42 personal property value worksheet

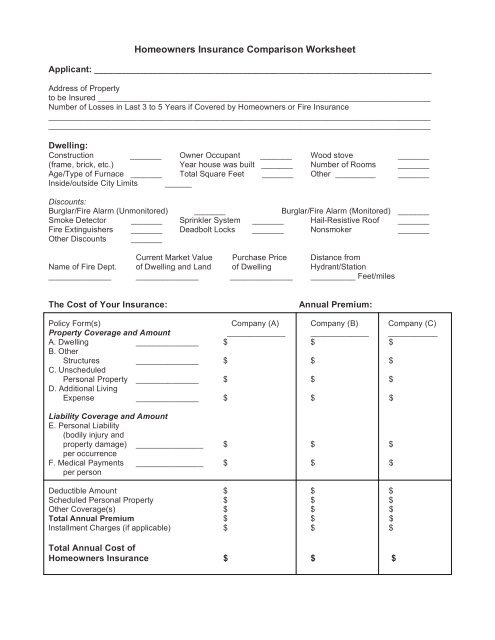

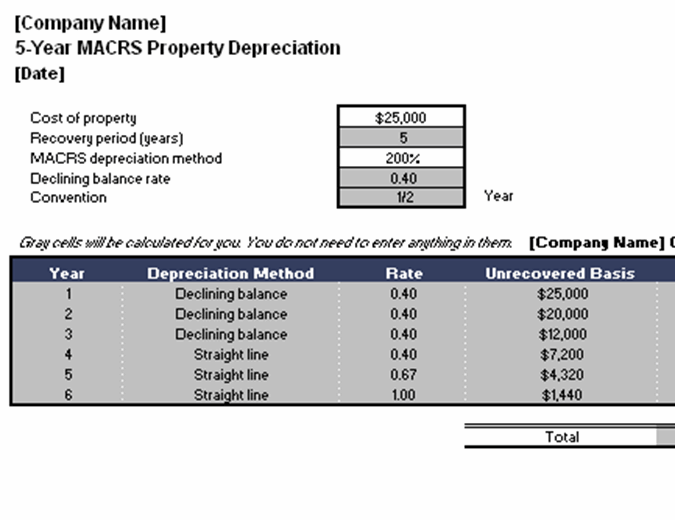

Personal Property Assessment Information Guide, August 2, 2021, Page 2 Nebraska Net Book Value. Nebraska net book value is the taxable value for personal property taxation. It is the Nebraska adjusted basis of the tangible personal property multiplied by the appropriate depreciation factor, based on the year placed in service and the recovery ... Home insurers rely on data-rich variables when they compute the amount of coverage for each homeowner's personal property. These variables include an item's depreciated value, replacement cost and ...

