40 Qualified Dividends And Capital Gain Tax Worksheet Fillable

All Department | Forms & Instructions | NH Department of ... Interest and Dividends Tax Return DP-10 Instructions I&D Checklist: DP-10-ES (fillable) DP-10-ES (print) Interest and Dividends Tax Estimated Quarterly Payment Forms See Form for Instructions: DP-14 (fillable) DP-14 (print) Meals and Rentals Tax Form: DP-31 (fillable) DP-31 (print) Application For Tobacco Tax License See Form for Instructions ... Qualified Dividends And Capital Gain Tax Worksheet ... Qualified Dividends and Capital Gain Tax WorksheetLine 11a. Data put and request legally-binding digital signatures. See Before completing this worksheet complete Form 1040 through line 11b. In order to use the qualified dividends and capital gain tax worksheet you will need to separate your ordinary dividends from qualified dividends.

2021 Capital Loss Carryover Worksheet and Similar Products ... The Capital gain or capital loss worksheet (PDF 143KB) This link will download a file. calculates a capital gain or capital loss for each separate capital gains tax (CGT) event. Remember that: you show the type of CGT asset or CGT event that resulted in the capital gain or capital loss, and. if a capital gain was made, you calculate it using.

Qualified dividends and capital gain tax worksheet fillable

What is a Qualified Dividend Worksheet? - Money Inc IRS introduced the qualified dividend and capital gain tax worksheet as an alternative to Schedule D and added the qualified dividends and new rates to the capital gains worksheet in 2003. The Forms 1040 and 1040A, therefore, help investors to take advantage of lower capital gains rates without having to fill out the Schedule D. Solved: Qualified dividends and capital gain tax worksheet ... Following this example, there is a simple way to calculate the tax: With $700,000 in both qualified dividends and capital gains, the tax should be: (a) 15% of $479,000, or $71,850 plus (b) 20% of the difference between $700,000 and $479,000, or $44,200 plus (c) the tax on $200,000 taxable income that is neither qualified dividends nor capital gains or $36,579. Qualified Dividends Tax Worksheet ≡ Fill Out Printable PDF ... Qualified Dividends Tax Worksheet - Fill Out and Use The Qualified Dividends Tax ...

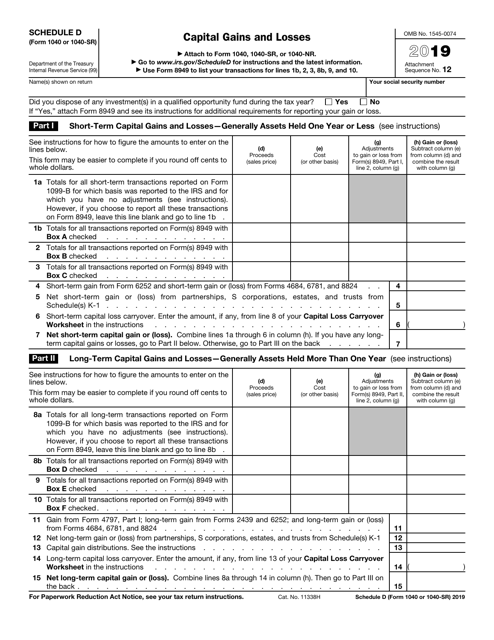

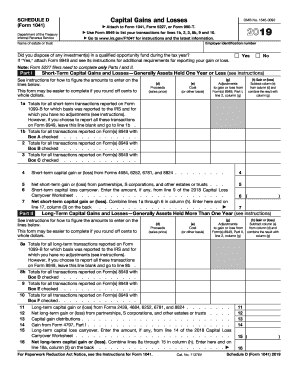

Qualified dividends and capital gain tax worksheet fillable. Qualified Dividends and Capital Gain Tax Worksheet. - CCH Use the Qualified Dividends and Capital Gain Tax Worksheet to figure your tax, if you do not have to use the Schedule D Tax Worksheet and if any of the following applies. You reported qualified dividends on Form 1040, line 9b. You do not have to file Schedule D and you reported capital gain distributions on Form 1040, line 13. Tax Worksheet Instruction ≡ Fill Out Printable PDF Forms ... Tax Worksheet Instruction: Form Length: 1 pages: Fillable? No: Fillable fields: 0: Avg. time to fill out: 15 sec: Other names: qualified dividends and capital gain tax worksheet fillable 2020, qualified dividends and capital gain tax worksheet 2019, 2020 qualified dividends and capital gains worksheet, qualified dividend and capital gain worksheet 2019 Fillable Form 1040 Qualified Dividends and Capital Gain ... Fill Online, Printable, Fillable, Blank Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 Form. Use Fill to complete blank online IRS pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 . On average this form takes 7 minutes to complete Forms and Publications (PDF) - IRS tax forms Click Find. Click on the product number in each row to view/download. Click on column heading to sort the list. You may be able to enter information on forms before saving or printing. Instructions for Schedule D (Form 1040 or Form 1040-SR), Capital Gains and Losses. Instructions for Schedule D (Form 1041), Capital Gains and Losses.

