39 self employed expenses worksheet

Hello everybody I'm an immigrant from an EU country, with Settled Status. My partner is a British citizen, and disabled. They receive Universal Credit and PIP. I am self employed to allow all the free time needed to care for my partner. I am a sole trader and is VAT registered. I work from home and have a dedicated office. My business was started after moving to the UK and has been operating for two years. When I moved to the UK I had only a few sets of clothing, a mobile phone and a laptop.... I have a video production business, in which I claim equipment purchased below the dollar threshold as expense. If I have an item that is financed for a year, am I able to claim the item as an expense prior to the item being paid off in full? There would be no situation in defaulting would be possible, it's monthly payments through an Apple Card on an apple product. Just wondering if that is possible to be claimed this year, or do I need to claim payments made this year on this years taxes...

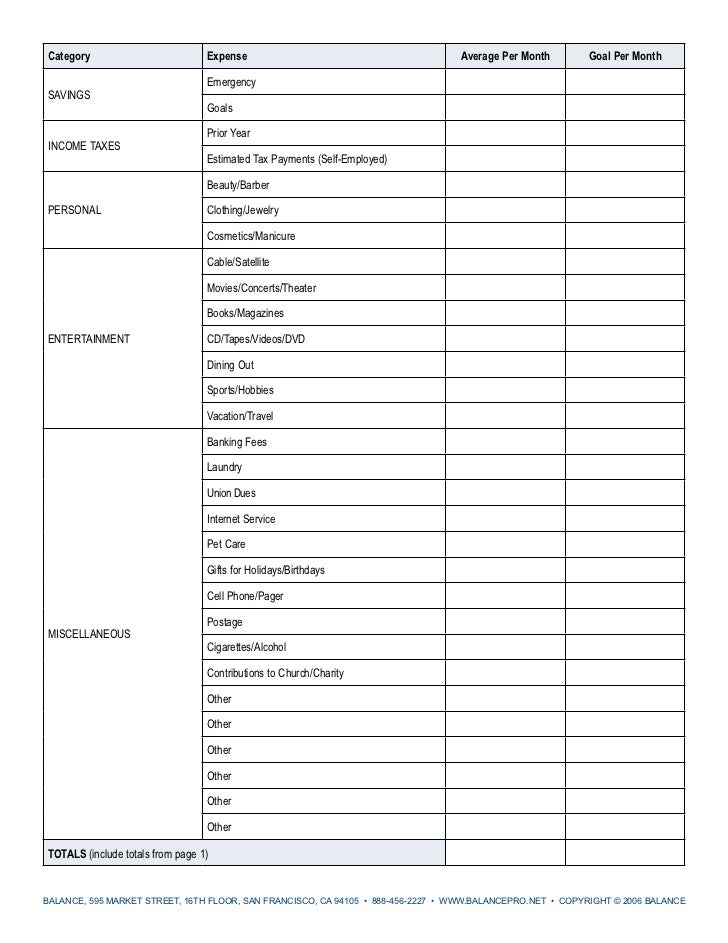

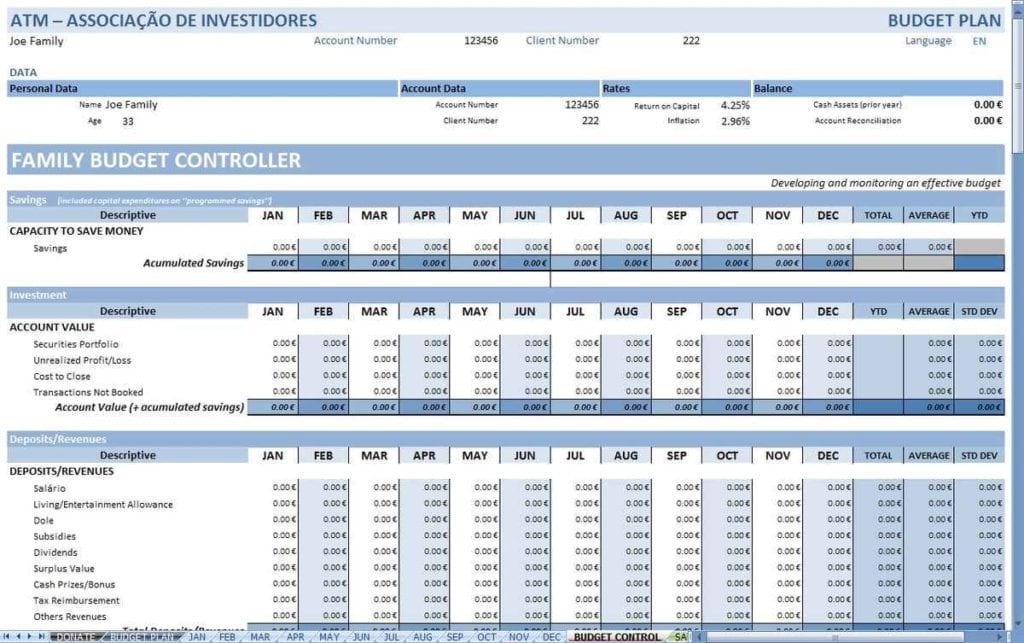

I’m self employed, get paid irregularly etc. As an artist/composer I have quite a lot of business expenses that are tax deductible- studio, instruments, software. Does YNAB have a way to record my business expenses to make it easier when I complete my tax return? I’m in the UK btw.