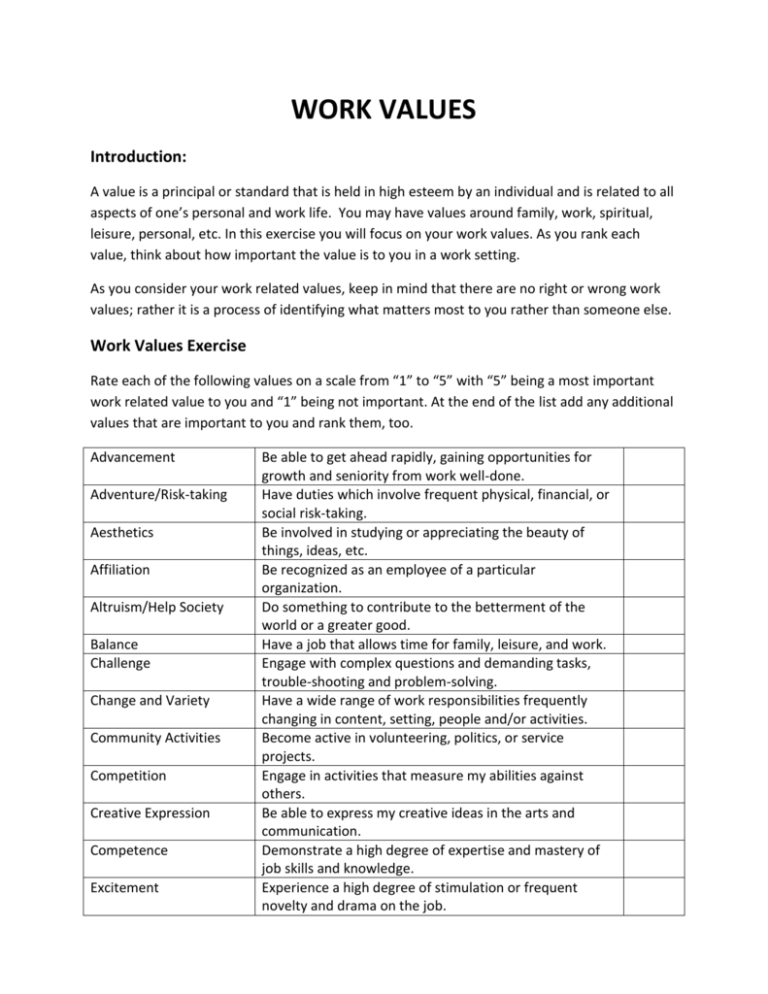

Listed below are 50 values. Read through the list. When you find a value that describes you, circle it. Next, condense the circled list to the 10 values that most describe you. Finally, reflect on the meaning of each of these 10 values, and ask yourself if they are congruent with the choices you make and the actions you take on a daily basis.

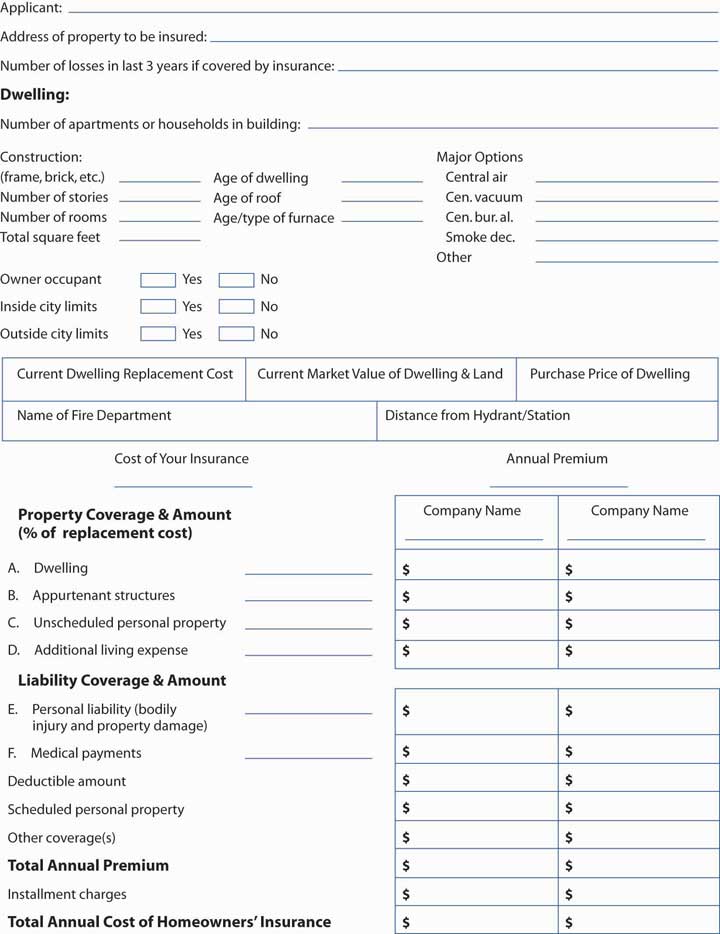

Personal property value worksheet

Get a personal property value estimate. Whether you live in a home, apartment, or condo, personal property coverage is one of the most important aspects of your insurance. It's essential to be knowledgeable about accurate replacement costs so we can best serve you in the event of a covered loss. Personal Property Calculator. Inventory your belongings and estimate their value with our personal property calculator. Lists of common items are in categories to jog your memory. You can also use the "Add Item" button to add as many items as you need. The applicant must file a Personal Property Return with the county assessor on or before May 1 of each year to receive this exemption. Penalties. All taxable tangible personal property must be reported each year. Any taxable tangible personal property value not reported each year by the May 1 filing deadline will be subject to a penalty.

Personal property value worksheet. 3) Report 2021 Personal Property Taxable Values Report 2021 personal property taxable values with the taxable values as of May 10, 2021. All reported taxable values must include any Renaissance Zone or MCL 211.7d (i.e. housing for elderly or disabled families) personal property taxable values for the requested classifications. Store this pamphlet and your receipts in a safe place (like a safety deposit box or online) and review it every year, since the value of your possessions can ...16 pages worksheet A person's values are the things they believe are most important. They help to determine life priorities, and they influence decision-making. For example, a person who values wealth might prioritize their career, while a person who values family might try to spend more time at home. When a person's actions do not match their values (e... ESTATE PLANNING WORKSHEET . ... IRA, SEP, 401(K), etc. Describe type of plan, plan name, current value of plan, and any other pertinent information. Total . U:\PReiss\ESTATE PLANNING\Estate Planning Worksheet 01.18.12.doc ... furs, and all other valuable non-business personal property (indicate type below and . give a lump sum value for ...