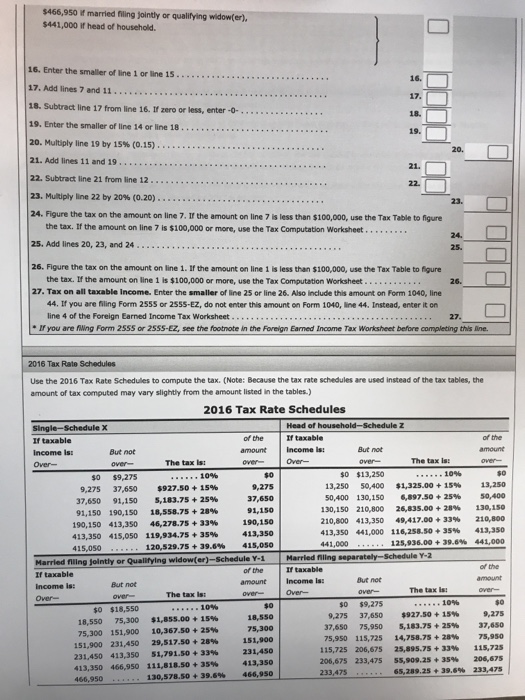

Each kind of investment income can ... - enukabu.fabbro.fvg.it Qualified Dividends And Capital Gain Tax Worksheet 593768 u s individual in e tax return forms instructions & tax table Qualified Dividends And Capital Gain Tax Worksheet 297385 An important concept in Canadian tax law is the idea of tax integration For example, foreign dividends may be taxed at their point of origin, and the IRS does not ... When To Use Qualified Dividends And Capital Gain Tax ... Capital gains tax rates are commonly used to compute qualified dividend taxes. If your taxable income falls below a certain threshold in 2021, qualifying dividends will be taxed at 0%. $80,801 - $501,600 for married couples filing jointly or widow(er)s who qualify to file. Qualified Dividends And Capital Gain Tax Worksheet Fillable ... Complete Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 in a few minutes following the guidelines listed below: Find the document template you need from our collection of legal form samples. Select the Get form key to open it and start editing. Fill in all of the requested fields (they are marked in yellow). How Your Tax Is Calculated: Qualified Dividends and ... Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates. Qualified Income is the sum of qualified dividends (line 2) and long-term capital gains (line 3). Ordinary Income is everything else or Taxable Income minus Qualified Income.

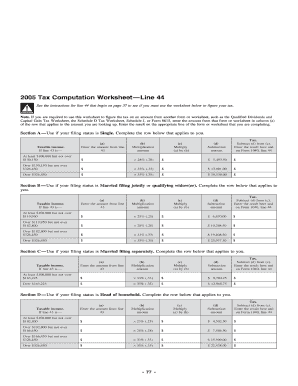

2016 Qualified Dividends And Capital Gain Tax Worksheet ... Find the 2016 Qualified Dividends And Capital Gain Tax Worksheet ... you want. Open it up using the cloud-based editor and begin editing. Fill the blank fields; involved parties names, addresses and phone numbers etc. Customize the template with smart fillable fields. Put the date and place your electronic signature. ACC 330 6-2 Final Project Two Submission Tax Return ... 2016 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43. If you do not have to file Schedule D and you received capital gain distributions, be sure you checked the box on line ... What is the Qualified Dividend and Capital Gains Tax ... The tax rate computed on your Form 1040 must consider any tax-favored items, such as qualified dividends and long-term capital gains, which are generally sub... Fillable 2020 QUALIFIED DIVIDENDS and CAPITAL GAIN TAX ... Fill Online, Printable, Fillable, Blank 2020 QUALIFIED DIVIDENDS and CAPITAL GAIN TAX WORKSHEET (H&Rblock) Form. Use Fill to complete blank online H&RBLOCK pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. 2020 QUALIFIED DIVIDENDS and CAPITAL GAIN TAX WORKSHEET (H&Rblock) On average this form takes 7 minutes to complete

Qualified Dividends And Capital Gain Worksheet Qualified Dividends And Capital Gain Tax Worksheet Chegg Com 2014 Child Tax Credit Worksheet Fill Online Printable Fillable Blank Pdffiller Figure The Tax On The Amount On Line 7 If The Amount On Line 7 Is Less Than 100 000 Use The Tax Table To Figure The Tax If The Amount On Line 7 Course Hero Qualified Dividends And Capital Gain Tax Worksheet Line 44 Capital Gain Tax Worksheet 1040 Com

