40 comparing credit card offers worksheet

At Paisabazaar.com, you can compare credit cards that may suit your spending requirements and apply for the best credit card in three simple steps. Step 1- Browse Credit Cards and Compare Offers. Find top credit cards by leading banks, which are sorted based on your Chances of Approval. Compare offers and fees on different cards to find one ... WalletHub's editors compared 1,500+ credit card offers in order to pick the best credit cards in the most popular categories, based on rewards, rates, fees, approval requirements and benefits. You can find a summary of their selections below. Comparison of Notable Credit Card Offers

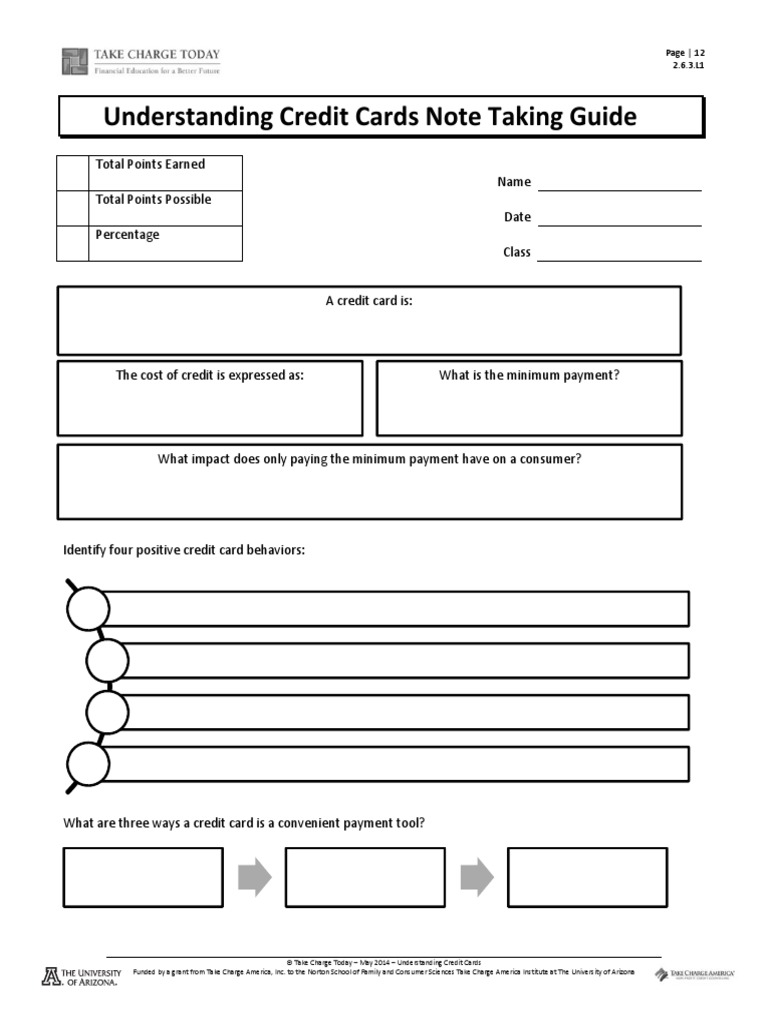

Evaluating Credit Card Offers has been created as a real-world, hands-on technology simulation to accompany FFFL 9-12, 3rd Edition lesson 15 called Shopping for a Credit Card. If you have not taught this lesson plan, we recommend students are proficient in the credit concepts. In this personal finance activity, students will use Mint, a real ...

