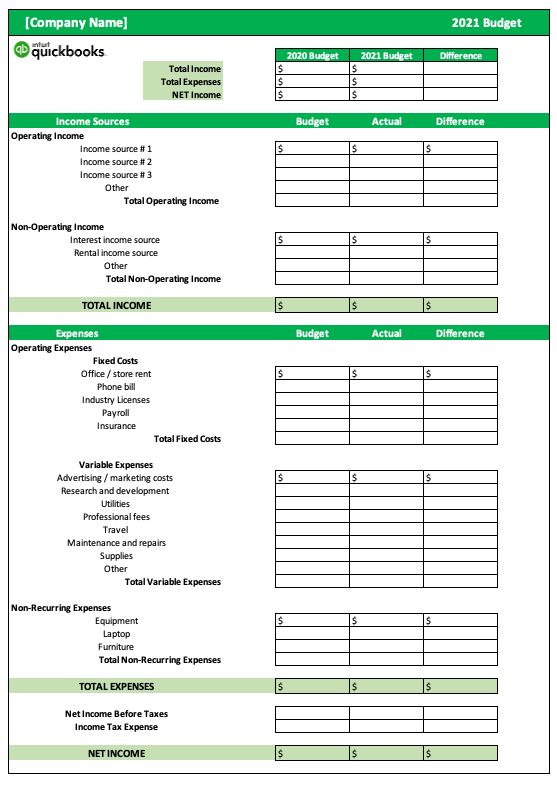

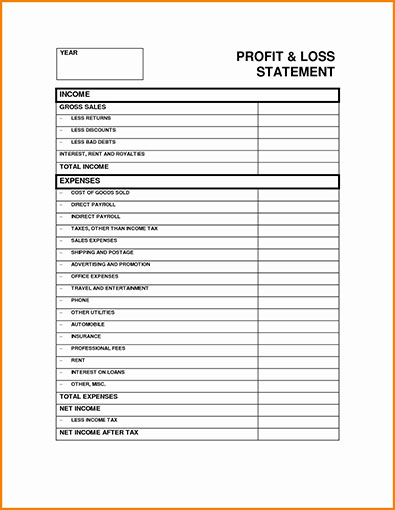

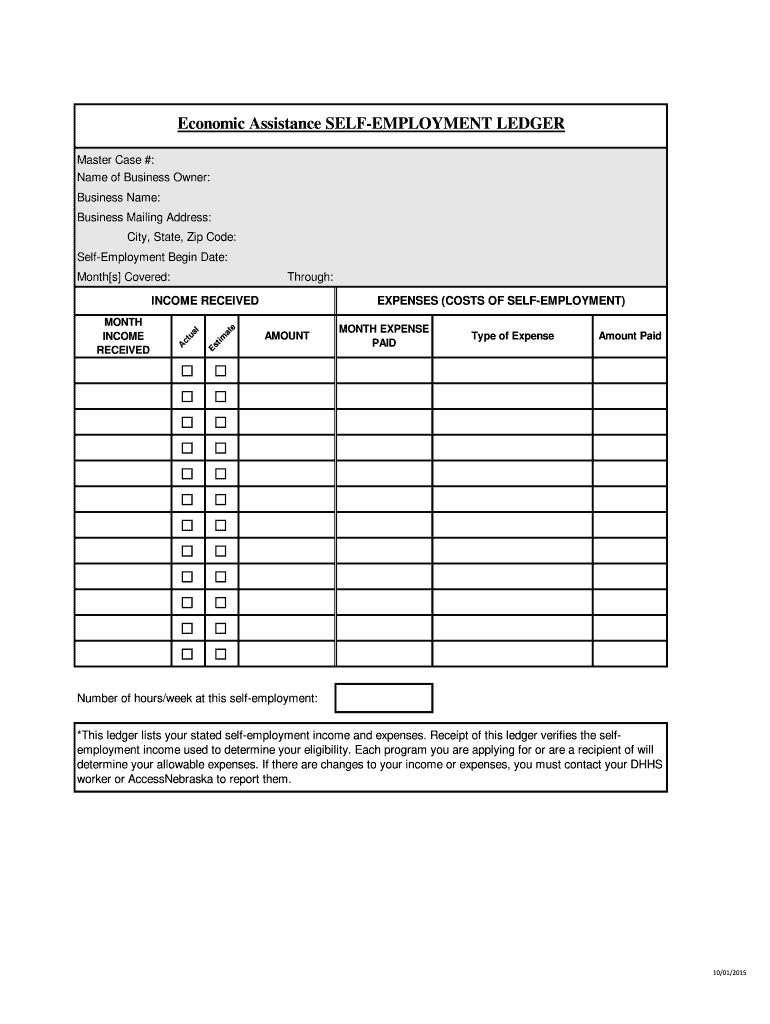

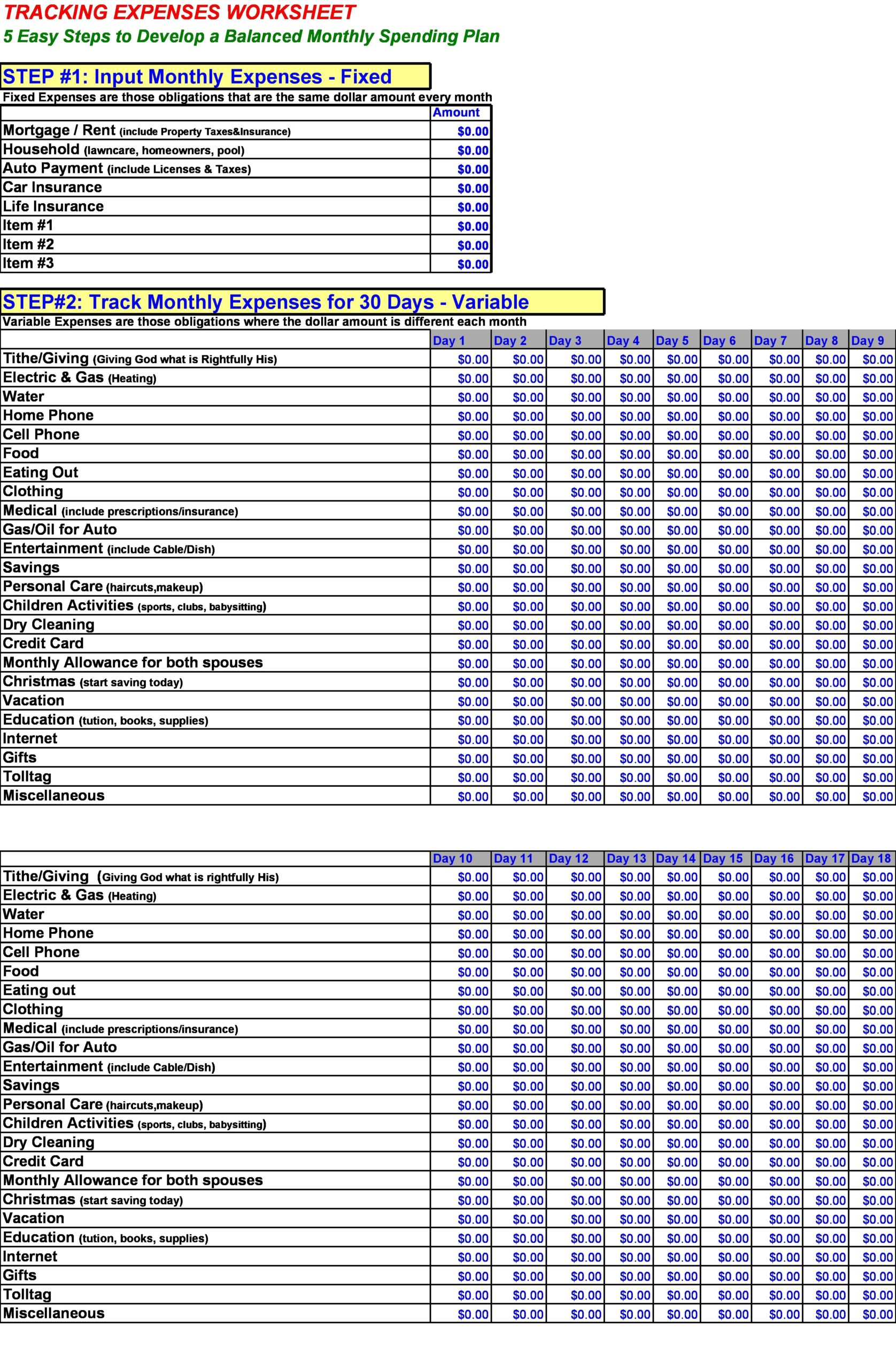

39 self employed business expenses worksheet - Worksheet ... self-employed business expenses worksheet The management of the income and the expenses that are to be managed and kept records of in the worksheet so that you can avoid the unnecessary wastage of the money. There is the worksheet that will involve in it the expenses done on the business and its related affair.

