39 nc-4 allowance worksheet

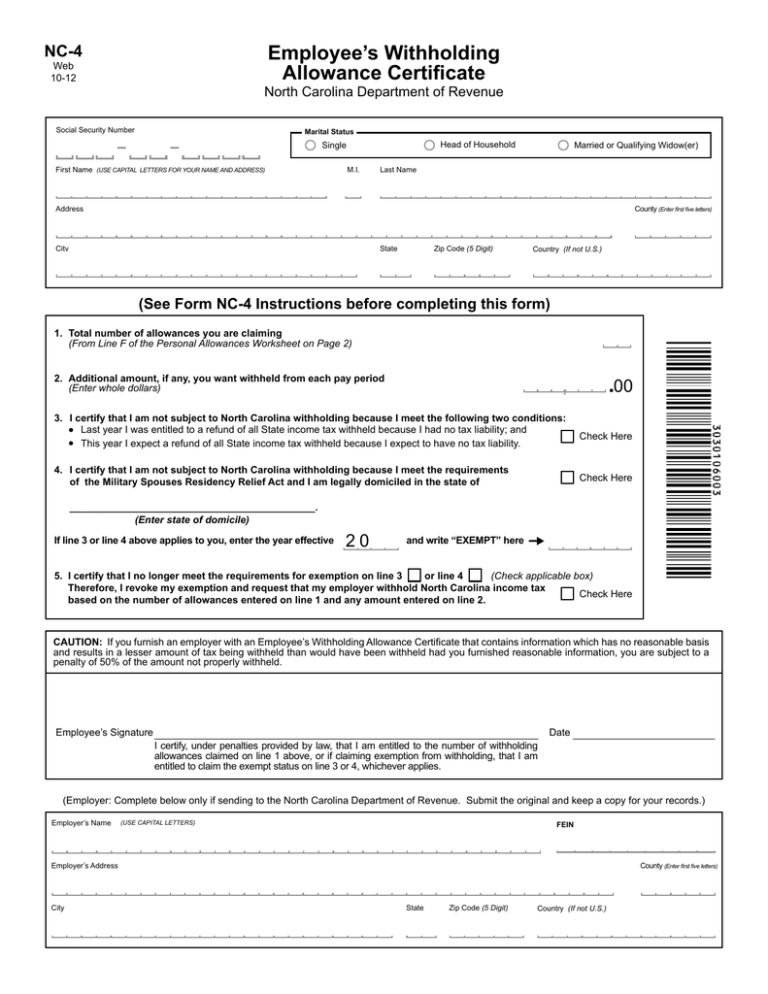

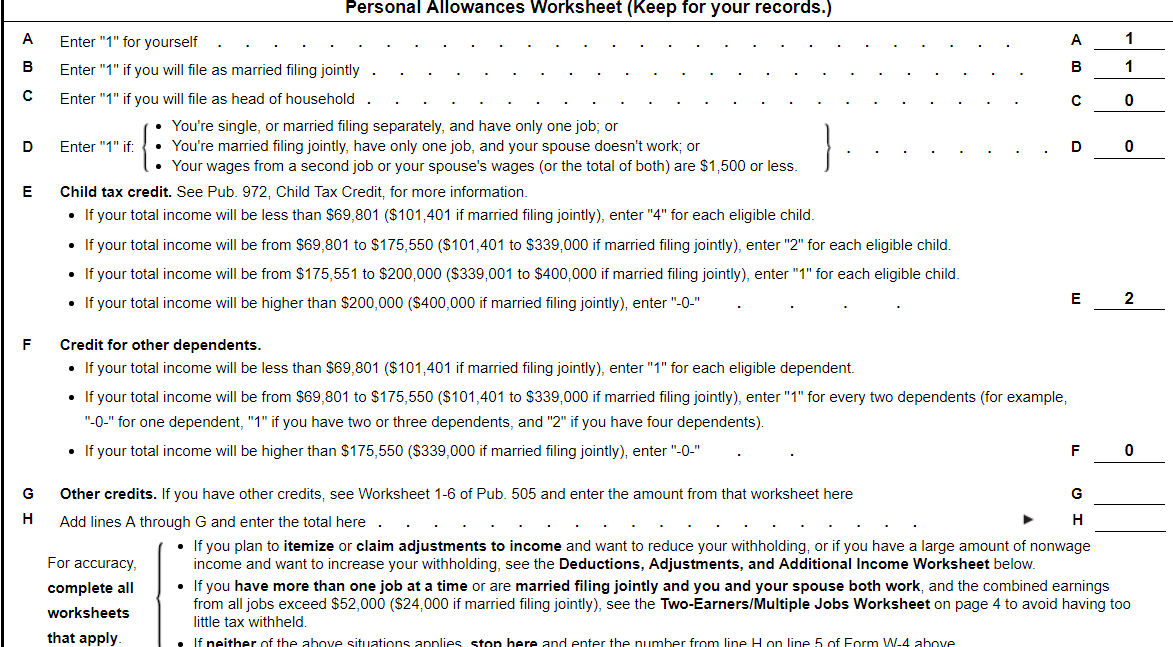

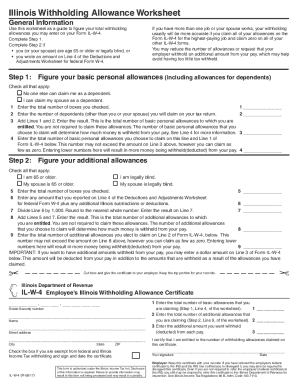

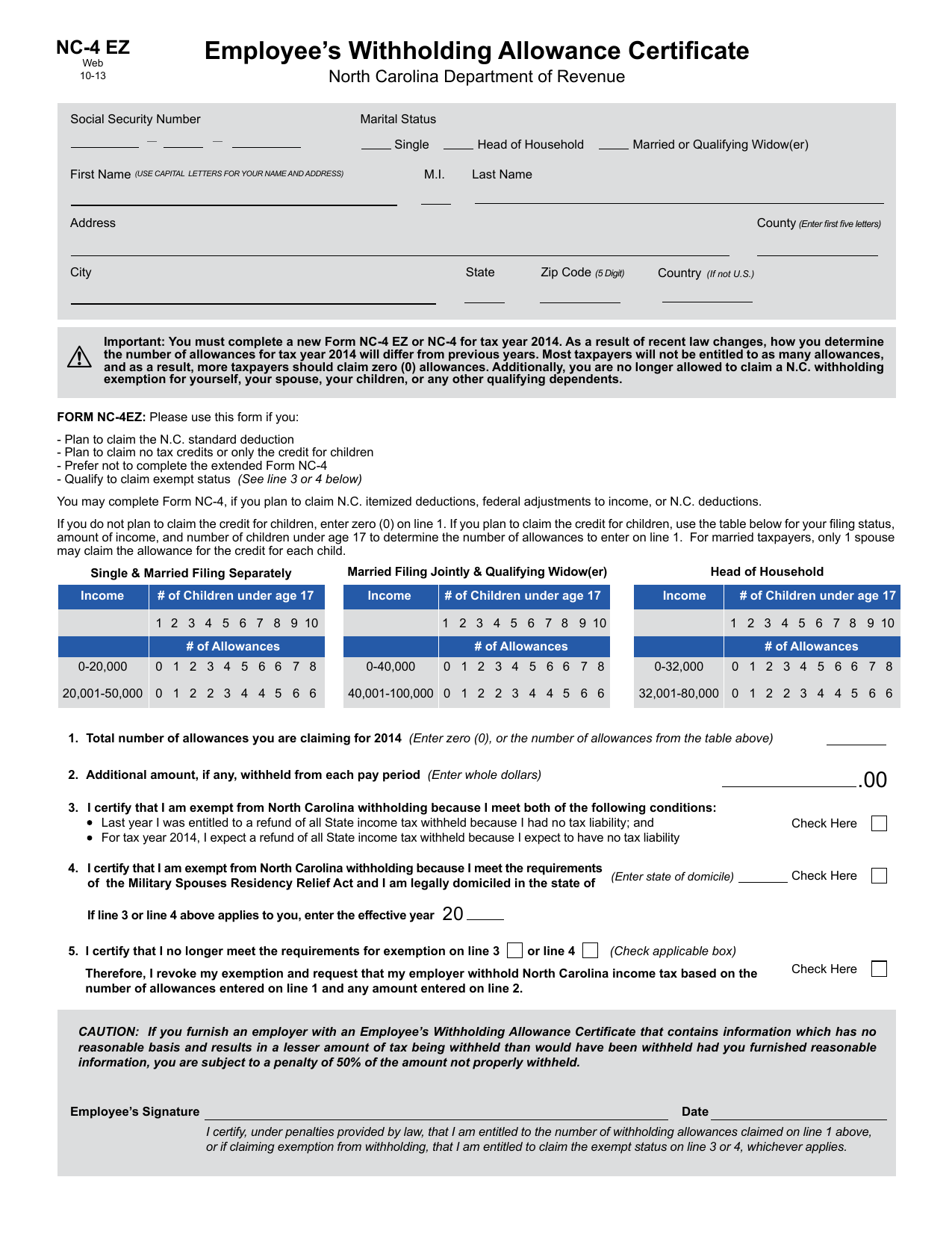

Nc 4 Allowance Worksheet - Addition Worksheets Pictures 2020 Allowance worksheet part i. It may send you back with a number to enter on line 1 or send you to complete part ii of the allowance worksheet. Instructions on completing new nc 4. Franchise tax corporate income tax and insurance premium tax rules and bulletins reflecting changes made in the 2017 regular session of the north carolina general ... Diy Nc 4 Allowance Worksheet - Goal keeping intelligence Additional withholding allowances may be claimed if you expect to have allowable itemized deductions exceeding the standard deduction. Itemized deductions and NC. Nc 4 Allowance Worksheet Nidecmege Itemized deductions and NC. Nc 4 allowance worksheet. NC-4 Allowance Worksheet Part II. Tax credits or tax credit carryovers from Page 4 Schedule 3.