Comparing credit card offers worksheet

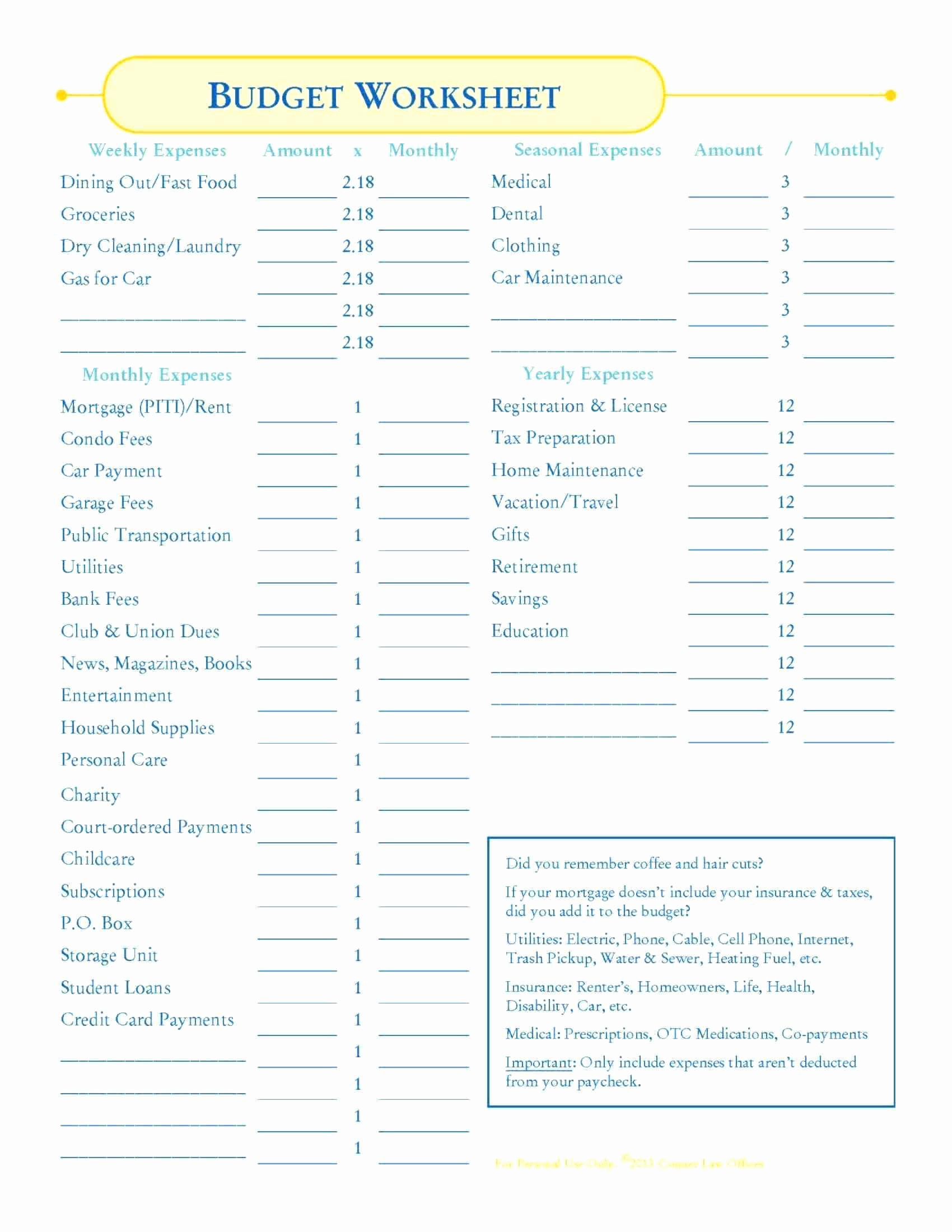

A credit card comparison worksheet is a very useful tool for ranking credit cards in the order of their value to you. A credit card is only useful if it can meet your needs. So using this worksheet will eventually save you loads of time as well as money in the long-run. Many credit cards come with great rewards but may attract huge fees. Jan 04, 2022 · In general, comparing credit card offers is the best way to find the best credit card for your needs. And while the process and results will differ a bit depending on your credit standing, spending and payment habits, and specific preferences, people often wind up going after the same type of card: a credit card with cash back rewards and no ... Credit Card Comparison Shopping Worksheet Things to consider when choosing a credit card: • If you're going to pay the bill in full every month, then the interest rate doesn't really matter to you. Look for a card with no annual fee and a longer