Self employed business expenses worksheet

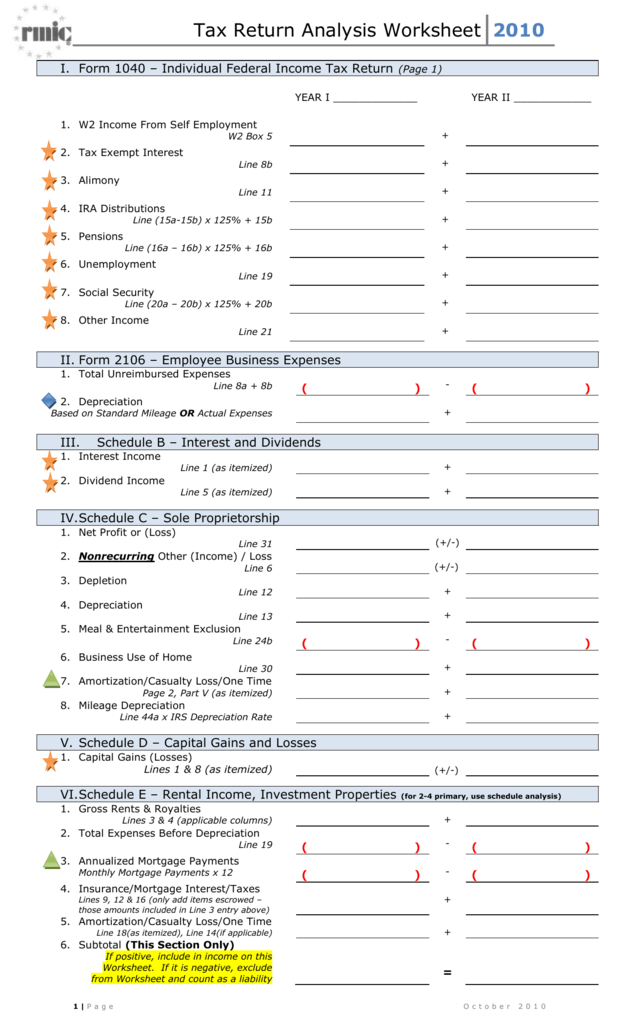

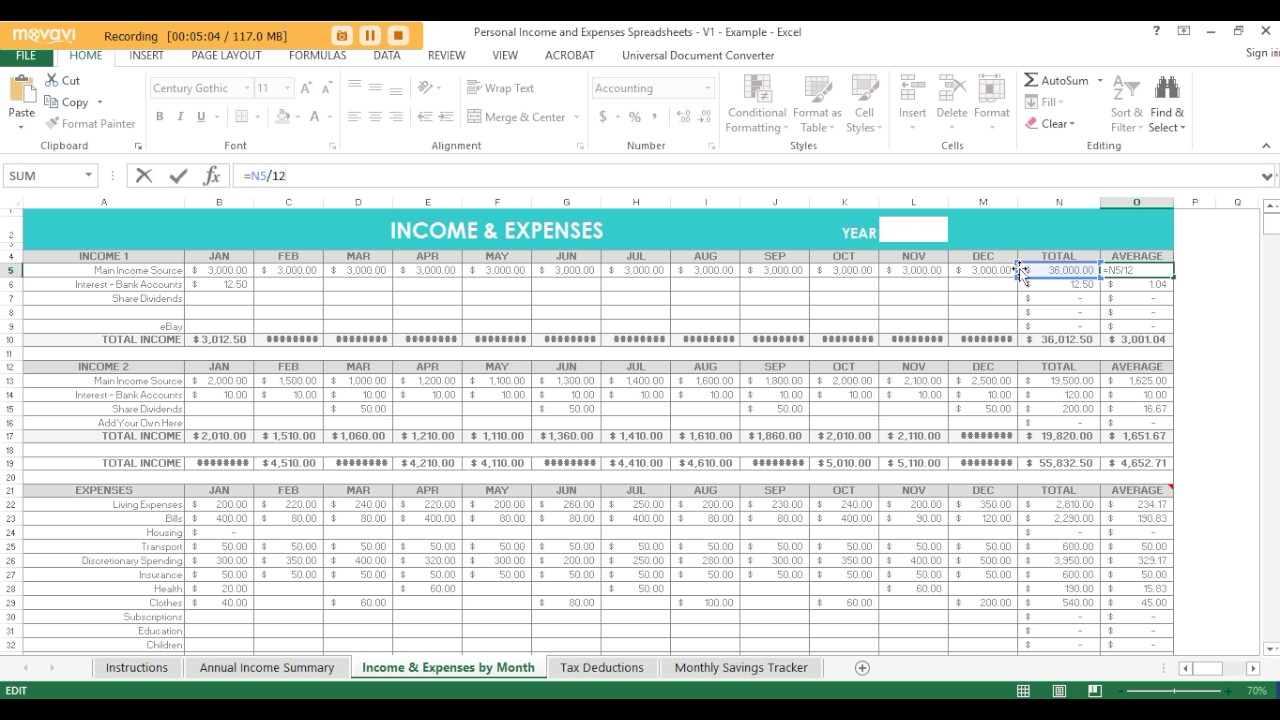

PDF 2021 Self-Employed (Sch C) Worksheet 2021 Self-Employed (Sch C) Worksheet (type-in fillable) (Complete a separate worksheet for each business) Business owner's name: If you checked any of the above, please stop here and speak with one of our Counselors. If you checked none of these above, please continue by completing the worksheet below for each business. 12+ Business Expenses Worksheet in PDF | DOC | Free ... self-employed business expenses worksheet The management of the income and the expenses that are to be managed and kept records of in the worksheet so that you can avoid the unnecessary wastage of the money. There is the worksheet that will involve in it the expenses done on the business and its related affair. › faqs › small-business-self-employedSmall Business, Self-Employed, Other Business | Internal ... Nov 04, 2021 · If you are a statutory employee (box 13 of Form W-2 checked), report your expenses using the same rules as self-employed persons on Schedule C (Form 1040). Additional Information: Publication 587 Business Use of Your Home