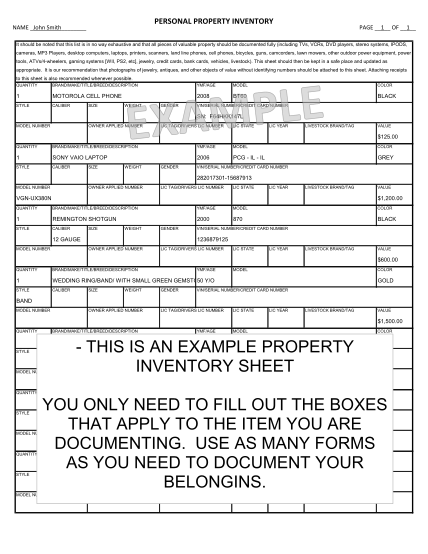

BANKRUPTCY INFORMATION WORKSHEETS. INSTRUCTIONS: The questions in these worksheets should be answered by the person who is considering a bankruptcy filing. In most cases, this means an individual, or an individual and their spouse. When a corporation is considering a filing, the term A you@ in these wor ksheets refers to the corporation itself. WORKSHEET - CONTENTS- PERSONAL PROPERTY. OMB Control Number: 1660-0005 Expiration: 7-31-2020. DATE OF REPORT. INSURED AND LOCATION. POLICY NO. FLADJUSTING FIRM AND ADDRESS (ADJUSTER) File No. Date of Loss:1 2 PROPERTY DATE ACQUIRED IN NAME OF PER MONTH ORIGINAL COST MARKET VALUE PRESENT BALANCE TERMS & INT. RATE HOLDER OF LIEN Residence $ TOTAL TO LINE 6 $ - TOTAL TO LINE 18 $ - SCHEDULE F FURNITURE, FIXTURES, PERSONAL PROPERTY Description and if Amount Owed, to Whom Amount Owed Interest Rate Original Cost Market … Description Title Value Encumbrance 11 Attach titles, if available. I. Tangible Personal Property Collectibles (art, goldware, coins, antiques, memorabilia, etc. having a significant value to a third party) Heirlooms (personal property having sentimental or historical significance - with or without value)