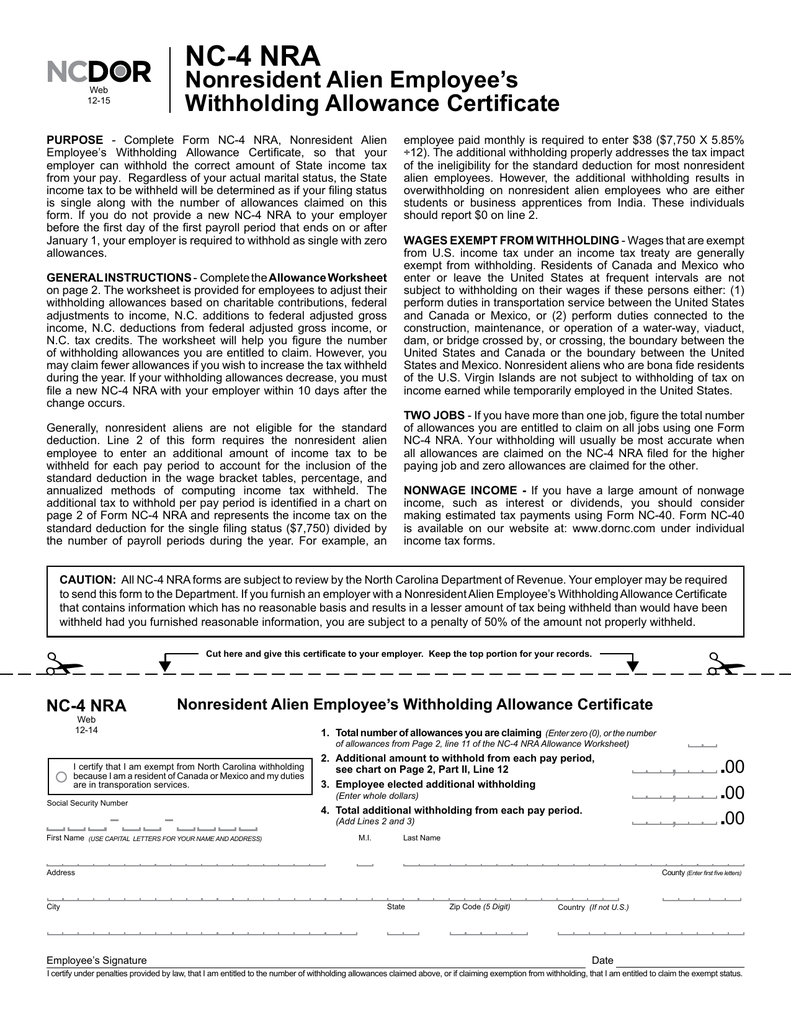

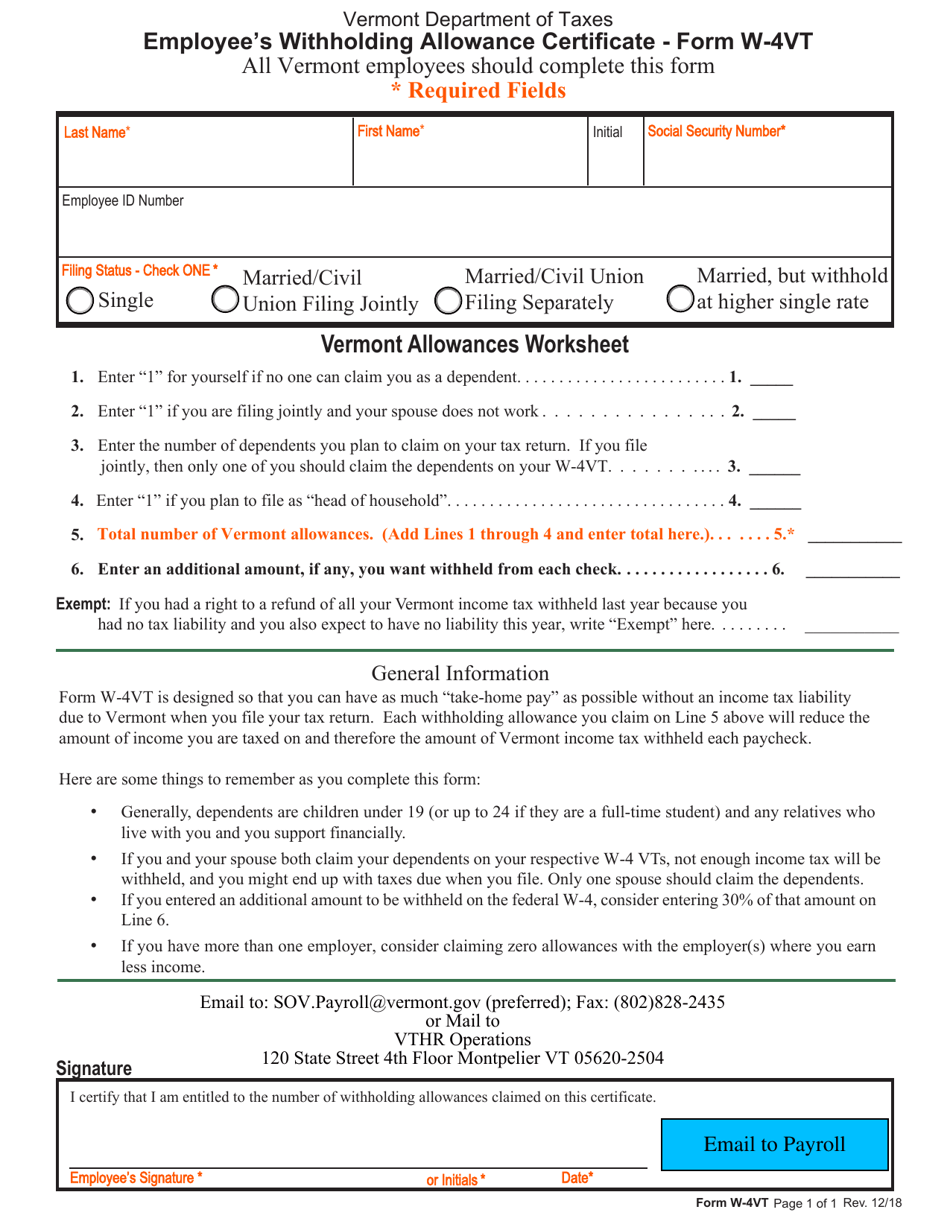

Nc 4 Allowances Worksheet : Suggested Addresses For ... NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the "Multiple Jobs Table" to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4).

