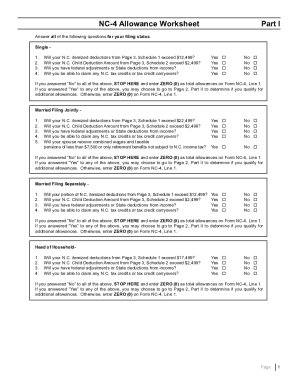

39 nc 4 allowance worksheet

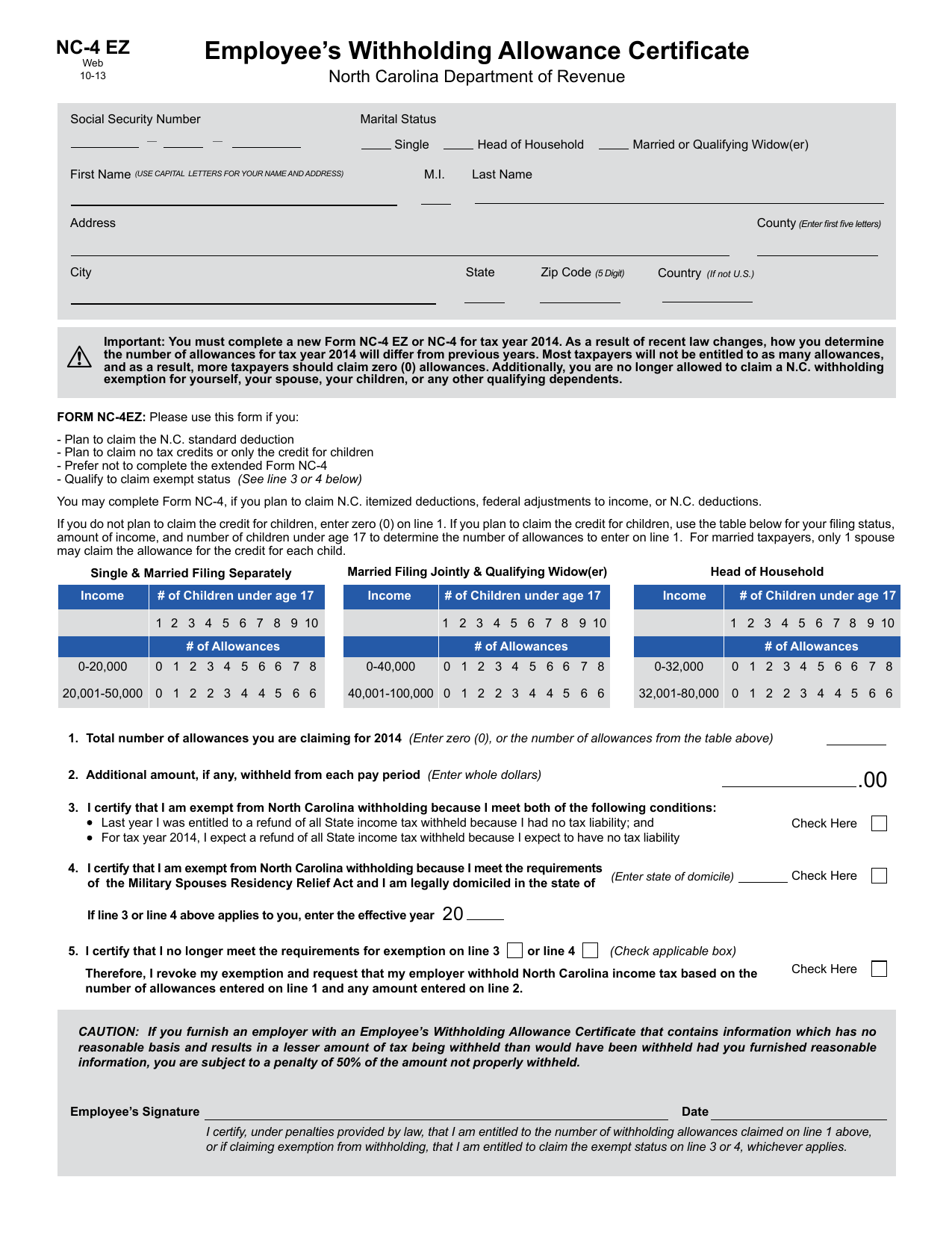

Employee's Withholding Allowance Certificate NC-4EZ - NCDOR » Employee's Withholding Allowance Certificate NC-4EZ Employee's Withholding Allowance Certificate NC-4EZ. Form NC-4EZ Web Employee's Withholding Allowance Certificate. Files. NC-4EZ_Final.pdf. PDF • 453.31 KB - December 17, 2021 Taxes & Forms. Individual Income Tax ... NC-4 Employee’s Withholding - University of Colorado NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the “Multiple Jobs Table” to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4).