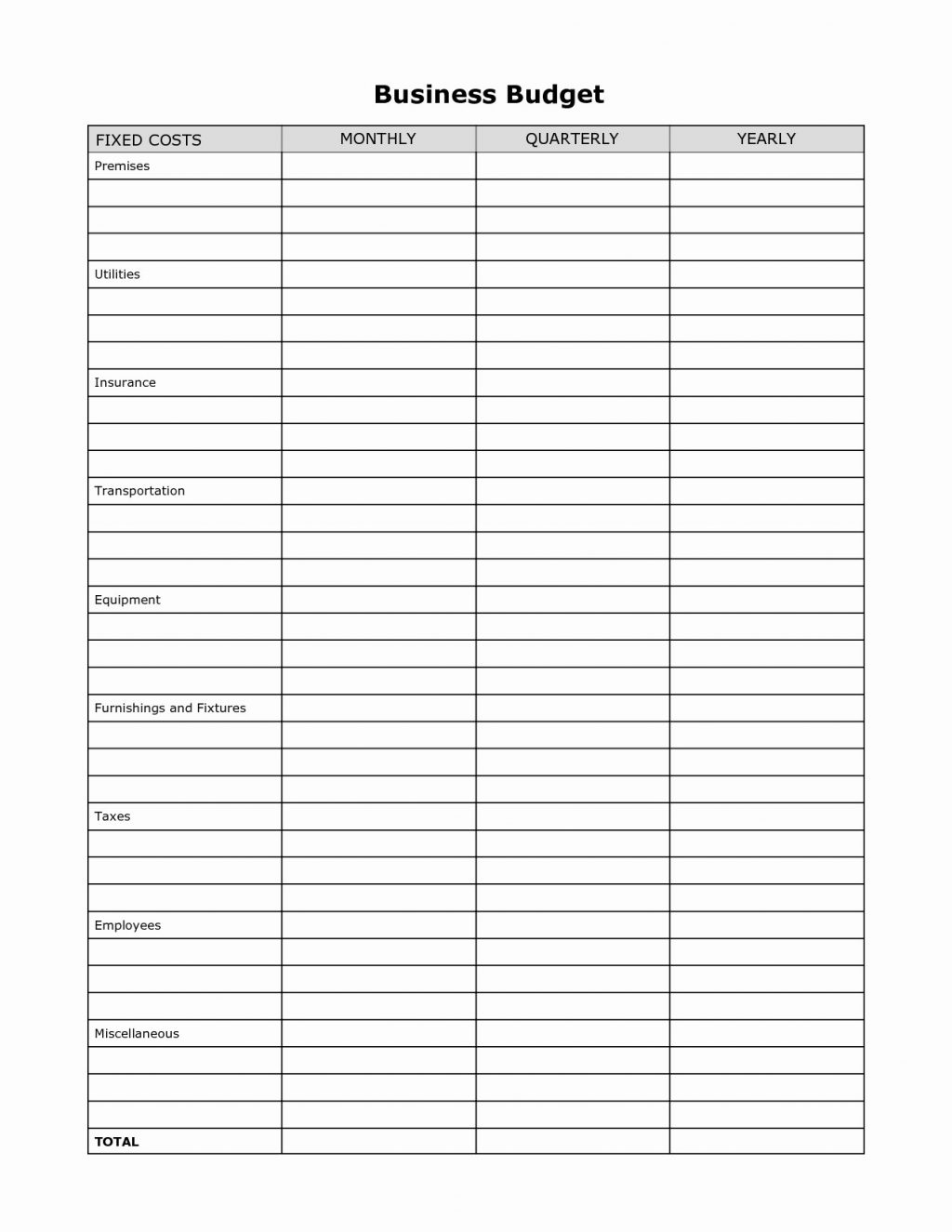

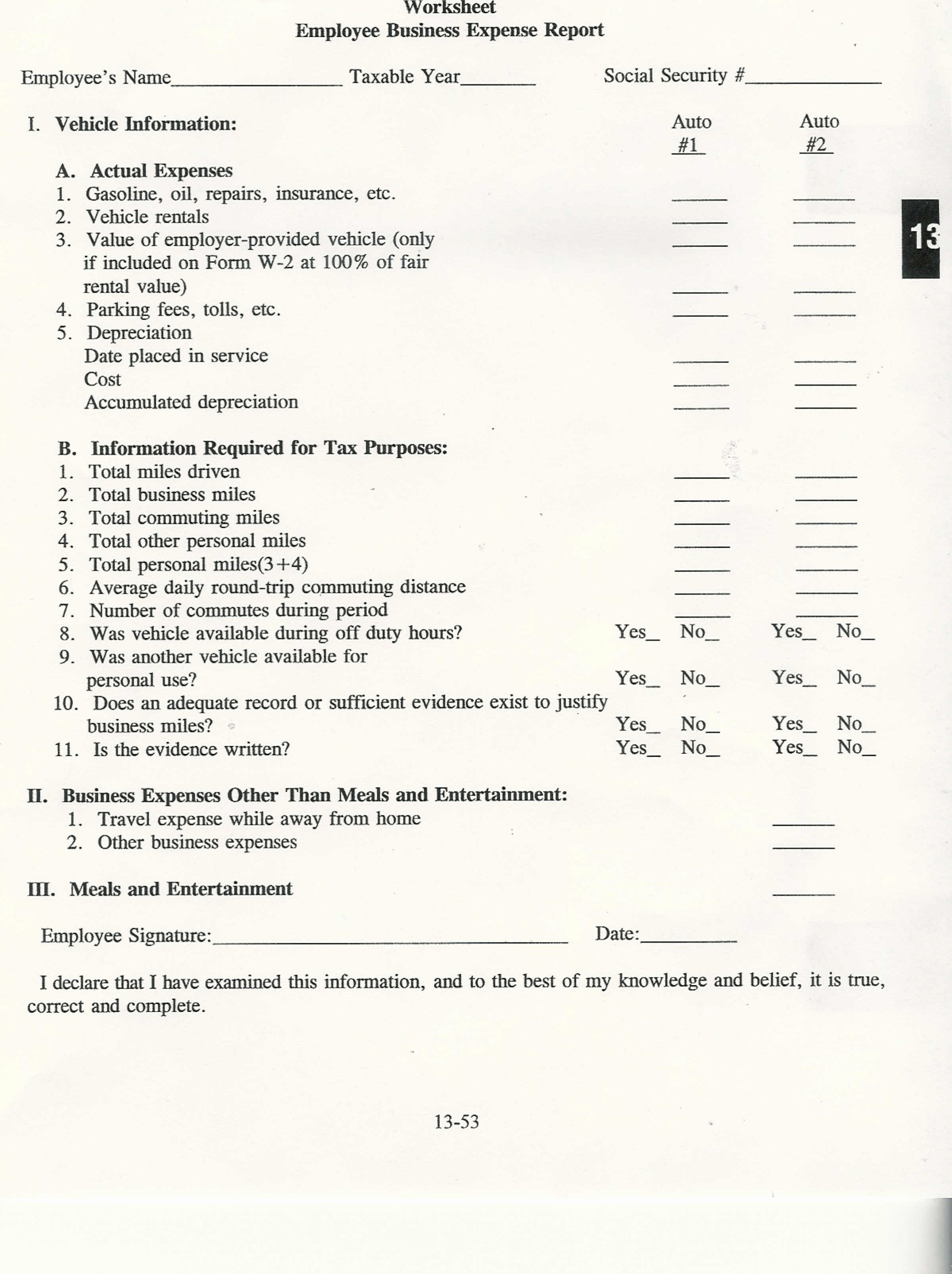

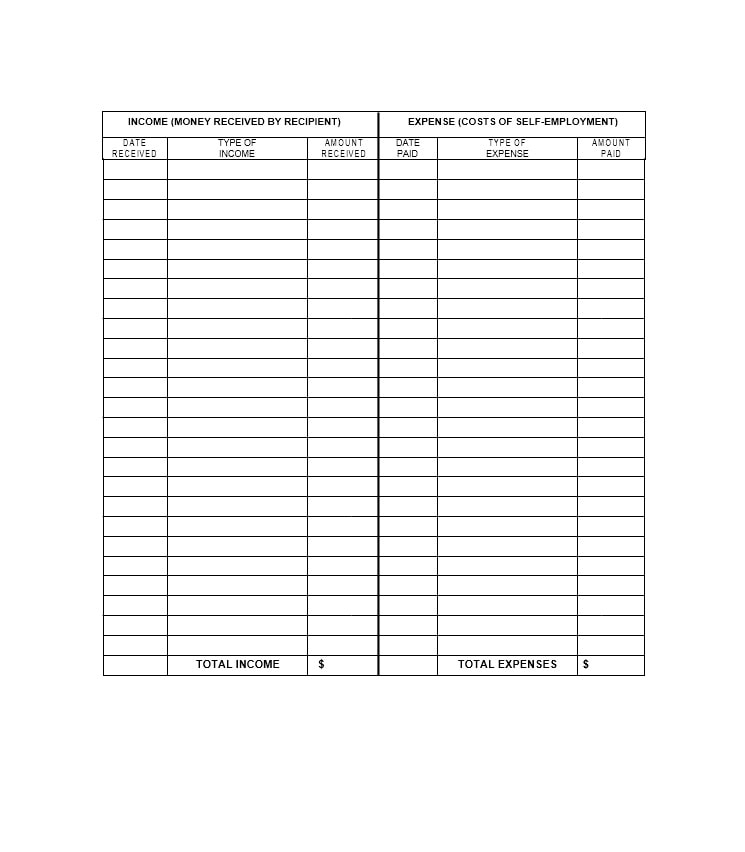

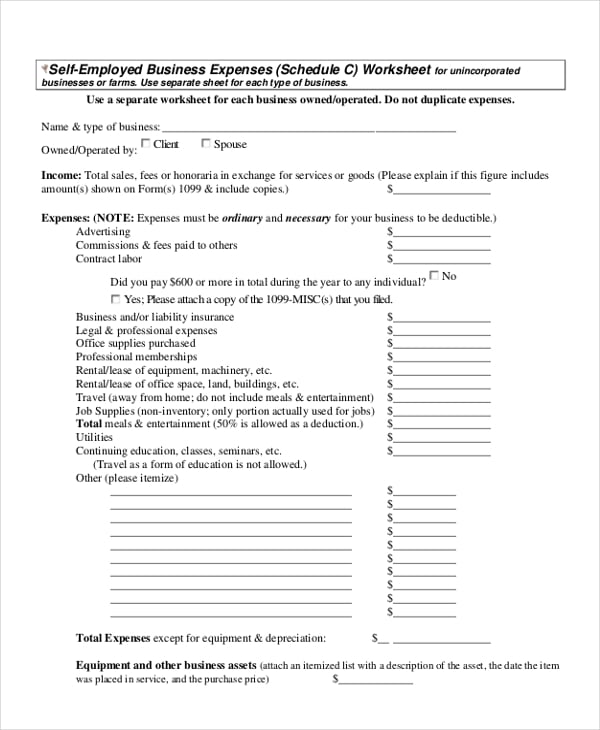

Self employed expenses worksheet

Planning my travels from the end of January and I wonder what can I claim as my expenses? Part of accommodation, co-working spaces etc? If I buy a new laptop, can I claim it? What do you guys claim? Thanks! me and my wife work full time jobs with separate employers, we normally file taxes jointly with our W2 income (form 1040). This year, we decided to open our own small business as a side job, we don’t have employees, is just me and my wife will be the owners and run the business by ourselves, and we will still work as full time job with our employers. How do I manage taxes for my small business? My search got me to multiple options and I don’t know which one is best for my case (e.g.: EIN, DBA,... I'm doing my tax return for 2020-21 and I'm confused about expenses. I started renting a place in Aug 2020 and worked from home 100% of the time, I share a 2 bedroom flat with 1 person. At the same time, I signed up for universal credit first time in my life and they started paying my rent some of the months when I wasn't paid by my clients, so roughly half of the time in that tax period. Now I'm doing my tax return and I don't know how to do my expenses. Can I claim part of the rent for the m...