Self employed business expenses worksheet. IRS Business Expense Categories List [+Free Worksheet] 19.3.2020 · 11. Self-employed health insurance: If you are self-employed, payments made for medical, dental, and qualified long-term care insurance for yourself, your spouse, and your dependents are deductible. The premiums are not deductible on Schedule C like other business expenses, but rather Form 1040, Schedule 1, line 16 as an adjustment to income. 12. › publications › p535Publication 535 (2021), Business Expenses | Internal Revenue ... Worksheet 6-A. Self-Employed Health Insurance Deduction Worksheet; Chronically ill individual. Benefits received. Other coverage. ... This publication discusses common business expenses and explains what is and is not deductible. The general rules for deducting business expenses are discussed in the opening chapter. ... If you are self-employed ... Self-Employed Tax Deductions Worksheet (Download FREE) The team at Bonsai organized this self-employed tax deductions worksheet (copy and download here) to organize your deductible business expenses for free. Simply follow the instructions on this sheet and start lowering your Social Security and Medicare taxes. PDF Self-Employed Worksheet - MB Tax Pro - Home Self-Employed Worksheet Client: _____ Tax Year: _____ Did you make any payments that would require you to file Form 1099? ... *Expenses must be ordinary and necessary and have a business purpose. The income and expenses above must be backed by receipts and/or other documentation. Title: Contractor's Deduction Worksheet