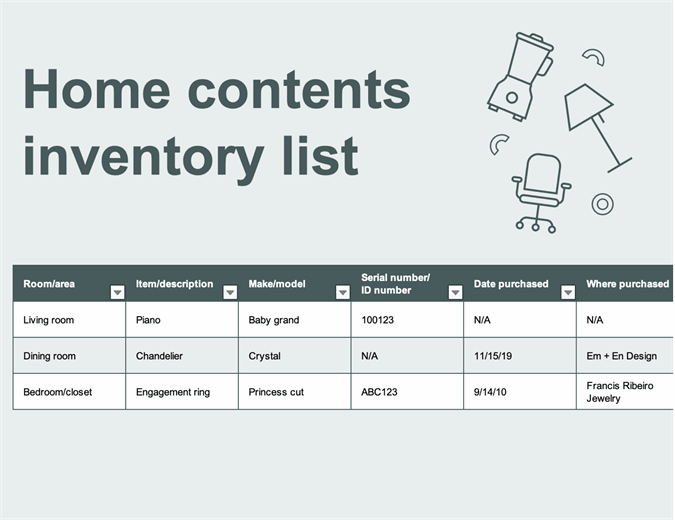

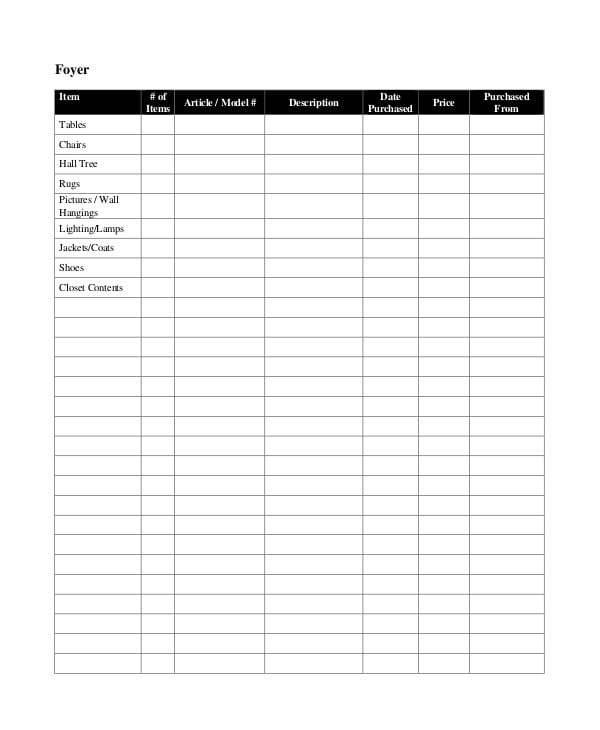

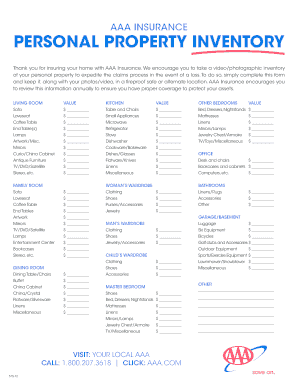

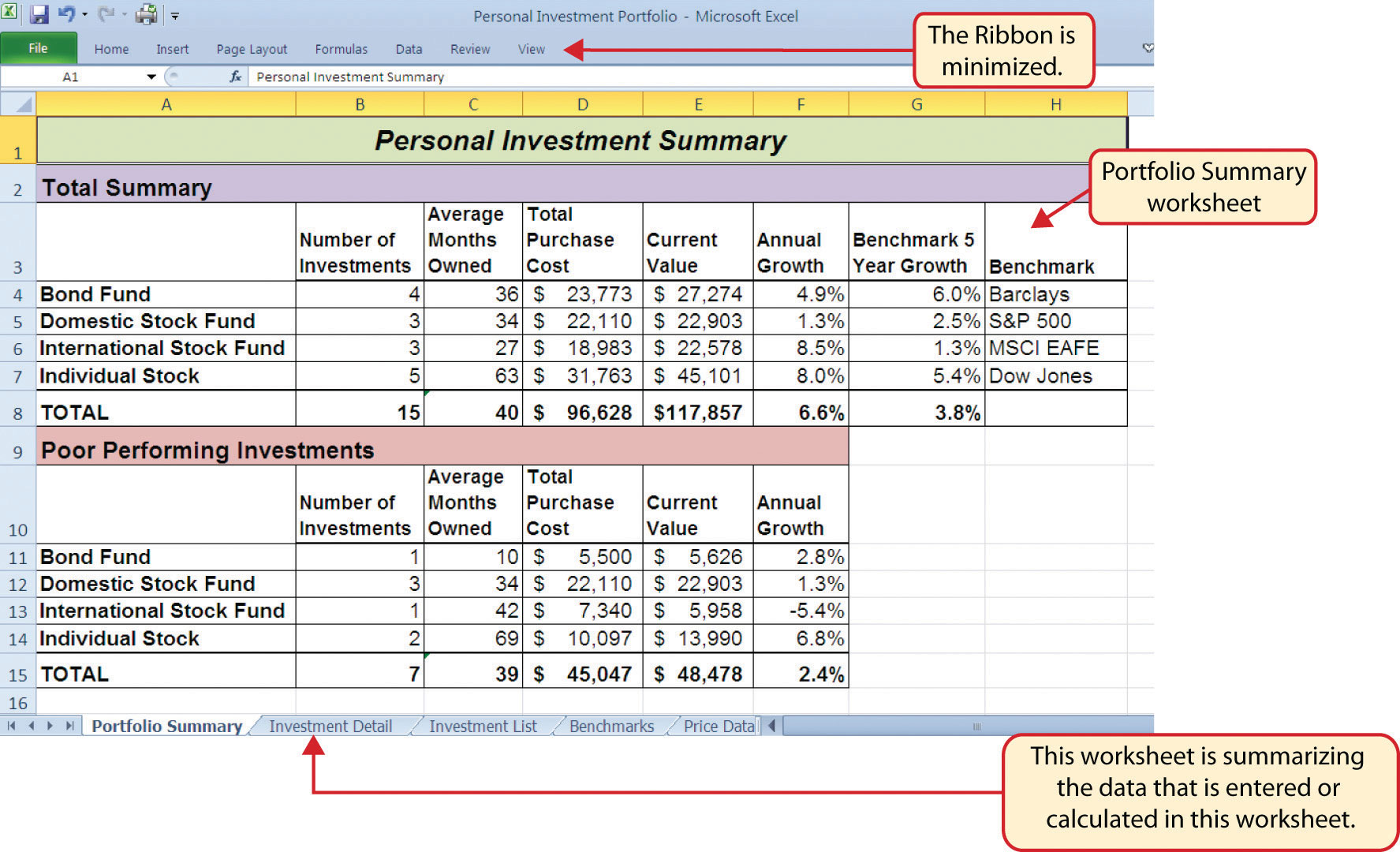

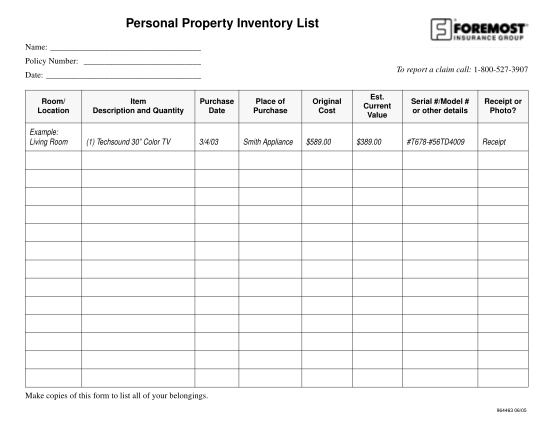

“Cash or the fair market value of property or services you receive for the use of real estate or personal property is taxable to you as rental income. In general, you can deduct expenses of renting property from your rental income.” Rental Income. Regular rent received from the tenant; Home Contents Inventory Worksheet ... with your insurance agent. In the event of a covered loss, you would be expected to provide a list of all of your personal property that was damaged or stolen, along with its estimated value and age at the time of ... purchase high value items. Home Inventory Living Room/Den The Personal Property Tax Relief exemption is applied prior to granting the beginning farmer exemption. Penalties. Any taxable tangible personal property value not reported by the May 1 filing deadline will be subject to a penalty. Depreciable taxable tangible personal property added after May 1 and on or before June 30 of the year the property was Net Worth A net worth statement is simply a personal balance sheet. It shows where you stand financially. It provides