Nc-4 allowance worksheet

Nc 4 Allowance Worksheet Help : Suggested Addresses For ... NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the "Multiple Jobs Table" to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4). NC-4 Employee's Withholding - University of Colorado NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the "Multiple Jobs Table" to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4). Nc 4 Allowance Worksheet 2020 : Suggested Addresses For ... Websites providing accurate and useful information regarding Nc 4 Allowance Worksheet 2020 are shown on the results list here. Scholarship enrollment, Scholarship details will be also included.

Nc-4 allowance worksheet. PDF NC-4 - Harnett NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the "Multiple Jobs Table" to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4). Nc 4 Allowance Worksheet - 2 : Complete this form so that ... The worksheet is provided for employees to adjust their withholding allowances based on charitable contributions, federal adjustments to income, n.c. copy of previous year federal 1040, 1040a, or 1040 ez. used to estimate income and deductions for . copy of previous year federal 1040, 1040a, or 1040 ez. used to estimate income and deductions for . PDF NC-4 Employee's Withholding Allowance Certificate NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the Multiple Jobs Table to determine the additional amount to be withheld on line 2 of Form NC-4 (See Allowance Worksheet). Nc 4 Allowance Worksheet - NEXTSSSSSS Nc 4 nra allowance worksheet schedules schedule 1 estimated nc. Find the secton for your marital status and answer all the questions for that section and follow its directions. Ncdor Employee S Withholding Allowance Certificate Nc 4 . The determination of the number of allowances on the nc 4ez or nc 4.