Inside Fisheries | NC DEQ North Carolina Department of Environmental Quality. 217 West Jones Street Raleigh, NC 27603 Map It 877-623-6748. Mailing Addresses. Work for Us. Job Opportunities at DEQ; For State Employees; DEQ Intranet; Twitter Feed. Tweets by NC DEQ. Follow Us. Facebook; Twitter; Instagram; YouTube; LinkedIn; DEQ Employee Directory; Translation Disclaimer;

Nc 4 allowance worksheet

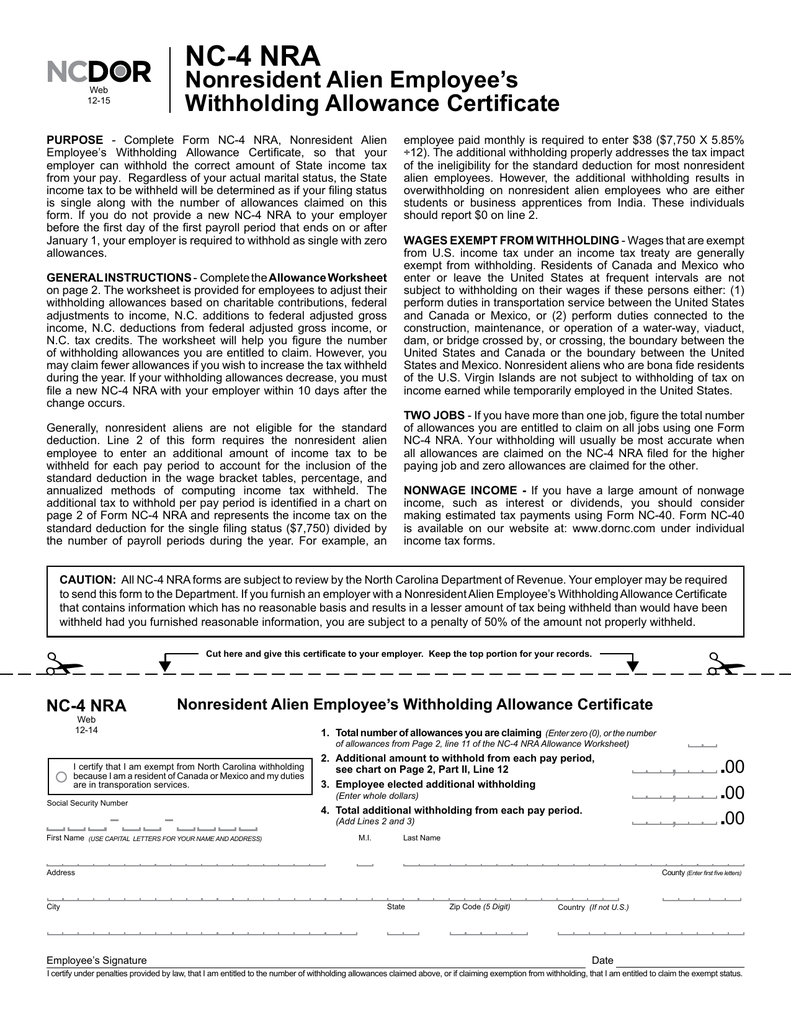

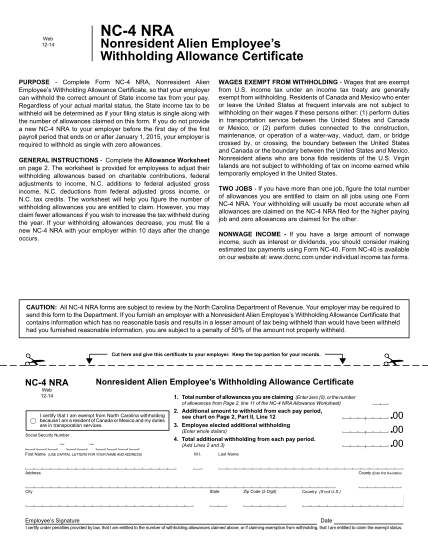

PDF How to fill out the NC-4 EZ - One Source Payroll Items needed to fill out NC-4 EZ Form NC-4 EZ Form NC-4 With Allowance Worksheet/schedules Copy of previous year Federal 1040, 1040A, or 1040 EZ Used to estimate income and deductions for 2014 How to Fill Out The Personal Allowances Worksheet (W-4 ... Here is more information about the W-4 Worksheet, including how to fill out the W-4 allowance worksheet, line by line. Although it is late in the year, if you were disappointed in the size of your refund or you had an unexpected balance due when you filed your 2018 tax return, it is not too late to make changes for 2019. PDF NC-4 NRA Nonresident Alien Employee's Withholding ... 1.Total number of allowances you are claiming (Enter zero (0), or the number of allowances from Page 2, line 11 of the NC-4 NRA Allowance Worksheet) Additional amount to withhold from each pay period, see chart on Page 2, Part II, Line 12 2. Employee elected additional withholding (Enter whole dollars) 3..00.00