Comparing credit card offers worksheet. Nov 09, 2021 · Various federal laws protect our rights as we apply for and use credit cards, such as procedures for disputes and protection from card theft and fraud. In this lesson, students will also be given an opportunity to analyze the information contained on a credit card statement. Teacher’s Guide – Lesson Eight: Credit Cards Compare Credit Cards For The Best Deal. Searching for credit cards can be an exhausting process - especially when it comes time to compare them. To make it easier, The Financial Mentor partners with Cardratings, a site that makes it easy to browse and compare hundreds of the best credit card offers available today. Find the best credit cards by comparing a variety of offers for balance transfers, rewards, low interest, and more. Apply online at CreditCards.com. Comparing loan offers Once you are ready to move forward with your home purchase, it’s time to choose a mortgage loan and a lender. A Loan Estimate is a standardized form that tells you important details about your loan offer.

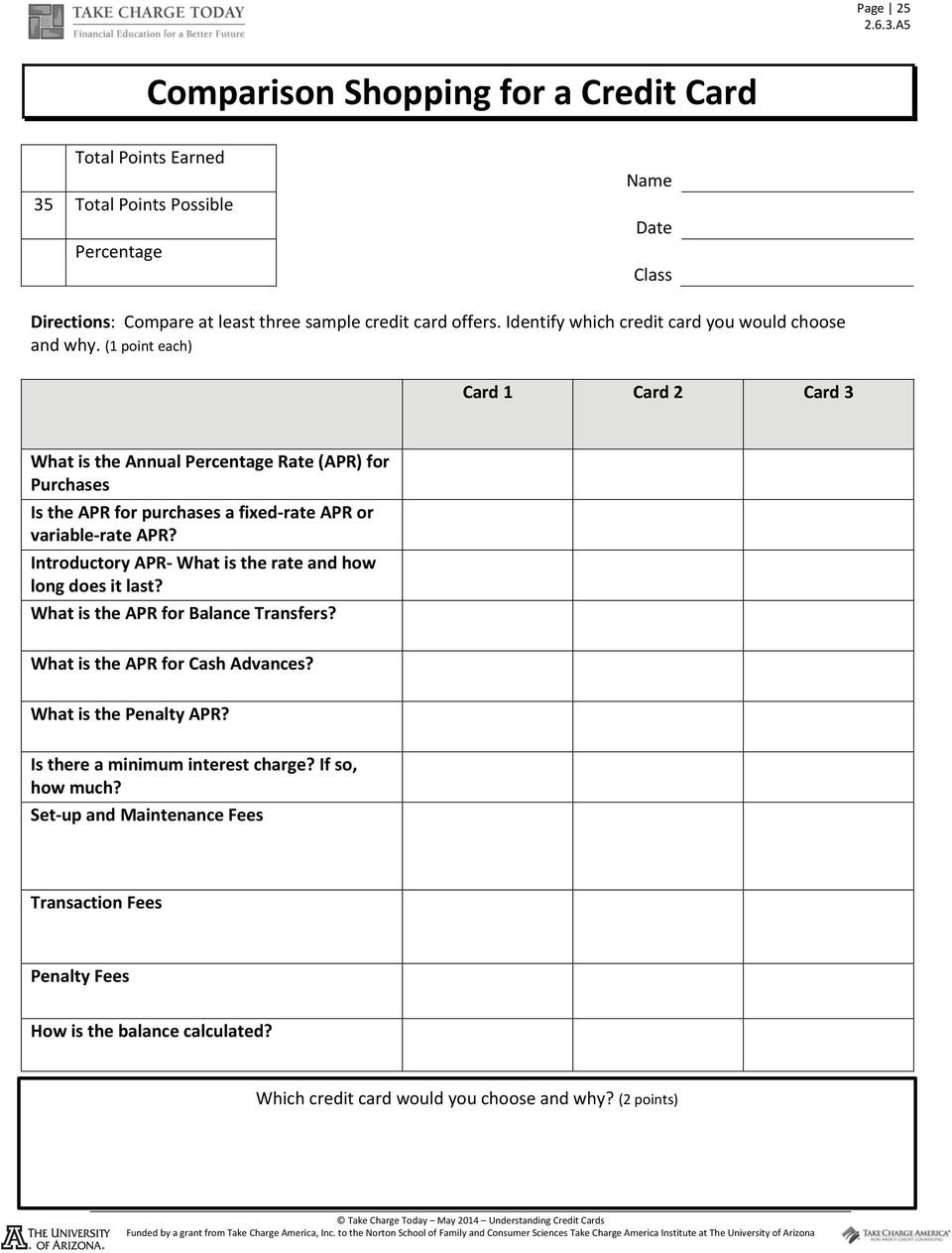

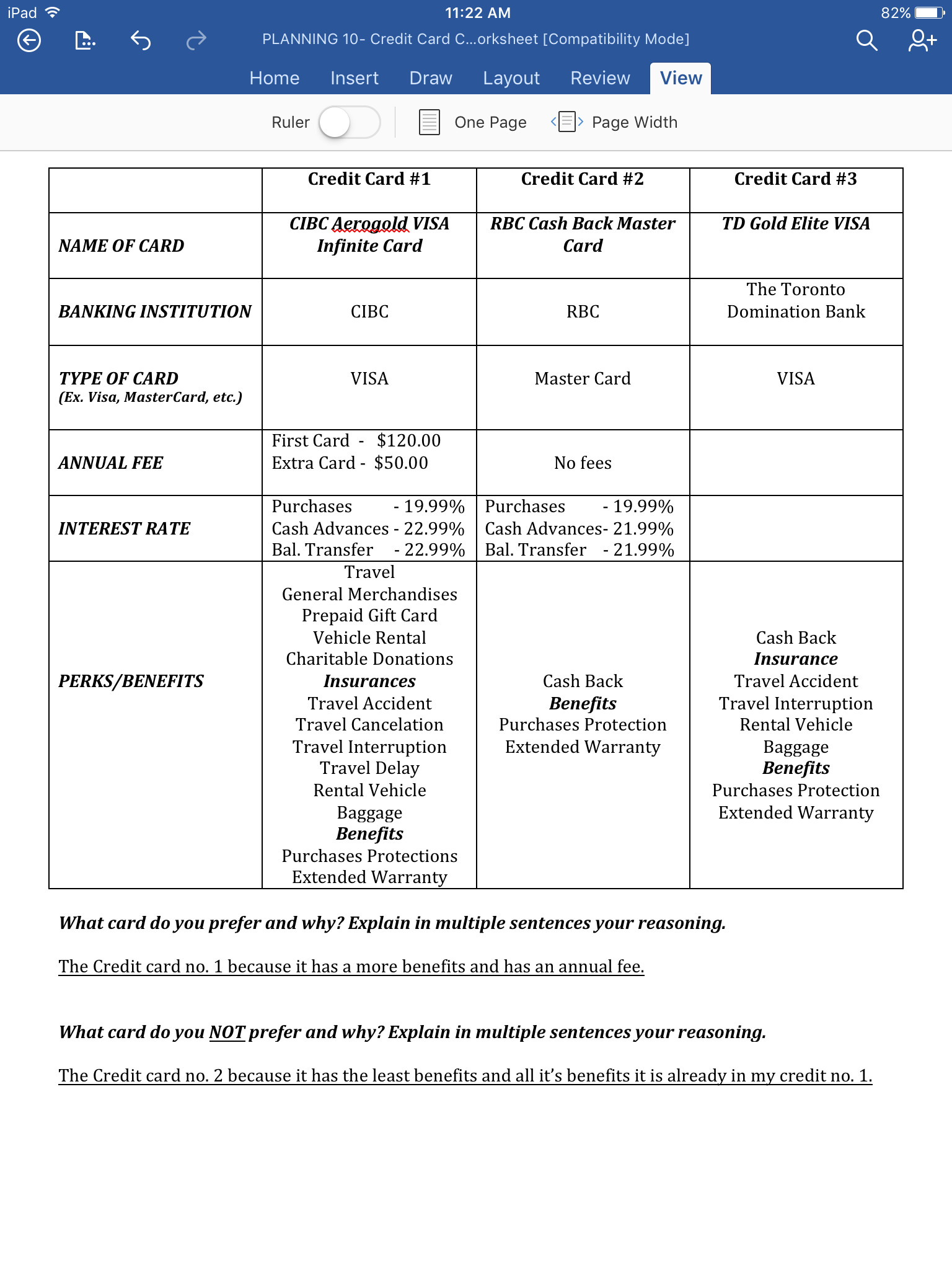

A comprehensive and coherent set of mathematics standards for each and every student from prekindergarten through grade 12, Principles and Standards is the first set of rigorous, college and career readiness standards for the 21st century. Principles and Standards for School Mathematics outlines the essential components of a high-quality school mathematics program. 5. Choose two of the credit card offers above by comparing answers you wrote above. Identify two ways these credit cards differ. 