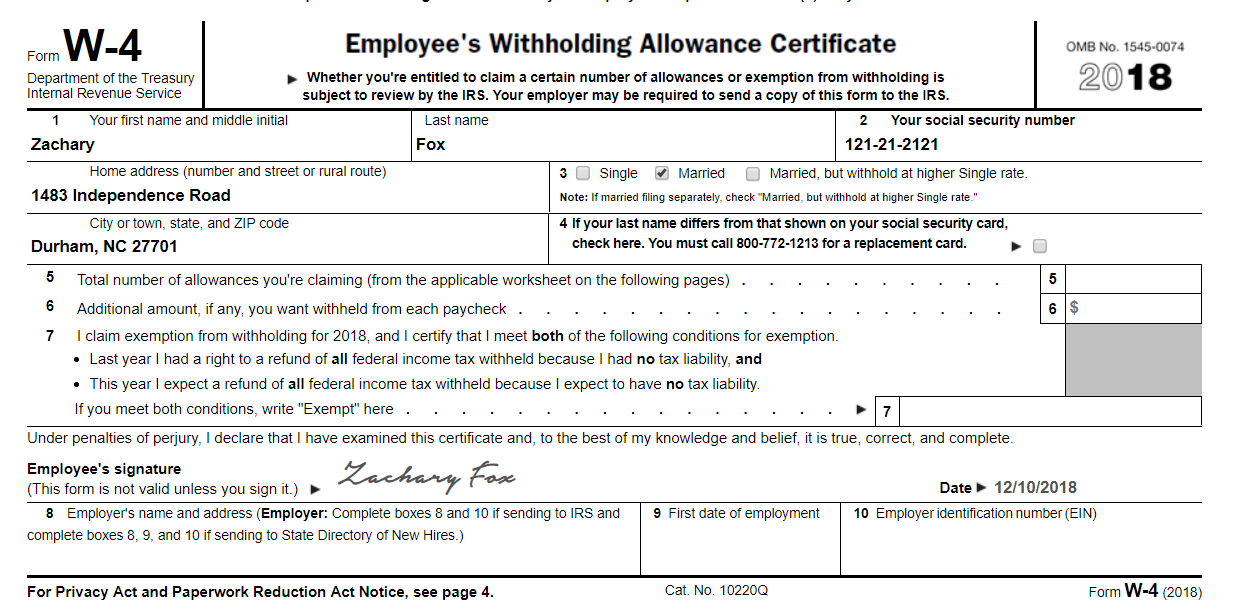

Nc-4 Allowance Worksheet - Withholding Certificate For ... Nc-4 Allowance Worksheet - Withholding Certificate For Pension Or Annuity Payments Pdf Free Download - New york state • new.. Generate traceable letters, words, names, and more. ¤ used to estimate income and deductions for 2014. (facial expressions, gestures, eye contact) video & movie activities warmers & coolers web tools for teachers ... megaroll.info › symptoms-of-late-onset-diabetes-2symptoms of late onset diabetes 2 🙍natural cures treatments Aug 26, 2021 · Home; COVID-19 ; Newsroom Phloridzin normalizes blood glucose in experimental models of diabetes, restoring insulin sensitivity in cells and living tissues. 23,46-48 Phloridzin also inhibits SGLT2 in the kidney, but to a far lesser extent than many pharmaceutical drugs currently undergoing intensive research and development. 49 Phloridzin has been shown to decrease food consumption and body ... › pub › irs-pdf2022 Form W-4 - IRS tax forms Step 2(b)—Multiple Jobs Worksheet (Keep for your records.) If you choose the option in Step 2(b) on Form W-4, complete this worksheet (which calculates the total extra tax for all jobs) on only ONE Form W-4. Withholding will be most accurate if you complete the worksheet and enter the result on the Form W-4 for the highest paying job. Note: Nc 4 Allowance Worksheet : Suggested Addresses For ... NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the "Multiple Jobs Table" to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4).