Claiming the Self-Employment Health Insurance Tax Deduction Dec 30, 2019 · You can only take the $12,000. And if your business reports a loss, you're not eligible for the deduction at all. You could still claim your health insurance expenses as a medical deduction on Schedule A if you itemize, but the above-the-line adjustment to income for self-employed people is usually more advantageous. Publication 505 (2021), Tax Withholding and Estimated Tax ... Certain business expenses of reservists, performing artists, and fee-based government officials. Health savings account or medical savings account deduction. Certain moving expenses for members of the Armed Forces on active duty. Deduction for self-employment tax. Deduction for contributions to self-employed SEP, and qualified SIMPLE plans. PDF TAX YEAR 2021 SMALL BUSINESS CHECKLIST - Tim Kelly self-employed health insurance premiums outside services (paid to other businesses) postage printing and copy expense professional memberships retirement contributions for employees retirement contributions for owner(s) rental of vehicles, machinery or equipment rental of space or property repairs security email to lynn@timkelly.com or fax to ... Self-Employed Worksheet - Decatur, TX I had more than $35,000 in business expenses I received a Form 1095-A I kept an inventory for my business I need to report a business loss I have assets to depreciate (any > $2,500) I don't use the cash method of accounting ... Self-Employed Worksheet (type-in fillable) Rev 2020-12-04. Title: Untitled Author: L S A

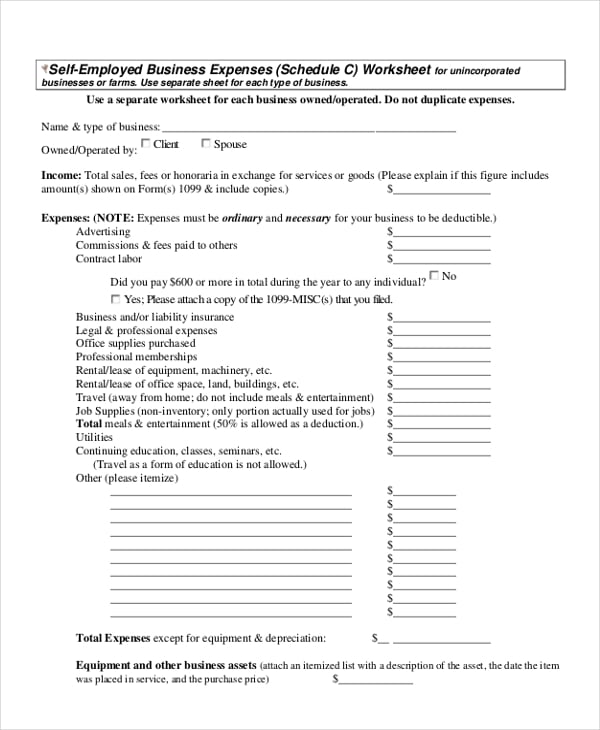

42 self employed expense worksheet - Worksheet For You PDF Self-Employed Business Expenses (Schedule C) Worksheet Self-Employed Business Expenses (Schedule C) Worksheet 1 Self-Employed Business Expenses (Schedule C) Worksheet for unincorporated businesses or farms. Use separate sheet for each type of business. Use a separate worksheet for each business owned/operated. Do not duplicate expenses. Self-Employed Individuals – Calculating Your Own ... 5.11.2021 · If you are self-employed (a sole proprietor or a working partner in a partnership or limited liability company), you must use a special rule to calculate retirement plan contributions for yourself.. Retirement plan contributions are often calculated based on participant compensation. For example, you might decide to contribute 10% of each participant's compensation to your … PDF Self-employed Tax Organizer Part 12: SELF-EMPLOYED BUSINESS EXPENSES A deductible business expense is one that is ordinary (commonly accepted in your industry) and necessary (helpful and appropriate even if not indispensable) for a particular business. Keep bank and credit card statements, but note these are not enough to verify expenses in case of audit. › posts › home-office-deductionHome Office Deduction Worksheet (Excel) - Keeper Tax Mar 11, 2022 · While the simplified method can be useful for some self-employed individuals, the deduction is capped at $1,500 each year. Since most self-employed individuals have more than $1,500 in deductible business expenses each year, it is usually better for them to choose the actual expense method.