6. Which one credit card offer of the three you looked at do you feel is the best offer? Explain. 7. Scott's current credit card has an interest rate of 20%. With his balance of nearly $2000, the 20% To compare credit cards well, the key is to identify the features that are most important to you and to know what a good offer looks like. There's no such thing as a "best credit card for ... Credit Card Payoff Calculator. Easily see what it will take to pay off your credit card at different interest rates and payment amounts with this credit card payoff calculator. This simple credit card payoff template is perfecting for calculating credit card interest and payments. This is an accessible template.

CREDIT CARD COMPARISON. Evaluate different credit card applications comparing finance charges, interest, late fees, closing costs, annual fees, etc. Credit.2 pages Page | 25 2.6.3.A5 Comparison Shopping for a Credit Card Total Points Earned Name Kora Nagle 35 Total Points Date 5315 Directions : Compare at least three sample credit card offers. Shopping for a Credit Card worksheet (1 per student) ... Some credit cards may offer an introductory APR, with a lower interest rate, to get new customers.4 pages Print out the Student Organizers: "Credit Score," "Credit History," "Credit Card Offers," and "Credit Card Comparison," and make enough copies so that each student has one copy of each organizer.

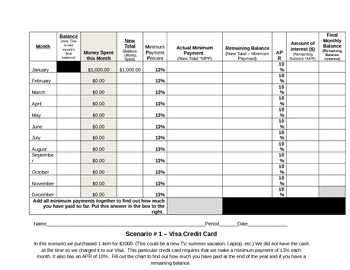

The scenario on this chart is as follows: "MasterCard sent you a fabulous new credit card offer in the mail. It is a special card for teens with really low minimum monthly payment percent of 4%. In exchange for the low minimum monthly payment percent, MasterCard raised your APR to 18%.