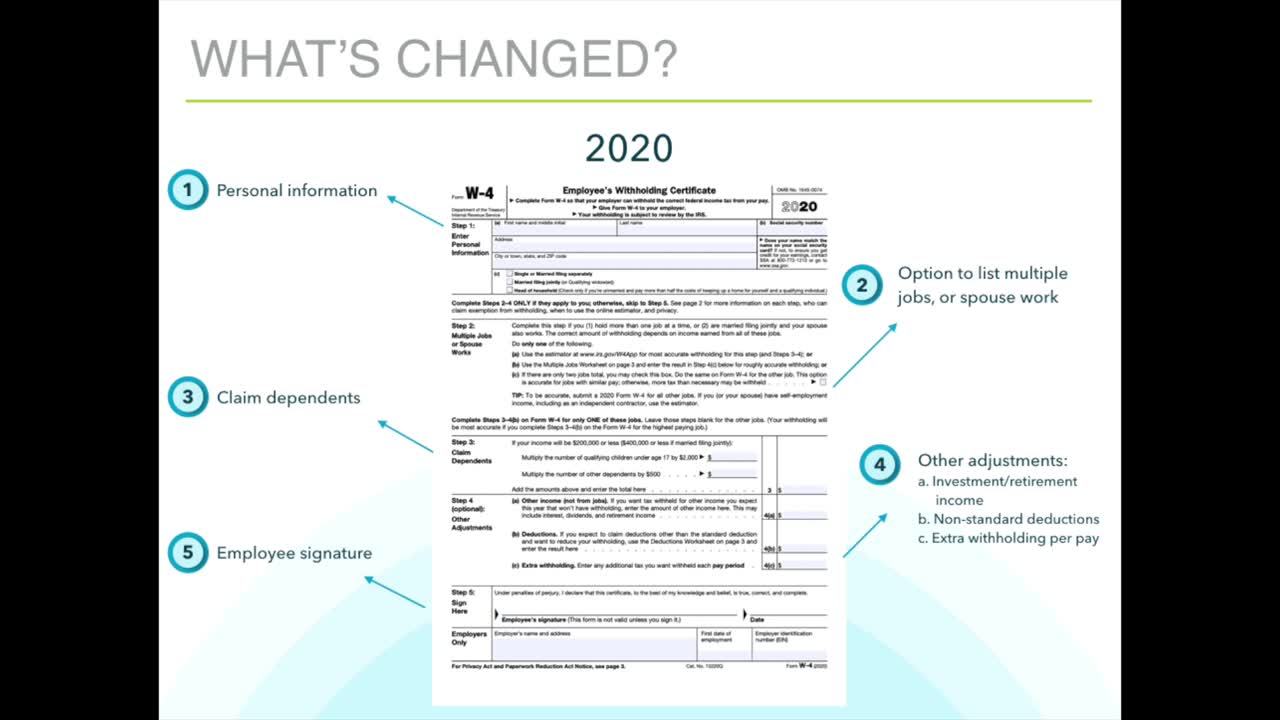

Nc 4 Allowance Worksheet 2021 : Suggested Addresses For ... Websites providing accurate and useful information regarding Nc 4 Allowance Worksheet 2021 are shown on the results list here. Scholarship enrollment, Scholarship details will be also included. 41 nc-4 allowance worksheet - Worksheet Database 41 nc-4 allowance worksheet. Form NC-4 With Allowance Worksheet/schedules Copy of previous year Federal 1040, 1040A, or 1040 EZ Used to estimate income and deductions for 2014 Line 1 of NC-4 You are no longer allowed to claim a N.C. withholding allowance for yourself, your spouse, your children, or any other dependents. Nc 4 Allowance Worksheet - being-rejected.blogspot.com Nc 4 nra allowance worksheet schedules schedule 1 estimated nc. Find the secton for your marital status and answer all the questions for that section and follow its directions. Ncdor Employee S Withholding Allowance Certificate Nc 4 . The determination of the number of allowances on the nc 4ez or nc 4. PDF Form NC-4 Instructions for Completing Form NC-4 Employee's ... consider completing a new NC-4 if your personal or financial situation has changed from the previous year. BASIC INSTRUCTIONS - Complete the Personal Allowances Worksheet on Page 2 of Form NC-4. An additional worksheet is provided on Page 2 for employees to adjust their withholding allowances based on itemized deductions, adjustments to income,

PDF Nc-4 NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the "Multiple Jobs Table" to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4).

› includes › pdfHow to fill out the NC-4 - One Source Payroll Form NC-4 With Allowance Worksheet/schedules Copy of previous year Federal 1040, 1040A, or 1040 EZ Used to estimate income and deductions for 2014 Line 1 of NC-4 You are no longer allowed to claim a N.C. withholding allowance for yourself, your spouse, your children, or any other dependents.

Employee's Withholding Allowance Certificate NC-4 | NCDOR » Employee's Withholding Allowance Certificate NC-4 Employee's Withholding Allowance Certificate NC-4. Form NC-4 Employee's Withholding Allowance Certificate. Files. NC-4_Final.pdf. PDF • 488.48 KB - December 17, 2021 Taxes & Forms. Individual Income Tax; Sales and Use Tax ...