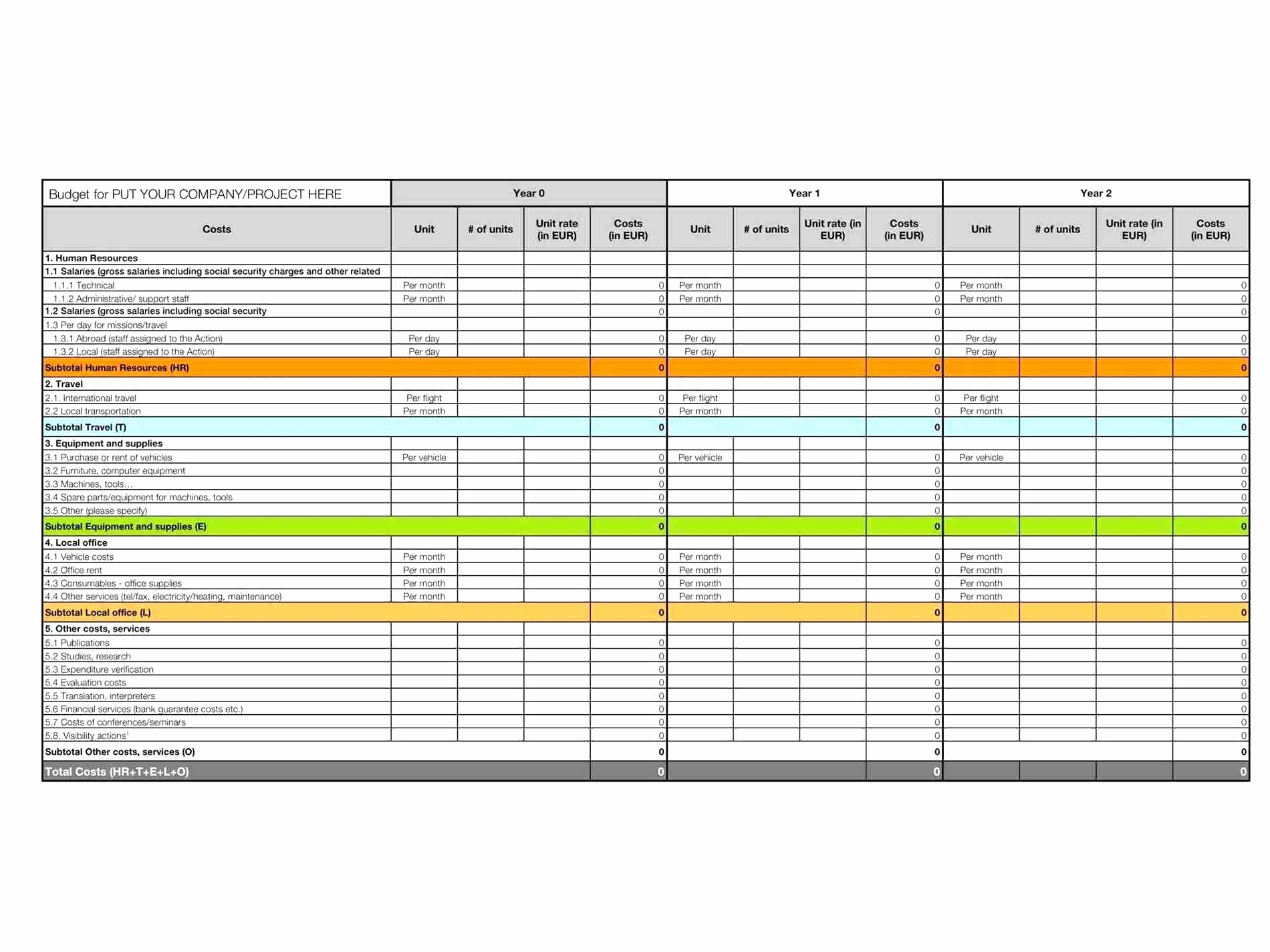

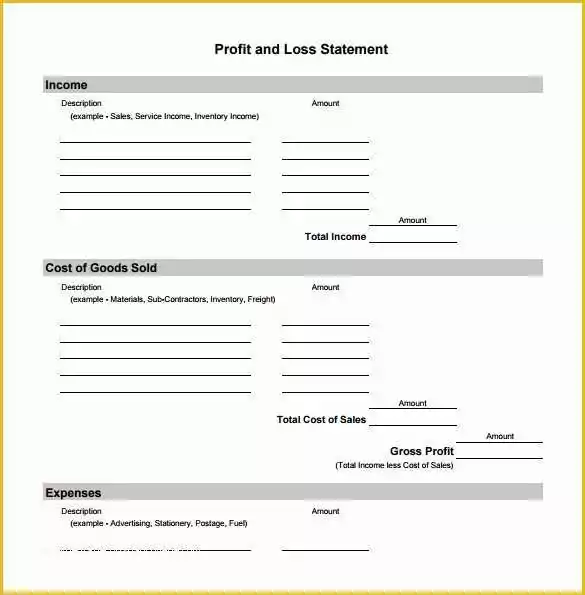

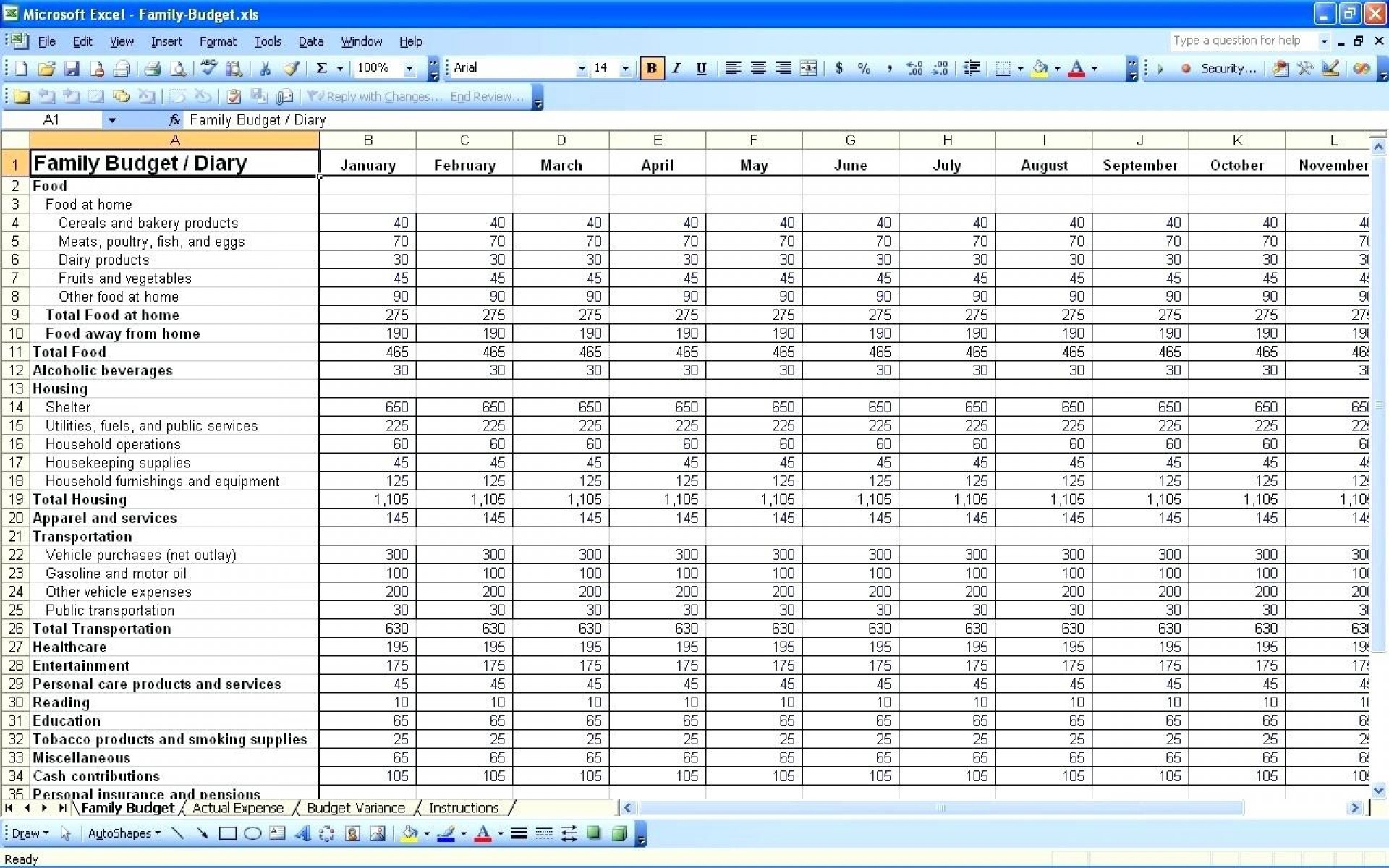

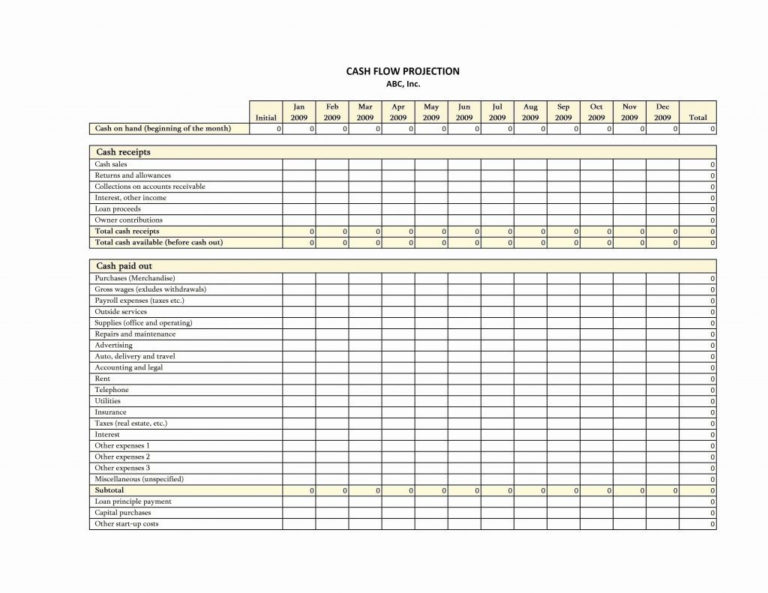

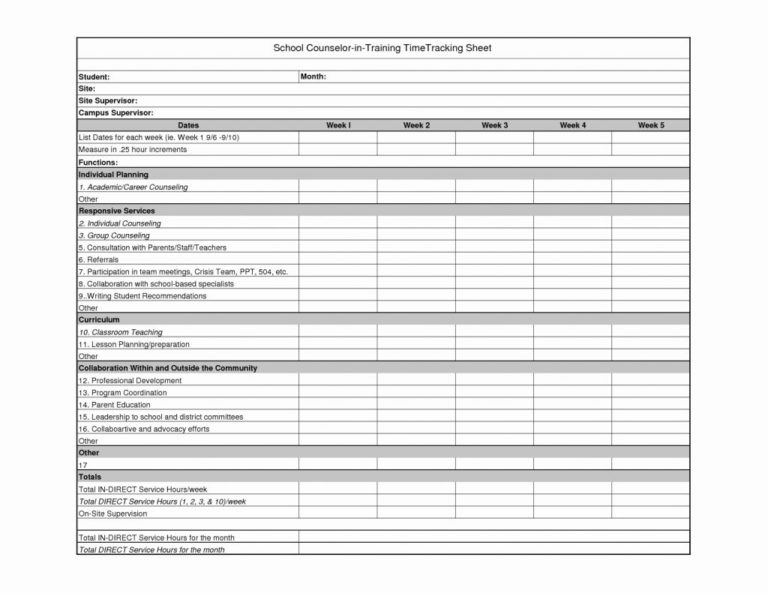

Self employed expenses worksheet. This worksheet may be used to prepare a written evaluation of the analysis of income related to self-employment. The purpose of this written analysis is to determine the amount of stable and continuous income that will be available to the borrower for loan qualifying purposes. IRS Form 1040 – Individual Income Tax Return Year_____ Year_____ 1. W-2 Income from Self … Many American workers are increasingly participating in the “gig economy” — a workforce shift from traditional full-time salaried or hourly employment to self-employment, which involves offering services and talents as an independent contra... Other Business Expenses Estimate your non-car work expenses for the whole year (cell phone bill, health insurance, etc) $ Estimate my taxes *Please select a valid state. Your Results. You will owe: of your self-employed income. Expect to owe around in taxes (of your income) Tax Breakdown. Federal. State. Social Security and Medicare (aka Self-Employment Tax) Total. … I'm a bit frustrated, as I had (for the first time) my Fed & State both rejected with the following errors: >Schedule1\_Self-Employed\_Health\_Insurance\_Hold\_Rule - Your federal return was rejected due to an issue with Self-Employed Health Insurance Deduction on Schedule 1: Additional Income and Adjustments to Income When I log into Turbotax, it states that it was rejected due to an issue on the Self Employed Health Insurance Deduction on Schedule 1. I will note that I didn't put a...