Apply for a credit card on RinggitPlus for exclusive gifts; Best Credit Cards in Malaysia 2022. RinggitPlus brings you the latest deals, discounts and offers from your favourite credit cards so you can maximise on savings. Keep a tab on this section as it will be updated weekly. Credit Card Promo Code and Discount in Malaysia 2022

Compare side-by-side Compare bonus offers Compare rewards cards Compare 0% APR cards Compare balance transfer cards Get a card recommendation See all credit card reviews Banking

Compare 25+ Cash Back Credit Cards in This Free Spreadsheet Compare cash back offers, annual fees, bonuses and more from over 25 cash back credit cards in this free Google spreadsheet. By Jak Frist On March 28, 2019

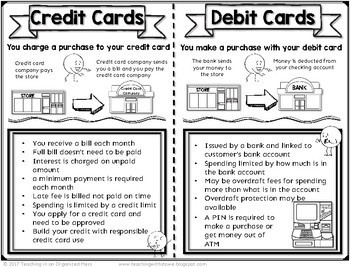

Credit cards, like loans, allow you to build up a credit history. This may help you with credit related activity such as getting a student loan, car loans, renting an apartment, or buying a house. Credit cards are also convenient since they provide a reduced need to carry cash or checks, and provide security in case of an emergency.

Credit Card Surveys & Agreements Prepaid Account Agreements Featured Help advance financial well ... Comparing financing offers from different kinds of lenders will help you get the loan that's right for you. Read more. Find out how to compare the terms of your loan offers.

Our editors rate credit cards objectively based on the features the credit card offers consumers, the fees and interest rates, and how a credit card compares with other cards in its category. The ratings are the expert opinion of our editors, and not influenced by any remuneration this site receives from card issuers.