a summary of your assets minus your liabilities. In other words, your personal net worth is calculated by listing all that you own, and then subtracting all that you owe to get a net number.

Start studying MindTap Worksheet 41.1: Personal vs. Real Property, Ownership of Personal Property, & Mislaid, Lost, and Abandoned Property. Learn vocabulary, terms, and more with flashcards, games, and other study tools. ... This occurs when property is enhanced in value by someone else, and the owner usually gains the benefit of that enhancement.

The market value of any significant assets - Significant assets may include but are not limited to, automobiles, real estate, life insurance policies, real property, jewelry, and firearms. Real Estate – Name each piece of real estate and personal property that you own. Specify what type of property it is, the date it was purchased, and its ...

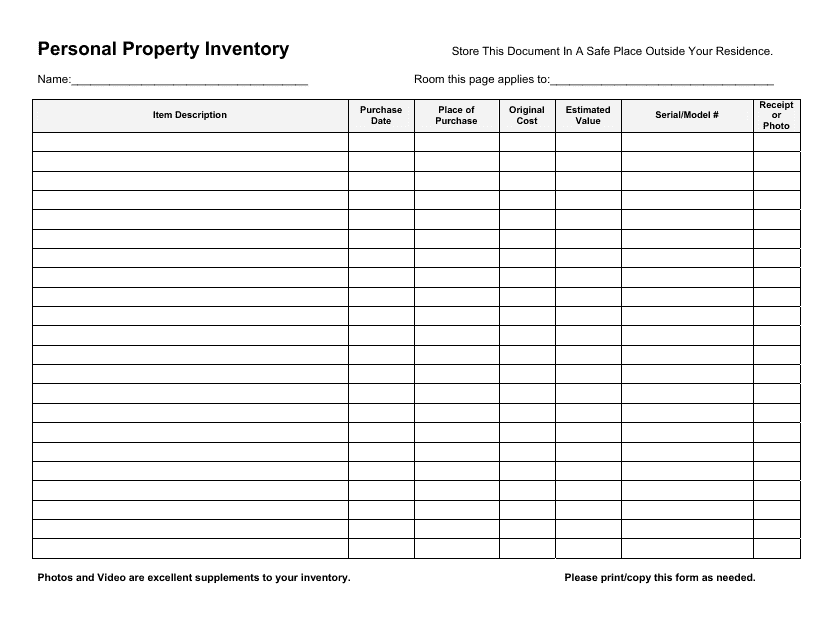

Personal Property Home Inventory . If your home was damaged by a fire or a burglar stole your valuables, would you be able to give your . insurance company a complete list of all the items damaged, destroyed, or stolen? Having an up-to-date personal property home inventory will help. Like many people, you may own much more than you realize.