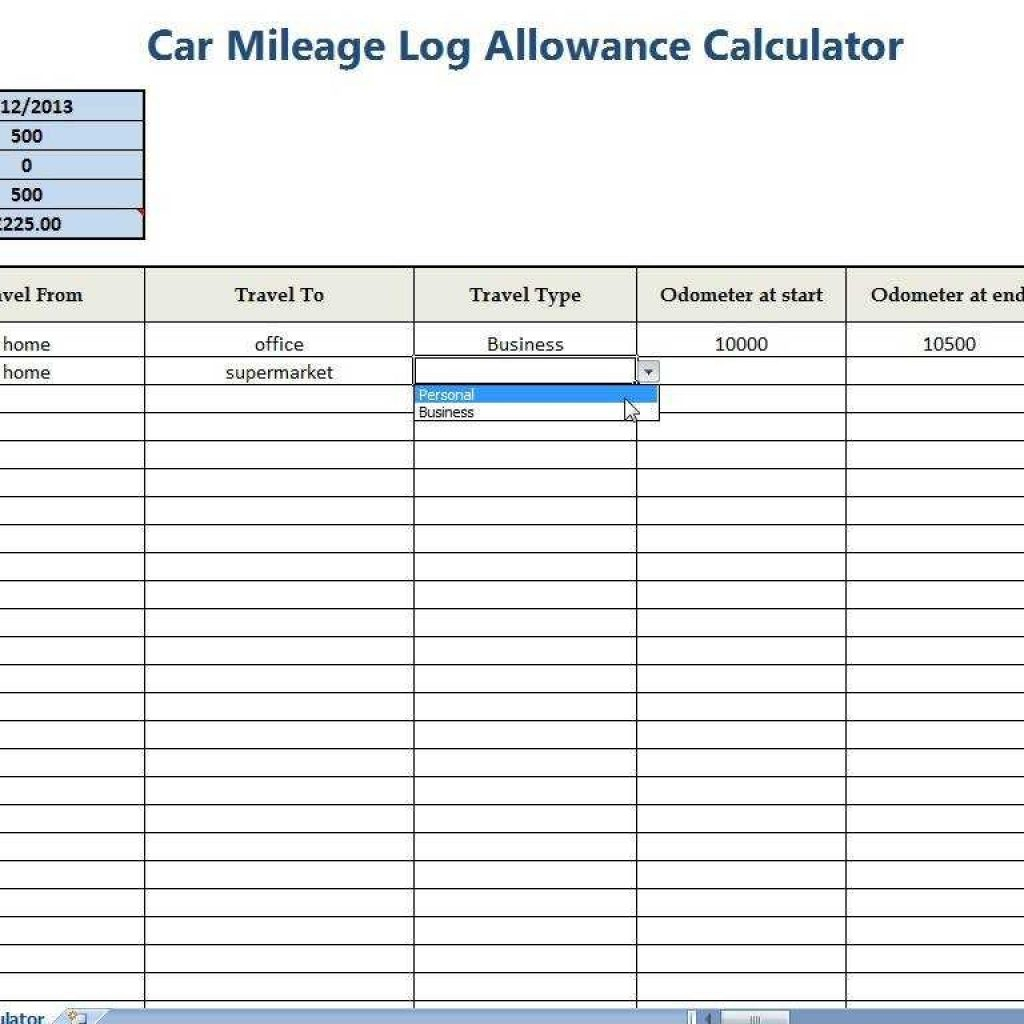

Hi there. I work in healthcare, intending to locum. Subsequently, I will be self employed travelling around a lot to different clinics. I read that when you claim mileage as an expense, travelling from home to work counts as personal rather than business related. Many of my colleagues in the same position manage to claim their travel as an expense…. What is the loop hole? General income tax and benefit guide line 323 Tax Laws & Rules > Rules > Income-tax Rules Filing Your Business Income Tax Return: A 7 Step Guide for a general overview of the topic self-employment earnings from line 10 on your T1 tax CRA General income tax and benefits guide benefits and Child Disability Benefit […] For information about the conditions which must be met by self-employed persons, see Income Tax Folio S4-F2-C2, Business Use of Home Expenses. Who is eligible? So I’ve been self employed on Universal Credit, I’m a freelancer rather than a traditional business, but I’ve been heavily investing in my work (audio industry), buying a lot of equipment etc. I have, perfectly within the rules, been claiming this as expenses when reporting my income, so often when I earn money I still get UC as the money I’ve earned I’ve just reinvested in the ‘business’. Something weird has now happened with my Universal Credit where I am now being asked to re-verify my self ...

Businesses & Self-Employed; Standard mileage and other information POPULAR; Earned Income Credit (EITC) ... You can claim both the exclusion and the credit for expenses of adopting an eligible child. For example, depending on the cost of the adoption, you may be able to exclude up to $14,440 from your income and also be able to claim a credit of up to $14,440. But, you … SELF-EMPLOYED WORKSHEET FOR RATES HOUSING BENEFIT/RATE RELIEF APPLICATION (4.0). Page 1 of 4 ... details of your income and expenses? From. DD/MM/YYYY. Hello everybody I'm an immigrant from an EU country, with Settled Status. My partner is a British citizen, and disabled. They receive Universal Credit and PIP. I am self employed to allow all the time needed to care for my partner. I am a sole trader and is VAT registered. I work from home and have a dedicated office. My business was started after moving to the UK and has been operating for two years. When I moved to the UK I had only a few sets of clothing, a mobile phone and a laptop. Orig... Mental health, as defined by the Public Health Agency of Canada, is an individual's capacity to feel, think, and act in ways to achieve a better quality of life while respecting the personal, social, and cultural boundaries. Impairment of any of these is a risk factor for mental disorders, which are components of mental health. Mental disorders are defined as the health conditions that ...

Hello! Important points to note: I'm employed full time, but I take on additional work elsewhere on a freelance basis. I do not make over the VAT threshold (both incomes combined), nor do I charge or claim VAT. I file my own self assessment tax return for my freelance work taking into account the tax and NI paid within the P45/P60 issued by my employer. This tax year, I've spent £3,000 on an editing machine which I use 90% for freelance work, not used by anyone other than myself. Is this ...

Laura Whateley answers your coronavirus money questions.

Use a simpler calculation to work out income tax for your vehicle, home and business premises expenses.

Get a free self-employed expenses spreadsheet or use Bonsai to track your expenses for free. Simplify your accounting and billing and get on with your work.

Schedule C Worksheet for Self-Employed Filers and Contractors – tax year 2020. This document will list and explain the information and documentation that we ...

Hoping to get some opinions on this. I know most nonmilitary people are no longer able to itemize moving expenses, but does this apply to a self-employed person claiming moving expenses if they are moving more than 50 miles away due to a move pertaining to their "business?" Specifically, this is a pastor and their income is subject to self-employment taxes and pastors are allowed to claim ordinary and necessary business expenses related to their "self-employment" income like any other business, ...

Fill self employed expense spreadsheet: Try Risk Free ... Get, Create, Make and Sign excel spreadsheet for self employed expenses. Get Form.

Title pretty much says it. 1. Google/facebook/linkedin Ads. Says they have to be targeted at Canada, not from a foreign broadcaster (Google.ca ?!) Obviously I can't target the USA I guess. Something about 80% of the ad content has to be relevant... I cant seem to find if Google (obviously American) qualified, I assume it does as a deduction on statement of business activities. 2. Wages deduction. It Says you can of course deduct wages/gross salaries, but I can't find anything on paying period ...

Tax Worksheet for Self-employed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099-MISC with box 7 income listed. Try your best to fill this out. If you’re not sure where something goes don’t worry, every expense on here, except for meals, is deducted at the same rate. If it goes in the wrong category it does not affect the ...