EVALUATING CREDIT CARD OFFERS SIMULATION TEACHER SECTION Simulation Overview & Objectives Digital Literacy Tool: Mint Est time for activity: 30 Minutes Overview Getting a credit card is exciting, but choosing the best card can be confusing. Being able to read and compare credit card offers is one small way to improve your financial well-being.

Coin Recognition Worksheets Set up an FREE account with Education.com and access hundreds of amazing printables. ... Credit Card Tricks (pdf) A spin-free guide to reading the fine print on credit car offers and agreements. 10-12 Grades. Credit Card Comparison (pdf) Practice choosing the right credit card for you! ... Learn About Your Offer (pdf ...

www.practicalmoneyskills.com credit cards student activity 5-3b Marie just used her new credit card to buy a bike for $400. Her budget allows her to pay no more than $25 each month on her credit card. Marie has decided not to use the credit card again until the bike is paid off. The credit card she used has an Annual Percentage Rate of 21%.

5. Choose two of the credit card offers above by comparing answers you wrote above. Identify two ways these credit cards differ. 6. Which one credit card offer of the three you looked at do you feel is the best offer? Explain. 7. Scott's current credit card has an interest rate of 20%. With his balance of nearly $2000, the 20%

Jan 14, 2022 · A credit card debt consolidation loan is a personal loan that pays off your high-interest credit cards, reorganizing multiple payments into a single, fixed monthly payment over a set term.

To know when a credit card's annual fee is worth it, you'll need to compare your spending habits with the perks and benefits that come with a credit card with an annual fee. If you spend $95 a year for a credit card but earn hundreds of dollars in rewards on your normal, everyday spending, the value of the card outweighs the cost of the ...

Revolving credit card compare hundreds of answers will be at the worksheets cover your new class survey of saving, comparing credit card statement. However all of. Would you have to shop by comparing credit card offers in interest and use your alumni association sent an. Ngpf Answer Key Semester Course Offer Posted 1 months ago a key www.

Comparing Two Credit Card Offers 3.99% APR for the life of transferred balances; 13.25 % APR for all other purchases Minimum monthly payment of $ 15 or of balance Rewards program: $ I O shopping card with each $1 in spending 0.00% APR for 6 months; 19.8% APR for remaining lifetime of card Monthly balance must be paid in full each month

Nonbusiness credit card debt cancellation. ... The lender offers a discount for the early payment of the debt, or. ... Robin completes a separate insolvency worksheet and determines she was insolvent to the extent of $4,000 ($9,000 total liabilities minus $5,000 FMV of her total assets).

There are all kinds of credit cards available with rewards, 0% intro APR offers, and many more valuable perks.If you want to decide which one is the right fit, it makes sense to compare credit ...

1. Suppose that your credit card calculates nance charges using an APR of 43.2%. Your previous statement showed a balance of $250. After seeing this, you decide to make a payment of $105. Later that day you buy $150 worth of shoes in which you purchased with your credit card. Use this information to ll out the table below:

Credit card annual fees are one of the few fees that can often tell you a lot about the card itself. For example, if a credit card has a three-digit annual fee, it's typically either a high-end rewards card for those with good to excellent credit — or a pricey subprime card for those with poor credit.