Assessor duties include the following: Responsible for assessing values of all personal property and real estate in Johnson County. Transfers ownership of real estate on tax records. Provides public information about property in the county. Issues certificates of non-assessment of taxes (exemptions).

Annuity (accumulated value) $ $ $ $ $ $ $ $ $ Business ownership Interests Real estate (rental property or land) Sole proprietorship Partnership C Corporation S Corporation Limited liability company Other:_____ $ $ $ $ $ $ $ Brokerage Other:_____ Total Invested Assets $ Total Cash $ Personal Net Worth Worksheet Page 1 of 2 ©2009 Charles Schwab ...

This worksheet provides step-by-step instructions for identifying your personal core values. It has an extensive list of core values to choose from. Lisa, the worksheet creator, invites those who use the worksheet to add more core values if what they resonate with isn't listed.

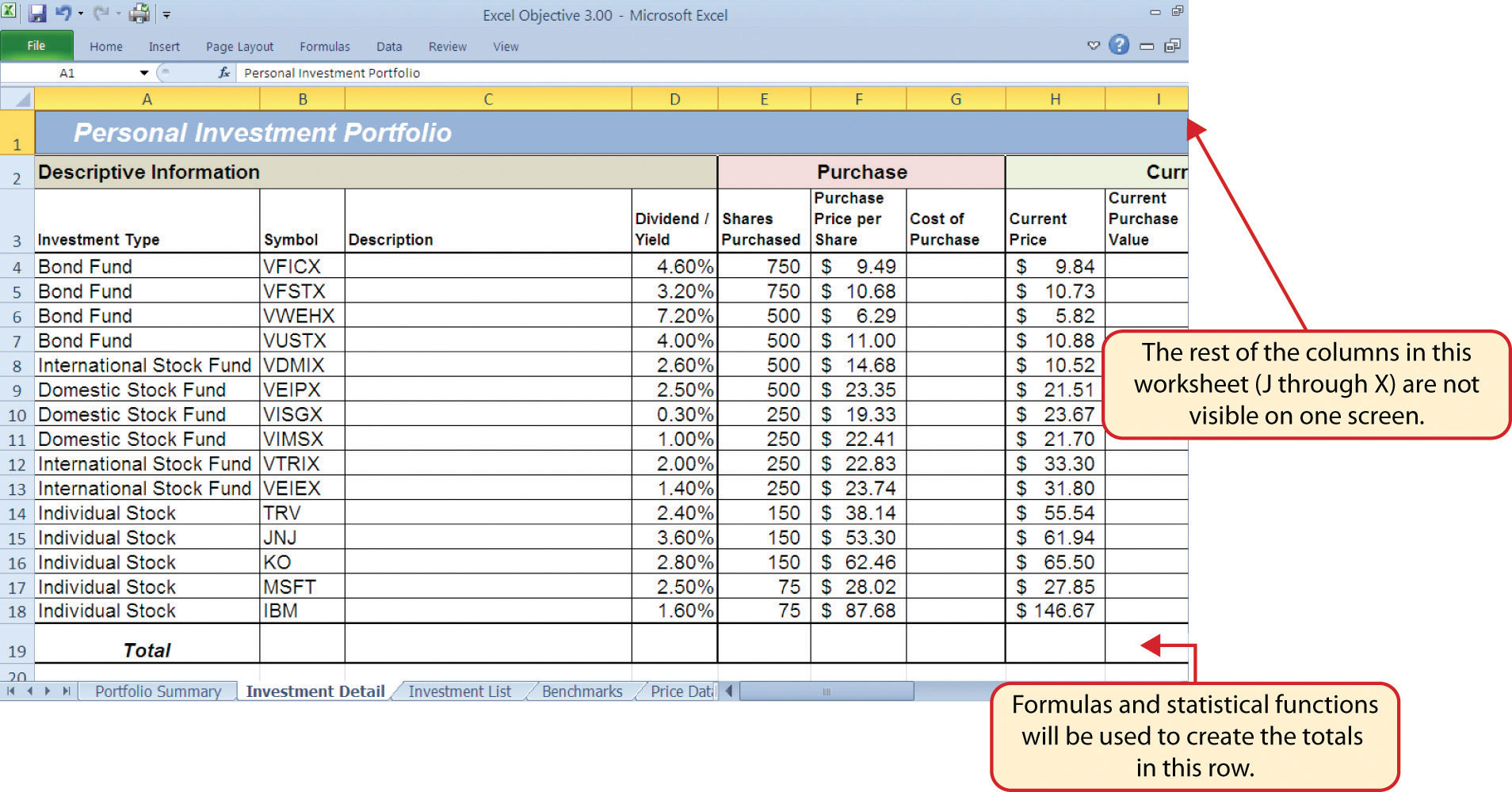

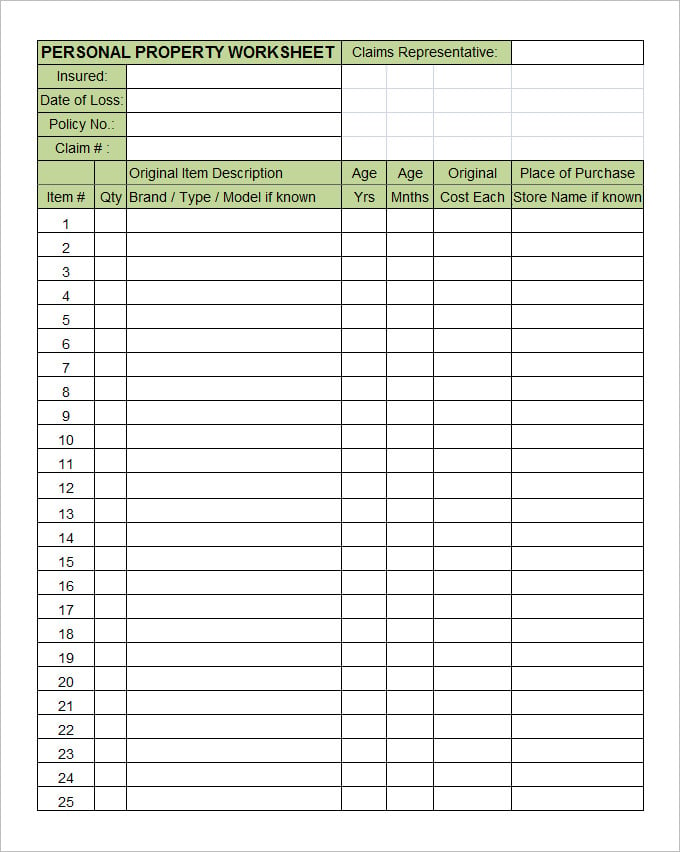

Jan 12, 2022 · Use this worksheet to inventory property and content losses, and obtain an estimate of replacement costs. It contains columns to factor in age, original cost, replacement cost and depreciation to calculate ACV (actual cash value).

More Values interactive worksheets. Courageous people who changed the world. marie curie. by charoguimo. The value of showing respect. by vicamera. Fairness. by vicamera. Song: Something just like this. by ANAPENYA.