› files › 109128408Tax Worksheet for Self-employed, Independent contractors ... Tax Worksheet for Self-employed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099-MISC with box 7 income listed. Try your best to fill this out. If you’re not sure where something goes don’t worry, every expense on here,

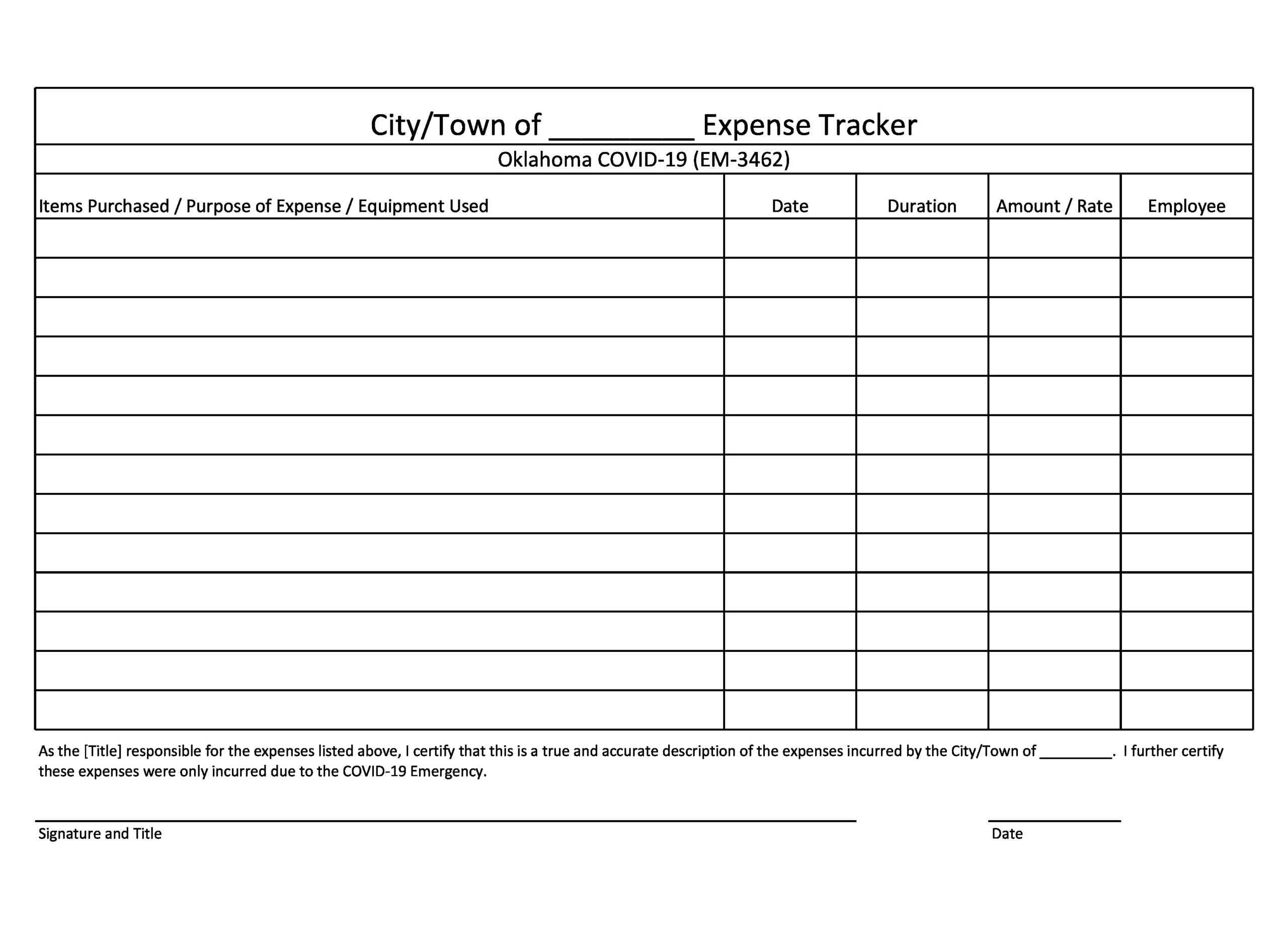

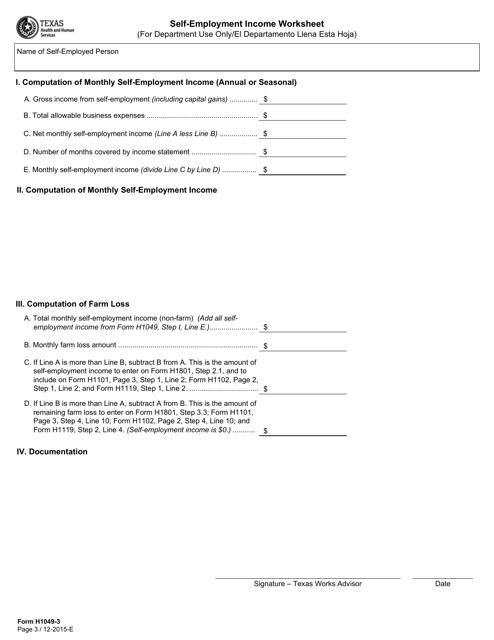

PDF Self Employment Income Worksheet Allowable expenses that can be deducted from income are listed below within the worksheet. Tacoma Public Utilities does not allow the same business deductions as the IRS. Income: Months:

PDF 2020 Sched C Worksheet - Alternatives Schedule C Worksheet for Self-Employed Filers and Contractors - tax year 2020 This document will list and explain the information and documentation that we will need in order to file a tax return for a self-employed person, a contract worker, or a sole-proprietor of a business.