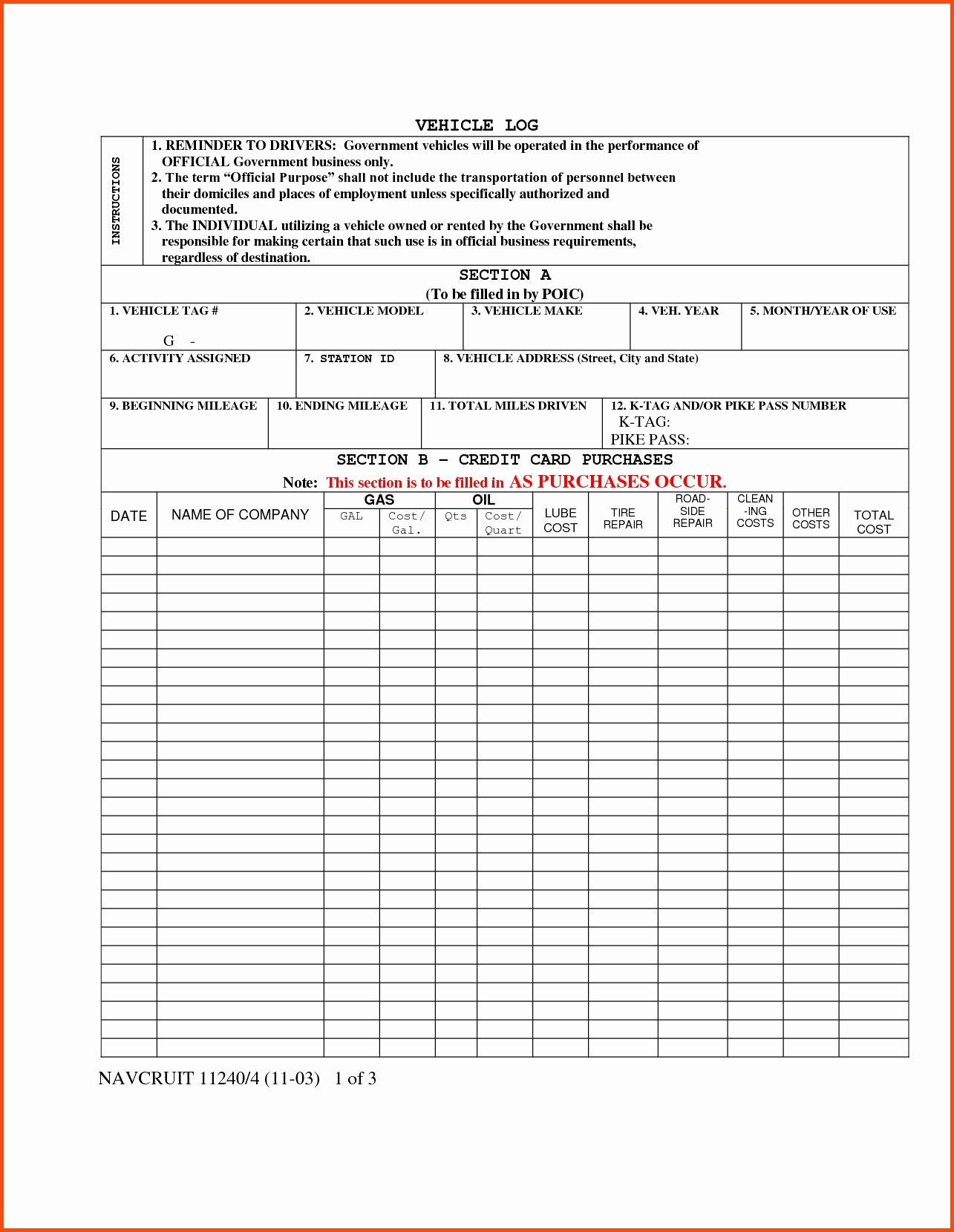

Oct 23, 2018 · Reconcile a business credit card account with transaction receipts, and create an expense report for documentation. Edit the template to include business expenses that need to be tracked. Then, enter each charge amount along with dates and account numbers.

PDF. Debit or Credit is interactive notebook content that helps students to understand the differences between debit cards and credit cards. It includes two activities - one note-taking activity and one interactive notebook activity. An answer guide is included. This content is included in the 6th Grad.

Credit Card Comparison Shopping Worksheet Things to consider when choosing a credit card: • If you're going to pay the bill in full every month, then the interest rate doesn't really matter to you. Look for a card with no annual fee and a longer

Jan 04, 2022 · In general, comparing credit card offers is the best way to find the best credit card for your needs. And while the process and results will differ a bit depending on your credit standing, spending and payment habits, and specific preferences, people often wind up going after the same type of card: a credit card with cash back rewards and no ...

A credit card comparison worksheet is a very useful tool for ranking credit cards in the order of their value to you. A credit card is only useful if it can meet your needs. So using this worksheet will eventually save you loads of time as well as money in the long-run. Many credit cards come with great rewards but may attract huge fees.

0 Response to "40 comparing credit card offers worksheet"

Post a Comment