May 05, 2021 · Personal Property (Contents) Worksheet (MUST DOWNLOAD) This form can be filled out online. FEMA Form 206-FY-21-106: Policyholders use this form to list the inventory of flood-damaged personal property (also known as contents), which includes the quantity, description, actual cash value and amount of loss. This form replaces FEMA Form 086-0-6 ...

Personal Inventory Worksheet Taking Personal Inventory - Personal Inventory = measure of where you are today. Let's say you decided to visit Orlando, Florida and go to Disney World, but you had never been there before. If you were to call and ask directions, what is the first thing they would ask you?

Business Law Model Curriculum Units: Discuss Consumer Law Description: Business Law Model Curriculum Units are sample units based on the DESE unit template with sample activities, instructional strategies, and assessments.

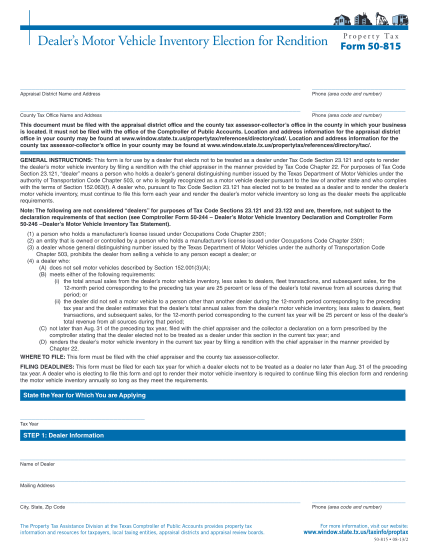

The Florida Tangible Personal Property Appraisal Guidelines Adopted in 1997 NOTICE: These Guidelines Are Out-of-Date The existing Florida Tangible Personal Property Appraisal Guidelines were adopted in 1997 and are now out-of-date due to various changes in law. For example, in 2007 the U.S. Supreme Court issued a decision holding

Personal Property Inventory Worksheet PERSONAL INSURANCE Number of Items Item Description Year Purchased Original Cost Value Estimate Today travelers.com The Travelers Indemnity Company and its property casualty affiliates. One Tower Square, Hartford, CT 06183 This material is for informational purposes only.