PDF Self-Employed Business Expenses (Schedule C) Worksheet Self-Employed Business Expenses (Schedule C) Worksheet 1 Self-Employed Business Expenses (Schedule C) Worksheet for unincorporated businesses or farms. Use separate sheet for each type of business. Use a separate worksheet for each business owned/operated. Do not duplicate expenses.

sharetheharvest.com › wp-content › uploads(Schedule C) Self-Employed Business Expenses Worksheet for Single (Schedule C) Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors. Use separate sheet for each business. Use a separate worksheet for each business owned/operated. Do not duplicate expenses. Name & type of business: _____ Owned/Operated by: Client Spouse Income: Total ...

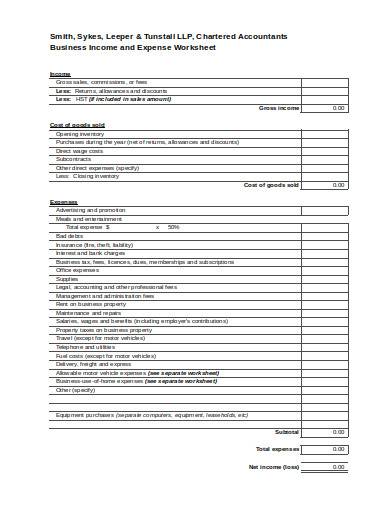

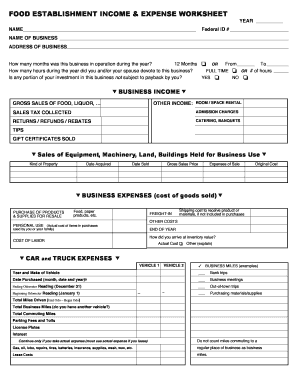

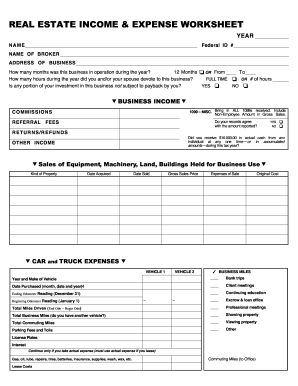

PDF SELF EMPLOYED INCOME/EXPENSE SHEET - CPA Accounting SELF EMPLOYED INCOME/EXPENSE SHEET NAME OF PROPRIETOR BUSINESS ADDRESS BUSINESS NAME FEDERAL I.D. NUMBER Automobile Mileage (Adequate records required) COST OF GOODS SOLD (If Applicable) Beginning of the Year Inventory End of Year Inventory Purchases Other:

41 self employed business expenses worksheet - Worksheet ... Self employed business expenses worksheet. PDF 2021 Self-Employed (Sch C) Worksheet 2021 Self-Employed (Sch C) Worksheet (type-in fillable) (Complete a separate worksheet for each business) Business owner's name: If you checked any of the above, please stop here and speak with one of our Counselors.

Self-Employed Individuals Tax Center | Internal Revenue ... Self-employed individuals generally must pay self-employment tax (SE tax) as well as income tax. SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. In general, anytime the wording "self-employment tax ...

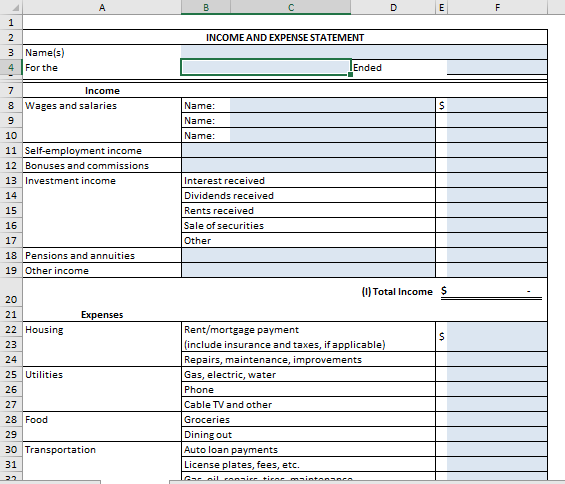

PDF Self-employed Income and Expense Worksheet SELF-EMPLOYED INCOME AND EXPENSE WORKSHEET TAXPAYER NAME SSN PRINCIPAL BUSINESS OR PROFESSION BUSINESS NAME EMPLOYER ID NUMBER BUSINESS ADDRESS BUSINESS ENTITY (CIRCLE ONE) INDIVIDUAL SPOUSE JOINT BUSINESS CITY, STATE, ZIP CODE INCOME EXPENSES $ GROSS RECEIPTS OR SALES $ ADVERTISING $ RETURNS & ALLOWANCES AUTO & TRAVEL $

PDF Self-Employed/Business Monthly Worksheet - OA Tax Partners Self-Employed/Business Name of Proprietor. Social Security Number: Monthly Worksheet: ... Auto & Truck Expense Bank Charges Business Contributions; Business Taxes Commissions; Delivery & Freight Dues & Subscriptions; Equipment Rental Gifts; Insurance Interest.

› faqs › small-business-self-employedSmall Business, Self-Employed, Other Business | Internal ... Nov 04, 2021 · If you are a statutory employee (box 13 of Form W-2 checked), report your expenses using the same rules as self-employed persons on Schedule C (Form 1040). Additional Information: Publication 587 Business Use of Your Home

12+ Business Expenses Worksheet in PDF | DOC | Free ... self-employed business expenses worksheet The management of the income and the expenses that are to be managed and kept records of in the worksheet so that you can avoid the unnecessary wastage of the money. There is the worksheet that will involve in it the expenses done on the business and its related affair.

PDF 2021 Self-Employed (Sch C) Worksheet 2021 Self-Employed (Sch C) Worksheet (type-in fillable) (Complete a separate worksheet for each business) Business owner's name: If you checked any of the above, please stop here and speak with one of our Counselors. If you checked none of these above, please continue by completing the worksheet below for each business.

![1099 Excel Template [Free Download]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/5f63b6bbc9752d68cdd11bac_excel-template-1099.png)

0 Response to "40 self employed business expenses worksheet"

Post a Comment