THIS BOOKLET DOES NOT CONTAIN INSTRUCTIONS ... - IRS tax … tax credit were made to your insurance company to reduce your monthly premium payment, you must attach Form 8962 to your return to reconcile (compare) the advance payments with your premium tax credit for the year. The Marketplace is required to send Form 1095-A by January 31, 2018 listing the advance payments and other , information you need to complete Form 8962. 1. …

How Your Tax Is Calculated: Understanding the Qualified ... Your 1040 Line 43 Taxable Income actually has hidden within it your qualified dividends and long-term capital gains, which are taxed at a different rate. So lines 1-7 of this worksheet are figuring what is your total qualified income (line 6) and your total ordinary income (line 7), so they can be taxed at their different rates.

Qualified Dividends And Capital Gain Worksheet Qualified Dividends And Capital Gain Worksheet Posted on February 17, 2022 February 19, 2022 by admin This is a Research and Development (R&D) with the ADDIE model the place 12 energetic college students of chemistry department concerned on the implementation stage.

1040 (2021) | Internal Revenue Service - IRS tax forms Qualified Dividends. Enter your total qualified dividends on line 3a. Qualified dividends are also included in the ordinary dividend total required to be shown on line 3b. Qualified dividends are eligible for a lower tax rate than other ordinary income. Generally, these dividends are shown in box 1b of Form(s) 1099-DIV.

2021 Instructions for Schedule D (2021) - IRS tax forms Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4g, even if you don't need to file Schedule D. Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and 1040-SR, line 16 (or in the instructions for Form 1040-NR, line 16) to figure your tax.

Achiever Student: Once payment has been made in full, your order will be assigned to the most qualified writer who majors in your subject. The writer does in-depth research and writes your paper to produce high-quality content. The order passes through our editing department after which it is delivered to you. How do I upload files for the writer? The best way to upload files is by using the “additional ...

Qualified Dividends And Capital Gains Worksheet Calculator ... Use the qualified dividends and capital gain tax worksheet in the instructions for form 1040 or 1040a to figure your total tax amount. 1 don t churn your portfolio you want to pay the long term capital gains rate and pay that as infrequently as possible. Do the job from any device and share docs by email or fax.