1. Prioritizing Personal Values. Prioritizing Personal Values is similar to the Top 5 Values worksheet mentioned earlier. You can use it when working with clients who already understand the concept of values. The tool begins with a prompt to reflect on personal values as well as a short list.

Sep 04, 2019 · Under the agreed value clause, the most your insurer will pay for a loss to damaged property is the proportion that the limit for that property bears to the agreed value of that property shown in the statement of values. For example, suppose that you own a building that you have insured on a replacement cost basis.

SOAH Efile link. If the property value as determined by the ARB order is over $1 million, you may be able to file an appeal with SOAH. You may only appeal to SOAH if the appeal concerns the determination of the appraised or market value of the property under Tax Code Section 41.41(a)(1) or an unequal appraisal under Tax Code Section 41.41(a)(2).

IA 8824 Worksheet, page 2 . 45-017b(08/03/2020) Part II — Realized Gain/(Loss), Recognized Gain, and Basis of Like-Kind Personal Property Received

Home inventory. Use this accessible template to keep track of all the stuff in your home by room and value. It also gives you information on your insurance company and agent.

Access Warrensburg property details and Warrensburg, MO public records. Find the property details you need today on realtor.com®.

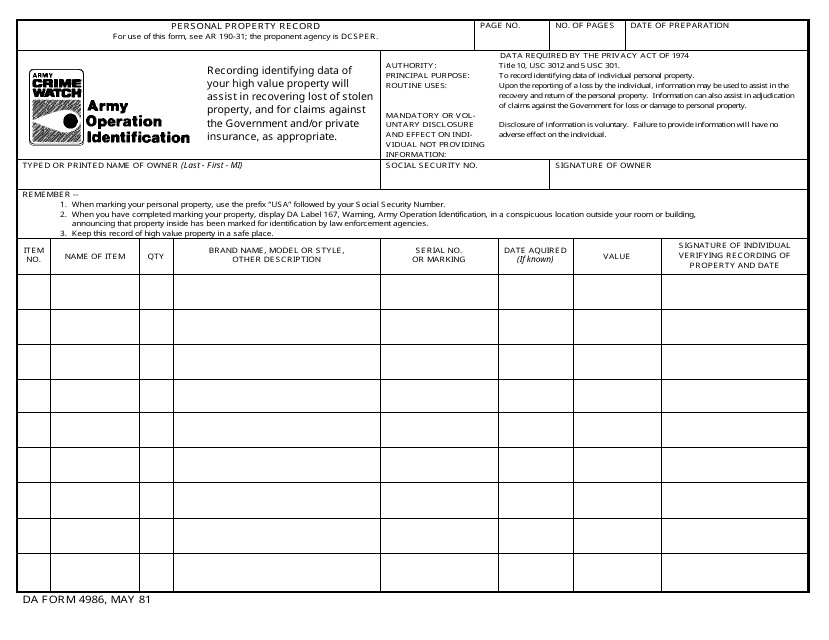

This form will expire with its prescribing directive. Page 1 of 2. HIGH-VALUE PERSONAL PROPERTY INVENTORY RECORD (Memo, USAREUR, AELG-X, 3 Aug 15, subject: Army in Europe Barracks Inspection and Recognition Program)

The applicant must file a Personal Property Return with the county assessor on or before May 1 of each year to receive this exemption. Penalties. All taxable tangible personal property must be reported each year. Any taxable tangible personal property value not reported each year by the May 1 filing deadline will be subject to a penalty.

Personal Property Calculator. Inventory your belongings and estimate their value with our personal property calculator. Lists of common items are in categories to jog your memory. You can also use the "Add Item" button to add as many items as you need.

Get a personal property value estimate. Whether you live in a home, apartment, or condo, personal property coverage is one of the most important aspects of your insurance. It's essential to be knowledgeable about accurate replacement costs so we can best serve you in the event of a covered loss.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/Its-Your-Money-Budget-Spreadsheet-56a2f0b55f9b58b7d0cfd06f.png)

![30 Free Inventory Spreadsheet Templates [Excel]](https://printabletemplates.com/wp-content/uploads/2020/12/inventory-spreadsheet-28-scaled.jpg)

0 Response to "42 personal property value worksheet"

Post a Comment