› north-carolina-tax-rates-forms-andNorth Carolina Income Tax Bracket and Rates and ... - eFile Other Standard Deductions by State: Compare State Standard Deduction Amounts IRS Standard Deduction: Federal Standard Deductions North Carolina Income Tax Forms. North Carolina State Income Tax Forms for Tax Year 2021 (Jan. 1 - Dec. 31, 2021) can be e-Filed in conjunction with a IRS Income Tax Return.

Nc 4 Allowance Worksheet : Form W-4 - Personal Allowances ... Nc 4 Allowance Worksheet : Form W-4 - Personal Allowances Worksheet - 2017 printable ... - You no longer need to calculate how many allowances to claim to increase or decrease your withholding.. The worksheet will help you determine the number of withholding allowances you are entitled to claim based on federal and state adjustments to gross ...

files.nc.gov › ncdps › documentsNC-4 Employee’s Withholding 9-16 Allowance Certificate NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the Multiple Jobs Table to determine the additional amount to be withheld on line 2 of Form NC-4 (See Allowance Worksheet).

Nc 4 Allowance Worksheet 2020 : Suggested Addresses For ... Websites providing accurate and useful information regarding Nc 4 Allowance Worksheet 2020 are shown on the results list here. Scholarship enrollment, Scholarship details will be also included.

NC-4 Employee's Withholding - University of Colorado NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the "Multiple Jobs Table" to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4).

Nc 4 Allowance Worksheet Help : Suggested Addresses For ... NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the "Multiple Jobs Table" to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4).

/cloudfront-us-east-1.images.arcpublishing.com/gray/XDQFMUVP4NFPXECEUEKYBL5SIE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/gray/XDQFMUVP4NFPXECEUEKYBL5SIE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/gray/XDQFMUVP4NFPXECEUEKYBL5SIE.jpg)

0 Response to "39 nc-4 allowance worksheet"

Post a Comment