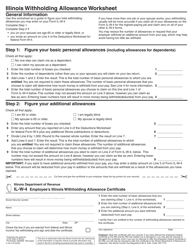

Nc 4 allowance worksheet. Pay Rates and Benefits - United States Coast Guard 2022 Reserve IDT Subsistence Allowance: Breakfast - $2.55; Lunch - $4.65; Dinner - $4.65; Cadet COMRATS. The subsistence allowance is applicable when in a leave or temporary duty status, and is equal to the daily rate for an enlisted member receiving Basic Allowance for Subsistence (ENL-BAS). Effective 1 January 2022, the daily rate is $13.566. PDF Frequently Asked Questions Re: Employee's Withholding ... completing the NC-4 Allowance worksheet? A15. No. Pre-tax items are not included in taxable income and similarly should not be included when completing the NC-4 Allowance worksheet. Q16. When do we send a NC-4EZ or NC-4 to the Department? A16. If an employee claims more than 10 allowances, you should forward this document to PDF Employee's Withholding Allowance Certificate NC-4 North ... complete the Personal Allowances Worksheet. An additional worksheet is provided on page 2 for employees to adjust their withholding allowances based on itemized deductions, adjustments to income, or tax credits. The worksheets will help you figure the number ... Form Employee's Withholding Allowance Certificate NC-4 Web 11-01 39 nc-4 allowance worksheet - Worksheet Resource Nc 4 Allowance Worksheet - Addition Worksheets Pictures 2020 Allowance worksheet part i. It may send you back with a number to enter on line 1 or send you to complete part ii of the allowance worksheet. Instructions on completing new nc 4. Franchise tax corporate income tax and insurance premium tax rules and bulletins reflecting changes made ...

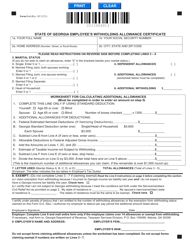

41 nc-4 allowance worksheet - Worksheet Database NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the Multiple Jobs Table to determine the additional amount to be withheld on line 2 of Form NC-4 (See Allowance Worksheet). Utility Assistance Programs - Rocky Mount NC Potentially the COVID-19 UAP assistance for a household can be equal to the total arrears for six monthly payments (including any amounts that accrue in the five month period that follows the date of the first assistance payment to meet the six-consecutive-month-period allowance) towards delinquent City of Rocky Mount utilities that became due ... NC-4 Employee’s Withholding 9-16 Allowance Certificate NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the Multiple Jobs Table to determine the additional amount to be withheld on line 2 of Form NC-4 (See Allowance Worksheet). PDF Surviving Spouse - Nc FORM NC-4 BASIC INSTRUCTIONS - Complete the NC-4 Allowance Worksheet. The worksheet will help you determine your withholding allowances based on federal and State adjustments to gross income including the N.C. Child Deduction Amount, N.C. itemized deductions, and N.C. tax credits.

Employee's Withholding Allowance Certificate NC-4 | NCDOR » Employee's Withholding Allowance Certificate NC-4 Employee's Withholding Allowance Certificate NC-4. Form NC-4 Employee's Withholding Allowance Certificate. Files. NC-4_Final.pdf. PDF • 488.48 KB - December 17, 2021 Taxes & Forms. Individual Income Tax; Sales and Use Tax ... How to fill out the NC-4 - One Source Payroll Line 2 of NC-4 Enter the amount of additional money you want withheld. Examples of persons who may use this line are: Individuals with more than one job Reference NC-4 instructions and NC-4 page 5 Pension recipients Note: If you have a large amount of nonwage income, such as interest or dividends, you should consider making Federal and North Carolina Paycheck Withholding Calculator NC-4 Allowance Worksheet Part II; Schedule 1 Estimated N.C. Itemized Deductions Qualifying Mortgage Interest: Real estate property taxes: Charitable Contributions (Same as allowed for federal): Medical and Dental Expenses (Same as allowed for federal): Itemized Total (after limits) Schedule 2 Estimated Child Deduction Amount PDF Fayetteville State University | Fayetteville, NC NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the "Multiple Jobs Table" to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 5).