Hi, A bit of a question about HMRC self-assessment here that might be obvious to some - if it's not the appropriate place let me know and I'll delete. In the last couple of years for covid reasons I've had to work from home. Because of this I've bought some equipment to help me do my work (extra monitor, desk, office chair etc as long with more minor things like stationary). I bought it myself without 'expensing' it through work. I've also had to heat and power my house more than usual. I a...

Deductible Expense: Advertising. Car/Truck Expenses. Commissions/Fees. Contract Labor. Depletion. Depreciation. Employee Benefit Programs. Insurance.

Fundamentals of Human Resource MANAGEMENT Sixth Edition Noe | Hollenbeck | Gerhart | Wright LEARNSMART ADVANTAGE WORKS A B C D 30.5% 33.5% 22.6% 8.7% A B C D

Formats and Editions of By the people debating American. By james a morone; rogan kersh print book: brief fifth edition . Support new america — we are dedicated to renewing the promise of america by continuing the quest to realize our nation's highest ideals, honestly confronting the challenges caused by rapid technological and social change, and seizing the opportunities those changes create.

Allowable expenses that can be deducted from income are listed below within the worksheet (#4-17). - Income Taxes (federal, state, and local ). EXPENSES:.

07.08.2021 · A self-employed 401k plan is a great way to save for retirement if you are an entrepreneur or solopreneur. A self-employed 401k plan is also know as a Solo 401k plan. This article will discuss how much you can contribute to your self-employed 401k plan. For 2021, the IRS says you can contribute up to $57,000 in your self-employed 401k plan.

Afaik mortgage lenders look at your gross income, not net, but someone told me banks look more into your net income when you’re self employed. Is that true? I’m planning to get a mortgage next year and I’m working on my taxes now. I can deduct many expenses in my business but I could not include them this year to increase my net income. Also I plan to sell part of my stocks for my down payment. Should I sell them this year to bump my income more, or would it be fine to do it shortly before I ...

I've been having a hard time determining what the CRA would consider travel vs a commute, if you guys could help that'd be great. I am a hockey referee for various independent leagues around metro Vancouver and I am required to drive to rinks to provide my services as a referee where required. I am by definition an independent contractor. Given I have no single location of work and multiple customers I'm of the opinion all the driving should be considered traveling and not commuting given my ho...

I am self employed and moving across the country. I don't strictly _need_ to to run my business, but there will be benefits and I want to move for other personal reasons anyway. Am I eligible to claim moving expenses or is that only for people whose employer is forcing them to move? The [CRA website](https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/deductions-credits-expenses/line-21900-moving-expenses/line-21900-yo...

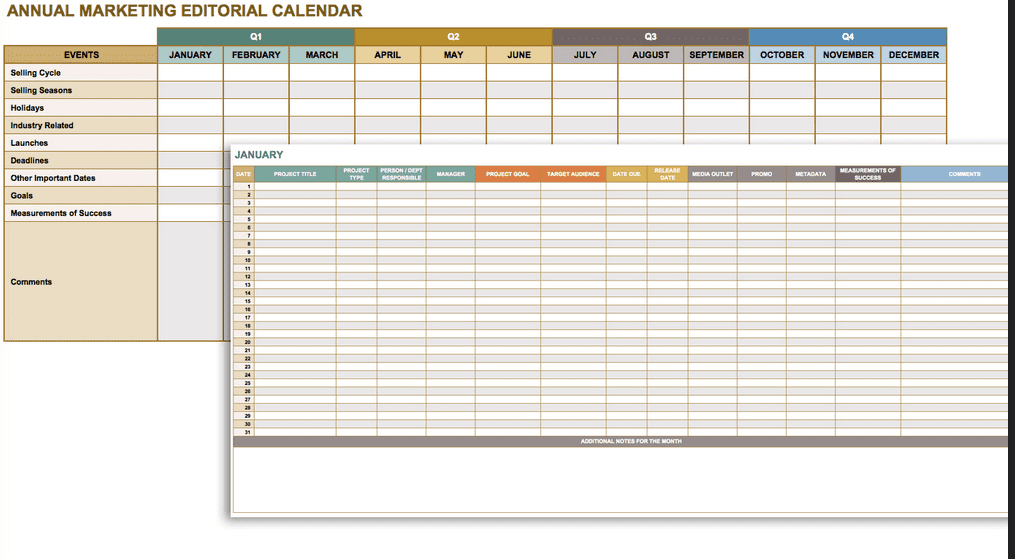

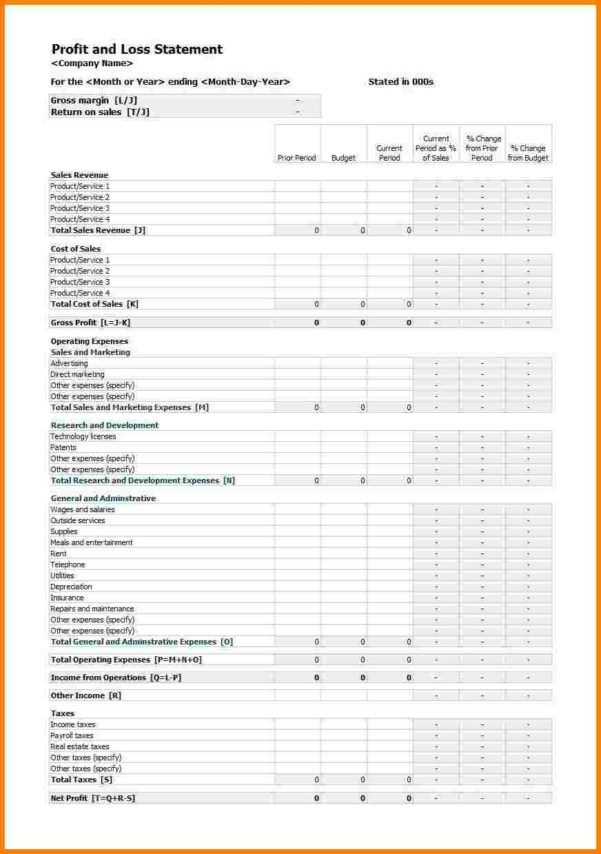

Overview:

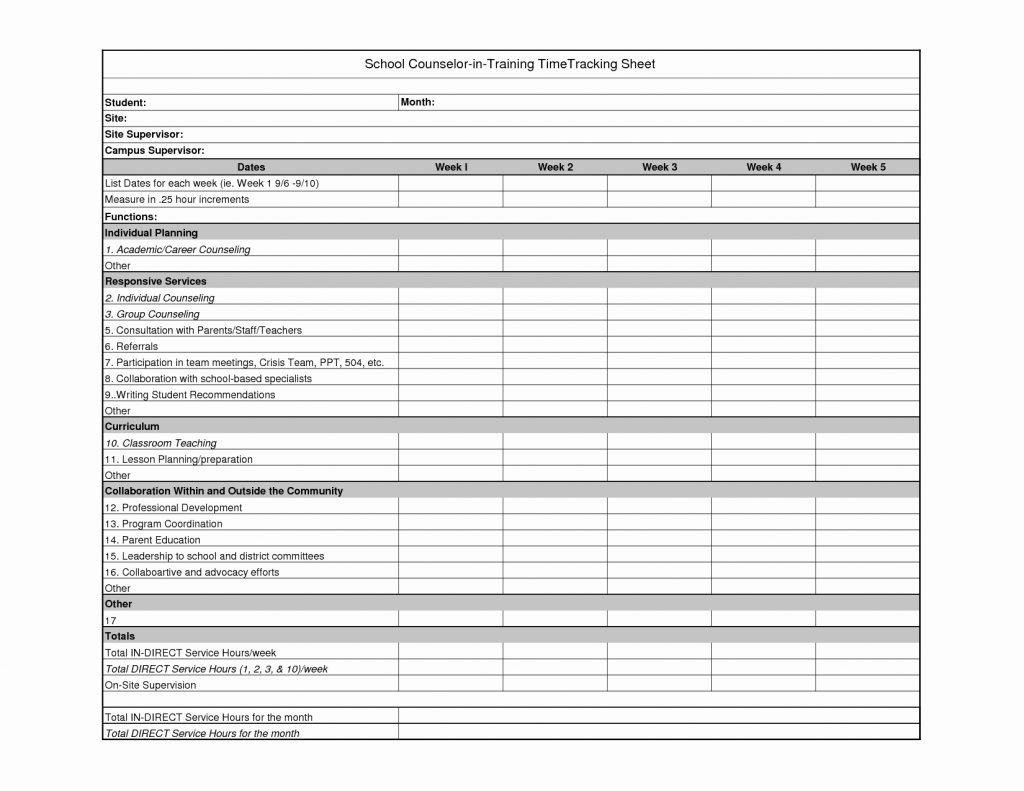

Provides informational and analytical services in support of strategic initiatives and management decisions for the Department of Pediatrics. Performs the specific duties and responsibilities commensurate with experience and education. The Business Analyst will support the Department by generating financial and statistical reports used for decision support, assisting in ...

Travel agent side business with based on commission and obviously no one traveled in 2020 so no income received and no 1099 received. There were some expenses incurred at the start of year (office supplies, license fees, insurance, a business conference, etc.). Do I just enter $0 into tax software even though no 1099 was received? Does no income affect ability to claim any expenses?

Where To Deduct explains where a self-employed person or partner will report the deduction. This publication also includes information on the following. Selling a home that was used partly for business. Deducting expenses for furniture and equipment used in your business. Records you should keep. Finally, this publication contains worksheets to help you figure the amount of your …

Position: Executive Personal Assistant to the COO (3 Months Contract)

The Role:

Essential function:

To support and enhance the executive function by performing administrative and office related duties.

Results Delivery

Apply cost effectiveness principles in everyday delivery to contribute to achievement of departmental financial targets

Inexperienced on graduate and law student . Lewis Clark graduate and law children may choose either a Federal Direct PLUS Loan or a private financing to cover instructional expenses when they need fatigued their unique government Direct Unsubsidized financing qualification.

(Schedule C) Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors. Use separate sheet for each business.

Evaluating yourself can be a challenge. You don’t want to sell yourself short, but you also need to make sure you don’t come off as too full of yourself either. Use these tips to write a self evaluation that hits the mark. A self evaluation...

07.01.2022 · Self-employment tax ensures that self-employed individuals make the same contribution and receive the same value of benefits as salaried workers. The 15.3% may shock those who are newly self-employed. But when all is said and done, tax deductions can save you from paying the entire tax.

As I said in the title really. I work as a decorator and have been for many years now. I’ve always done my own taxes and invoices ect ect using quickbooks and have never had any problems until now. I recently got hired to prepare and decorate some bespoke bookcases a local carpenter made and when I issued him the invoice he paid straight away less 20%. And issued me a CIS payment deduction receipt. My issue is I’ve always been paid directly by my clients until now and therefore am not CIS re...

Hey everyone, I am self employed and make 90%+ of my revenue through software development and design. I am also a landscape photographer and have sold enough of my photography to account for \~1-2% of my income. In the past year I also invested \~$5000 in new camera gear. Am I able to claim the cost of this gear (capital cost) despite it only reflecting or generating a disproportionate amount of revenue, relative to my earnings in a different sector? I am not incorporated. Thank you, happy...

Needs Assessment A Key Evaluation Tool for Professional Posted on 22.01.2022 by xiqiv. No Comments Leave a comment

16.10.2018 · Self-Employed defined as a return with a Schedule C/C-EZ tax form. Online competitor data is extrapolated from press releases and SEC filings. “Online” is defined as an individual income tax DIY return (non-preparer signed) that was prepared online & either e-filed or printed, not including returns prepared through desktop software or FFA prepared returns, 2020.

Find information on self-employment, including when and how to file your ... If your expenses are less than your income, the difference is net profit and ...

I'm doing my tax return for 2020-21 and I'm confused about expenses. I started renting a place in Aug 2020 and worked from home 100% of the time, I share a 2 bedroom flat with 1 person. At the same time, I signed up for universal credit first time in my life and they started paying my rent some of the months when I wasn't paid by my clients, so roughly half of the time in that tax period. Now I'm doing my tax return and I don't know how to do my expenses. Can I claim part of the rent for the m...

me and my wife work full time jobs with separate employers, we normally file taxes jointly with our W2 income (form 1040). This year, we decided to open our own small business as a side job, we don’t have employees, is just me and my wife will be the owners and run the business by ourselves, and we will still work as full time job with our employers. How do I manage taxes for my small business? My search got me to multiple options and I don’t know which one is best for my case (e.g.: EIN, DBA,...

Planning my travels from the end of January and I wonder what can I claim as my expenses? Part of accommodation, co-working spaces etc? If I buy a new laptop, can I claim it? What do you guys claim? Thanks!

0 Response to "39 self employed expenses worksheet"

Post a Comment