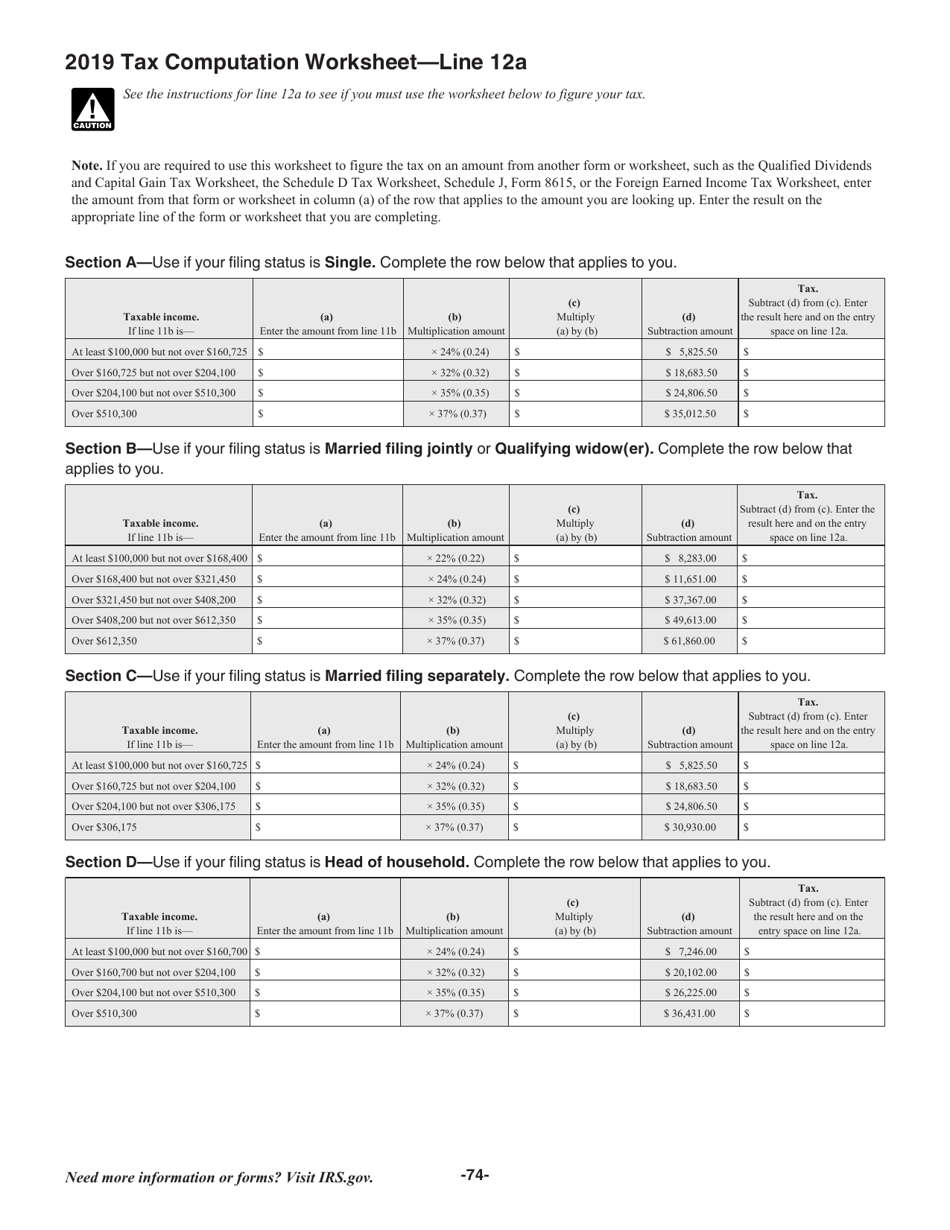

PDF 2020 Tax Computation Worksheet—Line 16 and Capital Gain Tax Worksheet, the Schedule D Tax Worksheet, Schedule J, Form 8615, or the Foreign Earned Income Tax Worksheet, enter the amount from that form or worksheet in column (a) of the row that applies to the amount you are looking up. Enter the result on the appropriate line of the form or worksheet that you are completing. Section A—

Get the free qualified dividends and capital gain tax ... The Qualified Dividends and Capital Gain Tax Worksheet is designed to calculate tax on capital gains at a particular rate. Since there is no common tax rate for all income, each income category should be calculated separately. In this worksheet the investors can benefit from the lower capital gains rates.

Capital Gain Tax Worksheet (PDF) - IRS tax forms If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Schedule 1. Before you begin: 1. Enter the amount from Form 1040, line 10. However, if you are filing Form 2555 or 2555-EZ (relating to foreign earned income), enter the amount from line 3 of the Foreign Earned Income Tax Worksheet .....1. 2. Enter the amount from Form 1040, line 3a*..... 2. 3.

Qualified Dividends And Capital Gain Tax Worksheet 2021 ... qualified dividends and capital gains worksheet 2020reate electronic signatures for signing a qualified dividends and capital gain tax worksheet 2021 in PDF format. signNow has paid close attention to iOS users and developed an application just for them. To find it, go to the AppStore and type signNow in the search field.

Qualified Dividends And Capital Gains Tax Worksheet Sep 13, 2018 · 1-1 Form IRS Instruction 1 Line 1 Fill Online, Printable In Qualified Dividends And Capital Gains Tax Worksheet. Based on teacher views, the E-Worksheet may be very possible to be applied in online and face-to-face studying especially within the covid-19 pandemic era. The E-Worksheet can be utilized as multimedia to assist online studying.

How to Figure the Qualified Dividends on a Tax Return ... Locate ordinary dividends in Box 1a, qualified dividends in Box 1b and total capital gain distributions in Box 2a. Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the...

Diy Qualified Dividends And Capital Gain Worksheet - The ... Qualified Dividends and Capital Gain Tax WorksheetLine 11a. File Form 1041 for 2021 by March 1 2022 and pay the total tax due. For tax year 2021 the 20 rate. Fill in all of the requested fields they are marked in yellow. Otherwise complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms.

Qualified Dividends Tax Worksheet ≡ Fill Out Printable PDF ... Qualified Dividends Tax Worksheet - Fill Out and Use The Qualified Dividends Tax ...

Solved: Qualified dividends and capital gain tax worksheet ... Following this example, there is a simple way to calculate the tax: With $700,000 in both qualified dividends and capital gains, the tax should be: (a) 15% of $479,000, or $71,850 plus (b) 20% of the difference between $700,000 and $479,000, or $44,200 plus (c) the tax on $200,000 taxable income that is neither qualified dividends nor capital gains or $36,579.

What is a Qualified Dividend Worksheet? - Money Inc IRS introduced the qualified dividend and capital gain tax worksheet as an alternative to Schedule D and added the qualified dividends and new rates to the capital gains worksheet in 2003. The Forms 1040 and 1040A, therefore, help investors to take advantage of lower capital gains rates without having to fill out the Schedule D.

0 Response to "40 Qualified Dividends And Capital Gain Tax Worksheet Fillable"

Post a Comment