Diy Nc 4 Allowance Worksheet - Goal keeping intelligence FORM NC-4 BASIC INSTRUCTIONS - Complete the NC-4 Allowance Worksheet. The worksheets will help you figure the number of withholding allowances you are entitled to claim. You should also refer to the Multiple Jobs Table to determine the additional amount to be withheld on line 2 of Form NC-4 See Allowance Worksheet.

PDF Form NC-4 Instructions for Completing Form NC-4 Employee's ... The worksheets will help you figure the number of withholding allowances you are entitled to claim. However, you may claim fewer allowances if you wish to increase the tax withheld during the year. If your withholding allowances decrease, you must file a new NC-4 with your employer within 10 days after the change occurs except that a new NC-4 ...

PDF NC-4 NRA Web Nonresident Alien Employee's Withholding ... Withholding Allowance Certificate NC-4 NRA 1.Total number of allowances you are claiming (Enter zero (0), or the number of allowances from Page 2, line 11 of the NC-4 NRA Allowance Worksheet) Additional amount to withhold from each pay period, see chart on Page 2, Part II, Line 12 2. Employee elected additional withholding (Enter whole dollars ...

2022 Form W-4 - IRS tax forms Step 2(b)—Multiple Jobs Worksheet (Keep for your records.) If you choose the option in Step 2(b) on Form W-4, complete this worksheet (which calculates the total extra tax for all jobs) on only ONE Form W-4. Withholding will be most accurate if you complete the worksheet and enter the result on the Form W-4 for the highest paying job. Note:

PDF NC-4 Employee's Withholding 10-17 Allowance Certicate NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 led for the higher paying job and zero allowances are claimed for the other. You should also refer to the "Multiple Jobs Table" to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 5).

PDF NC-4 NRA Part II GENERAL INSTRUCTIONS- Complete the NC-4 NRAAllowance Worksheet on page 2. The worksheet will help you determine the number of withholding allowances you are entitled to claim based on federal and State adjustments to gross income, including the N.C. Child Deduction Amount, N.C. itemized deduction for charitable contributions, and N.C. tax credits.

NC-4 Employee's Withholding NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the "Multiple Jobs Table" to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4).

PDF NC-4 Employee's Withholding - Rowan-Salisbury School System (From Line F of the Personal Allowances Worksheet on Page 2) Additional amount, if any, you want withheld from each pay period (Enter whole dollars) 2. • This year I expect a refund of all State income tax withheld because I expect to have no tax liability. ... NC-4 Web 10-12.

NC-4 - form.jotform.com Employee's Withholding Allowance Certificate North Carolina Department of Revenue. 1. Total number of allowances you are claiming (Enter zero (0), or the number of allowances from Page 2, line 16 of the NC-4 Allowance Worksheet) 2. Additional amount, if any, withheld from each pay period (Enter whole dollars)

NC-4 NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the “Multiple Jobs Table” to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4).

NC-4 Employee’s Withholding Allowance Certificate NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the Multiple Jobs Table to determine the additional amount to be withheld on line 2 of Form NC-4 (See Allowance Worksheet).

PDF NC-4 Employee's Withholding 11-15 Allowance Certificate NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the Multiple Jobs Table to determine the additional amount to be withheld on line 2 of Form NC-4 (See Allowance Worksheet).

PDF NC-4 NRA Nonresident Alien Employee's Withholding ... 1.Total number of allowances you are claiming (Enter zero (0), or the number of allowances from Page 2, line 11 of the NC-4 NRA Allowance Worksheet) Additional amount to withhold from each pay period, see chart on Page 2, Part II, Line 12 2. Employee elected additional withholding (Enter whole dollars) 3..00.00

How to Fill Out The Personal Allowances Worksheet (W-4 ... Here is more information about the W-4 Worksheet, including how to fill out the W-4 allowance worksheet, line by line. Although it is late in the year, if you were disappointed in the size of your refund or you had an unexpected balance due when you filed your 2018 tax return, it is not too late to make changes for 2019.

PDF How to fill out the NC-4 EZ - One Source Payroll Items needed to fill out NC-4 EZ Form NC-4 EZ Form NC-4 With Allowance Worksheet/schedules Copy of previous year Federal 1040, 1040A, or 1040 EZ Used to estimate income and deductions for 2014

/cloudfront-us-east-1.images.arcpublishing.com/gray/XDQFMUVP4NFPXECEUEKYBL5SIE.jpg)

/FormW-42022-92779be669a64b0da38ce644c949a9c6.jpeg)

0 Response to "39 nc 4 allowance worksheet"

Post a Comment